Professional Documents

Culture Documents

Fixed Assets Current Assets Fixed Assets Current Assets

Fixed Assets Current Assets Fixed Assets Current Assets

Uploaded by

maxribeiro@yahoo.comOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fixed Assets Current Assets Fixed Assets Current Assets

Fixed Assets Current Assets Fixed Assets Current Assets

Uploaded by

maxribeiro@yahoo.comCopyright:

Available Formats

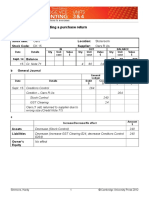

T.

Waterman

Trading and Profit and Loss Account for the year ended February 29, 2016

Opening Stock

16 430 Sales

127 340

Purchases

79 290

95 720

Closing Stock

(14 850)

Cost of Goods Sold

80 870

Gross Profit c/d

46 470

127 340

127 340

Expenses

16 795 Gross Profit b/d

46 470

Net Profit

29 675

46 470

46 470

Fixed Assets

Current Assets

Stock

Debtors

Bank

Cash

T. Waterman

Balance Sheet as at February 29, 2016

$

$

$

53 220 Capital

Net Profit

14 850

7 310

Drawings

9 521

1 243 32 924 Liabilities

Creditors

8 256

Bank Loan

13 456

86 144

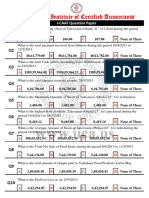

On the worksheet provided calculate the following:

a. Average Stock

b. Stock Turnover Ratio

c. Gross Profit as a percentage of Cost

d. Gross Profit as a percentage of Sales

e. Net profit as a percentage of Sales

f. Expenses as a percentage of Sales

g. Current Ratio

h. Working capital

i. Acid test ratio

j. Rate of Return on Capital

$

44 757

29 675

74 432

(10 000)

64 432

21 712

86 144

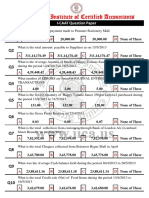

T. Waterman

Trading and Profit and Loss Account for the year ended February 29, 2016

Opening Stock

16 430 Sales

127 340

Purchases

79 290

95 720

Closing Stock

(14 850)

Cost of Goods Sold

80 870

Gross Profit c/d

46 470

127 340

127 340

Expenses

16 795 Gross Profit b/d

46 470

Net Profit

29 675

46 470

46 470

Fixed Assets

Current Assets

Stock

Debtors

Bank

Cash

T. Waterman

Balance Sheet as at February 29, 2016

$

$

$

53 220 Capital

Net Profit

14 850

7 310

Drawings

9 521

1 243 32 924 Liabilities

Creditors

8 256

Bank Loan

13 456

86 144

On the worksheet provided calculate the following:

a. Average Stock

b. Stock Turnover Ratio

c. Gross Profit as a percentage of Cost

d. Gross Profit as a percentage of Sales

e. Net profit as a percentage of Sales

f. Expenses as a percentage of Sales

g. Current Ratio

h. Working capital

i. Acid test ratio

j. Rate of Return on Capital

$

44 757

29 675

74 432

(10 000)

64 432

21 712

86 144

You might also like

- Moelis Valuation AnalysisDocument27 pagesMoelis Valuation AnalysispriyanshuNo ratings yet

- 101 Finals Departmental-JenDocument8 pages101 Finals Departmental-Jenmarie patianNo ratings yet

- Unit Rates Build UpDocument6 pagesUnit Rates Build UpBernard KagumeNo ratings yet

- TMT Steel Bar IndustryDocument68 pagesTMT Steel Bar IndustryRohitMishraNo ratings yet

- Rahul Sharma Leads 2may2022Document6 pagesRahul Sharma Leads 2may2022sharmarahulhemantNo ratings yet

- Cover Title - Cover 1 Optimise Equipment and Plant EfficiencyDocument24 pagesCover Title - Cover 1 Optimise Equipment and Plant EfficiencyAjanta BearingNo ratings yet

