Professional Documents

Culture Documents

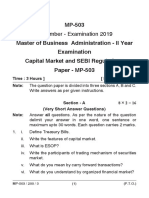

Chapter-1: Initial Public Offer

Uploaded by

Mustak R. DeraiyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter-1: Initial Public Offer

Uploaded by

Mustak R. DeraiyaCopyright:

Available Formats

Analysis On Initial Public Offering

CHAPTER- 1

INTRODUCTION

PART- 1.1 INITIAL PUBLIC OFFER

Initial public offering (IPO), also referred to

simply as a "public offering", is when a

company issues common stock or shares to

the public for the first time. They are often

issued by smaller, younger companies

seeking capital to expand, but can also be

done by large privately-owned companies

looking to become publicly traded. In an

IPO, the issuer may obtain the assistance of

an underwriting firm, which helps it determine what type of security to issue (common or

preferred), best offering price and time to bring it to market. Initial Public Offering (IPO)

in India means the selling of the shares of a company, for the first time, to the public in

the country's capital markets. This is done by giving to the public, shares that are either

owned by the promoters of the company or by issuing new shares. During an Initial

Public Offer (IPO) the shares are given to the public at a discount on the intrinsic value of

the shares and this is the reason that the investors buy Shares during

the Initial Public Offering (IPO) in order to make profits for themselves. IPO in India is

done through various methods like book building method, fixed price method, or a

mixture of both. The method of book building has been introduced in the country in 1999

and it helps the company to find out the demand and price of its shares.

A merchant banker is nominated as a book runner by the Issuer of the IPO. The company

that is issuing the Initial Public Offering (IPO) decides the number of shares that it will

Oriental Institute of Management 1

Analysis On Initial Public Offering

issue and also fixes the price band of the shares. All

these information are mentioned in the company's

red herring prospectus. During the company's Initial

Public Offering (IPO) in India, an

electronic book is opened for at least

five days. During this period of time,

bidding takes place which means that

people who are interested in

buying the shares of the Company makes an offer within the fixed price band. Once

the book building is closed then the issuer as well as the book runner of the Initial Public

Offering (IPO) evaluate the offers and then determine a fixed price. The offers for shares

that fall below the fixed price are rejected. The successful bidders are then allotted the

shares

IPO’s can be a risky investment. For the individual investor, it is tough to predict what

the stock or shares will do on its initial day of trading and in the near future since there is

often little historical data with which to analyze the company. Also, most IPO’s are of

companies going through a transitory growth period, and they are therefore subject to

additional uncertainty regarding their future value

PART 1.2 REASONS FOR LISTING

When a company lists its shares on a public exchange, it will almost invariably

look to issue additional new shares in order to raise extra capital at the same time. The

money paid by investors for the newly-issued shares goes directly to the company (in

contrast to a later trade of shares on the exchange, where the money passes between

investors). An IPO, therefore, allows a company to tap a wide pool of stock market

investors to provide it with large volumes of capital for future growth. The company is

Oriental Institute of Management 2

Analysis On Initial Public Offering

never required to repay the capital, but instead the new shareholders have a right to future

profits distributed by the company and the right to a capital distribution in case of

dissolution.

Oriental Institute of Management 3

Analysis On Initial Public Offering

The existing shareholders will see their shareholdings diluted as a proportion of the

company's shares. However, they hope that the capital investment will make their

shareholdings more valuable in absolute terms.

In addition, once a company is listed, it will be able to issue further shares via a rights

issue, thereby again providing itself with capital for expansion without incurring any

debt. This regular ability to raise large amounts of capital from the general market, rather

than having to seek and negotiate with individual investors, is a key incentive for many

companies seeking to list.

Major Reason for Listing IPO

The increase in the capital: An IPO allows a company to raise funds for utilizing

in various corporate operational purposes like acquisitions, mergers, working capital,

research and development, expanding plant and equipment and marketing.

Liquidity: The shares once traded have an assigned market value and can be

resold. This is extremely helpful as the company provides the employees with stock

incentive packages and the investors are provided with the option of trading their

shares for a price.

Valuation: The public trading of the shares determines a value for the company

and sets a standard. This works in favor of the company as it is helpful in case the

company is looking for acquisition or merger. It also provides the share holders of the

company with the present value of the shares.

Oriental Institute of Management 4

Analysis On Initial Public Offering

Increased wealth: The founders of the companies have an affinity towards IPO

as it can increase the wealth of the company, without dividing the authority as in case

of partnership.

PART-1.3 OBJECTIVES AND ROLE OF

IPO

To get the knowledge of IPO.

To analyze the returns of IPO’s which were issued in the year 2009

To know the return of those IPO’s for 1 month, 3 months, 6 months, and 1

year.

To know the market rate of return for the same period.

To know the procedure for calculating the Standard Deviation, calculating

Sharpe’s Ratio & the abnormal return.

Spread awareness about this process.

Find out the companies which like to adopt this technique.

Find out the factors which influence the IPO Listing Process.

What the companies are looking from Open New IPO’s in India?

Analysis between Share Holder and IPO Companies

Analysis of IPO’s post/present/future Prospects

Analysis of Auction, Pricing, Issued Price and Reverse IPO’s.

OBJECTS OF THE OFFERING NEW IPO

Oriental Institute of Management 5

Analysis On Initial Public Offering

Funds Requirement

Funding Plan (Means of Finance)

Appraisal

Schedule of Implementation

Funds Deployed

Sources of Financing of Funds already deployed

Details of Balance Fund Requirement

Interim Use of Funds

Basic Terms of Issue

Basis for issue price

Tax Benefits

Oriental Institute of Management 6

Analysis On Initial Public Offering

CHAPTER-2

SIGNIFICANCE OF THE STUDY

PART- 2.1 GLOBAL IPO MARKET

Globally, IPO activity picked up in the 2nd halfof2009, driven largely by Asia and

South America

These two regions raised $68.6B (in11months ending 30Nov’09),

accounting for 72% of total global IPO value

The recovery of global IPO activity was most pronounced in Asia,

particularly in the Hong Kong and Shanghai markets

– These two exchanges together raised $50B, accounting for 51% of total

global proceeds

The number of deals went down significantly from Jan’09 to Nov’09, with only

459 IPOs listings, compared to 745 deals in 2008

However, the capital raised through IPOs in 2009 aggregated at $95B,

nearly the same as 2008’s $94B, led by increase in average IPO size

Emerging market dominated the IPO market in 2009 with Chinese companies

the largest contributor of total funds raised globally

India contributed 3.5% of global IPOs (in terms of numbers) in 11 months ending

30 Nov’09, compared to 4.9% in 2008

Oriental Institute of Management 7

Analysis On Initial Public Offering

GLOBAL IPO MARKET IN VOLUME AND IN PROCEEDS

Source: ARC

Source: ARC

Global IPO Market: What Happened in 2009…..

Oriental Institute of Management 8

Analysis On Initial Public Offering

IPO proceeds in North America declined by ~38% from $26.6B in first 11 months of

2008 to $16.6B in the same period of 2009

Number of IPOs declined by 27%

European IPOs accounted for 10% of total global IPOs and a modest $5B proceed

from Jan’09 to Nov’09

This compares with 22% of total global IPOs raising US$13.6B in the same

period of 2008

IPO proceeds and activities have fallen dramatically in the Middle East from $13.1B

(from 51 deals in the first 11 months of 2008) to $2.1B in the same period in 2009,

with only 16 IPOs

Hong Kong Stock Exchange topped the list on the basis of funds raised with 18.7%

($17.7B) followed by New York Stock Exchange with 17.9% ($16.9B) and Shanghai

Stock Exchange with 17.0% ($16.1B)

The top three exchanges by deal activity are the Shenzhen Stock Exchange (73*),

Hong Kong Stock Exchange (47*) and KOSDAQ Stock Exchange (46*)

