Professional Documents

Culture Documents

Table of Contents

Uploaded by

Sanoob SidiqCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Table of Contents

Uploaded by

Sanoob SidiqCopyright:

Available Formats

TABLE OF CONTENTS

CONTENTS

INTRODUCTION

1.1 EVOLUTION OF BANKING INSTITUTIONS

1.2 ANCIENT INDIA

1.3 MEDIEVAL ERA

1.4 COLONIAL ERA

1.5 POST-INDEPENDENCE

1.6 NATIONALIZATION IN 1960S

1.7 LIBERALIZATION IN 1990S

1.8 CURRENT PERIOD

1.9 RESERVE BANK OF INDIA AND FUNCTIONS

1.9.1 TRADITIONAL FUNCTIONS OF RBI

1.9.2 PROMOTIONAL FUNCTIONS OF RBI

1.9.3 SUPERVISORY FUNCTIONS OF RBI

1.10 PHASES OF INDIAN BANKING SYSTEM

1.10.1 PHASE I

1.10.2 PHASE II

1.10.3 PHASE III

CHAPTER 2 BANKING INDUSTRY AN OVERVIEW

2.1 BRIEF PROFILE OF THE ORGANIZATION

2.2 MISSION OF INDIAN BANK

2.3 THE VISSION OF INDIAN BANKASSOCIATE BANKS

2.4 SUBSIDIARIES

2.5 THE INDIAN BANKING SYSTEM

2.6CURRENT SENARIO

2.7 DEPOSITS

2.8 DIGTIZATION

2.9 PROFIT AND PROFITABIITY

2.10 NEW INITIATIVES

PAGE NO

2.11 PRODUCT AND SERVICES

NRI FOREIGN EXCHANGE SCHEME

AGRICULTURE

GROUPS

TERM DEPOSITS

REMITTANCE

BUSINESS

DEMAND DEPOSIT

INSURANCE

PROFESSIONAL SELF EMPLOYED

SME

CARDS

NRI

PROPERTY

TECHNOLOGY

LOANS

PERSONAL /INDIVIDUAL

EDUCATION

SERVICES

3.1 STATEMENT OF THE PROBLEM

3.2 OBJECTIVE OF THE STUDY

3.3 METHODOLOGY OF THE STUDY

3.4 SAMPLING DESIGN

3.5 DATA COLLECTION METHODS

3.6 BENEFITS FOR STUDENTS

3.7 BENEFITS FOR PARENTS

3.8 PROBLEMS FACED BY BANKS IN GRANTING

EDUCATONAL LOANS

3.9 LIMITATIONS

3.10 SUGGESTIONS

3.11 CONCLUSION

3.12 BIBLIOGRAPHY

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- TrainingDocument15 pagesTrainingSanoob SidiqNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

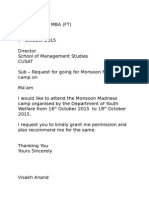

- Letter Format For EntryDocument3 pagesLetter Format For EntrySanoob SidiqNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- First Case WARNING CircularDocument2 pagesFirst Case WARNING CircularSanoob SidiqNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- TrainingDocument15 pagesTrainingSanoob SidiqNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Careers in Supply ManagementDocument65 pagesCareers in Supply ManagementSanoob SidiqNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Official Letter RequestingDocument1 pageOfficial Letter RequestingSanoob SidiqNo ratings yet

- Official Letter RequestingDocument1 pageOfficial Letter RequestingSanoob SidiqNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Official Letter RequestingDocument1 pageOfficial Letter RequestingSanoob SidiqNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Official Request Letter TemplateDocument1 pageOfficial Request Letter TemplateSanoob SidiqNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Aptitude HandbookDocument55 pagesAptitude HandbookSanoob SidiqNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- GM CarsDocument14 pagesGM CarsSanoob SidiqNo ratings yet

- Sources of Secondary DataDocument13 pagesSources of Secondary DataSanoob Sidiq0% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)