Professional Documents

Culture Documents

Cpa Review School of The Philippines: Auditing Problems Audit of Stockholders' Equity Problem No. 1

Cpa Review School of The Philippines: Auditing Problems Audit of Stockholders' Equity Problem No. 1

Uploaded by

ClarisaJoy SyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cpa Review School of The Philippines: Auditing Problems Audit of Stockholders' Equity Problem No. 1

Cpa Review School of The Philippines: Auditing Problems Audit of Stockholders' Equity Problem No. 1

Uploaded by

ClarisaJoy SyCopyright:

Available Formats

Page 1 of 7

CPA REVIEW SCHOOL OF THE PHILIPPINES

Manila

AUDITING PROBLEMS

AUDIT OF STOCKHOLDERS EQUITY

PROBLEM NO. 1

The following data were compiled prior to preparing the balance sheet of the Conviction

Corporation as of December 31, 2005:

Authorized common stock, P100 par value

Cash dividends payable

Donated capital

Gain on sale of treasury stock

Net unrealized loss on available for sale securities

Premium on capital stock

Premium on bonds payable

Reserve for bond sinking fund

Reserve for depreciation

Revaluation increment on property

Retained earnings, unappropriated

Subscribe capital stock

Stock subscriptions receivables

Stock warrants outstanding

Treasury stock, at cost

Unissued common stock

P4,000,000

160,000

800,000

80,000

96,000

320,000

240,000

400,000

600,000

800,000

720,000

480,000

120,000

200,000

144,000

800,000

REQUIRED:

Compute for the following:

1.

2.

3.

4.

5.

Common stock issued

Additional paid-in capital (APIC)

Appropriated retained earnings

Total stockholders equity

Legal capital

A

4,000,000

320,000

400,000

6,760,000

3,200,000

B

3,200,000

1,400,000

544,000

6,640,000

3,680,000

C

3,056,000

1,320,000

1,000,000

6,480,000

3,560,000

D

3,680,000

1,200,000

6,240,000

4,000,000

PROBLEM NO. 2

Following is the stockholders equity section of Tenacity Corporations balance sheet at

December 31, 2004:

Common stock, P10 par value; authorized 1,500,000

shares; issued and outstanding 900,000 shares

Additional paid-in capital

Retained earnings

Total stockholders equity

P9,000,000

750,000

2,700,000

P12,450,000

Transactions during 2005 and other information relating to the stockholders equity

accounts were as follows:

On January 26, Tenacity reacquired 75,000 shares of its common stock for P11 per

share.

On April 4, Tenacity sold 45,000 shares of its treasury stock for P14 per share.

On June 1, Tenacity declared a cash dividend of P1 per share, payable on July 15,

2005 to stockholders of record on July 1, 2005.

AP-5901

Page 2 of 7

On August 15, each stockholder was issued one stock right for each share held to

purchase two additional shares of stock for P12 per share. The rights expire on

October 31, 2005.

On September 30, 150,000 stock rights were exercised when the market value of the

stock was P12.50 per share.

On November 2, Tenacity declared a two for one stock split-up and charged the par

value of the stock from P10 to P5 per share. On November 20, shares were issued for

the stock split.

On December 5, 60,000 shares were issued in exchange for a secondhand equipment.

It originally cost P600,000, was carried by the previous owner at a book value of

P300,000, and was recently appraised at P390,000.

Net income for 2005 was P720,000.

QUESTIONS:

Based on the above and the result of your audit, determine the following as of December

31, 2005:

1.

2.

3.

4.

