Professional Documents

Culture Documents

Chapter 11 - 2013 Ed

Chapter 11 - 2013 Ed

Uploaded by

Jean PaladaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 11 - 2013 Ed

Chapter 11 - 2013 Ed

Uploaded by

Jean PaladaCopyright:

Available Formats

Franchise Accounting

177

CHAPTER 11

MULTIPLE CHOICE ANSWERS AND SOLUTIONS

11-1: b

No revenue is to be reported. Because the franchisor fails to render substantial

services to the franchisee as of December 31, 2013.

11-2: c

Initial franchise fee

Less: Cost of franchise

Net income

P5,000,000

____50,000

P4,950,000

11-3: a

The total initial franchise fee of P500,000 is to be recognized as earned because the

collectibility of the note for the balance is reasonably assured.

11-4: b

Cash downpayment

Collection of note applying to principal

Revenue from initial franchise fee

P 100,000

__200,000

P 300,000

Cash downpayment, January 2, 2008

Collection applying to principal, December 31, 2013

Total Collection

Gross profit rate [(5,000,000-500,000) 5,000,000]

Realized gross profit, December 31, 2013

P2,000,000

_1,000,000

3,000,000

_____90%

P2,700,000

Face value of the note (P1,200,000 - P400,000)

Present value of the note (P200,000 X 2.91)

Unearned interest income, July 1, 2013

P 800,000

__582,000

P 218,000

Initial franchise fee

Less: unearned interest income

Deferred revenue from franchise fee

P1,200,000

__218,000

P 982,000

Initial franchise fee

Continuing franchise fee (P400,000 X .05)

Total revenue

Cost

Net income

P 500,000

___20,000

520,000

___10,000

P 510,000

11-5: a

11-6: b

11-7: d

11-8: d

178

Chapter 11

11-9: b

Deferred Revenue from franchise fee:

Downpayment

Present value of the note (P1,000,000 X 2.91)

Less: Cost of franchise fee

P6,000,000

2,910,000

Deferred gross profit

Gross profit rate (6,910,000 8,910,000)

P8,910,000

_2,000,000

P6,910,000

77.55%

Downpayment (collection during 2013)

Gross profit rate

P6,000,000

___77.55%

Realized gross profit from initial franchise fee

Add: Continuing franchise fee (5,000,000 X .05)

P4,653,000

__250,000

Total

Less: Franchise expense

Operating income

Interest income, 12/31/13 (P2,910,000 X 14%) X 6/12

Net income

P4,903,000

___50,000

P4,853,000

__203,700

P5,056,700

Face value of the note receivable

Present value of the note receivable

P1,800,000

1,263,900

Unearned interest income

P 536,100

Initial franchise fee

Less: Unearned interest income

P3,000,000

__ 536,100

Deferred revenue from franchise fee

P2,463,900

Revenues from:

Initial franchise fee

Continuing franchise fee (P2,000,000 X .05)

Total revenue from franchise fees

P1,000,000

100,000

P1,100,000

11-10: b

11-11: a

11-12: d

Realized gross profit from initial franchise fee [(350,000 + 90,000) x 37%]

Continuing franchise fee (P121,000 + P147,500) x 5%

P 162,800

___13,425

Total revenue

Expenses

176,225

___42,900

Net operating profit

Interest income (P900,000 x 15%) x 6/12

133,325

___67,500

Net income

P 200,825

Franchise Accounting

179

11-13: c

Cash down-payment

Present of the note (P40,000 x 3.0374)

P 95,000

__121,496

Total

P 216,496

11-14: a

Initial franchise fee

Continuing franchise fee (P400,000 x 5%)

P 50,000

__20,000

Total revenue

P 70,000

Should be P80,000

Initial franchise fee down-payment (P100,000 / 5)

Continuing franchise fee (P500,000 x 12%)

P 20,000

__60,000

Total earned franchise fee

P 80,000

11-15: c

11-16: a

The unearned interest credited is the difference between the face value and the

present value of the notes receivable (900,000 720000).

