Professional Documents

Culture Documents

The Dna of Real Estate 2016 q1

Uploaded by

ZoltanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Dna of Real Estate 2016 q1

Uploaded by

ZoltanCopyright:

Available Formats

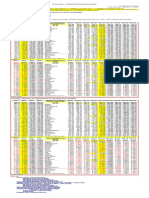

EUROPE

THE DNA OF REAL ESTATE

First Quarter | 2016

MARKET INDICATORS

Office Rental Growth (year-on-year)

REGION

Q1

2014

Q1

2015

Q1

2016

All Countries

0.9%

-0.4%

-0.6%

Western Europe

1.2%

1.9%

2.9%

EU Countries

1.2%

1.8%

3.0%

EMU Countries

0.8%

0.8%

2.6%

Eastern Europe

-0.3%

-9.1%

-13.8%

Central Europe

-0.3%

-0.9%

0.5%

SHORT

TERM

OUTLOOK

West

EU

EMU

10%

5%

East

CEE

40%

20%

0%

0%

-5%

-10%

60%

-20%

Mar06

Mar08

Mar10

Mar12

Mar14

Mar16

-40%

Mar- Mar- Mar- Mar- Mar- Mar06

08

10

12

14

16

High Street Retail Rental Growth (year-on-year)

REGION

Q1

2014

Q1

2015

Q1

2016

All Countries

1.7%

0.0%

1.2%

Western Europe

1.5%

3.2%

3.9%

EU Countries

1.4%

2.9%

4.0%

EMU Countries

1.2%

2.8%

3.0%

Eastern Europe

2.4%

-12.3%

-9.3%

Central Europe

1.3%

-0.7%

3.3%

SHORT

TERM

OUTLOOK

West

EU

EMU

15%

10%

East

CEE

40%

20%

5%

0%

0%

-5%

60%

-20%

Mar06

Mar08

Mar10

Mar12

Mar14

Mar16

-40%

Mar- Mar- Mar- Mar- Mar- Mar06

08

10

12

14

16

Logistics Rental Growth (year-on-year)

REGION

All Countries

Q1

2014

Q1

2015

Q1

2016

-0.4%

-3.7%

-0.8%

0%

-2%

Western Europe

-0.2%

1.0%

1.6%

EU Countries

-0.2%

0.9%

1.6%

EMU Countries

-0.4%

0.7%

1.5%

Eastern Europe

-1.4%

-21.2%

-10.2%

Central Europe

-1.6%

-0.4%

-1.1%

SHORT

TERM

OUTLOOK

West

EU

EMU

4%

2%

East

CEE

10%

0%

-10%

-4%

-20%

-6%

-8%

20%

Mar06

Mar08

Mar10

Mar12

Mar14

Mar16

-30%

Mar- Mar- Mar- Mar- Mar- Mar06

08

10

12

14

16

All sector Yield Aggregates and 10yr movements

REGION

Q1

2014

Q1

2015

Q1

2016

SHORT

TERM

OUTLOOK

All Countries

6.48%

6.31%

5.94%

9.00%

Western Europe

5.82%

5.45%

5.05%

7.00%

EU Countries

6.04%

5.67%

5.25%

5.00%

EMU Countries

6.04%

5.68%

5.24%

Eastern Europe

9.24%

9.74%

9.52%

Central Europe

7.54%

7.30%

6.78%

13.00%

10 yr yield range

Current yield level

11.00%

3.00%

OFFRET IND OFFRET IND OFFRET IND OFFRET IND OFFRET IND OFFRET IND

ALL

WEST

EAST

CEE

EU

Notes:

Western Europe countries: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, The Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom

Eastern Europe countries: Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Macedonia, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Turkey, Ukraine

