Professional Documents

Culture Documents

PSE Daily Stock Quotations Report

Uploaded by

srichardequipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PSE Daily Stock Quotations Report

Uploaded by

srichardequipCopyright:

Available Formats

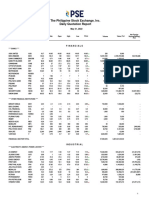

Report date: 06/01/2009 12:10 PM PHILIPPINE STOCK EXCHANGE

Trade date: Monday 06/01/2009 DAILY QUOTATIONS REPORT Page: 1

NET FOREIGN

NAME SYMBOL BID ASK OPEN HIGH LOW CLOSE VOLUME VALUE

TRADE (Peso)

BUYING (SELLING)

------------------------------------------------------------------------------------------------------------------------------------

F I N A N C I A L

**** BANKS ****

ASIATRUST DEV. BANK, INC. ASIA 5.50 5.60 5.60 5.6 5.5 5.5! 3,000 16,700 -

BANCO DE ORO UNIBANK,INC BDO 34.50 35.00 33.50 35.5 33.5 35! 4,006,700 138,537,750 38,249,750

BANK OF THE PHIL. ISLANDS BPI 46.00 46.50 44.50 47 44 46.5! 1,598,200 72,829,150 41,672,650

CHINA BANKING CORP. CHIB 370.0 372.5 362.5 375 362.5 370! 19,340 7,163,850 -

CHINATRUST COMM. BANK CHTR 15.25 27.00 - - - - - - -

CITYSTATE SAVINGS BANK CSB 24.50 27.00 - - - - - - -

METROPOLITAN BANK & TRUST MBT 35.50 36.00 34.00 36.5 34 36! 3,499,500 124,398,800 6,584,050

PHIL. BANK OF COMM. "A" PBC 35.00 45.00 - - - - - - -

PHILIPPINE NATIONAL BANK PNB 21.50 21.75 21.75 21.75 21.25 21.75! 1,159,200 24,994,525 546,250

PHIL. SAVINGS BANK PSB 33.00 40.00 40.00 40 40 40 100 4,000 -

RIZAL COMM. BANKING CORP. RCB 15.75 16.00 15.25 16 15.25 15.75! 329,400 5,163,850 ( 2,401,825)

SECURITY BANK CORPORATION SECB 41.50 42.00 42.00 43 42 42 179,600 7,658,400 ( 4,353,250)

UNION BANK OF THE PHIL. UBP 25.00 25.50 24.75 25.5 24.75 25! 1,339,800 33,678,000 ( 9,720,000)

**** OTHER FINANCIAL INSTITUTIONS ****

ATR KIMENG FIN. CORP. ATRK 2.40 4.20 - - - - - - -

BANKARD, INC. BKD 1.10 1.12 1.08 1.1 1.06 1.1! 121,000 130,300 -

BDO LEASING & FIN., INC. BLFI 1.28 1.30 1.30 1.3 1.28 1.28" 4,000 5,160 ( 2,600)

CITISECONLINE.COM, INC. COL 7.30 7.40 7.60 7.6 7.2 7.3" 1,088,000 7,889,400 58,400

FIRST ABACUS FINANCIAL FAF .5500 .7500 - - - - - - -

FILIPINO FUND, INC FFI 5.60 6.00 - - - - - - -

FIRST METRO INVEST. CORP FMIC 31.00 34.00 31.00 34 31 34 1,100 36,350 -

I-REMIT, INC. I 4.00 4.40 4.45 4.45 4.1 4.1" 21,000 86,450 -

MEDCO HOLDINGS MED .2000 .2200 .2300 .23 .23 .23 1,720,000 395,600 -

MANULIFE FINANCIAL CORP. MFC 770.0 835.0 - - - - - - -

NAT'L REINSURANCE CORP. NRCP 1.72 1.74 1.72 1.72 1.72 1.72" 110,000 189,200 -

PHIL. STOCK EXCHANGE INC. PSE 287.5 295.0 292.5 295 290 295! 15,500 4,512,925 -

SUN LIFE FINANCIAL, INC. SLF 990.0 995.0 990.0 995 990 995! 150 149,100 -

VANTAGE EQUITIES, INC. V 1.12 1.14 1.12 1.14 1.12 1.12" 1,352,000 1,520,420 -

I N D U S T R I A L

**** ELECTRICITY, ENERGY, POWER & WATER ****

ALSONS CONS. RES., INC. ACR .5500 .6300 .5600 .56 .56 .56" 100,000 56,000 -

ABOITIZ POWER CORPORATION AP 5.30 5.40 5.30 5.4 5.3 5.3 4,675,000 24,777,700 6,365,300

ENERGY DEV'T (EDC) CORP. EDC 3.65 3.70 3.65 3.7 3.65 3.7! 18,369,000 67,059,050 ( 23,583,300)

FIRST GEN CORPORATION FGEN 19.25 19.50 20.00 20 19.25 19.5" 2,179,900 42,207,575 ( 3,836,900)

FIRST PHIL HLDGS CORP FPH 28.00 28.50 28.50 28.5 28 28.5! 1,456,300 40,925,200 4,153,250

MANILA ELECTRIC COMPANY MER 117.0 118.0 116.0 118 114 118! 446,140 51,932,010 17,380,390

MANILA WATER CO., INC. MWC 13.75 14.00 14.00 14.25 13.75 14 4,655,200 65,137,350 ( 41,622,000)

