Professional Documents

Culture Documents

Ifil Islamic MF 12-13

Uploaded by

Dhoni KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ifil Islamic MF 12-13

Uploaded by

Dhoni KhanCopyright:

Available Formats

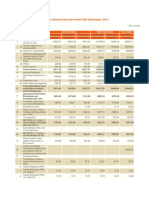

IFIL ISLAMIC MUTUAL FUND-1

Asset Manager: ICB Asset Management Company Limited

BDBL Building (Level-17), 8, Rajuk Avenue, Dhaka-1000.

In terms of the Rule 69 of the wmwKDwiwUR I GP Kwgkb (wgDPzqvj dv) wewagvjv 2001, the yearly audited accounts of the

IFIL Islamic Mutual Fund-1 for the period ended 30 June 2013 are appended below:

STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2013

2012-13

2011-12

ASSETS:

Taka

Taka

Marketable securities- at cost

Bank balances

Other current assets

1,056,422,278

15,203,455

4,157,122

Total Assets

CAPITAL AND LIABILITIES:

1,075,782,855

Capital

Retained earnings

Current liabilities and provisions

1,000,000,000

18,747,614

57,035,241

Total Capital and Liabilities

1,075,782,855

INCOME:

1,062,201,924

1,000,000,000

18,747,614

43,454,310

1,062,201,924

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 30 JUNE 2013

2012-13

Taka

Profit on Sale of Investment

Dividend from investment in shares

Profit on bank deposits and bonds

Other income

1,043,951,086

15,166,924

3,083,914

2011-12

Taka

11,625,995

16,194,167

1,525,759

-

16,862,939

17,205,268

2,463,339

95,135

29,345,921

36,626,681

11,283,160

1,000,000

739,153

1,000,000

190,000

15,750

75,000

286,844

11,992,979

1,000,000

787,864

1,000,000

190,000

26,125

15,000

353,544

14,589,907

14,756,014

888,646

13,867,368

15,365,512

21,261,169

1,410,650

19,850,519

Net profit for the year

Earnings Per Unit

Total Income

EXPENSES:

Management Fee

Trusteeship Fee

Custodian Fee

Annual Fee

Listing fee

Audit Fee

Shariah board director Fee

Other Operating Expenses

Total Expenses

Profit before provision

Provision for interest against dividend

Provision against Marketable Securities

STATEMENT OF CASH FLOW

FOR THE YEAR ENDED 30 JUNE 2013

2012-13

CASH FLOW FROM OPERATING ACTIVITIES:

Taka

2011-12

Taka

Dividend from investment in shares

Profit on bank deposits and bonds

Other income

Expenses

15,109,580

1,528,578

(15,729,784)

17,503,324

2,607,506

95,135

(11,989,648)

908,374

8,216,317

(130,430,489)

129,593,959

(201,005,515)

125,159,837

Net Cash Used in Investment Activities

CASH FLOWS FROM FINANCING ACTIVITIES:

(836,530)

(75,845,678)

Other liabilities (Share money deposit and others)

(30,000)

(340,000)

(30,000)

41,844

(340,000)

(67,969,361)

15,161,611

83,130,972

15,203,455

15,161,611

Net Cash from Operating Activities

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of marketable securities

Sales of marketable securities

Net Cash from Financing Activities

Net Increase in Cash

Opening cash and bank balance

Closing cash and bank balance

General Information:

Sponsor

Islamic Finance & Investment Limited

Trustee

Investment Corporation of Bangladesh

Custodian

Investment Corporation of Bangladesh

Auditor

Rahman Mostafa Alam & Co.

Banker

Shahjalal Islamic Bank Ltd, Motijheel Branch. Dhaka.

Other Financial Information:

2012-13

2011-12

Earnings Per Unit

Tk. 0

Tk. 0

Net Asset Value (NAV) Per Unit

Tk. 10.59

Tk. 10.45

At Cost Price

Tk. 7.99

Tk. 7.59

At market Price

The Trustee Committee did not recommend any dividend for the FY 2012-2013.

The detailed annual report is available for inspection at the Head Office of ICB Asset Management Company Ltd.

Interested Investors can collect a copy of annual report on payment of Tk. 20.00 only.

