Professional Documents

Culture Documents

Rahul Todi (Low Cost Housing)

Rahul Todi (Low Cost Housing)

Uploaded by

Tazeem Ahmad ChishtiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rahul Todi (Low Cost Housing)

Rahul Todi (Low Cost Housing)

Uploaded by

Tazeem Ahmad ChishtiCopyright:

Available Formats

Affordable Housing in India:

Building a New Paradigm

Indian Habitat Summit 25th Sep09

Rahul Todi

Bengal Shrachi Housing Development Ltd.

The Role of Real Estate - Shaping Indian Economy:

Real Estate in India is one of the most volatile & keenly watched

segments of the Indian Economy.

Real estate is second only to agriculture in terms of employment

generation and contributes heavily towards the GDP.

5% of the countrys GDP is contributed to the housing sector & in the

next 5 years this contribution to GDP is expected to rise to 6%

(Source: IBEF Indian Brand Equity Foundation).

Real Estate is responsible for the development of over 250 ancillary

industries such as cement, steel, paints etc.

ICRA shows construction industry ranks 3rd among 14 major sectors in

terms of direct, indirect & induced effects in the economy.

A unit increase in expenditure in this sector has a multiplier effect and

the capacity to generate income as high as 5 times. If the economy grows

at the rate of 10% housing sector will grow at the capacity of 14% with a

generation of 3.2 million jobs over a decade.

The Boom of Real Estate Buying Trends

From 2005-2008, the Indian Real Estate sector enjoyed 3 years

of boom & unprecedented growth.

During this period demand for various asset classes remained buoyant

leading to a sharp rise in market prices.

Supply along certain asset classes like the commercial & luxury

residential sectors also increased markedly.

Till Q108, end-users were very insistent on purchasing houses.

Easy credit availability and rising income levels resulted in higher

aspiration levels that were well beyond the means and actual

affordability of many individuals.

The above led to a continuous flow of transactions for developers and

spiraling house prices.

According to the National Housing Bank (NHB) Residex, house prices

have registered a year-on-year rise of 20-40% in cities like Mumbai,

Delhi, Kolkata between 2007 2008.

Sudden face of Recession Ripple Effects:

During the 2nd half of 08 onset of economic led both buyers & developers

to become wary of the situation.

Job market uncertainties resulted in apprehension in end users for long

term obligations in the residential sector.

Wait & Watch policy was adopted to take advantage of falling prices.

On the supply side there was concern about increased limited funding

option and decline in aggregate demand.

As a parallel movement the market for Affordable Housing started

grabbing great attention

Definition of Affordable Housing

In many developed countries like USA affordability norm is defined for a

residential unit as 30% or less of a households gross annual income.

Recent study shows that an Affordable House should be defined as one

that costs 3 years salary, assuming 10% down payment & 28% going towards

mortgage.

Back home, HDFC consider 5.1 times annual income as the maximum

affordability of a household (Household earning = Rs. 3 Lacs P/A : Affordable

Housing = Rs.15 Lacs).

Affordable Housing does not mean Low Cost Housing

In India Low Cost Housing is primarily aimed at Economically Weaker

Sections (EWS) & LIG groups with the intervention & involvement of Govt.

to be prominent.

The concept of Affordable Housing in contrast is applicable across

ALL income categories.

The affordability of a household in a given location is an interactive

outcome of house price, income, spending & saving behavior.

It is recognized that affordability is relative to geographical area,

time & income category.

Typical Case Studies of Kolkata :

Location

Tollygunge

Location

Garia

Category

B+

Category

B-

Area Req.

1,100 2,000

sq.ft

Area Req.

800 - 1,500

sq.ft

Affordability

Rs 2,700 3,000

Affordability

Rs 1,700 2,200

Ticket Prices

Rs.30 -45 Lacs

(Approx.)

Ticket Prices

Rs 15-25 Lacs

(Approx.)

Min COC

Min Rs. 2,300

Min COC

Min Rs. 1,400

**Here Cost of Construction mainly depends on the price of Land also**

Is it really a New Paradigm?