The down payment of P600,000 is recognized as revenue since it is a fair

measure of the services already performed by the franchisor.

11-17: b

Cora (P100,000 + P500,000)

Dora (P100,000 + P500,000)

Total

P 600,000

600,000

P1,200,000

Down payment (3,125,000 x 40%)

Present value of notes receivable ( 1,875,000/4) 468,750 x 3.04

Adjusted sales value of initial franchise fee

Direct cost of services

Gross profit

P1,250,000

1,425,000

2,675,000

802,500

1,872,500

11-18:

Gross profit rate (1,872,500 2,675,000)

70%

180

Chapter 11

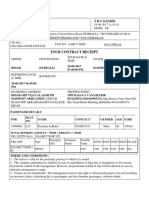

Date

Collection

Interest

1/1

6/30

468,750

171,000

12/30

468,750

135,270

Total collection applying to principal

Down payment

Total collection

Gross profit rate

Realized gross profit on

initial franchise fee

Principal

297,750

333,480

631,230

1,250,000

1,881,230

70%

Balance of PV of NR

P1,425,000

1,127,250

793,770

1,316,861

11-19: c

11-20: a

Unearned Franchise fee (21 x 30,000)

Estimated Bad debts

Net Unearned Revenue

P630,000

(20,000)

P610,000

11-21:

11-22: b

11-23:

All amounts are fully recognized as revenue, and therefore, there is no unearned

franchise revenue.

Franchise Accounting

181

SOLUTIONS TO PROBLEMS

Problem 11 1

a.

The collectibility of the note is reasonably assured.

Jan. 2:

July 31:

Cash ..... ..............................................................................12,000,000

Notes receivable................................................................. 8,000,000

Deferred Revenue from IFF. ........................................

20,000,000

Deferred cost of Franchises................................................ 2,000,000

Cash ..............................................................................

2,000,000

Nov. 30: Cash/AR ............................................................................

Revenue from continuing franchise fee (CFF)..............

29,000

Dec. 31: Cash / AR ..........................................................................

Revenue from CFF ........................................................

36,000

29,000

36,000

Cash .... .............................................................................. 2,800,000

Notes receivable ............................................................

Interest income (P8,000,000 x 10%) .............................

2,000,000

800,000

Adjusting Entries:

(1)

Cost of franchise revenue ........................................... 2,000,000

Deferred cost of franchises...................................

2,000,000

(2)

Deferred revenue from IFF .........................................20,000,000

Revenue from IFF...................................................

To recognize revenue from the initial franchise fee.

b.

20,000,000

The collectibility of the note is not reasonably assured.

Jan. 2 to Dec. 31 = Refer to assumption a.

Adjusting entry: to recognized revenue from the initial franchise fee (installment method)

(1)

(2)

To defer gross profit:

Deferred Revenue from IFF........................................20,000,000

Cost of Franchise Revenue...................................

Deferred gross profit Franchises .......................

GPR = P18,000 P20,000,000 = 90%

To recognize gross profit:

Deferred gross profit Franchises..............................12,600,000

Realized gross profit.............................................

(P14,000,000 X 90%)

2,000,000

18,000,000

12,600,000

182

a.

Chapter 11

Problem 11 2

Collection of the note is reasonably assured.

Jan. 5: Cash .. ..... .............................................................................. 600,000

Notes Receivable ................................................................... 1,000,000

Unearned interest income..................................................

Deferred revenue from F.F................................................

Face value of NR ............................................................................

Present value (P200,000 x P2,9906) ...............................................

1,000,000

__598,120

Unearned interest ............................................................................

401,880

Nov. 25: Deferred cost of Franchise ................................................

Cash ..............................................................................

179,718

Dec. 31: Cash / AR ..........................................................................

Revenue from CFF ........................................................

(P80,000 X 5%)

4,000

Cash .... ..............................................................................

Notes Receivable...........................................................

200,000

Adjusting Entries:

1) Unearned interest income ..................................................