Central Europe countries: Czech Republic, Hungary, Poland, Slovakia

EU countries: corresponds to the members of the European Union

EMU countries: corresponds to the members of the euro zone

Source: Cushman & Wakefield

EMU

KEY EUROPEAN OFFICE LOCATIONS IN FOCUS

Prime rents

COUNTRY

CITY

RENT

FREQUENCY

LOCAL

MEASURE

SQ.M/YR

Austria

Vienna

sq.m/mth

24.75

Belgium

Brussels

sq.m/yr

275

Bulgaria

Sofia

sq.m/mth

13.00

156

Czech Republic

Prague

sq.m/mth

20.00

240

Denmark

Copenhagen

sq.m/yr

Dkr1,850

248

Estonia

Tallinn

sq.m/mth

15.50

186

Finland

Helsinki

sq.m/mth

34.00

408

France

Paris*

sq.m/yr

775

775

Germany

Berlin

sq.m/mth

24.00

288

Germany

Frankfurt

sq.m/mth

37.00

Germany

Hamburg

sq.m/mth

24.50

Germany

Munich

sq.m/mth

Germany

Dusseldorf

sq.m/mth

Greece

Athens

Hungary

Budapest

Ireland

Dublin

Italy

Italy

Prime Yields

US$

SQ.FT/YR

Y/Y

GROWTH

297

$30.6

275

$28.3

$16.0

SHORT

TERM

OUTLOOK

CURRENT

VALUES

Q/Q

SHIFT

Y/Y

SHIFT

-2.0%

4.10%

-20 bp

-60 bp

1.9%

5.70%

0 bp

-25 bp

4.0%

8.50%

0 bp

-50 bp

$24.7

2.6%

5.50%

-25 bp

-50 bp

$25.5

2.8%

4.25%

0 bp

-75 bp

$19.1

3.3%

7.00%

0 bp

-50 bp

$42.0

2.3%

4.40%

0 bp

-20 bp

$79.7

3.3%

3.25%

0 bp

-50 bp

$29.6

6.7%

4.00%

-10 bp

-50 bp

444

$45.7

0.0%

4.35%

0 bp

-15 bp

294

$30.2

2.1%

4.00%

-15 bp

-25 bp

33.50

402

$41.4

0.0%

3.70%

0 bp

-15 bp

26.00

312

$32.1

0.0%

4.35%

0 bp

-25 bp

sq.m/mth

17.00

204

$21.0

-10.5%

8.20%

-10 bp

-10 bp

sq.m/mth

21.00

252

$25.9

0.0%

7.00%

0 bp

-25 bp

sq.m/yr

592

592

$60.9

12.0%

4.25%

0 bp

0 bp

Rome

sq.m/yr

400

400

$41.2

-2.4%

4.50%

-25 bp

-50 bp

Milan

sq.m/yr

490

490

$50.4

3.2%

4.25%

-25 bp

-50 bp

Latvia

Riga

sq.m/mth

16.00

192

$19.8

3.2%

7.00%

0 bp

0 bp

Lithuania

Vilnius

sq.m/mth

15.00

180

$18.5

3.6%

7.00%

0 bp

-50 bp

Luxembourg

Luxembourg City*

sq.m/mth

45.00

540

$55.6

0.0%

5.00%

-10 bp

-20 bp

Macedonia

Skopje

sq.m/mth

14.00

168

$17.3

0.0%

9.75%

50 bp

50 bp

The Netherlands

Amsterdam

sq.m/yr

370

370

$38.1

0.0%

5.00%

-50 bp

-100 bp

Norway

Oslo

sq.m/yr

Nkr3,800

378

$38.9

-5.0%

4.00%

-30 bp

-50 bp

Poland

Warsaw

sq.m/mth

24.00

288

$29.6

-4.0%

5.75%

0 bp

-50 bp

Portugal

Lisbon

sq.m/mth

18.00

216

$22.2

-2.7%

5.25%

0 bp

-75 bp

Romania

Bucharest

sq.m/mth

18.50

222

$22.8

0.0%

7.50%

0 bp

-25 bp

Russia

Moscow

sq.m/yr

$750

677

$69.7

-25.0%

10.50%

0 bp

-50 bp

Slovakia

Bratislava

sq.m/mth

15.50

186

$19.1

3.3%

7.00%

0 bp

-25 bp

Spain

Madrid

sq.m/mth

28.50

342

$35.2

9.6%

4.00%

0 bp

-75 bp

Spain

Barcelona

sq.m/mth

20.50

246

$25.3

13.9%

4.25%

-25 bp

-75 bp

Sweden

Stockholm

sq.m/yr

Skr5,700

619

$63.7

10.7%

3.80%

0 bp

-45 bp

Switzerland

Zurich

sq.m/yr

Sfr750

675

$69.4

0.0%

3.70%

0 bp

-10 bp

Switzerland

Geneva

sq.m/yr

Sfr800

720

$74.1

0.0%

4.00%

0 bp

-25 bp

Turkey

Istanbul

sq.m/mth

$45.00

488

$50.2

0.0%

6.80%

0 bp

0 bp

Ukraine

Kyiv

sq.m/mth

$25.00

271

$27.9

-13.8%

13.50%

0 bp

0 bp

United Kingdom

London

sq.ft/yr

125.00

1,809

$186.1

4.2%

3.25%

0 bp

-25 bp

United Kingdom

Manchester

sq.ft/yr

32.50

470

$48.4

1.6%

5.00%

0 bp

0 bp

United Kingdom

Birmingham

sq.ft/yr

32.00

463

$47.6

6.7%

5.00%

0 bp

-25 bp

United Kingdom

Edinburgh

sq.ft/yr

32.50

470

$48.4

8.3%

5.25%

0 bp

0 bp

United Kingdom

Glasgow

sq.ft/yr

29.50

427

$43.9

0.0%

5.50%

0 bp

0 bp

NOTES:

Yields marked in red are calculated on a net basis to include transfer costs, tax and legal fees.