Affordable housing always existed in society.

Some of the key aspects of Affordable Housing market

dynamics pertaining to were:

1. Location of the project

2. Property specifications

3. Amenities provided & price identified

4. Ticket Size of the project

A number of external hindrances faced by developers are :

1. High Land Cost

2. External & Internal development

3. Charges payable to the Govt.

4. Permissible Ground Coverage

5. Restrictive Density Norms

Real Time situation Potential in numbers:

The housing requirement for the Rs 3-10 Lacs income groups across 7

major cities are approx. 2.06 million housing units by 2011.

Assuming the above an avg. household size of 800 sq.ft translates to

a req. of 1,650 million sq.ft of residential space.

Assuming a price of Rs 2,000 per sq.ft being at par to the demand

catered to the total space requirement translates to a market size of

Rs 3,300 billion or USD 66 billion.

** Source Knight Frank 2009**

The Mistakes continue Dilemma for Buyers

A research showed that developers continued making the same mistake again

in order to tap the potential numbers.

Although a number of Affordable Housing projects have been announced

the location is in distant suburbs not having adequate basic infrastructure in

order to support them.

Research findings also indicate that good connectivity to frequently traveled

places primarily to work places is the most important factor for buyers.

Examples :

For instance a major project announced outside Mumbai with 1,500 odd apartments

with prices starting at Rs.380,000 or $8,600

Another major development with approx.1,500 flats would be available for Rs 220,000

Thus, defining affordable housing continues to be a challenge for

the major players of the Real Estate Industry

Government Support Overcome Bottlenecks

Expectations from Govt. to provide land bank at subsidized rates. Laws

restricting access to large tracks of land to be eased.

Affordable Housing projects could also thrive in suburban locations by

Govt. bringing far flung areas closer with proper infrastructure with

efficient transport system which is critical to such developments.

The extension of 80(IB) of the IT Act is a significant step towards this

direction.

Cross subsidization between Govt. & developer is also a classic example.

For instance, West Bengal we have seen the policy which is widely

supported by the Govt. as the PPP policy.

Government Support Facilitate Developers

Special Economic Zones to be converted to Special Residential Zones

Enjoying same fiscal benefits like no VAT , service tax etc.

This will enable to reduce costs by at least 30%

A cross subsidy model could also be introduced to enable EWS and LIG

Housing

Thank You

You might also like

- DLF Real Estate Project ReportDocument75 pagesDLF Real Estate Project Reportअंकित Jindal61% (28)

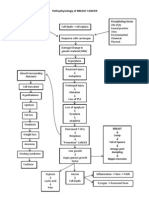

- Pathophysiology of BREAST CANCERDocument1 pagePathophysiology of BREAST CANCERAlinor Abubacar100% (6)

- Sales and Promotion of Real Estate ProjectDocument73 pagesSales and Promotion of Real Estate ProjectShubham Bhardwaj100% (1)

- Information MemorandumDocument38 pagesInformation Memorandumsun6raj18100% (1)

- The Role of Securitized Lending and Shadow Banking in The 2008 Financial CrisisDocument13 pagesThe Role of Securitized Lending and Shadow Banking in The 2008 Financial CrisisIndre67% (3)

- Affordable HousingDocument20 pagesAffordable HousingSourabh S PhanaseNo ratings yet

- The Patriot Privacy Kit Ebook 3.1Document114 pagesThe Patriot Privacy Kit Ebook 3.1smcgrew123No ratings yet

- Acc030 Assessment Group ProjectDocument7 pagesAcc030 Assessment Group ProjectAqilahNo ratings yet

- Theoretical FrameworkDocument30 pagesTheoretical Frameworkche verna100% (1)

- Sabey BlackRock Case StudyDocument2 pagesSabey BlackRock Case StudysabeyincNo ratings yet

- Account Activity Generated Through HBL MobileDocument4 pagesAccount Activity Generated Through HBL MobileMohammad ali HassanNo ratings yet