Interest income............................................................

P598,120 x 20%

2) Cost of Franchise...............................................................

Deferred cost of Franchise..........................................

b.

401,880

1,198,120

179,718

4,000

200,000

119,624

119,624

179,718

179,718

3) Deferred revenue from FF................................................. 1,198,120

Revenue from FF ........................................................

Collection of the note is not reasonably assured.

Jan. 5 to Dec. 31 before adjusting entries Refer to Assumption a.

Dec. 31: Adjusting Entries:

1) Unearned interest income .................................................

Interest income ...........................................................

2) Cost of franchise................................................................

Deferred cost of franchise...........................................

1,198,120

119,624

119,624

179,718

179,718

3) Deferred revenue from FF................................................. 1,198,120

Cost of Franchise ........................................................

Deferred gross profit Franchise ...............................

GPR = 1,018,402 1,198,120 = 85%)

179,718

1,018,402

4) Deferred gross profit Franchise......................................578,319.60

Realized gross profit Franchise................................

(P600,000 + P200,000- P119,624) x 85%

578,319.60

Franchise Accounting

183

Problem 11 3

2012

July 1:

Cash.. ...... ..... .............................................................................. 120,000

Notes Receivable.......................................................................... 320,000

Unearned interest income ......................................................

Deferred revenue from FF .....................................................

Face value of NR.......................................................................... P320,000

Present value (P80,000 x 3.1699)................................................. _253,592

Unearned interest income............................................................. P 66,408

Sept. 1 to

Nov. 15: Deferred cost of franchise ............................................................

Cash .. ..... ..............................................................................

(P50,000 + P30,000)

Dec. 31: Adjusting Entry:

Unearned interest income.............................................................

Interest income ......................................................................

(P253,592 x 10% x 1/2)

80,000

80,000

12,680

12,680

2013

Jan. 10: Deferred cost of franchise ............................................................

Cash .. ..... ..............................................................................

50,000

July 1:

80,000

Cash.. ...... ..... ..............................................................................

Note receivable ......................................................................

Dec. 31: Adjusting Entries:

(1) Cost of franchise ....................................................................

Deferred cost of franchise .................................................

66,408

373,592

50,000

80,000

130,000

130,000

(2) Deferred revenue from FF .....................................................

Revenue from FF...............................................................

373,592

(3) Unearned interest income ......................................................

Interest income ..................................................................

25,360

373,592

25,360

184

Chapter 11

Problem 11 4

2013

Jan. 10: Cash.. ...... ..... .............................................................................. 6,000,000

Deferred revenue from FF. ....................................................

6,000,000

Jan. 10 to

July 15: Franchise expense ........................................................................ 2,250,000

Cash .. ..... ..............................................................................

2,250,000

Deferred revenue from FF............................................................ 4,000,000

Revenue from FF ...................................................................

Initial Franchise fee .....................................................................P6,000,000

Deficiency

Market value of costs (P180,000 90%) x 10 yrs.................( 2,000,000)

Adjusted initial fee (revenue) .......................................................P4,000,000

July 15: (a) Continuing expenses..............................................................

Cash / Accounts payable ...................................................

a)

b)

4,000,000

180,000

(b) Deferred revenue from FF ..................................................... 200,000

Revenue from CFF ............................................................

(P180,000 90%)

Problem 11 5

Adjusted initial franchise fee:

Total initial F.F.............................................................................

Less: Face Market value of kitchen equipment............................

Adjusted initial FF........................................................................

Revenues:

Initial FF.. ..... ..............................................................................

Sale of kitchen equipment ............................................................

Continuing F.F. (P2,000,000 x 2%) .............................................

Total . ...... ..... ..............................................................................

Expenses:

Initial expenses.............................................................................P 500,000

Cost of kitchen equipment............................................................ 1,500,000

Net income..... ..... ..............................................................................