Common stock

a. P12,600,000

b. P10,800,000

c. P10,050,000

d. P12,300,000

Additional paid-in capital

a. P1,485,000

b. P1,575,000

c. P3,825,000

d. P1,275,000

Unapproriated retained earnings

a. P2,550,000

b. P2,422,500

c. P2,220,000

d. P2,190,000

Total stockholders equity

a. P16,425,000

b. P14,295,000

c. P16,095,000

d. P16,065,000

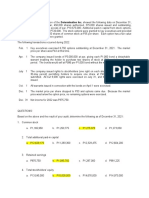

PROBLEM NO. 3

The stockholders equity section of the Determination Inc. showed the following data on

December 31, 2004: Common stock, P3 par, 450,000 shares authorized, 375,000 shares

issued and outstanding, P1,125,000; Paid-in capital in excess of par, P10,575,000;

Additional paid-in capital from stock options, P225,000; Retained earnings, P720,000. The

stock options were granted to key executives and provided them the right to acquire

45,000 shares of common stock at P35 per share. Each option has a fair value of P5 at

the time the options were granted.

The following transactions occurred during 2005:

Feb.

Key executives exercised 6,750 options outstanding at December 31,

2004. The market price per share was P44 at this time.

Apr.

The company issued bonds of P3,000,000 at par, giving each P1,000

bond a detachable warrant enabling the holder to purchase two shares

of stock at P40 each for a 1-year period. The bonds would sell at P996

per P1,000 bond without the warrant.

July

The company issued rights to stockholders (one right on each share,

exercisable within a 30-day period) permitting holders to acquire one

share at P40 with every 10 rights submitted. All but 9,000 rights were

exercised on July 31, and the additional stock was issued.

Oct.

All warrants issued in connection with the bonds on April 1 were

exercised.

AP-5901

Page 3 of 7

Dec. 1

The market price per share dropped to P33 and options came due.

Because the market price was below the option price, no remaining

options were exercised.

Dec. 31

Net income for 2005 was P375,750.

QUESTIONS:

Based on the above and the result of your audit, determine the following as of December

31, 2005:

1.

Common stock

a. P1,165,950

2.

3.

b. P1,250,775

c. P1,275,075

d. P1,273,050

Total additional paid-in capital

a. P12,629,175

b. P11,283,300

c. P12,329,475

d. P12,604,200

Retained earnings

a. P870,750

c. P1,287,000

d. P981,225

c. P14,676,000

d. P14,973,000

b. P1,095,750

Total stockholders equity

a. P13,545,000

b. P15,000,000

4.

PROBLEM NO. 4

With your representation, as Managing Partner of the Sy Pee Ey & Co., your firm was

engaged in the audit of the Fortitude Company at the close of the companys first year of

operations on December 31, 2005. The company closed its books prior to the time you

began your year-end fieldwork.

Your audit and review showed the following stockholders equity accounts in the general

ledger:

08/30/05

CD

Common Stock

P550,000

01/02/05

12/29/05

12/29/05

Retained Earnings

P545,000

12/01/05

12/31/05

12/31/05

12/31/05

J

J

Income Summary

P26,000,000

12/31/05

4,000,000

CR

J

P6,000,000

545,000

CR

J

P287,500

4,000,000

P30,000,000

Based on the other working papers submitted by your audit staff, the following additional

information was forwarded:

From the Articles of Incorporation of Fortitude Company:

Authorized capital stock 150,000 shares

Par value per share P100

From the board of directors minutes of meetings, the following resolutions were extracted:

01/02/05 authorized the issuance of 50,000 shares at P120 per share.

08/30/05 authorized the acquisition of 5,000 shares at P110 per share.

12/01/05 authorized the re-issuance of 2,500 treasury shares at P115 per share.

AP-5901

Page 4 of 7

12/29/05 Declared a 10% stock dividend, payable January 31, 2006, to

stockholders on record as of January 15, 2006. The market value of the stock on

December 29, 2005 was P130 per share.

REQUIRED:

1. Prepare adjusting entries as of December 31, 2005.

2. Based on the above and the result of your audit, determine the adjusted

the following as of December 31, 2005.

