Professional Documents

Culture Documents

Withholding

Uploaded by

Kitip Katherine Hernandez0 ratings0% found this document useful (0 votes)

11 views1 pageWithholding

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWithholding

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageWithholding

Uploaded by

Kitip Katherine HernandezWithholding

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

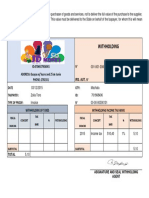

WITHHOLDING is the obligation of the purchaser of goods and services, not to deliver the full value of the purchase

to the supplier,

but to keep or retain a percentage in taxes. This value must be delivered to the State on behalf of the taxpayer, for whom this will mean

withholding prepayment or advance taxes.

WITHHOLDING

ID:0706927936001

ADDRESS: Guayas e/ Sucre and 25 de Junio

PHONE: 2792331

001-001-000000010

IRS. AUT. N

1117551590

DATE

03/12/2015

CITY:

Machala

TAXPAYER :

Zoila Toro

ID:

701868406

TYPE OF PROOF:

Invoice

00-00-00000101

FISCAL

CONCEPT

TAX WITHHOLDING

TAX

EXERCISE

BASE

WITHHOLDING

FISCAL

EXERCISE

2015

SUBTOTAL

TOTAL

SUBTOTAL

INCOME TAX WITHHOLDING

TAX

CONCEPT

%

BASE

Income tax

510,40

1%

WITHHOLDING

5,10

5,10

5,10

ASIGNATURE AND SEAL OF THE

WITHHOLDING AGENT

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cash Flow StatementDocument1 pageCash Flow StatementKitip Katherine HernandezNo ratings yet

- Sales ReportDocument1 pageSales ReportKitip Katherine HernandezNo ratings yet

- JD Money Balance Sheet From January 01 To December 31, 2015 (In Dollars)Document1 pageJD Money Balance Sheet From January 01 To December 31, 2015 (In Dollars)Kitip Katherine HernandezNo ratings yet

- Income StatementDocument1 pageIncome StatementKitip Katherine HernandezNo ratings yet

- Responsibilities For Each Member of The Accounting Office: Mayra Carche PadillaDocument2 pagesResponsibilities For Each Member of The Accounting Office: Mayra Carche PadillaKitip Katherine HernandezNo ratings yet

- General Ledger PostingDocument5 pagesGeneral Ledger PostingKitip Katherine HernandezNo ratings yet

- Accounting JournalDocument2 pagesAccounting JournalKitip Katherine HernandezNo ratings yet

- General Ledger PostingDocument5 pagesGeneral Ledger PostingKitip Katherine HernandezNo ratings yet

- PayrollDocument1 pagePayrollKitip Katherine HernandezNo ratings yet

- Responsibilities For Each Member of The Accounting Office: Mayra Carche PadillaDocument1 pageResponsibilities For Each Member of The Accounting Office: Mayra Carche PadillaKitip Katherine HernandezNo ratings yet

- Sales ReportDocument1 pageSales ReportKitip Katherine HernandezNo ratings yet

- ProjectDocument34 pagesProjectKitip Katherine HernandezNo ratings yet

- VocabularyDocument2 pagesVocabularyKitip Katherine HernandezNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow StatementKitip Katherine HernandezNo ratings yet

- Balance Sheet: JD Money Balance Sheet From 01 December 2015 (In Dollars)Document1 pageBalance Sheet: JD Money Balance Sheet From 01 December 2015 (In Dollars)Kitip Katherine HernandezNo ratings yet

- InvoiceDocument1 pageInvoiceKitip Katherine HernandezNo ratings yet

- WithholdingDocument1 pageWithholdingKitip Katherine HernandezNo ratings yet

- Income StatementDocument1 pageIncome StatementKitip Katherine HernandezNo ratings yet

- PayrollDocument1 pagePayrollKitip Katherine HernandezNo ratings yet

- Wanted BookkeepersDocument2 pagesWanted BookkeepersKitip Katherine HernandezNo ratings yet

- Responsibilities For Each Member of The Accounting OfficeDocument1 pageResponsibilities For Each Member of The Accounting OfficeKitip Katherine HernandezNo ratings yet

- Accounting Project-Techinical EnglishDocument1 pageAccounting Project-Techinical EnglishKitip Katherine HernandezNo ratings yet

- IntroductionDocument1 pageIntroductionKitip Katherine HernandezNo ratings yet