Professional Documents

Culture Documents

SFGSDF

Uploaded by

Camille Caramanzana0 ratings0% found this document useful (0 votes)

66 views1 pagefsdf

Original Title

sfgsdf

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfsdf

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

66 views1 pageSFGSDF

Uploaded by

Camille Caramanzanafsdf

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

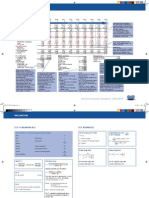

ESTIMATING THE WEIGHTED AVERAGE COST OF CAPITAL

Input cells are in yellow.

Comparable Companies

Firm 1

Firm 2

Firm 3

DATA

Amount of equity

Amount of debt

Tax rate

Equity beta

200

100

40%

1.10

200

200

35%

1.25

300

200

38%

0.90

RESULT

1+ (1-T)D/E

Unlevered equity beta

1.30

0.85

1.65

0.76

1.41

0.64

Average

0.75

Project or Acquisition

DATA

% Debt

% Equity

Tax rate

40%

60%

40%

RESULT

1+ (1-T)D/E

Unlevered project beta

Project equity beta

1.40

0.75

1.05

DATA

Risk-free rate

Market risk premium

RESULT

Project equity beta

Market risk premium

Equity risk premium

Plus risk-free rate

Cost of equity

= average of unlevered equity betas of comparable firms

6.00% = yield on long-term Treasury bonds

7.40% = historical average excess return of S&P 500

1.05

7.40%

7.74%

6.00%

13.74%

Note: The estimate of the market risk premium is the arithmetic average from 1927-1997, based on

the Ibbotson Associates "Stocks, Bonds, Bills and Inflation" data.

DATA

Cost of debt

9.0%

RESULT

Weights

After-tax cost of debt

5.4%

Cost of equity

13.7%

Weighted average cost of capital

40.0%

60.0%

Weighted

Cost

2.2%

8.2%

10.4%

You might also like

- Cima E3 Certs4uDocument94 pagesCima E3 Certs4uRashmiJurangpathy100% (2)

- Solutions To Chapters 7 and 8 Problem SetsDocument21 pagesSolutions To Chapters 7 and 8 Problem SetsMuhammad Hasnain100% (1)

- Leverage and Financing for Symonds ElectronicsDocument9 pagesLeverage and Financing for Symonds ElectronicsThomas Roberts100% (1)

- Answers: L1CF-TBB207-1412 - Medium Lesson 2: Costs of The Different Sources of CapitalDocument220 pagesAnswers: L1CF-TBB207-1412 - Medium Lesson 2: Costs of The Different Sources of CapitalJoel Christian MascariñaNo ratings yet

- Financial Management Solved ProblemsDocument50 pagesFinancial Management Solved ProblemsAnonymous RaQiBV75% (4)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CMA USA Ratio Definitions 2015Document4 pagesCMA USA Ratio Definitions 2015Shameem JazirNo ratings yet

- W10 Excel Model Cash Flow, Net Cost, and Capital BudgetingDocument5 pagesW10 Excel Model Cash Flow, Net Cost, and Capital BudgetingJuan0% (1)

- (Factsheet) MBDF-21040152Document2 pages(Factsheet) MBDF-21040152YUP SONG GUI MoeNo ratings yet

- All Project ReportDocument10 pagesAll Project ReportABHIJEET RATHODNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesMd Rakibul HasanNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesNabilNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesTalha ImtiazNo ratings yet

- Calculate WACC for Project Using Comparable Firm BetasDocument1 pageCalculate WACC for Project Using Comparable Firm BetasEdi SaputraNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesvinayakgundaNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesAndhika Artha PrayudhaNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesMd Rakibul HasanNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesDwinanda SeptiadhiNo ratings yet

- BetawaccDocument1 pageBetawaccAndera PararinoNo ratings yet

- Copia de BetawaccDocument1 pageCopia de BetawaccDamaris ChavezNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesAbhinav SharmaNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesAlberto FloresNo ratings yet