To convert local rents to euros, exchange rates applicable at the last day of the quarter are used.

(*) marked data reflect legacy Cushman & Wakefield information.

Source: Cushman & Wakefield

SHORT

TERM

OUTLOOK

KEY EUROPEAN HIGH STREET LOCATIONS IN FOCUS

Prime rents

COUNTRY

CITY

RENT

FREQUENCY

Austria

Vienna

Belgium

Brussels

Bulgaria

Prime Yields

LOCAL

MEASURE

SQ.M/YR

US$

SQ.FT/YR

Y/Y

GROWTH

sq.m/mth

300

3,600

$370

sq.m/yr

1,850

1,850

$190

Sofia

sq.m/mth

46

552

$56.8

Czech Republic

Prague

sq.m/mth

200

2,400

Denmark

Copenhagen

sq.m/yr

Dkr18,250

2,450

Estonia

Tallinn

sq.m/mth

32

384

Finland

Helsinki

sq.m/mth

130

1,560

France

Paris*

sq.m/yr

18,000

13,255

Germany

Berlin

sq.m/mth

305

3,660

Germany

Frankfurt

sq.m/mth

315

Germany

Hamburg

sq.m/mth

310

Germany

Munich

sq.m/mth

Germany

Dusseldorf

sq.m/mth

Greece

Athens

sq.m/mth

Hungary

Budapest

sq.m/mth

Ireland

Dublin

sq.m/yr

Italy

Rome

sq.m/yr

Italy

Milan

sq.m/yr

Latvia

Riga

Lithuania

Vilnius

Luxembourg

Macedonia

The Netherlands

Amsterdam

Norway

Oslo

Poland

Warsaw

Portugal

Lisbon

Romania

Bucharest

Russia

Moscow

Slovakia

Bratislava

Spain

Madrid

sq.m/mth

255

3,060

Spain

Barcelona

sq.m/mth

275

3,300

Sweden

Stockholm

sq.m/yr

Skr14,900

1,613

Switzerland

Zurich

sq.m/yr

Sfr9,000

8,247

Switzerland

Geneva

sq.m/yr

Sfr4,000

Turkey

Istanbul

sq.m/mth

Ukraine

Kyiv

sq.m/yr

SHORT

TERM

OUTLOOK

CURRENT

VALUES

Q/Q

SHIFT

Y/Y

SHIFT

0.0%

3.50%

-25 bp

-60 bp

5.7%

3.60%

-15 bp

-55 bp

4.5%

8.50%

0 bp

-25 bp

$247

8.1%

4.25%

-50 bp

-65 bp

$252

2.8%

3.50%

-10 bp

-50 bp

$40

14.3%

7.00%

0 bp

0 bp

$160

0.0%

4.50%

0 bp

-25 bp

$1,364

0.0%

2.75%

-25 bp

-50 bp

$377

1.7%

3.80%

0 bp

-30 bp

3,780

$389

0.0%

3.80%

0 bp

-20 bp

3,720

$383

0.0%

3.80%

0 bp

-30 bp

370

4,440

$457

0.0%

3.30%

0 bp

-20 bp

280

3,360

$346

1.8%

3.90%

0 bp

-20 bp

195

2,340

$241

8.3%

6.90%

-10 bp

-10 bp

100

1,200

$123

5.3%

6.25%

-25 bp

-50 bp

5,750

3,232

$332

27.8%

4.00%

0 bp

-75 bp

11,000

11,000

$1,132

15.8%

3.25%

0 bp

-75 bp

12,000

12,000

$1,235

20.0%

3.25%

0 bp

-75 bp

sq.m/mth

40

480

$49

0.0%

6.75%

0 bp

0 bp

sq.m/mth

40

480

$49

0.0%

7.00%

0 bp

-25 bp

Luxembourg City*

sq.m/mth

210

2,520

$259

13.5%

4.20%

-10 bp

-40 bp

Skopje

sq.m/mth

30

360

$37

0.0%

9.50%

25 bp

25 bp

sq.m/yr

3,000

3,000

$309

3.4%

4.00%

-10 bp

-10 bp

sq.m/yr

Nkr27,000

2,865

$295

8.0%

4.25%

0 bp

-25 bp

sq.m/mth

90

1,080

$111

5.9%

5.50%

-25 bp

-100 bp

sq.m/mth

98

1,170

$120

2.6%

5.00%

0 bp

-75 bp

sq.m/mth

45

540

$55.6

0.0%

8.00%

0 bp

-75 bp

sq.m/yr

$3,800

3,335

$343

-17.4%

12.50%

0 bp

0 bp

sq.m/mth

44

528

$54.3

10.0%

7.50%

0 bp

0 bp

$315

4.1%

3.75%

0 bp

-50 bp

$340

1.9%

3.75%

0 bp

-50 bp

$166

0.0%

3.90%

0 bp

-35 bp

$848

0.0%

3.20%

0 bp

-30 bp

3,665

$377

0.0%

4.25%

0 bp

0 bp

$275

2,896

$298

-1.8%

5.80%

0 bp

0 bp

$40

421

$43

-33.3%

10.00%

0 bp

0 bp

United Kingdom

London

sq.ft/yr

1,500

12,220

$1,257

15.4%

2.25%

0 bp

-25 bp

United Kingdom

Manchester

sq.ft/yr

275

1,904

$196

5.8%

4.25%

-25 bp

-100 bp

United Kingdom

Birmingham

sq.ft/yr

190

1,316

$135

2.7%

4.75%

0 bp

-75 bp

United Kingdom

Edinburgh

sq.ft/yr

215

2,007

$206

7.5%

4.75%

0 bp

-25 bp

United Kingdom

Glasgow

sq.ft/yr

280

2,614

$269

7.7%

4.50%

0 bp

-25 bp

NOTES:

Rents in France, Ireland and the UK relate to Zone A.

To convert local rents to euros, exchange rates applicable at the last day of the quarter are used.

Yields marked in red are calculated on a net basis to include transfer costs, tax and legal fees.

(*) marked data reflect legacy Cushman & Wakefield information.