- Sales 204,490: Opening Inventory PurchasesDocument15 pagesSales 204,490: Opening Inventory PurchasesvickyleNo ratings yet

- Homework For Next ClassDocument3 pagesHomework For Next ClassSimo El Kettani20% (5)

- Assignment FSADocument5 pagesAssignment FSAgeo023No ratings yet

- Aau ModelDocument34 pagesAau ModelTayech TayuNo ratings yet

- QN 1 - Final Accounts: One ApproachDocument42 pagesQN 1 - Final Accounts: One ApproachAbhijeet PatilNo ratings yet

- Q Part 876Document10 pagesQ Part 876Mansoor AliNo ratings yet

- Spreadsheet TutorialDocument7 pagesSpreadsheet TutorialabhishekNo ratings yet

- Q Part 23Document10 pagesQ Part 23kajkargroupNo ratings yet

- Pre Midterm ActivityDocument3 pagesPre Midterm ActivityCarlo PerezNo ratings yet

- Financial Accounti ng1: Transactions For The Month of January of A Small Finishing RetailerDocument16 pagesFinancial Accounti ng1: Transactions For The Month of January of A Small Finishing RetailerYassin ElsafiNo ratings yet

- Q Part 701Document10 pagesQ Part 701Mansoor AliNo ratings yet

- Basic Accounting 1-10Document2 pagesBasic Accounting 1-10RicardoRichardsNo ratings yet

- Q Part 181Document10 pagesQ Part 181kajkargroupNo ratings yet

- Q Part 201Document10 pagesQ Part 201Mansoor AliNo ratings yet

- Q Part 528Document10 pagesQ Part 528Mansoor AliNo ratings yet

- Q Part 843Document10 pagesQ Part 843Mansoor AliNo ratings yet

- Q Part 904Document10 pagesQ Part 904Mansoor AliNo ratings yet

- Q Part 740Document10 pagesQ Part 740Mansoor AliNo ratings yet

- Q Part 259Document10 pagesQ Part 259kajkargroupNo ratings yet

- Acca Paper F3 / Fia Ffa Financial Accounting: May 2014 For Marking)Document11 pagesAcca Paper F3 / Fia Ffa Financial Accounting: May 2014 For Marking)bingbongmyloveNo ratings yet

- Ratio ExampleDocument1 pageRatio ExampleAshwin SoniNo ratings yet

- 1101AFE Final Exam Practice Paper SEM 1Document10 pages1101AFE Final Exam Practice Paper SEM 1张兆宇No ratings yet

- A Level Accounting Papers Nov2010Document145 pagesA Level Accounting Papers Nov2010frieda20093835No ratings yet

- Q Part 770Document10 pagesQ Part 770Mansoor AliNo ratings yet

- Q Part 177Document10 pagesQ Part 177Mansoor AliNo ratings yet

- Q Part 329Document10 pagesQ Part 329Mansoor AliNo ratings yet

- Sources of Funds: Balance Sheet of Essar OilDocument16 pagesSources of Funds: Balance Sheet of Essar OilAkshay HosabettuNo ratings yet

- Q Part 46Document10 pagesQ Part 46kajkargroupNo ratings yet

- Q Part 21Document10 pagesQ Part 21Mansoor AliNo ratings yet

- Acc34 Ch13ExerciseSolutionsDocument17 pagesAcc34 Ch13ExerciseSolutionsAnonymous HSWUQRbNo ratings yet

- Q Part 258Document10 pagesQ Part 258Mansoor AliNo ratings yet

- International Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified AccountantsDocument10 pagesInternational Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified AccountantsMansoor AliNo ratings yet

- Q Part 857Document10 pagesQ Part 857Mansoor AliNo ratings yet

- International Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified AccountantsDocument10 pagesInternational Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified AccountantsMansoor AliNo ratings yet

- Accounting 3000 Hw#4Document38 pagesAccounting 3000 Hw#4super pigNo ratings yet

