Professional Documents

Culture Documents

An Augmented Model of Customer Loyalty For Organizational Purchasing of Financial Services

An Augmented Model of Customer Loyalty For Organizational Purchasing of Financial Services

Uploaded by

Andreea GheorghescuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Augmented Model of Customer Loyalty For Organizational Purchasing of Financial Services

An Augmented Model of Customer Loyalty For Organizational Purchasing of Financial Services

Uploaded by

Andreea GheorghescuCopyright:

Available Formats

This article was downloaded by: [Romanian Ministry Consortium]

On: 2 March 2010

Access details: Access Details: [subscription number 918910197]

Publisher Routledge

Informa Ltd Registered in England and Wales Registered Number: 1072954 Registered office: Mortimer House, 3741 Mortimer Street, London W1T 3JH, UK

Journal of Business To Business Marketing

Publication details, including instructions for authors and subscription information:

http://www.informaworld.com/smpp/title~content=t792303971

An Augmented Model of Customer Loyalty for Organizational Purchasing

of Financial Services

Yew-Wing Lee a; Steven Bellman b

a

Arab Insurance Group, University of Western Australia, Perth, Australia b Interactive Television

Research Institute (ITRI), Murdoch University, Perth, Australia

To cite this Article Lee, Yew-Wing and Bellman, Steven(2008) 'An Augmented Model of Customer Loyalty for

Organizational Purchasing of Financial Services', Journal of Business To Business Marketing, 15: 3, 290 322

To link to this Article: DOI: 10.1080/15470620802059299

URL: http://dx.doi.org/10.1080/15470620802059299

PLEASE SCROLL DOWN FOR ARTICLE

Full terms and conditions of use: http://www.informaworld.com/terms-and-conditions-of-access.pdf

This article may be used for research, teaching and private study purposes. Any substantial or

systematic reproduction, re-distribution, re-selling, loan or sub-licensing, systematic supply or

distribution in any form to anyone is expressly forbidden.

The publisher does not give any warranty express or implied or make any representation that the contents

will be complete or accurate or up to date. The accuracy of any instructions, formulae and drug doses

should be independently verified with primary sources. The publisher shall not be liable for any loss,

actions, claims, proceedings, demand or costs or damages whatsoever or howsoever caused arising directly

or indirectly in connection with or arising out of the use of this material.

An Augmented Model of Customer

Loyalty for Organizational Purchasing

of Financial Services

1547-0628

WBBM

Journal

of Business-to-Business Marketing

Marketing, Vol. 15, No. 3, July 2008: pp. 151

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Yew-Wing OF

JOURNAL

LeeBUSINESS-TO-BUSINESS

and Steven Bellman

MARKETING

Yew-Wing Lee

Steven Bellman

ABSTRACT. Purpose. To understand how the drivers of loyalty in

business-to-business (B2B) markets for financial services might be moderated by short- versus long-term relational orientation to help companies in

those markets optimize the allocation of their marketing resources.

Methodology/Approach. The basis of this study was the European

Customer Satisfaction Index (ECSI) model of customer loyalty, which was

relevant for this B2B market because the ratio of customers to suppliers

was large and, therefore, similar to a business-to-consumer (B2C) market.

Partial least squares (PLS) was used to estimate the ECSI model in two

groups defined by a median split on Ganesans (1994) buyers relational

orientation (BRO) scale.

Findings. Buyers relational orientation was a significant moderator of

several relationships in the ECSI model. For buyers with a higher (longterm) BRO, loyalty was driven by satisfaction, corporate image, product

quality, and service quality. For buyers with a lower (short-term) BRO,

what little loyalty existed was driven by product quality alone, rather than

service quality, image, or satisfaction.

Yew-Wing Lee is Singapore Branch Manager for the Arab Insurance Group

(Arig). This research is based on his DBA thesis, completed as a student of the

University of Western Australia, Perth, Australia (E-mail: lee.w@arig.com.sg).

Steven Bellman is Associate Professor and Deputy Director of the Interactive

Television Research Institute (ITRI), Murdoch University, Perth, Australia.

Address correspondence to: Steven Bellman, Interactive Television Research

Institute, Murdoch University, South Street, Murdoch, WA 6150, Australia

(E-mail: S.Bellman@Murdoch.edu.au).

290

Journal of Business-to-Business Marketing, Vol. 15(3) 2008

Available online at http://www.haworthpress.com

2008 by The Haworth Press. All rights reserved.

doi:10.1080/15470620802059299

Yew-Wing Lee and Steven Bellman

291

Originality/Value/Contribution. This study demonstrates the usefulness

of testing for differences in the drivers of loyalty for customers with

short-versus long-term relational orientation. The management implications are the usefulness of adopting a portfolio approach to managing

financial services customers by (1) segmenting customers into high and

low BRO groups and (2) implementing different marketing approaches for

these two segments.

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

KEYWORDS. Customer loyalty, financial services, satisfaction, relational

orientation, moderating effect, portfolio approach, partial least squares

Customer loyalty has been the subject of much research during recent

years because of the belief that higher loyalty leads to better results in the

marketplace due to higher price tolerance, favorable word-of-mouth, and

opportunities for cross-selling (Reichheld and Sasser 1990). There have

been concerns, however, that the extensive customer satisfaction programs adopted by companies to promote customer loyalty might have had

a negative impact on their profitability (Westbrook 1997). This study

set out to understand the drivers and moderators of loyalty in businessto-business (B2B) markets for financial services and to help companies in

those markets optimize the allocation of their limited resources by

targeting expensive customer-relationship strategies only to the customer

segments where they would be most effective (Martensen, Grnholdt, and

Kristensen 2000).

The importance of satisfaction as a key driver of loyalty in business

relationships has been examined in more than seventy studies since 1970

(Geyskens, Steenkamp, and Kumar 1999). The conceptual model that

forms the basis of this study is the European Customer Satisfaction Index

(ECSI) model of customer loyalty. Although it was developed to measure

loyalty in end-consumer markets, it has previously been used in a B2B

context (Kristensen, Martensen, and Grnholdt 2000) and has advantages

over other models of B2B loyalty because of its conceptual simplicity and

its relative ease of measurement. Many studies have demonstrated the fit

and validity of the ECSI model. However, it is relevant for B2B markets

only if the number of customers for each supplier is large, necessitating

the use of customer relationship management (CRM) software to keep

track of customer information. Such B2B markets are very similar to

consumer markets. In B2B markets with smaller numbers of customers,

customer relationships are conducted through personal relationships and

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

292

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

are better understood using network analysis and longitudinal case studies

(the Industrial Marketing and Purchasing [IMP] Group approach, see,

e.g., Ford et al. 2002).

There are other variables, besides satisfaction, that are relevant in

organizational buying but not in consumer buying and vice versa

(Patterson, Johnson, and Spreng 1997). An extensive review of the B2B

marketing literature revealed that a major constructa buyers relational

orientation (BRO), which is not present in the ECSI modelis an important predictor of customer loyalty in B2B markets (Anderson and Weitz

1992; Cannon and Perreault 1999; Ganesan 1994; Reichheld 2001). This

study augmented the original ECSI model by using BRO to segment

customers in a B2B context into high and low BRO groups, which would

allow sellers to use a portfolio approach to managing their relationships

with their customers.

