Professional Documents

Culture Documents

Micro 2 Decision 2014 Lectures Part 3

Uploaded by

Anirudh Jayaraman0 ratings0% found this document useful (0 votes)

6 views34 pagesDecision Theory Notes

Original Title

Micro2Decision2014LecturesPart3

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDecision Theory Notes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views34 pagesMicro 2 Decision 2014 Lectures Part 3

Uploaded by

Anirudh JayaramanDecision Theory Notes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 34

|

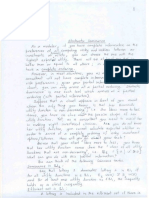

Microeconomic Theory

Uncertain ves Pact IL

Uncertainty Letures Pact ID

Marschak - Machina Triangles :

Consider the set of all loHeries or vicky assets over

three fixed outcomes, viz, %1, Ap and %, cohere

X 2%, 2%, hat would these tcHlener Jacsets/} rototshh

Aichibutions Wack like ? They should look ike bs Chr bs, Ps)

where as probatily of outcome 2%; and ge port.

ble know then that py = (pi fa.

Hence, geomeenlly we can represent these probetihly

dishtbudions over 1,42, %3 omtcomes usin sinds te

the unit tangle in te (pr, fs) plane

4

increasing Chg? +: 3

Fa. f preferences | 53, >),

> prob %a) Ge, when you

iow vac,

gee go deeb

bi

° 4 Poudeome

be

hespmete? fete a

fats oll cee

Seis ag, ves

S3,.)

Upward movements in the tangle inerewe ps 4) the

expense of pa; leftward movements increase ps at the

expense of pr. So, amy leaned si upwind rmovemant

mans bali ttlees. How do T read any poir! hee?

Fader vecitzal

The base voy ead the arene axis value of the point

as pf and the vertical axis value ac ba, ad t= bi-bs

aS

shal are the in Hereaee ewes? — They ave the loci af

solutions + the equation (ee ia ili: from EU

Sorm ot N-M ne function) :

1X1) & Cl~fe-bs) ular + sacs) = a dr

different values of the constant ‘c’

What should be the ar of his. indifference carve?

Recall: N-m uilidy dunction: U¢b) = & uC:

2 fpiucad tc put)

From total difserenhation: {I + pauers

du=o 5 ucm)db, + uery) (-dby - apa)

+ lds) dpby =o

=> = Cucx2) - wea) dp,

+ Cucazy - ucaz)) 4 a

> $= UAL) = WH) >

es “ulas) ua)

Cgtven that 43.72%)

This is the slobe of the indifference curve. As HH Is

positive, the indifference cures should be upward

sloping. Nabe Observe cavedully thet the slope

axbvession cloes not have pi or ps ; a slopes

ave unaffected by changes ia fp. Ther the

indefferance curves ave parallel traaght ol Increasing

in value in the norlhwest direchon,

We can rewrite the slope of the indifference curve

pe UOa,) — UO) HUCTe) —uCK) + 46%3) -40G)

WC43) — ulx,)

Chasically we ave adding and subbactng Ulta) and ucas) )

Hhat do we get from this seeming “insanity P

-UC%3) Fultz) + UlX,) ~ UO) Utz) 40%)

Ul%a) — ul4,) (Alay) 44)

> - (ucts) - cx) — Cucds) - uct)

a Ula) -UCA%2)

Leaving aside 4, the fist part is a clisevete axologue

of Atrow- Pratt coefficient af absolute nish aversion

~ WON vox).

Ide know that Cmay be later) the move risk averse

fs a DM, more concave hisfher Bernoulle catili

duncton Lecomes, then higher is te Arrow Pra

eortficient of absolute risk aversim. Then, giver

two expected ally maximizing Dis, the one

with the steeber indifference “curves will be prove

yvisR averse.

let us draw out anole subtle interpretation »

Recall expected valug of a lottery f= Chr, ha, bs)

3

ee Ect) = Se peme

ier

Py prxi Clb, —p3) wre + ps Ag

Then, we can also feure out what the iso- expected

value (ies should be. They should be solutens t

Xr FOC bi ~ fy) Hab py zy = Constant by

vaging the conshets, —“ihat should be the slope of

these” iso. expected value lines? Xa. —¥)

os =e

Concavity of ‘a’ should toll ws that

UCAr) — UCAi) Xs —2y

& O%3)= alae) Sag eee

By My hs My.

Novth east movements along these lines do not change

the exbected value of Ieeries but increase the

probabilhes tdthe tril outcomes x, and X5 at the

xxbense of the midelling outcome %,. blhat ave

ou doing then? Yor ave preserving the mean by

tohaing webabilily mas Som he mille and Sfreadi

th to Gals, Basics Your ave increasing the paved

visk. These ave called ‘mean preserving” shreads vars)

Search increases in pure risks will bead to lower

indtSfevence curves Sor risk vere DM. [By same

logic, such increases in ure risk Cmove ment

mim tso- expected value curves towards orth east)

will” Lead 40 higher indidference carves doy ith lovgg

DMs.

Vy ES

solid line: cadifterence’ curves

dotted line: ts0- expected value lines

Steab tadHerence cues af

visk avere DM

Flat indifference curves

of a Wak lover.

Again you can see that the DM who is move risk

averse possesses steeper indifference curves.

There is yet another subHe point here. rf is nol so

much the linearly of the indrfference curves thal matte;

But that their slobes bev area] ey than the sted iso-

expected value lines xo that. it it necessary end sufheioat

dor all mean preserving spread increases in risk to make

the DM wsorée off. So, you can imagine non-lineay

indifference curves ; but theiv tangents) slobe eught

te be everywhere steeper than Ih iso~ axpect

value lines,

hat is driving the linearly 19 probabilities ?