- BetawaccDocument1 pageBetawaccOmar GhaniNo ratings yet

- BetawaccDocument1 pageBetawaccamro_baryNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesSaadatNo ratings yet

- betawaccDocument1 pagebetawaccSachin KulkarniNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesShubham SharmaNo ratings yet

- betawaccDocument1 pagebetawaccDj (Dj)No ratings yet

- BetawaccDocument1 pageBetawaccNabarun BhattacharyaNo ratings yet

- Estimating WACC using comparable companiesDocument1 pageEstimating WACC using comparable companiesmspanskiNo ratings yet

- BetawaccDocument1 pageBetawaccwelcome2jungleNo ratings yet

- Estimating WACC using comparable companiesDocument1 pageEstimating WACC using comparable companiesgraskoskirNo ratings yet

- BetawaccDocument1 pageBetawaccMuhammad Ahsan MukhtarNo ratings yet

- BetawaccDocument1 pageBetawaccRajesh KatyalNo ratings yet

- CapstructDocument46 pagesCapstructLong NguyễnNo ratings yet

- Calculate Aggie Company Value Using Miller Tax Shield FormulaDocument1 pageCalculate Aggie Company Value Using Miller Tax Shield FormulaLâm Thanh Huyền NguyễnNo ratings yet

- Chapter 6 Review in ClassDocument32 pagesChapter 6 Review in Classjimmy_chou1314No ratings yet

- P14 Syl2012Document16 pagesP14 Syl2012Sridhar SriramanNo ratings yet

- Boeing Financial AnalysisDocument21 pagesBoeing Financial AnalysisMohamed Ali SalemNo ratings yet

- Solved ProblemsDocument24 pagesSolved ProblemsSammir MalhotraNo ratings yet

- Cost of Equity: DR (CA) Anil AroraDocument41 pagesCost of Equity: DR (CA) Anil AroraladosehrawatNo ratings yet

- Cv. Chapter 5Document23 pagesCv. Chapter 5VidhiNo ratings yet

- Inputs For Synthetic Rating EstimationDocument2 pagesInputs For Synthetic Rating EstimationWalter Morales NeyreNo ratings yet

- Case 5Document26 pagesCase 5ibrahim ahmedNo ratings yet

- Ueht3 2021 - Finc3015 - Trần Hữu Phước - 20448989.Document8 pagesUeht3 2021 - Finc3015 - Trần Hữu Phước - 20448989.phuoc.tran23006297No ratings yet

- Cost of Equity and Beta: Debt RatiosDocument11 pagesCost of Equity and Beta: Debt Ratiosminhthuc203No ratings yet

- CH 05Document15 pagesCH 05ercis6421No ratings yet

- Financial and Operation LeverageDocument19 pagesFinancial and Operation LeverageAnusha_SahukaraNo ratings yet

- Analysis of Financial StatementsDocument54 pagesAnalysis of Financial StatementsBabasab Patil (Karrisatte)No ratings yet

- APV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Document23 pagesAPV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Vineet AgarwalNo ratings yet

- APV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Document23 pagesAPV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Vineet AgarwalNo ratings yet

- Capital Structure and Leverage AnalysisDocument55 pagesCapital Structure and Leverage AnalysisSuzana MerchantNo ratings yet

- Discussion On Leverage and Unleveraged FirmDocument15 pagesDiscussion On Leverage and Unleveraged Firmvarun kumar100% (1)

- RSK4805 Assignment 1 2020Document8 pagesRSK4805 Assignment 1 2020kevinNo ratings yet

- FIN338 Ch15 LPKDocument90 pagesFIN338 Ch15 LPKjahanzebNo ratings yet

- Capital Structure Decisions: Part I: Answers To End-Of-Chapter QuestionsDocument8 pagesCapital Structure Decisions: Part I: Answers To End-Of-Chapter Questionssalehin1969No ratings yet

- Corporate Finance - Mock ExamDocument8 pagesCorporate Finance - Mock ExamLưu Quỳnh MaiNo ratings yet

