Professional Documents

Culture Documents

Financial Plan Word

Financial Plan Word

Uploaded by

api-300132327Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Plan Word

Financial Plan Word

Uploaded by

api-300132327Copyright:

Available Formats

Financial Plan

A. Your Pricing Plan: Our prices match our competitors store. Stomping

Grounds is in the main building close to the cafeteria at the high school.

The competitors are charging the same amount of money for the same goods

we sell. Costumers will pretty much pay the same amount at Elephant

Central, the vending machines and Stomping Grounds.

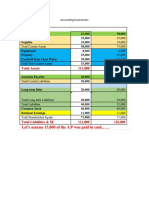

B. Sales Revenue Forecast: In a month we made at least $200, by the end of

the school year, we should have made around $2000.

C. Major Costs: All of our money goes back to the school store since the

employees do not get paid. The money gets spent for more and newer

supplies for the school store.

D. Break-Even Analysis: Our monthly sales are around $300. We have a

break-even of a $100 since we make about $200 in profit monthly.

E. Debt/Equity Investment Needed: We needed $500 to get started that we

received from Stomping Grounds.

F. Use of Investment and Equity Capital: Instead of Elephant Central taking

out a loan of $500 from a bank, Stomping Grounds gives us $500 dollars

for the start.

G. Return to Investor: Our only investor is the school store on the main

campus called, Stomping Grounds. They will receive their money that

Elephant Central borrowed which is $500.

H. Exit Strategy: To close Elephant Central, we would have to sell

everything that is in the store and pay off the debt that we owe.

You might also like

- Ndividual Ssignment AnagementDocument5 pagesNdividual Ssignment AnagementJoel Christian MascariñaNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Worksheet 2 - Accounting and Economic ProfitDocument3 pagesWorksheet 2 - Accounting and Economic ProfitRuchika100% (2)

- Sample PaperDocument8 pagesSample Paperneilpatrel31No ratings yet

- EconomicsDocument1 pageEconomicsAnonymous 7Un6mnqJzN100% (1)

- Financial PlanDocument1 pageFinancial Planapi-270611498No ratings yet

- Financial Plan2Document1 pageFinancial Plan2api-270507542No ratings yet

- Financialplan 2Document1 pageFinancialplan 2api-270697924No ratings yet

- ACG 2071 - Managerial Accounting Study Probes - Chapter 2 SOLUTIONDocument6 pagesACG 2071 - Managerial Accounting Study Probes - Chapter 2 SOLUTIONShoniqua JohnsonNo ratings yet

- Financial Strategy and Financial Objectives: "Running by The Numbers"Document13 pagesFinancial Strategy and Financial Objectives: "Running by The Numbers"Dr-Komal S TanejaNo ratings yet

- 2 in Order To Achieve A Competitive AdvantageDocument2 pages2 in Order To Achieve A Competitive AdvantagekimkimberlyNo ratings yet

- Principles of Economics 6th Edition Frank Test Bank 1Document89 pagesPrinciples of Economics 6th Edition Frank Test Bank 1penelope100% (53)

- The FinancialsDocument11 pagesThe Financialsapi-661653599No ratings yet

- Theory of Cost and ProfitDocument22 pagesTheory of Cost and ProfitCRESTINE JOYCE DELA CRUZNo ratings yet

- Profit and LossDocument2 pagesProfit and LossGaurav JhaNo ratings yet

- Ap COSTSDocument4 pagesAp COSTSferNo ratings yet

- As Q2 ENTREP AS2 Week 3 and 4 Approved 12-7-21Document6 pagesAs Q2 ENTREP AS2 Week 3 and 4 Approved 12-7-21Shiela Mae CeredonNo ratings yet

- Chapter 1 QS - StudDocument7 pagesChapter 1 QS - StudCw ChenNo ratings yet

- Cambridge Wordfest - Financial FeasibilityDocument4 pagesCambridge Wordfest - Financial FeasibilityArvinte GiorgianaNo ratings yet

- Principles of Microeconomics Brief Edition 3Rd Edition Frank Test Bank Full Chapter PDFDocument61 pagesPrinciples of Microeconomics Brief Edition 3Rd Edition Frank Test Bank Full Chapter PDFphenicboxironicu9100% (11)

- Principles of Microeconomics 6th Edition Frank Test BankDocument38 pagesPrinciples of Microeconomics 6th Edition Frank Test Bankjaydenwells3w8100% (21)

- BM Module 1 CommissionsDocument15 pagesBM Module 1 CommissionsHp laptop sorianoNo ratings yet

- Entrepreneurship: Quarter 2 - Module 7 Forecasting Revenues and CostsDocument27 pagesEntrepreneurship: Quarter 2 - Module 7 Forecasting Revenues and CostsIra Jane CaballeroNo ratings yet

- Chapter 1 QSDocument4 pagesChapter 1 QSCw ChenNo ratings yet

- Latihan UAS Manacc TUTORKU (Answered)Document10 pagesLatihan UAS Manacc TUTORKU (Answered)Della BianchiNo ratings yet

- Accounting Exam Notes PDFDocument9 pagesAccounting Exam Notes PDFJohnson ParkNo ratings yet

- Unit 3 GoodwillitsvaluationDocument21 pagesUnit 3 GoodwillitsvaluationMir AqibNo ratings yet

- FINAN204-21A - Tutorial 2 Week 2Document13 pagesFINAN204-21A - Tutorial 2 Week 2Danae YangNo ratings yet

