Professional Documents

Culture Documents

Fin A

Uploaded by

Parth VaswaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin A

Uploaded by

Parth VaswaniCopyright:

Available Formats

1. Working with Uncertainty.

Calculating Returns, Standard Deviations, and

coefficients of variation, based the following information. Compare the riskreturn profiles of A, B and the (Portfolio of A&B), what is the lesson we can

draw from the comparision.

State of

economy

Recession

Normal

Boom

expected

return

Standard

deviation

cov

(stdev /

expected

return)

Probabilit

yof the

state

0.15

0.55

0.3

Rate of Returns

stock A

0.2

0.1

-0.15

stock B

-0.3

0.18

0.31

50% A +

50%B

?

?

?

2. Finding the WACC. Given the following information for Janicek Power Co., find

the WACC. Assume the companys tax rate is 35 percent.

Debt:

o 9,500 of 7 percent coupon bonds outstanding, $1,000 par value, 25

years to maturity, selling for 118 percent of par; the bonds make

semiannual payments.

Common stock:

o 200,000 shares outstanding, selling for $87 per share; beta is 1.25.

o 7 percent market risk premium and 3.1 percent risk-free rate.

Preferred stock:

o 15,000 shares of 4.8 percent preferred stock outstanding, currently

selling for $100 per share.

tax rate

Debt

Stock

Preferred

before

tax

cost

?

?

?

total value

aftertax

cost

?

?

?

mkt

value

?

?

?

wgt %

?

?

?

wacc

debt

?

?

shares

price

value

value

?

?

?

<-- sum of market value for

each component

<-- sum of cost

components

preferr

ed

stock

shares

price

coupon

rate

par

maturity

# of

payment

per year

after-tax

cost * wgt

cost

compone

nts

?

?

?

?

?

?

beta

rm-rf

rf

?

?

?

requir

ed ret

shares

price

?

?

value

div /

price

price

nper

pmt

pv

fv

?

?

?

?

rate

ytm

ytm * # of

payments per year

Yield

?

cost

from

cost of

preferr

CAPM

ed

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Fire Your Over-Priced Financial Advisor and Retire SoonerFrom EverandFire Your Over-Priced Financial Advisor and Retire SoonerRating: 5 out of 5 stars5/5 (1)

- FM11 CH 04 Mini CaseDocument6 pagesFM11 CH 04 Mini CaseAmjad IqbalNo ratings yet

- CFR Sample QuestionsDocument10 pagesCFR Sample Questionsisgigles157No ratings yet

- FIN300 Homework 3Document4 pagesFIN300 Homework 3JohnNo ratings yet

- Cfa L1 R1 OutlineDocument9 pagesCfa L1 R1 OutlineKazi HasanNo ratings yet

- Merrill Finch IncDocument7 pagesMerrill Finch IncAnaRoqueniNo ratings yet

- CH 02 Mini CaseDocument18 pagesCH 02 Mini CaseCuong LeNo ratings yet

- Questions F9 Ipass PDFDocument60 pagesQuestions F9 Ipass PDFAmir ArifNo ratings yet

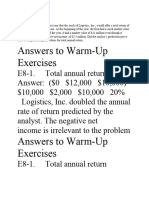

- Warm Up Chapter 8Document5 pagesWarm Up Chapter 8abdulraufdghaybeejNo ratings yet

- Solution For Chapter 15Document9 pagesSolution For Chapter 15Shin Cucu100% (2)

- Finance Homework 3Document5 pagesFinance Homework 3LâmViênNo ratings yet

- Chapter 6assignmentDocument6 pagesChapter 6assignmentUnni KuttanNo ratings yet

- POST Final Exam 2 April 2006-1Document12 pagesPOST Final Exam 2 April 2006-1Bi ChenNo ratings yet

- Problem Solving 16Document11 pagesProblem Solving 16Ehab M. Abdel HadyNo ratings yet