Source: Cushman & Wakefield

SHORT

TERM

OUTLOOK

KEY EUROPEAN LOGISTICS LOCATIONS IN FOCUS

Prime rents

COUNTRY

CITY

RENT

FREQUENCY

LOCAL

MEASURE

Q/Q

SHIFT

Y/Y

SHIFT

Austria

Vienna

sq.m/mth

4.75

57

$5.86

Belgium

Brussels

sq.m/yr

58

58

$5.97

0.0%

6.50%

-40 bp

-75 bp

5.5%

6.80%

-10 bp

-20 bp

Bulgaria

Sofia

sq.m/mth

3.80

46

$4.69

1.3%

10.50%

-25 bp

-75 bp

Czech Republic

Prague

sq.m/mth

3.85

46

Denmark

Copenhagen

sq.m/yr

Dkr550

74

$4.75

0.0%

6.75%

0 bp

-25 bp

$7.59

10.0%

7.25%

-25 bp

-25 bp

Estonia

Tallinn

sq.m/mth

4.50

54

Finland

Helsinki

sq.m/mth

9.50

114

$5.56

0.0%

8.00%

-50 bp

-100 bp

$11.73

0.0%

6.50%

0 bp

-25 bp

France

Paris*

sq.m/yr

55

55

Germany

Berlin

sq.m/mth

4.70

56

$5.66

1.9%

5.80%

-20 bp

-95 bp

$5.80

0.0%

5.75%

0 bp

-100 bp

Germany

Frankfurt

sq.m/mth

6.00

Germany

Hamburg

sq.m/mth

5.40

72

$7.41

0.0%

5.65%

0 bp

-65 bp

65

$6.67

0.0%

5.70%

0 bp

-80 bp

Germany

Munich

sq.m/mth

Germany

Dusseldorf

sq.m/mth

6.50

78

$8.02

4.0%

5.50%

-10 bp

-85 bp

5.40

65

$6.67

0.0%

5.65%

0 bp

-70 bp

Greece

Athens

sq.m/mth

4.00

48

$4.94

0.0%

11.70%

-30 bp

70 bp

Hungary

Budapest

Ireland

Dublin

sq.m/mth

3.50

42

$4.32

0.0%

8.50%

0 bp

-50 bp

sq.m/yr

81

81

$8.33

15.7%

5.75%

0 bp

-75 bp

Italy

Italy

Rome

sq.m/yr

53

53

$5.45

-3.6%

7.75%

0 bp

-25 bp

Milan

sq.m/yr

51

51

$5.25

0.0%

7.00%

0 bp

-50 bp

Latvia

Riga

sq.m/mth

4.50

54

$5.56

0.0%

8.60%

0 bp

-65 bp

Lithuania

Vilnius

sq.m/mth

4.50

54

$5.56

-10.0%

8.50%

0 bp

0 bp

Luxembourg

Luxembourg City*

sq.m/mth

8.00

96

$9.88

0.0%

8.00%

0 bp

0 bp

Macedonia

Skopje

sq.m/mth

2.50

30

$3.09

0.0%

13.00%

0 bp

0 bp

The Netherlands

Amsterdam

sq.m/yr

88

88

$9.05

0.0%

6.30%

-20 bp

-45 bp

Norway

Oslo

sq.m/yr

Nkr1,125

112

$11.52

2.3%

6.00%

0 bp

-25 bp

Poland

Warsaw

sq.m/mth

5.40

65

$6.67

-1.8%

7.00%

0 bp

-50 bp

Portugal

Lisbon

sq.m/mth

3.50

42

$4.32

0.0%

7.00%

0 bp

-50 bp

Romania

Bucharest

sq.m/mth

3.90

47

$4.81

0.0%

9.00%

0 bp

-75 bp

Russia