- Capital Structure DecisionDocument26 pagesCapital Structure DecisionNet BeeNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- PrivatecompanywaccDocument1 pagePrivatecompanywacckunaltiwari81No ratings yet

- The Value of Control: Stern School of BusinessDocument38 pagesThe Value of Control: Stern School of Businessavinashtiwari201745No ratings yet

- 6 Capital StructureDocument41 pages6 Capital StructureTrịnh Thu HươngNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- SFDFDocument5 pagesSFDFCamille CaramanzanaNo ratings yet

- Alternative Courses of ActionDocument20 pagesAlternative Courses of ActionCamille CaramanzanaNo ratings yet

- Ethical Decision Making in Business: Mcgraw-Hill/IrwinDocument31 pagesEthical Decision Making in Business: Mcgraw-Hill/IrwinCamille CaramanzanaNo ratings yet

- Ethical Decision Making in Business: Mcgraw-Hill/IrwinDocument31 pagesEthical Decision Making in Business: Mcgraw-Hill/IrwinCamille CaramanzanaNo ratings yet

- Ethical Decision Making in Business: Mcgraw-Hill/IrwinDocument31 pagesEthical Decision Making in Business: Mcgraw-Hill/IrwinCamille CaramanzanaNo ratings yet

- CASE2 Deutsche BrauereiDocument5 pagesCASE2 Deutsche BrauereiRedilyn Bautista MagbitangNo ratings yet

- Clinical Case Studies-LibreDocument12 pagesClinical Case Studies-LibreCazimir SaftuNo ratings yet

- Ethical Decision Making in Business: Mcgraw-Hill/IrwinDocument31 pagesEthical Decision Making in Business: Mcgraw-Hill/IrwinCamille CaramanzanaNo ratings yet

- Background of The StudyDocument1 pageBackground of The StudyCamille CaramanzanaNo ratings yet

- Walter Benjamin: The Arcades ProjectDocument20 pagesWalter Benjamin: The Arcades ProjectCamille CaramanzanaNo ratings yet

- Walter Benjamin: The Arcades ProjectDocument20 pagesWalter Benjamin: The Arcades ProjectCamille CaramanzanaNo ratings yet

- Production Department Dec-14 Jan-15 Feb-15Document13 pagesProduction Department Dec-14 Jan-15 Feb-15Camille CaramanzanaNo ratings yet

- CPDocument1 pageCPCamille CaramanzanaNo ratings yet

- Jameson Postmodernism and Consumer SocietyDocument12 pagesJameson Postmodernism and Consumer Societyوليد فتحى محمد النعمانى100% (1)

- NPV For Sell The Five Fullsize BusDocument6 pagesNPV For Sell The Five Fullsize BusCamille CaramanzanaNo ratings yet

- Ancient Philosophers' Theories Sparked Human Consciousness EvolutionDocument1 pageAncient Philosophers' Theories Sparked Human Consciousness EvolutionCamille CaramanzanaNo ratings yet

- CWDocument40 pagesCWCamille CaramanzanaNo ratings yet

- ADocument2 pagesACamille CaramanzanaNo ratings yet

- Section 7 BORDocument4 pagesSection 7 BORCamille CaramanzanaNo ratings yet

- SONADocument13 pagesSONACamille CaramanzanaNo ratings yet

- CDocument12 pagesCCamille CaramanzanaNo ratings yet

- CDocument12 pagesCCamille CaramanzanaNo ratings yet

- GDocument18 pagesGCamille CaramanzanaNo ratings yet

- Assets: Cash Contingency Common Stock Stock ContingencyDocument9 pagesAssets: Cash Contingency Common Stock Stock ContingencyCamille CaramanzanaNo ratings yet

- CWDocument40 pagesCWCamille CaramanzanaNo ratings yet

- RacfestDocument6 pagesRacfestCamille CaramanzanaNo ratings yet

- Chapter 1 TBCDocument20 pagesChapter 1 TBCCamille CaramanzanaNo ratings yet

- ACI DealingDocument210 pagesACI DealingDarshana Shasthri Nakandala0% (1)