In the Kraljic (1983) portfolio approach to business purchasing, strategic items with high profit impact and high supply risk are differentiated

from other items with either lower profit impact or lower supply risk. For

strategic items, customers are advised to take a collaborative approach to

purchasing or, in other words, to adopt a long-term relational orientation

with the supplier. In contrast, for leverage items (high profit impact, low

supply risk), a transactional approach that exploits the customers purchasing power is recommended. Reduction of suppliers, in effect adopting a long-term relational orientation, can also be an effective way of

reducing transaction costs (Kalwani and Narayandas 1995) for noncritical

items (low profit impact and supply risk) and ensuring delivery for bottleneck items (low profit impact but high supply risk). The more sophisticated a company is in terms of its purchasing strategy the more likely it is

that the company uses a portfolio approach to purchasing (Gelderman and

van Weele 2005), and therefore the more likely it is that the firm adopts a

high BRO approach for some suppliers and a low BRO approach to others. Although there is little evidence so far that customer firms adopt a

portfolio approach to buying services (e.g., van der Valk, Wynstra, and

Axelsson 2005), there are strong theoretical reasons for assuming that

customers differentiate between staff (MRO) and line (production) services, with critical services requiring greater vertical and horizontal management involvement, at least for new buys (Fitzsimmons, Noh, and

Thies 1998), and presumably adopt a strategic, high BRO approach for

these critical services as well.

Portfolio approaches have also been recommended for sellers in B2B

markets. Walter, Ritter, and Gemnden (2001) proposed that customers

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Yew-Wing Lee and Steven Bellman

293

can be mapped using two dimensions of value for the supplier. Value can

be direct or indirect, depending on whether the value received comes from

the customer (direct) or is derived from sales to other companies, or future

developments, made possible by the relationship with that customer

(indirect). High-performing relationships deliver on both dimensions. Our

portfolio approach differs from that proposed by Walter, Ritter, and

Gemnden (2001) because the market we are considering is the reverse of

their study: they looked at many small suppliers (employing 445 persons

on average) servicing large customers (employing 1,076 on average). Our

sample consists mainly of large suppliers servicing many smaller customers. Walter and colleagues found that direct functions (profit) were more

important than indirect functions, especially for larger suppliers who are

less dependent on any single relationship. But Walter and colleagues did

not examine nonrational or noneconomical reasons behind relationships,

such as the social functions of relationships, which could have positive or

negative (dysfunctional) economic effects (e.g., lock-in). Also, they modeled only the outcomes of relationships (profitability) rather than their

determinants, such as trust and commitment (Blankenburg Holm, Eriksson,

and Johanson 1996; Wetzels, de Ruyter, and van Birgelen 1998).

Our portfolio approach, based on differentiating between customers with

low versus high BRO, is likely to be more encompassing than the purely economic and outcome-based approach adopted by Walter, Ritter, and

Gemnden (2001) because customers can adopt a high BRO for social as well

as economic reasons. Considering the social functions of a relationship (the

interaction between customer and supplier) is likely to be more important for

services than it is for products (Kristensen, Martensen, and Grnholdt 2000).

This study tested the usefulness of a portfolio approach based on high versus

low BRO, using data from the B2B market for financial services in Singapore.

LITERATURE REVIEW

The European Customer Satisfaction Index (ECSI)

The ECSI model of customer loyalty was introduced in 1999

(Martensen, Grnholdt, and Kristensen 2000) and drew its inspiration

from the Swedish Customer Satisfaction Barometer (SCSB; Fornell 1992)

and the American Customer Satisfaction Index (ACSI; Fornell et al.

1996). Several studies that use the basic ECSI model have been

undertaken in Europe since then (Grnholdt, Martensen, and Kristensen

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

294

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

2000; Kristensen, Martensen, and Grnholdt 2000). The ECSI model

has been shown to be a good fit to the data from B2C markets in

several industries in Europe, including financial services, with an average

R2 = .69 (Martensen, Grnholdt, and Kristensen 2000). Although there is

limited evidence of the ECSI models suitability in B2B markets, a recent

study involving Post Denmark (Kristensen, Martensen, and Grnholdt

2000), where the business market was included, demonstrated that the

ECSI model can provide a good explanation of business customer satisfaction and business customer loyalty (R2 = .78).

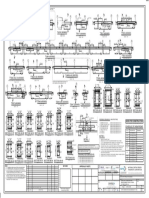

There are seven variables in the basic ECSI model (see Figure 1),

customer loyalty (the dependent variable) and six antecedent independent

variables: (1) customer satisfaction, (2) perceived value, (3) perceived

corporate image, (4) customer expectations, (5) perceived quality of hardware (i.e., product quality), and (6) perceived quality of human ware (i.e.,

service quality). The main premise of the ECSI model is that product and

service performance is reflected in customer satisfaction, which in turn is

the main driver of customer loyalty and the value of the company (Anderson,

Fornell, and Mazvancheryl 2004; Fornell et al. 2006; Johnson 1998).

FIGURE 1. The ECSI Model of Customer Loyalty.

Perceived

Image

Expectations

Perceived

Value

Satisfaction

Loyalty

Hardware

Quality

Human

Ware Quality

Original ECSI model paths shown as solid lines. Extra paths identified by Kristensen, Martensen, and

Grnholdt (2000) shown as dashed lines.

Yew-Wing Lee and Steven Bellman

295

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

The other drivers of customer loyalty are corporate image and quality of

human ware. The main drivers of customer satisfaction are perceived

value, expectations, and quality of hardware. The drivers of perceived

value are corporate image, expectations, and quality of both hardware and

human ware. These variables and their relationships in the basic ECSI

model are backed by much research in the past decades and this explains

the popularity of this model for measuring customer satisfaction across

industries, especially in Europe.

Customer Loyalty

According to the ECSI model, customer loyalty is a behavioral intention rather than actual buying behavior, which might be constrained artificially by, for example, long-term contracts. So that the ECSI would be

relevant for our sample, we surveyed only organizational buyers who had

the freedom to choose between competitive alternatives. The ECSI model

measures four characteristics of customer loyalty (Grnholdt, Martensen,

and Kristensen 2000): intention to repurchase, intention to cross-purchase

from the same supplier, intention to stay with that supplier rather than

switch to a competitor, and intention to recommend the supplier to other

customers. The ECSI is a cross-sectional model that does not incorporate

feedback effects (i.e., the effects of loyalty on its antecedents), but implicitly, the beliefs that define the constructs in the model (e.g., satisfaction),

will be more informed the longer a customer has had a relationship with a

seller.

Customer Satisfaction

Overall customer satisfaction is a cumulative evaluation based on total

purchase and consumption experience with a good or service over time

(Anderson, Fornell, and Lehmann 1994). While the customers overall

satisfaction is influenced by the sellers performance on various criteria

(e.g., product and service quality), the customers re-purchase intention is

also affected by the relative level of his or her satisfaction with the seller

compared to the sellers competitors (Kumar 2002). According to the

logic of the satisfactionperformance relationship, satisfaction affects

future buying intentions (Liu and Leach 2001) and, generally, satisfied

customers are more loyal, which increases revenue and lowers operating

costs and therefore higher satisfaction lifts return on investments, stock

price, and market-value added (Anderson, Fornell, and Mazvancheryl

2004; Fornell et al. 2006). The more competitive a market is, the more

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

296

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

sensitive changes in customer loyalty are to changes in customer satisfaction (Grnholdt, Martensen, and Kristensen 2000). Also, because of the

intangibility of services, satisfaction has a greater effect on loyalty for

services than it does for products, and also revenue growth for services is

more dependent on the effects of loyalty, that is, customer referrals and

word-of-mouth, and therefore the overall effect of satisfaction on profit

and growth is greater for services than it is for products (Edvardsson et al.

2000).

Some researchers have challenged this satisfaction-loyalty-performance

argument. Studies have shown that up to 20% of customers who have

switched banks did so even though they were satisfied (Keaveney 1995).