- Q Part 152Document10 pagesQ Part 152Mansoor AliNo ratings yet

- Ex9 (Data Tables2)Document4 pagesEx9 (Data Tables2)Mohammed ZubairNo ratings yet

- Q Part 128Document10 pagesQ Part 128Mansoor AliNo ratings yet

- Q Part 301Document10 pagesQ Part 301Mansoor AliNo ratings yet

- Q Part 989Document10 pagesQ Part 989Mansoor AliNo ratings yet

- Q Part 19Document10 pagesQ Part 19kajkargroupNo ratings yet

- Acc 566Document18 pagesAcc 566Happy MountainsNo ratings yet

- Q Part 898Document10 pagesQ Part 898Mansoor AliNo ratings yet

- Q Part 996Document10 pagesQ Part 996Mansoor AliNo ratings yet

- Q Part 20Document10 pagesQ Part 20kajkargroupNo ratings yet

- Q Part 992Document10 pagesQ Part 992Mansoor AliNo ratings yet

- Q Part 203Document10 pagesQ Part 203Mansoor AliNo ratings yet

- Q Part 17Document10 pagesQ Part 17kajkargroupNo ratings yet

- 7110 w10 QP 01Document12 pages7110 w10 QP 01iisjafferNo ratings yet

- Q Part 330Document10 pagesQ Part 330Mansoor AliNo ratings yet

- Marking Scheme: Section ADocument8 pagesMarking Scheme: Section Aaegean123No ratings yet

- Q Part 175Document10 pagesQ Part 175Mansoor AliNo ratings yet

- Q Part 272Document10 pagesQ Part 272kajkargroupNo ratings yet

- Q Part 96Document10 pagesQ Part 96Mansoor AliNo ratings yet

- International Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified AccountantsDocument10 pagesInternational Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified Accountants International Institute of Certified AccountantsMansoor AliNo ratings yet

- Preweek Drill2Document7 pagesPreweek Drill2Grave KnightNo ratings yet

- Q Part 639Document10 pagesQ Part 639Mansoor AliNo ratings yet

- Q Part 998Document10 pagesQ Part 998Mansoor AliNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Stock Valuation: There Was No Opening Stock-In-HandDocument3 pagesStock Valuation: There Was No Opening Stock-In-Handmaxribeiro@yahoo.comNo ratings yet

- Name of Business Profit and Loss Appropriation Account For The Period Ended (Date)Document2 pagesName of Business Profit and Loss Appropriation Account For The Period Ended (Date)maxribeiro@yahoo.comNo ratings yet

- STock Valuation MCQDocument1 pageSTock Valuation MCQmaxribeiro@yahoo.comNo ratings yet

- Delicious Desserts AdjustmentsDocument1 pageDelicious Desserts Adjustmentsmaxribeiro@yahoo.comNo ratings yet

- Date Purchases Sales Balance: Très Magnifique Stock Form (FIFO Method)Document3 pagesDate Purchases Sales Balance: Très Magnifique Stock Form (FIFO Method)maxribeiro@yahoo.comNo ratings yet

- Date Transaction Value: $ Fifo Lifo AvcoDocument4 pagesDate Transaction Value: $ Fifo Lifo Avcomaxribeiro@yahoo.comNo ratings yet

- Trini To The BoneDocument1 pageTrini To The Bonemaxribeiro@yahoo.comNo ratings yet

- Photosynthesis: "Putting Together With Light,"Document1 pagePhotosynthesis: "Putting Together With Light,"maxribeiro@yahoo.comNo ratings yet

- Government Assistance To BusinessDocument2 pagesGovernment Assistance To Businessmaxribeiro@yahoo.comNo ratings yet

- Direct Taxes: DefinitionsDocument2 pagesDirect Taxes: Definitionsmaxribeiro@yahoo.comNo ratings yet

- Explanation of ProductionDocument4 pagesExplanation of Productionmaxribeiro@yahoo.comNo ratings yet