- 08 Handout 124Document11 pages08 Handout 124bernadette soteroNo ratings yet

- FebResearch Team:Source: BSPDocument3 pagesFebResearch Team:Source: BSPRobert RamirezNo ratings yet

- Joka Bulls CaseDocument2 pagesJoka Bulls Caseshivam kumarNo ratings yet

- Nafta Stock Markets Integration, Conditional Tangency Portfolio Changes, Foreign FlowsDocument3 pagesNafta Stock Markets Integration, Conditional Tangency Portfolio Changes, Foreign FlowsFrancisco López-HerreraNo ratings yet

- Solution Maf603 Jun 2019Document11 pagesSolution Maf603 Jun 2019Hadi DahalanNo ratings yet

- Working Capital - LupinDocument13 pagesWorking Capital - Lupinprashantrikame1234No ratings yet

- IFRS 9 - Financial InstrumentsDocument37 pagesIFRS 9 - Financial InstrumentslaaybaNo ratings yet

- Mutual Funds in India A Comparative Study of Select Public Sector and Private Sector CompaniesDocument13 pagesMutual Funds in India A Comparative Study of Select Public Sector and Private Sector Companiesarcherselevators0% (1)

- About London Stock ExchangeDocument24 pagesAbout London Stock ExchangeNabadeep UrangNo ratings yet

- The Cost of Capital, Corporation Finance & The Theory of InvestmentDocument16 pagesThe Cost of Capital, Corporation Finance & The Theory of Investmentlinda zyongweNo ratings yet

- Technical Guide PAYGo PERFORM KPDocument85 pagesTechnical Guide PAYGo PERFORM KPDancillaNo ratings yet

- BANKING CSEB KERALA BANK KSCARD BANK - 063459 (6 Files Merged)Document15 pagesBANKING CSEB KERALA BANK KSCARD BANK - 063459 (6 Files Merged)Ajith SMNo ratings yet

- Case: Cenabal (A) Time Period: 12 July 2006 Protagonist: Jennifer Macdonald, The Owner of CenabalDocument3 pagesCase: Cenabal (A) Time Period: 12 July 2006 Protagonist: Jennifer Macdonald, The Owner of CenabalROSE AUGUSTINE CHERUKARA 2227044No ratings yet

- Sample Business Plan PresentationDocument66 pagesSample Business Plan PresentationvandanaNo ratings yet

- Dawood Money Market FundDocument3 pagesDawood Money Market FundSyed Salman HassanNo ratings yet

- Assignment 1Document2 pagesAssignment 1georgeNo ratings yet

- FEDAI RulesDocument39 pagesFEDAI Rulesnaveen_ch522No ratings yet

- Determinants of The Cost of International Projects & Their Management by Rajat JhinganDocument8 pagesDeterminants of The Cost of International Projects & Their Management by Rajat Jhinganrajat_marsNo ratings yet

- Solutions Practice Questions - Chapter 19Document4 pagesSolutions Practice Questions - Chapter 19Purna ChoudharyNo ratings yet

- Guide To Self Directed Investing - Equity Trust CompanyDocument24 pagesGuide To Self Directed Investing - Equity Trust CompanyEquityTrustNo ratings yet

- Answer Key Far Assessment Questionairre 1Document22 pagesAnswer Key Far Assessment Questionairre 1Johnfree VallinasNo ratings yet

- Covered call strategy for monthly returns using BESSDocument4 pagesCovered call strategy for monthly returns using BESSÂj AjithNo ratings yet

- Mercury QuestionsDocument6 pagesMercury Questionsapi-239586293No ratings yet

- Tutorial 8 (Exercise)Document2 pagesTutorial 8 (Exercise)Vidya Intani100% (1)

- PDIC Maximum Deposit Insurance CoverageDocument7 pagesPDIC Maximum Deposit Insurance CoverageChiemy Atienza YokogawaNo ratings yet