Moscow

sq.m/yr

Rub4,000

54

$5.56

-20.2%

12.75%

0 bp

-25 bp

Slovakia

Bratislava

sq.m/mth

3.60

43

$4.44

0.0%

7.75%

0 bp

-75 bp

Spain

Madrid

sq.m/mth

5.25

63

$6.48

5.0%

7.00%

0 bp

0 bp

Spain

Barcelona

sq.m/mth

5.50

66

$6.79

10.0%

7.00%

0 bp

-25 bp

Sweden

Stockholm

sq.m/yr

Skr1,050

114

$11.73

0.0%

6.15%

0 bp

-10 bp

Switzerland

Zurich

sq.m/yr

Sfr140

126

$12.96

-3.4%

5.70%

10 bp

10 bp

Switzerland

Geneva

sq.m/yr

Sfr180

162

$16.67

0.0%

6.00%

0 bp

0 bp

Turkey

Istanbul

sq.m/mth

$7.00

76

$7.80

0.0%

8.75%

0 bp

-25 bp

Ukraine

Kyiv

sq.m/yr

$3.10

34

$3.46

-31.1%

15.00%

0 bp

0 bp

United Kingdom

London

sq.ft/yr

14.00

203

$20.85

7.7%

4.25%

0 bp

-50 bp

United Kingdom

Manchester

sq.ft/yr

6.00

87

$8.93

4.3%

5.25%

0 bp

-25 bp

United Kingdom

Birmingham

sq.ft/yr

6.50

94

$9.68

8.3%

5.25%

0 bp

-25 bp

United Kingdom

Edinburgh

sq.ft/yr

7.50

109

$11.17

3.4%

6.00%

0 bp

0 bp

United Kingdom

Glasgow

sq.ft/yr

6.25

90

$9.31

0.0%

7.00%

0 bp

0 bp

(*) marked data reflect legacy Cushman & Wakefield information.

Source: Cushman & Wakefield

US$

SQ.FT/YR

Prime Yields

CURRENT

VALUES

NOTES:

Yields marked in red are calculated on a net basis to include transfer costs, tax and legal fees.

To convert local rents to euros, exchange rates applicable at the last day of the quarter are used.

SQ.M/YR

Y/Y

GROWTH

SHORT

TERM

OUTLOOK

SHORT

TERM

OUTLOOK

TOP GROW TH MARKETS IN Q1 2016

Offices

Rental Growth

Yield Compression

Skopje (Inner City)

Capital Value Growth

Amsterdam (Southaxis)

Brno

Sofia (Non-CBD)

Prague (Outer City)

Amsterdam (Southaxis)

Lisbon (Western Corridor)

Rotterdam (Region)

Barcelona (Centre (CBD))

Brno

Leuven

Birmingham

Ghent

Aarhus (Aarhus)

Leipzig (Decentralised)

Sofia (Non-CBD)

St Helier (Seaton Place &

Copenhagen (South&West)

Lisbon (Western Corridor)

Luxembourg City (Kirchberg)

Limassol (CBD)

Paris (Centre East)

Dresden (Decentralised)

Copenhagen (Frederiksberg)

London (City Core)

Oslo (CBD)

Luxembourg City (Kirchberg)

Limassol (CBD)

0%

Hamburg (Decentralised)

