Professional Documents

Culture Documents

Statement of Profit

Statement of Profit

Uploaded by

Sanket Patel0 ratings0% found this document useful (0 votes)

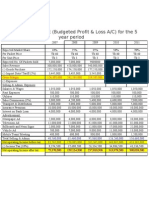

3 views2 pagesRevenue from operations decreased 1.22% from the previous year. Total expenses increased 6.03% due to increases in production, transportation, selling and distribution costs as well as exploratory well costs. Profit before tax decreased 18.12% and profit after tax decreased 19.74% compared to the previous year. Earnings per share also decreased 19.74% from the previous year.

Original Description:

Financial and cos accounting

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRevenue from operations decreased 1.22% from the previous year. Total expenses increased 6.03% due to increases in production, transportation, selling and distribution costs as well as exploratory well costs. Profit before tax decreased 18.12% and profit after tax decreased 19.74% compared to the previous year. Earnings per share also decreased 19.74% from the previous year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesStatement of Profit

Statement of Profit

Uploaded by

Sanket PatelRevenue from operations decreased 1.22% from the previous year. Total expenses increased 6.03% due to increases in production, transportation, selling and distribution costs as well as exploratory well costs. Profit before tax decreased 18.12% and profit after tax decreased 19.74% compared to the previous year. Earnings per share also decreased 19.74% from the previous year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Statement of Profit & Loss Comparison for

the year ended 31 March, 2015 and 31

March, 2014 and Analysis

Particulars

1. Income

Revenue from operations

(Gross)

Less: Excise Duty

Revenue from operations

(Net)

Other Income

Total Revenue

2.Expenses

(Increase)/ Decrease in

inventories

Purchases of Stock-in-Trade

Production, Transportation,

Selling and Distribution

Expenditure

Survey Costs

Exploratory well Costs

Depreciation, Depletion,

Amortisation and Impairment

Financing Costs

Provisions and Write-offs

Adjustments relating to Prior

Period (Net)

Total Expenses

Profit before Exceptional,

Extraordinary items and

Tax

Exceptional items

Profit before Extraordinary

items and Tax

Profit before Tax

Tax Expense

Current Tax

MAT Credit Entitlement

Earlier years

Deferred Tax

Profit after Tax

Earnings per Equity Share

- Basic and Diluted

2014-15

2013-14

%

Change

830,934.67

842,027.80

-1.32%

2,225.06

828,709.61

3,125.09

838,902.71

-28.8%

-1.22%

53,665.67

882,375.28

67,131.99

906,034.70

-20.1%

-2.61%

1,674.29

1,042.80

60.55%

44.11

392,662.80

31.80

393,334.90

8.71%

-0.17%

19,146.47

86,078.16

114,583.12

15,911.62

62,445.15

109,258.90

20.33%

37.85%

4.87%

27.87

2,115.60

3,839.09

3.57

2,188.50

(2,501.86)

680.67%

3.33%

53.45%

616,822.93

265,552.35

581,715.38

324,319.32

6.03%

-18.12%

265,552.35

324,319.32

-18.12%

265,552.35

324,319.32

-18.12%

82,000.00

5,848.30

12,071.11

177,329.54

20.73

65,500.00

2,800.00

2,145.87

38,525.38

220,948.07

25.83

26.15%

-100%

172.53%

-68.66%

-19.74%

-19.74%

(Face Value ` 5/-Per Share)

Analysis:

You might also like

- Trial Balance (Excel Format)Document4 pagesTrial Balance (Excel Format)Mohammed Shabil50% (2)

- Asian Paints - Financial Modeling (With Solutions) - CBADocument47 pagesAsian Paints - Financial Modeling (With Solutions) - CBAavinashtiwari201745No ratings yet

- Vertical and Horizontal Analysis of PidiliteDocument12 pagesVertical and Horizontal Analysis of PidiliteAnuj AgarwalNo ratings yet

- GodrejDocument21 pagesGodrejVishal V. ShahNo ratings yet

- Foreign Banks P&LDocument8 pagesForeign Banks P&LKarthik K JanardhananNo ratings yet

- CH 04 Income StatementDocument6 pagesCH 04 Income Statementnreid2701No ratings yet

- Macys 2011 10kDocument39 pagesMacys 2011 10kapb5223No ratings yet

- 1H15 PPT - VFDocument29 pages1H15 PPT - VFClaudio Andrés De LucaNo ratings yet

- CF Roll No. 12046Document24 pagesCF Roll No. 12046Shilpa GiriNo ratings yet

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Idea ConsolidatedDocument26 pagesIdea ConsolidatedSheetal AhluwaliaNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- Acctg Chap 2Document23 pagesAcctg Chap 2Mateo RjNo ratings yet