A

B

C

1. Capital stock

5,995,000

5,545,000

5,000,000

2. APIC

1,012,500

1,000,000

1,155,000

3. Total retained earnings

3,525,000

3,572,500

3,382,500

4. Treasury stock

250,000

550,000

275,000

5. Total stockholders equity

10,012,500

9,215,000

9,737,500

balances of

D

5,475,000

965,000

3,512,500

9,262,500

PROBLEM NO. 5

The Retained Earnings account of Endurance Company shows the following debits and

credits for the year 2005:

RETAINED EARNINGS

Date

Jan. 1

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(l)

(m)

(n)

(o)

(p)

(q)

(r)

(s)

Balance

Loss from fire

Write-off of goodwill

Stock dividends distributed

Loss on sale of equipment

5,250

52,500

140,000

48,300

Balance

Debit

Credit

726,400

721,150

668,650

528,650

480,350

Officers compensation related to income of

prior periods accrual overlooked

325,500

154,850

70,000

129,500

84,850

214,350

8,470

204,350

212,820

25,900

15,050

10,500

50,050

238,720

253,770

264,270

314,320

100,000

414,320

389,320

369,320

409,320

659,320

559,320

Debit

Loss on retirement of preferred shares

at more than issue price

Paid in capital in excess of par

Stock issuance expenses

(related to letter g)

Stock subscription defaults

Gain on retirement of preferred stock at

less than issue price

Gain on early retirement of bonds

Gain on life insurance policy settlement

Correction of a fundamental error

Effect of change in accounting principle

from FIFO to weighted average

Dividends payable

Loss on sale of treasury stock

Proceeds from sale of donated stock

Appraisal increase in land

Appropriated for property acquisition

Credit

10,000

25,000

20,000

40,000

250,000

100,000

REQUIRED:

1.

2.

Prepare adjusting journal entries to correct the Retained Earnings account.

Determine the correct amount of Retained Earnings account.

PROBLEM NO. 6

In connection with your audit of the balance sheet of the Guts Company on December 31,

2005, the Liability side of the Balance Sheet shows following items:

AP-5901

Page 5 of 7

Current liabilities

Bonds payable

Reserve for bond retirement

6% Cumulative preferred stock, P100 par value (liquidation

value, P115 per share); Authorized, 6,000 shares; issued,

4,000 shares; in treasury, 600 shares

Common stock, P100 par value, authorized, 20,000 shares;

issued and outstanding, 8,000 shares

Premium on preferred stock

Premium on common stock

Retained earnings

Treasury preferred stock, at cost

P571,000

600,000

320,000

400,000

800,000

150,000

165,000

458,600

84,000

REQUIRED:

1. Compute for the total stockholders equity as of December 31, 2005.

2. Compute for the book value per share of each class of stock as of December 31, 2005.

3. Assuming the preferred stock is participating, compute for the book value per share of

each class of stock as of December 31, 2005.

PROBLEM NO. 7

In connection with the audit of Courage Companys financial statements for the year

ended December 31, 2005, your audit senior asked you to analyze the companys

stockholders equity section and provide him with certain figures. The stockholders equity

sections of the companys comparative balance sheets as of December 31, 2005 and 2004

are presented below:

12% Preferred stock, P100 par

Common stock, P10* par

Paid-in capital in excess of par - preferred

Paid-in capital in excess of par - common

Paid-in capital from treasury stock

Retained earnings

Total stockholders equity

*Par value after May 31, 2005 stock split.

12.31.05

12.31.04

P 330,000 P 270,000

1,642,400

1,598,400

53,600

36,800

257,200

235,200

7,200

3,200

1,884,800

1,585,840

P4,175,200 P3,729,440

Courage had 65,000 common stock outstanding as December 31, 2003.

The following stockholders equity transactions were recorded in 2004 and 2005:

2004

May 1

July 1

July 31

Aug. 30

Dec. 31

2005

Feb. 1

May 1

May 31

Sep. 1

Oct. 1

Nov. 1

Sold 9,000 common shares for P24, par value P20.