180,000

200,000

P4,500,000

_1,800,000

P2,700,000

P2,700,000

1,800,000

___40,000

4,540,000

_2,000,000

P2,540,000

Journal Entries:

Jan. 2: Cash .. ..... .............................................................................. 1,500,000

Notes receivable..................................................................... 3,000,000

Deferred revenue from FF (adjusted SV)..........................

Revenue from FF (Market value of equipment)................

2,700,000

1,800,000

Cost of kitchen equipment ..................................................... 1,500,000

Kitchen equipment ............................................................

1,500,000

Franchise Accounting

185

Jan. 18: Franchise expense ........................................................................

Cash.... ..............................................................................

500,000

500,000

April 1: Cash ...... ..... ..............................................................................2,000,000

Notes receivable ................................................................

2,000,000

Dec. 31: Cash ...... ..... ..............................................................................1,000,000

Notes receivable ................................................................

1,000,000

Cash / Account receivable............................................................

Revenue from continuing FF.............................................

40,000

40,000

Deferred revenue from FF............................................................ 2,700,000

Revenue from FF...............................................................

2,700,000

Problem 11 6

Recognition of initial franchise fee (IFF) (6 mos. after opening)

Revenue from initial FF:

Total initial FF ..... ..............................................................................P2,500,000

Less: Deficiency in continuing FF (Sch. 1) ........................................ 160,000

Expense (costs of initial services) ...............................................................

Net income .. ... ...... ..... ..............................................................................

Schedule 1 Estimated deficiency in CFF

(1)

Yr. of

Estimated

Contract

Continuing FF

1

P220,000

2

220,000

3

220,000

4

220,000

5

220,000

6

150,000

7

150,000

8

150,000

9

90,000

10

90,000

(2)

Market Value

of Continuing Services

P250,000

250,000

250,000

125,000

125,000

125,000

125,000

125,000

125,000

125,000

2,340,000

__700,000

P1,640,000

(Excess of 2 over 1)

Deficiency

P 30,000

30,000

30,000

35,000

__35,000

P160,000

Recognition of revenue from CFF and costs:

Years 1-3

Revenue from CFF ........................ P250,000

Expenses . ...... ..... ......................... _200,000

Net income..... ..... ......................... P 50,000

Years 4-5

P220,000

_100,000

P120,000

Years 6-8

P150,000

_100,000

P 50,000

Years 9-10

P125,000

_100,000

P 25,000

186

Chapter 11

Problem 11 7

Revenues:

Initial FF (Sch. 1)

Interest income

Continuing FF

Others

Expenses:

Initial expenses

Continuing expense

Others

Net Income

1/12/2008

6/1/2008

7/1/2008

6/30/2009

62,500

80,000

287,200

45,490*

48,000

( 50,000)

P 12,500

( 68,000)

P 12,000

( 70,000)

P217,200

( 36,000)

P 57,490

* P454,900 x 10% = P45,490

Schedule 1: Computation of initial FF to the recognized:

Total initial fee ...... ...................................................................................................

Less:

Interest unearned on the note ........................................................................

Market value of inventory ............................................................................

Market value of equipment ...........................................................................

Deficiency in continuing costs......................................................................

Adjusted initial FF .. ...................................................................................................

A.

B.

P750,000

( 145,100)

( 80,000)

( 62,500

( 175,200)

P287,200

A

B

B

C

Unearned Interest:

Face value of the note ..........................................................................................

Present value (120,000 x 3.7908) ........................................................................

Unearned interest .................................................................................................

P600,000

454,900

P145,100

rounded

Market value of equipment and inventory:

Equipment (P50,000 80%)................................................................................

Inventory... ...... ...................................................................................................

P 62,500

80,000

Income from Sales:

Sales Price. ...... ..........................................

Cost.... ...... ...... ..........................................

Net income ...... ..........................................

C.

Equipment

P62,500

50,000

P12,500

Analysis of Continuing costs:

Market value of costs is P4,000/Mo. or P48,000 / yr.

Continuing Fees:

Years 1-4

Gross revenues ..........................................