Oriental Institute of Management 9

Analysis On Initial Public Offering

Source: ARC

GLOBAL IPO MARKET- COUNTRY WISE PROCEEDS

Source: ARC

Oriental Institute of Management

10

Analysis On Initial Public Offering

IPO MARKET- INDIA vs CHINA

VOLUME* (NO.) Source: ARC

PROCEEDS* ($B) * On the basis of listings

Source: ARC

GLOBAL IPO MARKET- SECTOR COMPARISON

Oriental Institute of Management

11

Analysis On Initial Public Offering

In 2009*, on the basis of proceeds Financials, Industrials*** and Real Estate

sector accounted for 50%* of total IPO proceeds with 23%, 17% and 10%

compared to 28%, 15%, and 2% in 2008 respectively

In 2008, Financials, Energy & Power, Materials*** and Industrial accounted for

~80% of total proceeds with 28%, 19%, 17% and 15%respectively

*Till Nov’09

** Others include Energy and Power, Telecom, Consumer goods and retail, Media and

Entertainment, Financials, Healthcare, Real estate

*** Includes Automobiles and components, Building/Construction and Engineering;

Construction Materials, Machinery and other industrials, Transportation and infrastructure

**** Includes chemicals, Construction materials, Containers and Packaging; Metals, Mining

and other materials; Paper and Forest Products

LARGEST IPOs IN 2009: global

Oriental Institute of Management

12

Analysis On Initial Public Offering

China dominated the largest IPO list, representing seven of the ten initial public

offerings

Top five IPOs in 2009 includes two construction firms from China and three

financial companies, two from Brazil and one from China

BancoSantander Brasil SA’s $8.1B was the largest IPO of the year across the

globe in 2009, followed by $7.3B IPO of China State Construction

The largest IPO of 2009 (BancoSantander Brasil SA, Brazil, $8.1B) was just

45% (in terms of value) of the largest IPO of 2008 (Visa, US, $17.86B), but

equivalent to largest IPO of 2007 (VTB Bank, Russia, $8B)

Financial sector was the pick with 4 largest IPOs in top 10, contributing 47%

of the top 10 IPO proceeds

Largest IPOs in 2009

COMPANY NAME COUNTRY OFFER ISSU INDUSTRY RETUR

DATE E

Oriental Institute of Management

13

Analysis On Initial Public Offering

SIZE

N (%)*

$B

Banco Santander Brasil SA Brazil 06 Oct'09 8.1 Financial 4.O%

China State Construction China 23 Jul'09 7.3 Capital Goods 12.90%

Metallurgical Corp. of

China Hong Kong 16 Sep'09 5.1 Capital Goods -15.30%

VisaNet(Cielo) Brazil 25 Jun'09 4.3 Financial 2.30%

China Minsheng Banking Hong Kong 19 Nov'09 3.9 Financial -4.00%

China Pacific Insurance Hong Kong 16 Dec'09 3.8 Financial -8.50%

Maxis Malaysia 09 Nov'09 3.3 Communications 7.40%

Sands China Hong Kong 21 Nov'09 2.4 Consumer -8.90%

China Longyuan Power Hong Kong 04 Dec'09 2.3 Energy 23.00%

China Shipbuilding Industry China 10 Dec'09 2.2 Transportation 2.70%

*Offer Price to closing price on 31st Dec’2009 Source: ARC

PART-2.2 IPO MARKET IN INDIA

The IPO Market in India has been developing since the liberalization of the Indian

economy. It has become one of the foremost methods of raising funds for various

Oriental Institute of Management

14

Analysis On Initial Public Offering

developmental projects of different companies. The IPO Market in India is on the boom

as more and more companies are issuing equity shares in the capital market. With the

introduction of the open market economy, in the 1990s, the IPO Market went through its

share of policy changes, reforms and restructurings. One of the most important

developments was the disassembling of the Controller of Capital Issues (CCI) and the

introduction of the free pricing mechanism.

This step helped in developing the IPO Market in India, as the companies were permitted

to price the issues. The Free pricing mechanism permitted the companies to raise funds

from the primary market at competitive price.

The Central Government felt the need for a governed environment pertaining to the

Capital market, as few corporate houses were using the abolition of the Controller of

Capital Issues (CCI) in a negative manner. The Securities Exchange Board of India

(SEBI) was established in the year 1992 to regulate the capital market. SEBI was given

the authority of monitoring and regulating the activities of the bankers to an issue,

portfolio managers, stockbrokers, and other intermediaries related to the stock markets.

The effects of the changes are evident from the trend of the resources of the primary

capital market which includes rights issues, public issues, private placements and

overseas issues.

The IPO Market in India experienced a boom in its activities in the year 1994. In the year

1995 the growth of the Indian IPO market was 32 %. The growth was halted with the

South East Asian crisis. The markets picked up speed again with the introduction of the

software stocks.

Energy and Power, Hottest Sector Among the Investors…

Oriental Institute of Management

15

Analysis On Initial Public Offering

India IPO Activity Ramping Up Out of Deep Slumber… (1/2)

Oriental Institute of Management

16

Analysis On Initial Public Offering

Even though the Sensex surged ~8,000 points or 81% in 2009, public issues

remained stagnant for most part of the year

With secondary markets going north since Mar’09, primary market picked up the

pace in 2nd half of 2009 and accounted for 15 listings out of total of 17 in 2009

Continuing the trend witnessed in 2008, number of IPOs declined by 55% in 2009

over 2008 and 83% on 2007 levels

In 2008 and 2009, number of IPOs oversubscribed by more than 10 times, was a

mere 25% compared to ~50% in 2007

Source: ARC

India IPO Activity Ramping Up Out of Deep Slumber… (2/2)

Oriental Institute of Management

17

Analysis On Initial Public Offering

Capital raised by Corporate India through IPO route in 2009 aggregated at

INR157B, lowest in the last 4 years

NHPC contributed 39% of the total proceeds in 2009

There was very little excitement in the IPO market after it dried. But a flurry of

debuts came in the 2nd half of 2009 as confidence in stock markets grew

Though the volume and proceeds declined in 2009, the average IPO size increased

to INR9.2B in 2009 from INR5.0B in 2008, an increase of 86%

Oriental Institute of Management

18

Analysis On Initial Public Offering

PART-2.32 UPCOMING IPOs IN THE MARKET

Upcoming Initial Public Offering (IPOs) in India at a glance:

Initial Public Offer (IPO) in India, means the first sale by a private company of its shares

to the public. Initial Public Offers (IPOs) in India, are usually issued by small companies

but at the same time big private companies also go public by issuing their shares.

Various companies issuing upcoming IPOs in India as on 8th March 2010 are:

S.N. Company Lead Managers

JM FINANCIAL SERVICES PVT

1 STERLITE ENERGY LTD LTD

2 PERSTIGE ESTATES PROJECTS LTD ENAM SECURITIES PVT LTD

JM FINANCIAL SERVICES PVT

3 NITESH ESTATES LTD LTD

4 KUMAR URBAN DEVELOPMENT LTD. ENAM SECURITIES PVT LTD

5 JAYPEE INFRATECH LTD ENAM SECURITIES PVT LTD

ANAND RATHI FINANCIAL

6 INFINITY INFOTECH PARKS LTD SERVICES PVT LTD

7 AJANTA MANUFACTURING LTD ENAM SECURITIES PVT LTD

8 APOLLO HEALTH STREET LTD ICICI SECURITIES LTD

9 RITES LTD ENAM SECURITIES PVT LTD

JM FINANCIAL SERVICES PVT

10 BHARAT OMAN REFINERIES LTD LTD

11 FUTURE VENTURES INDIA LTD ENAM SECURITIES PVT LTD

JM FINANCIAL SERVICES PVT

12 PRINCE FOUNDATIONS LTD LTD

13 MULTI COMMODITY EXCHANGE INDIA LTD JM MORGAN STANLEY

Oriental Institute of Management

19

Analysis On Initial Public Offering

FINANCIAL SERVICES PVT LTD

14 NKG INFRASTRUCTURE LTD SPA SECURITIES LTD

15 MICROSEC FINANCIAL SERVICES LTD SBICAP SECURITIES LTD

JM FINANCIAL SERVICES PVT

16 RELIANCE INFRATEL LTD LTD

17 PNC INFRATECH LTD ENAM SECURITIES PVT LTD

18 VIGRO ENGINEERS LTD ENAM SECURITIES PVT LTD

19 ASHOKA BULDCON LTD ENAM SECURITIES PVT LTD

20 JAIPRAKASH POWER VENTURES LTD ENAM SECURITIES PVT LTD

21 UTI ASSET MANAGEMENT COMPANY LTD SBICAP SECURITIES LTD

SAFFRON CAPITAL ADVISORS

22 RITHWIK PROJECTS LTD PVT LTD

23 MADHANA INDUSTRIES LTD EDELWEISS SECURITIES LTD

24 PRIDE HOTELS LTD EDELWEISS SECURITIES LTD

CITIGROUP GLOBAL MARKETS

25 RAMKY INFRASTRUCTURE LTD INDIA PVT LTD

26 ACME TELE POWER LTD KOTAK SECURITIES LTD

27 JHAVERI FLEXO INDIA LIMITED SREI CAPITAL MARKETS LTD

28 NEEL METAL PRODUCTS LTD ICICI SECURITIES LTD

29 TCG LIFESCIENCES ENAM SECURITIES PVT LTD

30 YBRANT TECHNOLOGIES LTD ENAM SECURITIES PVT LTD

31 KHADIM INDIA LTD MICROSEC INDIA LTD

32 TACPRO SYSTEMS LTD SBICAP SECURITIES LTD

Oriental Institute of Management

20

Analysis On Initial Public Offering

33 RNS INFRASTRUCTURE LTD ICICI SECURITIES LTD

34 RAMSARUP LOHH UDYOG LTD MICROSEC CAPITAL LTD

35 MIDVALLEY ENTERTATIANMENT LTD RELIGARE SECURITIES LTD

36 BRAHAMPUTRA CONSORTIUM LTD A K STOCKMART PVT LTD

37 OSWAL WOLLEN MILLS LTD UTI BANK LTD

38 UMA PRECISION LTD KARVY STOCK BROKING LTD

Source: ARC

Oriental Institute of Management

21

Analysis On Initial Public Offering

CHAPTER-3

REVIEW OF LITERATURE

PART-3.1 ADVANTAGES AND DRAWBACKS OF IPO

The Advantages of IPO are numerous. The companies are launching more and more

IPO’s to raise funds which are utilized for undertakings various projects including

expansion plans. The Advantages of IPO is the primary factor for the immense growth of

the same in the last few years. The IPO or the initial public offering is a term used to

describe the first sale of the shares to the public by any company. All types of companies

with the idea of enhancing growth launch IPOs to generate funds to cater the

requirements of capital for expansion, acquiring of capital instruments, undertaking new

projects.

Major Advantages of IPO

IPO has a number of advantages. IPO helps the company to create a publi

c awareness about the company as these public offerings generate publicity by inducing

their products to various investors.

The increase in the capital: An IPO allows a company to raise funds for utilizing

in various corporate operational purposes like acquisitions, mergers, working capital,

research and development, expanding plant and equipment and marketing.

Liquidity: The shares once traded have an assigned market value and can be

resold. This is extremely helpful as the company provides the employees with stock

incentive packages and the investors are provided with the option of trading their shares

for a price.

Oriental Institute of Management

22

Analysis On Initial Public Offering

Valuation: The public trading of the shares determines a value for the company

and sets a standard. This works in favor of the company as it is helpful in case the

company is looking for acquisition or merger. It also provides the share holders of the

company with the present value of the shares.

Increased wealth: The founders of the companies have an affinity towards IPO

as it can increase the wealth of the company, without dividing the authority as in case of

partnership.

Drawbacks of IPO’s

Time and Expense

It is true that IPO raises huge capital for the issuing company. But, in order to

launch an Initial Public Offering (IPO), it is also necessary to make certain investments.

Setting up an IPO does not always lead to an improvement in the economic performance

of the company. A continuing expenditure has to be incurred after the setting up of an

IPO by the parent company. A lot of expenses have to be incurred in the form of legal

fees, printing costs and accounting fees, which are connected to the registering of an IPO.

Such expenses might cost hundreds of US dollars. Apart from such enormous costs, there

are other factors as well that should be taken into consideration by the company while

introducing an IPO.

Such factors include the rules and regulations involved to set up public offerings and this

entire process on the other hand involve a number of complexities which sometime

require the services of experts in relevant fields. Some companies hire experts to do the

needful to ensure a hassle-free execution of the task. After the IPO is introduced, the

expenses become a routine in every activity involved. Besides, the CEO of the company

would have to spend a lot of time in handling the SEC regulations or sometimes he hires

experts to do the same. All these aspects, if not handled with efficiency, prove to be some

major drawbacks related to the launch of IPOs.

Oriental Institute of Management

23

Analysis On Initial Public Offering

Management Decision based on ownership of shares

The launch of IPO also brings about shareholders of the company. Shareholders

have ownership in the company. The primary owners of the company or the people

holding maximum authority in the company cannot take decisions all by themselves once

an IPO has been launched and shareholders have been formed. The shareholders have an

active participation in every decision that is being taken even if they do not hold 50

percent share of the company. They have their individual demands to be met as they own

a certain percentage of stakes in the company. The SEC regulations require notifications

from the shareholders of the company, meetings, and also approvals from them while

making important business decisions. A major risk with shareholders is that, they can sell

off their stocks any time they want, in case they see the price band of the stakes of that

company is going down. This will lead to a further drop of the value of shares in the

market which in turn will decrease the overall value of the company.

Decisions based upon Stock Price

Management's decisions may be effected by the market price of the shares and the

feeling that they must get market recognition for the company's stock.

Regulatory Review

The Company will be open to review by the SEC to ensure that the company is

making the appropriate filings with all relevant disclosures.

Falling Stock Price

If the shares of the company's stock fall, the company may lose market

confidence, decreased valuation of the company may affect lines of credits, secondary

Oriental Institute of Management

24

Analysis On Initial Public Offering

offering pricing, the company's ability to maintain employees, and the personal wealth of

insiders and investors.

Vulnerability

If a large portion of the company's shares are sold to the public, the company may

become a target for a takeover, causing insiders to lose control. A takeover bid may be

the result of shareholders being upset with management or corporate raiders looking for

an opportunity. Defending a hostile bid can be both expensive and time consuming. Once

a company has weighed the advantages and disadvantages of being a public company, if

it decides that it would like to conduct an IPO it will have to retain a lead

Disclosure

The SEC disclosure rules are very extensive. Once a company is a reporting

company it must provide information regarding compensation of senior management,

transactions with parties related to the company, conflicts of interest, competitive

positions, how the company intends to develop future products, material contracts, and

lawsuits. In addition, once the offering statement is effective, a company will be required

to make financial disclosures required by the Securities and Exchange Act of 1934. The

1934 Act requires public companies to file quarterly statements containing unaudited

financial statements and audited financial statements annually. These statements must

also contain updated information regarding nonfinancial matters similar to information

provided in the initial registration statement. This usually entails retaining lawyers and

auditors to prepare these quarterly and annual statements. In addition, a company must

report certain material events as they arise. This information is available to investors,

employees, and competitors.

Oriental Institute of Management

25

Analysis On Initial Public Offering

PART-3.2 IPO ALLOTMENT STATUS

Initial public offering is also popularly known as IPO, is the first time sale of

stocks, of a private company. A new company can launch IPO to raise capital to initiate

its business. Moreover, Initial Public Offering can also be launched to raise money for

expansion or other important operations of an existing company. The sale of stock

through such Initial Public Offering (IPO) is meant for the individual and corporate

investors. The aim of such issuance of Initial Public Offering is to invest the accumulated

corpus for, either opening -up of a company or expansion of an existing company.

Thus, effectively, an Initial Public Offering pools investments and utilizes it in building

or expansion of the said company. The shares held by such investors give them the rights

of the company and to its future profits. The process which involves determination of the

issue size and type, offer price and best time of introduction into the market is called

"underwriting". The underwriting is generally done by the investment bankers. These

underwriting firms or investment bankers are allotted some specified numbers of shares

to sell, which is called as IPO Allotment Status. In other words, IPO Allotment Status

can also be defined as the number of stocks which an investment banker is permitted to

sell to the general investor before the share is being traded on an exchange. The excess

shares are then allotted to other investment bankers which are eligible to sell such shares.

