Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

38 viewsAcknowledgement of CST May 09

Acknowledgement of CST May 09

Uploaded by

jyotsna_pawarACKNOWLEDGEMENT E Return Form CST Transaction_Date Particulars Jun 27, 2009 detailes of Amount(Rs.) DELUXE PAPER MART 27040011372C ORIGINAL MONTHLY From:May 1, 2009 to :May 31, 2009 5457031. 5212.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ethics Case Tobacco ProtestorsDocument1 pageEthics Case Tobacco ProtestorsIncognito InvognitoNo ratings yet

- Consignee (Despatch To) Customer Karachi: National SuppliesDocument1 pageConsignee (Despatch To) Customer Karachi: National SuppliesAsad S MirzaNo ratings yet

- 167043-2012-Jiao v. National Labor Relations CommissionDocument12 pages167043-2012-Jiao v. National Labor Relations CommissionChristian VillarNo ratings yet

- Support Material / Material de Apoyo Learning Activity 3 / Actividad de Aprendizaje 3Document6 pagesSupport Material / Material de Apoyo Learning Activity 3 / Actividad de Aprendizaje 3Alexandra ChavarroNo ratings yet

- List of Laboratory ActivitiesDocument2 pagesList of Laboratory ActivitiesRuvy Jean Codilla-FerrerNo ratings yet

- Literary Appreciation SkillsDocument69 pagesLiterary Appreciation SkillsAlmarez BastyNo ratings yet

- Section 2a - Final - 2 - 10 - 15Document10 pagesSection 2a - Final - 2 - 10 - 15Dana RamosNo ratings yet

- Joan Cruz V Royal Supermart Plaintiff Position PaperDocument6 pagesJoan Cruz V Royal Supermart Plaintiff Position PaperKringNo ratings yet

- Lulik: The Core of Timorese Values (Published Version)Document14 pagesLulik: The Core of Timorese Values (Published Version)Josh TrindadeNo ratings yet

- The Scientific Revolution of The 16 TH and 17 TH CenturyDocument9 pagesThe Scientific Revolution of The 16 TH and 17 TH CenturyMa.Tricia GanaciasNo ratings yet

- ODLI20161010 - 035-UPD-es - AR-FastFlex-LED-module 2x8 - 740-Gen-Ficha-TécnicaDocument11 pagesODLI20161010 - 035-UPD-es - AR-FastFlex-LED-module 2x8 - 740-Gen-Ficha-TécnicamyryqNo ratings yet

- Unit 6Document143 pagesUnit 6Venkatesh SharmaNo ratings yet

- Í ( - Zcè3Â Payuan Markâanthonyââ C Ç 0+27eî Mr. Mark Anthony Carpio PayuanDocument2 pagesÍ ( - Zcè3Â Payuan Markâanthonyââ C Ç 0+27eî Mr. Mark Anthony Carpio Payuanmacp16No ratings yet

- BoastDocument2 pagesBoastSyahmil SyazrenNo ratings yet

- TWELFTH NIGHT - Role of Feste in Twelfth NightDocument2 pagesTWELFTH NIGHT - Role of Feste in Twelfth NightAmanda F.50% (2)

- How Newsgroups WorkDocument8 pagesHow Newsgroups WorkPhaniraj LenkalapallyNo ratings yet

- Aniket Nagapure: Work Experience SkillsDocument1 pageAniket Nagapure: Work Experience Skillsaniket nagapureNo ratings yet

- CAENRFID Catalog 2020 WEB PDFDocument33 pagesCAENRFID Catalog 2020 WEB PDFfenixconNo ratings yet

- ECSS v3 BrochureDocument39 pagesECSS v3 BrochureMahesh BhatNo ratings yet

- 501 Reading Comprehension Questions: Spiteful Remarks To The Media, Which Almost Ruined The Referee'sDocument13 pages501 Reading Comprehension Questions: Spiteful Remarks To The Media, Which Almost Ruined The Referee'sKalaivani Rajendran100% (1)

- Inside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)Document10 pagesInside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)QuantDev-MNo ratings yet

- Y4 Unit 1 Our CommunityDocument12 pagesY4 Unit 1 Our Communitymerlyn90No ratings yet

- Canteen MenuDocument3 pagesCanteen MenuAravind ChidambaramNo ratings yet

- Characteristics of Effective FeedbackDocument1 pageCharacteristics of Effective Feedbacklou_rivera_1No ratings yet

- The Nature of B2B MarketingDocument14 pagesThe Nature of B2B MarketingAnshu Singh100% (1)

- Is Tithing Required in The New CovenantDocument3 pagesIs Tithing Required in The New Covenantsuhail farooqNo ratings yet

- Parts Catalog: Inner 2 Way Tray-D1Document18 pagesParts Catalog: Inner 2 Way Tray-D1utilscNo ratings yet

- Bid Docs Supply of Fuel For SPMCDocument41 pagesBid Docs Supply of Fuel For SPMCjoyNo ratings yet

- Abhishek DubeyDocument89 pagesAbhishek DubeyVeekeshGuptaNo ratings yet

- GoatmanDocument2 pagesGoatmanCute AkoNo ratings yet

Acknowledgement of CST May 09

Acknowledgement of CST May 09

Uploaded by

jyotsna_pawar0 ratings0% found this document useful (0 votes)

38 views1 pageACKNOWLEDGEMENT E Return Form CST Transaction_Date Particulars Jun 27, 2009 detailes of Amount(Rs.) DELUXE PAPER MART 27040011372C ORIGINAL MONTHLY From:May 1, 2009 to :May 31, 2009 5457031. 5212.