- Housing - Mod 3Document19 pagesHousing - Mod 3amlaNo ratings yet

- Double Impact NMIMSDocument9 pagesDouble Impact NMIMSabeer_chakravartiNo ratings yet

- Retail/Real Estate Sector OverviewDocument4 pagesRetail/Real Estate Sector Overviewkajal aggarwalNo ratings yet

- Affordable 28 12 10 110117004033 Phpapp02Document19 pagesAffordable 28 12 10 110117004033 Phpapp02abhiperiwalNo ratings yet

- Author: Kana Ram National Institute of Urban Affairs, New Delhi, IndiaDocument12 pagesAuthor: Kana Ram National Institute of Urban Affairs, New Delhi, IndiaHrutik GaikwadNo ratings yet

- "A Study of The Prospects and Challenges of Real Estate Market" (With Special Reference To Thane District.)Document8 pages"A Study of The Prospects and Challenges of Real Estate Market" (With Special Reference To Thane District.)shweta meshramNo ratings yet

- Sir Report - Copy To Cross CheckDocument50 pagesSir Report - Copy To Cross CheckmcbaajaNo ratings yet

- Table of ContentDocument19 pagesTable of ContentRohit ShahNo ratings yet

- Real EstateDocument52 pagesReal EstateAkshay Vetal100% (1)

- Real Estate: Unobservable Theoretical Construct. Housing Stock Depreciates Making It QualitativelyDocument9 pagesReal Estate: Unobservable Theoretical Construct. Housing Stock Depreciates Making It QualitativelykrupaleeNo ratings yet

- Affordable Housing in Urban Areas: The Need, Measures and InterventionsDocument17 pagesAffordable Housing in Urban Areas: The Need, Measures and Interventionspallavi kapoorNo ratings yet

- Demand and Supply For HousingDocument5 pagesDemand and Supply For HousingJimmy DeolNo ratings yet

- Improving The Life of MassesDocument6 pagesImproving The Life of MassesAnish NarulaNo ratings yet

- Real Estate: Reasons For Slump and The Way ForwardDocument9 pagesReal Estate: Reasons For Slump and The Way ForwardVinay V NaikNo ratings yet

- F 409, AssignmentDocument10 pagesF 409, AssignmentDaniel CarterNo ratings yet

- Final ArticleDocument12 pagesFinal ArticlesahulreddyNo ratings yet

- Current Parameters To Promote Successful Deliverance of Affordable HousingDocument3 pagesCurrent Parameters To Promote Successful Deliverance of Affordable HousingAppzNo ratings yet

- 4 (K) A Studuy On Investors PreferenceDocument16 pages4 (K) A Studuy On Investors PreferenceKanika MaheshwariNo ratings yet

- FSM Sonamon 354Document30 pagesFSM Sonamon 354Yashu Sharma100% (1)

- Complete ProjectDocument54 pagesComplete ProjectAbhijit SahaNo ratings yet

- Housing Finance Scenario in IndiaDocument9 pagesHousing Finance Scenario in IndiaTanvi AhujaNo ratings yet

- Asim Final DissertationDocument83 pagesAsim Final Dissertationshad.jawdNo ratings yet

- 1212am - 1.EPRA JOURNALS 12463Document5 pages1212am - 1.EPRA JOURNALS 12463msyncast1No ratings yet

- Blue o Can Research Journals Residential Flats MarketDocument10 pagesBlue o Can Research Journals Residential Flats MarketJayashrita PaulNo ratings yet

- Shahbaaz KhanDocument86 pagesShahbaaz KhanChandan SrivastavaNo ratings yet

- DMGT511 Security Analysis and Portfolio Management Assignment - I Maximum Marks 50Document3 pagesDMGT511 Security Analysis and Portfolio Management Assignment - I Maximum Marks 50rockstar1227No ratings yet

- Affordable Housing in India : Ms. Harshleen Kaur SethiDocument8 pagesAffordable Housing in India : Ms. Harshleen Kaur SethiNipra GuptaNo ratings yet