In India, the main governing body that determines such eligibility criteria and the IPO

Allotment Status is the Securities and Exchange Board of India (SEBI).

Oriental Institute of Management

26

Analysis On Initial Public Offering

PART-3.3 IPO PROCEDURE

IPO’s generally involve one or more investment banks as "underwriters." The

company offering its shares, called the "issuer," enters a contract with a lead underwriter

to sell its shares to the public. The underwriter then approaches investors with offers to

sell these shares.

The sale (that is, the allocation and pricing) of shares in an IPO may take several forms.

Common methods include:

Best efforts contract

Firm commitment contract

All-or-none contract

Bought deal

Dutch auction

Self distribution of stock

A large IPO is usually underwritten by a "syndicate" of investment banks led by one or

more major investment banks (lead underwriter). Upon selling the shares, the

underwriters keep a commission based on a percentage of the value of the shares sold.

Usually, the lead underwriters, i.e. the underwriters selling the largest proportions of the

IPO, take the highest commissions—up to 8% in some cases.

Multinational IPOs may have as many as three syndicates to deal with differing legal

requirements in both the issuer's domestic market and other regions. For example, an

issuer based in the E.U. may be represented by the main selling syndicate in its domestic

market, Europe, in addition to separate syndicates or selling groups for US/Canada and

for Asia. Usually, the lead underwriter in the main selling group is also the lead bank in

the other selling groups.

Oriental Institute of Management

27

Analysis On Initial Public Offering

Because of the wide array of legal requirements, IPOs typically involve one or more law

firms with major practices in securities law, such as the Magic Circle firms of London

and the white shoe firms of New York City.

Usually, the offering will include the issuance of new shares, intended to raise new

capital, as well the secondary sale of existing shares. However, certain regulatory

restrictions and restrictions imposed by the lead underwriter are often placed on the sale

of existing shares.

Public offerings are primarily sold to institutional investors, but some shares are also

allocated to the underwriters' retail investors. A broker selling shares of a public offering

to his clients is paid through a sales credit instead of a commission. The client pays no

commission to purchase the shares of a public offering; the purchase price simply

includes the built-in sales credit.

The issuer usually allows the underwriters an option to increase the size of the offering

by up to 15% under certain circumstance known as the green shoe or over allotment

option.

The first sale of stock by a private company to the public. IPOs are often issued by

smaller, younger companies seeking the capital to expand, but can also be done by large

privately owned companies looking to become publicly traded. In an IPO, the issuer

obtains the assistance of an underwriting firm, which helps it determine what type of

security to issue (common or preferred), the best offering

Oriental Institute of Management

28

Analysis On Initial Public Offering

MAJOR PROCESS OF AN IPO

Eligibility Criteria:

Net Tangible assets of Rs. 3.00 Crore in each of the preceding 3 years.

Track record of Distributable profits at least 3 out of 5 preceding years.

The Company has a Networth of Rs. 1.00 Crore in preceding 3 years.

The proposed issue should not exceed 5 times of its Pre-issue

The process of an IPO - Eligibility criteria: (Alternate route)

Book building process and 50% of the offer to QIBs or

15% participation in project by F/Is or Schedule Banks;

10% of the Project cost from appraiser;

10% of the Issue to QIBs.

Minimum post issue face capital of Rs.10 Crores or

Market making for 2 years and Minimum number of allottees atleast 1000

Official Process of IPO

Appointment of Brokers, Advertisers and Bankers

Conducting Road shows and Press Conference

Opening and closing of Subscription list

Preparation of Basis of Allotment

Allotment of shares

Listing of shares

price and the time to bring it to market

Oriental Institute of Management

29

Analysis On Initial Public Offering

Oriental Institute of Management

30

Analysis On Initial Public Offering

PART-3.4 CRITICAL AREAS TO FOCUS

Compliance with SEBI Guidelines

90% subscription of the issue

Underwriting Agreements

Firm Allotments

Listing approvals from the Stock Exchanges

ROC approval for the prospectus

Advertising and Road Shows

Statutory advertisements

In-time allotments and refunds

Listing of the shares with the Exchanges

SEBI GUIDELINES

Filing of prospectus:

Prospectus to be filed with SEBI through Merchant Banker At least 30 days < filing with

ROC SEBI may suggest changes < 30 days SEBI to consider only after approval

from St.Ex

Issuer is obligated

SEBI is not obligated

Application for Listing:

No IPO without application for listing

Oriental Institute of Management

31

Analysis On Initial Public Offering

Dematerialization of shares:

Agreement with Depository Present shares also to be in demat public may opt either

physical or demat shares

“Qualified Institutional Buyer” shall mean:

Public financial institution as defined in section 4A of the Companies Act,

1956; scheduled commercial banks;

Mutual funds;

Foreign institutional investor registered with SEBI;

Multilateral and bilateral development financial institutions;

Venture capital funds registered with SEBI;

Foreign venture capital investors registered with SEBI;

State industrial development corporations;

Insurance companies registered with the Insurance Regulatory and

Development Authority (IRDA);

Provident funds with minimum corpus of Rs. 25 crores;

Pension funds with minimum corpus of Rs. 25 crores).

Exemption from Eligibility Norms:

Banking Co. including Pvt. Banks Subject to licensing by

RBI

New Bank being set up on acquisition or take over of a

bank

An infrastructure Company, whose project is appraised by

F/I, IL & FS and IDFC

Oriental Institute of Management

32

Analysis On Initial Public Offering

IPO Grading:

No IPO unless; (as on the date of filing the

prospectus with ROC):

Grading for IPO has been obtained from at

least one agency

Grading and the rationale have been

included in the prospectus

Grading expenses to be borne by the issuer

Present shares to be fully paid-up:

No IPO, if there are any

shares partly paid up as on the date of IPO

The Shares to be fully paid

up or forfeited

Price Band:

Price Band to be 20%

Max price can be 20% above the floor price

Board of directors may be authorized to fix the price

Denomination of shares

Denomination of the shares is not restricted

In case the issue price is <Rs.500, the Face Value shall be Rs.10/-

The Face Value may be less, where the issue price is Rs.500 or

more

Oriental Institute of Management

33

Analysis On Initial Public Offering

Full disclosure of the face value in offer document

Guidelines on issue of advertisement:

Advertisement shall be truthful, fair and clear

Shall not contain untrue or misleading or

misleading statement

Disclose all relevant facts

Clear, concise and

Understandable language

Avoid technical, legal, complex terms

No advertisement in Crawlers

Reference to the red-herring prospectus

No slogans, captions or one liners

Shall include risk factors

Risk factors to be given in the same font size

The print size shall not be less than point size 7

Oriental Institute of Management

34

Analysis On Initial Public Offering

PART-3.5

UNDERSTANDING THE ROLE OF INTERMEDIARIES

Who are the intermediaries in an issue?

Merchant Bankers to the issue or Book Running Lead Managers (BRLM),

syndicate members, Registrars to the issue, Bankers to the issue, Auditors of the

company, Underwriters to the issue, Solicitors, etc. are the intermediaries to an issue. The

issuer discloses the addresses, telephone/fax numbers and email addresses of these

intermediaries. In addition to this, the issuer also discloses the details of the compliance

officer appointed by the company for the purpose of the issue.

Who is eligible to be a BRLM?

A Merchant banker possessing a valid SEBI registration in accordance

with the SEBI (Merchant Bankers) Regulations, 1992 is eligible to act as a Book Running

Lead Manager to an issue.

Oriental Institute of Management

35

Analysis On Initial Public Offering

What is the role of a Lead Manager? (pre and post issue)

In the pre-issue process, the Lead Manager (LM) takes up the due

diligence of company’s operations/ management/ business plans/ legal etc. Other

activities of the LM include drafting and design of Offer documents, Prospectus, statutory

advertisements and memorandum containing salient features of the Prospectus. The

BRLMs shall ensure compliance with stipulated requirements and completion of

prescribed formalities with the Stock Exchanges, RoC and SEBI including finalization of

Prospectus and RoC filing. Appointment of other intermediaries viz., Registrar(s),

Printers, Advertising Agency and Bankers to the Offer is also included in the pre-issue

processes. The LM also draws up the various marketing strategies for the issue.