Consider utility function v',

uv . is Itneat Then, take

o” yo uo lotteries hiv ale

on bey Chere p~qy).

Now take conver combination

oh qand ¥ as well as foand Y,

Yu get ay tidy and Apt Cet) y,

Nous, Apt City y¥ axgytCi-ayy AS kp CID

lies on a hegher indifference curve, This viclates the

tndebendence axiom as ee (here bw 4,)

does not mean ee pkey % xy bed) Y. Tn

order + restore the independence axiom, wa need the

indifference curve OU" 4> fais fbrugh oc prey;

that is, we need UO" 4y be parallel of

Also, considev ‘~ q' as both eve on the

IndtHerence curve U. By independence axiom,

Ap! + cindy y ~~ «G)+Ci-a) y

ee )

So, any convax combinaton belveen duo point on

the same indifference curve must be on that carve to.

This will hafben wilh lineay incktterance curves. If

we instead had a hon-lineey indifference cuvve wu

that is passing through BI, 4! then wa gat

p+ cia) g! ery y' , as v' lier above vo".

Hence, non-lineay indifference carves violate the

indebendence axiom.

Alteinahvely put, any viclaton of the insepencoce

axiom will mese up the linearly of the indrfference

curves in probabilities. But, “that in itself chould

not bother us, as long as we have the slope of

the ent + the honhneay (ndifference curves fo

be shether Rverywhere than the jso- expected value

ines whenever you consider MPS increare in pure

visk.

Let us now explore the violations.

Violahons of linear abilities :

In ordev understand the general structure of

venous experiment violations, we need + undershrd

dirst Sepmabilily across mutially exclusive event

that Is inherent in N-M Eu theory, Let us break

it inte two propertes : ¢) Replacement separability and

and ci) Mochue se] wali.

Replacement separability :

As the name suggests, this follows fom the additive

Structure of the EU hen 2 p,. uct) and

the duct that the contibutin of “each pele els

pay Cpe, %) te this sum is independent of” the

other outceme/ robabilily pairs, as shown below.

bs a pect

pale ta 4 7

Simple } ery e bo wots)

Conbibuhon of each P : .

cam Mh par Pr Ucn)

Rie d Pte Soke

alee HE

ca . t b.. [asacr, t44oy)]

Contibuton of °

each sub-ltHlery P Xa

‘phe ae 2 Se iy bo [1 u0s) + ao)]

Ife pM byaters to replace Ca br) by C91, pi)

above, Cire. 1 loHery (91s pis %aepay- Anspn) 75

prefered Cary pis Ar, paso Hn, bed) Inen he

would also pveder to yeplace C41, pi) by (9 pd

in any othey lottery of the dorm Coys pis oh bE,

ae a) This will be tue even if one ov more

outcomes of C%1,... xn) oF Cosy. 0,8) fake the

Same value as A or Y,.

Mixhwe sebarabilly :

Tt follows from the fact that the contibution af

zach outcome / probability baiy ts EU can be interbreted

as the utility of tty outcome, utac) mutblted by ats

obabilrdy pe Because pucy,. > bf, Ucn)

=> uly uu), an BU maximizag DM ast Il

prefer Cy, > brs 2) fais 2m, pn) over

Ct, pri Fay pas - pin pr if and only iS he preders

yy tn an ough choice over these fuo sure

outcomes.

These sebarabilty notions extend 4 seam mutually

exclusive surfatteries oJ a compound lotte,

Contribution of sack sub-loHery fo the Eu of «

compound loHery i6 tndebendent of te ofber sub-

lottery Cor sub-lotteres) in the compound lottery.

I$ an EU maximizing DM prefers fo replace the

upper sub-lotley Cia the second diagram above) by

Hs 7 I. ,

another sub-lottery, he if nx,

eas aaa

Vi As =

ho,

then he would prefer to make this replacement for

any othey condiguyahon of lower sut-lotlery in the

diagram, which is nothi but veplacement

barat “over cubletlead.

Now, ffom the diagram, + ts clear that the

contibution of each subletlery fo EU can Le interpretel

as the EU of subloter multiplied by its probabildy

(say bi Ov pa). Because

bi [44 Cao + dz alya) + 43 ucys)]

> b Lauct d+ q240))

ity [a uly) + An wcy) + Ja, wen) > Lamont gacsy|

an EU maximizing DM will sxhibit fre breterence in”

the above diagram if and only if

A Yr yy ay

4s ee

ta an oubight choice Lehween frese two simple

lotteries, This is mixture Separability over sublotteries,

Independence xxiom is a combinakon of the

above duo separabilites across mubally exclusive

outcomes and/or subleHeres. The axiom Cind ependence)

and hence he above two arabilly properties is

eyuivelent to the pavperly Mat NOM utildy functor

takes the Expected Otildy dum : U Cp) = Epc),

Violakons of separacility :

Allais Peradox:.

Consider

a,: 4 chance of 1,000,000

versus

4: (0.1 chance ef 5,000,000

©.89 chance of |}, 000, 000

Jets chance sf 0

and

a3 : §e! chance of 5,000, 000

64 chance of O

Versus

a: 13 chance of 1,000,000

0-384 Chance of ©

Make your choices.

Letting § f2,,22, 43) = § 051,000,005 5,000,000}

these Souy gambles will Soom a parallelogram in

the Chi, fx)” plane.

4 Experimental evidence: A, and 3,

If you chee ay over | a,’

gour indefference carves ave

[Ax 4s steep and hence you should

° have chosen ay over A

a 4% © re you had hte inde teres

curves, you should have chosen a, and 43 ja the

two sthvatons given 4 you.

