Professional Documents

Culture Documents

Sec 87A

Uploaded by

ManikdnathCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sec 87A

Uploaded by

ManikdnathCopyright:

Available Formats

JAYESH SANGHRAJKA & CO.

Chartered Accountants

From the Research Desk______________________________________

New Section 87A of the Income Tax Act, 1961,

Inserted by Finance Bill, 2013-14

In the Budget 2013 Speech, The Finance Minister had said, Nevertheless, I am inclined

to give some relief to the tax payers in the first bracket of Rs. 2 Lakh to Rs. 5 Lakh.

Assuming an inflation rate of 10% and a notional rise in the threshold exemption

from Rs. 2,00,000/- to Rs. 2,20,000/- I propose to provide a tax credit of Rs.

2,000/- to every person who has a total income upto Rs. 5 Lakh.

As stated by the Finance minister above, the detailed explanation of the

newly

inserted section is mentioned below:

The above amendment was bought by inserting a new Section 87A in the

Income Tax Act, 1961.

It is to be noted that, the above amendment does not mean that basic

Exemption Limit has been raised from Rs. 2,00,000/- to Rs. 2,20,000/-.

It is a Rebate and not a deduction, meaning an assessee will get reduction in

the Income tax payable by him.

It is available ONLY to an INDIVIDUAL assessee, resident in India whos

Total Income during the PY does not exceeds Rs. 5 Lakh.

However, the above rebate benefit is not applicable to a super senior citizen,

since he is already fully exempted up to Rs. 5 lakh.

It is applicable for Assessment Year 2014-15 and thereafter.

This Rebate not available to a Non resident individual.

If the total tax payable is less than Rs. 2000/-, rebate is restricted to total

tax payable.

1

his letter is for private circulation only. The letter is brought by a group of professionals Batgach. These

professionals represent several well established Chartered Accountancy Firms. The letter is being brought

onlywiththeintentiontogiveinformation¬tosolicitclientsorbusinessagainsttheguidelinesissuedby

TheInstituteofCharteredAccountantsofIndia.

You might also like

- 33 Revision of Assessment Under Section 264 PDFDocument1 page33 Revision of Assessment Under Section 264 PDFCma Saurabh AroraNo ratings yet

- Taxation Workbook 2022Document204 pagesTaxation Workbook 2022Navya GulatiNo ratings yet

- Frequently Asked Questions (FAQ's)Document3 pagesFrequently Asked Questions (FAQ's)rockyrrNo ratings yet

- A Critical Analysis of The Union Budget 2021Document4 pagesA Critical Analysis of The Union Budget 2021Jamila MustafaNo ratings yet

- Income Tax Deductions FY 2016Document13 pagesIncome Tax Deductions FY 2016Nishant JhaNo ratings yet

- Income Tax KnowledgeDocument5 pagesIncome Tax KnowledgeAbhishekNo ratings yet

- The Financial Kaleidoscope - July 19 PDFDocument8 pagesThe Financial Kaleidoscope - July 19 PDFhemanth1128No ratings yet

- Sanskar Bangera TCM2223003Document5 pagesSanskar Bangera TCM2223003Sanskar BangeraNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Tax Planning IndiaDocument20 pagesTax Planning IndiaRohanTheGreatNo ratings yet

- FAQ S On Income Tax 2022-23Document4 pagesFAQ S On Income Tax 2022-23Ranjan SatapathyNo ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxreemaNo ratings yet

- Budget 2021Document9 pagesBudget 2021VRINDA GUPTANo ratings yet

- DT AmendmentsDocument39 pagesDT AmendmentsMurali GopalakrishnaNo ratings yet

- PF Employee Contribution Interest Taxability FAQsDocument3 pagesPF Employee Contribution Interest Taxability FAQssusannaNo ratings yet

- How To Determine That An Individual Is NRI. 115C: Annual Statement of Tax Deducted U/s 203AA Rule No.:31ABDocument12 pagesHow To Determine That An Individual Is NRI. 115C: Annual Statement of Tax Deducted U/s 203AA Rule No.:31ABPradeep PandeyNo ratings yet

- Army Institute of Law, Mohali: Provisions Relating To Rebates Under The Income Tax Act, 1961 A Project Submitted ToDocument7 pagesArmy Institute of Law, Mohali: Provisions Relating To Rebates Under The Income Tax Act, 1961 A Project Submitted ToAyushi JaryalNo ratings yet