- Green Marketing - Emerging Dimensions: Sandeep Tiwari, Durgesh Mani Tripathi, Upasana Srivastava, Yadav P.K.Document6 pagesGreen Marketing - Emerging Dimensions: Sandeep Tiwari, Durgesh Mani Tripathi, Upasana Srivastava, Yadav P.K.Noob ab AbNo ratings yet

- Topic 4 - Workshop Activities 2021Document6 pagesTopic 4 - Workshop Activities 2021Shiv SookunNo ratings yet

- 1120 UN Avenue Barangay 661 Ermita, City of Manila, NCR, Philippines, 1000Document31 pages1120 UN Avenue Barangay 661 Ermita, City of Manila, NCR, Philippines, 1000Nigel GarciaNo ratings yet

- Reviewer in OMGTDocument11 pagesReviewer in OMGTana delacruzNo ratings yet

- Trade Based Money Laundering, Compliance and Related Risks: Mr. Salim ThobaniDocument2 pagesTrade Based Money Laundering, Compliance and Related Risks: Mr. Salim ThobaniMuhammad shazibNo ratings yet

- HDFC Bank - Research Insight 3Document7 pagesHDFC Bank - Research Insight 3Sancheet BhanushaliNo ratings yet

- Financial Disclosure Report - Ryan ZinkeDocument4 pagesFinancial Disclosure Report - Ryan ZinkeNBC MontanaNo ratings yet

- Report-1 Cwted Project: Stall Name: - TeavolutionDocument14 pagesReport-1 Cwted Project: Stall Name: - TeavolutionAshley CorreaNo ratings yet

- Case Study Analysis: BAL's Current Procurement Processes Student's Name: Course: Instructor: DateDocument12 pagesCase Study Analysis: BAL's Current Procurement Processes Student's Name: Course: Instructor: DateMauricio QuijanoNo ratings yet

- ABLE Contract - Godrej Project (Attachment)Document5 pagesABLE Contract - Godrej Project (Attachment)Ferris FerrisNo ratings yet

- Cruz - Case StudiesDocument18 pagesCruz - Case StudiesKyco CruzNo ratings yet

- Positioning Services in Competitive MarketsDocument76 pagesPositioning Services in Competitive MarketsFarda AmaliaNo ratings yet

- Faculty of Management Studies: End Sem (Odd) Examination Dec-2019 MS5OE01 Mutual Fund ManagementDocument3 pagesFaculty of Management Studies: End Sem (Odd) Examination Dec-2019 MS5OE01 Mutual Fund ManagementMohit kumar sahuNo ratings yet

- Ivy Trading PlanDocument4 pagesIvy Trading PlanVincentius KrigeNo ratings yet

- International Production: A Decade of Transformation AheadDocument60 pagesInternational Production: A Decade of Transformation AheadSunil ChoudhuryNo ratings yet

- Reliance Share PriceDocument9 pagesReliance Share PriceGumansinh RajputNo ratings yet

- Home Loan AllDocument3 pagesHome Loan Allsumanpal78No ratings yet

- Tutorial 3 Solutions - ERPsDocument2 pagesTutorial 3 Solutions - ERPsKhathutshelo KharivheNo ratings yet

- GMATDocument220 pagesGMATElites ChoraleNo ratings yet

- Business Studies Project - AAYUSHDocument11 pagesBusiness Studies Project - AAYUSHabarajitha sureshkumarNo ratings yet

- Studyguide360: Chapter - 09 Civics A Shirt in The MarketDocument1 pageStudyguide360: Chapter - 09 Civics A Shirt in The MarketYashNo ratings yet

- Sbfedbookselfie 5725 (1) UnlockedDocument17 pagesSbfedbookselfie 5725 (1) Unlockedbindu mathaiNo ratings yet

- Money Management CycleDocument25 pagesMoney Management CycleabieNo ratings yet

- Chapter 5 - Accounting EquationDocument17 pagesChapter 5 - Accounting EquationRiya AggarwalNo ratings yet

- Consumer Satisfaction Survey Courier 2019Document42 pagesConsumer Satisfaction Survey Courier 2019Trang BeeNo ratings yet