Let us present these stliahons differently now,

y 5/080,

ol 4,000,000 eae

oil eee

a, —<— vewus a, a Ti~o

mea 1,000, 000 Bee

and 1ofr__. 5,000,000

oN 7 e bo. 1,600,000

a ¥ Versus a

sq +

oan ° 23a

You can see that Allais Paradox is Violating the

independence axiom, If you Itked Co. 11, tye09,008 )

over © \) chance of 1%, 1 51000000 5 fy

then ivresbective of the irrelevant third option, “you

Should choose the same. Ifowever, you have

Hipped cif you chose a, and a3). This is also

the violation oH replacement separability over subbtere

as the choice of a, over a, imbltes « prederanc

Sov replacing “ppey sublotary in a, by « sure

outcome 1,0, 080, when lowey branch ives 1,000, c00.

However, chotce of 4a, over ay Vnpltes an

wnwuillingness te do the same when the lower branch

Gives “20,

In the diagram such violabons (ay, and ag choices)

can a whea indifference curves stb being parallel

and instead San out.

Leb us take another approach + understand the above

vielation, You can visuahze these loferics as a coin

toss experiment. Len ‘heads’ you get fo play Sy.

and when nile somathing alse CGAY aecebendinea

axiom falls you that preferences over what would h

when ‘head’ oe should not depend on what would

oN

hebben wher M1? abpears. To make it cencrete:

a, x 2hvee00 F CH- ON) SL

VRysus

Az + ONT 1 vat, 5000/0005 30] + 01-01) Oy woe,

Nea: - ae. BIA [ [8-52.00 pe] teresa eo

Versus

Ay = 0." Ld ®abwyose] + C10. )bge x0

Okiously, when the DM is belter off in the event of

tail (1,000,000 versus Zero), the more risk averse

he becomes over what he would got in the event of

“head! hen the tail payoff becomes low, he becemes

were less yisk averse. ‘This fhenomenon, vid. « swing

in preference from more visky less risky subloteries

in ene branch of compound loffery as the sublottery in

the other branch imbroves in the sense af Aut ordey

stochashe dominance [_ probabilily of Letter outcone betley]

is called as ‘ common consequence effect’ An

alternahve interbrekhon is that, given DARA, in

the Common consequence effect, 4 disjolays more

WER aversion jn the event of an obborhinit bss,

and less risk xvertion in the event of an Opporhinily

gun.

The next Rind of Wolaton occurs on acceunt

of viclaton of mix-ure Separabillly. J ee

. . ' 1S % chance ol

Consider a, + Saeacetich versus 432 aiact 5,

Tp chance of X Sty chance of ¥

Mig:< y

pia Sy erp chance of 6 OM 44 ake

where Pr ps2 Of%LY and otra:

outcomes ave fo, 7%} and lotteries can be

yepresented on this outcome Space,

Didderently representing the same IcHeries :

bx ee)

a Versus az os

en ;

hp -F@~o

and Yi Xx ap:

a, see ° venus Ay ja O

1-7~ ° I-r~ ©

From mischare. ssharability, you would choose az

over ag “Ahoncuer :

y [ pace) + cp) co) | > [4 4cy)+ci~y)uco)]

<> pfaex) 40] > gy Pucgy — ue0)]

Alternatively, 44 over

8) neler even ag and ay oer 4

ee Pe eal

However people in. te experiments chase Gy a,

and a. This phenomenon Is Rnown as ‘Common

watis effect’. the ame comes Sam the tack

that prebCA)/ tui y) in ay versus ay is

the same as in Az versus ag,

In case you are myshdied, here is ancthay eaunple,

choose beween 2000 For sure veysus 2-8 4000

0:25. 3000

choose behuson 2 5 venus

os

Peeble in axbeviments choose 3000 for sure and doy) chance

of 4000. Here, the Sam is like: (Yb o!—b) and

Ca, Api ©, 1~Ap) where x >4. Here rot i constant

odds and ends wih N-M_ utility Aincken:

Is N-M utility ordinal ey cardinal ?

Even though we uce the tum ‘utlily’ in the

ey cones vs ubldy ts distinet pe ep ordinal

utilely function consumer the Breneva| eguilibriam Iheory,

ok en distinehon lies in reid 4's that “ke latter a

defined on the set of consumfton bundles /oulcemes , wherers

the former CNM bly) is dabaed on Ihe space. af

probabilidy distibutions“Nen\ "outdone Space. The second

crucial difference is“ that the Latter — uledy

consumers) can be subjected 4. any monobnic transformation,

while oe wkilidy CH only be Spas + attine ;

deans dovmahons “Cue. «0lx)+b, boo; vib, “ Chenge

63 ongin and/or scale; but do aa charge the shape of

the Aanction). Te, that extent, His cardinal; yizl, the

EU properly 18 cardinal,

Is it « probability Aanction or an etildy Sanchon?

Recall that tn the foroof of the N-M theerem,

we took uct) € Lo, 1] and called if an elementary

uhldy dunchon. Does 4 mean that the atl, Sunchon

of “monetary outcome is bounded behveen o and 4?

No. It can dake any value due to affine fyansiormaten,

Example:

Lott

Lahey J asset A (asset B

ae bea) 2 pcx)

s Sr & x

lo %,

: 2 ti H

wes) 2 a? Then, B,uct)= +5) + Ler

= 42-5. |

7 Egucx) = 4, cays bf

Wi ux) = loox E, 4, C1) = 62-8 x10 = 6250

1 ‘ = 6f00

Ep Uy lx) = 64x 100 .

cin) area) = 100 +t" , here b= -/00, @ =!

Reduction of cempound IcHleries ;

Note that the agent is alusays indifferent between

any compound pies and ds probabilist cally epuivalent

sidgle stage ‘simble’ lottery That is, ¢nherently we are

assuming that ‘the sequential nature of choice in a

compound lottery does not vequire significant mount

oS time. ;

Example: mH x aan

bh bit

pri. ps) :

Va - 2

fs ta > tae ta Xa

He ave ignoring the ‘hme ail taken 40 perdocm first

and subsequent randomization Che Chupa) aod then

C442) or CTs) and also ignoring the sequential

nature oF the sitsetion in the combound lottery care.