PETRON CORPORATION PCOR 5.90 6.00 5.80 6 5.8 6 1,585,000 9,353,700 8,235,500

PHOENIX PETROLEUM PHILS. PNX 5.80 6.00 6.00 6 5.8 6! 22,000 130,100 -

EAST ASIA POWER RES. CORP PWR .3000 .3300 .3100 .31 .31 .31 110,000 34,100 -

SPC POWER CORPORATION SPC 2.10 3.00 - - - - - - -

TRANS-ASIA OIL AND ENERGY TA 1.06 1.08 1.04 1.08 1.04 1.06! 475,000 507,800 -

VIVANT CORPORATION VVT 4.10 5.80 - - - - - - -

**** FOOD, BEVERAGE & TOBACCO ****

ALASKA MILK CORPORATION AMC 4.30 4.40 4.40 4.4 4.4 4.4 17,000 74,800 8,800

AGRINURTURE, INC. ANI 20.00 23.00 22.75 22.75 22.75 22.75" 20,000 455,000 -

CADP GROUP CORPORATION CAC 1.60 2.20 - - - - - - -

CEN AZUCAR DE TARLAC CAT 1.78 3.50 - - - - - - -

GINEBRA SAN MIGUEL, INC. GSMI 15.00 15.75 15.25 15.5 15.25 15.5! 648,200 9,891,800 -

JOLLIBEE FOODS CORP. JFC 49.00 49.50 48.00 50 48 49.5! 1,138,000 56,029,850 16,872,300

PANCAKE HOUSE, INC. PCKH 6.00 10.00 - - - - - - -

PEPSI-COLA PRODUCTS PHILS PIP 1.36 1.38 1.38 1.38 1.36 1.38! 12,218,000 16,695,080 ( 1,785,180)

RFM CORPORATION RFM .3300 .3400 .3400 .34 .34 .34" 1,200,000 408,000 -

ROXAS HOLDINGS, INC. ROX 2.70 3.00 - - - - - - -

SWIFT FOOD, INC. SFI .2000 .2300 .2000 .2 .2 .2" 30,000 6,000 -

SAN MIGUEL BREWERY, INC. SMB 9.20 9.40 9.10 9.2 9.1 9.2! 85,000 776,300 -

SAN MIGUEL CORP. "A" SMC 52.50 53.00 53.00 53 52 52.5! 52,500 2,756,350 -

SAN MIGUEL CORP. "B" SMCB 52.50 53.50 53.00 53.5 52.5 53.5! 100,300 5,336,100 1,263,450

TANDUAY HOLDINGS, INC. TDY 2.70 3.30 - - - - - - -

PHIL TOB FLUE CUR & REDRY TFC 10.25 - - - - - - - -

ALLIANCE TUNA INT'L. INC. TUNA 1.34 1.36 1.32 1.34 1.3 1.34! 8,489,000 11,280,560 ( 27,400)

UNIVERSAL ROBINA CORP. URC 8.20 8.30 8.30 8.4 8.2 8.2 13,547,000 111,197,900 ( 18,544,300)

VITARICH CORPORATION VITA .1550 .1850 .1400 .155 .14 .155! 270,000 41,700 -

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

BACNOTAN CONS INDUS INC. BCI 8.10 8.20 8.20 8.2 8.1 8.1" 19,000 154,400 ( 32,400)

CONCRETE AGGREGATES "A" CA - 65.00 - - - - - - -

SOUTHEAST ASIAN CEMENT CMT .8900 .9000 .8400 .9 .83 .9! 11,360,000 9,760,400 -

ENGINEERING EQUIP. INC. EEI 1.84 1.86 1.86 1.9 1.84 1.86! 5,870,000 10,945,120 ( 6,867,460)

FEDERAL RES. INV. GROUP FED 6.50 13.00 - - - - - - -

HOLCIM PHILIPPINES, INC. HLCM 3.80 3.85 3.85 3.95 3.8 3.8" 2,329,000 8,938,650 ( 2,904,750)

REPUBLIC CEMENT CORP. RCM 2.30 2.38 2.30 2.36 2.3 2.36! 445,000 1,045,260 -

SUPERCITY RLTY DEV. CORP. SRDC .4800 - - - - - - - -

TKC STEEL CORPORATION T 3.45 3.50 3.45 3.65 3.45 3.5! 168,000 592,800 ( 17,500)

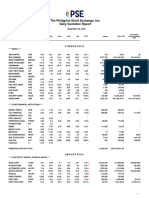

Report date: 06/01/2009 12:10 PM PHILIPPINE STOCK EXCHANGE

Trade date: Monday 06/01/2009 DAILY QUOTATIONS REPORT Page: 2

NET FOREIGN

NAME SYMBOL BID ASK OPEN HIGH LOW CLOSE VOLUME VALUE

TRADE (Peso)

BUYING (SELLING)

------------------------------------------------------------------------------------------------------------------------------------

VULCAN IND'L VUL .7800 .8400 - - - - - - -

**** CHEMICALS ****

CHEMREZ TECHNOLOGIES, INC COAT 2.16 2.18 2.10 2.22 2.1 2.18! 242,000 526,940 -

EURO-MED LAB. PHIL., INC. EURO 1.40 1.50 1.50 1.5 1.5 1.5" 2,000 3,000 ( 3,000)

MANCHESTER INTERNATIONAL MIH .3500 - - - - - - - -

MANCHESTER INT'L "B" MIHB .6000 .7500 - - - - - - -

MABUHAY VINYL CORP. MVC .6000 .7000 - - - - - - -

**** DIVERSIFIED INDUSTRIALS ****

IONICS, INC. ION 1.28 1.36 1.30 1.38 1.3 1.38! 20,000 27,240 -

MUSX CORPORATION MUSX .1100 .1150 .1150 .12 .11 .115 63,980,000 7,224,450 12,100

PANASONIC MFG PHIL CORP PMPC 6.10 6.20 - - - - - - -

SPLASH CORPORATION SPH 2.85 2.90 2.90 3 2.9 2.9 1,215,000 3,549,250 ( 2,211,500)