Another study found that up to 75% of customers who switched said they

were satisfied with their previous provider (Storbacka and Lehtinen

2001). Neal (1999) argued that while the relationship between customer

dissatisfaction and customer defection is strong, the converse is very

weak. Once a suppliers performance level has reached a certain minimum acceptable standard, customer satisfaction alone cannot reliably

predict repeat purchases (loyalty). This nonlinearity of the satisfactionloyalty link (Anderson and Mittal 2000) means that customer satisfaction

can be a poor predictor of future behavior, especially if brand choice does

not matter (all options are acceptable; Hofmeyr and Rice 2000). For this

reason, the ECSI model incorporates other drivers of customer loyalty

mentioned by the critics of pure customer satisfaction modelsperceived

image, product and service quality, and perceived value, although in the

ECSI model perceived value affects loyalty only indirectly, via customer

satisfaction.

Perceived Value

Perceived value is an important concept because it drives satisfaction

(Patterson, Johnson, and Spreng 1997) and, in turn, loyalty. Customers

compare quality received with investment put in (Storbacka and Lehtinen

2001) and choose the product or service that offers the best relative value

compared to others in their consideration set (Neal 1999). Although many

studies have shown that price is perhaps the most important determinant

of customer loyalty (Wathne, Biong, and Heide 2001), the perceived

value construct is more dynamic than price because the nature and determinants of value assessments may change during various stages of a

customers association with the seller (Slater and Narver 1994; Woodruff

1997). Also, using value judgments rather than price, as the ECSI model

Yew-Wing Lee and Steven Bellman

297

does, allows for comparability across firms and industries, even though

absolute price levels would vary widely, and controls for differences in

income and budget constraints across respondents (Lancaster 1971).

Empirical studies using the ECSI support its assumption that perceived

value has a direct influence on customer satisfaction but only an indirect

effect on customer loyalty. This was also the conclusion of the wellvalidated ACSI model.

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Perceived Quality

Perceived quality is a customers assessment of the ability of a product

or service to give satisfaction relative to the available alternatives (Dodds

and Monroe 1985). There are two dimensions of perceived quality in the

ECSI model (Grnholdt, Martensen, and Kristensen 2000): hardware,

which consists of the quality of the attributes of the product or service,

and human ware, which represents the associated customer interactive

elements in service, that is, the personal behavior of the service personnel

and the atmosphere of the service environment. Grnroos (2000) makes a

similar distinction between technical quality, the outcomes delivered by a

product or service, and functional quality, the manner in which those outcomes are delivered.

Several studies have found that perceived quality has a direct effect on

customer satisfaction (Bruhn and Grund 2000; Kristensen, Martensen,

and Grnholdt 1999). Fornell and colleagues (1996) found that the impact

of quality on customer satisfaction is greater than the impact of value.

While value may be central to the formation of the customers initial

preference and choice, quality is more important to the consumption

experience itself. Higher quality hardware generally has greater product

reliability (Adams and Browning 1989) and higher perceived value

(Homburg et al. 2002; Zeithaml 1988). Besides the indirect effect of hardware quality on loyalty via value and satisfaction, Kristensen, Martensen,

and Grnholdt (1999) also found that perceived quality of hardware had a

direct effect on customer loyalty. Martensen, Grnholdt, and Kristensen

(2000) found that for Swedish banks the second largest driver of customer

loyalty in the B2C market was service quality. This was because in that

market new products could be easily copied and implemented by competitors whereas service quality and corporate image were harder to duplicate and therefore the main differentiating factors. However, it is more

difficult to achieve an appreciably high and consistent standard of quality

with services compared to products. Consequently, researchers have

298

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

found that products generally outperform services in the area of perceived

quality and satisfaction (Fornell et al. 1996).

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Service Quality in B2B Markets

Studies employing the ACSI have suggested that customization is

more central to perceptions of quality than reliability, especially in service-oriented sectors (Fornell et al. 1996). Grewal and Sharma (1991)

argued that in B2B exchanges, the effectiveness of a seller at providing

consultative services will be a prominent attribute in the formation of

customer satisfaction. The services literature related to B2B markets has

also highlighted the importance of the salesperson. Kristensen, Martensen,

and Grnholdt (2000) found that, for the business market they examined,

good customer interaction was important for customer satisfaction, and in

fact, customer interaction was more important in the business market than

it was in the consumer market. Garbarino and Johnson (1999) also found

that for customers with a weak relationship with the company as a whole,

satisfaction with the salesperson was the main driver of future intentions

to buy.

However, a recent study, based on a sample of corporate buyers of

financial services from commercial banks in America, found that service

quality may be less important in B2B markets for financial services than

providers of financial services might think it is (Wathne, Biong, and

Heide 2001). Buyers and suppliers both considered price the most important factor influencing the decision to switch, but while suppliers regarded

interpersonal relationships as the second most important factor, buyers

rated firm-level switching costs second. The reason why corporate buyers

give less importance to interpersonal relationships is because managers

are also businesspeople who are asked to maximize profits for their

employers, as well as friends of the suppliers representative who feel an

obligation to cooperate in order to maintain that relationship (Montgomery

1998). In many cases, the customers role as friend assumes less

importance in the presence of explicit competitive offers (Wathne, Biong,

and Heide 2001).

Customer Expectations

Deighton (1992) argues that the critical performance issue for a service is

not what kind of performance the service provider is attempting, but rather

what kind of performance the customers expect or think they are viewing.

According to the confirmationdisconfirmation paradigm, performance

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Yew-Wing Lee and Steven Bellman

299

is compared with a preconsumption expectation to form an overall judgment of satisfaction or dissatisfaction (Churchill and Suprenant 1982).

Kristensen, Martensen, and Grnholdt (1999) reviewed the literature and

found that there is no conclusive evidence for whether expectations have

a positive or negative influence on perceived quality and customer satisfaction. Some studies have shown that expectations affect both perceived

quality and customer satisfaction directly (Oliver and DeSarbo 1988;

Spreng and Olshavsky 1993). Other studies have shown that expectations

have no influence on perceived quality but do have a direct influence on

customer satisfaction (Westbrook and Reilly 1983). Using the ECSI

methodology, however, Kristensen, Martensen, and Grnholdt (1999)

confirmed its assumption that expectations have a significant direct effect

only on perceived value, not customer satisfaction. Fornell and colleagues

(1996) showed that the total effects of expectations were lowest in both

the durable manufacturing and the finance sectors because current quality

experiences may be more salient and thus take precedence over previous

quality experiences.

Perceived Corporate Image

According to Martensen, Grnholdt, and Kristensen (2000), image is

the main driver of customer satisfaction and loyalty when there are many

suppliers, presumably because image is used as a screening variable to

reduce the consideration set down to a more manageable size. Previous

studies have found that corporate credibility (image) has a significant

influence on customer loyalty, as measured by purchase intentions

(Lafferty and Goldsmith 1999), especially for services (Grnroos 2000).

Laroche, Kim, and Zhou (1996) also found that product purchase decisions were in part influenced by the consumers positive view of the companys citizenship. However, Kristensen, Martensen, and Grnholdt

(2000) found that in the business market, compared with the consumer

market, image had less impact on customer loyalty and customer satisfaction, although image was still the most important driver of loyalty.

The Post Denmark ECSI Model

In the B2B market for services from Post Denmark, Kristensen,

Martensen, and Grnholdt (2000) discovered that the predictive ability of

the ECSI model could be improved by adding three new paths: corporate

image to customer satisfaction, product quality (hardware) to customer

loyalty, and service quality (human ware) to customer satisfaction (see

300

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

Figure 1). In our model we also included these three paths because we

were similarly analyzing data from a B2B market for services.