Sold 700 preferred shares for P124, par value P100.

Issued an 8% stock dividend on common stock. The market value of

common stock was P30 per share.

Declared cash dividends of 12% on preferred stock and P3 per share

on common stock.

Net income for the year amounted to P1,345,040

Sold 2,200 common shares for P30.

Sold 600 preferred shares for P128.

Issued a 2-for-1 split of common stock. The par value of the common

stock was reduced to P10 per share.

Purchased 1,000 common shares for P18 to be held as treasury stock.

Declared cash dividends of 12% on preferred stock and P4 per share

on common stock.

Sold 1,000 shares of treasury stock for P22.

AP-5901

Page 6 of 7

REQUIRED:

Compute for the basic earnings per share for the year 2004 and 2005.

PROBLEM NO. 8

Select the best answer for each of the following:

1.

In an examination of shareholders equity, an auditor is most concerned that

a. Capital stock transactions are properly authorized.

b. Stock splits are capitalized at par or stated value on the dividend declaration date.

c. Dividends during the year under audit were approved by the shareholders.

d. Changes in the accounts are verified by a bank serving as a registrar and stock

transfer agent.

2.

In audit of a medium-sized manufacturing concern, which one of the following areas

can be expected to require the least amount of audit time?

a. Owners equity

b. Assets

c. Revenue

d. Liabilities

3.

When a corporate client maintains its own stock records, the auditor primarily will rely

upon

a. Confirmation with the company secretary of shares outstanding at year-end.

b. Review of the corporate minutes for data as to shares outstanding.

c. Confirmation of the number of shares outstanding at year-end with the appropriate

state official.

d. Inspection of the stock book at year-end and accounting for all certificate

numbers.

4.

When a client company does not maintain its own stock records, the auditor should

obtain written confirmation from the transfer agent and registrar concerning

a. Restrictions on the payment of dividends.

b. The number of shares issued and outstanding.

c. Guarantees of preferred stock liquidation value.

d. The number of shares subject to agreement to repurchase

5.

The auditor is concerned with establishing that dividends are paid to client

corporation shareholders owning stock as of the

a. Issue date

c. Record date

b. Declaration date

d. Payment date

6.

An audit program for the retained earnings account should include a step that

requires verification of the

a. Fair value used to charge retained earnings to account for a two-for-one-stock

split.

b. Approval of the adjustment to the beginning balance as a result of a write-down of

an account receivable.

c. Authorization for both cash and stock dividends.

d. Gain or loss resulting from disposition of treasury shares.

7.

During an audit of an entitys shareholders equity accounts, the auditor determines

whether there are restrictions on retained earnings resulting from loans, agreements,

or law. This audit procedure most likely is intended to verify managements assertion

of

a. Existence

c. Valuation

b. Completeness

d. Presentation and disclosure

AP-5901

Page 7 of 7

8.

If the auditee has a material amount of treasury stock on hand at year-end, the

auditor should

a. Count the certificates at the same time other securities are counted.

b. Count the certificates only if the company had treasury stock transactions during

the year.

c. No count the certificates if treasury stock is a deduction from shareholders equity.

d. Count the certificates only if the company classifies treasury stock with other

assets.

9.

In performing tests concerning the granting of stock options, an auditor should

a. Confirm the transaction with the Securities and Exchange Commission.

b. Verify the existence of option holders in the entitys payroll records or stock

ledgers.

c. Determine that sufficient treasury stock is available to cover any new stock issued.

d. Trace the authorization for the transaction to a vote of the board of directors.

10. The auditor would not expect the client to debit retained earnings for which of the

following transactions?

a. A 4-for 1 stock split.

b. "Loss" resulting from disposition of treasury shares.

c. A 1-for 10 stock dividend.

d. Correction of error affecting prior year's earnings.