P330,000/mo.

Gross fees per month ..................................

P 2,475/mo.

Gross fees per year......................................

Market value of continuing costs ................

Deficiency per year .....................................

Number of years .........................................

Deficiency

..........................................

Total deficiency for 20 years is P175,200

P 29,700

( 48,000)

( 18,300)

x4

P( 73,200)

Inventory

P80,000

68,000

P12,000

Total

P142,500

118,000

P 24,500

Years 5-16

P450,000/mo.

P 3,375/mo.

Years 17-20

P500,000/mo.

P 3,750/mo.

P 40,500

( 48,000)

(

7,500)

x 12

P( 90,000)

P 45,000

( 48,000)

(

3,000)

x4

P( 12,000)

Franchise Accounting

Dates of Revenue Recognition: .....................................................

January 12, 2013 ............................................................

June 1, 2013 ...................................................................

July 1, 2013 ....................................................................

June 30, 2014 .................................................................

187

Types of Revenue

Sale of equipment

Sale of inventory

Initial FF (as adjusted0

Interest income and

continuing revenue.

You might also like

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFDocument190 pagesAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFErica Daprosa50% (2)

- Affidavit of Damage To VehicleDocument2 pagesAffidavit of Damage To VehicleShiela PilarNo ratings yet

- Harding Vs Commercial Union Assurance CoDocument2 pagesHarding Vs Commercial Union Assurance CoShiela Pilar100% (1)

- Affidavit of Damage To VehicleDocument2 pagesAffidavit of Damage To VehicleShiela PilarNo ratings yet

- AFAR Self Test - 9002Document7 pagesAFAR Self Test - 9002Jennifer RueloNo ratings yet

- CHAPTER13 Home Office and Branch - Special ProblemsDocument21 pagesCHAPTER13 Home Office and Branch - Special ProblemsAlgifariAdityaNo ratings yet

- Cpa Review School of The Philippines: Management Advisory Services AGE OFDocument9 pagesCpa Review School of The Philippines: Management Advisory Services AGE OFJohn Carlo CruzNo ratings yet

- Answers - Installment Sales - DayagDocument11 pagesAnswers - Installment Sales - DayagAye Buenaventura75% (16)

- Afar - CVPDocument3 pagesAfar - CVPJoanna Rose Deciar0% (1)

- Procedure For Internal AuditDocument2 pagesProcedure For Internal AuditPaul UwayaNo ratings yet

- Micro Sample Midterm AnsDocument7 pagesMicro Sample Midterm AnsPranjali TripathiNo ratings yet

- FS ExerciseDocument30 pagesFS Exercisesaiful2522No ratings yet

- Evaluation of Strategies Followed by Maruti Suzuki India LTDDocument7 pagesEvaluation of Strategies Followed by Maruti Suzuki India LTDankitmarchNo ratings yet

- Chapter 11 Advance Accounting SolmanDocument12 pagesChapter 11 Advance Accounting SolmanShiela GumamelaNo ratings yet

- CHAPTER 9 Guerrero Installment SalesDocument22 pagesCHAPTER 9 Guerrero Installment SalesMacoy Liceralde50% (6)

- Chapter 5-Advance Accounting (Guerrero)Document23 pagesChapter 5-Advance Accounting (Guerrero)Bianca Jane Maaliw63% (8)

- Chapter 10 Advance Accounting SolmanDocument21 pagesChapter 10 Advance Accounting SolmanShiela Gumamela100% (5)

- Chapter 13 GuerreroDocument40 pagesChapter 13 GuerreroJose Sas100% (2)

- Advance Accounting 2 Chapter 12Document16 pagesAdvance Accounting 2 Chapter 12Mary Joy Domantay0% (2)

- Chapter 18 Cost Accounting.Document19 pagesChapter 18 Cost Accounting.Kheng BinuyaNo ratings yet

- Chapter 17 - Consol. Fs Part 2Document6 pagesChapter 17 - Consol. Fs Part 2PutmehudgJasdNo ratings yet