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Buyers Relational Orientation (BRO)

Relational orientation (or commitment) has been defined as a customers psychological attachment, loyalty, concern for future welfare,

identification, and pride in being associated with the organization

(Garbarino and Johnson 1999, 73). Jackson (1985) suggested that the

application of high-cost relational marketing should depend on the

buyers relational orientation. Buyers with a short-term (or transactional)

orientation rely on the price efficiencies of market exchanges to maximize

their profits over a series of transactions. In contrast, buyers with a longterm orientation rely on transaction efficiencies through joint synergies

and risk sharing to maximize profits over a series of transactions (Ganesan

1994), benefiting from improved quality and process performance and

continuous cost reduction (Chow and Holden 1997). Generally, buyers

with a generic need and facing a continuous availability of competing but

similar suppliers are likely to choose or prefer a transactional exchange,

while those customers with a unique need will see the benefits of a relationship to reduce the risk of failure of supply and to have services or

products that are tailored to meet their specific requirements (Pels,

Coviello, and Brodie 2000).

Several researchers have argued that positive relational orientation is

important in determining whether customers would repurchase from the

same service provider (Cannon and Perreault 1999; Garbarino and

Johnson 1999; Morgan and Hunt 1994). Recent studies have shown that

relational elements such as long-term orientation and mutual commitment

enhance performance outcomes and satisfaction and hence loyalty

between buyers and sellers (Anderson and Weitz 1992; Ganesan 1994).

Walter (2000) found that the more a customer valued a relationship with a

seller, the stronger their intentions to remain loyal to that seller. Ganesan

(1994) also found that a customers relational orientation had a direct

effect on their relationship and dependence on a vendor.

But insufficient understanding of the BRO can lead to problems such

as attempting a relationship marketing approach when transaction marketing is more suitable (Ganesan 1994). Although the ECSI model has a

good track record for explaining customer loyalty in general, there is

evidence from the relationship marketing area that taking a portfolio

approach with the ECSI model may be more appropriate, especially for

Yew-Wing Lee and Steven Bellman

301

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

more mature and sophisticated B2B marketers. The relationships between

variables in the ECSI model may differ systematically between customers

with a high versus a low BRO. For example, Garbarino and Johnson (1999)

found that a customers relational orientation may affect the relative importance of satisfaction, product quality (quality of hardware), and service quality (quality of human ware), as predictors of customer loyalty. But since

there is little evidence on which to base specific hypotheses for all the potential moderating effects of relational orientation on the paths in the ECSI

model, we propose the following overall exploratory research question.

RQ: Buyers relational orientation moderates relationships between

variables in the ECSI model.

For one path in the ECSI model, however, it is possible to propose a

specific hypothesis of moderation based on previous empirical results.

Garbarino and Johnson (1999) found that while the link between satisfaction and loyalty was strong for transactional customers, this link was not

so important for customers with a higher relational orientation (who

forgave the occasional poor performance from a service provider).

The following hypothesis tests whether relational orientation moderates

the association between satisfaction and loyalty.

H1: Satisfaction will have a significantly stronger effect on loyalty for

customers with lower relational orientation (a transactional

orientation).

This specific moderator effect hypothesis (H1) would be supported if the

interaction between the independent variable and the moderator variable

has a significant negative effect on the dependent variable (Baron and

Kenny 1986), that is, higher BRO will reduce the impact of satisfaction on

loyalty. For the more general exploratory research question (RQ), a simple

way of testing for moderation effects using structural equation modeling is

to split the sample at the median for the proposed moderator and compare

the relationships between variables in the two groups (Srbom 1974).

This research question and its related hypothesis are important because if

BRO affects the relative importance of the drivers of loyalty in the ECSI

model, financial service providers would be better off using a portfolio

approach to their relationships with customers. The costs to service providers of investing in long-term relationships, in identical ways with all their

customers, may far exceed the long-term gains. If high BRO customers differ

302

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

systematically from low BRO customers in terms of what drives their loyalty, financial services firms should target their CRM efforts differently

across these two segments. The following sections describe a survey carried

out to test for differences between these two groups (high vs. low BRO),

using data from the B2B market for financial services in Singapore.

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

RESEARCH METHODOLOGY

The Sample

The sample consisted of 118 business customers for financial services

in Singapore. Singapore is an open economy and, therefore, there are

many choices for buyers of financial services so that Singapore is a suitable environment in which to research the attitudinal loyalty of organizational

customers. Although relatively small, this sample size was adequate for

testing the research question and the hypothesis. According to Chin

(1998), the PLS analysis technique, which is essential for estimating the

ECSI model, requires a sample size of at least ten times the number of

items associated with the construct with the largest number of indicators,

or ten times the number of structural paths associated with the construct

with the largest number of structural paths, whichever number is higher.

In this case, two constructs in the ECSI model (Customer Loyalty and

Perceived Corporate Image) had the largest number of indicators, four,

and the largest number of structural paths was also four. This meant that

the minimum sample size required was at least 40 companies, so the

sample of 118 was more than large enough, as it enabled a median split

into two samples of 59.

An advantage of confining the survey to one country, Singapore, is that

this minimized the impact of environmental and cultural variables on the

research. It also allows for cross-country comparison with existing

research using the ECSI model in other countries. Also, by limiting the

survey only to companies based in Singapore, the survey was cheaper to

conduct and survey responses were faster.

All of the respondents had some influence on the buying decision for

their companies because this was a criterion for participation (high

influence, 27%; significant influence, 41%; some influence, 32%). Most

company types were represented in the sample in roughly the same

proportions they occupied in the Singaporean economy, although

government-linked organizations were underrepresented (multinational

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Yew-Wing Lee and Steven Bellman

303

companies, 49%; large local companies, 12%; small or medium size companies, 27%; government-linked companies, 6%; others, 6%).

The sample covered a fairly wide range of financial services and buying situations, although it mainly represented banking services supplied to

companies with two or more financial service providers. To ensure that

the respondents answered questions about suppliers that were not locked

in, and could be switched away from, all of the questions in the survey

referred to the Financial Service Provider indicated as being the one that,

if a decision was made to change that provider, the respondent would

have the most influence on that decision to change. The main type of service provider indicated was principal banker (57%), followed by secondary bankers (18%), insurance brokers (8%), insurers/reinsurers (7%),

investment bankers (6%), stockbrokers (2%), and others (2%). These

numbers indicate that our results are more applicable to banking services

than to any other type of financial services. Even within the same type of

services, asymmetries in power and information would vary with the relative size of the supplier and buyer companies. Our sample had a wide spectrum of company size, which is related to the use of a portfolio approach to

purchasing and other aspects of purchasing maturity (Gelderman and van

Weele 2005). About one third (30%) of the companies represented in our

sample employed more than 250 people, another third (33%) employed

from 51 to 150, and another third (29%) were very small companies,

employing 50 or less (8% employed from 151 to 250 employees). Similarly, half (50%) of the sample had a turnover of less than $50 million

(Singapore Dollars [SGD]), while one third (29%) turned over between $51

million and $250 million, and one seventh (14%) turned over in excess of

$500 million (7% turned over between $251 million and $500 million).

Further evidence of the range of contexts represented in this sample was

provided by the number of suppliers used. Three quarters of the sample

(75%) used from two to six suppliers of financial services while around a

sixth (17%) used just one supplier (8% used more than six suppliers).

