Professional Documents

Culture Documents

Jacobs2ce ISM Ch13

Uploaded by

Fernando D'OriaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jacobs2ce ISM Ch13

Uploaded by

Fernando D'OriaCopyright:

Available Formats

Chapter 13 Supply Chain Management Strategies

CHAPTER 13

SUPPLY CHAIN MANAGEMENT STRATEGIES

Review and Discussion Questions (on Connect)

1. What recent changes have caused supply chain management to gain importance?

Changes include:

a. Competitive pressures from foreign firms.

b. Elevation of product quality to a very high level of importance.

c. International marketing and international purchasing.

d. Trends towards choosing sole-source suppliers and long term relationships.

e. Product varieties and ranges are rapidly changing, and speed of delivery to market is

essential.

f.

Product life cycles have shortened necessitating knowledge and control of inventories

in the various pipelines.

g. Adoption of JIT production has changed supplier relationships and has also increased

the focus on reducing inventories.

h. Trends in the legal system hold manufacturers liable for product failures, even though

causes of failure may lie outside of the production system itself.

i.

Use of EDI in purchasing.

j.

The growth of supplier development.

2. With so much productive capacity and room for expansion in the Canada, why would a

company based in the Canada choose to purchase items from foreign firm? Discuss the pros

and cons.

The use of foreign firms can provide a Canadian firm more alternatives in selecting a

supplier. The pros are more choices, potentially reduced costs in the areas of materials,

transportation, production, and distribution, and potentially moving closer to a foreign

market. The cons are the distance is generally increased, communications problems are

increased due to distance, culture, and technology. There may be problems with customs,

government regulations, political stability, etc.

3. Describe the differences between functional and innovative products.

Functional products are staples that people buy in a wide range of retail outlets. Typically,

they do not change much over time, have low profit margins, stable predictable demand and

long life cycles. Innovative products, on the other hand, give customers additional reasons to

Chapter 13 - Global Sourcing and Procurement

buy. Fashionable clothes and personal computers are examples of innovative products.

Innovative products have short life cycles, high profit margins, and volatile demand.

4. What are characteristics of efficient, responsive, risk-hedging and agile supply chains? Can a

supply chain be both efficient and responsive? Risk-hedging and agile? Why or Why not?

Efficient supply chains are designed to minimize cost that requires high utilization,

minimizing inventory, and selecting vendors based primarily on cost and quality, and

designing products that are produced at minimum cost. Market-responsive supply chains are

designed to minimize lead time to respond to unpredictable demand, thus minimizing

stockout costs and obsolete inventory costs. Risk sharing supply chains are those that share

resources so that risks in the supply chain can be shared. Agile are those supply chains that

are flexible while still sharing risks of shortages across the supply chain. Generally, these

supply chains carry excess capacity and higher buffer stocks. Vendor in responsive supply

chains would be selected for speed, flexibility, and quality. It is possible to be both efficient

and responsive, and both Risk-hedging and Agile, but Exhibit 10.4 helps illustrate why

supply chains are generally not both.

5. As a supplier, which factors would you consider about a buyer (your potential customer) to be

important in setting up a long-term relationship?

The financial stability and credit worthiness of the company is of primary importance. The

reputation of the company vis--vis their supplier is also very important. For example, is this

a company that is fair with its suppliers and honours its payables in a timely fashion? Is the

technological match between supplier and customer sufficient? Will delivery schedules and

quantities be stable, facilitating smooth operations?

6. What are the advantages of using the postponement strategy?

Process postponement delays the process step that differentiate the product to as late in the

supply chain as possible. The advantages of this approach are that lower levels of inventory,

and fewer models are needed to match customer requirements. This results in higher levels

of customer satisfaction at a lower cost.

7. Describe how outsourcing works. Why would a firm want to outsource?

Outsourcing is the act of moving some of a firm's internal activities and decision

responsibilities to outside providers. The terms of the agreement are established in a contract.

Outsourcing goes beyond the more common purchasing and consulting contracts because not

only are the activities transferred, but also resources that make the activities occur are

transferred. Reasons for outsourcing are listed in Exhibit 10.6. Some of the major categories

from this Exhibit include organizational, improvement, financial, revenue, cost, and

employee driven reasons.

8. What are the basic building blocks of an effective mass customization program? What kind

of company wide cooperation is required for a successful mass customization program?