Eriven this tmplretl axiom, he EU of both the

compound lofley Cwhich is< malki-stege one) and the

equvalent sible loHery ¢ which is Single stye ene) are

Ine same:

big, 4 Ce) + bi G2 Cas) + p27 Mts) + pate UC ry)

This is of course, ‘lineay in probabilthes? which means

that EO fereterences exhibit separability across muraly

exclusive events.

Money lotteries

Henceforth we will fake it that risky loHertes

yesult in outcomes expressed (nm money terms, Let us

take monetary outcomes as a conknuows variatle. Then,

ary lolery can be described by the cumulahve

atstibuhen fanchon CepF) F: IR —> Lot], To

vecall, Fla) is the ae that the realized outcome

is less than oy equal xy te. Pexy ("Pade

ae bes

We will view ouv space af Ietedes as space of

all diskibuken Sunetons over set of monchany outcomes

As usual, UCF) will be N-M uly funchon over

loHtedes, or eauivalently CDF and uca) will be

Bernoulli ubldy fanchon el" SiPcomes x, x 6%.

OCr) = Uc) d Fox)

EK Bernoulle ability

= wea) £oa) dx

xe Fel density Sunchon

Let us recall Tensens ioequalrly . Consider a real valued

funckon 'f' “Gad any rvandom variable Cr.v.) %. This

inequality states th at

BL Pte). 2 #LecBol ih Pee

In continuous terms, ae

Sucrsordx 2 ul fxdearax]

Recall that $ is concave iff rE C1) and ¥

CAA) ce alone alt

rfea) + Ct-rn) feb) 2 $ Crat G-ryb)

6

Note that the ‘if4' statement in D fllows hom the

equivalence behveen (0 and @ when ¥ is binary

and dichibuted as (4,A; b, CIN). OF course,

Jensen's ineyualey extends this dediathon fo any general

nV,

Remarks:

GO) TS f£ is convex, tea 3 vv. F we

E[#eE) = £ Leck).

(» To ay Jensen's inequality, we do not heed ty

know whether is diHerenbable er not. However, if itis,

then # is concave iff $f" 20 when domf = IR,

Definthen: ,

Call a risk ‘achanally Soar’ oy * pure risk’ if

it has mean zero; je ECE) =o

Dediathen:

A DM is risk avese. if she declikes all mean

Ber risks at all wealth levels.

Let the DM's a wealth oe Let hey

engage in risky actu /[ote, denoted by the

Oe Then, final — See is ye rv

Hence, BE ut wt %) ull ECwot®)]

OL w+ EcX)]

= u (ud) AL BCX)=0,

Ser all pure risks,

Equivalently this DM is yisk avere if and enly

fo EucE 2€ 4u(6cd)] fr all nv &

representag foal wealth F = woth ; ECE) =0,,

Hence, a DM is risk avene If replacing an

uncertain. final wealth by its expected value Dect

her better off. From Tensen’s inequality, this # Is tue

and only if Su’ is concave. Hence we have the

Sollowing result.

Result,

An agent /DM =e with Bernoulle uklidy dunchon

UL) ts ae averse if and wily if utr) is concave.

WY an agent is ASR loving If F her utile) tunchon

is convex “and yisk neuve! iff her ublily Aincton

(Ss hnear.

Hon

Risk Averse DM

ule)

wee) fec3)

2s) wg cect)

7° cece) 5 ack ¥

mE) = eck) - cack)

Deginth on: 20.

Certainly equivalent of a lottery, sey 3, wie,

CECE) is the amount of money for Which the DM

is indedfevent behveorn the gamble and the cevimn

amount ; ve. =U CCECE)Y = EUCT), In terms

of CDF notxton, u(ce (Fad) = {aon 4Fey

= fue $ca) dy.

Note hat uCec®)) =z & uc®).

So, in CDF notation:

cecru) 4 [x dFtx) ¥ F means DMis risk

xs KAKO) Seer

Let us check fit ts tue.

cecr,u) 2 fxdrFer)

C2 wlee Cha) € u ( fade)

<> fucarydroad 42 uC fxare)

“UW CceCFuy) = fucsydery)

which (s Jensen's inequally, a dedsathon of ce

dekniton of DM's risk aversion charackershe .

DeSiathon:

Risk premium To is the «mount the DM is

willing 4 pay fa ordey t avoid a pure risk.

eee visk averse agent, risk premium W is

posttive.

That ts: EuCwt%) £ u[ecuwrX) -1]

= ufw.-7]

Using Taylor series abproximahon, LHS. is:

Eu Cudy + L) _ [ucwse) + uleud) 3X

7

ullCwe), oy...

es

des gate) + w'lude) BCH) + uC.) 23)

ree

a

ule) + SH y"Cw) fas ECKa0]

2

Using Taylor series abproximakon, RAS is

UC Wo -T) = UC.) — TT. ullW.) 4 --

es

2 Uw) — 7 u'cube) 1@

Equedag LHS and RH.S :

US) + S% UlCwe) = — UCwBe) — 17 u'Ceby)

2

i»

= — rei pies

o U' CW)

ce Crd (2 u"Cuds) 7}

r 2 vicw.) 4°

Deginiken: = Ralito)

aun) Lirias) ce) odes. ass aE

coedhvieat of “absolute risk avecion .