Measures

European Customer Satisfaction Index (ECSI)

The items for the ECSI model were adapted from a survey used by

Kristensen, Martensen, and Grnholdt (2000), which were used in both

B2C and B2B contexts. All the items were measured on ten-point semantic differential scales, with end points adapted to the item (Andrews 1984;

Cassel, Hackl, and Westlund 2000). All items loaded significantly on

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

304

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

their correct factors, which indicated cross-cultural factorial invariance

for the ECSI (Steenkamp and Baumgartner 1998). Construct reliabilities

were all above the minimum .70 criterion (Nunnally, 1978; lowest = .87

for Customer Loyalty) and Average Variance Extracted (AVE) was above

the minimum .50 for all seven scales (Fornell and Larcker 1981; again,

lowest = .62 for Customer Loyalty). In addition, the R2 (the amount of

variance explained) for Customer Satisfaction (.74), exceeded the criterion (.65) required by the ECSI technical committee. This means that the

items used in the ECSI in this study had more than adequate reliability

and predictive validity in this Singaporean sample. The scores for each

factor can be converted to a score out of 100 by multiplying the mean by

ten. Customer Satisfaction in the market for B2B financial services in

Singapore, 70 (95% CI; 40 to 100), compared favorably with B2B satisfaction with Sweden Post, 61 (measured by the ACSI; Kristensen,

Martensen, and Grnholdt 2000), and was at the upper limit of the general

range found in the United States and Sweden (56 to 70).

Buyers Relational Orientation (BRO)

Buyers relational orientation includes both long term relationship orientation (Ganesan 1994) and relational norms (Kaufmann and Stern

1988). However, no existing instrument captures both these aspects of the

construct. Ganesans (1994) instrument was chosen, although it does not

cover relational norms, because it has been validated in a B2B marketing

context. Cronbachs alpha for this scale in this Singaporean context (.86)

was higher than the .82 reported by Ganesan (1994) in the United States.

The confidence interval for the Singaporean sample (3.13 to 6.97;

SD = .98) includes the norm reported by Ganesan (1994), 5.49 (SD = .93).

Discriminant Validity

We used PLS to evaluate the discriminant validity of the ECSI factors

(Gefen and Straub 2005) because PLS is the method mandated by the

originators of the scale and our sample size was too small to use covariance structure analysis techniques such as LISREL (Anderson and

Gerbing 1988; Marsh, Balla, and McDonald 1988). The correlations

between factors ranged from .16 (Expectations and Loyalty) to .97

(Human Ware and Hardware), and AVE ranged from .62 (Loyalty) to .92

(for both Value and Expectations). The highest correlation (.97, between

Human Ware and Hardware) exceeded the square root of AVE for both factors (Human Ware .88 [square root = .94], Hardware .84 [square root = .92]),

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Yew-Wing Lee and Steven Bellman

305

indicating no discriminant validity between perceptions of product quality

and service quality for the financial services examined in this study. For

all other correlations between factors, the correlation was lower than the

square root of AVE for both factors.

We conducted a similar test of the discriminant validity between

Loyalty, the dependent variable of the ECSI model, and our proposed

moderator variable, BRO. The correlation between these two factors was .55

and AVE was .62 (square root = .79) for Loyalty and .56 (square root = .75)

for BRO. For both factors, the correlation was less than the square root of

AVE, indicating discriminant validity between them. We also conducted

a principal components exploratory factor analysis of the items used to

measure these two factors. Two factors, with eigenvalues greater than

one, were extracted and Table 1 shows the item loadings on these two factors, after varimax rotation, with loadings greater than .7 indicated in

bold. Six of the seven BRO items had their highest loading on the first

factor, and three of the four Loyalty items had their highest loading on the

second factor. However, many items had significant loadings on both factors indicating a lack of clear discrimination between the two scales.

Because of the close relationship between these two factors, we did not

include BRO as a predictor of Loyalty but instead tested whether differences in BRO, which in our data is close to but empirically distinct from

Loyalty, moderated relationships between variables in the ECSI model of

Loyalty.

Survey Procedure

The questions in the survey questionnaire were first adapted from

the various measurement scales, as stated earlier, and then tested

on a group of twenty respondents that were representative of the

final sample. The feedback received was used to further modify the

survey questions to make them more clear and more specific in some

cases.

Of the 1,365 companies listed as members of the Singapore National

Employers Federation (SNEF) at the end of 2002, 900 (66%), chosen at

random, were approached for this survey over a five-month period, from

February to June 2003. The questionnaires were addressed either to the

CEO or the CFO to ensure that we received responses from top-level

managers involved in strategic purchasing, as well as the views of chief

purchasing officers (CPOs) and middle managers involved in more routine purchasing. Respondents were encouraged to pass the survey on to

306

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

TABLE 1. Rotated factor analysis of CL items

from the ECSI model and BRO items

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Factor

BRO4: My company is willing to make sacrifices to help this

financial service provider from time to time.

BRO2: I believe that maintaining a long-term relationship with

this financial service provider is important to my company.

BRO3: I focus on long-term goals when I deal with this

financial service provider.

BRO7: Any concessions that I make to this service provider

will even out in the long run.

BRO1: I believe that over the long run, my companys relationship

with this financial service provider will be profitable.

BRO6: I expect this financial service provider to work

with us for a long time.

CL2: Would you buy a different product or service from

this financial service provider?

CL4: Do you intend to switch to another financial service

provider? [Reverse coded]

CL1: Do you intend to continue buying from this financial

service provider?

CL3: Would you recommend this financial service provider?

BRO5: I am only concerned with the benefits to my company in

my dealings with this financial service provider. [Reverse coded]

Eigenvalues (unrotated)

.83*

.03

.82*

.34*

.82*

.18

.80*

.04

.77*

.40*

.73*

.41*

.47*

.38*

.15

.81*

.25*

.77*

.50*

.41*

.68*

.46*

5.54

1.55

*p < .05 (loading > .18, i.e., 1.96 SE, where SE = 1/ N , and N = 118).

Notes: Loadings greater than .70 shown in bold. CL = Customer Loyalty (dependent variable

from ECSI model), BRO = Buyers Relational Orientation. Extraction method = principal component analysis. Rotation Method = varimax with Kaiser normalization. Kaiser-Meyer-Olkin

measure of sampling adequacy = .870. Bartletts test for sphericity: 2(55) = 773.56, p < .001.

Two factors with Eigenvalues greater than 1.0 explained 64.5% of total variance.

the person in the firm who was best able to answer its questions: This

survey is for managers who are either the decision maker for changing or

retaining any financial service providers to their company, or have some

influence on these decisions. If another person in your company is a more

suitable respondent, please pass this survey form to him or her. Several

reminders were sent to encourage response. Another 46 respondents (5%

of the total sample) were Singaporean MBA students. The response rate,

12.5% (118 usable surveys from 946 sent out), was poor, but typical for

B2B surveys (Dillman 2000).

Yew-Wing Lee and Steven Bellman

307

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Analysis Techniques

Partial least squares, a type of structural equation modeling (SEM),

was used to estimate the ECSI model, as mandated by the ECSI technical

committee (Kristensen, Martensen, and Grnholdt 1999, 609). Partial

least squares attempts to maximize the variance explained in the dependent

variables by iteratively estimating the relationships between measured

indicators and their related latent variables (the outer or measurement

model), and then updating the relationships between these latent variables

(the inner or structural model). Chin (2000) describes in more detail how

PLS-Graph, the software we used, derives its inner and outer weights. For

example, the inner weights are based on the estimated covariances

between adjacent latent constructs, which in turn are determined by the

current approximations of the weights allocated across the indicators of

these latent constructs.