The three organizational design principles for mass customization are 1) A product should be

designed so it consists of independent modules that can be assembled into different forms of

the product easily and inexpensively, 2) Manufacturing and service processes should be

designed so that they consists of independent modules that can be moved or rearranged easily

Chapter 13 Global Sourcing and Procurement

to support different distribution network designs, 3) The supply network--the positioning of

inventory and the location, number, and structure of service, manufacturing, and distribution

facilities--should be designed to provide two capabilities. First, it must be able to supply the

basic product to the facilities performing the customization in a cost-effective manner.

Second, it must have the flexibility and the responsiveness to take individual customer's

orders and deliver the finished, customized good quickly.

Chapter 13 - Global Sourcing and Procurement

Problems

1. Inventory turnover = cost of goods sold/average aggregate inventory value

= (4,000 hamburgers * $1 per pound * 1/4 pound per hamburger * 52 week per year)/(350

pounds * $1

per pound)

= 148.5 turns/year

Day of supply = (average aggregate inventory value/cost of goods sold)*365

= ((350 pounds * $1 per pound)/( 4,000 hamburgers * $1 per pound * 1/4 pound per

hamburger * 52

week per year))*365

= 2.46 days

2.

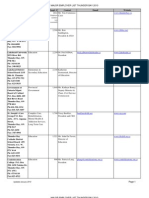

a. Inventory turnover = costs of good sold/average aggregate inventory value.

Quarter

Cost of goods sold

Raw material

WIP

Distribution Center

Inventory

Aggregate Inventory

1

2

3

4 Total

280 295 340 350 1265

50 40 55 60

100 105 120 150

40 42 43 51

190 187 218 261

Average aggregate inventory value = (190 + 187 + 218 + 261)/4 = 214

Inventory turnover = 1265/214 = 5.91

b. Focus on reducing WIP.

c. Average raw material inventory value = (50 + 40 + 55 + 60)/4 = 51.25

Day of supply = (average aggregate raw material inventory value/cost of goods sold)*52

= (51.25/500)*52 = 5.33

3.

Year:

Demand

Cost of Capital

Purchase Cost

Per Unit

Shipping/Unit

Inventory

charge/Unit

Monthly charge

1

200,000

2

300,000

3

500,000

Purchase Option

$20,000.0

0.1

0

0.01

$2,000.00

$30,000.0

0

$3,000.00

$50,000.0

0

$5,000.00

$1,500.00

$2,500.00

0.15

0.005

$1,000.00

20

$240.00

$23,240.0

0

Total Purchase Cost

$240.00

$34,740.0

0

$240.00

$57,740.0

0

Chapter 13 Global Sourcing and Procurement

Make Option

$10,000.0

0

$15,000.0

0

Direct Material

0.05

Direct Labor

0.03

$6,000.00

$9,000.00

50% Surcharge

0.015

Indirect Labor

0.011

50% Surcharge

0.0055

Overhead 100%

0.03

DL

Total Variable Manufacture

Cost

$3,000.00

$2,200.00

$1,100.00

$4,500.00

$3,300.00

$1,650.00

$6,000.00

$9,000.00

Investment Engineer

Equipment

$28,300.0

0

$42,450.0

0

$30,000.

00

$10,000.

00

Cost Comparison Analysis

$40,000.

Make Cost Buy Cost

$5,060.00 $7,710.00

00

Discount factor

1

0.86957

0.75614

$40,000.

NPV (Make Buy)

$4,400.00 $5,829.87

00

Total NPV

$58,784.1

(Make - Buy)

5

Buy

Make

Difference

$25,000.0

0

$15,000.0

0

$7,500.00

$5,500.00

$2,750.00

$15,000.0

0

$70,750.0

0

Alternative: Option NPV Calculations

$143,226 $40,000. $24,608.7 $32,098.3

.27

00

0

0

$84,442.

$20,208.7 $26,268.4

11

0

3

$58,784.

15

$13,010.0

0

0.65752

$8,554.29

$46,519.2

7

$37,964.9

9

Continuing to make in-house would cost us over $58,000 more in current dollars than

buying from the supplier. We should accept the bid.

Chapter 13 - Global Sourcing and Procurement

4.