The post issue activities including management of escrow accounts, co-

ordinate non-institutional allocation, intimation of allocation and dispatch of refunds to

bidders etc are performed by the LM. The post Offer activities for the Offer will involve

essential follow-up steps, which include the finalization of trading and dealing of

instruments and dispatch of certificates and demat of delivery of shares, with the various

agencies connected with the work such as the Registrar(s) to the Offer and Bankers to

the Offer and the bank handling refund business. The merchant banker shall be

responsible for ensuring that these agencies fulfill their functions and enable it to

discharge this responsibility through suitable agreements with the Company.

What is the role of a registrar?

The Registrar finalizes the list of eligible allottees after deleting the

invalid applications and ensures that the corporate action for crediting of shares to the

demat accounts of the applicants is done and the dispatch of refund orders to those

applicable are sent. The Lead manager co-ordinates with the Registrar to ensure follow

up so that that the flow of applications from collecting bank branches, processing of the

Oriental Institute of Management

36

Analysis On Initial Public Offering

applications and other matters till the basis of allotment is finalized, dispatch security

certificates and refund orders completed and securities listed.

What is the role of bankers to the issue?

Bankers to the issue, as the name suggests, carries out all the activities of

ensuring that the funds are collected and transferred to the Escrow accounts. The Lead

Merchant Banker shall ensure that Bankers to the Issue are appointed in all the mandatory

collection centers as specified in DIP Guidelines. The LM also ensures follow-up with

bankers to the issue to get quick estimates of collection and advising the issuer about

closure of the issue, based on the correct figures.

Question on Due diligence

The Lead Managers state that they have examined various documents

including those relating to litigation like commercial disputes, patent disputes, disputes

with collaborators etc. and other materials in connection with the finalization of the offer

document pertaining to the said issue; and on the basis of such examination and the

discussions with the Company, its Directors and other officers, other agencies,

independent verification of the statements concerning the objects of the issue, projected

profitability, price justification, etc., they state that they have ensured that they are in

compliance with SEBI, the Government and any other competent authority in this behalf.

Oriental Institute of Management

37

Analysis On Initial Public Offering

PART-3.6 PARAMETERS TO JUDGE AN IPO

Good investing principles demand that you study the minutes of details prior to investing

in an IPO. Here are some parameters you should evaluate:-

Promoters

Is the company a family run business or is it professionally owned? Even with a

family run business what are the credibility and professional qualifications of those

managing the company? Do the top level managers have enough experience (of at

least 5 years) in the specific type of business?

Industry Outlook

The products or services of the company should have a good demand and

scope for profit.

Business Plans

Oriental Institute of Management

38

Analysis On Initial Public Offering

Check the progress made in terms of land acquisition, clearances from

various departments, purchase of machinery, letter of credits etc. A higher initial

investment from the promoters will lead to a higher faith in the organization.

Financials

Why does the company require the money? Is the company floating more

equity than required? What is the debt component? Keep a track on the profits,

growth and margins of the previous years. A steady growth rate is the quality of a

fundamentally sound company. Check the assumptions the promoters are making and

whether these assumptions or expectations sound feasible.

Risk Factors

The offer documents will list our specific risk factors such as the

company’s liabilities, court cases or other litigations. Examine how these factors will

affect the operations of the company.

Key Names

Every IPO will have lead managers and merchant bankers. You can figure

out the track record of the merchant banker through the SEBI website.

Pricing

Compare the company’s PER with that of similar companies. With this

you can find out the P/E Growth ratio and examine whether its earning projections seem

viable.

Listing

You should have access to the brokers of the stock exchanges where the

company will be listing itself.

Oriental Institute of Management

39

Analysis On Initial Public Offering

PART-3.7 GREEN SHOE OPTION

Companies that want to venture out and start selling their shares to the public

have ways to stabilize their initial share prices. One of these ways is through a legal

mechanism called the greenshoe option. A greenshoe is a clause contained in the

underwriting agreement of an initial public offering (IPO) that allows underwriters to buy

up to an additional 15% of company shares at the offering price. The investment banks

and brokerage agencies (the underwriters) that take part in the greenshoe process have the

ability to exercise this option if public demand for the shares exceeds expectations and

the stock trades above the offering price.

The Origin of the Greenshoe

The term "greenshoe" came from the Green Shoe Manufacturing Company (now called

Stride Rite Corporation), founded in 1919. It was the first company to implement the

greenshoe clause into their underwriting agreement.

Oriental Institute of Management

40

Analysis On Initial Public Offering

In a company prospectus, the legal term for the greenshoe is "over-allotment option",

because in addition to the shares originally offered, shares are set aside for underwriters.

This type of option is the only means permitted by the Securities and Exchange

Commission (SEC) for an underwriter to legally stabilize the price of a new issue after

the offering price has been determined. The SEC introduced this option in order to

enhance the efficiency and competitiveness of the fundraising process for IPOs.

Price Stabilization

This is how a greenshoe option works:

The underwriter works as a liaison (like a dealer), finding buyers for the shares

that their client is offering.

A price for the shares is determined by the sellers (company owners and directors)

and the buyers (underwriters and clients).

When the price is determined, the shares are ready to publicly trade. The

underwriter has to ensure that these shares do not trade below the offering price.

If the underwriter finds there is a possibility of the shares trading below the

offering price, they can exercise the greenshoe option.

In order to keep the price under control, the underwriter oversells or shorts up to 15%

more shares than initially offered by the company.

For example, if a company decides to publicly sell 1 million shares, the underwriters (or

"stabilizers") can exercise their greenshoe option and sell 1.15 million shares. When the

shares are priced and can be publicly traded, the underwriters can buy back 15% of the

shares. This enables underwriters to stabilize fluctuating share prices by increasing or

decreasing the supply of shares according to initial public demand.

Oriental Institute of Management

41

Analysis On Initial Public Offering

If the market price of the shares exceeds the offering price that is originally set before

trading, the underwriters could not buy back the shares without incurring a loss. This is

where the greenshoe option is useful: it allows the underwriters to buy back the shares at

the offering price, thus protecting them from the loss.

If a public offering trades below the offering price of the company, it is referred to as a

"break issue". This can create the assumption that the stock being offered might be

unreliable, which can push investors to either sell the shares they already bought or

refrain from buying more. To stabilize share prices in this case, the underwriters exercise

their option and buy back the shares at the offering price and return the shares to the

lender (issuer).

Full, Partial and Reverse Greenshoes

The number of shares the underwriter buys back determines if they will exercise a partial

greenshoe or a full greenshoe. A partial greenshoe is when underwriters are only able to

buy back some shares before the price of the shares increases. A full greenshoe occurs

when they are unable to buy back any shares before the price goes higher. At this point,

the underwriter needs to exercise the full option and buy at the offering price. The option

can be exercised any time throughout the first 30 days of IPO trading.

There is also the reverse greenshoe option. This option has the same effect on the price of

the shares as the regular greenshoe option, but instead of buying the shares, the

underwriter is allowed to sell shares back to the issuer. If the share price falls below the

offering price, the underwriter can buy shares in the open market and sell them back to

the issuer

The Greenshoe Option in Action

Say, for instance, that a company is planning to issue only 100,000 shares, but in order to

utilize the greenshoe option, it actually issues 115,000 shares, in which case the over-

Oriental Institute of Management

42

Analysis On Initial Public Offering

allotment would be 15,000 shares. The company does not issue any new shares for the

over-allotment.

The 15,000 shares used for the over-allotment are actually borrowed from the pre-issue

existing shareholders and promoters with whom the stabilizing agent enters into a

separate agreement. For the subscribers of a public issue, it makes no difference whether

the company is allotting shares out of the freshly issued 100,000 shares or from the

15,000 shares borrowed from the promoters. Once allotted, a share is just a share for an

investor.