There are several advantages of using PLS to analyze the results of this

survey: (1) while PLS, like other forms of SEM, accommodates the network of cause and effect relationships among the various latent variables

in a model, PLS is considered better for explaining complex relationships

(Fornell and Bookstein 1982); (2) PLS estimates are more accurate than

multiple regression and principal components regression when estimating

complex customer loyalty models (Ryan, Rayner, and Morrison 1999);

(3) PLS is extremely robust against potential deficiencies in data sets and

model specification, for example, the erroneous omission of indicator and

latent variables, multicollinearity, and non-normal or heavily skewed

response distributions (Cassel, Hackl, and Westlund 2000); and (4) PLS

can utilize small sample sizes, even less than fifty per group, whereas

other SEM methods (e.g., LISREL) require a minimum sample size of

200 in each group (Anderson and Gerbing 1988).

The PLS analyses reported in this article were carried out following the

procedural steps outlined by Ryan, Rayner, and Morrison (1999, 24):

(1) specify the hypothetical model to be tested; (2) estimate all the regression path weights in the structural model as well as the relationships

between the latent variables and their components (the significance of

these regression weights and factor loadings were determined using bootstrap analysis); and finally (3) estimate direct and indirect paths in the

model (indirect effects were calculated by multiplying the direct effects in

a causal chain; total effects were the sum of direct and indirect effects).

In PLS, the significance of an interaction effect is tested using a latent

variable defined by the cross products of the indicators of the independent

308

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

variable and the moderator variable (Chin, Marcolin, and Newsted 1996).

The latent interaction variable for the test of H1 would have required a

total of 21 cross-product indicators (7 for BRO 3 for satisfaction). Estimating this model would therefore have required a minimum sample size

of 210, which was larger than the actual sample size of 118. Therefore,

H1 was tested using classical regression (Jaccard, Turrisi, and Wan

1990).

RESULTS

Descriptive Statistics

Table 2 lists the means, standard deviations, and correlations between

the variables in the proposed augmented ECSI model. The standard deviations of all the variables were quite high, indicating a fairly wide dispersion of values, so the research question and hypothesis tests conducted by

this survey did not suffer from range restriction. The business buyers in

this survey were generally loyal to their financial service providers. However, the fact that about 30% of the respondents were willing to switch

providers showed that there was a significant business segment that was

TABLE 2. Means, standard deviations, and correlations among

variables in the proposed augmented ECSI model

Variable

Mean (SD)

1. Customer Loyalty

2. Customer Satisfaction

3. Perceived Value

4. Customer Expectations

5. Perceived Quality

of Hardware

6. Perceived Quality of

Human Ware

7. Perceived Corporate

Image

8. Buyers Relational

Orientationa

6.33 (.96)

6.91 (1.60)

6.93 (1.54)

7.47 (1.19)

7.24 (1.46)

.55

.56

.16*

.61

.76

.32

.85

.35

.75

.33

7.22 (1.47)

.62

.86

.76

.37

.97

7.36 (1.40)

.50

.78

.65

.45

.81

.83

5.05 (.98)

.55

.56

.63

.22

.61

.61

.52

.46

*p > .05 (not significant).

Measured on a seven-point scale; all other variables were measured using ten-point

scales.

a

Yew-Wing Lee and Steven Bellman

309

dissatisfied with what they were getting from their existing providers. The

rating given to BRO was also generally high.

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

European Customer Satisfaction Index (ECSI) Model

Figure 2 shows the fit of the basic ECSI model (without the three extra

paths found in the Post Denmark study by Kristensen, Martensen, and

Grnholdt 2000) to data from the B2B market for financial services in

Singapore. It achieved excellent fit, explaining 66% of the variance in

Customer Loyalty. In these data, Satisfaction had a significantly positive

effect on Customer Loyalty ( = .49, t = 4.19, p < .001). However, the

effects of Perceived Corporate Image ( = .20, t = 1.27) and Perceived

Quality of Human Ware ( = .13, t = .88) were not significant. Product

quality (Perceived Quality of Hardware) had a significant effect on Satisfaction ( = .67, t = 6.44, p < .001), as did Perceived Value ( = .25,

t = 2.39, p < .05), but the effect of Expectations was not significant

( = .02, t = .27). Product quality (Hardware) also had an effect on Value

( = .47, t = 4.60, p < .001), as did service quality (Human Ware: = .28,

t = 2.70, p < .01).

FIGURE 2. Direct effect of BRO on Customer Loyalty.

Perceived

Image

.02

.20

.04

.25*

.45***

Expectations

.04

Perceived

Value

Satisfaction

Loyalty

.48***

Hardware

Quality

.28***

.04

Human

Ware Quality

.66***

* p < .05. ** p < .01. *** p < .001.

Explained variance (R ): Value = .66, Satisfaction = .74, Loyalty = .67.

310

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Moderating Effects of BRO

To explore all possible moderation effects of BRO (the RQ), the overall sample was split at the median for BRO into two groupsHigh versus

Lowand the three additional paths indicated by the Post Denmark study

(Kristensen, Martensen, and Grnholdt 2000) were included in the ECSI

model. The High group was significantly more long-term relationally oriented

than the Low group (MHigh = 5.75 on a seven-point scale vs. MLow = 4.32;

t = 11.44, p < .001). The High group was also more Loyal overall

(MHigh = 6.80 vs. MLow = 5.85; t = 6.19, p < .001).

Figure 3 shows the differences in path coefficients for the structural

(inner) model across the two groups. Not only was the High BRO group

more loyal, the ECSI model was more effective in predicting loyalty for

this group of buyers compared to the Low BRO group (R2High = .81 vs. R2Low

=.60). The R2 of .67 obtained for the unmoderated ECSI model (Figure 2)

was obviously an average over these two groups. The R2 for satisfaction in

both groups of buyers was similar (R2High = .84 vs. R2Low = .75), which

indicated that the ECSI model was a good predictor of buyers satisfaction for buyers with High and Low BRO.

FIGURE 3. Moderating effects of BRO on the ECSI Model.

Perceived

Image

.28

.11

.02

.28*

.02

.38

.23

Low BRO

High BRO

.27*

.56

.08

.28

.30*

Expectations

.07

Perceived

Value

.05

Satisfaction

Loyalty

.62***

.13

Hardware

Quality

.34*

.10

.04

.06

Human

Ware Quality

.35

.55***

.12

.33*

.19

.27*

*p < .05. ** p < .01. *** p < .001.

Explained variance (R ): Value: High BRO = .48, Low BRO = .67; Satisfaction: High BRO = .84,

Low BRO = .75; Loyalty: High BRO = .81, Low BRO = .60.

Yew-Wing Lee and Steven Bellman

311

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Other Differences Between the High and Low BRO Groups

None of the drivers of Customer Loyalty in the Post Denmark ECSI

model was significant for both BRO groups. In particular, the effect of

Satisfaction on Loyalty was significant in the High BRO group but not in

the Low BRO group.

Confining attention just to the path coefficients that were significant in

at least one group, the following differences in paths were observed

between the Low and the High BRO groups: (1) product quality (Hardware) had a highly significant effect on Value for customers with a Low

BRO but no effect for customers with a High BRO; (2) similarly, service

quality (Human Ware) affected Value for Low BRO customers but not for

High BRO customers; (3) together, these results explained why the R2 for

Value was higher for the Low BRO group (R2Low = .67 vs. R2High = .48);

and (4) why Value had a significant impact on Satisfaction for Low BRO

customers, whereas its influence was insignificant for High BRO customers; (5) product quality (Hardware) had a significant direct effect on Satisfaction for High rather than Low BRO customers; but (6) product quality

had a significant direct effect on Loyalty for Low rather than High BRO

customers; also (7) service quality (Human Ware) had a significant direct

effect on Loyalty for High BRO rather than Low BRO customers; and

finally (8) Perceived Image had a significant effect on Satisfaction in the

High BRO group but not in the Low BRO group.