Requirement (annual forecast)

Weight

Order processing cost

Inventory carry cost

Lot Size (order quantity)

Supplier

Unit Price

12,000.0

0

22

$125.00

20%

1,000

units

pounds per engine

per order

of average

inventory

Units - given in the case

1

$510

$6,120,0

00

$22,000

12

$1,500

$51,000

2

$505

$6,060,0

00

$20,000

12

$1,500

$50,500

125

100

Weight per load

22,000

Transportation (Less-than-truckload)

$1.20 per 2,000 lbs. per mile

$19,800

$15,840

$6,214,3

00

$6,147,8

40

Annual Purchase Cost

One-Time Tooling Cost

Orders per year

Order Processing Cost

Inventory carry cost

Distance

Total Cost

We would prefer supplier #2.

Required lot size for truckload

Supplier

Unit Price

Annual Purchase Cost

One-Time Tooling Cost

Orders per year

Annual Order Processing Cost

Annual Inventory carry cost

Distance

Weight per load

Transportation (truckload)

$0.80 per 2,000 lbs. per mile

1818

miles

$66,460

difference

Units (40,000 lbs. max. load/22 lbs. per

engine)

1

$500

$6,000,0

00

$22,000

6.6

$825

$90,900

2

$505

$6,060,0

00

$20,000

6.6

$825

$91,809

125

100

miles

40,000

$13,200

$10,560

$6,126,9

$6,183,1

Total Cost

25

94 $56,269 difference

Yes, it would make sense to order in truckload lots as we can reduce total costs. While

carrying costs increase, purchase and transportation costs decrease by a greater amount.

Note that if ordering in truckload lots, supplier #1 becomes the lowest choice option.

In future years the cost would be reduced by the one-time tooling cost included here.

Chapter 13 Global Sourcing and Procurement

CASE

Pepe Jeans Teaching Note

This case is designed to illustrate the use of process postponement in the manufacturing of

fashion jeans. The case can be done with a marketing instructor very effectively. Pepe Jeans

is a real company in the UK, but the data given in the case is fictitious, so you might

anticipate some questions that relate to whether Pepe actually made the changes that are

developed in the case.

The HP Deskjet case, in Chapter 13 also illustrates postponement, but from the viewpoint of

inventory cost saving through pooling synergy. Using Pepe Jeans and HP Deskjet together is

a good way to illustrate the types of changes companies are making today as they globalize

operations.

The following are the answers to the discussion questions:

1. Acting as an outside consultant, what would you recommend that Pepe do? Given the

data in the case, perform a financial analysis to evaluate the alternatives that you have

identified. (Assume that the new inventory could be valued at six weeks worth of the yearly

cost of sales. Use a 30 percent inventory carrying cost rate.) Calculate the payback period

for each alternative.

Assume that Sales are 200M

Cost of Sales @ 40% = 80M

Operating Expense @ 28% = 56M

Profit @ 32% = 64M

If lead-time is cut to 6 weeks then cost of sales go up 30%

80 + 24 = 104M

Assuming that operating expenses stay the same, Pepe would only make 40M/yr assuming

that sales to not go up.

Locating the finishing operation in the UK requires the following investment:

Equipment = 1M

Renovation = .3M

Inventory investment cost. First, assume that the cost of the jeans would be reduced by 10%

or 80M x .1 = 8M. The basic jeans would then cost about 72M.

Inventory investment

(6 weeks supply of basic jeans) = 72 x (6/52) = 8.31M (Value of inventory)

Inventory Carrying Cost (yearly) = 8.31M x .3 = 2.49M

Total cost of the investment = 1M + .3M + 2.49M = 3.79M

Yearly savings for the option is the cost of sales reduction of 10% accompanied by a yearly

increase in UK operating expenses of .5M.

8M + .5M = 7.4M savings per year.

Profit would improve to 71.4M and increase of 11.6%.

The payback on the investment is then

3.79M / 7.4M = .5 years

This looks like a very attractive investment.

Chapter 13 - Global Sourcing and Procurement

2. Are there other options that Pepe should consider?

Pepe may want to consider sourcing the Jeans in Europe, but this would probably not be very

attractive, since costs would go up due to the much higher labour costs.