For the company, however, the situation is totally different. The money received from the

over-allotment is required to be kept in a separate bank account. The main job of the

stabilizing agent begins only after trading in the share starts at the stock exchanges. In

case the shares are trading at a price lower than the offer price, the stabilizing agent starts

buying the shares by using the money lying in the separate bank account. In this manner,

by buying the shares when others are selling, the stabilizing agent tries to put the brakes

on falling prices. The shares so bought from the market are handed over to the promoters

from whom they were borrowed. In case the newly listed shares start trading at a price

higher than the offer price, the stabilizing agent does not buy any shares.

Then how would he return the shares? At this point, the company by exercising the

greenshoe option issues new shares to the stabilizing agent, which are in turn handed over

to the promoters from whom the shares were borrowed.

Conclusion

One of the benefits of using the greenshoe is its ability to reduce risk for the company

issuing the shares. It allows the underwriter to have buying power in order to cover their

short position when a stock price falls, without the risk of having to buy stock if the price

rises. In return, this helps keep the share price stable, which positively affects both the

issuers and investors.

Oriental Institute of Management

43

Analysis On Initial Public Offering

CHAPETR - 4

RESEARCH DESIGN AND METHODOLOGY

PART-4.1 SOURCES OF DATA

Data’s are the useful information or any forms of document designed in a systematic and

standardize manner which are used for some further proceedings. One of the important

tools for conducting marketing research is the availability of necessary and useful data.

Some time the data are available readily in one form or the other and some time the data

are collected afresh. The sources of Data fall under two categories, Primary Source and

Secondary Sources.

Primary Data- the primary data was collected through the following activities:

Filled the IPO Industry related questionnaire to managers of a select group of companies

And Paper Conversation

Oriental Institute of Management

44

Analysis On Initial Public Offering

Secondary Data- the secondary data was collected through the following:

Online Research material of the Various Financial Institution directly or indirectly

involved with IPO, Secondary Data used in External Source of Information Like internet,

magazine, paper cutting.

Oriental Institute of Management

45

Analysis On Initial Public Offering

PART-4.2 OTHER SOURCE

Information Sources

Information has been sourced from namely, books, newspapers, trade

journals, and white papers, industry portals, government agencies, trade

associations, monitoring industry news and developments, and through

access to access to more than 3000 paid databases.

Analysis Method

The analysis methods include the following: Ratio Analysis, Historical Trend

Analysis, Linear Regression Analysis using software tools, Judgmental

Forecasting and Cause and Effect Analysis etc.

Oriental Institute of Management

46

Analysis On Initial Public Offering

CHAPTER – 5

DATA ANALYSIS

PART-5.1 PAST/PRESENT AND FUTURE OF IPO IN INDIA

India’s rapid economic growth, robust corporate profit stability, and a four-year

bull run on Bombay’s Stock Exchange (BSE), continue to fuel India’s strong IPO

markets. “Keen investor interest in India’s strong growth story has been real acted in the

attractive valuations and key price/earnings multiples garnered by Indian companies,”

says R. Balanchine, IPO Leader, Strategic Growth Markets, Ernst & Young India. In

2006, India’s markets launched 78 IPO’s and raised US$7.23 billion. Currently, India’s

exchanges rank eighth in the world for numbers of IPO’s and value in 2006. Despite a

May 2006 market tumble that erased more than US$100 billion in value in the BSE and

sparked concerns that the four-year Indian stock rally was over, Indian IPO activity

quickly resumed its upward momentum. In 2006, India’s IPO market has been fairly

broad-based, although energy companies dominated with more than 50% share of funds

raised. In 2006, India’s largest IPO was petroleum rife nine company, Reliance

Petroleum, which raised US$1.8 billion, followed by the oil production and exploration

company, Cairn Energy, which raised US$1.3 billion. Real estate IPO’s also generated

stellar returns for investors.

In the United States, during the dot-com bubble of the late 1990s, many venture capital

driven companies were started, and seeking to cash in on the bull market, quickly offered

IPO’s. Usually, stock price spiraled upwards as soon as a company went public. Investors

sought to get in at the ground-level of the next potential Microsoft and Netscape.

Oriental Institute of Management

47

Analysis On Initial Public Offering

Initial founders could often become overnight millionaires, and due to generous stock

options, employees could make a great deal of money as well. The majority of IPOs

could be found on the NASDAQ stock exchange, which lists companies related to

computer and information technology. However, in spite of the large amounts of financial

resources made available to relatively young and untested firms (often in multiple rounds

of financing), the vast majority of them rapidly entered cash crisis. Crisis was particularly

likely in the case of firms where the founding team liquidated a substantial portion of

their stake in the firm at or soon after the IPO (Mudambi and Treichel, 2005).

This phenomenon was not limited to the United States. In Japan, for example, a similar

situation occurred. Some companies were operated in a similar way in that their only goal

was to have an IPO. Some stock exchanges were set up for those companies, such as

Osaka Securities Exchange.

Perhaps the clearest bubbles in the history of hot IPO markets were in 1929, when closed-

end fund IPOs sold at enormous premiums to net asset value, and in 1989, when closed-

end country fund IPOs sold at enormous premiums to net asset value. What makes these

bubbles so clear is the ability to compare market prices for shares in the closed-end funds

to the value of the shares in the funds' portfolios. When market prices are multiples of the

underlying value, bubbles are likely to be occurring.

Oriental Institute of Management

48

Analysis On Initial Public Offering

SECTOR: - Energy & Power

SECTOR:- INDUSTRIAL

SECTOR: - HOSPITALITY

* On the basis of listings # Offer price to closing price on 31stDecember 2009 Source: ARC

Oriental Institute of Management

49

Analysis On Initial Public Offering

SECTOR: TELECOM, MEDIA AND TECHNOLOGY

SECTOR: - CONSUMER GOODS AND RETAIL

SECTOR: OUTSOURCING

SECTOR: - EDUCATION

Oriental Institute of Management

50

Analysis On Initial Public Offering

* On the basis of listings # Offer price to closing price on 31stDecember 2009 Source: ARC

A Brief Note on Future of IPOs in India

Secondary markets out performed primary markets in 2009, but we expect 2010 will

be exciting performance for both primary and secondary markets

With more than 60 firms already in process for approval from SEBI to raise

approximate INR400B, we expect the number of draft offer documents filed with SEBI

will match the levels of 2007

The divestment programme is expected to gain the momentum in 2010, with

government expecting to raise INR500B by end of 2010.

2010 will see the IPOs of BSNL and RITES and FPO of SAIL

With the handy increase in liquidity in market and stabilization in secondary

markets, the companies will raise money with ease in early in 2010.

Oriental Institute of Management

51

Analysis On Initial Public Offering

PART-5.2 MAJOR PLAYERS OF IPO IN INDIA

Of the total amount mobilized through the primary market by corporate India, 4

issues raised over INR134B (85% of total IPO proceeds in 2009)

Out of the 17 issues that hit the capital market this year, as many as 8 were of the

size of less than INR 1,000M (including 4 less than INR500M)

Issue Size Issue Size Issue Price Price(INR) *Return

Company (INRM) ($M) (INRM) 31 Dec'09 (%)

NHPC 60,385 1,257.80 36 34.00 -5.60%

Adani Power 30,165 621.70 100 98.90 -1.20%

Oil India 27,772 571.80 1050 1241.00 18.20%

Indiabulls Power 15,291 332.00 45 34.90 -22.40%

Cox and Kings (INDIA) 6,105 131.30 330 452.20 37.00%

Pipavav Shipyard 4,956 102.80 58 54.20 -6.60%

Den Networks 3,900 82.40 195 196.00 0.50%

Mahindra Holdays &

Resorts India 2,780 57.00 300 473.00 57.70%

Raj Oil Mills 1,140 23.70 120 73.00 -39.20%

Jindal Cotex 844 17.40 75 96.00 28.00%

Oriental Institute of Management

52

Analysis On Initial Public Offering

* Offer price to closing price on 31stDec’09 Source:

ARC

PART- 5.3 CASE STUDY ON IPO ON Syncom Healthcare Ltd

(SHL)

Highlights of the issue:

SHL started as a marketing Company, which was outsourcing its requirement of finished

products (Under Its Own Brand And Drug License) from other formulation

manufacturing units based in and around Indore. Presently also SHL is outsourcing some

of its requirement of finished products. With these companies, SHL has a purchase and

sale arrangement where the supplier unit is manufacturing SHL’s products on SHL’s

specification and under SHL’s quality control under which SHL controls the quality of

raw material, their sourcing by the supplier as well as production in the units of these

suppliers. The manufactured goods, manufactured for SHL are sold to SHL on pre-

decided order prices for each formulation product so manufactured.