- Assignment 01Document6 pagesAssignment 01mahadazam2005No ratings yet

- Budget 2012: What's in It For The Real Estate SectorDocument4 pagesBudget 2012: What's in It For The Real Estate SectorsimmishwetaNo ratings yet

- Affordable Housing To Drive Realty in 2018 - The Economic Times - Mumbai, 2018-01-02Document2 pagesAffordable Housing To Drive Realty in 2018 - The Economic Times - Mumbai, 2018-01-02Raja SekharNo ratings yet

- About Real Estate in India: Samalkha, Panipat-132102 GFHGFDocument8 pagesAbout Real Estate in India: Samalkha, Panipat-132102 GFHGFTushar ShanNo ratings yet

- Dump - Indian Real State SectorDocument10 pagesDump - Indian Real State SectorDeepak AgrawalNo ratings yet

- Affordable Housing India-1Document20 pagesAffordable Housing India-1Venkat RamanNo ratings yet

- Housing Finance System in India and China - An Exploratory InvestigationDocument18 pagesHousing Finance System in India and China - An Exploratory InvestigationatuljndalNo ratings yet

- Main Chapters of WIP 1 To 15 (PGDM - PIBM)Document37 pagesMain Chapters of WIP 1 To 15 (PGDM - PIBM)Khushi SharmaNo ratings yet

- India Real Estate Industry Dec-2013Document6 pagesIndia Real Estate Industry Dec-2013softtech_engineersNo ratings yet

- Real Estate PPT - V GoodDocument144 pagesReal Estate PPT - V GoodShreenivas KVNo ratings yet

- Real EstateDocument59 pagesReal EstateManish RajakNo ratings yet

- WP Iimb 477Document48 pagesWP Iimb 477Chaitra balotagiNo ratings yet

- Literature ReviewDocument7 pagesLiterature ReviewNadeem KhanNo ratings yet

- Research Paper Housing MarketDocument4 pagesResearch Paper Housing Marketikrndjvnd100% (1)

- Housing and GDPDocument4 pagesHousing and GDPVishalSheokandNo ratings yet

- Literature Review of Real Estate Sector in IndiaDocument6 pagesLiterature Review of Real Estate Sector in Indiagvyztm2f100% (1)

- Trends in Residential Market in BangalorDocument9 pagesTrends in Residential Market in BangalorAritra NandyNo ratings yet

- Estate IndiaDocument12 pagesEstate IndiaShipra MehandruNo ratings yet

- Microsoft Word - News Item - Will Property Prices Fall 03.06 (Http://reliancepropertysolutions - Blogspot.com/)Document4 pagesMicrosoft Word - News Item - Will Property Prices Fall 03.06 (Http://reliancepropertysolutions - Blogspot.com/)reliancerpsNo ratings yet

- First Draft Article Buying CheaperhoseDocument3 pagesFirst Draft Article Buying CheaperhoseAtul KhekadeNo ratings yet

- Success Paper PublishedDocument6 pagesSuccess Paper PublishedManoj SSNo ratings yet

- Issues in Real Estate and Urban Management - A Note: Sebastian MorrisDocument11 pagesIssues in Real Estate and Urban Management - A Note: Sebastian MorrisEconomst PuyNo ratings yet

- The Major Challenges Faced by Housing Finance Company in IndiaDocument6 pagesThe Major Challenges Faced by Housing Finance Company in IndiaAARYA SATAVNo ratings yet

- Real Estate Investing: Building Wealth with Property Investments: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #2From EverandReal Estate Investing: Building Wealth with Property Investments: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #2No ratings yet

- The Versatility of the Real Estate Asset Class - the Singapore ExperienceFrom EverandThe Versatility of the Real Estate Asset Class - the Singapore ExperienceNo ratings yet

- 2023 Real Estate Trends: A Comprehensive Look at the Changing LandscapeFrom Everand2023 Real Estate Trends: A Comprehensive Look at the Changing LandscapeNo ratings yet