Another option would be to keep with the current supplier arrangement, but carry inventory

in the UK. In this case, Pepe could deliver orders from stock, rather than manufacturing

everything directly to order. The investment in the inventory and the cost to manage that

inventory would need to be offset by increased sales. Some interesting issues can be

discussed relating to this option including the need to forecast sales, how unsold (obsolete)

inventory would be sold, how would returns be handled, and how the distribution center

would be operated.

Case: Global Sourcing Decisions Grainger: Reengineering the China/U.S. Supply

Chain

1. Evaluate the current China/Taiwan logistics costs. Assume a current total volume of 190,000

CBM and the 89% is shipped direct from the supplier plants in containers. Use the data from

the case and assume that the supplier loaded containers are 85% full. Assume that

consolidation centers are run at each of the four port locations. The consolidation centers

only use 40 containers and fill them to 96% capacity. Assume that it costs $480 to ship a 20

container and $600 to ship a 40 container. What is the total cost to get the containers to the

United States? Do not include United States port costs in this part of the analysis.

Basic Data

Total Current Volume (CBM)

190,000

Direct Ship Percentage

0.89

Direct Ship Volume (CBM)

169,100

Consolidation Center Volume

20,900

Shipping Cost Calculations

Direct Ship by Container Type

Volume (%)

Volume (CBM)

Container Capacity Used

20'

40'

21%

79%

35511

133589

85%

85%

Consolidation Center by Container Type

Volume (%)

100%

Volume (CBM)

20900

Container Capacity Used

96%

Container Capacity (CBM)

34

67

Chapter 13 Global Sourcing and Procurement

Containers Shipped

1,229

$

480.00

$

589,920

$

2,192,520

Shipping Cost per Container

Shipping Costs by Container Size

Total Shipping Cost

2,671

$

600.00

$

1,602,600

Consolidation Center Operating Cost

Calculations

Number of Centers

Total Annual Consolidation Center Costs

$

75,000

$

300,000

$

4.90

$

102,410

$

402,410

Total China/Taiwan Logistics Cost

$

2,594,930

Annual Fixed Cost per Center

Total Annual Fixed Cost

Variable Cost per CBM

Total Annual Variable Cost

2. Evaluate an alternative that involves consolidating all 20 volume and using only a single

consolidation center in Shanghai/Ningbo. Assume that all the existing 20 volume and the

existing consolidation center volume is sent to this single consolidation center by suppliers.

This new consolidation center volume would be packed into 40 containers filled to 96% and

shipped to the United States. The existing 40 volume would still be shipped direct from the

suppliers at 85% capacity utilization.

Basic Data

Total Current Volume (CBM)

190000

Direct Ship Percentage

0.7031

Direct Ship Volume (CBM)

133589

Consolidation Center Volume

56411

Shipping Cost Calculations

Direct Ship by Container Type

20'

Volume (%)

Volume (CBM)

Container Capacity Used

40'

0%

100%

133589

85%

85%

Consolidation Center by Container Type

Volume (%)

100%

Volume (CBM)

56411

Container Capacity Used

96%

Chapter 13 - Global Sourcing and Procurement

Container Capacity (CBM)

Containers Shipped

34

67

3223

$

600.00

$

1,933,800

$

480.00

$

$

1,933,800

Shipping Cost per Container

Shipping Costs by Container Size

Total Shipping Cost

Consolidation Center Operating Cost

Calculations

Number of Centers

Total Annual Consolidation Center Costs

$

75,000

$

75,000

$

1.40

$

78,975

$

153,975

Total China/Taiwan Logistics Cost

$

2,087,775

Annual Fixed Cost per Center

Total Annual Fixed Cost

Variable Cost per CBM

Total Annual Variable Cost

Assuming the new consolidation center has the same fixed cost as before (questionable given the

increase in volume), the new approach saves $507,155 per year.

3. What should be done based on your analytics analysis? What have you not considered that

may make your analysis invalid or that may strategically limit success? What do you think

Grainger management should do?

Consolidating the 20 volume and using only a single Consolidation Center looks very

attractive from this analysis. However, there are other issues to be considered.

-

For one, we have not considered the increased cost to the suppliers that currently pack

their own 20 containers. These suppliers will need to bear the cost of shipping their

goods to the Shanghai/Ningbo consolidation center. This cost will probably be pushed

back to Grainger in the long run.

There will also be some added cost for the suppliers that currently ship to consolidation

centers directly. These will all need to use the Shanghai/Ningbo now, which might not be

as close as their current consolidation center.

