Professional Documents

Culture Documents

Subjects in CPA

Uploaded by

kautiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Subjects in CPA

Uploaded by

kautiCopyright:

Available Formats

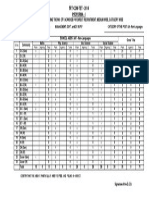

SUBJECT DETAILS FOR CPA EXAM

FINANCIAL ACCOUNTING & REPORTING FARE

FARE 1:

FARE2:

FARE 3:

FARE 4:

FARE 5:

FARE 6:

FARE 7:

FARE 8:

FARE 9:

Accounting standards and conceptual frameworks. Income statement. Income from continuing operations.

Discontinued operations and exit or disposal activities. Extraordinary items. Accounting changes and error

corrections. Comprehensive income Balance sheet and disclosures overview. Interim financial reporting.

Segment reporting. Development-stage enterprises (U.S. GAAP). Fair value measurements and disclosures.

First-time adoption of IFRS SEC reporting requirements.

Timing issues: Matching of revenue and expenses, correcting and adjusting accounts. Long-term construction

contracts. Accounting for instalment sales. Accounting for nonmonetary exchanges. Partnerships . Financial

reporting and changing prices. Foreign currency accounting. Other financial statement presentations.

Marketable securities. Business combinations/consolidations. Cost method (external reporting). Equity method

and joint ventures (external reporting). Consolidated financial statements. Acquisition method (external

reporting). Intercompany transactions. Combined financial statements/push down accounting. Variable interest

entities (VIES).

Working capital and its components. Inventories. Fixed assets. Depreciable assets and depreciation. Fixed

asset impairment. Appendix: IFRS vs. U.S. GAAP.

Present values and annuities. Accounting for leases. Asset retirement and environment obligations. Long-term

liabilities and bonds payable. Troubled debt restructurings. Other Liabilities and debt covenants.

Pension plans. Postretirement benefits other than pensions. Other deferred compensation and benefits.

Estimated and accrued liabilities. Contingencies. Subsequent events. Accounting for income taxes. Appendix:

IFRS vs. U.S. GAAP. Class questions

Financial instruments. Stockholders' equity. Earnings per share. Statement of cash flows. Ratio analysis.

Governmental accounting overview. Modified accrual accounting. Governmental funds. Proprietary funds.

Fiduciary funds.

Governmental accounting (Part B). Not-for-profit organizations.

AUDITING & ATTESTATION AUD & ATT

AUD&ATT 1:

AUD&ATT 2:

AUD&ATT 3:

AUD&ATT 4:

AUD&ATT 5:

Audited financial statements: The basics. Professional standards. Reports on audited financial statements.

Reports on comparative financial statements. Events occurring after year-end. Reporting on other information.

Professional responsibilities. Appendix: Licensing and disciplinary systems within the profession

Quality control standards. Other engagements, reports and accounting services. Compilation and review of

financial statements (pre-June 2011). Compilation and review of financial statements (post-June 2011).

Reporting on comparative financial statements. Review of interim financial information. Letters for

underwriters.

Engagement acceptance and understanding the assignment. Planning and supervision. Audit risk. Fraud risk.

Understanding the entity and its environment. Internal control. Responding to the assessed risk of material

misstatement.

Audit documentation. Audit evidence. Audit procedures by transaction cycles. Other audit procedures. The

effect of information technology on the audit. Evaluating audit findings. Financial ratios.

Audit sampling. Internal control communications. Communication with those charged with governance.

Management representations. Government auditing.

REGULATION REG

REG 1:

REG 2:

REG 3:

REG 4:

REG 5:

REG 6:

REG 7:

Individual taxation: Filing status. Individual taxation: Exemption. Individual taxation: Gross income. Individual

taxation: Capital gains and losses.

Adjustments and itemized deductions. Tax calculations and credits. Individual taxation: Other taxes and Items

C corporation, depreciation, and MACRS. Small business corporations (S corporations). Exempt organizations

Partnership taxation. Estate, trust and gift taxation. Ethics and professional responsibilities in tax services.

Federal tax procedures and legislative process. Sole proprietorship and joint venture. General partnership.

Limited liability partnership. Limited partnership. Limited liability company. Corporation.

Contracts. Sales. Employer-employee law.

Commercial paper. Documents of title. Secured transactions. Suretyship & creditor's rights. Money laundering.