- Advacc2 Guerrero Chapter 14Document14 pagesAdvacc2 Guerrero Chapter 14jediiik50% (2)

- Advance Accounting 2 by GuerreroDocument14 pagesAdvance Accounting 2 by Guerreromarycayton60% (10)

- Chapter 11Document12 pagesChapter 11Ya LunNo ratings yet

- Multiple Choice Answers and Solutions: Franchise AccountingDocument7 pagesMultiple Choice Answers and Solutions: Franchise Accountingmark_torreonNo ratings yet

- ParDocument4 pagesParLeiann MagnayeNo ratings yet

- Multiple Choice Answers and Solutions: Franchise Accounting 177Document11 pagesMultiple Choice Answers and Solutions: Franchise Accounting 177Mazikeen DeckerNo ratings yet

- Accounting Seminar 16: Team 6Document64 pagesAccounting Seminar 16: Team 6Jerilynn YeoNo ratings yet

- Franchise Accounting: Jovit G. Cain, CPADocument24 pagesFranchise Accounting: Jovit G. Cain, CPAJao FloresNo ratings yet

- PRTC - Final PREBOARD Solution Guide (2 of 2)Document37 pagesPRTC - Final PREBOARD Solution Guide (2 of 2)Anonymous Lih1laaxNo ratings yet

- Income Taxation PPT 6 Passive IncomeDocument10 pagesIncome Taxation PPT 6 Passive Income2023200285No ratings yet

- Solutions Manual: Problem 1 (Partnership Formation) Ans: BDocument12 pagesSolutions Manual: Problem 1 (Partnership Formation) Ans: BJake ManansalaNo ratings yet

- FR 1 Set 1 (Answer Key)Document11 pagesFR 1 Set 1 (Answer Key)Suhani PareekNo ratings yet

- Capital BudgetingDocument21 pagesCapital BudgetingRalph Clarence NicodemusNo ratings yet

- Theories: B. 2 and 3 OnlyDocument5 pagesTheories: B. 2 and 3 OnlyLucille Mae EndigaNo ratings yet

- Chpater 37 - AnswerDocument23 pagesChpater 37 - Answerfrincess laboneteNo ratings yet

- Taxation Material 2Document7 pagesTaxation Material 2Shaira BugayongNo ratings yet

- MCQADVACCDocument27 pagesMCQADVACCJungkookie BaeNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- Fringe Benefits AnswersDocument5 pagesFringe Benefits AnswersJonnah Grace SimpalNo ratings yet

- IV. Assessment QUIZ 1. Instruction: Prepare The 2016 Projected Financial Statement of JSC Foods CorpDocument9 pagesIV. Assessment QUIZ 1. Instruction: Prepare The 2016 Projected Financial Statement of JSC Foods Corpjennie martNo ratings yet

- FinalroundDocument35 pagesFinalroundJenny Keece RaquelNo ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- Multiple Choice ProblemsDocument24 pagesMultiple Choice ProblemsRodeth CeaNo ratings yet

- CH4 Seminar SolutionsDocument3 pagesCH4 Seminar SolutionsrisitsavaniNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- Acctg34 Franchise Pret. Remaining Items AkeyDocument6 pagesAcctg34 Franchise Pret. Remaining Items AkeyDonna Mae SingsonNo ratings yet

- Work Book of Corporate Financial Accounting 23-04-2022Document33 pagesWork Book of Corporate Financial Accounting 23-04-2022SWAPNIL JADHAVNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Chaechapter 7 SolutionsDocument16 pagesChaechapter 7 Solutionsmadddy_hydNo ratings yet

- FL-Answers AFARDocument13 pagesFL-Answers AFARRisalyn BiongNo ratings yet

- 91 - Final Preaboard AFAR Solutions (WEEKENDS)Document9 pages91 - Final Preaboard AFAR Solutions (WEEKENDS)Joris YapNo ratings yet

