Professional Documents

Culture Documents

Finanzas Corporativas - Final 2011-II - Mangrut PDF

Finanzas Corporativas - Final 2011-II - Mangrut PDF

Uploaded by

Mile León Meza0 ratings0% found this document useful (0 votes)

5 views7 pagesOriginal Title

Finanzas Corporativas -Final 2011-II- Mangrut.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views7 pagesFinanzas Corporativas - Final 2011-II - Mangrut PDF

Finanzas Corporativas - Final 2011-II - Mangrut PDF

Uploaded by

Mile León MezaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

Nombre: Lesewds CostWlo

—Ailbewrrewin

UNIVERSIDAD DEL PACIFICO

DEPARTAMENTO ACADEMICO DE CONTABILIDAD

FINANZAS CORPORATIVAS es

ANO 2011 - SEGUNDO SEMESTRE

Profesor: Samuel Mongrut (

ey RC

Tiempo: 02 horas Cx

1. Five years ago Karla Cabellos bought the company “Musique” for 4 million

dollars, one million dollar more than its book value at that time. With the

Company, Karla hired a research and development team dedicated to

producing and manufacturing new types of vinyl capable of reproducing music

with high fidelity, such the old vinyl, but at the same time resistant to scratches.

During year 2011, they managed to develop such type of vinyl and to put it

ready for the market. The following tables show the Balance Sheet and the

Profit and Loss Statement of the company for 2011.

Cédigo : _ 2909 !/9%15

FINAL EXAM

Balance Sheet

Company "Musique"

(in Thousands of dollars at December 2011)

Assets USS Liabilities uss

Cash 100 Account Payables 100

‘Account Receivables 1000 Long-Term Debt 900

Inventory 1500

Goodwill, 3000 Equity

Cumulative Amortization -1000 Social Capital 3000

Fixed Assets 1500 Retained Earnings 11600

Cumulative Depreciation -500

Total 5600 Total 5600

Profit and Loss Statement

‘Company "Musique"

(in thousands of dollars for the year 2011)

uss

Sales 6000

Cost of goods sold -3000

Gross Margin 3000

Sales and Administrative Expenses 500

Amortization of Goodwill -200

Depreciation of fixed assets 100

Expenses in Research and Development -1000

Extraordinary gains and losses 500

Earnings before Interests and taxes 700

Interest 100

Earnings before taxes 600

Taxes (30%) 180

Net income 420

Given the previous information you are being asked to answer the following

questions:

1.1. Estimate the Invested Capital of the Company “Musique” for year 2011

Note: Take into account only the accounts that reflect invested capital

with a cost for the company in order to generate the profit from the core

business. (02 points)

Answer:

Tce wwe + AF + Cane - Pc)

WEL RE-PE = 19041000 +1500 -190 2500

AF = 1500-S0q = 1900

ANC-PNC = 3000 gAMFR-G0d = 2100 VV

00

FC= 2S00 +1009 +2100 =

1.2 Estimate the corresponding Net Operating Profit Less Adjusted Taxes

(NOPAT) for year 2011 (02 points)

Answer:

NoPAT = 709 (1-9.3) 5) \

wore > 499

1.3 If the unlevered cost of equity is 15%, the cost of debt is 10% and the

total market capitalization of the company is US$ 5100 dollars, what is

the levered cost of equity for the company? Note: The company long-

term is quoted in the capital market with a rating AAA (02 points)

Answer:

Acciomes Devde,

Porsdorireach 83.617, 16.397

Cost. Isy, iby,

WK [2.54 7 oue

(4197. x iL

WACe =

1.4 Estimate the company economic value added (EVA) for the year 2011.

Interpret the result (02 points)

Answer:

evap = NoeAt - LEC) (waccd] 50

puAs 490 — CGeoe) ( 14,137. a

EVA S - 304.08

1.5 Do you agree with the following statement from Prof. Damodaran (2001,

p. 821) *...Economic Value Added is an approach skewed toward

assets-in- place and away from future growth...” Explain your answer.

(02 points)

| Answer:

El EVA ade ol surplus ew vevsledles morcforiag of

es oreedle Por yd, Byngrtiq, pr ss oth ves en tao

© EXIM gy UY pUttooe determi. Bayo este

AS es armel la od pnts ACL te Resor Deyradlone ye

ya qe ot OVA st anu, en les ms MN vsp

Para asi evifne ser el mredely de PcF gr pume,

fect datos emupulads, sim ombigs ma form el ormavrd

fubre Ac le empresa eo} BVA

2. Mrs. Cabellos hired Mr. Sergio Medina to help her to establish a proper

dividend policy for the company. During the last five years, the Company

“Musique” had a net income annual growth rate of 15% and Mr. Medina is

thinking that this growth rate could be kept into the future. If the dividend

payout ratio was 25% for 2011, you are being ask to answer the following

questions:

2.1 What will be the distributed dividends in year 2012 if the company

follows a policy of growing dividends? (01 point)

Answer:

paho 2011 > 287.

durdydes 2012 = (0.25 7 Ss)

g= 1S¥.

ek vrcome = 420 a OS fh!