- Golden Drop: Mark Behrmann Barbara Reis Kayleen OlivasDocument5 pagesGolden Drop: Mark Behrmann Barbara Reis Kayleen OlivasBarbara ReisNo ratings yet

- Homework Chap 26 PDFDocument4 pagesHomework Chap 26 PDFAn leeNo ratings yet

- BUS - MATH 11 Q1 Module 6Document21 pagesBUS - MATH 11 Q1 Module 6Angel Lou DalugduganNo ratings yet

- Ebook Corporate Finance 9Th Edition Ross Test Bank Full Chapter PDFDocument67 pagesEbook Corporate Finance 9Th Edition Ross Test Bank Full Chapter PDFquachhaitpit100% (9)

- Tutorial Week 2 SolutionDocument13 pagesTutorial Week 2 SolutionXiaohan LuNo ratings yet

- Financial Plan: 1. PayrollDocument3 pagesFinancial Plan: 1. Payrollle nghiNo ratings yet

- Chapter 03Document12 pagesChapter 03Asim NazirNo ratings yet

- Business ProposalDocument9 pagesBusiness ProposalAminah FarazNo ratings yet

- PEC (Partner E-Commerce) : Brand Drop-Shipping CompanyDocument27 pagesPEC (Partner E-Commerce) : Brand Drop-Shipping Companyw7r52cbfdfNo ratings yet

- Principles of Economics A Streamlined Approach 3Rd Edition Frank Test Bank Full Chapter PDFDocument36 pagesPrinciples of Economics A Streamlined Approach 3Rd Edition Frank Test Bank Full Chapter PDFdonna.vanauker351100% (17)

- Lesson Number: 9 Topic: Costs of Production: Course Code and Title: BACR2 Basic MicroeconomicsDocument10 pagesLesson Number: 9 Topic: Costs of Production: Course Code and Title: BACR2 Basic MicroeconomicsVirgie OrtizNo ratings yet

- Econ 1 Final Fall 2011 UCSDDocument10 pagesEcon 1 Final Fall 2011 UCSDgradiansNo ratings yet

- Economics in Modules 3rd Edition Krugman Solutions ManualDocument24 pagesEconomics in Modules 3rd Edition Krugman Solutions Manualshannonswansonga0a100% (18)

- Sample Activities For Financial MathematicsDocument3 pagesSample Activities For Financial MathematicsAlexa Daphne M. EquisabalNo ratings yet

- Costs, Revenue and ProfitDocument10 pagesCosts, Revenue and Profitemma_nationNo ratings yet

- TERREL DAVIS - Test 3Document13 pagesTERREL DAVIS - Test 3KEVIN GORDONNo ratings yet

- Foundations of Engineering EconomyDocument50 pagesFoundations of Engineering EconomyOrangeNo ratings yet

- Break Even Point ExampleDocument10 pagesBreak Even Point Examplerakesh varmaNo ratings yet

- Consumer ArithmeticDocument40 pagesConsumer ArithmeticShannon SmithNo ratings yet

- PDF Test Bank For Microeconomics 12Th Canadian Edition Mcconnell Online Ebook Full ChapterDocument86 pagesPDF Test Bank For Microeconomics 12Th Canadian Edition Mcconnell Online Ebook Full Chapterfrankie.politte129100% (2)

- Unit 7 Finance: Costs and BreakevenDocument15 pagesUnit 7 Finance: Costs and BreakevenkobeadjordanNo ratings yet

- 102 Bmidterm 2Document19 pages102 Bmidterm 2grrarrNo ratings yet

- Forecasting Revenues and Cost IncurredDocument30 pagesForecasting Revenues and Cost Incurredjenleihoneymagdua-stemNo ratings yet

- QUIZ AKL - I Semester I TA 2019/2020Document6 pagesQUIZ AKL - I Semester I TA 2019/2020Bob Ahsan FikaNo ratings yet

- Duplicate Technical Problems: Mcgraw-Hill EducationDocument3 pagesDuplicate Technical Problems: Mcgraw-Hill EducationErma CaseñasNo ratings yet

- Financial AnalysisDocument4 pagesFinancial AnalysisMario EnriqueNo ratings yet

- EconomicsDocument1 pageEconomicsAnonymous 7Un6mnqJzNNo ratings yet

- Finanzas I - C03 - Valor Presente y Objetivos CorporativosDocument39 pagesFinanzas I - C03 - Valor Presente y Objetivos CorporativosKatherine V. GarcíaNo ratings yet

- Principles of Microeconomics Brief Edition 3rd Edition Frank Solutions ManualDocument37 pagesPrinciples of Microeconomics Brief Edition 3rd Edition Frank Solutions Manualjaydenwells3w8100% (14)

- Business MathematicsDocument2 pagesBusiness Mathematicsmanuel gallosNo ratings yet

- 26 MacroDocument4 pages26 MacroVu Thao NguyenNo ratings yet

- Capital Budgeting Part-1Document3 pagesCapital Budgeting Part-1Omar FarukNo ratings yet

- Balance SheetDocument1 pageBalance Sheetapi-300132327No ratings yet

- Product Price List: DATE: - Completed ByDocument13 pagesProduct Price List: DATE: - Completed Byapi-300132327No ratings yet

- Operations DraftDocument2 pagesOperations Draftapi-300132327No ratings yet

- Business CardDocument1 pageBusiness Cardapi-300132327No ratings yet