As you can see, if nish aversion Is eajshured by

fhe concavity , Hyen a measure of nsk aversion should

‘eitert of, o

cApluve the “concavily, Lhy act ou" alone then ?

a

Tt will not be immune fo affine transformations, Note

that Ula) and waeauta) +5 ave same dor us ; but,

u"ox) and au'ex)

aivding by lcd

int a pbesikve number

ave didferent.

and minus Sign

as ull) is

Relehen bebveen CE and Ris premium

How ave they related? Trinal.

ucce¢e)) = Eucé)

= u(ecd) -7)

CELE). = BLS) =T]

Hence, we ave

ust converts iF

ahve.

eel), = Caray x,

alta) 2 gice) =o as ECR S12,

Differentate © once again werbe k:

EL ul Cato tk) | aff g'Ce)] * u'Cwe —gck))

—g' Ck). us 'CuS,, -4Ck))

=> grtk) = - uw! Cw) ecx*)

uiCus, )

Using Taylor sevies expansion of g wud k=o:

Ww aiayaty ER gtk) ~ (ate) + kai lo)

# he -g)

rte Paya) y= +. EC¥*). Ry Cum)

It says frat risk premium for small pure sk is

abbesximalely —beoporlional 4 ils variance.

As size 6¢ visk k tends te 200, rvisk premium

tends + zero in the order of k*. This is what

is Rnown «as ‘second order risk aversion’.

Usiag cl jedsnithon ;

8 ced a, RCR+R)) = RR - & RY. Rabo). £65)

20

For small R, CE of risk CHER) equals AP, aad

the riskiness of the situaken does nef matter

Note that what we have Sy Tis an Ap proxi

makon. This abbrxtmaton (ir = + EtY*). Rl))

works dine as long «1 k £4. For lacger le i

andereskmates true T.

Crudely put, Rp Cu) measures the maximum

amount that a 2M wih wealth wo, whildy 4 is

yeady te pay to get vid of « small risk wilh variances,

(in owe 7 apprximaton ).

Comparakve Risk Avecion across _pMa:

He want fo compare two DMs and want to

say when one will be more nik averse than the other,

From our discussion of Arrow- Pratt cocthieienl of

absolute risk aversion or risk premium, we know

that DMs is more risk -averse than pMa2 itt

Ra Coo) soy pM) 7 RA bute) for Doz. rf So,

then TT Cue, u,, X) > TT Coy, 4, ,%), lettin

boy's utility 45 be uy and DM 25 te be uy Leb

us dormahze all this row,

crude Definihon Cverbal):

Suppose uy and Uz have the same inital wealth.

DM uy, is more aise averse than DM uz tf uy dislikes

all loHeries that uy dislelees, independent ed their

inthal wealth,

To characterize this notion ‘more risk averse’,

dedine a functoa P such that

ptu) = aCus'cw) ¥ u

Because uz is increasing Co u,!>0 ), $ is well

Aekned By dedinition:

wc2) = Cusce)) + 2

Thevedre, cb transdorms «Ug. Info Uy.

2

Also, aiC2) =! Cuca). us ca),

> icuc2) = WA), 503)

RAS. is besitve as beth u, and Ur ave increasing,

Hence is lncreasings

Is $ concave ?

Differentiate 4'C2) = o'Cuzca)) uy!Cay eae

u"C2) = oon 2°C2) ) [u,'Cay)7 + # C4020 a ey

= Plager) (u'r + 42). u,"c2)

uittey 3

Divide throughout by urced:

eee ah ulcey 4. uaa)

uy ue = $! Gusca) £ ay 2

uy ce) “asiee) i

=> uly uta _ Sac

ast) u,i€2) aa}

Now, u,'>0, uz. so, fslcel7, 5 a ésay)

"C2) _ usta - $'Ca,c2))

ute) PHEY)

UEC) Ue. 5 trek ia. tat

u'C2), u'c2)

DMI > Ry of DMZ, thon LH-s. 's pesthve.

> 4"Cace) 2 o.

So, > must be concave iff Ry of DM, >

Ry of DM 2,

Consider now any risk X tel fs dtsliked by DM2

That is, Eu, CWotX) £ u, ( & (wet x)

= Wz Lae).

Since is Increast and concave, Jensen's jn ality

tell mae: 4 ce

22

E[ucmix)] = EL ocuy €4304%) ) |

4 [e Ca, (wot )) |

& Cu, ¢w))

U, Cwo)-

D> concaviy of 18 sufherent te grersatee thet

) Arshkes “All risks that u, dislikes.

Concavily of b & also necessay. If ¢ is

not concave, then 3 an interval a the image set of

tae where = ou, Cas'G)) 1s | convex

Consider an inihal wealth uo and leery 3

has its support ta that violatiqg caterval 4.

Euzl Wot) 2 us cue), “using Tenrene inepaalidy

as above but with locally convex ? ytelds the resuif

frat ou, likes 3, meaning she is more prene te risk

than 4, , a conbadichom

Hence, we conclude that u, is more risk averse

than uz fF ou, te a concave transdermahon of ty, Ee

we assume that these two wW,4, are twice dcbiterentalle,

"20. That ts,

glace) os ais [ Ra Cun) ~ & Cu,)]

2

where Ralis) = = 4y''Ce)/,

iN

nit

Abe Woth

(ay

uly

and Balt) = — WEY cay

is concave (44 Ry Cxr,) > Ril),

ng nll thr, we get the follousing result

Se, conclude th at

Sammandi

Results

Sabbose us and 4% are duce alfferentatle. Then,

the Sollowing are equivalent :

ci) DM uy ts more uk averse han DM uy,

cil) Uris a concave transformakon Up

GB) RACH) is umidormly Maraer than Ra Cus)

23

This yesult should also mean that rcu,) > Tee)

and CE, CH) « ce, cz). Let us see how jf

works gor isk premium and Cerbrindy eynivalent,

A more risk averse agent ouphi f be wsilhag

te pag higher risk premium te escape a given risk.