SHL has set up a manufacturing facility at Dehradun in the state of Uttrakhand, which is

a Tax free & duty free Zone. The Company set up its Plant at Dehradun and it has started

the commercial production in November, 2006.

Catering primarily to the domestic market, SHL manufactures and markets

pharmaceutical formulation under its own brand name in four product segments —

generics, OTC (over the counter), ethical and herbal. It also undertakes contract

manufacturing for various pharmaceutical formulations, neutraceutical products, food

supplements and cosmetics for domestic companies such as Lupin and Piramal

Oriental Institute of Management

53

Analysis On Initial Public Offering

Healthcare. Further, it recently added other companies such as Wockhardt, Klar Sehen

and Canixa Sciences to its existing list of contract manufacturing companies.

SHL reported operating income and Profit after Tax (PAT) for the 4MFY10 of Rs. 2.42

crs and Rs. 1.60 crs respectively. For FY09 the same was reported at Rs 6.55 crs and Rs

3.81 crs respectively.

Issue Snapshot:

Issue period January 27 – January 29, 2010

Price Band: Rs. 65 – Rs. 75

Issue Size: Rs. 48.75 cr – Rs. 56 cr

Issue Size: 75,00,000 equity shares

QIB atleast 37,50,000 eq sh

Retail atleast 26,25,000 eq sh

Non Institutional atleast 11,25,000 eq sh

Face Value: Rs 10

Book value: Rs 21.29 (March 31, 2009)

Bid size: 90 equity shares and in multiples thereof

100% Book built Issue

Oriental Institute of Management

54

Analysis On Initial Public Offering

Capital Structure:

Pre Issue Equity: Rs. 10.00 cr

Post issue Equity: Rs. 17.50 cr

Listing: BSE & NSE

Lead Manager: Chartered Capital and Investment Ltd.

Registrar to issue: Link Intime India Pvt Ltd

CARE IPO grading: 2/5 indicating average fundamentals

Current Shareholding Pattern:

Share Holding Pattern Pre Issue % Post Issue %

Promoters and Promoters Group 100 57.14

Public (Incl institutions) * 42.86

Total 100 100

Source: HDFC securities

Objects of Issue:

The objects of the Issue are:

· To set up new manufacturing unit at Indore SEZ for manufacturing of various

pharmaceuticals formulations.

· To undertake the upgradation / modernization facilities at Dehradun Plant.

· To meet working capital requirements.

· To set up an Export office in Mumbai.

Oriental Institute of Management

55

Analysis On Initial Public Offering

· To undertake “Brand & Product Registration and Approval”.

· General Corporate purposes.

· To meet issue expenses.

Means of Finance: The entire fund requirement will be met from the proceeds of the

fresh issue and from internal accruals.

Fund Requirement: Rs. Cr.

Total Fund Fund Estimated schedule

S.No

Activity requiremen already of deployment of

.

t deployed balance fund

2009-10 2010-11

To set up new manufacturing

1 unit at Indore SEZ 20.48 0.00 3.50 16.98

To undertake the Up gradation/

modernization of manufacturing

2 facilities at Dehradun 6.62 0.66 3.49 2.47

To meet Working Capital

3 Requirements 15.00 0.00 6.00 9.00

For opening Export Office at

4 Mumbai 4.00 0.00 3.00 1.00

For "Brand & Product

5 Registration and Approval" 3.00 0.00 0.75 2.25

Oriental Institute of Management

56

Analysis On Initial Public Offering

6 General Corporate Purpose * 0.00 * *

7 Issue Expenses * 0.00 * *

Total * 0.58 * *

Source: HDFC securities

Risks & Concerns:

· Top 10 customers constitutes 68.95%, 68.77%, 55.59%, 51.56%, 40.25% of sales

during the FY 2009, 2008, 2007, 2006, 2005 respectively and loss of any one or more of

clients could adversely affect SHL’s business and financial operations.

· The sundry debtors of the company are very high & Debtors outstanding for a period

over six months have increased manifold from the year 2006-07 to the year 2007-2008.

· SHL’s dependency on few suppliers could affect the financial position and operations

of the company if these suppliers fail to provide the raw materials of specified quality and

quantity at proper time at reasonable rates to the company.

· There are no supply agreements for the raw materials required for manufacturing of

SHL’s products. Volatility in the prices of the raw material could have an adverse impact

on its business and financial operations.

· SHL’s business is dependent on the decisions and actions of its customers, and there

are number of factors relating to its customers that are outside its control that might result

in the termination of contract or the loss of any customer. Any of these factors could

Oriental Institute of Management

57

Analysis On Initial Public Offering

adversely affect the business operations and in turn adversely affect SHL’s financial

operations.

· Business of SHL depends on its manufacturing facility. Any loss of or shutdown of

operations of the manufacturing facility on any grounds could adversely affect its

business or results of operations.

· SHL’s inability to fulfill export obligations could result in custom duty liability, which

in turn could adversely affect its financial operations to that extent.

· SHL’s business (pharmaceutical formulations) inherently exposes it to potential

liability. Also, product liability claims could require a pharmaceutical company to spend

money on litigation, divert management's time, damage a company's reputation and affect

the marketability of a company's products.

· Total income of SHL has grown from Rs.11.60 crore in fiscal year 2003 to Rs. 60.56

crore in the fiscal year 2009 at a growth rate of 55.66%, (13.90)%, 24.28%, 58.93%,

78.85% and 10.21% year on year. Profit after tax has grown from Rs.0.10.crore in fiscal

year 2003 to Rs.3.81 crore in the fiscal year 2009 at a growth rate of (1.01)%, (46.44)%,

289.98%, 1115.59%, 33.53% and 4.04% year on year. It, may not be able to sustain its

growth or maintain a similar rate of growth in the future due to a variety of reasons

including a decline in the demand for its products, increased competition, non-availability

of professionals with necessary skill sets, lack of management resources or due to a

general slowdown in the economy. A failure to sustain its growth may have a material

adverse effect on its financial condition and results of operations.

· SHL operates in a highly competitive environment. Significant additional competition

in the markets where it sells its products may erode market share and may result in

Oriental Institute of Management

58

Analysis On Initial Public Offering

reduced prices and thereby may negatively affect its revenues and profitability.

Competition from competent low cost competitors may adversely impact SHL’s

revenues.

Conclusion:

SHL’s total income has grown at a CAGR of 47% over the past three years primarily

driven by increase in sales volume from SHL’s manufacturing unit, which became

operational during FY07. During FY 09 total income increased by 17% to Rs. 60.56 crore

which was backed by overall increase in sales from traded and manufactured goods.

During FY09 SHL earned an EPS of Rs. 3.78 compared to Rs.4.55 during FY08. The dip

in EPS was on account of increase in share capital on account of issue of equity shares to

promoters at par coupled with moderate increase in PAT

The small size of operations, relatively lesser experience in manufacturing, modest

branded product portfolio and competitive nature of Indian formulations market,

moderate profitability, longer working capital cycle, restriction on SHL’s access to export

markets on certain brands and pricing at 23.6 – 27.3 times FY10 (E) EPS (some peers

available at single digit P/E) makes the issue unattractive.