5%

10%

15%

-75

Q/Q growth

-50

-25

Leuven

0

0%

5%

Basis point change

10%

15%

Q/Q growth

High Street Shops

Rental Growth

Yield Compression

Capital Value Growth

London (Sloane Street)

Rotterdam (Lijnbaan)

Budapest (Andrassy ut)

Budapest (Andrassy ut)

Arnhem (Ketelstraat)

London (Sloane Street)

Odense (Vestergade)

Prague (Na Pkop street )

Rotterdam (Lijnbaan)

Athens (Ermou)

Belfast (Donegal Place)

Prague (Na Pkop street )

Katowice (Stawowa)

Budapest (Andrassy ut)

Katowice (Stawowa)

Glasgow (Buchanan Street)

Maastricht (Grote Staat)

Odense (Vestergade)

Athens (Tsakalof)

Warsaw (Nowy Swiat)

Tallinn (Viru Street)

Warsaw (Nowy Swiat)

Paris (Avenue Montaigne)

Oporto (Baixa (Rua de Santa Catarina))

Palma de Mallorca (Jaime III)

0%

5%

10%

15%

Arnhem (Ketelstraat)

Oslo (Bogstadt St.)

Athens (Ermou)

Aarhus (Sondersarde)

20%

-100

Q/Q growth

-75

-50

-25

Paris (Avenue Montaigne)

0

0%

5%

Basis point change

10%

15%

20%

25%

Q/Q growth

Logistics

Rental Growth

Yield Compression

Capital Value Growth

Thessaloniki

Tallinn

Thessaloniki

Athens

Pilsen

Athens

Dublin

Vienna

Pilsen

Liege

Utrecht

Dublin

Genk

Athens

Liege

Munich

Nijmegen

Genk

Kaunas

Thessaloniki

Tallinn

Klaipeda

Warsaw (Zone II)

Vienna

Bologna

Copenhagen

Munich

Stuttgart

Tilburg

Utrecht

0%

5%

10%

Q/Q growth

15%

20%

-75

-50

-25

0%

5%

Basis point change

NOTES:

The above charts represent the top 10 growth locations of all monitored areas in Europe. If several locations are monitored within a city, the best performing submarket will be represented.

Source: Cushman & Wakefield

10%

15%

Q/Q growth

20%

25%

Our Research Services

Visit our website to access...

Cushman & Wakefield (C&W) is known the world over as an

industry knowledge leader. Through the deliveyr of timely,

accurate, high-quality research reports on the leading trends,

markets around the world and business issues of the day, we

aim to assist our clients in making property decisions that meet

their objectives and enhance their competitive position. IN

addition to producing regular reports such as global rankings

and local quarterly updates available on a regular basis, C&W

also provides customised studies to meet specific information

needs of owners, occupiers and investors.

...Global Research Reports

To learn more about the global trends in the commercial real

estate sectors that are shaping economic development,

business practices and real estate strategies.

...Local Market Reports

To find out about local real estate trends in the office,

industrial and retail sectors in markets around the world

...White Papers and Strategic Insights

For authoritative and insightful commentary and analysis on

the business landscape for commercial property markets

...Economic Reports

To keep you updated on global economic events and

emerging trends that will influence finance, investment,

business and real estate markets

...Cushman & Wakefield global real estate blogs

To hear our point of view on global market trends and how

they are impacting on real estate decision making

Accessing Cushman & Wakefield Research

To access our industry-recognized research, please visit:

cushmanwakefield.com

Joanna Tano

Director

EMEA Research

+44 20 7152 5944

joanna.tano@cushwake.com

Istvn Tth

Senior Research Analyst,

EMEA Research

+36 1 484 1302

istvan.toth@cushwake.com

Disclaimer

This report has been produced by Cushman & Wakefield LLP (C&W) for use by those with an

interest in commercial property solely for information purposes and should not be relied upon as a

basis for entering into transactions without seeking specific, qualified professional advice. It is not

intended to be a complete description of the markets or developments to which it refers. This report

uses information obtained from public sources which C&W has rigorously checked and believes to

be reliable, but C&W has not verified such information and cannot guarantee that it is accurate or

complete. No warranty or representation, express or implied, is made as to the accuracy or

completeness of any of the information contained in this report and C&W shall not be liable to any

reader of this report or any third party in any way whatsoever. All expressions of opinion are subject

to change. The prior written consent of C&W is required before this report or any information

contained in it can be reproduced in whole or in part, and any such reproduction should be

credited to C&W.

