Professional Documents

Culture Documents

Credit Rating Article

Uploaded by

ashek ishtiak haqCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Rating Article

Uploaded by

ashek ishtiak haqCopyright:

Available Formats

New Age | Newspaper

Page 1 of 3

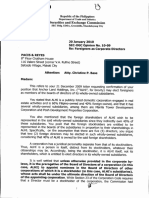

Home | OP-ED | Can credit rating be panacea for the SME industry?

Admin

19/01/2011 23:39:00

Can credit rating be panacea for the

SME industry?

Font size:

by Ashek Ishtiak Haq

ACCESS to finance has always ranked high in any survey that tried to find out the key hindrance to the

development of small and medium enterprises. Inability to access finance may be one of the reasons

why we do not see a robust correlation between SME prevalence and economic growth, says the World

Bank. A MIDAS survey in 2004 found that only 18 per cent of the total funding for the SMEs is coming

from the banking channel. Numerous microfinance institutions have emerged to lend money to the

hardcore poor (whether it has done them any good is a debate we will not get into) and, at the same

time, large corporations continue to be pampered by a crowded banking industry. Although SMEs

consist of 90 per cent of all enterprises, provide employment for 87 per cent of the total industrial

labour force (40 per cent of total population), contribute 25 per cent of the total GDP (Tk 741 billion in

2003), it draws only 20.17 per cent of the total loan disbursed.

Bankers consider SME a profitable sector which records high in credit risk. Regulators on the other

hand think its a winning formula to create employment opportunity (a 2005 study by the World Bank

found that almost 48 per cent of employment in low-income countries is generated by the informal

economy and SMEs), eradicate poverty (SMEs provide three quarters or more of the household income

in both urban and rural areas in Bangladesh) and technology transfer. The regulators who generally

appear reticent to most of the issues have in fact adopted a more gung-ho approach towards the

development of SMEs. Efforts such as the establishment of the SME Foundation, creating a Tk 665

crore SME refinancing fund in the Bangladesh Bank (Tk 1,541 crore has been refinanced up to April

2010), adopting a SME Credit Policy (the central bank set a target to disburse Tk 240 billion worth of

loan for the SMEs), and opening up an SME department in the central bank are definitely laudable.

Banks have enough reason to enter these segments, because, through financing SMEs, they can move

into a huge untapped market, earn higher interest spread (six per cent), diversify their portfolio, access

refinancing facilities, realise the yield and growth potential, comply with the regulations put forward by

regulators, and earn CSR brownie points. However, SME financing is not a walk in the park as some

might have imagined in the beginning. The industry has its own challenges and peculiarity. The sheer

http://newagebd.com/newspaper1/op-ed/5692.html

1/20/2011

New Age | Newspaper

Page 2 of 3

size and the lack of information make it a daunting task for anybody to sort out the real, deserving

candidates from the unwanted ones. A clear-cut effort has not been made to identify the multiple needs

of the multiple segments. To cater to them a common practice is to design one size fits all products

which often appear wanting in fulfilling SME needs. The SME ecosystem presents unique demand on

the skill set of banks and financial institutions because of the assumption-based accounting practices

they need to adopt, increased dependence on close monitoring they need to implement, absence of

industry benchmarks necessary to properly analyze loan proposals, and lack of the information that

would have helped them form proper industry understanding. Because of the unstructured nature of

the business and lack of professionalism, most entrepreneurs tend to dip into the financing of the

business for personal use.

The greatest challenge for the financial institutions is to create enough ground for the SMEs to get the

loan, as they often fail to provide the much needed financial information that are needed to assess their

riskiness, credit needs, collateral requirements and other credit requirements. To overcome these

challenges, FIs have adopted their own method to assess the SMEs financial health. In the absence of

proper book of accounts, one common practice is to extrapolate the whole years performance (profit

and loss accounts, balance sheet etc) from some basic seasonal numbers. Another more conservative

approach is to depend wholly on the ventures bank statement to make credit decisions. This approach

is much better than the previous one because it is based on institutional data that is easily verifiable.

However, this makes loan procurement impossible for a new venture or for a venture that doesnt

maintain any bank account.

These factors not only lead to a harder access to finance regime but also increase the amount of nonperforming SME loans. In the absence of real data, lets assume that 20 per cent (same as the

percentage of SME loan compared to total loan) of the total FI industrys Non Performing Loan is

coming from SME. This means that, by a very simplistic assumption, SMEs contribution to the

industrys total NPL can be Tk 48.2 billion. SME credit rating can play a pivotal role in saving at least a

portion of this amount by identifying the level of real risk behind each SME case.

The concept of credit rating is quite common in the financial world, but the Bangladeshi SME

ecosystem is yet to open up to the idea. A credit rating estimates an entitys credit worthiness. It is an

evaluation made by a credit bureau or agency (one needs a license from the Securities and Exchange

Commission to operate an agency) by making a detailed analysis of the borrowers credit history. The

general idea is to run the financial data through an analytical model that delivers a risk matrix resulting

in an accurate assessment of the ventures risk level.