- FIN674 - Final - Sample 1 - QuestionsDocument8 pagesFIN674 - Final - Sample 1 - QuestionsFabricio Cifuentes EspinosaNo ratings yet

- Selected Problems For Credit RiskDocument3 pagesSelected Problems For Credit RiskTuan Tran VanNo ratings yet

- Tarea 7 Finanzas CorpDocument12 pagesTarea 7 Finanzas Corpvuzo123No ratings yet

- Questions - Cost of CapitalDocument3 pagesQuestions - Cost of Capitalmaidaoftu15No ratings yet

- Old Exam 2Document5 pagesOld Exam 2clementNo ratings yet

- Assignment I - Numericals - Summer 2021Document5 pagesAssignment I - Numericals - Summer 2021Anhad SinghNo ratings yet

- Jun18l1-Ep04 QaDocument23 pagesJun18l1-Ep04 Qajuan100% (1)

- Unit 2.1 & 2.2 Risk & ReturnDocument43 pagesUnit 2.1 & 2.2 Risk & ReturnHamdan SheikhNo ratings yet

- HW5 S10Document6 pagesHW5 S10danbrownda0% (1)

- FNCE 10002 Sample FINAL EXAM 1 For Students - Sem 2 2019 PDFDocument6 pagesFNCE 10002 Sample FINAL EXAM 1 For Students - Sem 2 2019 PDFC A.No ratings yet

- Capital Structure DecisionsDocument11 pagesCapital Structure Decisionsuyenpham4190No ratings yet

- Risk Return Sharpe QsDocument2 pagesRisk Return Sharpe QsKshitij TyagiNo ratings yet

- Shapiro CHAPTER 6 SolutionsDocument10 pagesShapiro CHAPTER 6 SolutionsjzdoogNo ratings yet

- ÔN TẬP CUỐI KÌ TCDN1 MS. TRANG PDFDocument6 pagesÔN TẬP CUỐI KÌ TCDN1 MS. TRANG PDFHoàng Việt VũNo ratings yet

- MAN 321 Corporate Finance Final Examination: Fall 2001Document8 pagesMAN 321 Corporate Finance Final Examination: Fall 2001Suzette Faith LandinginNo ratings yet

- 2Document13 pages2Ashish BhallaNo ratings yet

- #1 - Midterm Self Evaluation SolutionsDocument6 pages#1 - Midterm Self Evaluation SolutionsDionizioNo ratings yet

- RiskDocument43 pagesRiskMOHAMMAD 22152No ratings yet

- Expected & Unexpected LossDocument5 pagesExpected & Unexpected LossAdil AnwarNo ratings yet

- Chapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BDocument4 pagesChapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BAnsleyNo ratings yet

- Calculations OnlyDocument10 pagesCalculations OnlyPatience AkpanNo ratings yet

- Tutorial 4Document3 pagesTutorial 4sera porotakiNo ratings yet

- EF 5129P 2019 Financial Theory and Markets CA Assessment 3Document5 pagesEF 5129P 2019 Financial Theory and Markets CA Assessment 3Macharia NgunjiriNo ratings yet

- Budgeting Ac 2023Document3 pagesBudgeting Ac 2023Tonie NascentNo ratings yet

- Risk - Systematic - UnsystematicDocument15 pagesRisk - Systematic - UnsystematicRashi GaikwadNo ratings yet

- Report p2Document58 pagesReport p2Roland Jay DelfinNo ratings yet

- Tutorial Chapter: Risk and Return: (Answer 12.5%, 20%) (Answer 5.12%, 20.49%) (Answer 0.4, 1.02)Document19 pagesTutorial Chapter: Risk and Return: (Answer 12.5%, 20%) (Answer 5.12%, 20.49%) (Answer 0.4, 1.02)FISH JELLYNo ratings yet

- Financial Management AssignmentDocument3 pagesFinancial Management AssignmentHamza FayyazNo ratings yet