The cost calculations also assume that the Shanghai/Ningbo center can handle the

increased workload and the fixed cost will remain the same. Neither of these

assumptions is guaranteed (or even likely).

We may want to seriously consider using two consolidation centers with the other being in

Yantian/Hong Kong. It may be attractive to have consolidation centers in both

10

Chapter 13 Global Sourcing and Procurement

Shanghai/Ningbo and Yantian/Hong Kong since these are the most heavily used ports.

Assumptions regarding the consolidation center fixed costs would need to be tested as well.

11

You might also like

- 3 Supply Chain Management HomeworkDocument51 pages3 Supply Chain Management HomeworkRhys SinclairNo ratings yet

- Designing and Managing Integrated Marketing ChannelsDocument15 pagesDesigning and Managing Integrated Marketing ChannelsSiddharth SetiaNo ratings yet

- Introduction To Materials Management BookDocument2 pagesIntroduction To Materials Management Bookka5227No ratings yet

- Team B 1 Consumer Behavior Case HimalayaDocument30 pagesTeam B 1 Consumer Behavior Case HimalayaErlita KusumaNo ratings yet

- Solution Proposed by CVSDocument2 pagesSolution Proposed by CVSArjun VikasNo ratings yet

- DsvesrvceswcdsacDocument1 pageDsvesrvceswcdsacBagasNo ratings yet

- Case 1 - TQMDocument8 pagesCase 1 - TQMladdooparmarNo ratings yet

- Vendor Managed Inventory FMCG SectorDocument5 pagesVendor Managed Inventory FMCG SectorAjay Sharma0% (1)

- Supply Chain AssignmentDocument29 pagesSupply Chain AssignmentHisham JackNo ratings yet

- The+Five+M of AdvertisingDocument10 pagesThe+Five+M of AdvertisingSafwat ZargarNo ratings yet

- Chapter 7 Section 9 AnswersDocument7 pagesChapter 7 Section 9 Answersjohn brownNo ratings yet

- Case Study 1: E-Procurement at IBM: Answer The Questions (A)Document5 pagesCase Study 1: E-Procurement at IBM: Answer The Questions (A)Zannatun NayeemNo ratings yet

- L5 SupplyContracts UpdatedDocument44 pagesL5 SupplyContracts Updatedkit_mak_5No ratings yet

- Practice Problem 1 - Max's Slice Problem - Week 4 Practice Problems - CTLDocument5 pagesPractice Problem 1 - Max's Slice Problem - Week 4 Practice Problems - CTLSrinivasa RaghavanNo ratings yet

- Ch07 Circuit Board FabricatorsDocument3 pagesCh07 Circuit Board FabricatorsBagus KrisviandikNo ratings yet

- Case Study Vendor Managed InventoryDocument9 pagesCase Study Vendor Managed InventoryNaveen BabuNo ratings yet

- History of Push and Pull Inventory PhillosophiesDocument6 pagesHistory of Push and Pull Inventory PhillosophiesRishaana SaranganNo ratings yet

- Case Study: Zara: Question 1: Would Zara's Model Work For Other Retailers? Why or Why Not?Document1 pageCase Study: Zara: Question 1: Would Zara's Model Work For Other Retailers? Why or Why Not?Cầm Ngô PhụngNo ratings yet

- Supply Chain Risk Management Concept... Presentation 2nd SemDocument29 pagesSupply Chain Risk Management Concept... Presentation 2nd SemIsaac Tetteh CharnorNo ratings yet

- Walmart Using The Value Chain and Competitive Forces ModelsDocument2 pagesWalmart Using The Value Chain and Competitive Forces ModelsNguyễn QuỳnhNo ratings yet

- CASE Swimsuit ProductionDocument6 pagesCASE Swimsuit ProductionJovanny2014No ratings yet

- All ChaptersDocument612 pagesAll ChaptersMarco ChanNo ratings yet

- In Not More Than 20 Words)Document7 pagesIn Not More Than 20 Words)Shyaan MughalNo ratings yet

- Kelompok C - Case HimalayaDocument40 pagesKelompok C - Case HimalayaErlita Kusuma100% (1)

- Meditech Surgical CaseDocument1 pageMeditech Surgical Casemoonlit28No ratings yet