A credit rating by an independent agency has a lot of virtues. First, by decreasing the turnaround time

for risk assessment it will speed up the loan disbursement process. Second, the rating will reduce the

subjectivity associated with FIs internal credit assessment process. Third, it will enable FIs to identify

the key risk factors of a venture; facilitating the setting up of a relevant covenant and adopting right

credit enhancement measures. Fourth, basing on risk level, FIs will be able to reward an SME with

http://newagebd.com/newspaper1/op-ed/5692.html

1/20/2011

New Age | Newspaper

Page 3 of 3

lower interest rate or penalise it by increasing it. Fifth, it will provide a neutral, third-party and

unbiased opinion on the borrower. Sixth, a rating model that is dynamic enough to assess industrial risk

factors will churn out ratings that will serve to mitigate not only business risk but also industry-specific

risk. Seventh, it is possible to gear up the model to assess location-specific risk factors, enabling it to

mitigate geographical risk. Eighth, the benchmark set for each sub-sector by the agency will help shed

some light on the data vacuum in which the FIs have to operate. Ninth, the authentication of the SMEs

key documents by the rating agency will save FIs time and effort. Tenth, the rating will help FIs to

simplify their lending norms.

Benefits of SME credit rating do not end with the FIs; it has utility for the SMEs as well. For the first

time, with the aid of credit rating, SMEs will be able to shop around for better credit terms. SMEs with

good ratings will be able to enjoy a relaxed collateral requirement and will find it easier to raise

adequate capital. Through a comprehensive rating report, SMEs will be able to find out the

shortcomings in the business model and take corrective measures. The rating will immediately enhance

the SMEs credibility and acceptance among the FIs. It will help them to gain the trust of the

international trade community and will also make the enlistment with the

customers/vendors/lenders/investors much easier.

SME focused credit rating agencies are operating successfully around the world (DP Credit Rating

Singapore, Credit Bureau Malaysia etc). One bright example is the SME Rating Agency of India

Limited, jointly established by Small Industries Development Bank of India, Dun & Bradstreet India

and several leading banks. This award winning agency is Indias first rating agency to focus solely on the

Indian Micro, Small and Medium Enterprises segment. So far SMERA has given rating to 8,200

MSMES.

By signing the BASEL II regime, Bangladesh Bank has clearly agreed that a bank has to keep 125 per

cent provision for loans without credit rating versus only 50 percent for rated firms. So in future rating

of SME will be a reality that everybody has to adhere by. However, if credit rating becomes mandatory

for SMEs, it will impose additional cost on them. Considering the cost saving it can bring for the

industry, regulators (the government, SMEF, industries ministry etc) may contemplate subsidising the

fee for the SMEs (for example, the government of India initially bore with the aid of the foreign

donors 75 per cent of the SMEs rating fee). SME rating has utility that no one can deny and, to ensure

the necessary evolution of the SME ecosystem, it has to be introduced in a comprehensive manner with

proper regulatory support.

____________________________

Ashek Ishtiak Haq is an analyst with a masters degree in business administration from the Institute of

Business Administration at Dhaka University and currently enrolled for the level 2 exam of CFA.

ashanto123@yahoo.com.

http://newagebd.com/newspaper1/op-ed/5692.html

1/20/2011

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- SME Credit RatingDocument3 pagesSME Credit Ratingashek ishtiak haq100% (1)

- Skip To Job Description Skip To Job Tools Resume Jobs Career ResourcesDocument6 pagesSkip To Job Description Skip To Job Tools Resume Jobs Career Resourcesashek ishtiak haqNo ratings yet

- BSRM Steels LimitedDocument2 pagesBSRM Steels Limitedashek ishtiak haqNo ratings yet

- The Ecstasy of GoldDocument3 pagesThe Ecstasy of Goldashek ishtiak haqNo ratings yet

- Doing Agribusiness in BangladeshDocument20 pagesDoing Agribusiness in Bangladeshashek ishtiak haqNo ratings yet

- Dont Die Before Watching These 100 MoviesDocument102 pagesDont Die Before Watching These 100 Moviesashek ishtiak haqNo ratings yet

- 12 Angry Men (1957)Document21 pages12 Angry Men (1957)ashek ishtiak haqNo ratings yet

- At Capital Weekly 7 December 2008Document24 pagesAt Capital Weekly 7 December 2008ashek ishtiak haqNo ratings yet

- Bangladesh Business Second IssueDocument56 pagesBangladesh Business Second Issueashek ishtiak haq100% (4)

- Overview of The Economic Activities of Bangladesh in 2009Document8 pagesOverview of The Economic Activities of Bangladesh in 2009ashek ishtiak haqNo ratings yet

- Major Problems Faced by Businesses in Rural and Urban BangladeshDocument4 pagesMajor Problems Faced by Businesses in Rural and Urban Bangladeshashek ishtiak haq83% (18)

- At Capital Weekly 4 January 2009Document20 pagesAt Capital Weekly 4 January 2009aliimamNo ratings yet