- New Microsoft Office Excel WorksheetDocument26 pagesNew Microsoft Office Excel WorksheetMac Ferds100% (1)

- Exercises Responsibility Accounting AnswersDocument6 pagesExercises Responsibility Accounting AnswersAlexis Jaina Tinaan100% (1)

- Profitability Ratios: ProblemsDocument5 pagesProfitability Ratios: ProblemsMae Cuizon ComendadorNo ratings yet

- FM Solved PapersDocument83 pagesFM Solved PapersAjabba87% (15)

- Afar by Dr. Ferrer First Preboard Review 85Document4 pagesAfar by Dr. Ferrer First Preboard Review 85Julie Neay AfableNo ratings yet

- Afar by Dr. FerrerDocument4 pagesAfar by Dr. FerrerFrans HechanovaNo ratings yet

- Chapter 14 Exercise 12Document7 pagesChapter 14 Exercise 12freaann03No ratings yet

- Franchise AccountingDocument18 pagesFranchise Accountingforentertainment purposesNo ratings yet

- Lecture 14 - Franchise AccountingDocument8 pagesLecture 14 - Franchise Accountingdavis lizardaNo ratings yet

- Chapter 12 - SolutionsDocument8 pagesChapter 12 - SolutionsShahariar RiasatNo ratings yet

- Afar by Dr. FerrerDocument4 pagesAfar by Dr. FerrerJade GomezNo ratings yet

- Tax Chapter 8 Deduct From Gross IncomeDocument14 pagesTax Chapter 8 Deduct From Gross Incomemacklyn220% (1)

- Solution Chapter 7Document31 pagesSolution Chapter 7P.FabieNo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Ege, Kenneth M. Bsa22A1Document3 pagesEge, Kenneth M. Bsa22A1Kenneth Marcial Ege IINo ratings yet

- Gsis Vs AlcarazDocument3 pagesGsis Vs AlcarazShiela PilarNo ratings yet

- ATTY. ALLAN S. MONTAÑO vs. ATTY. ERNESTO C. VERCELESDocument12 pagesATTY. ALLAN S. MONTAÑO vs. ATTY. ERNESTO C. VERCELESShiela PilarNo ratings yet

- Caneda vs. CADocument8 pagesCaneda vs. CAShiela PilarNo ratings yet

- Taurus Taxi Co Inc v. The Capital Insurance Surety Co IncDocument3 pagesTaurus Taxi Co Inc v. The Capital Insurance Surety Co IncShiela PilarNo ratings yet

- Mallarte v. Court of AppealsDocument3 pagesMallarte v. Court of AppealsShiela PilarNo ratings yet

- Del Rosario v. Equitable Insurance Casualty Co.Document4 pagesDel Rosario v. Equitable Insurance Casualty Co.Shiela PilarNo ratings yet

- Balantakbo v. Court of AppealsDocument7 pagesBalantakbo v. Court of AppealsShiela PilarNo ratings yet

- Balatero v. Intermediate Appellate CourtDocument7 pagesBalatero v. Intermediate Appellate CourtShiela PilarNo ratings yet

- Alliance Tobacco Corp. Inc. v. PhilippineDocument6 pagesAlliance Tobacco Corp. Inc. v. PhilippineShiela PilarNo ratings yet

- Paylago v. JarabeDocument6 pagesPaylago v. JarabeShiela PilarNo ratings yet

- Pasagui v. VillablancaDocument5 pagesPasagui v. VillablancaShiela PilarNo ratings yet

- Servicewide Specialists Inc. v. Court of AppealsDocument2 pagesServicewide Specialists Inc. v. Court of AppealsShiela PilarNo ratings yet

- Edu vs. GomezDocument3 pagesEdu vs. GomezShiela PilarNo ratings yet

- Addison vs. FelixDocument4 pagesAddison vs. FelixShiela PilarNo ratings yet

- Duran vs. Intermediate Appellate CourtDocument3 pagesDuran vs. Intermediate Appellate CourtShiela PilarNo ratings yet

