Professional Documents

Culture Documents

Financial Management 2011-12

Uploaded by

simmercool0 ratings0% found this document useful (0 votes)

19 views3 pagesFM 2011-12

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFM 2011-12

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views3 pagesFinancial Management 2011-12

Uploaded by

simmercoolFM 2011-12

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

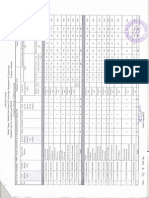

Programme:

Subject:

Date:

INSTRUCTIONS: Candidate should read carefully the instructions printed on

the question paper and on cover of Answer book, which is provided for their use

27/04/2012

NOTE:

Ql

iii

iv.

ae

vi

Under MM approach, all of the following are assumed except

a. that there are no corporate or personal income taxes

b.

©. the operating earnings of a firm grow at a decreasing rate

d.

IRR method will not be good for considering the project

a. When the project being considered is independent

b.

c. When the project is being financed by own funds and borrowings

d

If the interest on long term debt is 18% p.a and the tax rate of the firm is 35%,

SVKM’s NMIMS

Mukesh Patel School Of Technology Management & E:

MBA(Tech)-ALL STREAMS Year: IV Trimester:

Academic Year : 2011-2012

Financial Management Marks:

‘Time:

Duration:

Final - Examination

(1) Total No. of questions - 7

(2) Part A3 questions compulsory, Part B - answer 2 out of 4,

(3) Total Questions to be answered 5

(4) Working will form part of answer

PART A — Compulsory Questions

(Mark each total 5 Marks)

the dividend payout ratio is 100%

there are no bankruptcy cost

When the cash flows are conventional

In all the above situations

the effective cost of debt will be

a

b.

c

a

10.70%

11.70%

12.85%

12.70%

Risk free discount rate means

a.

b.

¢. Discount rate used as base rate for adjustment of project related risk

4

Cost of capital applicable to the project

Weighted average cost of capital

None of the above

Commercial paper

pe se

Is a transferable instrument

Not a transferable instrument

Can be transferred with the consent of the issuer

Can be transferred with the approval of RBI

Page 1 of 3

2.00 pm To 4.00 pm

Q2 Firm X has following base data

Number of shares 10,00,000

Price per share Rs. 20

Market value of shares Rs. 2,00,00,000

Operating income Rs. 40,00,000

i. Mr. S CEO of the firm believes that the shareholders of the firm

will be benefited in case the firm has debt equity ratio of 1:1

ii, Therefore Mr. S proposes to issue 15% non convertible debenture

of Rs.1,00,00,000 and use the proceeds to repurchase 5,00,000

shares and reduce the share capital to 1,00,00,000

iii, Mr. S would like to check the results at operating income levels of

Rs.20,00,000 and Rs.60,00,000 also

iv. The finance manager of the firm differs from Mr. $ and opines that

a When share holders have the option to borrow on their

‘own account why the firm need borrow

b. If investor put his own money of Rs.20, borrows Rs.20

himself and invests Rs.40 in 2 shares of unlevered firm

x”

©. The retum on his own investment will be same as that of

what he will get from his investment in 1 share of levered

firm

vy. calculate the following for all 3 levels of operating income

equity earning of unlevered firm X

earning per share of unlevered firm X

retum on equity of unlevered firm X

prepare base data for levered firm X at operating income

evel of 40,00,000

equity earning of levered firm X

earning per share of levered firm X

return on equity of levered firm X

what are your conclusions with reasons? Do you agree

with CEO

prepare eaming per share and return on equity for the

investor, who resorts to personal leverage, for all 3 levels

of operating income

j. what are your conclusions with reasons? Do you agree

with Finance manager

ae oP

re me

(15 Marks)

Page 2 of 3

a

3 -Mis A Lid bas provide flowing information

Net operating income Rs. 40 million

ii ntereston debt Rs. 10 million

iii, Cost of equity 18%

iv. Cost of debt 12%

y. Work out

a Market value of debt

b. Market value of equity

©. Average cost of capital

vi, Assume further that A Lid.

a. Takes additional debt of Rs. 100 million

b. Uses the additional debt to finance a project which ears

additional operating income of Rs, 20 million

©. There are no taxes

vii, work out following by using Net Operating Income (NOI) approach

taking into account additional details of point (vi) also

a Equity earnings

b. Market value of debt

©. Market value of equity

d. Average cost of capital

(10 Marks)

PART B— Answer Any Two questions out of Four (All questions 10 marks each)

Q.4 Why firms pay dividends? What is the importance of payout ratio, stability and

retained earings in the payment of dividends? Explain difference between

dividend payment and share buyback method.

Q.5 Discuss time value of money, Present value and Future Value concepts. Explain

with examples,

2.6 What are the assumptions and limitations of MM appfoach?-How arbitrage

{method works in proposition I of MM approach? Give example also.

a 7 Short Notes (Attempt any 4 short notes)

Pecking order theory

Gorden’s Growth model of dividend policy’

Signaling theory with scenarios

Trade-off theory

Traditional approach in Capital structure

weene

—* sw ee

Page 3 of 3

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Annexure 1Document22 pagesAnnexure 1simmercoolNo ratings yet

- Flow - PresentationDocument1 pageFlow - PresentationsimmercoolNo ratings yet

- Indralogic L20 System DescriptionDocument124 pagesIndralogic L20 System DescriptionCristopher EntenaNo ratings yet

- PLC ExerciseDocument1 pagePLC Exercisesimmercool0% (1)

- Stem and Leaf PlotDocument2 pagesStem and Leaf PlotsimmercoolNo ratings yet

- TQM 1Document16 pagesTQM 1simmercoolNo ratings yet

- Kano Model of VOCDocument3 pagesKano Model of VOCgogo07906No ratings yet

- Bargaining Price With The ChineseDocument1 pageBargaining Price With The Chinesesimmercool100% (1)

- Customer SatisfactionDocument33 pagesCustomer SatisfactionsimmercoolNo ratings yet

- Introduction To QualityDocument25 pagesIntroduction To QualityDr Rushen SinghNo ratings yet

- Business Economics 2006-2007Document2 pagesBusiness Economics 2006-2007simmercoolNo ratings yet

- Sem 6 Technical SyllabusDocument16 pagesSem 6 Technical SyllabussimmercoolNo ratings yet

- Antenna and Wave Propagation 2011-12Document2 pagesAntenna and Wave Propagation 2011-12simmercoolNo ratings yet

- AsdfghkjlxDocument1 pageAsdfghkjlxsimmercoolNo ratings yet

- InfinityDocument1 pageInfinitysimmercoolNo ratings yet

- Principles of Communication Systems by Taub & SchillingDocument119 pagesPrinciples of Communication Systems by Taub & SchillingInsane Clown Prince40% (5)

- FibonacciDocument1 pageFibonaccisimmercoolNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)