- Benefits For Senior Citizens Very Senior Citizens - EnglishDocument8 pagesBenefits For Senior Citizens Very Senior Citizens - EnglishmonishaNo ratings yet

- IT Assignment 2Document7 pagesIT Assignment 2Srinivasulu Reddy PNo ratings yet

- Benefits To Salary Employees in Lieu of Budget 2018Document16 pagesBenefits To Salary Employees in Lieu of Budget 2018Rashi GuptaNo ratings yet

- Budget Synopsis 2015-16 PDFDocument12 pagesBudget Synopsis 2015-16 PDFBhagwan PalNo ratings yet

- ALEKYA - Tax Saving SchemsDocument14 pagesALEKYA - Tax Saving SchemsMOHAMMED KHAYYUMNo ratings yet

- Income Tax Planning in India With Respect To Individual Assessee MBA ProjectDocument93 pagesIncome Tax Planning in India With Respect To Individual Assessee MBA Projectnirmala periasamyNo ratings yet

- Union Budget Group 6Document18 pagesUnion Budget Group 6GayatriNo ratings yet

- Taxation Law ProjectDocument15 pagesTaxation Law Projectraj vardhan agarwalNo ratings yet

- Chartered ClubDocument3 pagesChartered ClubkajshdiNo ratings yet

- Amity Global Business School, PuneDocument15 pagesAmity Global Business School, PuneChand KalraNo ratings yet

- Union Budget 2021 Highlights and ImpactDocument10 pagesUnion Budget 2021 Highlights and Impact200409120010No ratings yet

- Highlights of Union BudgetDocument2 pagesHighlights of Union BudgetsamsworldrocksNo ratings yet

- Interim Budget 2019: Proposed Amendments in Direct Tax ProvisionsDocument4 pagesInterim Budget 2019: Proposed Amendments in Direct Tax ProvisionsaaNo ratings yet

- Budget 2019 Key PointsDocument2 pagesBudget 2019 Key Pointsrathishsrk03No ratings yet

- Indian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountDocument23 pagesIndian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountshankarinsideNo ratings yet

- Bold Step Towards 5 Trillion Economy: CMA Bhogavalli Mallikarjuna GuptaDocument3 pagesBold Step Towards 5 Trillion Economy: CMA Bhogavalli Mallikarjuna GuptavenkannaNo ratings yet

- TDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Document5 pagesTDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Nishit MarvaniaNo ratings yet

- Union BudgetDocument3 pagesUnion BudgetPoojaNo ratings yet

- ITR SectionsDocument6 pagesITR SectionsRohan SharmaNo ratings yet

- Major Schemes: New Scheme-Namely "Pradhan Mantri Kisan Samman Nidhi (Pm-Kisan) " To Extend ToDocument42 pagesMajor Schemes: New Scheme-Namely "Pradhan Mantri Kisan Samman Nidhi (Pm-Kisan) " To Extend ToPrakharesh AwasthiNo ratings yet

- Does The Budget Benefit You?Document1 pageDoes The Budget Benefit You?mailwithvaibhav9675No ratings yet

- Individual Txation FY 203 24Document44 pagesIndividual Txation FY 203 24Smarty ShivamNo ratings yet

- BIR Tax Briefing - RR 11-2018Document3 pagesBIR Tax Briefing - RR 11-2018Jeff BulasaNo ratings yet

- Tax Lift Goes Down, You're Up One Floor: Take A Home Loan, Take Home MoreDocument1 pageTax Lift Goes Down, You're Up One Floor: Take A Home Loan, Take Home MoreIna PawarNo ratings yet

- Tax On Salary: Income Tax Law & CalculationDocument7 pagesTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniNo ratings yet

- Notes On DTC BillDocument5 pagesNotes On DTC Billshikah sidarNo ratings yet

- What's New With Income Taxes and E-Filing This YearDocument1 pageWhat's New With Income Taxes and E-Filing This YearharpreetresearchNo ratings yet

- Individual Txation FY 2019 20 With Demo of Return FilingDocument73 pagesIndividual Txation FY 2019 20 With Demo of Return FilingGanesh PNo ratings yet