H O L D I N G F I R M S

**** HOLDING FIRMS ****

ASIA AMALGAMATED HOLDINGS AAA .1600 .2300 - - - - - - -

ABACUS CONS. RES. & HLDG. ABA .9500 .9800 .9600 .98 .96 .98! 580,000 560,700 -

ATOK-BIG WEDGE.,INC. B ABB 2.26 - - - - - - - -

AYALA CORPORATION AC 305.0 307.5 290.0 312.5 290 305! 831,800 252,490,175 41,292,050

ABOITIZ EQUITY VENTURES AEV 6.00 6.10 6.10 6.3 6 6 1,074,000 6,518,100 1,689,500

ALLIANCE GLOBAL GROUP INC AGI 3.15 3.20 3.05 3.2 2.95 3.2! 34,160,000 107,004,900 ( 59,302,850)

AJO.NET HOLDINGS, INC. AJO .0575 .0600 .0600 .06 .06 .06! 12,600,000 756,000 -

A. SORIANO CORPORATION ANS 2.34 2.38 2.38 2.4 2.38 2.38 35,000 83,400 ( 71,400)

ALCORN GOLD RES. CORP. APM .0090 .0095 .0090 .009 .009 .009 61,000,000 549,000 -

ATN HOLDINGS, INC. ATN 3.85 4.00 4.00 4.05 3.9 4.05" 150,000 590,000 -

ATN HOLDINGS, INC. "B" ATNB 4.00 4.15 4.15 4.15 4.15 4.15 3,000 12,450 -

BENPRES HOLDINGS CORP. BPC 1.88 1.90 1.92 1.92 1.86 1.9" 11,773,000 22,274,220 ( 5,617,360)

DMCI HOLDINGS, INC. DMC 7.40 7.50 7.30 7.5 7.2 7.5! 3,900,000 28,959,800 ( 5,638,800)

FILINVEST DEV. CORP. FDC 1.92 1.94 1.82 1.92 1.82 1.92! 535,000 1,015,840 ( 37,600)

F&J PRINCE HOLDINGS CORP. FJP 1.02 1.10 1.02 1.02 1.02 1.02" 631,000 643,620 -

F&J PRINCE HLDGS. "B" FJPB 1.02 - - - - - - - -

HOUSE OF INVESTMENTS,INC. HI 1.70 1.76 - - - - - - -

J.G. SUMMIT HOLDINGS, INC JGS 5.30 5.40 5.30 5.4 5.2 5.4! 186,000 993,900 -

JOLLIVILLE HOLDINGS CORP. JOH 1.30 1.42 1.30 1.3 1.3 1.3! 14,000 18,200 -

KEPPEL HOLDINGS KPH 1.92 2.50 - - - - - - -

KEPPEL HOLDINGS "B" KPHB 1.92 2.40 - - - - - - -

LODESTAR INVT.HLDG.CORP LIHC 8.10 8.30 8.30 8.3 8.1 8.3! 791,000 6,479,400 -

MABUHAY HOLDINGS CORP. MHC .2400 .2700 .2600 .27 .24 .24" 70,000 17,300 -

MINERALES INDUSTRIAS CORP MIC 3.30 3.35 3.15 3.35 3.15 3.35! 747,000 2,443,200 -

UEM DEVELOPMENT PHILS INC MK 2.50 - - - - - - - -

METRO PACIFIC INV. CORP. MPI 6.30 6.40 6.60 7.1 6.3 6.4! 14,834,000 100,204,800 340,800

PACIFICA PA .0800 .0825 .0775 .0825 .0775 .0825! 160,800,000 12,776,000 -

PRIME ORION PHILS., INC. POPI .3100 .4200 .3000 .3 .3 .3" 10,000 3,000 -

PRIME MEDIA HOLDINGS, INC PRIM .2150 - .2800 .28 .28 .28! 10,000 2,800 -

REPUBLIC GLASS HLDG. CORP REG - 1.50 - - - - - - -

SOLID GROUP, INC. SGI .4800 .5000 .4900 .49 .49 .49! 400,000 196,000 ( 49,000)

SINOPHIL CORPORATION SINO .2100 .2150 .2150 .22 .215 .215! 1,530,000 330,450 -

SM INVESTMENTS CORP. SM 317.5 320.0 332.5 332.5 315 320" 711,720 233,981,725 49,009,000

SOUTH CHINA RESOURCES INC SOC 1.34 1.36 1.30 1.36 1.3 1.36! 467,000 614,260 -

SEAFRONT RESOURCES CORP. SPM 1.04 1.48 1.10 1.1 1.1 1.1! 10,000 11,000 -

UNIOIL RES. & HOLDINGS CO UNI .1200 .1300 - - - - - - -

WELLEX INDUSTRIES, INC. WIN .1350 .1400 .1400 .14 .135 .14 1,010,000 140,050 -

ZEUS HOLDINGS, INC. ZHI .2900 .3100 .3000 .3 .3 .3 10,000 3,000 -

P R O P E R T Y

**** PROPERTY ****

ARTHALAND CORPORATION ALCO .1450 .2300 - - - - - - -

ANCHOR LAND HOLDINGS,INC. ALHI 6.10 6.50 - - - - - - -

AYALA LAND INC. ALI 9.20 9.40 9.00 9.4 9 9.2! 23,273,000 211,782,400 74,367,800

ARANETA PROPERTIES, INC. ARA .3500 .4000 - - - - - - -

BELLE CORPORATION BEL .7800 .8200 .7800 .8 .78 .8" 300,000 238,400 -

A BROWN COMPANY, INC. BRN 2.85 2.90 2.90 2.95 2.8 2.85 2,437,000 6,910,850 -

CITYLAND DEVELOPMENT CORP CDC 1.30 1.60 1.30 1.3 1.3 1.3" 8,000 10,400 -

CROWN EQUITIES, INC. CEI .0430 .0440 .0420 .043 .042 .043! 24,100,000 1,030,300 -

CEBU HOLDINGS, INC. CHI 1.88 1.90 1.90 1.92 1.9 1.9 156,000 296,460 ( 290,760)