Agency. Bankruptcy. Securities regulation. CPA legal liability. Antitrust law. Copyrights and patents.

BUSINESS ENVIRONMENT & CONCEPTS BUS. ENV.

BEC 1:

BEC 2:

BEC 3:

BEC 4:

BEC 5:

Corporate governance. Control environment. Operations management: Performance management and impact

of measures on behaviour. Operations management: Cost measurement methods and techniques. Operations

management: Process management. Operations management: Project management. Terminology

Changes in economic and business cycles. Economic measures/indicators. Globalization and local economies.

Market influences on business strategies. Financial risk management

Financial modelling projections and analysis. Financial decisions. Capital management, including working

capital. Financial valuation. Financial transactions processes and controls

Organizational needs assessment. Systems design and other elements. Security. Internet implications for

business. Types of information systems and technology risks. Disaster recovery and business continuity

Market and risk analysis. Strategy development, implantation and monitoring. Planning techniques: Forecasting

and projection. Planning techniques: Budget and analysis. Planning techniques: Coordinating information from

various sources for integrated planning

You might also like

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisVivek SuranaNo ratings yet

- Roll of Accounting Standards and AuditingDocument47 pagesRoll of Accounting Standards and AuditingRishabh PandeyNo ratings yet

- REG Study Guide 4-21-2013Document213 pagesREG Study Guide 4-21-2013Valerie ReadhimerNo ratings yet

- Chap 1 Financial AcctgDocument6 pagesChap 1 Financial AcctgKunal DattaNo ratings yet

- Course Title - Financial Accounting - 1Document19 pagesCourse Title - Financial Accounting - 1IK storeNo ratings yet

- Accounting - Chapter 1Document4 pagesAccounting - Chapter 1elainetamdfsdvxcnvxNo ratings yet

- Chapter 4Document53 pagesChapter 4tangliNo ratings yet

- Finance For Managers NotesDocument114 pagesFinance For Managers NotesDavid Luko Chifwalo100% (1)

- Lecture 1 Undrstading Financial AccountingDocument32 pagesLecture 1 Undrstading Financial AccountingbhojNo ratings yet

- Financial Accounting (F3/FFA) : July 2012 SessionDocument148 pagesFinancial Accounting (F3/FFA) : July 2012 SessionxxxtrememohsinNo ratings yet

- Syllabus Financial Reporting and Analysis - Level One ModuleDocument8 pagesSyllabus Financial Reporting and Analysis - Level One ModuleJazzer NapixNo ratings yet

- Financial Accts - PG1Document47 pagesFinancial Accts - PG1Abhishek SinghNo ratings yet

- HND, Unit 10, Level 5Document26 pagesHND, Unit 10, Level 5Abrar Khan MarwatNo ratings yet

- Slas 03Document11 pagesSlas 03Dinushika MadhubhashiniNo ratings yet

- Accounting: Prof: Jim Wallace TA: Charles YehDocument50 pagesAccounting: Prof: Jim Wallace TA: Charles YehNijith NTNo ratings yet

- XCFBJJKMDocument33 pagesXCFBJJKMApurbh Singh KashyapNo ratings yet

- Difference Between Cost Accounting and Financial Accounting: Sl. No. NatureDocument2 pagesDifference Between Cost Accounting and Financial Accounting: Sl. No. NatureDema Dee EdenNo ratings yet

- Framework For Business Analysis and Valuation Using Financial StatementsDocument18 pagesFramework For Business Analysis and Valuation Using Financial StatementsFarhat987No ratings yet

- Basics of AccountingDocument38 pagesBasics of AccountingshyanamitaliNo ratings yet

- ACC301 Advanced Financial Accounting: Level: Credit Units: 5 Credit Units Presentation Pattern: EVERY SEMESTERDocument2 pagesACC301 Advanced Financial Accounting: Level: Credit Units: 5 Credit Units Presentation Pattern: EVERY SEMESTERSafira DhyantiNo ratings yet

- Financial Versus Managerial AccountingDocument4 pagesFinancial Versus Managerial Accountinggoodabhi_99No ratings yet

- Both The CourseworksDocument7 pagesBoth The CourseworksUnderstand_Islam10No ratings yet

- Syllabus PGDM FMDocument73 pagesSyllabus PGDM FMyash_meetuNo ratings yet

- Qualifying Examinations 2023 CoverageDocument8 pagesQualifying Examinations 2023 Coverageolfuqc.3rdyearrep2324No ratings yet