- Philippine Suburban Development Corp. vs. Auditor GeneralDocument8 pagesPhilippine Suburban Development Corp. vs. Auditor GeneralShiela PilarNo ratings yet

- Estate of Litton v. Mendoza & Court of AppealsDocument2 pagesEstate of Litton v. Mendoza & Court of AppealsShiela PilarNo ratings yet

- Paray and Espeleta v. RodriguezDocument4 pagesParay and Espeleta v. RodriguezShiela Pilar100% (1)

- Citibank N.A. & Investors Finance Corporation v. SabenianoDocument1 pageCitibank N.A. & Investors Finance Corporation v. SabenianoShiela Pilar100% (1)

- Acids, Bases and SaltsDocument8 pagesAcids, Bases and SaltsAnonymous TX2OckgiZNo ratings yet

- Financial Ratio Calculator: Income StatementDocument18 pagesFinancial Ratio Calculator: Income StatementPriyal ShahNo ratings yet

- Spicejet TicketDocument2 pagesSpicejet TicketAnonymous qEh0BxrNo ratings yet

- CH 5 SolutionDocument21 pagesCH 5 SolutionJoe MichaelsNo ratings yet

- New Mofussil Bus Terminus at Kelambakkam May Cost Rs 985 Crore - The New Indian ExpressDocument3 pagesNew Mofussil Bus Terminus at Kelambakkam May Cost Rs 985 Crore - The New Indian ExpressgowthamsankarNo ratings yet

- The Ansoff MatrixDocument2 pagesThe Ansoff MatrixBhodzaNo ratings yet

- Multiple Choice QuestionsDocument3 pagesMultiple Choice QuestionsAbdii DhufeeraNo ratings yet

- Beacon BusinessesDocument9 pagesBeacon BusinessesByronNo ratings yet

- The Well-Time Strategy Managing The Business CycleDocument9 pagesThe Well-Time Strategy Managing The Business CycleLejla ArapcicNo ratings yet

- Case Study 1Document2 pagesCase Study 1Ndhs NairNo ratings yet

- GDP, Nominal, Real and GDP DeflatorDocument4 pagesGDP, Nominal, Real and GDP DeflatorDivya RajNo ratings yet

- Build Build Build ProgramDocument2 pagesBuild Build Build Programlanz kristoff rachoNo ratings yet

- Bus 103 AccountingDocument3 pagesBus 103 AccountingDyne Morte0% (1)

- Bus TKTDocument4 pagesBus TKTPrasanna S Kulkarni0% (1)

- Pascack Valley Train LineDocument2 pagesPascack Valley Train Lineacb3434No ratings yet

- Association of Cultural Offices in Philippine Educational Institutions, IncDocument2 pagesAssociation of Cultural Offices in Philippine Educational Institutions, IncChris AgudaNo ratings yet

- International Logistics & Global Supply Chain Management PDFDocument2 pagesInternational Logistics & Global Supply Chain Management PDFSumant Sethi100% (1)

- Business Cycle Measurement (Chapter 3)Document48 pagesBusiness Cycle Measurement (Chapter 3)Teachers OnlineNo ratings yet

- Backus and Johnston BreweryDocument4 pagesBackus and Johnston BreweryCesarElectoDocenteCisNo ratings yet

- SAP FICO Asset Accounting 1Document3 pagesSAP FICO Asset Accounting 1Ananthakumar ANo ratings yet

- Assistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyDocument2 pagesAssistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyKathrynJaneRipleyNo ratings yet

- Iron and Steel Industry in BelgiumDocument3 pagesIron and Steel Industry in BelgiumAvirup Biswas100% (1)

- Bori Ek LyDocument2 pagesBori Ek Lyapi-295828311No ratings yet

- Catholic Syrian BankDocument29 pagesCatholic Syrian BanksherwinmitraNo ratings yet

- Business Plan Template Excel FreeDocument13 pagesBusiness Plan Template Excel FreeUsmanNo ratings yet