Suppose ou, is more risk averse than “Uo. Then,

fe show: T( 20, 41, %) = 7, Z Wlte,u, X)=m,

ey EUs CP4t¥) = us (26-72)

SD. pC te +) =) wes. Sa 5, 1 reo,

RWS = 7, 7 ie,

Define Bs, = 2 =-T, and Ya B47, .

This *s then equivalent tu, ecting all Inttenes

dor which uz ts iadrfterent, assuming they have same

wealth u%. Lie know thal this is Hue ; ard only if

4, Is more concave than uz. Summarizing tars

lato the Following result;

Result:

Agent uy is ready & fay mere nsk premium, he,

Tr Zin for any u9o,% Fe 4 is more Hsk averse

than Uy.

This result should alse mean cac#) 4 ce G)

gyen thal 1 = eck) = ce cxy.' :

Attevnahve Prof :

U, Cee, CX) = ELa, eX)

As wey) = Curc-r),

4 Cee, 6%) = Ef pcuc-r]

£ fe Cured).

Bet Efuscy) = a fF, CX) .

So, wee, CX) 4 Lu, (ce, ¢x))

DS Ww lee 6) 2 a feu C11

=> 8,00 4 Cey GX) iL Pecan

=> Wu) 2 T4g,%) — Le dedn comechg

i and cB).

Comparakve risk aversion across Wealth:

It is usidely belteved that the more wealthy

one is, the smaller rs the visk premium, This

corresbends te decreasing absolute risk aversion Cosa).

Dediathen:

Pregerences exhibit DARA if the v1sk byemium

associated with any risk is a dacreasing Function of

wealth: fe. STH) 4 6 for any Woy X.

3 We

Recall: Fucus +%) = UC. - Tl, u,5))

Differenhate werk. ue:

Buller Ht). 4 = a'Cudy-Tlde,4,5))

«Ci = Bmw 2X) ]

> eu'twothk) = ult.) - u'C.9aT

5 %%we = wiCweaTen) = Bul

u' Cade =

This is negatve if Eu'(w.t®) 2 u! CW.)

=> wwe, Wak, ‘

EuCutet®) = uC wo —T) > cults rzutga)

This is hke puy zarher result wilh uz =a and

Uosc-u.

lthat ts oa! 2? ule -u" ; bit ul ze as

U is concave. Hence, u,' yo. uj =" sill Sey

Hence, -ul is @ concave Sunchon, Lie brow that

Chom our eavhey yesult) uu, is more risk avene

than 4p. Hence, the necessary and sufficient candthen

fer isk premium to be decreasing 19 8. 18 tha

25

1

—u be more concave than U,

bet PCa) = - UMCa) /u"¢2) dencte the

degree of concavity of ul. It 13 called Ihe cohen

of absolute risk bridence. Now, -u'l 1s mnre concave

than u 1f the degree of concaviy of ul 19 uniformly

lewgey than tw that of u 5 we. Plum) = ky (ud)

This ts equivalent te the condition that Ry be

decreasing in wealth +

RyhCwo) = Ry Cuda) [ Ry Cus) — Pu ) |

For Ra + be decreasing (A aS, Ry! Co) 2 0.

D> Plado) > Ry Cad).

Let us summarize all thy in the Silleesing resalt

Result:

Suppose wis tntee deffeventatle. Then the Flexing

awe uivaleat.

GC) The wisk premium ts a decreasing funchon of wealth

cil) The coehhtient of absolute xk aversion t's

decreasing ia wealth.

eit) =u! isa concave tranrdormaton of u . te.

~ ula) Anca) 2a"), * a,

tle can then tk xbout Increasing absolule risk

aversion CIARA) when Ry (eS oo and

constant absolute visk averion ¢CARA) when

Ry Cum) 20. From those dedinitions, ove can uneacth

theorems siexd analogous te the one above.

26

Relative Risk Aversion.

The dundamental guechon behind abseute rick

aversion 18: how altitude to rick changes with changes in

the inthal wealth, without changes in fhe size & the

lery /gamble, ele could now ask: bow cloes abihdle

fo risk changes when invhal wealth and the scale of he

loHeng / gamble” change together rhonally.

fay cour OM B vepvesente ae inereesing

concave utility functon, which is Voice continucas h

Aibterenkable. He chooses simple probasilitly distibuten

over outcome space. bet uw be Ais inittal wealth.

We will now consider multiplieatve risk. If he

indulges ia the risky achwily /gamble /lHey , his Sine!

wealth will be + %, = uw Cit RY)

Dedina velakve risk premium, IT (we, u, RY) as the

meximum shave of ones wealth that one is reacly fo

te escape the risk of lasing a vandem share ky of his

wealth, a

he. TT (we ,u, kf) =

Tor WekZ)

We

If £c9) =o and hk is small, the Arvow- Pratt

Aabproxt mation yields: . uf

Wwe, u, RF) & tp ECke) [== eee

G48.) oC,

Here, — We" ricany IS the ceedticient of relahve risk

aversion; we can denofe it as Re Cw)

Hence, the relatve risk premiam is cp proximately

proportional to Re Cus).

Think of Ra Cue) comparing altitudes ts visky lHertes

ushosa outcomes ave absolute gains oy losses fom current

wealth, By the same logic, Rel) then Compares risky

loHenes whose outcomes ave percentage grins or percontage

losses of current wealth. The Re tsa Strengev measure

than Raj a risk averse DM wilh decreasing Rp will exhibit

2

decreasing Ra , but the converse ray not be true.

Again, for relahve ask aversion, we can

prove “equivalence theorems as we have clone dor

absolute risk aversion.

tle can also dledine ‘Decreasing relative visk

aversion’ CDRRA) as ARR@/S 2o 4 2.

This says that the DM becomes [ass nish averse with

ard & loteries that ave proportional t hes wealth, as

his wealth increases.