CEBU PROP. VENT. "A" CPV 1.70 1.86 - - - - - - -

CEBU PROP. VENT "B" CPVB 1.60 2.00 - - - - - - -

CYBER BAY CORPORATION CYBR .3400 .3500 .3100 .37 .31 .34! 38,210,000 12,976,500 ( 2,433,400)

EMPIRE EAST LAND INC. ELI .4400 .4500 .4200 .44 .42 .44! 5,140,000 2,236,600 -

ETON PROP. PHILS., INC. ETON 2.32 2.50 2.50 2.5 2.4 2.4" 68,000 165,000 -

EVER-GOTESCO RESOURCES EVER .1100 .1150 .1200 .12 .11 .11" 4,410,000 502,200 -

FILINVEST LAND, INC. FLI .7700 .7800 .7400 .78 .73 .77! 410,170,000 305,656,400 1,251,000

HIGHLANDS PRIME, INC. HP 3.00 3.05 3.05 3.05 3.05 3.05 5,000 15,250 ( 15,250)

INTERPORT RES. IRC .7000 .7700 .7500 .79 .72 .72" 340,000 255,700 -

INTERPORT RES. "B" IRCB .6000 .9300 - - - - - - -

KEPPEL PHILS. PROP., INC. KEP .7000 - - - - - - - -

CITY & LAND DEVELOPERS LAND 1.20 2.00 - - - - - - -

FIL-ESTATE LAND, INC. LND .3100 .3200 .3000 .33 .3 .32! 14,190,000 4,564,600 ( 1,522,800)

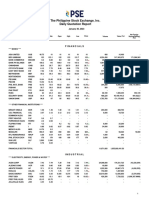

Report date: 06/01/2009 12:10 PM PHILIPPINE STOCK EXCHANGE

Trade date: Monday 06/01/2009 DAILY QUOTATIONS REPORT Page: 3

NET FOREIGN

NAME SYMBOL BID ASK OPEN HIGH LOW CLOSE VOLUME VALUE

TRADE (Peso)

BUYING (SELLING)

------------------------------------------------------------------------------------------------------------------------------------

MEGAWORLD CORPORATION MEG 1.06 1.08 .9500 1.08 .95 1.08! 378,900,000 386,364,700 90,405,500

MRC ALLIED IND., INC. MRC .2300 .2350 .2150 .235 .215 .23! 9,080,000 2,054,150 -

PHILIPPINE ESTATES CORP. PHES - .2500 - - - - - - -

POLAR PROPERTY HOLDINGS PO 1.80 3.90 - - - - - - -

PRIMEX CORPORATION PRMX 3.90 4.00 - - - - - - -

ROBINSONS LAND CORP. RLC 7.30 7.40 7.30 7.5 7.3 7.4! 2,836,000 20,853,700 ( 9,858,900)

PHIL REALTY AND HOLDINGS RLT .3000 .3200 .3600 .36 .31 .32" 90,000 29,100 -

SHANG PROPERTIES, INC. SHNG 1.40 1.48 1.40 1.4 1.4 1.4 10,000 14,000 -

STA. LUCIA LAND, INC. SLI .8000 .8500 .8500 .85 .85 .85 10,000 8,500 -

SM DEVELOPMENT CORP. SMDC 3.00 3.05 3.05 3.05 3 3" 13,000 39,050 -

SM PRIME HOLDINGS, INC. SMPH 9.20 9.30 8.70 9.3 8.7 9.2! 5,751,000 51,631,700 11,769,400

SUNTRUST HOME DEV., INC. SUN .5200 .5300 .5100 .59 .51 .53! 2,640,000 1,441,900 ( 5,400)

UNIWIDE HOLDINGS, INC. UW .1050 .1100 .1050 .105 .105 .105" 300,000 31,500 -

VISTA LAND & LIFESCAPES VLL 1.74 1.76 1.72 1.76 1.72 1.74 12,726,000 22,185,880 ( 509,000)

S E R V I C E

**** MEDIA ****

ABS-CBN BROADCASTING CORP ABS 20.75 21.00 21.00 21 21 21" 15,500 325,500 -

GMA NETWORK, INC. GMA7 6.90 7.10 7.30 7.3 6.8 7.1" 1,215,000 8,503,100 -

MANILA BULLETIN PUB. CORP MB .4200 .4900 .4400 .44 .44 .44" 40,000 17,600 -

**** TELECOMMUNICATIONS ****

DIGITAL TELECOM PHILS INC DGTL 1.36 1.38 1.34 1.38 1.32 1.36 980,000 1,325,840 -

GLOBE TELECOM, INC. GLO 945.0 950.0 920.0 950 915 950! 120,710 112,695,400 ( 55,451,200)

PILIPINO TEL. CORP. PLTL 7.80 7.90 7.90 7.9 7.8 7.9" 1,265,000 9,973,000 ( 2,108,800)

PHIL. LONG DIS TEL CO. TEL 2220 2225 2230 2235 2220 2225! 230,110 512,540,300 ( 1,919,600)