- Eccentric Reducers and Straight Runs of Pipe at Pump SuctionEccentric Reducers and Straight Runs of Pipe at Pump SuctionDocument4 pagesEccentric Reducers and Straight Runs of Pipe at Pump SuctionEccentric Reducers and Straight Runs of Pipe at Pump SuctionSudha SamantNo ratings yet

- Question 933239Document6 pagesQuestion 933239Pradhuman AgrawalNo ratings yet

- Impact of Covid-19 Pandemic On Consumer Behaviour: Mukt Shabd Journal ISSN NO: 2347-3150Document12 pagesImpact of Covid-19 Pandemic On Consumer Behaviour: Mukt Shabd Journal ISSN NO: 2347-3150Muhammad bilalNo ratings yet

- Solution Manual For Introduction To Managerial Accounting 5th Canadian Edition by BrewerDocument6 pagesSolution Manual For Introduction To Managerial Accounting 5th Canadian Edition by Brewera548723154No ratings yet

- MSC Economics Ec413 Macroeconomics: The Labour Market IDocument27 pagesMSC Economics Ec413 Macroeconomics: The Labour Market Ikokibonilla123No ratings yet

- Vision and MissionDocument8 pagesVision and Missionabrar100% (2)

- Webster Self Assessed Wisdom ScaleDocument10 pagesWebster Self Assessed Wisdom ScaleghinaNo ratings yet

- Challenges in Recruiting Females and Minority Groups For Clinical TrialsDocument5 pagesChallenges in Recruiting Females and Minority Groups For Clinical TrialsJeffersonNo ratings yet

- Legislative Branch ArticleDocument2 pagesLegislative Branch Articleapi-246209857100% (1)

- AES Watch Vs COMELECDocument28 pagesAES Watch Vs COMELECElaine GuayNo ratings yet

- IAS-37 Provisions, Contingent Liabilities and Contingent AssetsDocument29 pagesIAS-37 Provisions, Contingent Liabilities and Contingent AssetsAbdul SamiNo ratings yet

- Sti Pre-2016 First KeyDocument2 pagesSti Pre-2016 First Keyrahul.ramteke00000No ratings yet

- Gateway b1 Students Book 2nd Edition PDF FreeDocument153 pagesGateway b1 Students Book 2nd Edition PDF Freebethita77No ratings yet

- Introduction 6Document8 pagesIntroduction 6Study BuddyNo ratings yet

- Speak English To Me Latest Emcee Script 2016 - Final VersionDocument13 pagesSpeak English To Me Latest Emcee Script 2016 - Final VersionFarid Ibni AzizNo ratings yet

- Booking Flow - Entries: Ticketless Access Airline Availability Display PNR PricingDocument2 pagesBooking Flow - Entries: Ticketless Access Airline Availability Display PNR PricingEric SGNNo ratings yet

- Ey Gamification Brochure Digital FinalDocument8 pagesEy Gamification Brochure Digital FinalSasa SanandraNo ratings yet

- Satellite Intelsat 8Document11 pagesSatellite Intelsat 8RS.Banua MamaseNo ratings yet

- Identifying Sentence ErrorsDownload NowDocument20 pagesIdentifying Sentence ErrorsDownload NowIsh TaylorNo ratings yet

- Effect of Seamount Anak Krakatau On Seaweed Growth in The Sunda StraitDocument16 pagesEffect of Seamount Anak Krakatau On Seaweed Growth in The Sunda StraitDellaAyuLestariNo ratings yet

- Annexure 1Document3 pagesAnnexure 1Saksham SharmaNo ratings yet

- Alan Forsberg Rios Vol Adores EnglishDocument4 pagesAlan Forsberg Rios Vol Adores EnglishChaski KlandestinxNo ratings yet

- Paradise Road movie review & film summary (1997) - Roger Ebert - 副本Document2 pagesParadise Road movie review & film summary (1997) - Roger Ebert - 副本yvonne yingNo ratings yet