End of AP-5901

AP-5901

You might also like

- 2024 Becker CPA Financial (FAR) Mock Exam QuestionsDocument19 pages2024 Becker CPA Financial (FAR) Mock Exam QuestionscraigsappletreeNo ratings yet

- Audit of Stockholders EquityDocument25 pagesAudit of Stockholders Equityxxxxxxxxx87% (39)

- Audit of Stockholders' EquityDocument32 pagesAudit of Stockholders' EquityReverie Sevilla100% (3)

- May 2017Document7 pagesMay 2017Patrick Arazo0% (1)

- CHAPTER 6 Caselette - Audit of InvestmentsDocument30 pagesCHAPTER 6 Caselette - Audit of InvestmentsCharlene Mina0% (1)

- Ap RmycDocument16 pagesAp RmycJoseph Bayo BasanNo ratings yet

- Acctng Reviewer 2Document21 pagesAcctng Reviewer 2alliahnah33% (3)

- Auditing Problems v.1 - 2018Document18 pagesAuditing Problems v.1 - 2018Christine Ballesteros Villamayor33% (3)

- (Problems) - Audit of Other Income StatementsDocument8 pages(Problems) - Audit of Other Income StatementsapatosNo ratings yet

- Karkits CorporationDocument4 pagesKarkits Corporation김우림0% (3)

- Ap105 InvestmentsDocument5 pagesAp105 InvestmentsVandix100% (1)

- AP PreboardDocument6 pagesAP PreboardMark Kenneth Chan BalicantaNo ratings yet

- Activity For Finals TermDocument6 pagesActivity For Finals TermRhegee Irene RosarioNo ratings yet

- Quiz 5Document5 pagesQuiz 5Mickaellah MacasNo ratings yet

- Financial Accounting and Reporting Ii Final Quiz 2/3Document7 pagesFinancial Accounting and Reporting Ii Final Quiz 2/3Patrick Ferdinand Alvarez50% (2)

- JJJDocument12 pagesJJJCamille ManalastasNo ratings yet

- Comprehensive Review For CorporationDocument14 pagesComprehensive Review For CorporationJoemar Santos Torres33% (3)

- Auditing Problem (Modules 7-10)Document6 pagesAuditing Problem (Modules 7-10)Serena Van der WoodsenNo ratings yet

- AP - LiabilitiesDocument4 pagesAP - LiabilitiesEarl Donne Cruz100% (4)

- AP-5903 - PPE & Intangibles.-Supporting Notes PDFDocument8 pagesAP-5903 - PPE & Intangibles.-Supporting Notes PDFAlbert Macapagal100% (2)

- Applied Auditing Quiz #1 (Diagnostic Exam)Document7 pagesApplied Auditing Quiz #1 (Diagnostic Exam)ephraimNo ratings yet

- Audit of EquityDocument5 pagesAudit of EquityKarlo Jude Acidera0% (1)

- IntangiblesDocument15 pagesIntangiblesJ RodriguezNo ratings yet

- Auditing Cup - 19 Rmyc Answer Key Final Round House StarkDocument13 pagesAuditing Cup - 19 Rmyc Answer Key Final Round House StarkCarl John PlacidoNo ratings yet

- Accounting 162 - Material 006: For The Next Few RequirementsDocument3 pagesAccounting 162 - Material 006: For The Next Few RequirementsAngelli LamiqueNo ratings yet

- Audit of LiabilityDocument8 pagesAudit of LiabilityMark Lord Morales Bumagat50% (2)

- 36 - Balance SheetDocument3 pages36 - Balance SheetLara Lewis Achilles100% (2)

- Finacc 3Document6 pagesFinacc 3Tong WilsonNo ratings yet

- Ge Acctg 7Document5 pagesGe Acctg 7ezraelydanNo ratings yet

- Anthony and Anjo-Audit of Stockholders' EquityDocument14 pagesAnthony and Anjo-Audit of Stockholders' EquityCodeSeeker75% (4)

- Straight ProblemsDocument12 pagesStraight Problemsnana100% (2)