**** INFORMATION TECHNOLOGY ****

BOULEVARD HOLDINGS, INC. BHI .1150 .1200 .1150 .12 .115 .12! 2,170,000 252,600 -

DIVERSIFIED FIN. NETWORK DFNN 8.00 8.20 8.00 8.2 7.9 8.2! 725,000 5,808,600 2,318,000

IMPERIAL RES. IMP - 12.50 - - - - - - -

IPVG CORPORATION IP 2.40 2.42 2.38 2.44 2.38 2.4! 1,418,000 3,390,900 -

ISLAND INFO AND TECH INC. IS .0750 .0775 .0775 .0775 .0775 .0775 200,000 15,500 -

ISM COMMUNICATIONS CORP. ISM .0250 .0260 .0270 .027 .025 .026 13,200,000 345,800 -

TRANSPACIFIC BROADBAND TBGI 3.50 3.55 3.70 3.7 3.5 3.55" 275,000 991,500 -

PHILWEB CORPORATION WEB .0490 .0500 .0490 .05 .049 .05! 552,900,000 27,222,800 5,000

**** TRANSPORTATION SERVICES ****

ASIAN TERMINALS, INC. ATI 3.40 3.50 3.50 3.5 3.5 3.5 95,000 332,500 -

ABOITIZ TRANS. SYS. CORP. ATS 1.24 1.28 1.24 1.24 1.24 1.24 46,000 57,040 -

INT'L CONTAINER TERM'L SV ICT 16.50 16.75 15.75 17 15.5 16.75! 6,109,300 99,820,025 ( 22,686,725)

KEPPEL PHILS. MARINE, INC KPM 2.10 2.30 - - - - - - -

LORENZO SHIPPING CORP. LSC 1.04 1.30 - - - - - - -

MACROASIA CORPORATION MAC 2.80 2.85 2.80 2.8 2.8 2.8 141,000 394,800 ( 70,000)

PAL HOLDINGS, INC. PAL 2.95 3.00 - - - - - - -

METRO PACIFIC TOLLWAYS TOL 10.50 10.75 10.50 11 10.5 10.75! 32,100 347,375 -

**** HOTEL & LEISURE ****

ACESITE PHILS HOTEL CORP. DHC 7.60 8.50 8.50 8.5 8.5 8.5" 6,000 51,000 -

LEISURE & RESORTS CORP. LR 1.32 1.38 1.36 1.38 1.32 1.32" 426,000 568,600 -

MANILA JOCKEY CLUB MJC 2.90 3.20 3.20 3.2 3.2 3.2 2,000 6,400 -

PREMIERE ENT. PHILS.,INC. PEP .6100 .6300 .6500 .65 .63 .63 530,000 334,200 119,900

PHILIPPINE RACING CLUB PRC 2.38 - 2.38 2.38 2.38 2.38! 11,000 26,180 -

WATERFRONT PHILS., INC. WPI .3200 .3500 .3300 .34 .31 .31" 500,000 167,100 ( 37,300)

**** EDUCATION ****

CENTRO ESCOLAR UNIVERSITY CEU 5.80 6.00 - - - - - - -

FAR EASTERN UNIVERSITY FEU 755.0 785.0 - - - - - - -

IPEOPLE, INC IPO 2.70 3.00 2.70 2.7 2.7 2.7 1,000 2,700 -

**** DIVERSIFIED SERVICES ****

APC GROUP, INC. APC .3900 .4000 .3800 .39 .38 .39! 1,470,000 571,400 -

EASYCALL PHILS., INC.-COM ECP 1.20 1.90 - - - - - - -

JTH DAVIES HOLDINGS, INC. JTH 1.22 2.10 1.22 2.1 1.22 2.1! 108,000 225,920 -

PACIFIC ONLINE SYS. CORP. LOTO 10.25 10.50 10.25 10.25 10.25 10.25 40,300 413,075 -

PAXYS, INC. PAX 2.48 2.50 2.65 2.65 2.48 2.48" 6,822,000 17,425,700 522,000

PRIME GAMING PHILS., INC. PGPI 8.80 8.90 8.90 8.9 8.9 8.9 10,000 89,000 -

PHILIPPINE SEVEN CORP. SEVN 2.00 - - - - - - - -

M I N I N G & O I L

**** MINING ****

ATOK-BIG WEDGE CO., INC. AB 1.28 - - - - - - - -

APEX MINING CO., INC. "A" APX 3.35 3.40 3.45 3.5 3.35 3.4! 580,000 1,979,650 -

APEX MINING CO., INC "B" APXB 3.45 3.50 3.40 3.5 3.35 3.5! 341,000 1,170,000 102,000

ABRA MINING & INDUSTRIAL AR .0055 .0060 .0055 .006 .0055 .006! 81,000,000 453,000 -

BENGUET CORP. "A" BC 9.50 10.00 9.90 10 9.9 10! 20,000 199,300 -

BENGUET CORP. "B" BCB 9.00 10.25 10.75 11 9 9" 47,000 456,800 ( 292,300)

DIZON COPPER SILVER MINES DIZ 4.15 4.25 4.00 4.5 4 4.15! 55,000 225,700 -

GEOGRACE RES. PHIL., INC. GEO .7200 .7400 .6900 .74 .69 .74! 41,390,000 29,675,400 -

LEPANTO CONS MNG. CO. "A" LC .2050 .2100 .1950 .21 .195 .21! 72,030,000 14,607,200 -

Report date: 06/01/2009 12:10 PM PHILIPPINE STOCK EXCHANGE

Trade date: Monday 06/01/2009 DAILY QUOTATIONS REPORT Page: 4

NET FOREIGN

NAME SYMBOL BID ASK OPEN HIGH LOW CLOSE VOLUME VALUE

TRADE (Peso)

BUYING (SELLING)

------------------------------------------------------------------------------------------------------------------------------------

LEPANTO CONS. MNG. CO "B" LCB .2100 .2150 .1900 .215 .19 .21! 33,790,000 7,012,900 ( 12,300)