Since product and service quality were highly related in this sample,

we checked these results using a variable (Financial Service Product

Quality [FSPQ]) that was the mean of all six items used to measure product and service quality (Cronbachs alpha = .94). The pattern of results

was very similar. Financial service product quality had a more significant

relationship with Value for Low rather than High BRO customers (rLow =

.57, p < .001 vs. rHigh = .38, p = .004; controlling for Image and Expectations). But FSPQ had a more significant relationship with Satisfaction for

High rather than Low BRO customers (rHigh = .61, p < .001 vs. rLow = .33,

p = .014; controlling for Image, Expectations, and Value). Finally, the

relationship between FSPQ and Loyalty was significant only for customers with a High BRO (rHigh = .35, p = .009 vs. rLow = .21, p = .132; controlling for Image, Expectations, Value, and Satisfaction).

The Moderating Effect of BRO on the SatisfactionLoyalty Link

To test H1, a hierarchical regression model was used with Loyalty as the

dependent variable. All the variables in the model were first standardized

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

312

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

before constructing the product term, BRO Satisfaction, to minimize

multicollinearity between the interaction term and its constituent variables (Jaccard, Turrisi, and Wan 1990). First, the exogenous variables in

the ECSI model were entered, Image, Expectations, Hardware, and

Human Ware, which together explained a significant amount of the variance in Loyalty (R2 = .387, p < .001). Next, Perceived Value was

entered, which had a significant effect on Loyalty ( = .229, SE = .113,

p = .044, R2 = .409, R2 = .022), followed by Satisfaction, which did not

( = .010, SE = .156, p = .949, R2 = .409, R2 = .000). Finally, the addition of BRO significantly increased explained variance in Loyalty

( = .242, SE = .096, p = .013, R2 = .442, R2 = .032), as did the interaction between BRO and Satisfaction ( = .131, SE = .066, p = .048,

R2 = .461, R2 = .020). The highest condition index for all these models

was 12.91 (for a factor highly correlated with Hardware [.90] and Human

Ware [.93]), which was below the critical level of 15 at which multicollinearity problems would be indicated. Although the interaction effect

was significant, it was significantly positive and, therefore, in the opposite direction to that predicted by H1.

The moderating effect of BRO can be illustrated using the method recommended by Jaccard, Turrisi, and Wan (1990). The relationship

between Satisfaction and Loyalty at different levels of BRO is given by

the following equation.

b1 at X 2 = b1 + b3 X 2 ,

where b1 is the slope of the effect of Satisfaction (X1), X2 is the level of

BRO, and b3 is the slope of the interaction effect between X1 and X2

(Satisfaction and BRO). Using one standard deviation on either side of

the mean to define Low and High Relational Orientation (using standardized variables, the standard deviation = 1), and results from the final

model including the interaction effect, the following slopes are obtained.

b1 at Low X2 (BRO = 1) = .018 + (.131) (1) = .018.131 = .149

b1 at Medium X2 (BRO = 0) = .018 + (.131) (0) = .018

b1 at High X2 (BRO = +1) = .018 + (.131) (1) = .018+.131 = .113

For customers with a Low Relational Orientation, the effect of Satisfaction on Loyalty is negative but insignificant. As Relational Orientation

increases, Satisfaction has an increasingly positive effect on Loyalty. In

Yew-Wing Lee and Steven Bellman

313

contrast, H1 predicted that Satisfaction would have an increasingly negative (i.e., less significant) effect on Loyalty as BRO increased.

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

DISCUSSION

This study tested whether the preferences of individual B2B buyers for

long-term or short-term (transactional) relationships with their service

providers makes a difference to the influences on their loyalty. We found

that buyers relational orientation (BRO) affected the significance of

many relationships between variables in one of the most reliable models

of B2B customer loyalty available, the European Customer Satisfaction

Index (ECSI) model. In particular, the loyalty of customers with a High

BRO is positively influenced by their satisfaction with the supplier,

whereas satisfaction had a negative but insignificant effect on loyalty for

customers with a Low BRO.

The last finding, that satisfaction had a significant effect on loyalty for

High BRO customers rather than Low BRO customers, was in the opposite direction to the one predicted by H1, based on a previous study by

Garbarino and Johnson (1999). Garbarino and Johnson found that customers with a High BRO were more resilient, and remained loyal even

after experiencing low satisfaction occasionally, because their loyalty was

also driven by trust and commitment. On the other hand, the loyalty of

Low BRO customers was entirely determined by their satisfaction. In

Garbarino and Johnsons (1999) study, however, the items measuring

specific attributes of the offering were more likely to be confidently evaluated by regular customers rather than occasional customers, which

would have increased the predictive value of global satisfaction. In our

study, the components of satisfaction, image, expectations, and product

and service quality, were all measured at a relatively abstract level suitable even for one-time buyers, and this may have increased the relative

importance of all these components relative to global satisfaction. Our

result is also more consistent with Jacksons (1985) view that customers

looking for a long-term relationship are more sensitive and intolerant of

any inadequacies because they have so much invested in the relationship.

Our findings also suggest that the three extra paths included in the Post

Denmark version of the ECSI model should be routinely included in future

estimations of the ECSI model, especially in B2B markets. Although only

one of these additional paths (hardware to loyalty) was significant in this

Singaporean sample, all three may be significant in other samples.

314

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

Management Implications

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Customer Segmentation

The finding that BRO is an important moderator of customer loyalty

means that financial service providers can usefully segment their customers according to whether they have a long-term or a short-term BRO.

Ganesans (1994) seven-item questionnaire could be useful for this or

BRO could be inferred from customer sales records. More likely, however, because B2B relationships generally involve continual direct and

personal contact, company representatives will be able to assign customers

to segments (for specific products) based on their own in-depth knowledge of the company. If the number of customers is large enough to justify the use of a CRM database, CRM programs should be focused to the

needs of the high BRO segment, which is the only segment that desires a

long-term relationship with their supplier (Garbarino and Johnson 1999;

Jackson 1985). Their financial service providers need to have greater

competence in image, product quality, and service quality because all

three have significant direct or indirect effects on loyalty for these customers, as well as substantial total effects (image = .48, product quality = .29,

service quality = .14). All three drove High BRO customers satisfaction

in these data, and the linkage between satisfaction and loyalty was strong

for this group of buyers.

For those customers with a Low BRO, the main driver of loyalty in this

sample was product quality (total effect = .69; image = .04, service

quality = .04). Hultman and Shaw (2003) suggest that the offer of a standardized product at a reduced price might be attractive to these Low BRO

customers because they are more interested in tangible offers (i.e., product quality) rather than company image or how the product is delivered.

Since the needs of the High and Low Relational Orientation segments

are different, this differentiation of marketing strategy and tactics, and the

differential allocation of resources across High and Low Relational

Orientation segments, would be more effective and cheaper than using

one strategy for all customers.

Another possibility, suggested by Ganesan (1994), is for the service

provider to try to convert buyers with a short-term orientation to become

more long-term orientated through trust-enhancing behaviors like providing

promised benefits reliably or by increasing switching costs through substantial investments in meeting specific needs. Each investment in a currently

transactional customer would need to be evaluated on a case-by-case basis.

Yew-Wing Lee and Steven Bellman

315

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Limitations and Suggestions for Future Research

Similar to most quantitative models of satisfaction and loyalty this

study assumed that the direction of causality flowed from perceptions of

the supplier and the suppliers goods and services to perceptions of value,

satisfaction, and, finally, intentions to remain loyal to that supplier. But

the cross-sectional nature of this study cannot rule out reverse causality as

a reason for the high correlations between the variables in these data. If

reverse causality was present, then the drivers of loyalty would not be the

variables in the ECSI model. For example, if a buyer had a high intention

to buy again from the same supplier for situational reasons, such as

pressure from a powerful superior, time pressure, habit, or structural

bonds (e.g., Storbacka and Lehtinen 2001), then to maintain cognitive

consistency the buyer might realign perceptions of the supplier so that

they are more favorable toward that intention (Festinger 1957; Sweeney,

Hausknecht, and Soutar 2000). Future studies using the ECSI model in

B2B markets should use longitudinal experimentation, combined perhaps

with in-depth case studies, to investigate how much reverse causality

affects its apparent findings.