= 120-75

2.2 What will be the distributed dividends in year 2012 if the company

follows a policy of constant dividend payout? (04 point)

Answer:

Pividewdos Lol2 = 10S SN oeene y

4p

0.28 x 483 = \20.4 nf

2.3. If the company is facing a capital budget of US$ 426,000 dollars for the

year 2012 and it is operating at its optimal capital structure, what would

be the distributed dividends in year 2012 if the company follows a

residual approach? (01 point)

Answer:

Dividewdas 20%

Uv oly = HS 420, 463

= Opertumualodss de nverson = “126

D WWidbedos residual es

2.4 Which of the previous dividend policies is the better for the company?

Explain your answer. (01 point)

Answer: \

La Zera poldkea gave Ttpowls

de Rividenows 9 sea or

s) See se ye rope aber

During the last year, Mrs. Ima Tam financial manager of “Papelito Company”

has been worried about the decreasing level of monthly credit sales, which on

average are about US$ 80,000 dollars and also with a decreasing market

share due to the entrance of its main competitor “Arts Company”. According to

the new sales manager, Mr. Victor Quispe, “Arts Company” has “stolen”

customers due to an aggressive credit policy that goes with a discount for early

payment of 10/30, 1/60. Given this situation, Mrs. Tam has decided ease the

company credit policy by changing its current discount for early payment from

5/30, n/60 to 20/30, n/60. The new credit policy for “Papelito Company” is

expected to raise the level of monthly credit sales to USS 120,000 dollars and

to increase the proportion of credit sales that will take the discount for early

payment from 40% to 60% of the average monthly credit sales.

In the other hand, Mrs. Tam has decided to avoid the opportunity cost of having

cash in the company and she has established the policy of investing any

excess of cash in short-term fixed income securities with a variable cost of US$

0.002 and a fixed cost of US$ 30 dollars per deposit. However, whenever she

has to withdraw part of this investment, her broker will charge a variable cost of

US$ 0.004 dollars and a fixed cost of US$ 40 dollars per withdrawal. Given this

information you are asked to:

3.1. Determine the monthly opportunity cost of having cash for “Papelito

Company” assuming that its providers are offering a discount for early

payment of 20/30, n/60. (02 points)

Answer:

60-30

( 1-0-2) C14 Co/38) =

ES)

(\ + Cos)=

Neorie Oe

{4 oso = ybzs

eee L

Coste Au.2s) = 1) 365 ae

pete on deste

36S

2,3250382 ) ‘

eee

u

TER: (le V4 40329

3.2 What is the minimum monthly cost of managing cash for “Papelito

Company"? (02 points)

Answer:

\

A

C= LC2.« 120,900 x40) = 6,149,998 /~

a Be

R= Iza 000 x [@.01 uous GIN8.Mhaé 9, 904 4

9.2539

oe

= 120,00~ 8984.76, 015.24 Be We

3.3 If the annual effective opportunity cost for “Papelito Company” with the

Previous discount for early payment was 7%, it is convenient or not for

the company to implement the new discount for early payment equal to

2s

20/30, n/60? (02 points)

‘Answer: 1

Bo

TED = [i+ 0.2539) J 1+ 0.00853

: Win —

onl eee eos Ge sg) = 0.000186

VP = (9-6) (0-8) (120,099) (1.00459) + (0.4) {120,295) (1) Doase) 6

= ©-4) (0.95)(129, 020) (1,009 86"? + ee

Si es tonvenltite trplenremkor le mwtve, pow,

de peel yr oe od UP a Gesihvg

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Caso - Inferencia Estadistica - Caso02 - Jorge RubioDocument9 pagesCaso - Inferencia Estadistica - Caso02 - Jorge RubioMile León MezaNo ratings yet

- PD1 2023-1Document5 pagesPD1 2023-1Mile León MezaNo ratings yet

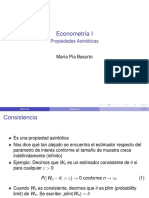

- 03 - Propiedades AsintóticasDocument9 pages03 - Propiedades AsintóticasMile León MezaNo ratings yet

- QuestionsDocument9 pagesQuestionsMile León MezaNo ratings yet

- EAp2 2013 2P4Document7 pagesEAp2 2013 2P4Mile León MezaNo ratings yet

- Libro1 Mate3Document44 pagesLibro1 Mate3Mile León MezaNo ratings yet

- Mate 3 EF (2003-II) Solución PDFDocument7 pagesMate 3 EF (2003-II) Solución PDFMile León MezaNo ratings yet