Sd/Md. Alauddin Khan

Chief Executive Officer

You might also like

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Notes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Document10 pagesNotes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Arafath CholasseryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Samba Statements 11 +12Document46 pagesSamba Statements 11 +12Shyair GanglaniNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- IDB Financial Statements 2009Document68 pagesIDB Financial Statements 2009tjl84No ratings yet

- Beximco Hy2014Document2 pagesBeximco Hy2014Md Saiful Islam KhanNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Document16 pagesStandalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- UBL Financial Statement AnalysisDocument17 pagesUBL Financial Statement AnalysisJamal GillNo ratings yet

- Balance Sheet Analysis 2013-2012Document2 pagesBalance Sheet Analysis 2013-2012Syed Nabeel Hassan JafferyNo ratings yet

- United Bank Limited: Consolidated Condensed Interim Financial StatementsDocument19 pagesUnited Bank Limited: Consolidated Condensed Interim Financial StatementsMuhammad HassanNo ratings yet

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- INTERIM FINANCIALSDocument44 pagesINTERIM FINANCIALS2friendNo ratings yet

- Ar 11 pt03Document112 pagesAr 11 pt03Muneeb ShahidNo ratings yet

- Development Bank of MongoliaDocument68 pagesDevelopment Bank of MongoliasodbayargNo ratings yet

- Financial Statements June 2012 Paper Ad 3rd ProofDocument1 pageFinancial Statements June 2012 Paper Ad 3rd ProofArman Hossain WarsiNo ratings yet

- Balance Sheet Analysis June 2013Document1 pageBalance Sheet Analysis June 2013abrofab123No ratings yet

- Central Bank of Eutopia Statement of Financial Position (Continued.)Document0 pagesCentral Bank of Eutopia Statement of Financial Position (Continued.)Sanath FernandoNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- 4.JBSL AccountsDocument8 pages4.JBSL AccountsArman Hossain WarsiNo ratings yet

- DemonstraDocument74 pagesDemonstraFibriaRINo ratings yet

- 3Q14 Financial StatementsDocument58 pages3Q14 Financial StatementsFibriaRINo ratings yet

- S H D I: Untrust OME Evelopers, NCDocument25 pagesS H D I: Untrust OME Evelopers, NCfjl300No ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- Unaudited Financial Results Q2 2014Document4 pagesUnaudited Financial Results Q2 2014Dhruba DebnathNo ratings yet

- Balance Sheet: Notes 2010 Taka 2009 TakaDocument5 pagesBalance Sheet: Notes 2010 Taka 2009 TakaThushara SilvaNo ratings yet

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocument14 pagesASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)No ratings yet

- Universal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFDocument27 pagesUniversal Tech - Final Result Announcement For The Year Ended 31 December 2012 PDFalan888No ratings yet

- Airbus Annual ReportDocument201 pagesAirbus Annual ReportfsdfsdfsNo ratings yet

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDocument8 pagesJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNo ratings yet

- PCC - Financial Stahtements 2013 - Final by RashidDocument56 pagesPCC - Financial Stahtements 2013 - Final by RashidFahad ChaudryNo ratings yet

- Hyundai Motor Company and Its SubsidiariesDocument84 pagesHyundai Motor Company and Its SubsidiariesCris TinaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument81 pagesDemonstra??es Financeiras em Padr?es InternacionaisFibriaRINo ratings yet

- 2010Document51 pages2010Mahmood KhanNo ratings yet

- Al-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Document6 pagesAl-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Umair KhanNo ratings yet

- 2010 Financial Report C I LeasingDocument24 pages2010 Financial Report C I LeasingVikky MehtaNo ratings yet

- Financial StatementDocument115 pagesFinancial Statementammar123No ratings yet

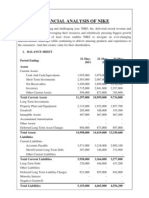

- Financial Analysis of NikeDocument5 pagesFinancial Analysis of NikenimmymathewpkkthlNo ratings yet

- POAL Financial Review 2013Document13 pagesPOAL Financial Review 2013George WoodNo ratings yet

- Final Accounts 2005Document44 pagesFinal Accounts 2005Mahmood KhanNo ratings yet

- A Comparative Study On ITC PVT LTD and HUL PVT LTDDocument18 pagesA Comparative Study On ITC PVT LTD and HUL PVT LTDVishal RoyNo ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- National Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Document36 pagesNational Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Ghulam AkbarNo ratings yet

- IFC AnnRep2013 Volume2 PDFDocument134 pagesIFC AnnRep2013 Volume2 PDFcarlonewmannNo ratings yet

- Balance Sheet HighlightsDocument4 pagesBalance Sheet HighlightsjointariqaslamNo ratings yet

- Company Financial StatementsDocument49 pagesCompany Financial StatementsStar ShinnerNo ratings yet

- Financil Statements As of 31 December 2011Document70 pagesFinancil Statements As of 31 December 2011Camel RasioNo ratings yet

- Unaudited Financials H1 2014Document2 pagesUnaudited Financials H1 2014Kristi DuranNo ratings yet

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- Grace Corporation: Statement of Management's Responsibility For Financial StatementsDocument14 pagesGrace Corporation: Statement of Management's Responsibility For Financial StatementsLaiza Joyce Sales100% (2)

- JansevaDocument21 pagesJansevaHarshil KoushikNo ratings yet

- Bank Islam Malaysia Berhad Interim Financial Statements H1 2017Document46 pagesBank Islam Malaysia Berhad Interim Financial Statements H1 2017Hamdan HassinNo ratings yet