MANILA MINING CORP. "A" MA .0160 .0170 .0160 .017 .015 .017! 163,500,000 2,604,900 -

MANILA MINING CORP. "B" MAB .0160 .0170 .0160 .017 .015 .017! 104,600,000 1,669,100 -

NIHAO MINERAL RESOURCES NI 8.20 8.30 8.20 8.4 8 8.2! 690,000 5,657,400 -

OMICO CORPORATION OM .0090 .0095 .0095 .0095 .0085 .009 883,000,000 8,003,000 1,800,000

ORIENTAL PENINSULA RES. ORE .6000 .6100 .5900 .61 .59 .61! 210,000 125,900 -

PHILEX MINING CORPORATION PX 7.50 7.60 7.40 7.6 7.3 7.6! 7,574,000 56,353,900 ( 1,656,200)

SEMIRARA MINING CORP. SCC 41.50 42.00 41.00 42 41 42! 909,500 37,547,600 ( 33,214,800)

UNITED PARAGON MINING CO. UPM .0085 .0090 .0090 .009 .009 .009 40,000,000 360,000 -

**** OIL ****

BASIC ENERGY CORPORATION BSC .1650 .1750 - - - - - - -

ORIENTAL PET. & MIN. "A" OPM .0150 .0160 .0150 .016 .015 .015 32,200,000 483,800 -

ORIENTAL PET. & MIN. "B" OPMB .0150 .0160 .0160 .016 .016 .016 43,500,000 696,000 -

THE PHILODRILL CORP. OV .0160 .0170 .0160 .017 .015 .016 430,800,000 6,892,800 ( 224,000)

PNOC EXPLORATION CORP.-A PEC 3.35 - - - - - - - -

PNOC EXPLORATION CORP.-B PECB 8.20 10.25 - - - - - - -

PETROENERGY RES. CORP. PERC 6.90 7.20 7.20 7.2 7.1 7.2! 48,000 344,900 -

P R E F E R R E D

AYALA CORP. PREF. "A" ACPA 505.0 510.0 510.0 510 510 510! 2,000 1,020,000 -

AYALA CORP. PREF. "B" ACPR 105.0 106.0 106.0 106 106 106" 264,490 28,035,940 -

FIRST PHIL HLDGS. - PREF. FPHP 93.50 96.00 93.00 93 93 93" 800 74,400 -

PLDT (10% PREF) SERIES H TELH 10.50 - - - - - - - -

PLDT (10% PREF) SERIES K TELK 10.50 - - - - - - - -

PLDT (10% PREF) SERIES L TELL 10.50 - - - - - - - -

PLDT (10% PREF) SERIES M TELM 10.50 - 10.50 10.5 10.5 10.5" 100 1,050 -

PLDT (10% PREF) SERIES N TELN 10.50 - - - - - - - -

PLDT (10% PREF) SERIES O TELO 10.50 - - - - - - - -

PLDT (10% PREF) SERIES P TELP 10.50 - - - - - - - -

PLDT (10% PREF) SERIES Q TELQ 10.50 - - - - - - - -

PLDT (10% PREF) SERIES R TELR 10.50 - - - - - - - -

PLDT (10% PREF) SERIES S TELS 10.50 - - - - - - - -

PLDT (10% PREF) SERIES T TELT 10.50 - - - - - - - -

PLDT (10% PREF.) SERIES U TELU 10.50 - 10.50 10.5 10.5 10.5" 100 1,050 -

PLDT (10% PREF) SERIES V TELV 10.50 - 10.50 10.5 10.5 10.5 300 3,150 -

PLDT (10% PREF) SERIES W TELW 10.50 - 10.50 10.5 10.5 10.5 200 2,100 -

PLDT (10% PREF) SERIES X TELX 10.50 - - - - - - - -

PLDT (10% PREF) SERIES Y TELY 10.50 - - - - - - - -

PLDT (10% PREF) SERIES Z TELZ 10.50 - - - - - - - -

PLDT 10% PREF SERIES "AA" TLAA 10.50 - - - - - - - -

PLDT 10% PREF SERIES "BB" TLBB 10.50 - - - - - - - -

PLDT 10% PREF SERIES "CC" TLCC 10.50 - - - - - - - -

PLDT 10% PREF SERIES "DD" TLDD 10.50 - - - - - - - -

PLDT 10% PREF SERIES "EE" TLEE 10.50 - - - - - - - -

WARRANTS, PHIL. DEPOSIT RECEIPTS, ETC.

ABS-CBN HLDGS. CORP (PDR) ABSP 21.00 21.25 21.00 21 21 21" 607,000 12,747,000 ( 1,724,100)

GMA HOLDINGS, INC. (PDR) GMAP 6.80 6.90 7.00 7 6.7 6.8" 6,181,000 42,259,400 ( 15,554,300)

OMICO CORP-WARRANTS OMW2 .0046 .0055 - - - - - - -

SMALL AND MEDIUM ENTERPRISES

INFORMATION CAPITAL TECH. ICTV 1.02 1.30 - - - - - - -

MAKATI FINANCE CORP. MFIN 1.30 2.00 - - - - - - -

Financial 596.35 UP 25.16 16,567,590 429,359,930.00

Industrial 3,208.95 UP 45.75 157,538,540 559,837,535.00

Holding Firms 1,432.35 UP 22.66 308,873,520 779,673,290.00

Property 878.27 UP 48.53 935,163,000 1,031,295,240.00

Service 1,278.50 UP 17.08 591,104,020 804,241,455.00

Mining & Oil 5,736.49 UP 242.59 1,936,284,500 176,519,250.00

All Shares Index 1,598.59 UP 30.72

PSEi 2,458.65 UP 69.34

GRAND TOTALS : 3,945,531,170 3,780,926,700.00

SPECIAL BLOCK SALES:

---------------------

TOTAL (P 0.00) %MKT 0.00

=====================

NO. OF ADVANCES: 85 NO. OF DECLINES: 43 NO. OF UNCHANGED: 42

NO. OF TRADED ISSUES: 170

NO. OF TRADES: 13,271

OPEN HIGH LOW

Financial 573.02 598.31 573.02

Industrial 3,178.09 3,208.95 3,172.32

Holding Firms 1,413.10 1,439.86 1,409.55

Property 846.22 883.30 843.89

Service 1,265.46 1,278.88 1,264.21

Report date: 06/01/2009 12:10 PM PHILIPPINE STOCK EXCHANGE

Trade date: Monday 06/01/2009 DAILY QUOTATIONS REPORT Page: 5

NET FOREIGN

NAME SYMBOL BID ASK OPEN HIGH LOW CLOSE VOLUME VALUE TRADE (Peso)

BUYING (SELLING)

------------------------------------------------------------------------------------------------------------------------------------

Mining & Oil 5,561.77 5,736.49 5,555.68

All Shares 1,577.33 1,598.73 1,575.79

PSEi 2,404.62 2,459.83 2,404.48

ODD LOTS VOLUME : 890,503

ODD LOTS VALUE : 542,643.46

MAIN BOARD CROSS VOLUME : 379,572,960

MAIN BOARD CROSS VALUE : 1,178,468,970.00

BONDS VOLUME : 0

BONDS VALUE : 0.00

NON-SECTORAL VOLUME : 7,055,990

NON-SECTORAL VALUE : 84,144,090.00

TOTAL FOREIGN BUYING : P 1,624,565,512.39

TOTAL FOREIGN SELLING : P 1,546,394,593.39

EXCHANGE NOTICE:

PANASONIC MANUFACTURING PHILIPPINES CORP. ("PMPC")

CASH DIVIDEND:

==============

CASH - P0.05 PER SHARE

EX-DATE - JUNE 16, 2009

RECORD DATE - JUNE 19, 2009

PAYMENT DATE - JUNE 30, 2009

Companies Under Suspension by the Exchange as of May 29, 2009

SYMBOL COMPANY

AGP,AGPB AGP Industrial Corp.

APO Anglo Phil Holdings Corp.

AT Atlas Cons. Min & Dev't.

BF,BFC & Banco Filipino Savings and Mortgage Bank

BFNC

CBC Cosmos Bottling Corporation

EIBA,EIBB Export and Industry Bank, Inc.

FC Fil-Estate Corporation

FPI Forum Pacific, Inc.

FYN & FYNB Filsyn Corporation

GO,GOB Gotesco Land, Inc.

MC,MCB Marsteel Consolidated, Inc.

MAH & MAHB Metro Alliance Holdings & Equities Corp.

MON Mondragon International Philippines, Inc.

MII MJCI Investments, Inc.

NXT NextStage, Inc.

PHC Philcomsat Holdings Corporation

PNC Philippine National Construction Corporation

PTT Philippine Telegraph & Telephone Corporation

PCP Picop Resources, Inc.

PMT Primetown Property Group, Inc.

PPC Pryce Corporation

STN Steniel Manufacturing Corporation

SWM Sanitary Wares Manufacturing Corporation

UP Universal Rightfield Property Holdings, Inc.

VMC Victorias Milling Co., Inc.

WHI,WHIB Wise Holdings, Inc.

Companies Under Rehabilitation

LIB Liberty Telecoms Holdings, Inc.

PMT Primetown Property Group, Inc.

RLT Phil. Realty and Holdings

VMC Victorias Milling Co., Inc.

VITA Vitarich Corporation

**** END OF REPORT ****

You might also like

- TOP 500 Non Individual - Arranged - AlphabeticallyDocument12 pagesTOP 500 Non Individual - Arranged - AlphabeticallyjcalaqNo ratings yet

- 2009jun02 StockquoteDocument5 pages2009jun02 StockquotesrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: January 03, 2022Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: January 03, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation ReportDocument12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation ReportcraftersxNo ratings yet

- Stockquotes 02012023Document13 pagesStockquotes 02012023Jonathan M.No ratings yet

- September 29, 2023-EODDocument14 pagesSeptember 29, 2023-EODMJA MAMANo ratings yet

- Stockquotes 01302023Document13 pagesStockquotes 01302023Jonathan M.No ratings yet

- Stockquotes 03012023Document13 pagesStockquotes 03012023Jonathan M.No ratings yet

- December 04, 2023-EODDocument14 pagesDecember 04, 2023-EODjimmhugo21No ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: December 27, 2021Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: December 27, 2021craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report October 09, 2018Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report October 09, 2018hezeNo ratings yet

- Group 1 Final PerfinDocument9 pagesGroup 1 Final PerfinZellie RegonasNo ratings yet

- September 29, 2022-EODDocument13 pagesSeptember 29, 2022-EODcraftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report September 04, 2020Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report September 04, 2020craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report June 04, 2018Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report June 04, 2018hezeNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2021楊祖维No ratings yet

- Stockquotes 12012020 PDFDocument9 pagesStockquotes 12012020 PDFXander 4thNo ratings yet

- PSE Daily ReportDocument9 pagesPSE Daily ReportEdgar LayNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report November 08, 2019Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report November 08, 2019craftersxNo ratings yet

- February 15, 2024-EODDocument14 pagesFebruary 15, 2024-EODMJA MAMANo ratings yet

- Stockquotes 07172017Document9 pagesStockquotes 07172017Alexander AbonadoNo ratings yet

- Philippine Stock Exchange: Head, Disclosure DepartmentDocument4 pagesPhilippine Stock Exchange: Head, Disclosure DepartmentPaulNo ratings yet

- PSE Daily ReportDocument13 pagesPSE Daily ReportJonathan M.No ratings yet

- PSE Daily ReportDocument9 pagesPSE Daily ReportEdgar LayNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 20, 2014John Paul Samuel ChuaNo ratings yet

