Professional Documents

Culture Documents

Exercise

Uploaded by

Dedi JuventiniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise

Uploaded by

Dedi JuventiniCopyright:

Available Formats

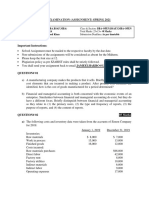

EXERCISE 2-3 COST OF GOODS MANUFACTURED AND COST OF OPERATION

The Huffer manufacturing company manufactures rubber rafts. For the month of

January, it incurred the following cost :

Materials……………………..$ 10,000 (80% for direct materials)

Labor………………………… 5,000 (70% for direct labor)

Factory overhead……………. 5,000 (for heat, light and power)

And addition to the costs of production, the company incurred selling expenses of %

7,500 and general administrative expenses of % 8,500.

Required : Compute the cost of goods manufactured and the total costs.

EXERCISE 2-4 COST OF GOODS MANUFACTURED

The following information relates to the Comfy Water Bed Manufacturing Company :

At the beginning of the period, there was $ 50,000 in work-in-process inventory.

During the year , Comfy incurred costs of $ 17,200 for direct labor and $ 32,100 for

factory overhead (heat, light and power) . at the end of period, there was work in

process inventory of $40,000.

Required : compute the cost of goods manufactured for the Comfy Water Bed

Manufacturing Company.

EXERCISE 2-5 COST OF GOODS MANUFACTURED AND SOLD STATEMENT

In September 19x7, the B. B. Gun Company put into process $ 60,000 of raw

materials (all direct materials). Department A used 15,000 direct labor hours at the

total cost of $40,000 , and department B used 10,500 direct labor hours at the cost of

%6 per hour. Factory overhead is applied in department A and B at a rate of %3,75

and % 4,50 per direct labor hour, respectively. Inventories on September 1 were the

following: materials, $20,000; work in process, $28,000; finished goods, %15,100. On

September 30, the inventories were: materials, $18,725; work in process, $24,500;

finished goods, $ 16,500. The company produced 30,000 units during the month.

Required : prepare a combined statement of cost of goods manufactured and sold.

You might also like

- Cost Accounting Worksheet Chap 3Document5 pagesCost Accounting Worksheet Chap 3Muhammad UsmanNo ratings yet

- Basic Mas ConceptsDocument7 pagesBasic Mas Conceptsjulia4razoNo ratings yet

- Tarea 4Document2 pagesTarea 4Luisa Martinez Mateos100% (1)

- Exam # 2 Chapter 15, 16, 17 ReviewDocument2 pagesExam # 2 Chapter 15, 16, 17 ReviewAnnNo ratings yet

- Example of Job Order Costing SystemDocument1 pageExample of Job Order Costing SystemHananNo ratings yet

- Worksheet1-Basics & COGSDocument5 pagesWorksheet1-Basics & COGSmohsinmustafa.2001No ratings yet

- Problems of MACSDocument29 pagesProblems of MACSPreetham GowdaNo ratings yet

- Revision Excercises Midterm Cost Accounting CA232Document6 pagesRevision Excercises Midterm Cost Accounting CA232Chacha gmidNo ratings yet

- 4 5879525209899272176 PDFDocument4 pages4 5879525209899272176 PDFYaredNo ratings yet

- Summative QuizDocument2 pagesSummative QuizVIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- Assignment No 1 - Cost ClassificationDocument7 pagesAssignment No 1 - Cost ClassificationJitesh Maheshwari100% (1)

- CIMA - Question Bank (Relevant For F2)Document12 pagesCIMA - Question Bank (Relevant For F2)bebebam100% (1)

- Problem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andDocument4 pagesProblem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andIvan BorresNo ratings yet

- Cost Accounting Cycle ProblemsDocument3 pagesCost Accounting Cycle ProblemsAnonymous sn5Tcc100% (1)

- BÍ KÍP LUYỆN RỒNG ANSDocument14 pagesBÍ KÍP LUYỆN RỒNG ANSReina TrầnNo ratings yet

- Assignment One and TwoDocument5 pagesAssignment One and Twowalelign yigezawNo ratings yet

- Job Order in Class Practice QuestionsDocument5 pagesJob Order in Class Practice QuestionsBisma ShahabNo ratings yet

- ComaDocument21 pagesComamanojNo ratings yet

- Accounting QuestionDocument8 pagesAccounting QuestionMusa D Acid100% (1)

- Practice Problem Set 01Document7 pagesPractice Problem Set 01priya bhagwatNo ratings yet

- Managerial Accounting JONGAY (AutoRecovered)Document24 pagesManagerial Accounting JONGAY (AutoRecovered)Jhoy AmoscoNo ratings yet