- Financial Reporting & Analysis Mock Test For Mid Term ExaminationDocument6 pagesFinancial Reporting & Analysis Mock Test For Mid Term ExaminationTanuj AroraNo ratings yet

- Financial Statement Model For Colgate General AssumptionDocument4 pagesFinancial Statement Model For Colgate General AssumptioncphanhuyNo ratings yet

- Financial - CocaColaDocument45 pagesFinancial - CocaColadung nguyenNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document2 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Statement Of: Comprehensive IncomeDocument24 pagesStatement Of: Comprehensive IncomeBrian Reyes GangcaNo ratings yet

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Result)Document5 pagesFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderNo ratings yet

- Operating Model Build v33Document22 pagesOperating Model Build v33chandan.hegdeNo ratings yet

- Fin Feasibiltiy Zubair Reg 54492Document9 pagesFin Feasibiltiy Zubair Reg 54492kzubairNo ratings yet

- Roadshow Natixis Mar09Document47 pagesRoadshow Natixis Mar09sl7789No ratings yet

- Descriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsDocument15 pagesDescriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsVALLIAPPAN.PNo ratings yet

- DPPO Financial Statements Fiscal March 31 2015 V05 25 2015Document1 pageDPPO Financial Statements Fiscal March 31 2015 V05 25 2015DPPONo ratings yet

- CEB and PAL Disclosures CompilationDocument11 pagesCEB and PAL Disclosures CompilationIvan BendiolaNo ratings yet

- Particulars 31march2012 Trend% 31 March 2013 Trend%Document4 pagesParticulars 31march2012 Trend% 31 March 2013 Trend%duck786No ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Summarized Income Statement Equation For Usha Martin:: Missing ItemsDocument1 pageSummarized Income Statement Equation For Usha Martin:: Missing ItemsAnkit LodhaNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosAbhishek RampalNo ratings yet

- Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonDocument9 pagesNet Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To VerizonvenkeeeeeNo ratings yet

- P & L Bookmybread Year 1 Year 2Document2 pagesP & L Bookmybread Year 1 Year 2Ramanjit SinghNo ratings yet

- Financial Statement (Budgeted Profit & Loss A/C) For The 5 Year PeriodDocument1 pageFinancial Statement (Budgeted Profit & Loss A/C) For The 5 Year PeriodShakhawat Hossen MunnaNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- (5414) Specialized Design Services Sales Class: $500,000 - $999,999Document15 pages(5414) Specialized Design Services Sales Class: $500,000 - $999,999Christyne841No ratings yet

- Adam Sugar LTD Financial AnalysisDocument20 pagesAdam Sugar LTD Financial AnalysiswamiqrasheedNo ratings yet

- Projet PGPM RatioDocument16 pagesProjet PGPM RatioViren PatelNo ratings yet

- HDFC Life and IciciDocument5 pagesHDFC Life and IciciSubhashNo ratings yet

- Modül Business Decisions and EconomicsDocument60 pagesModül Business Decisions and Economicsmuhendis_8900No ratings yet

- Komprehensif KonsolidasianDocument2 pagesKomprehensif KonsolidasianABDUL AjisNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Corporate Finance Presentation EditorialDocument96 pagesCorporate Finance Presentation EditorialtozammelNo ratings yet

- Sebi MillionsDocument3 pagesSebi MillionsShubham TrivediNo ratings yet

- Dandot CementDocument154 pagesDandot CementKamran ShabbirNo ratings yet

- Online Presentation 11-1-11Document18 pagesOnline Presentation 11-1-11Hari HaranNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Cont ProfitDocument1 pageCont ProfitYonela JordanNo ratings yet

- Answers March2012 f1Document10 pagesAnswers March2012 f1kiransookNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Different: ... and Better Than EverDocument4 pagesDifferent: ... and Better Than EverViral PatelNo ratings yet

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungNo ratings yet

- SMF DCF Training (Done) FinalDocument22 pagesSMF DCF Training (Done) FinalWayne Weixian HoNo ratings yet

- Chapter 22 2014 App AudDocument25 pagesChapter 22 2014 App AudClarize R. MabiogNo ratings yet

- 2010 Ibm StatementsDocument6 pages2010 Ibm StatementsElsa MersiniNo ratings yet

- BankingDocument113 pagesBankingKiran MaheenNo ratings yet