Professional Documents

Culture Documents

Donor's TAx

Uploaded by

George Poligratis Rico0 ratings0% found this document useful (0 votes)

18 views2 pagesDonor's TAx

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDonor's TAx

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesDonor's TAx

Uploaded by

George Poligratis RicoDonor's TAx

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

& DONOR’S TAX: NATURE AND CONCEPT

* Donation is an act of liberality whereby a person disposes

of gratuitously a thing or right in favor of another (donee)

who accepts it. It is a voluntary transfer of property from

one person to another without any compensation or

consideration thereof.

= Donor’s tax or gifttax is a tax imposed on the right or

privilege of the donor to make a gift. It is a tax on a

donation or gift, hence an excise tax.

TMD

& Requisites of a Valid Donation

® Capacity of the Donor

= Donative intent (except gifts under Sec. 100 NIRC)

* Acceptance by the Donee

Delivery of the gift to the donee either actually

or constructively

4

A donor subject to tax may be a natural or juridical

person.

Properties, whether real or personal, tangible or

intangible, including alienable rights, may be the

object of donation. The discussion on estate

taxation regarding the valuation of estates are also

applicable to donor's taxation.

TMD

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Sample Computation of Estate Tax Part 2Document4 pagesSample Computation of Estate Tax Part 2George Poligratis RicoNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Real Estate Mathematics SAMPLE PROBLEMS (REF: 0505) W/ SolutionDocument11 pagesReal Estate Mathematics SAMPLE PROBLEMS (REF: 0505) W/ SolutionGeorge Poligratis Rico100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

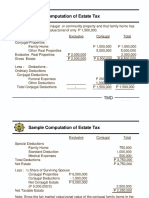

- Sample Computation of Estate TaxDocument2 pagesSample Computation of Estate TaxGeorge Poligratis RicoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Real Estate Mathematics Sample Problems (Ref: 0505) : I. Perimeter Fencing ProblemDocument4 pagesReal Estate Mathematics Sample Problems (Ref: 0505) : I. Perimeter Fencing ProblemGeorge Poligratis RicoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Real Estate Brokerage PracticeDocument23 pagesReal Estate Brokerage PracticeGeorge Poligratis Rico67% (3)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Gross Gift Valuation and CompositionDocument2 pagesGross Gift Valuation and CompositionGeorge Poligratis RicoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Classification of Donors TaxDocument1 pageClassification of Donors TaxGeorge Poligratis RicoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Deductions From Gross GiftsDocument1 pageDeductions From Gross GiftsGeorge Poligratis RicoNo ratings yet

- REVIEWER: Mathematics in Brokerage Practice Problems/QuestionDocument18 pagesREVIEWER: Mathematics in Brokerage Practice Problems/QuestionGeorge Poligratis Rico100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Accounting & Taxation On Real Estate Transactions by DDV Nov 2015Document159 pagesAccounting & Taxation On Real Estate Transactions by DDV Nov 2015George Poligratis RicoNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Exponential Geometrical Linear-Growth RateDocument1 pageExponential Geometrical Linear-Growth RateGeorge Poligratis RicoNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- ILLUSTRATION - RESIDUAL TECHNIQUE by PDFDocument12 pagesILLUSTRATION - RESIDUAL TECHNIQUE by PDFGeorge Poligratis RicoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 25 RESA vs. MO 39Document37 pages25 RESA vs. MO 39George Poligratis Rico100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Subdivision Approach Valuation: Drainage, Water & Other Utilities) P 100,000,000Document1 pageSubdivision Approach Valuation: Drainage, Water & Other Utilities) P 100,000,000George Poligratis RicoNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Pmt-Annuities-Problem Cash Flow Formula El-733a MS Excel PDFDocument1 pagePmt-Annuities-Problem Cash Flow Formula El-733a MS Excel PDFGeorge Poligratis RicoNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)