- The Review of The Investment Policies of BangladeshDocument30 pagesThe Review of The Investment Policies of Bangladeshashek ishtiak haq100% (8)

- At Capital Weekly 08 September 2008Document23 pagesAt Capital Weekly 08 September 2008ashek ishtiak haqNo ratings yet

- At Capital Weekly 29 September 2008Document30 pagesAt Capital Weekly 29 September 2008ashek ishtiak haq100% (2)

- At Capital Weekly 22 September 2008Document25 pagesAt Capital Weekly 22 September 2008ashek ishtiak haqNo ratings yet

- At Capital Weekly July 07Document22 pagesAt Capital Weekly July 07ashek ishtiak haqNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Example 2 Find Revenue With One PriceDocument28 pagesExample 2 Find Revenue With One PriceramanNo ratings yet

- LTIF NewsletterDocument11 pagesLTIF NewslettergattacaNo ratings yet

- Project Feasibility Study: Rajendra ResortDocument23 pagesProject Feasibility Study: Rajendra ResortMELVIN A SNo ratings yet

- Project On Credit Scheme Offered by State Bank of India and HDFC Bank in Coimbatore CityDocument63 pagesProject On Credit Scheme Offered by State Bank of India and HDFC Bank in Coimbatore Cityprakalya100% (1)

- Section 5Document2 pagesSection 5Walid Mohamed AnwarNo ratings yet

- Zumbro Shopper 49Document12 pagesZumbro Shopper 49Kristina HicksNo ratings yet

- Project CMA SPDocument34 pagesProject CMA SPalponseNo ratings yet

- Feasibility Study of Diethyl Sulfate ProductionDocument3 pagesFeasibility Study of Diethyl Sulfate ProductionIntratec SolutionsNo ratings yet

- Securities and Exchange Commission: Department of Trade and Industry SEC Bldg. EDSA, Greenhills, Mandaluyong CityDocument3 pagesSecurities and Exchange Commission: Department of Trade and Industry SEC Bldg. EDSA, Greenhills, Mandaluyong CityJakko MalutaoNo ratings yet

- Substantive Tests ApplicationDocument5 pagesSubstantive Tests ApplicationdNo ratings yet

- Note 2Document7 pagesNote 2faizoolNo ratings yet

- Securities Market in India: References: Ramesh Singh, Mishra and Puri, NCERTDocument10 pagesSecurities Market in India: References: Ramesh Singh, Mishra and Puri, NCERTridhiNo ratings yet

- VP Finance Controller CFO in Cincinnati OH Resume Jerome StanislawDocument2 pagesVP Finance Controller CFO in Cincinnati OH Resume Jerome StanislawJeromeStanislawNo ratings yet

- United Planters Sugar Milling Vs CA Full TextDocument7 pagesUnited Planters Sugar Milling Vs CA Full TextJennifer StoneNo ratings yet

- International BankingDocument25 pagesInternational Bankingvikas nabikNo ratings yet

- Energy Pro USA - Executive SummaryDocument7 pagesEnergy Pro USA - Executive SummaryS. Michael Ratteree100% (2)

- Course Syllabus & Schedule: ACC 202 - I ADocument8 pagesCourse Syllabus & Schedule: ACC 202 - I Aapi-291790077No ratings yet

- Risk & ReturnDocument26 pagesRisk & ReturnAmit RoyNo ratings yet

- Finalexam Shd2213shad2043 Pengurusan Kewangan Semester1sesi20122013Document6 pagesFinalexam Shd2213shad2043 Pengurusan Kewangan Semester1sesi20122013Noor Wahida SulaimanNo ratings yet

- Securities Regulations Law OutlineDocument32 pagesSecurities Regulations Law Outlinetwbrown1220100% (2)

- Earnings Management and Creative AccountingDocument13 pagesEarnings Management and Creative Accountingjaclyn3kohNo ratings yet

- Summary of The Book "How Innovation Really Works" BY Anne Marie KnottDocument18 pagesSummary of The Book "How Innovation Really Works" BY Anne Marie Knottaziz fuadiNo ratings yet

- General Instructions: Stock Corporation: General Information Sheet (Gis)Document9 pagesGeneral Instructions: Stock Corporation: General Information Sheet (Gis)Deo Paolo Marciano HermoNo ratings yet

- India's Economic Performance - Globalisation As Its Key DriveDocument16 pagesIndia's Economic Performance - Globalisation As Its Key DriveludovicoNo ratings yet

- Marketing ManagementDocument21 pagesMarketing ManagementAnonymous mcfjOENo ratings yet

- GreenTech Automotive Confidential Private Placement MemorandumDocument71 pagesGreenTech Automotive Confidential Private Placement MemorandumDavid Herron100% (1)

- Bancassurance ModelsDocument2 pagesBancassurance ModelsAzade Zakeri100% (3)

- Chapter 7 Naked EconomicsDocument34 pagesChapter 7 Naked EconomicsIker EspañaNo ratings yet

- AirBlue ReportDocument7 pagesAirBlue Reportzohaibalibutt0% (1)