Professional Documents

Culture Documents

Adjusting

Adjusting

Uploaded by

openid_Z0YayEPS0 ratings0% found this document useful (0 votes)

3 views1 pageThe document outlines adjustments to various accounts including: 1) allocating 5% of accounts receivable to bad debts expense; 2) recognizing 3 months of prepaid rent expense for the period of June 1 to August 31, 2010; and 3) calculating depreciation expense for the period on furniture and fixtures with a 3% annual rate and equipment with a 10 year useful life and $4,000 scrap value. It also includes adjusting supplies expense for the 30% of supplies remaining and calculating interest expense on accounts payable with an interest rate of 25% per month.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines adjustments to various accounts including: 1) allocating 5% of accounts receivable to bad debts expense; 2) recognizing 3 months of prepaid rent expense for the period of June 1 to August 31, 2010; and 3) calculating depreciation expense for the period on furniture and fixtures with a 3% annual rate and equipment with a 10 year useful life and $4,000 scrap value. It also includes adjusting supplies expense for the 30% of supplies remaining and calculating interest expense on accounts payable with an interest rate of 25% per month.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageAdjusting

Adjusting

Uploaded by

openid_Z0YayEPSThe document outlines adjustments to various accounts including: 1) allocating 5% of accounts receivable to bad debts expense; 2) recognizing 3 months of prepaid rent expense for the period of June 1 to August 31, 2010; and 3) calculating depreciation expense for the period on furniture and fixtures with a 3% annual rate and equipment with a 10 year useful life and $4,000 scrap value. It also includes adjusting supplies expense for the 30% of supplies remaining and calculating interest expense on accounts payable with an interest rate of 25% per month.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

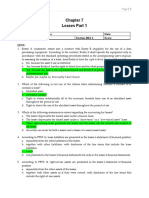

Adjusting Data

A. 5% of the accounts receivable is allotted for bad debts.

Bad debts Expense

Allowance for bad debts

75,000 x .05 = 3,750

B. Prepaid rent represents 3 months starting June 1, 2010.

Rent Expense

Prepaid Rent

9,000/3 months =3,000 x .07 = 210

C. 30% of the supplies still on hand.

Supplies Expense

Supplies

18115 x .30 = 5434.5

D. The Furnitures and Fixtures has an annual depreciation of 3% starting June 1,2010.

Depreciation Expense - F&F

Accumulated Depreciation - F&F

16,300 x .03 = 489/12 = 40.75 x 8 = 326

E. The eq. has estimated useful life of 10 years w/ a scrap value of 4,000 purchased June 1,2010

Depreciation Expense - Equipment

Accumulated Depreciation - Equipment

141000 – 4000/10 = 13,700

F. Accounts Payable has interest rate of 25% per month due December 21,2010

Interest Expense

Interest Payable

1,125 x .25 = 281.25/360 = 0.78 x 10 = 7.8

You might also like

- Frankwood Question Bank DSEDocument19 pagesFrankwood Question Bank DSEAu Tsz Man50% (4)

- Bonds PayableDocument9 pagesBonds PayableKayla MirandaNo ratings yet

- Adjusting Entries Exercises - EditedDocument4 pagesAdjusting Entries Exercises - EditedCINDY LIAN CABILLON100% (2)

- Use The Following Information To Answer Items 1 To 4Document4 pagesUse The Following Information To Answer Items 1 To 4Chris Jay LatibanNo ratings yet

- Chapter 5 - Employee Benefits Part 1Document7 pagesChapter 5 - Employee Benefits Part 1XienaNo ratings yet

- Class Example and Notes Taking - 1020Document3 pagesClass Example and Notes Taking - 1020Rasha YatmeenNo ratings yet

- Exercise. AdjustmentsDocument6 pagesExercise. AdjustmentsDavid Con Rivero79% (14)

- Intermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa IiiDocument3 pagesIntermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa Iiimiljane perdizoNo ratings yet

- Lease Practical Accounting ProblemsDocument2 pagesLease Practical Accounting ProblemsCamille BonaguaNo ratings yet

- Practice 1 - AnswerDocument2 pagesPractice 1 - AnswerNatanael SiraitNo ratings yet

- Examination About Investment 13Document2 pagesExamination About Investment 13BLACKPINKLisaRoseJisooJennieNo ratings yet

- FA1 Chapter 1 EngDocument21 pagesFA1 Chapter 1 EngYong ChanNo ratings yet

- Untitled 1Document2 pagesUntitled 1bebshinodaNo ratings yet

- FM I - Tutorial Excercise 2 Ch3Document2 pagesFM I - Tutorial Excercise 2 Ch3natnaelsleshi3No ratings yet

- Adjusting EntriesDocument30 pagesAdjusting EntriesRizza Morada100% (1)