- CRV Sir's DT Material May 2022Document293 pagesCRV Sir's DT Material May 2022esaiinternalauditNo ratings yet

- Investment DeclarationDocument3 pagesInvestment DeclarationDipanjal SaikiaNo ratings yet

- Here Are Five Changes in Income Tax Rules, Proposed in Union Budget 2018-19Document5 pagesHere Are Five Changes in Income Tax Rules, Proposed in Union Budget 2018-19harish nayakNo ratings yet

- MATH PROJECT TOPIC 2 (Income Tax)Document7 pagesMATH PROJECT TOPIC 2 (Income Tax)avinamakadiaNo ratings yet

- Taxmann - Budget Highlights 2022-2023Document42 pagesTaxmann - Budget Highlights 2022-2023Jinang JainNo ratings yet

- IncomeTax DeductionsDocument5 pagesIncomeTax DeductionsAjay MagarNo ratings yet

- Individual Taxation (Ay 2019-20)Document29 pagesIndividual Taxation (Ay 2019-20)Mudit SinghNo ratings yet

- A Guide To Income Tax Benefits For Senior CitizensDocument18 pagesA Guide To Income Tax Benefits For Senior CitizensAshutosh JaiswalNo ratings yet

- Beatles Tax Breaks Pranab MukherjeeDocument2 pagesBeatles Tax Breaks Pranab MukherjeeTasneema MakandarNo ratings yet

- Expectations From BudgetDocument8 pagesExpectations From BudgetNehaNo ratings yet

- Penalty For Underpayment of TaxDocument5 pagesPenalty For Underpayment of Taxjwasundara1654No ratings yet

- GST AuditDocument9 pagesGST Auditdhruv MahajanNo ratings yet

- Tax FinalDocument21 pagesTax Finalshweta_narkhede01No ratings yet

- Supertax Revenue Impact Estimated at Rs 80 BillionDocument1 pageSupertax Revenue Impact Estimated at Rs 80 BillionMuhammad Anas DaraNo ratings yet

- Goods and Services Tax 2022 English (31!03!2022) Final For Printing-062f0e3be13e397.79281451Document198 pagesGoods and Services Tax 2022 English (31!03!2022) Final For Printing-062f0e3be13e397.79281451Cma Saurabh AroraNo ratings yet

- Indian Economic CrisisDocument7 pagesIndian Economic CrisisCma Saurabh AroraNo ratings yet

- Delivery Challan Issue For Jobw WorkDocument1 pageDelivery Challan Issue For Jobw WorkCma Saurabh AroraNo ratings yet

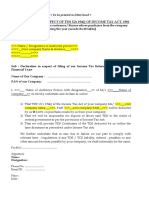

- Declaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Document2 pagesDeclaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Cma Saurabh AroraNo ratings yet

- Solution:: The Following Are The Data Given in The Question For FactoringDocument1 pageSolution:: The Following Are The Data Given in The Question For FactoringCma Saurabh AroraNo ratings yet

- Chart PatternsDocument3 pagesChart PatternsCma Saurabh AroraNo ratings yet

- Bajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersDocument16 pagesBajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersCma Saurabh AroraNo ratings yet

- Name of Organisation Month: YearDocument6 pagesName of Organisation Month: YearCma Saurabh AroraNo ratings yet

- Chapt ER: Real Options, Investment Strategy and ProcessDocument18 pagesChapt ER: Real Options, Investment Strategy and ProcessCma Saurabh AroraNo ratings yet

- Challenges and Impact of Disinvestment On Indian Economy: Dr. M. K. Rastogi, Sharad Kr. ShuklaDocument10 pagesChallenges and Impact of Disinvestment On Indian Economy: Dr. M. K. Rastogi, Sharad Kr. ShuklaCma Saurabh AroraNo ratings yet

- Impact of Housing On GDP Employment FULL REPORTDocument94 pagesImpact of Housing On GDP Employment FULL REPORTCma Saurabh AroraNo ratings yet

- QUESTION: I Own A Commercial Building Giving Me A Rent of Rs. 4 Lakhs A Month. TheDocument3 pagesQUESTION: I Own A Commercial Building Giving Me A Rent of Rs. 4 Lakhs A Month. TheCma Saurabh AroraNo ratings yet