- The Cpa Licensure Examination Syllabus Complete)Document8 pagesThe Cpa Licensure Examination Syllabus Complete)Ssan DunqueNo ratings yet

- Af101 - Extra NotesDocument4 pagesAf101 - Extra Noteskaveet kavitesh kumarNo ratings yet

- Financial Statement Analysis: Course DescriptionDocument4 pagesFinancial Statement Analysis: Course DescriptionMohsin RazaNo ratings yet

- Company Law and Allied RulesDocument11 pagesCompany Law and Allied RulesFaisalNo ratings yet

- Financial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32Document77 pagesFinancial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32gazmeerNo ratings yet

- FA - ACCA Lecture NotesDocument115 pagesFA - ACCA Lecture NotesmosesmuomeliteNo ratings yet

- Presentation1 1Document15 pagesPresentation1 1Monika NankaniNo ratings yet

- Definition, Nature and Scope of Accounting: Actbas1 C.L. MagpayoDocument14 pagesDefinition, Nature and Scope of Accounting: Actbas1 C.L. MagpayoDavid Guerrero TerradoNo ratings yet

- Williams Haka Bettner MeigsDocument21 pagesWilliams Haka Bettner Meigsshani807No ratings yet

- AMANDocument11 pagesAMANDIBESH PADIA-BCOMNo ratings yet

- Indian Accounting StandardsDocument6 pagesIndian Accounting StandardsNinad DaphaleNo ratings yet

- GaapDocument7 pagesGaapjoyceNo ratings yet

- 2023 CPA Study PlanDocument8 pages2023 CPA Study PlanDaryl Mae Mansay100% (1)

- Week 1 Slides s06 2Document50 pagesWeek 1 Slides s06 2Pallavi ChawlaNo ratings yet

- MCom Finance-Specialization 1-Financial Analysis PDFDocument5 pagesMCom Finance-Specialization 1-Financial Analysis PDFjamalzareenNo ratings yet

- Accounting 301 Lecture Notes: Autumn 2013 Paul Febry, CPADocument16 pagesAccounting 301 Lecture Notes: Autumn 2013 Paul Febry, CPABella EveNo ratings yet

- Part II - AppendixDocument73 pagesPart II - AppendixsamaanNo ratings yet

- Chapter 02 FSADocument21 pagesChapter 02 FSAUmar AbbasNo ratings yet

- FS-sample-FRFforSMEs Illustrative Financial StatementsDocument38 pagesFS-sample-FRFforSMEs Illustrative Financial StatementscherikokNo ratings yet

- University of Lagos: Akoka Yaba School of Postgraduate Studies PART TIME 2017/2018 SESSIONDocument5 pagesUniversity of Lagos: Akoka Yaba School of Postgraduate Studies PART TIME 2017/2018 SESSIONDavid OparindeNo ratings yet

- Chan-A Comparison of Government Accounting and Business AccountingDocument13 pagesChan-A Comparison of Government Accounting and Business AccountingAndy LincolnNo ratings yet

- Allan and CharlesDocument6 pagesAllan and CharlesNkuuwe EdmundNo ratings yet

- Reviewer On ACC101Document7 pagesReviewer On ACC101Ysai GeverNo ratings yet

- IntroductionDocument44 pagesIntroductionAmeerul IkhramNo ratings yet

- 1.1 IntroductionDocument11 pages1.1 IntroductionKISAKYE MOSESNo ratings yet

- Objectives of Financial ReportingDocument7 pagesObjectives of Financial ReportingThakur MangalNo ratings yet

- Accounting (G (1) .a.a.pGAAP)Document18 pagesAccounting (G (1) .a.a.pGAAP)Arman SinghNo ratings yet

- Powerpoint Presentation For Business StudentsDocument31 pagesPowerpoint Presentation For Business StudentsjonkeyboarderNo ratings yet

- Carol Sawatzky, CPA, CA (ON), CPA (MI, IL) - Personal & Corporate Accounting & TaxDocument5 pagesCarol Sawatzky, CPA, CA (ON), CPA (MI, IL) - Personal & Corporate Accounting & TaxCarol SawatzkyNo ratings yet

- Recommendations and Conclusion:: Disadvantages-Of-Accounting-Standards-Accounting-Essay - Php#Ixzz3TrnjpbraDocument9 pagesRecommendations and Conclusion:: Disadvantages-Of-Accounting-Standards-Accounting-Essay - Php#Ixzz3TrnjpbraarpanavsNo ratings yet