For more information, please contact our Research

Department: Cushman & Wakefield LLP

125 Old Broad Street, London EC2N 1AR

To see a full list of all our

publications, please go to

cushmanwakefield.com

or download the My C&W

Research App

www.cushmanwakefield.com

You might also like

- Cushman: DNA of Real Estate 2014 Q2Document5 pagesCushman: DNA of Real Estate 2014 Q2vdmaraNo ratings yet

- Steel 2020Document46 pagesSteel 2020Bích NgọcNo ratings yet

- Newco Case AnalysisDocument48 pagesNewco Case AnalysisAnubhav BigamalNo ratings yet

- Base Data: Risk On ?Document40 pagesBase Data: Risk On ?S.KAMBANNo ratings yet

- Home Loan Vs Rent Calc 1Document38 pagesHome Loan Vs Rent Calc 1Sathish KandasamyNo ratings yet

- Basic Sales ReportDocument5 pagesBasic Sales ReportDedu IonutNo ratings yet

- Top 100 countries by internet population and online revenueDocument4 pagesTop 100 countries by internet population and online revenueanryuu0% (1)

- Code Icd - 10Document162 pagesCode Icd - 10onkie arisandiNo ratings yet

- Europe International Association Meetings 2010-2019Document13 pagesEurope International Association Meetings 2010-2019gaurav englesNo ratings yet

- Lundin CMD Presentation 2011Document60 pagesLundin CMD Presentation 2011Samuel TsuiNo ratings yet

- Web Table 29. The Top 100 Non-Financial Tncs From Developing and Transition Economies, Ranked by Foreign Assets, 2010Document3 pagesWeb Table 29. The Top 100 Non-Financial Tncs From Developing and Transition Economies, Ranked by Foreign Assets, 2010Stas BasiulNo ratings yet

- Global Manufacturing PMI - July 2013Document1 pageGlobal Manufacturing PMI - July 2013Eduardo PetazzeNo ratings yet

- Top 100 non-financial TNCs by foreign assetsDocument1 pageTop 100 non-financial TNCs by foreign assetsIordache G. IulianNo ratings yet

- International Marketing Project On NIODocument32 pagesInternational Marketing Project On NIOOsen GaoNo ratings yet

- ChitDocument9 pagesChitprashanthNo ratings yet

- Numarul de Unitati de Cazare Pentru TuristiDocument14 pagesNumarul de Unitati de Cazare Pentru TuristiIoana Eliza NastasiuNo ratings yet

- Euro Area - Industrial Production IndexDocument1 pageEuro Area - Industrial Production IndexEduardo PetazzeNo ratings yet

- Rizal Ave.Document10 pagesRizal Ave.Inimitable_AnneNo ratings yet

- Economic Data Release Calendar: June 19, 2011 - June 24, 2011Document4 pagesEconomic Data Release Calendar: June 19, 2011 - June 24, 2011Tarek NabilNo ratings yet

- Cotizaciones Retornos Fecha Ecopetrol Eur/Usd TRM Brent Oro Fecha EcopetrolDocument6 pagesCotizaciones Retornos Fecha Ecopetrol Eur/Usd TRM Brent Oro Fecha EcopetrolJessel RodriguezNo ratings yet

- European Union, Trade With QatarDocument12 pagesEuropean Union, Trade With QatarnuraladysNo ratings yet

- All Vehicles 2010 ProvisionalDocument1 pageAll Vehicles 2010 ProvisionalMichael Rafael YumangNo ratings yet

- 6 16072019 Ap enDocument6 pages6 16072019 Ap enValter SilveiraNo ratings yet

- Euro Area International Trade in Goods Surplus 15.7 BN: April 2019Document6 pagesEuro Area International Trade in Goods Surplus 15.7 BN: April 2019Valter SilveiraNo ratings yet

- GDP, Exchange Rates, Unemployment for Switzerland, EU, Germany, France, Italy, UK, US (1980-2011Document7 pagesGDP, Exchange Rates, Unemployment for Switzerland, EU, Germany, France, Italy, UK, US (1980-2011Avinash LoveNo ratings yet

- Gross Domestic Product: at Current PricesDocument3 pagesGross Domestic Product: at Current PricesAlexandru MihalceaNo ratings yet

- Market Analysis IVD ColombiaDocument6 pagesMarket Analysis IVD ColombiaThimo KleinNo ratings yet

- Itv Spot Costs - 2016Document1 pageItv Spot Costs - 2016api-268965515No ratings yet

- 22/2010 - 12 February 2010Document2 pages22/2010 - 12 February 2010Dennik SMENo ratings yet

