Professional Documents

Culture Documents

BM12 Revision: Balance Sheet + Profit & Loss

BM12 Revision: Balance Sheet + Profit & Loss

Uploaded by

Brian TanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BM12 Revision: Balance Sheet + Profit & Loss

BM12 Revision: Balance Sheet + Profit & Loss

Uploaded by

Brian TanCopyright:

Available Formats

BM12 Revision: Balance Sheet + Profit & Loss

Individually, complete the following problems on a separate sheet of

paper. Make sure to show your work. You may use a calculator.

If you finish early, start reading* on Investment Appraisal: Payback

Period on p. 310-312 in Hoang

Cash

0.1

or in Mr. Slaughters BM Blog.

Creditors

0.8

http://goo.gl/lOYbHW

Debtors

0.2

Fixed assets equipment

1.5

For homework, take notes

Fixed assets land and buildings

9

on Payback Period. I will check

Loan capital

4

these next class because Id

Retained profit

2

like to offer tips on how to

Share capital

4

strengthen note-taking.

PART ONE:

Miley Co. Profit & Loss

For the year 2010, Miley Co. generated average monthly revenues of

$125,000. This was achieved by pricing the goods with an average

mark up of 50% of total direct costs.

The companys expenses for the year included:

Advertising

$

50,000

Salaries

$100,000

Interest payable $ 15,000

Rent

$ 75,000

Utilities

$ 25,000

Taxes

$ 45,000

From the net profits, the company retained 50% and paid out the

balance as dividends to shareholders.

HL & SL: Prepare a profit and loss account for Miley Co. for 2010.

PART TWO:

Bieber Co. Balance Sheet

Selected financial information from Bieber Co. accounts as at

3l March 2014 (all figures in US$m)

1) HL & SL: Using the information provided, prepare a balance

sheet for Bieber Co. as at 31 March 2014.

2) HL: Using the reducing balance method of depreciation at a

rate of 40% per year, calculate the total depreciation charge on

the equipment purchased three years ago (show all your

working).

3) HL: Prepare Bieber Co.s new balance sheet as at 31 March

2014, taking into account the depreciation charge calculated in

no. 2.

You might also like

- Tax ReviewerDocument22 pagesTax ReviewercrestagNo ratings yet

- Accounting Papers of Ibp Part TwoDocument64 pagesAccounting Papers of Ibp Part TwoTehreem Ali50% (2)

- 2008 F F3250 Exam 1 KeyDocument8 pages2008 F F3250 Exam 1 Keyproject44No ratings yet

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsZHANG EmilyNo ratings yet

- F1 May 2010 For Print. 23.3Document20 pagesF1 May 2010 For Print. 23.3mavkaziNo ratings yet

- 7110 w09 QP 1Document12 pages7110 w09 QP 1mstudy123456No ratings yet

- ACCT 570 Chap 1 NoteDocument15 pagesACCT 570 Chap 1 Notedothimyuyen123No ratings yet

- Acca f5 2012 DecDocument8 pagesAcca f5 2012 DecgrrrklNo ratings yet

- (169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsDocument5 pages(169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsJervin LabroNo ratings yet

- ACCT557 W1 HW QuestionsDocument3 pagesACCT557 W1 HW Questionsnidal charaf eddineNo ratings yet

- 3 Partnership AccountsDocument93 pages3 Partnership AccountsCA K D Purkayastha100% (1)

- Module 3 Exercises Statement of Changes in EquityDocument3 pagesModule 3 Exercises Statement of Changes in EquityArjay CorderoNo ratings yet

- Sample Questions For Valuation Fundamentals PDFDocument4 pagesSample Questions For Valuation Fundamentals PDFJasonSpringNo ratings yet

- Canadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test BankDocument15 pagesCanadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test Bankbennie100% (22)

- A Level Accounting Paper1 SpecimenDocument12 pagesA Level Accounting Paper1 Specimenfrieda20093835No ratings yet

- Sample Questions For Valuation Fundamentals PDFDocument5 pagesSample Questions For Valuation Fundamentals PDFAnuradha SharmaNo ratings yet

- FABM2 Module 3 Exercises - Statement of Changes in EquityDocument3 pagesFABM2 Module 3 Exercises - Statement of Changes in EquityJennifer NayveNo ratings yet

- FIN 310 - Chapter 2 Questions - AnswersDocument7 pagesFIN 310 - Chapter 2 Questions - AnswersKelby BahrNo ratings yet

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- GBA Strategy TestDocument26 pagesGBA Strategy TestHitesh HarNo ratings yet

- F1 May 2011Document20 pagesF1 May 2011Shamra KassimNo ratings yet

- Canadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test BankDocument13 pagesCanadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test Bankalisonfernandezmerzigfkap100% (15)