- Elevator Case Study PDFDocument26 pagesElevator Case Study PDFDivyaNo ratings yet

- MA JambalinoDocument16 pagesMA Jambalinovaibhav guptaNo ratings yet

- HP - Supplying The DeskJet Printer in EuropeDocument4 pagesHP - Supplying The DeskJet Printer in Europeroberto0% (1)

- SCM of Samsung ElectronicsDocument20 pagesSCM of Samsung ElectronicsĐinh Công Thành100% (1)

- August in em EdDocument10 pagesAugust in em Edharsimran52No ratings yet

- Cutco Case Analysis QuestionsDocument4 pagesCutco Case Analysis QuestionshssyanNo ratings yet

- Unit 2 L2 Network DesignDocument23 pagesUnit 2 L2 Network DesignJUILI dharmadhikariNo ratings yet

- Capital Structure: Limits To The Use of DebtDocument24 pagesCapital Structure: Limits To The Use of Debtari kristiadiNo ratings yet

- E - Procurement Platforms & IBM Case StudyDocument4 pagesE - Procurement Platforms & IBM Case StudyVaishali Sonare50% (2)

- Inventory ControlDocument41 pagesInventory ControlantoniobhNo ratings yet

- Zara Case PresentationDocument50 pagesZara Case PresentationFahlevi Dzulfikar100% (1)

- 3 Supply Chain ManagementDocument9 pages3 Supply Chain ManagementkarimakkiNo ratings yet

- Strategic Capacity Management: Discussion QuestionsDocument11 pagesStrategic Capacity Management: Discussion QuestionsTTNo ratings yet

- CH07 Assessment PreparationDocument13 pagesCH07 Assessment PreparationEthan RuppNo ratings yet

- Marketing, Production & Business Analytics Functions of WalmartDocument15 pagesMarketing, Production & Business Analytics Functions of WalmartJay PrajapatiNo ratings yet

- Syincicate 2 - 48ADocument3 pagesSyincicate 2 - 48AHenny ZahranyNo ratings yet

- Introduction Dr. BeckettDocument5 pagesIntroduction Dr. BeckettThu Hương LêNo ratings yet

- Ifm GR.5 CH.7Document8 pagesIfm GR.5 CH.7Nguyễn LâmNo ratings yet

- INDE7390 Case13Document1 pageINDE7390 Case13chuczyNo ratings yet

- Heizer 13 Aggregate Planning 2016Document59 pagesHeizer 13 Aggregate Planning 2016Saskia Asyari100% (1)

- The Fundamentals of CostingDocument4 pagesThe Fundamentals of CostingAkash KhanNo ratings yet

- Types of Production SystemsDocument26 pagesTypes of Production SystemsAjinkya_Bhat_5012100% (5)

- Coyle Chapter 8 Order Management & CustomerDocument57 pagesCoyle Chapter 8 Order Management & CustomerBilalPervezNo ratings yet

- IV Sem MBA - TM - Supply Chain Management Model Paper 2013Document2 pagesIV Sem MBA - TM - Supply Chain Management Model Paper 2013vikramvsu0% (1)

- Case Study - ALDI & HomePlusDocument3 pagesCase Study - ALDI & HomePlusgiemansitNo ratings yet

- Gas or Grouse AnswersDocument2 pagesGas or Grouse AnswersAshley Victor CoelhoNo ratings yet

- Ebay: An Examination of A Business Model Without Boundaries: Christopher Chavez and Daniel Lindquist The HistoryDocument6 pagesEbay: An Examination of A Business Model Without Boundaries: Christopher Chavez and Daniel Lindquist The HistoryNishtha GargNo ratings yet

- IKEA Case Study: Q.1 What Are IKEA's Competitive Priorities? Answer 1Document2 pagesIKEA Case Study: Q.1 What Are IKEA's Competitive Priorities? Answer 1Maulesh PatelNo ratings yet

- Bis CorporationDocument2 pagesBis CorporationXinru ChenNo ratings yet

- Chapter 17 Limits To The Use of DebtDocument25 pagesChapter 17 Limits To The Use of DebtFahmi Ahmad FarizanNo ratings yet

- ManualDocument41 pagesManualTuan Bình0% (2)