- R CLTRSMDocument2 pagesR CLTRSMM Saad SowaleheenNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Jun GomezNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 04, 2021Jun GomezNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaNo ratings yet

- Top 100 ABS-CBN StockholdersDocument5 pagesTop 100 ABS-CBN StockholdersCarl VonNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 20, 2010Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 20, 2010Maria Iza Javate CabacunganNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2021Xander 4thNo ratings yet

- Stockquotes 07082020 PDFDocument9 pagesStockquotes 07082020 PDFMarlon DNo ratings yet

- NLI Securities Limited: Direct Trading AccountDocument12 pagesNLI Securities Limited: Direct Trading AccountSaiful IslamNo ratings yet

- 2009aug07 StockquoteDocument6 pages2009aug07 StockquotesrichardequipNo ratings yet

- SMC2K - Top 100 Stockholders As of September 30, 2022Document3 pagesSMC2K - Top 100 Stockholders As of September 30, 2022John Kenie CayetanoNo ratings yet

- TBL Major Shareholders' DividendDocument3 pagesTBL Major Shareholders' Dividendrukiaa100% (3)

- The Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 05, 2021Jun GomezNo ratings yet

- Book 12Document2 pagesBook 12Ritchelle Quijote DelgadoNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2020Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report June 01, 2020craftersxNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report December 16, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report December 16, 2016Jun GomezNo ratings yet

- Data For The Year 2005: Close - End Mutual FundDocument18 pagesData For The Year 2005: Close - End Mutual FundObaid GhouriNo ratings yet

- Top 500 Corporate Taxpayers in Philippines in 2011Document8 pagesTop 500 Corporate Taxpayers in Philippines in 2011Lala RimandoNo ratings yet

- Top 100 Companies 1969-2006Document3 pagesTop 100 Companies 1969-2006Bryan LagonoyNo ratings yet

- Company Name: 2go Group, Inc. List of Top 100 Stockholders As of September 30, 2020Document18 pagesCompany Name: 2go Group, Inc. List of Top 100 Stockholders As of September 30, 2020Jan Ellard CruzNo ratings yet

- Stockquotes 02112014 PDFDocument8 pagesStockquotes 02112014 PDFJohn Paul Samuel ChuaNo ratings yet

- Monthly Expenditure Report Pt. Tunggal Idaman AbdiDocument4 pagesMonthly Expenditure Report Pt. Tunggal Idaman Abdinofianti ekaputriNo ratings yet

- Top Non Individual by Rank PDFDocument12 pagesTop Non Individual by Rank PDFRenzon DoniegoNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report June 21, 2021Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report June 21, 2021Jun GomezNo ratings yet

- Merced-Hernandez Pawnshop & Jewelry, Inc.: Page 1 of 2Document2 pagesMerced-Hernandez Pawnshop & Jewelry, Inc.: Page 1 of 2keanlucassmithNo ratings yet

- Closing Rate Summary From:: Flu No: Pageno: 1 090/2019 P.Kse100 Ind: C.Kse100 Ind: Net ChangeDocument11 pagesClosing Rate Summary From:: Flu No: Pageno: 1 090/2019 P.Kse100 Ind: C.Kse100 Ind: Net ChangeMadeeha AwanNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report August 18, 2020Document9 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report August 18, 2020kalboNo ratings yet

- FY25 House Education BudgetDocument16 pagesFY25 House Education BudgetTrisha Powell CrainNo ratings yet

- Sokoto Road Oct 2010Document43 pagesSokoto Road Oct 2010ayoolaalabiNo ratings yet

- British Commercial Computer Digest: Pergamon Computer Data SeriesFrom EverandBritish Commercial Computer Digest: Pergamon Computer Data SeriesNo ratings yet

- British Commercial Computer Digest: Pergamon Computer Data SeriesFrom EverandBritish Commercial Computer Digest: Pergamon Computer Data SeriesNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipNo ratings yet

- Stockquotes 02112015 PDFDocument8 pagesStockquotes 02112015 PDFsrichardequipNo ratings yet

- Stockquotes 02062015Document8 pagesStockquotes 02062015srichardequipNo ratings yet

- Stockquotes 02112015 PDFDocument8 pagesStockquotes 02112015 PDFsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipNo ratings yet

- Stockquotes 02042015 PDFDocument8 pagesStockquotes 02042015 PDFsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipNo ratings yet

- October 2015: Sun Mon Tue Wed Thu Fri SatDocument1 pageOctober 2015: Sun Mon Tue Wed Thu Fri SatjNo ratings yet

- ECCODocument3 pagesECCOsrichardequipNo ratings yet

- wk03 Jan2013mktwatchDocument3 pageswk03 Jan2013mktwatchsrichardequipNo ratings yet

- wk02 Jan2013mktwatchDocument3 pageswk02 Jan2013mktwatchsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 13, 2013srichardequipNo ratings yet

- wk01 Jan2013mktwatchDocument3 pageswk01 Jan2013mktwatchsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2013srichardequipNo ratings yet

- PSE Daily ReportDocument7 pagesPSE Daily ReportsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 16, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 17, 2013srichardequipNo ratings yet

- Philippine Stock Exchange Daily Report Provides Financial Sector and Stock PerformanceDocument7 pagesPhilippine Stock Exchange Daily Report Provides Financial Sector and Stock PerformancesrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 14, 2013srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 08, 2013srichardequipNo ratings yet

- PSE REPORTDocument7 pagesPSE REPORTsrichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report January 10, 2013srichardequipNo ratings yet

- Stockquotes 04022013Document7 pagesStockquotes 04022013srichardequipNo ratings yet

- Table 1 Marriage 2011Document1 pageTable 1 Marriage 2011srichardequipNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013Document7 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report April 01, 2013srichardequipNo ratings yet