- Financial Reporting Assignment 1Document2 pagesFinancial Reporting Assignment 1Peh Shao WeiNo ratings yet

- Basic Recording Process: Topics To Be DiscussedDocument7 pagesBasic Recording Process: Topics To Be DiscussedmeyuliaNo ratings yet

- Fa4e SM Ch01Document21 pagesFa4e SM Ch01michaelkwok1100% (1)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Sri Venkateswara UniversityDocument5 pagesSri Venkateswara UniversitykautiNo ratings yet

- University of Hyderabad: General Category Reserved CategoriesDocument1 pageUniversity of Hyderabad: General Category Reserved CategorieskautiNo ratings yet

- Selected Thesis Topics 2014-2015Document5 pagesSelected Thesis Topics 2014-2015Miguelo Malpartida BuenoNo ratings yet

- Reve I W Questions Introduction To Economic UnderstandingDocument2 pagesReve I W Questions Introduction To Economic UnderstandingkautiNo ratings yet

- How To Obtain A PHD in GermanyDocument16 pagesHow To Obtain A PHD in GermanykautiNo ratings yet

- Clearing and Settlement: Financial DerivativesDocument24 pagesClearing and Settlement: Financial DerivativesAayush SharmaNo ratings yet

- JFE10 Ugc NetDocument49 pagesJFE10 Ugc NetkautiNo ratings yet

- Glossary MonetraDocument17 pagesGlossary MonetrakautiNo ratings yet

- Ca Business Sectors Revision NotesDocument1 pageCa Business Sectors Revision NoteskautiNo ratings yet

- Hydrogen TwoDocument6 pagesHydrogen TwokautiNo ratings yet

- Impact of Inflation IndianDocument3 pagesImpact of Inflation IndiankautiNo ratings yet

- Money Market ReformDocument6 pagesMoney Market ReformkautiNo ratings yet

- Concession List NaturalDocument7 pagesConcession List NaturalkautiNo ratings yet

- Accounting ConceptDocument50 pagesAccounting Conceptrsal.284869430No ratings yet

- General Securities Representative Qualification Examination (Series 7)Document46 pagesGeneral Securities Representative Qualification Examination (Series 7)kautiNo ratings yet

- 01 - Basic UnixDocument43 pages01 - Basic UnixkautiNo ratings yet

- June 2013 Final GCE Advanced Double Awards Including Applied SubjectsDocument11 pagesJune 2013 Final GCE Advanced Double Awards Including Applied SubjectskautiNo ratings yet

- SAS Programming II: Manipulating Data With The DATA Step: Course DescriptionDocument3 pagesSAS Programming II: Manipulating Data With The DATA Step: Course DescriptionkautiNo ratings yet

- Statement Showing The No. of Vacancies For Direct Recruitment, Medium Wise, Category WiseDocument1 pageStatement Showing The No. of Vacancies For Direct Recruitment, Medium Wise, Category WisekautiNo ratings yet

- School Assistant Non LanguagesDocument1 pageSchool Assistant Non LanguageskautiNo ratings yet

- The Search For Persistence: Is Past Performance Related To Future Performance?Document2 pagesThe Search For Persistence: Is Past Performance Related To Future Performance?kautiNo ratings yet

- International Exam FaqDocument4 pagesInternational Exam FaqckrishnaNo ratings yet

- British Council Entry Procedure January 2016Document2 pagesBritish Council Entry Procedure January 2016kautiNo ratings yet

- S 17 13 III (Management)Document32 pagesS 17 13 III (Management)kautiNo ratings yet

- Financial Institutions, Markets, and Money, 9 Edition: Power Point Slides ForDocument23 pagesFinancial Institutions, Markets, and Money, 9 Edition: Power Point Slides ForkautiNo ratings yet

- Grade 7 Solving Percent ProblemsDocument9 pagesGrade 7 Solving Percent ProblemskautiNo ratings yet

- Rates Revision NotesDocument1 pageRates Revision NoteskautiNo ratings yet

- Comparing Investments - An Example: D E A F B CDocument1 pageComparing Investments - An Example: D E A F B CkautiNo ratings yet

- Biological KnowledgeDocument1 pageBiological KnowledgekautiNo ratings yet

- Interview QuestionsDocument1 pageInterview QuestionskautiNo ratings yet