- Balance Sheet2006Document50 pagesBalance Sheet2006malikzai777No ratings yet

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- Hinopak Motors Limited Balance Sheet As at March 31, 2013Document40 pagesHinopak Motors Limited Balance Sheet As at March 31, 2013nomi_425No ratings yet

- Ual Jun2011Document10 pagesUal Jun2011asankajNo ratings yet

- Final Grace CorpDocument14 pagesFinal Grace CorpAnonymous 0M5Kw0YBXNo ratings yet

- 0455 w14 Ms 23 PDFDocument16 pages0455 w14 Ms 23 PDFDhoni KhanNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDocument12 pagesUniversity of Cambridge International Examinations General Certificate of Education Ordinary LevelAbdul Fayad MajidNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDocument12 pagesUniversity of Cambridge International Examinations General Certificate of Education Ordinary LevelAbdul Fayad MajidNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDocument12 pagesUniversity of Cambridge International Examinations General Certificate of Education Ordinary LevelDhoni KhanNo ratings yet

- 0625 w14 Ms 11Document2 pages0625 w14 Ms 11Haider AliNo ratings yet

- 0455 m18 Ms 12 PDFDocument2 pages0455 m18 Ms 12 PDFNiNo ratings yet

- 0455 m18 Ms 12 PDFDocument2 pages0455 m18 Ms 12 PDFNiNo ratings yet

- 0455 m18 Ms 12 PDFDocument2 pages0455 m18 Ms 12 PDFNiNo ratings yet

- Grade Thresholds - November 2018: Cambridge O Level Second Language Urdu (3248)Document1 pageGrade Thresholds - November 2018: Cambridge O Level Second Language Urdu (3248)Uzair KhanNo ratings yet

- 0455 m18 Ms 12 PDFDocument2 pages0455 m18 Ms 12 PDFNiNo ratings yet

- Economics: Cambridge International General Certificate of Secondary EducationDocument1 pageEconomics: Cambridge International General Certificate of Secondary EducationDhoni KhanNo ratings yet

- 0455 m18 Ms 12 PDFDocument2 pages0455 m18 Ms 12 PDFNiNo ratings yet

- Cambridge IGCSE Economics March 2016 Multiple Choice Mark SchemeDocument2 pagesCambridge IGCSE Economics March 2016 Multiple Choice Mark SchemeBalrajSinghBatthNo ratings yet

- 0455 m17 Ms 12Document3 pages0455 m17 Ms 12eco2dayNo ratings yet

- Cambridge IGCSE Economics March 2016 Multiple Choice Mark SchemeDocument2 pagesCambridge IGCSE Economics March 2016 Multiple Choice Mark SchemeBalrajSinghBatthNo ratings yet

- Economics: University of Cambridge International Examinations International General Certificate of Secondary EducationDocument4 pagesEconomics: University of Cambridge International Examinations International General Certificate of Secondary EducationDhoni KhanNo ratings yet

- Step Guide For IGCSE, O Level and A Level Exam Registration BangladeshDocument5 pagesStep Guide For IGCSE, O Level and A Level Exam Registration BangladeshDhoni KhanNo ratings yet

- Economics: Cambridge International General Certificate of Secondary EducationDocument1 pageEconomics: Cambridge International General Certificate of Secondary EducationDhoni KhanNo ratings yet

- MARK SCHEME For The May/June 2006 Question Paper: University of Cambridge International ExaminationsDocument2 pagesMARK SCHEME For The May/June 2006 Question Paper: University of Cambridge International ExaminationsDhoni KhanNo ratings yet

- Economics: University of Cambridge International Examinations International General Certificate of Secondary EducationDocument2 pagesEconomics: University of Cambridge International Examinations International General Certificate of Secondary EducationDhoni KhanNo ratings yet

- EconomicsDocument7 pagesEconomicsDhoni KhanNo ratings yet

- Why CVs Are RejectedDocument1 pageWhy CVs Are RejectedDhoni KhanNo ratings yet

- Edexcel IGCSE Business Studies Student Book and ActiveBook CDDocument1 pageEdexcel IGCSE Business Studies Student Book and ActiveBook CDDhoni KhanNo ratings yet

- 1906 Ial Grade Boundaries v3Document10 pages1906 Ial Grade Boundaries v3Dhoni KhanNo ratings yet

- Session 2-2Document10 pagesSession 2-2Dhoni KhanNo ratings yet

- 2281 s06 QP 2Document4 pages2281 s06 QP 2Mohammad HussainNo ratings yet

- Members of The NSU Syndicate-18062019Document1 pageMembers of The NSU Syndicate-18062019Dhoni KhanNo ratings yet

- HypothesisDocument1 pageHypothesisDhoni KhanNo ratings yet

- Problem 3Document3 pagesProblem 3Dhoni KhanNo ratings yet

- Pearson Edexcel 2018 Examination Start TimesDocument3 pagesPearson Edexcel 2018 Examination Start TimesDhoni KhanNo ratings yet