In the same manner, we can also define increas

reledive risk averion CIRRA) ARR, vow 2

and constant reledve isk avertion CcoRRA ARKO). 9

ae

An altemabve , intattive interbretatten is that

undey ERRA, the wealth elasherly of the pu's

demand for risky asset is shictly less than 1. That is,

the prebertion ef DM's inital wealth invested in the

risky asset will decline as the woalh increases.

Onder cRRA, the wealth elastely of

Ay risky asset equals 4 and under DERA, it

exceeds 4,

ble can see all these fymalized fa the next few

pages tn the context of fortdelio choice,

mand

28

Harmonic Absolule Risk Aversion CHARA):

This is someligg you might come acrss offen m

ney stpleten anlens

An tilly fuacton exdibils HARA if the jnvewe

of tts absolute risk aversion is linear iq wealth. the

inverse of absolute visk aversion is called the absolute

risk tolerance ( Tew),

ie, Tow) = Ye a8) . rae

Consider ucus) = oo (Bt uW/, ) desned on

the domain of uw 4.b. pty Sa, Then,

u's) = a Cl- 7h (prey) ~”

"() = -— a Ci-» + /)~

utes) a Uw) (pty) F

ut = cle v+l i

u“Cos) a& 2S +!) Cpt)

for wizo, v"Zo, we need acres >,

‘ - Wy, be

Race) 2 - MOY 5) = (P+ %)

1

Tlw) = heey = . PI ~

Pow) = - wee) rp) = ERY Mk

Reto) = -ar lls) - “ecpesy”

“u'es)

Angin parameters and V, one can

By

ale al wll functions that exhibit HARA. Lef us

See thyea sach cases.

CRRA:

If B=o, Rplw) = VY ahich is

non-negakve. Thus, B= 0 corresbends to a siheation

24

where yelatve risk aversion is independent of umalt,

tia u'G) condition , we can choose @ in such a

way as normalize v'C1) =|. That Is,

Red CG) ot 5 ee

zea

Hence, w'cus) can be rewntlen as: u'tw) = ys

Integrateg we can unearth: |»

ucw) = we fi-r th ve

In os if Yar

Linen yp 21, ubldy goes Som ob 20 as uo goes fem

ot 0, hen yoi, ubhy gow dom — <0 jo 0.

Note thal all these atilly Junctions exhib'l DARA:

Le Ratw) = = igh Ao:

CARA:

From Ra Cus) expression , RAC!) fs jndebendeat

of ws i. ys +. Then, Pace) =

= constant ‘ke’ say.

Then, solve the edeffevenhal uation

is GG9) re. cheba ceal Las gh

ut) = = exh (-Re) fp -

All such utility dunctions exhibit IRRA.

Quadvade ability fancton,

Choose Y=-!. These Rinchons have two

peblems. First they can be defined only on the interval

of wealth w94 B, since they ave decreasing when

> p. Second, they exhibit” LARA, which ic not

combakble with the chseruahon that risk fremia fy

additve visks ave decransing with wealth,

Porttolio choice problem:

Consider a portfelto choice problem of a risk averse

DM who strictly prefers more ts less C increasing Bernoulls

utility danckon). If the pm vinvests ay in risky aset

and W@W, — £4;) in the ruk See accet, her

“end of the fered! “uncertain weal will be:

wo = Cle = Bag) he) # 2 4 C47)

A Lares pide Ci) 8 FAd CY; -G)

where F is the vandom rate of return on fr ritky

asset and % is the risk Sree yate of return.

The DM ante: - [aQwocmper gay Oy -4))

rg

Since De is risk averte, wu fs Concave, and fence Foca

ave also sufficient. They are:

e[v'c®) CF, -y)J =o we

A DM who is risk averse and who stictly presers more

to less will undertake risky investments iff he rade af

yelurn on at leas! one misky asset exceeds the risk

fren yate of yeburn, How ? a

For the DM to ‘invest nothing in tha ricky assets

t be an obhmal choice, it 1s eatin that the Foca

evaluated at ‘no risky investments? be nonprsthve:

te EF [ulcwectty)) CY —4 J] 20 #4.

That Is, r

al welity)) E Ctp-%¢) £0 & §.

This habbens when ay =0 consaints held goede

Bul ui 20. tlence, “the above says that

ay £0 vy only 1h EC -y) soy,

That ts, the DM will avoid any Pe risky investment

onl if none of fhe yishy ausets have a shichly

posthve risk premium.

Let us simpliSy and now allow Sor only a siggle risky asset,

and one viskless asset. Then, the F-0.€. simplidies

E [ul (Woclty) + a C¥—%y YC¥ -%)] =0,

where ¥ is the rate of return on the siqale risky «itet

Then, dor this DM fo invest all her weal in the risky asset

EL u'Cwoct FM%-%)J] Zo

Cr here a = we 3 erhre wealth id investecl in the viskyavel)

Now, we want te know what would be the risk promiam

that is neeced fo make fhe DM invest all her wealth in the

risky asset. To do 503 Jet. us Sirst take Tayky sertes

expansion of daetpthin SMareund weit), get

UIC, Clty) + a CH-G)) we (ul Cwecity))

+ a. CF 1%). Ulap

+ higher ecber terms

Take expectohon now and evaluate t when a2 ah :

e [e' (0% C1#%G)) + wu Cuscitrs)) C7 =% |

1a)

Reeall that we need an abfereimaton for El ultw.cit¥))

CY - 17) Jzocendihon, Hence,

Efulewecu?)) C¥-G)] we & U Cw, Citys) EC

# w, ECF —-y)*],

tl (ud rp) )

Cusing @) ancl

Yamembering 40 multiply by

-%)

Su lWwonpea-yrwe bape o

SD ECYH%) 2% (wocty)) we. e[c?—4y"]

where Ry = -u"CVy1G) «

LuW-s. is the risk premium and the Ris. ceadchon is

alveady familar t us. Hence, Jor the DM 4o invest

all hey wealts in the visky asset, the minimam risk premiam

veqwived should ot lest be RylwWellty)) a. E [C71]

DARA _and risky assel:

Leb us now explore the links behveen DARA and the

tavestment vn the risky assel, Recall DARA: 42) 20

2. Basically, RAC) should be x shretly deterring

function

Our iatuiten should be that as with DARA over

whe entre domain of Rat), demand for miky asset

should incresse as wealth increases. Let us formahee it.