- NBruk Week 2 Problem SetDocument4 pagesNBruk Week 2 Problem SetNat Ali100% (1)

- Adjusting Entries ProblemsDocument5 pagesAdjusting Entries ProblemsDirck VerraNo ratings yet

- Chap009 doc-HebaGazzazDocument5 pagesChap009 doc-HebaGazzazmdsalmanskib27No ratings yet

- CHP 6 - Time Value of MoneyDocument11 pagesCHP 6 - Time Value of MoneyShahnawaz KhanNo ratings yet

- Applied - 4 Semi-FinalDocument8 pagesApplied - 4 Semi-FinalMarjorieNo ratings yet

- 1.31.2022 Adjusting EntriesDocument1 page1.31.2022 Adjusting EntriesNicole Capistrano PabillarNo ratings yet

- Midterm Solved 2Document9 pagesMidterm Solved 2hamna wahabNo ratings yet

- Math Mini PTDocument11 pagesMath Mini PTMary Beth Rebayla CamsonNo ratings yet

- CF Unit 2 Solutions 09-01-2022Document22 pagesCF Unit 2 Solutions 09-01-2022SuganyaNo ratings yet

- 6 - Time Value of Money - MyraDocument38 pages6 - Time Value of Money - MyraJeson MalinaoNo ratings yet

- Maths Final orDocument5 pagesMaths Final ortemedebereNo ratings yet

- Chapter Four Lecture Notes On Business MathematicsDocument24 pagesChapter Four Lecture Notes On Business MathematicsErmias Guragaw100% (3)

- Quizzer 1Document4 pagesQuizzer 1Arvin John MasuelaNo ratings yet

- Financial Accounting IIDocument16 pagesFinancial Accounting IIMiguel BuenoNo ratings yet

- Financial Accounting IIDocument16 pagesFinancial Accounting IIMiguel BuenoNo ratings yet

- Question MolarDocument3 pagesQuestion MolarKian TuckNo ratings yet

- Continuation of Partnership AccountingDocument12 pagesContinuation of Partnership AccountingMujieh NkengNo ratings yet

- P Tax ExamplesDocument4 pagesP Tax Examplespankaj kumarNo ratings yet

- InterestDocument41 pagesInterestClariza Mae BaisaNo ratings yet

- Use The Following Information For The Next Five Questions:: ST TH THDocument2 pagesUse The Following Information For The Next Five Questions:: ST TH THRiah LuchaNo ratings yet

- Debenture 10 Years ExplanationDocument17 pagesDebenture 10 Years Explanationoldtaxi9No ratings yet

- Time ValueDocument10 pagesTime ValueBhaskar VishalNo ratings yet

- Accting PPT Simple and Compound InterestDocument39 pagesAccting PPT Simple and Compound InterestAlmarie gil0% (1)

- Unit 4 MMDocument21 pagesUnit 4 MMChalachew EyobNo ratings yet

- Time Value of Money-ExercisesDocument15 pagesTime Value of Money-Exerciseshassan baradaNo ratings yet

- W2 Time Value of MoneyDocument20 pagesW2 Time Value of Moneyasif rahanNo ratings yet

- St. Mary'S University Department of Accounting Advanced Accounting MID EXAM (30%)Document7 pagesSt. Mary'S University Department of Accounting Advanced Accounting MID EXAM (30%)temedebereNo ratings yet

- ACC314 A31 ProblemsDocument12 pagesACC314 A31 ProblemsaceNo ratings yet

- Biochemical CorpDocument2 pagesBiochemical CorpKaran SinghNo ratings yet

- Present Value ProblemDocument2 pagesPresent Value ProblemTricia LuceroNo ratings yet

- 23232424Document15 pages23232424JV De Vera100% (1)

- Karma Company Sells Televisions at An Average Price of P7Document1 pageKarma Company Sells Televisions at An Average Price of P7Nicole AguinaldoNo ratings yet

- FM I Chapter 3Document12 pagesFM I Chapter 3mearghaile4No ratings yet

- Engr Econ Practice Exam 2011Document6 pagesEngr Econ Practice Exam 2011Beverly PamanNo ratings yet

- Arpia Lovely Rose Quiz Chapter 7 Leases Part 1Document3 pagesArpia Lovely Rose Quiz Chapter 7 Leases Part 1Lovely ArpiaNo ratings yet

- Home Mortgage - College AlgebraDocument11 pagesHome Mortgage - College AlgebraDebalina Dass100% (1)

- FNCE 5101 Assignment1 SolutionsDocument2 pagesFNCE 5101 Assignment1 Solutionsmauricio0327No ratings yet

- Annuity: Sinking Fund and AmortizationDocument6 pagesAnnuity: Sinking Fund and AmortizationMaria Monica DaculloNo ratings yet