- Forex Factory 1Document9 pagesForex Factory 1Idon WahidinNo ratings yet

- AnalisisUnivariadoyMultivariado Eje 3 Analisis de DatosDocument8 pagesAnalisisUnivariadoyMultivariado Eje 3 Analisis de DatosjoanaNo ratings yet

- European Union, Trade With ChinaDocument12 pagesEuropean Union, Trade With ChinaYuvrajNo ratings yet

- European Pulp and Paper Industry Key Statistics 2011Document32 pagesEuropean Pulp and Paper Industry Key Statistics 2011Felipe Augusto Diaz SuazaNo ratings yet

- 10 - Paul Nillesen - PWC PDFDocument4 pages10 - Paul Nillesen - PWC PDFSjoerdNo ratings yet

- Management Logistic MurfatlarDocument48 pagesManagement Logistic MurfatlarOana PopaNo ratings yet

- 2 Refuerzo Ampliacion Casa ConoDocument1 page2 Refuerzo Ampliacion Casa ConoJayne WojtasikNo ratings yet

- EU Proposes Binding Climate Targets for Member StatesDocument3 pagesEU Proposes Binding Climate Targets for Member StatesLuís CastroNo ratings yet

- 161/2009 - 13 November 2009Document2 pages161/2009 - 13 November 2009Dennik SMENo ratings yet

- HDP EuDocument2 pagesHDP EuDennik SMENo ratings yet

- Euro Area and EU27 GDP Up by 1.0%Document6 pagesEuro Area and EU27 GDP Up by 1.0%qtipxNo ratings yet

- Scorecard Hotel El VallecitoDocument9 pagesScorecard Hotel El VallecitoJuan JiménezNo ratings yet

- World Motor Vehicle Production by Country and Type: All Vehicles 2014 2015 % ChangeDocument1 pageWorld Motor Vehicle Production by Country and Type: All Vehicles 2014 2015 % ChangeSam9mamaNo ratings yet

- LSEG - Electronic Order Book Trading: June 2016Document2 pagesLSEG - Electronic Order Book Trading: June 2016Rio Ariesta HedityaNo ratings yet

- Thiebaud BaselworldDocument14 pagesThiebaud BaselworldGregory PonsNo ratings yet

- Deficitul Romaniei A Ajuns La 3,2% Din PIB Pe Primul Trimestru Din 2017Document3 pagesDeficitul Romaniei A Ajuns La 3,2% Din PIB Pe Primul Trimestru Din 2017Daniel IonascuNo ratings yet

- EU-Turkey TradeDocument12 pagesEU-Turkey TradeYuvrajNo ratings yet

- Los Hidrocarburos Como Recurso de Poder: Rusia y Sus Relaciones Con Europa OccidentalDocument24 pagesLos Hidrocarburos Como Recurso de Poder: Rusia y Sus Relaciones Con Europa OccidentalppalfonzoNo ratings yet

- EAPA - Asphalt in Figures 2014Document9 pagesEAPA - Asphalt in Figures 2014Xavi Planas WillisNo ratings yet

- Economic Data Release Calendar: June 05, 2011 - June 10, 2011Document5 pagesEconomic Data Release Calendar: June 05, 2011 - June 10, 2011Tarek NabilNo ratings yet

- Date Comisia Europeana AMECO 1Document20 pagesDate Comisia Europeana AMECO 1Dorina BouthNo ratings yet

- EU trade with Turkmenistan overviewDocument12 pagesEU trade with Turkmenistan overviewYuvrajNo ratings yet

- Lispa de PartesDocument12 pagesLispa de PartesEdwing William Salhuana MendozaNo ratings yet

- Framework Loan 2015Document20 pagesFramework Loan 2015Adrian TajmaniNo ratings yet

- Alternative Investment Indices 11-2010Document1 pageAlternative Investment Indices 11-2010j.fred a. voortmanNo ratings yet

- BetaDocument7 pagesBetaMutaz AleidehNo ratings yet

- The European Economy: An OverviewDocument17 pagesThe European Economy: An OverviewChandrashekhara V GNo ratings yet

- Bulgari Group Reports 23.1% Revenue Decline in Q1 2009Document38 pagesBulgari Group Reports 23.1% Revenue Decline in Q1 2009sl7789No ratings yet

- Project Investment Particulars No Per Unit CostDocument28 pagesProject Investment Particulars No Per Unit CostMirza JunaidNo ratings yet

- Estimated Revenues: Year Year 2 Year 3 Operation Programme Currency: EURDocument21 pagesEstimated Revenues: Year Year 2 Year 3 Operation Programme Currency: EURAdrian PetcuNo ratings yet