- Samples Solution Manual Designing and Managing The Supply Chain 3rd Edition by David Simchi Levi SLM1060Document11 pagesSamples Solution Manual Designing and Managing The Supply Chain 3rd Edition by David Simchi Levi SLM1060mathimurugan n0% (1)

- Simchi Levi3E SMDocument56 pagesSimchi Levi3E SMKhang HuynhNo ratings yet

- Conception for Procurement Excellence: The performance profile and degree of digitalization of procurementFrom EverandConception for Procurement Excellence: The performance profile and degree of digitalization of procurementNo ratings yet

- MM Probable Questions and AnswersDocument3 pagesMM Probable Questions and AnswersBisweswar DashNo ratings yet

- Interactive AdvertisingDocument10 pagesInteractive AdvertisingMangesh PandeyNo ratings yet

- Marginal CostingDocument17 pagesMarginal CostingGovind PrajapatiNo ratings yet

- DoveDocument15 pagesDovePuja AryaNo ratings yet

- Case study-BRMDocument6 pagesCase study-BRMankitasaatpute21No ratings yet

- A Study of Consumer Buying Behaviour in Departmental Store (With Special Reference To Coimbatore City)Document6 pagesA Study of Consumer Buying Behaviour in Departmental Store (With Special Reference To Coimbatore City)sabryNo ratings yet

- Atlas Copco Industrial Technique 14001Document5 pagesAtlas Copco Industrial Technique 14001sofianesedkaouiNo ratings yet

- Patinig at KatinigDocument5 pagesPatinig at KatinigAngelo EstrellaNo ratings yet

- How P&G Tripled Its Innovation Success RateDocument3 pagesHow P&G Tripled Its Innovation Success RateRae SlaughterNo ratings yet

- Elise Marie Trent Graduate ResumeDocument1 pageElise Marie Trent Graduate Resumeemt43No ratings yet

- Advertising of Vicco Turmeric Ayurvedic CreamDocument40 pagesAdvertising of Vicco Turmeric Ayurvedic CreamChandan Parsad80% (5)

- MKT535/532/561/520 April 2008Document3 pagesMKT535/532/561/520 April 2008myraNo ratings yet

- Bain-Customer SegmentationDocument47 pagesBain-Customer SegmentationJonathan WenNo ratings yet

- 1 MGDocument16 pages1 MGAnkit PuniaNo ratings yet

- PadiniDocument30 pagesPadinikristin_kim_13No ratings yet

- Data WarehousingDocument10 pagesData WarehousingAVINASH JoeNo ratings yet

- Pet Hotel Business Plan TemplateDocument21 pagesPet Hotel Business Plan TemplateSulemanNo ratings yet

- Survey QuestionnaireDocument4 pagesSurvey QuestionnaireHoney Lee RojaNo ratings yet

- Spencer Tire PurchaseDocument28 pagesSpencer Tire PurchaseJitendra Choudhary0% (2)

- How To Answer BP's Application Form Question On 'Our Values'Document7 pagesHow To Answer BP's Application Form Question On 'Our Values'Farid AliyevNo ratings yet

- Chap 012Document45 pagesChap 012palak32100% (6)

- DHL CourierDocument48 pagesDHL CourierJitender ChandhokNo ratings yet

- AuraDocument3 pagesAuraJohanna Ü RatillaNo ratings yet

- Major Employers in Thunder Bay OntarioDocument7 pagesMajor Employers in Thunder Bay OntarioJamesNo ratings yet

- Production Part Approval ProcessDocument11 pagesProduction Part Approval ProcessDorian GrayNo ratings yet

- Measuring The Effectiveness of The Promotional ProgramDocument16 pagesMeasuring The Effectiveness of The Promotional ProgramShruti AwasthiNo ratings yet

- Soal Bahasa Inggris Kls Xi TKRDocument10 pagesSoal Bahasa Inggris Kls Xi TKRmita mustikaNo ratings yet

- Facebook Registration StatementDocument50 pagesFacebook Registration StatementLettera43100% (1)

- Level of Satisfaction of Accounting Technology Students Towards Jollibee Products and ServicesDocument10 pagesLevel of Satisfaction of Accounting Technology Students Towards Jollibee Products and Servicesxyrl14No ratings yet

- 1.samsung Electronics Success by Design PDFDocument20 pages1.samsung Electronics Success by Design PDFbalaganesh78100% (1)