- PRTC AP 1405 Final PreboardDocument14 pagesPRTC AP 1405 Final PreboardLlyod Francis LaylayNo ratings yet

- QUIZ7 Audit of LiabilitiesDocument3 pagesQUIZ7 Audit of LiabilitiesCarmela GulapaNo ratings yet

- Accounting ProbDocument2 pagesAccounting ProbLino GumpalNo ratings yet

- Integrated Review Ceu PDFDocument28 pagesIntegrated Review Ceu PDFHello Kitty100% (1)

- Problems On Audit of Shareholders EquityDocument26 pagesProblems On Audit of Shareholders EquityNhel AlvaroNo ratings yet

- Audt3 - Applied Auditing Complete ModuleDocument232 pagesAudt3 - Applied Auditing Complete ModuleDominique Anne BenozaNo ratings yet

- Examination About Investment 9Document3 pagesExamination About Investment 9BLACKPINKLisaRoseJisooJennieNo ratings yet

- (Problems) - Audit of LiabilitiessDocument17 pages(Problems) - Audit of Liabilitiessapatos0% (2)

- AA MIDTERMS - With AnswerDocument9 pagesAA MIDTERMS - With AnswerChristopher NogotNo ratings yet

- FAR.2845 Statement of Profit or Loss and OCI PDFDocument6 pagesFAR.2845 Statement of Profit or Loss and OCI PDFGabriel OrolfoNo ratings yet

- INTANGIBLES With AnswersDocument3 pagesINTANGIBLES With AnswersRae Anne Ü100% (1)

- AP.2903 Intangible-AssetsDocument4 pagesAP.2903 Intangible-AssetsmoNo ratings yet

- Chapter 31SMEs Property Plant and EquipmentDocument2 pagesChapter 31SMEs Property Plant and EquipmentDez ZaNo ratings yet

- Audit of LiabDocument9 pagesAudit of LiabCielo Mae Parungo0% (1)

- AP Equity 3Document2 pagesAP Equity 3Mark Michael Legaspi100% (1)

- AP - Shareholders Equity PDFDocument5 pagesAP - Shareholders Equity PDFJasmin NgNo ratings yet

- Cpa Review School of The PhilippinesDocument11 pagesCpa Review School of The PhilippinesKCNo ratings yet

- Cpa Review School of The Philippines: Auditing Problems Audit of Stockholders' Equity Problem No. 1Document24 pagesCpa Review School of The Philippines: Auditing Problems Audit of Stockholders' Equity Problem No. 1Hello KittyNo ratings yet

- AP 5904Q InvestmentsDocument4 pagesAP 5904Q Investmentskristine319No ratings yet

- Shareholder's Equity ReviewerDocument16 pagesShareholder's Equity ReviewerJudelle Ibarrientos Garing100% (2)

- QuestionsDocument3 pagesQuestionslois martinNo ratings yet

- Unit Viii - Audit of Equity Accounts T1 2014-2015 PDFDocument9 pagesUnit Viii - Audit of Equity Accounts T1 2014-2015 PDFSed ReyesNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument6 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- AP 5901q She Shareholders EquituDocument6 pagesAP 5901q She Shareholders EquituAccounting FilesNo ratings yet

- 04 Audit of HSreholders Equity ExercisesDocument19 pages04 Audit of HSreholders Equity Exerciseskara albueraNo ratings yet

- 5th Year Exam APMIDTERMDocument11 pages5th Year Exam APMIDTERMMark Domingo MendozaNo ratings yet

- Shareholder S Equity ReviewerDocument20 pagesShareholder S Equity ReviewerKarlovy DalinNo ratings yet

- Stockholders - Equity ExercisesDocument4 pagesStockholders - Equity ExercisessweetEmie031No ratings yet

- Discussion Questions 8-1:: Unit 8 Audit of Equity Accounts Estimated Time: 4.5 HOURSDocument7 pagesDiscussion Questions 8-1:: Unit 8 Audit of Equity Accounts Estimated Time: 4.5 HOURSmimi96No ratings yet