- Chapter:1 Fundamentals: 1. Fixed and Fluctuating Capital AccountsDocument98 pagesChapter:1 Fundamentals: 1. Fixed and Fluctuating Capital Accountsashit_rasquinha100% (1)

- DL PT1Q F3 201301Document14 pagesDL PT1Q F3 201301MpuTitasNo ratings yet

- First Evaluation Examination Practical Accounting Problems 2 (BSA 4-1 P2 EVALS)Document18 pagesFirst Evaluation Examination Practical Accounting Problems 2 (BSA 4-1 P2 EVALS)LJBernardoNo ratings yet

- 5 6053042764831000707Document16 pages5 6053042764831000707SoNam ZaNgmoNo ratings yet

- f3 MockDocument36 pagesf3 MockMuhammad MujtabaNo ratings yet

- Chapter 2Document8 pagesChapter 2cindyNo ratings yet

- Choose One Answer To Each QuestionDocument5 pagesChoose One Answer To Each QuestionNguyễn Vũ Phương AnhNo ratings yet

- Test Bank For Financial Statement Analysis 10th Edition K R SubramanyamDocument26 pagesTest Bank For Financial Statement Analysis 10th Edition K R Subramanyamagnesgrainneo30No ratings yet

- Partnership Operation Quiz 1 Combined OnlineDocument7 pagesPartnership Operation Quiz 1 Combined OnlineZyka SinoyNo ratings yet

- Mock Exam Paper: Time AllowedDocument9 pagesMock Exam Paper: Time AllowedVannak2015No ratings yet

- Practice Exam: TEXT: PART A - Multiple Choice QuestionsDocument12 pagesPractice Exam: TEXT: PART A - Multiple Choice QuestionsMelissa WhiteNo ratings yet

- Income Tax Fundamentals 2013 31St Edition Whittenburg Test Bank Full Chapter PDFDocument67 pagesIncome Tax Fundamentals 2013 31St Edition Whittenburg Test Bank Full Chapter PDFjohndorothy0h3u100% (12)

- Income Tax Fundamentals 2013 31st Edition Whittenburg Test BankDocument46 pagesIncome Tax Fundamentals 2013 31st Edition Whittenburg Test Bankhoatuyenbm5k100% (27)

- Business Expenses: Publication 535Document50 pagesBusiness Expenses: Publication 535Birgitte SangermanoNo ratings yet

- Name - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sDocument11 pagesName - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sAtty CpaNo ratings yet

- 7110 s11 QP 12Document12 pages7110 s11 QP 12mstudy123456No ratings yet

- PDF Solution Manual For Financial Accounting in An Economic Context Pratt 9Th Edition Online Ebook Full ChapterDocument50 pagesPDF Solution Manual For Financial Accounting in An Economic Context Pratt 9Th Edition Online Ebook Full Chapterzenaida.mcpherson439100% (6)

- ACCOUNTING AllPapersDocument128 pagesACCOUNTING AllPapersAbbas AliNo ratings yet

- DsdsDocument10 pagesDsdsAnonymous zXwP003No ratings yet

- KTQT LMS1 27 - 08Document14 pagesKTQT LMS1 27 - 08Khánh Vy Hà VũNo ratings yet

- Comprehensive Exam FDocument14 pagesComprehensive Exam Fjdiaz_646247100% (1)

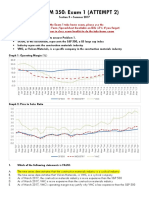

- BUS ADM 350: Exam 1 (ATTEMPT 2)Document6 pagesBUS ADM 350: Exam 1 (ATTEMPT 2)Maddah HussainNo ratings yet

- 7110 s05 QP 1Document12 pages7110 s05 QP 1kaviraj1006No ratings yet

- Trắc Nghiệm ENG NLKT Chap1-6 Có Đáp Án-trangDocument45 pagesTrắc Nghiệm ENG NLKT Chap1-6 Có Đáp Án-trangVũ Quang MạnhNo ratings yet

- Korteweg FBE 432: Corporate Financial Strategy Spring 2019Document6 pagesKorteweg FBE 432: Corporate Financial Strategy Spring 2019PeterNo ratings yet

- Chapter 16 QuizDocument3 pagesChapter 16 Quizbeckkl05No ratings yet

- P9 Nov 09 ExampaperDocument24 pagesP9 Nov 09 ExampaperShahbazYaqubNo ratings yet

- 7110 s12 QP 11Document12 pages7110 s12 QP 11mstudy123456No ratings yet

- CIMA Financial Accounting Fundamentals Past PapersDocument107 pagesCIMA Financial Accounting Fundamentals Past PaperssedikingNo ratings yet

- Team Go For It Chapter17 FIN 2600 CorrectedDocument14 pagesTeam Go For It Chapter17 FIN 2600 CorrectedThái TranNo ratings yet

- Tax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024From EverandTax Savings Strategies for Small Businesses: A Comprehensive Guide For 2024No ratings yet