- Exercise Ch11 RiskReturnDocument2 pagesExercise Ch11 RiskReturnPeterNo ratings yet

- Ratio Analysis AssignmentDocument6 pagesRatio Analysis Assignmentcmverma82100% (1)

- HuDocument13 pagesHujt626No ratings yet

- FM11 CH 04 Mini-Case Old6Document19 pagesFM11 CH 04 Mini-Case Old6AGNo ratings yet

- FM Testbank Ch08Document6 pagesFM Testbank Ch08David LarryNo ratings yet

- ExamDocument18 pagesExamLiza Roshchina100% (1)

- Fa 06 Ex 3Document7 pagesFa 06 Ex 3MuhammadIjazAslamNo ratings yet

- MC For Test 1Document13 pagesMC For Test 1Michelle LamNo ratings yet

- Solutions BD3 SM15 GEDocument9 pagesSolutions BD3 SM15 GEAgnes Chew100% (1)

- Final AnswerDocument15 pagesFinal AnswerHedNo ratings yet

- Review Chapter12 - 14Document1 pageReview Chapter12 - 14minhhunghb789No ratings yet

- Serie 9Document11 pagesSerie 9AshutoshNo ratings yet

- Corporate Finance 3rd AssignmentDocument5 pagesCorporate Finance 3rd AssignmentMuhammad zahoorNo ratings yet

- CapitalBudgeting WACCDocument3 pagesCapitalBudgeting WACCRahul SharmaNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Detailed Course Outline For Term - V - 2016-17Document124 pagesDetailed Course Outline For Term - V - 2016-17Parth Vaswani0% (1)

- Throwdown! With Bobby Flay, Inc. Restaurant Expansion Analysis Chapter 12 Comprehensive Capital Budgeting Decision ProjectDocument4 pagesThrowdown! With Bobby Flay, Inc. Restaurant Expansion Analysis Chapter 12 Comprehensive Capital Budgeting Decision ProjectParth VaswaniNo ratings yet

- DEA Practice ProblemsDocument2 pagesDEA Practice ProblemsParth VaswaniNo ratings yet

- As More Open Source Companies Get Acquired, Questions and Tensions Are Raised About The Use of That SoftwareDocument5 pagesAs More Open Source Companies Get Acquired, Questions and Tensions Are Raised About The Use of That SoftwareParth Vaswani100% (1)

- Quiz 13 AnsDocument5 pagesQuiz 13 AnsParth VaswaniNo ratings yet

- Student Council Ratings Term I - IVDocument1 pageStudent Council Ratings Term I - IVParth VaswaniNo ratings yet

- CH 09Document39 pagesCH 09Parth Vaswani0% (1)

- Quiz 11 AnsDocument3 pagesQuiz 11 AnsParth VaswaniNo ratings yet

- 14a20b2ed284e62f3f1ba34e42872fea_e3d2685d66cb0554efcb57bb4bd332c6Document1 page14a20b2ed284e62f3f1ba34e42872fea_e3d2685d66cb0554efcb57bb4bd332c6Parth VaswaniNo ratings yet

- Quiz 8Document4 pagesQuiz 8Parth VaswaniNo ratings yet

- Quiz 9Document3 pagesQuiz 9Parth VaswaniNo ratings yet

- Quiz 12 AnsDocument3 pagesQuiz 12 AnsParth VaswaniNo ratings yet

- Quiz 6Document4 pagesQuiz 6Parth VaswaniNo ratings yet

- Quiz 10 AnsDocument3 pagesQuiz 10 AnsParth VaswaniNo ratings yet

- Lecure Slides For Session 10Document28 pagesLecure Slides For Session 10Parth VaswaniNo ratings yet

- Iimc Auditorium Coffee Break: Section Room NoDocument2 pagesIimc Auditorium Coffee Break: Section Room NoParth VaswaniNo ratings yet