Oriental Institute of Management

59

Analysis On Initial Public Offering

CHAPTER-6

FINDINGS AND CONCLUSION

MAJOR FINDINGS

Indian IPO Market Touched Bottom of Last 5 Years

30% of the top 10 IPOs of 2009 actually were the IPOs of 2008 or 2007, which

could not hit market earlier when markets were going south

NHPC, Adani Power and Cox&Kings waited for more than a year to get listed on

stock exchange in 2009, though they received SEBI approval in 2007 or 2008

Despite a surge in the secondary market, the IPO market witnessed just 17* issues in

2009 compared to 37* and 103* public issues got listed in 2008 and 2007 respectively

In terms of the proceeds, 2009 raised INR157B from the market as compared to

INR185B in 2008 and INR342B in 2007

Oriental Institute of Management

60

Analysis On Initial Public Offering

Most of the IPO activities witnessed in 2 nd half of 2009. 15* out of the 17* IPOs

came in the 2nd half which garnered INR156.5B out of the total 2009 proceeds of

INR157B

In Jun’ 09, SEBI introduced the concept of anchor investors to help the price

discovery process, and lower listing day volatility by bringing in a class of investors with

a slightly longer term view

An anchor investor (who cannot be a promoter of the company) can subscribe up to

half of the 60% portion reserved for qualified institutional buyers in an IPO, but have to

stay invested in the issue for a month after listing

Also, unlike other QIBs who need to pay only 10% as margin money, an anchor

investor has to cough up 25% and follow it up with the remaining 75% within two days

of the closure of the issue

An anchor investor gets firm allotment of shares, as opposed to the proportionate

allotment that other QIB constituents would

SEBI also extended the ASBA (application supported blocked amount) facility to

corporate investors and high net worth individuals (HNIs) to enable them to apply for

IPOs or rights issue by keeping the application money in their bank accounts till

allotment with effect from 1Jan’10

CONCLUSION

Oriental Institute of Management

61

Analysis On Initial Public Offering

IPO is used by a company to raise its funds. The extra amount obtained from

public may be invested in the development of the company, although it costs a little to a

company but it gives a way to get more money for long term investments.

CHAPTER-7

LIST OF ABBRIVIATIONS AND DEFINITIONS

Allotment Issue of Equity Shares of the Company pursuant to the Public Issue to the

successful Bidders.

Allottee The successful Bidder to whom the Equity Shares are being issued.

Bankers to the Issue ICICI Bank Limited, Standard Chartered Bank, Deutsche Bank, Kotak

Mahindra Bank Limited

Bid An indication to make an offer made during the Bidding Period by a

prospective investor to subscribe to Equity Shares of the Company at a

price within the Price Band, including all revisions and modifications

thereto

Bid Price / Bid Amount The amount equal to highest value of the optional Bids indicated in the

Bid cum Application Form and payable by the Bidder on submission of

the Bid in the Issue

Bid Opening Dates / Issue The date on which the Syndicate Members shall start accepting Bids for

Opening Date the Issue, which shall be the date notified in a widely circulated English

national newspaper, a Hindi national newspaper and a Marathi regional

Oriental Institute of Management

62

Analysis On Initial Public Offering

newspaper

Bid Closing Date / Issue The date after which the Syndicate Members will not accept any Bids for

Closing Date the Issue, which shall be notified in a widely circulated English national

newspaper, a Hindi national newspaper and a Marathi regional newspaper

Bid cum Application Form The Form in terms of which the Bidder shall make an offer to purchase

the Equity Shares of the Company and which will be considered as the

application for allotment of the Equity Shares in terms of this Red

Herring Prospectus

Bidder Any prospective investor who makes a Bid pursuant to the terms of this

Red Herring Prospectus

Bidding Period / Issue The period between the Bid/Issue Opening Date and the Bid/Issue

Period Closing Date inclusive of both days and during which prospective

Bidders can submit their Bids

Book Building Process Book building route as provided under Chapter XI of the SEBI

Guidelines, in terms of which, this Issue is being made

BRLM Book Running Lead Manager to the Issue.

CAN / Confirmation of The note or advice or intimation of allocation of Equity Shares sent to the

Allocation Note Bidders who have been allocated Equity Shares in accordance with the

Book Building Process

Cap Price The higher end of the Price Band, above which the Issue Price will not be

finalized and above which no bids will be accepted

Cut-off price Cut-off price refers to any price within the Price Band. A Bid submitted

at Cut-off is a valid Bid at all price levels within the Price Band

Designated Stock Exchange Bombay Stock Exchange Limited and National Stock Exchange Limited

Designated Date The date on which the funds are transferred from the Escrow Account of

the Company to the Public Issue Account after the Prospectus is filed

with the ROC, following which the Board of Directors shall allot Equity

Shares to successful bidders

Red Herring Prospectus This Red Herring Prospectus issued in accordance with Section 60B of

the Companies Act, which does not have complete particulars on the

price at which the Equity Shares are offered and size of the Issue. It

carries the same obligations as are applicable in case of a Prospectus and

Oriental Institute of Management

63

Analysis On Initial Public Offering

will be filed with ROC at least three days before the bid/offer opening

date. It will become a Prospectus after filing with ROC after the pricing

Equity Shares Equity Shares of the Company of the face value Rs. 10 each, unless

otherwise specified in the context thereof

Escrow Account Account opened with the Escrow Collection Bank(s) and in whose favour

the Bidder will issue cheques or drafts in respect of the Bid Amount and

refunds (if any) of the amount collected to the Bidders

Escrow Agreement Agreement entered into amongst the Company, the Registrar, the Escrow

Collection Bank(s), the Syndicate Members and the BRLMs for

collection of the Bid Amounts and refunds (if any) of the amounts

collected to the Bidders

Escrow Collection Bank(s) ICICI Bank Limited, Standard Chartered Bank, Deutsche Bank, Kotak

Mahindra Bank Limited

First Bidder The Bidder whose name appears first in the Bid cum Application Form or

Revision Form

Floor Price The lower end of the Price Band, below which the Issue Price will not be

finalized and below which no Bids will be accepted

Issuer Syncom Healthcare Ltd (SHL)

Issue Price The final price at which Equity Shares will be issued and allotted in terms

of this Red Herring Prospectus, as determined by the Company in

consultation with the BRLMs, on the Pricing Date

Margin Amount The amount paid by the Bidder at the time of submission of his/her Bid,

being 10% to 100% of the Bid Amount

Members of the Syndicate The BRLM and the Syndicate Members

Non-Institutional Bidders All Bidders that are not Qualified Institutional Buyers, or Retail

Individual Bidders and who have Bid for Equity shares for an amount

more than Rs.1,00,000.

Pay-in-date The last date specified in the CAN sent to the Bidders

Pay-in-Period This term means

Oriental Institute of Management

64

Analysis On Initial Public Offering

(i) With respect to Bidders whose Margin Amount is 100% of the Bid

Amount, the period commencing on the Bid/issue Opening Date and

extending until the Bid/issue Closing Date, and

(ii) With respect to Bidders whose Margin Amount is less than 100% of

the Bid Amount, the period commencing on the Bid/issue Opening

Date and extending until the closure of the Pay-in-Date

Price Band The Price band of a minimum price (Floor Price) of Rs.65/- and the

maximum price (Cap Price) of Rs. 75/- and includes revision thereof

Pricing Date The date on which the Company in consultation with the BRLM finalizes

the Issue Price

Prospectus The Prospectus filed with the ROC containing, inter alia, the Issue Price

that is determined at the end of the Book Building Process, the size of the

Issue and certain other information

Public Issue Account In accordance with Section 73 of the Companies Act, 1956, an account

opened with the Banker(s) to the Issue to receive monies from the Escrow

Account for the Issue on the Designated Date

QIB Portion The portion of the net issue being not less than mandatory 37,50000

Equity Shares of Rs. 10 each at the Issue Price, available for allocation to

QIBs

Qualified Institutional Public Financial Institutions as specified in Section 4A of the Companies

Act, Scheduled Commercial Banks, Mutual Funds registered with SEBI,

Buyers/ QIBs

Foreign Institutional Investors registered with SEBI, Multilateral And

Bilateral Development Financial Institutions, Venture Capital Funds

registered with SEBI, Foreign Venture Capital Investors registered with

SEBI, State Industrial Development Corporations, Insurance Companies

registered with the Insurance Regulatory And Development Authority

(IRDA), Provident Funds with a minimum corpus of Rs.2500 Lakhs and

Pension Funds with a minimum corpus of Rs. 2500 Lakhs.

Retail Individual Bidders Individual Bidders (including HUFs and NRIs) who have not Bid for an