Result) C Arrow, Ko.)

Ok 4, <6 +2 9 ah

w Uo.

CRecall: ‘a’ is the amount invested in the ricky asset )

Prood :

AM the effimum, i

E Lulcwocitrs) + ac¥-%)) C¥-G)] = 0

CY Quo

From Implreit funckon theorem, vie a7

Hence, & (uN) 6% -vg) J Lrg)

da. et So ee, Sie ae bi

os, = eG

where % = wolity) + aCF¥-%), vib, the end off period weallt.

The denominator +s “+*ve as by risk aversion uC) 20

Hence, sign of Bef, = Sign of [ elu" &)c¥-4)))

Onder DARA, when ¥ Z rp, we have :

a 2 We lit%y) as the amount invested in the risky

asset is shtetly posthve. Thus,

Ry CB) 2 Ra Cure City). 3 ©

Similarly, when ry > ¥, we heave B 4 weCity)

and hence Ral) 7 Ra (welt). —3 ©

Multi ply © and @ by -~WOB)C¥—y) :

> u'CB)C¥—-1s) 2B ~ Ra Codec yy) wei) CF ~1y)

Cr % zB tg In this case) lw =

and UNC) CF =p) > — Ra Cool its) uC) CF 14) 5

Cz te > F in Mais cate)

33

From @ and ® we gel: ty

& Lule) C¥ yO] > - Ra Cwoc try efile) el

nS

Cr pb. of F> te must he ia Co) dor an obhmal soltion

to extst.)

Recall the Fo-c.: ELeCR)CF—17)] = 6. sabshhte

in® ie ElutcC¥ -)] 7 ©. Hence, te

sign of 44/40, sew. fs positive, thereby letting us

conclude thed — F4/Judn > 0.

Similarly we can prove the Sollowing :

LARA: ARDY, vo #2 > he, cava

CARAs ARACI/4g =O ¥2 DS Aa/jw, = 2,4,

Note: au Va ¢ay)®

—— Ral = -¥ C2). wl) + Cullc2) a

ay Teta £0

> ul zo,

Relahve risk aversion and risky assets,

Aw we have Seen, the propery of DARA js

related 4o money demand of the risky asset. Thas the DM

with a DARA wy dunction may acksslly increase, decrease

or held constant the preortion of his wealth Invesied in the

risky asset as his wealth increases.

Let us vecall that the Arow- Prat coefhivien! of

yelatve risk aversion is: Rpl2) = 2. Ryle). Thok

now, fora change, about Increasing velative risk

aversion CIRRA), flere, Ake, >So «2.

The wealth elasheily of the DMS demand cbr risky

asset is shicHy less than 4, That is, the frmberhen

of DM inital wealth invested & in the risky asset

will decline «s his wealth tacyoaser. Under CRRA,

the wealls elasheity od demand Jor the risky asset wille 4

and undey DRRA, it will be greater than 4. letussechw,

The wealth elashetly of demand for the risky asset,

2 = Vn °% = 1+ Celeste

= Eli rap

a,

From the enrkor result, we know “Me, = TER gel

Substituting it in the above 2 sxpression: ne

w0CliTs) ELule Icy 4d] + 4 E [nici ce)" ]

= V+ oe —— — rr

L = a Flu) oF)

Denominatar is postive as uw £0.

The numerabor can be writen as:

E Lud) C wol ty) + 4 CFG) CF-H)J

= Eu") & c¥-y)]

Hence , oe “c) B c¥ -¥)

[al') FG i

> sy of y-1 = spa of SE Lulcd) Bc¥ -i Ny

Under IRRA:

Re lOoli4G) +aCF-4)) = Re (wocitty) )

if ¥zrty

and Rp CWolitty + acy -~G)) 42 Re laycurrp))

if Yery.

Mullifly both sides by - UCD) L%—%) te get =

wld) & CV-G) = Re (uC) CBI -G D

when ¥2 4%

uc) WO CY -G) 2 — Re Cae City) CBE -G)

when F< tp.

From these two and Foc. €E [u'CB)@-yI)] =e,

we get:

and

E [ulem) OC¥-W] =o,

Hence, sign oo y-+ £6

eh = ele See

Similarly, one can forsve analogens results ef DRRA

and CRRA

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Micro 2Decision2014LecturesPart5Document9 pagesMicro 2Decision2014LecturesPart5Anirudh JayaramanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Micro 2 Decision 2014 Lectures Part 4Document30 pagesMicro 2 Decision 2014 Lectures Part 4Anirudh JayaramanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Decision Theory Part 2: These Are Lecture Notes No Originality, Other Than The Organization of The Material, Is ClaimedDocument16 pagesDecision Theory Part 2: These Are Lecture Notes No Originality, Other Than The Organization of The Material, Is ClaimedAnirudh JayaramanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Decision Theory Part 1Document38 pagesDecision Theory Part 1Anirudh JayaramanNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Micro 2 Decision 2014 FiguresDocument4 pagesMicro 2 Decision 2014 FiguresAnirudh JayaramanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- TG Number SystemDocument92 pagesTG Number SystemShayak R100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)