- Ap Drill 3 (She)Document5 pagesAp Drill 3 (She)ROMAR A. PIGANo ratings yet

- Last QuizDocument5 pagesLast QuizMariah MacasNo ratings yet

- AP 2007 (Shareholder's Equity) v.20Document4 pagesAP 2007 (Shareholder's Equity) v.20jalrestauroNo ratings yet

- Acc Ch-5 Lecture NoteDocument14 pagesAcc Ch-5 Lecture NoteBlen tesfayeNo ratings yet

- Home Assignment 3Document3 pagesHome Assignment 3AUNo ratings yet

- Pfizer Exam Solution ManualDocument25 pagesPfizer Exam Solution ManualDiego AguirreNo ratings yet

- Tax Alert - 2005 - SepDocument7 pagesTax Alert - 2005 - SepjeffreyNo ratings yet

- Auditing Problem For Shareholder's EquityDocument14 pagesAuditing Problem For Shareholder's Equityblack hudieNo ratings yet

- Retained Earnings PDFDocument3 pagesRetained Earnings PDFIllion IllionNo ratings yet

- Bonus Activity Corporation LawDocument3 pagesBonus Activity Corporation LawBJ SoilNo ratings yet

- Earnings Per Share: Name: Date: Professor: Section: Score: QuizDocument5 pagesEarnings Per Share: Name: Date: Professor: Section: Score: QuizLovErsMaeBasergo0% (1)

- Chapter 11: Corporations: Organization, Share Transactions, Dividends, and Retained EarningsDocument57 pagesChapter 11: Corporations: Organization, Share Transactions, Dividends, and Retained EarningsJihen SmariNo ratings yet

- Chapter 19 Exercises & ProblemsDocument10 pagesChapter 19 Exercises & ProblemsRiza Mae AlceNo ratings yet

- The Other Face of Managerial AccountingDocument20 pagesThe Other Face of Managerial AccountingModar AlzaiemNo ratings yet

- Finals Answer KeyDocument11 pagesFinals Answer Keymarx marolinaNo ratings yet

- A6Share Holders EquityDocument2 pagesA6Share Holders Equitysalamat lang akinNo ratings yet

- ACTBFAR Work Text - Chapter 12 - 2T1920 - FormattedDocument18 pagesACTBFAR Work Text - Chapter 12 - 2T1920 - FormattednuggsNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 13 Corporations orDocument103 pagesTest Bank Accounting 25th Editon Warren Chapter 13 Corporations orRoland Ron Bantilan0% (1)

- Compiled Corporation QuestionsDocument20 pagesCompiled Corporation QuestionsKatNo ratings yet

- (ACCCOB2) Reflection Paper 4Document5 pages(ACCCOB2) Reflection Paper 4Courtney TulioNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument1 pageDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Mercantile Law Codal PDFDocument112 pagesMercantile Law Codal PDFBeya AmaroNo ratings yet

- Rofo 2018 ArDocument18 pagesRofo 2018 ArNate TobikNo ratings yet

- Types of SharesDocument1 pageTypes of SharesMauti Nyakundi CollinsNo ratings yet

- 8commissioner V Manning - Capitalization, Treasury SharesDocument2 pages8commissioner V Manning - Capitalization, Treasury SharesIanNo ratings yet

- Chapter 6 - Retained EarningsDocument30 pagesChapter 6 - Retained Earningslou-924No ratings yet

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument16 pagesSol. Man. - Chapter 16 - Accounting For DividendspehikNo ratings yet

- At The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt The Beginning of 2011 Greene Inc Showed The Following: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Introduction To Corporations: Dr. Ronnie G. Salazar, CpaDocument102 pagesIntroduction To Corporations: Dr. Ronnie G. Salazar, CpaJoshua CabinasNo ratings yet