- Standard CostingDocument2 pagesStandard CostingsumairaNo ratings yet

- Chapter 2 - Asgmt-1Document2 pagesChapter 2 - Asgmt-1MarkJoven BergantinNo ratings yet

- Accounting For Manufacturing Concern UST-AMV College of Accountancy Financial Accounting and ReportingDocument3 pagesAccounting For Manufacturing Concern UST-AMV College of Accountancy Financial Accounting and ReportingJuan Dela CruzNo ratings yet

- CA Group Task Job Costing 26032021 080344pm 15112021 065026pmDocument2 pagesCA Group Task Job Costing 26032021 080344pm 15112021 065026pmMeraj AliNo ratings yet

- Practice Questions - Class Excercises 2Document12 pagesPractice Questions - Class Excercises 2Chris With LuvNo ratings yet

- Demonstration ProblemsDocument3 pagesDemonstration Problemsnega guluma100% (1)

- 1 Manufacturing ExercisesDocument3 pages1 Manufacturing ExercisesRead this SecretNo ratings yet

- Discussion 1Document10 pagesDiscussion 1athirah jamaludinNo ratings yet

- (W1) ANS - Question AnswerDocument13 pages(W1) ANS - Question AnswerMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- Local Media2422589097727665216 074325Document7 pagesLocal Media2422589097727665216 074325Nashebah A. BatuganNo ratings yet

- Cost FlowDocument30 pagesCost FlowAndrea Nicole MASANGKAYNo ratings yet

- Job Order Costing Difficult RoundDocument8 pagesJob Order Costing Difficult RoundsarahbeeNo ratings yet

- Chapter 02 and 04 Extra ProblemsDocument4 pagesChapter 02 and 04 Extra ProblemsElvan Mae Rita ReyesNo ratings yet

- Cost AcctgDocument6 pagesCost AcctgMarynelle Labrador SevillaNo ratings yet

- Comp ExamsDocument13 pagesComp ExamsKeith Joanne SantiagoNo ratings yet

- MANACC01Document4 pagesMANACC01Justine Paul Pangasi-anNo ratings yet

- Bai Tap On Tap QTDNDocument4 pagesBai Tap On Tap QTDNDuyên Nguyễn Nữ KỳNo ratings yet

- Reviewer 2Document21 pagesReviewer 2nicolearetano417No ratings yet

- Job Order CostingDocument9 pagesJob Order CostingApple BaldemoroNo ratings yet

- Cost 531 2021 AssignmentDocument10 pagesCost 531 2021 AssignmentWaylee CheroNo ratings yet

- Ejercicios de Estado de Costo de Producción y VentasDocument4 pagesEjercicios de Estado de Costo de Producción y VentasRodrigo RojasNo ratings yet

- Finl - Acg Computational - QnsDocument2 pagesFinl - Acg Computational - Qnsgmurali_179568No ratings yet

- Managerial Set 2Document5 pagesManagerial Set 2Dan OrbisoNo ratings yet

- Apex Corporation Manufactures Eighteenth Century Classical StylDocument1 pageApex Corporation Manufactures Eighteenth Century Classical StylAmit Pandey0% (1)

- Quiz September 1Document3 pagesQuiz September 1ANGIE BERNALNo ratings yet

- Job Costing and Overhead ER PDFDocument16 pagesJob Costing and Overhead ER PDFShaira VillaflorNo ratings yet

- Cost Accounting Mastery - 2Document2 pagesCost Accounting Mastery - 2Mark Revarez0% (1)

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- Programmazione e Controllo Esercizi Capi PDFDocument43 pagesProgrammazione e Controllo Esercizi Capi PDFHeap Ke XinNo ratings yet

- ABC and Flexible BudgetDocument6 pagesABC and Flexible BudgetLhorene Hope DueñasNo ratings yet

- 2.4 Exercises - Job Oder Costing - Straight Problems (NEW) 1Document3 pages2.4 Exercises - Job Oder Costing - Straight Problems (NEW) 1Darius Delacruz50% (2)

- Exam 1 OnlineDocument2 pagesExam 1 OnlineGreg N Michelle SuddethNo ratings yet

- Preliminary Exam in Cost Accounting and ControlDocument5 pagesPreliminary Exam in Cost Accounting and ControlMohammadNo ratings yet

- Job Order CostingDocument2 pagesJob Order CostingMahnoor MujahidNo ratings yet

- Management Accounting 21.1.11 QuestionsDocument5 pagesManagement Accounting 21.1.11 QuestionsAmeya TalankiNo ratings yet

- International Relations: A Simple IntroductionFrom EverandInternational Relations: A Simple IntroductionRating: 5 out of 5 stars5/5 (9)

- The Process of Capitalist Production as a Whole (Capital Vol. III)From EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)No ratings yet