The lack of significance of some results could have been due to the

small sample size used. There is a need to replicate this study with a

larger sample size. In a different market, there would probably be the

usual distinction between product and service quality, which exhibited

low discriminant validity in this sample. Also, the finding that satisfaction was more predictive of loyalty for high BRO customers needs further replication because it may have been due to peculiarities of the

sample or the method we used. The moderation effects we found in

relation to our research question also need confirmation using a

hypothesis-testing approach. Another limitation is that, as far we are

aware, this was the first B2B marketing research study to use the ECSI

model in Singapore, so we have no local benchmarks to compare

against. Our results suggest, however, that the ECSI model performs

well in this context and this may encourage other researchers to use the

ECSI model in other countries in the Asian region and in other B2B

markets.

Most critically, however, the use of the ECSI model requires B2B markets that resemble B2C markets in that a small number of suppliers serve

large numbers of customers. We acknowledge that for many B2B markets

this is not the case, and our results may not be applicable outside the types

of contexts represented in our sample.

316

JOURNAL OF BUSINESS-TO-BUSINESS MARKETING

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

REFERENCES

Adams, R. J. and J. M. Browning (1989), Purchasing and product liability, International

Journal of Purchasing and Materials Management 25(Summer):29.

Anderson, E. and B. Weitz (1992), The use of pledges to build and sustain commitment in

distribution channels, Journal of Marketing Research 29(February):1834.

Anderson, E. W. and V. Mittal (2000), Strengthening the satisfaction-profit chain, Journal

of Service Research 3(2):107120.

Anderson, E. W., C. Fornell, and D. R. Lehmann (1994), Customer satisfaction, market

share, and profitability: Findings from Sweden, Journal of Marketing 58(July):5366.

Anderson, E. W., C. Fornell and S. K. Mazvancheryl (2004), Customer satisfaction and

shareholder value, Journal of Marketing 68(October):172185.

Anderson, J. C. and D. W. Gerbing (1988), Structural equation modeling in practice:

A review and recommended two step approach, Psychological Bulletin 103(May):

411423.

Andrews, F. M (1984), Construct validity and error components of survey measures: A

structural modeling approach, Public Opinion Quarterly 48:409442.

Baron, R. M. and D. A. Kenny (1986), The moderatormediator variable distinction in

social psychological research: Conceptual, strategic, and statistical considerations,

Journal of Personality and Social Psychology 51(6):11731182.

Blankenburg Holm, D., K. Eriksson, and J. Johanson (1996), Business networks and

cooperation in international business relationships, Journal of International Business

Studies 27(5):10331053.

Bruhn, M. and M. A. Grund (2000), Theory, development, and implementation of national

customer satisfaction indices: The Swiss Index of Customer Satisfaction (SWICS),

Total Quality Management 11(7):10171028.

Cannon, J. P. and W. D. Perreault, Jr. (1999), Buyerseller relationships in business markets, Journal of Marketing Research 36(November):439460.

Cassel, C. M., P. Hackl, and A. H. Westlund (2000), On measurement of intangible

assets: A study of robustness of partial least squares, Total Quality Management

11(7):897907.

Chin, W. W. (1998), Overview of the PLS method. Available at http://dics-nt.cba.uh.edu/

chin/PLSINTRO.HTM. Last accessed July 21, 2008.

Chin, W. W. (2000), Partial least squares for researchers: An overview and presentation of

recent advances using the PLS approach. ICIS 2000 Tutorial. Available at http://

disc-nt.cba.uh.edu/chin/icis2000plstalk.pdf. Last accessed July 21, 2008.

Chin, W. W., B. L. Marcolin, and P. R. Newsted (1996), A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo

simulation study and voice mail emotion/adoption study. In Proceedings of the 17th

International Conference on Information Systems, ed. J. I. DeGross, S. Jarvenpaa, and

A. Srinivasan. Cleveland, Ohio: 2141.

Chow, S. and R. Holden (1997), Toward an understanding of loyalty: The moderating role

of trust, Journal of Managerial Issues 9(Fall):275298.

Churchill, G. A. and C. Suprenant (1982), An investigation into the determinants of

customer satisfaction, Journal of Marketing Research 19(November):491504.

Downloaded By: [Romanian Ministry Consortium] At: 19:52 2 March 2010

Yew-Wing Lee and Steven Bellman

317

Deighton, J. (1992), The consumption of performance, Journal of Consumer Research

19(December):362372.

Dillman, D. A. (2000), Mail and internet surveys: The tailored design method, 2nd ed.

New York: John Wiley & Sons.

Dodds, W. B. and K. B. Monroe (1985), The effect of brand and price information on

subjective product evaluations. In Advances in consumer research, Vol. 12, ed.

E. C. Hirschman and M. B. Holbrook. Provo, UT: Association for Consumer Research:

8590.

Edvardsson, B., M. D. Johnson, A. Gustafsson, and T. Strandvik (2000), The effects of

satisfaction and loyalty on profits and growth: Products versus services, Total Quality

Management 11(7):917927.

Festinger, L. (1957), A theory of cognitive dissonance. Stanford, CA: Stanford University Press.

Fitzsimmons, J. A., J. Noh, and E. Thies (1998), Purchasing business services, Journal of

Business & Industrial Marketing 13(4/5):370380.

Ford, D., P. Berthon, S. Brown, L.-E. Gadde, H. Hkansson, P. Naud, T. Ritter, and

I. Snehota (2002), The business marketing course: Managing in complex networks.

Chichester, UK: John Wiley & Sons.

Fornell, C. (1992), A national customer satisfaction barometer: The Swedish experience,

Journal of Marketing 56(January):621.

Fornell, C. and F. L. Bookstein (1982), Two structural equation models: LISREL and PLS

applied to consumer exit-voice theory, Journal of Marketing Research 19(November):

440452.

Fornell C. and D. F. Larcker (1981), Evaluating structural equation models with unobservable measurement error, Journal of Marketing Research 18(February):3950.

Fornell, C., S. Mithas, F. V. Morgeson III, and M. S. Krishnan (2006), Customer satisfaction and stock prices: High returns, low risk, Journal of Marketing 70(January):314.

Fornell, C., M. D. Johnson, E. W. Anderson, J. Cha, and B. E. Bryant (1996), The

American Customer Satisfaction Index: Nature, purpose, and findings, Journal of

Marketing 60(October):718.

Ganesan, S. (1994), Determinants of long term orientation in buyerseller relationships,

Journal of Marketing 58(April):119.

Garbarino, E. and M. S. Johnson (1999), The different roles of satisfaction, trust, and commitment in customer relationships, Journal of Marketing 63(April):7087.

Gefen, D. and D. Straub (2005), A practical guide to factorial validity using PLS-graph:

Tutorial and annotated example, Communications of the AIS 16:91109.

Gelderman, C. J. and A. J. van Weele (2005), Purchasing portfolio models: A critique and

update, Journal of Supply Chain Management 41(Summer):1928.

Geyskens, I., J.-B. E.M. Steenkamp, and N. Kumar (1999), A meta-analysis of satisfaction

in marketing channel relationships, Journal of Marketing Research 36(May):223238.