Original Description:

Original Title

Acknowledgement of Cst May 09

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACKNOWLEDGEMENT E Return Form CST Transaction_Date Particulars Jun 27, 2009 detailes of Amount(Rs.) DELUXE PAPER MART 27040011372C ORIGINAL MONTHLY From:May 1, 2009 to :May 31, 2009 5457031. 5212.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views1 pageAcknowledgement of CST May 09

Acknowledgement of CST May 09

Uploaded by

jyotsna_pawarACKNOWLEDGEMENT E Return Form CST Transaction_Date Particulars Jun 27, 2009 detailes of Amount(Rs.) DELUXE PAPER MART 27040011372C ORIGINAL MONTHLY From:May 1, 2009 to :May 31, 2009 5457031. 5212.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

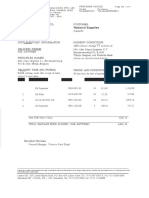

ACKNOWLEDGEMENT

E Return Form CST

Transaction_id 1507250 Transaction_Date Jun 27, 2009

Sr Box No as Particulars detailes of Amount(Rs.)

No per Return

1 Box II Name of Dealer DELUXE PAPER

MART

2 Box I C.S.T. R.C./ TIN No. 27040011372C

3 Box I Type of Return ORIGINAL

4 Box III Periodicity of Return MONTHLY

5 Box III Period Covered by Return From:May 1, 2009

To :May 31, 2009

6 Box 1 Gross turnover of sale 5457031.0

7 Box 6 Total Amount of C.S.T Payable 5212.0

8 Box 7 Amount deffered ( out of Box ( 6) ( under package scheme of

incentives ) if any

9 Box 8 Balance Amount Payable 5212.0

10 Box 9(a) a) Interest Payable

11 Box 9(b) b) Amount ofTax collected in excess of the tax payable if any ( As 0.0

per Box 5)

12 Box 10 Total Amount Payable 5212.0

13 Box 10(a) Excess Credit brought forward from previous return

14 Box 10(b) Excess MVAT refund to be adjusted against the CST liability.

15 Box 10(c) Amount already paid 5212.0

16 Box 10(d) Adjustment of Refund Avaialable as per Refund Adjustment order

Amount ( Details to be entered in Box 12 (d))

17 Box 11(a) Excess Credit carried forward to subsequent return

18 Box 11(b) Excess Credit claimed as refunt 0.0

19 Box 12 Balance Amount payable 0.0

Disclaimer :- This acknowledgement is generated from the information submitted in the return. It should not

be treated as the acceptance of claims made in the return.

Acknowledgement to be Submitted by the Dealer

Place

Date (Signature,Name and Designation of Authorised Person)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ethics Case Tobacco ProtestorsDocument1 pageEthics Case Tobacco ProtestorsIncognito InvognitoNo ratings yet

- Consignee (Despatch To) Customer Karachi: National SuppliesDocument1 pageConsignee (Despatch To) Customer Karachi: National SuppliesAsad S MirzaNo ratings yet

- 167043-2012-Jiao v. National Labor Relations CommissionDocument12 pages167043-2012-Jiao v. National Labor Relations CommissionChristian VillarNo ratings yet

- Support Material / Material de Apoyo Learning Activity 3 / Actividad de Aprendizaje 3Document6 pagesSupport Material / Material de Apoyo Learning Activity 3 / Actividad de Aprendizaje 3Alexandra ChavarroNo ratings yet

- List of Laboratory ActivitiesDocument2 pagesList of Laboratory ActivitiesRuvy Jean Codilla-FerrerNo ratings yet

- Literary Appreciation SkillsDocument69 pagesLiterary Appreciation SkillsAlmarez BastyNo ratings yet

- Section 2a - Final - 2 - 10 - 15Document10 pagesSection 2a - Final - 2 - 10 - 15Dana RamosNo ratings yet

- Joan Cruz V Royal Supermart Plaintiff Position PaperDocument6 pagesJoan Cruz V Royal Supermart Plaintiff Position PaperKringNo ratings yet

- Lulik: The Core of Timorese Values (Published Version)Document14 pagesLulik: The Core of Timorese Values (Published Version)Josh TrindadeNo ratings yet

- The Scientific Revolution of The 16 TH and 17 TH CenturyDocument9 pagesThe Scientific Revolution of The 16 TH and 17 TH CenturyMa.Tricia GanaciasNo ratings yet

- ODLI20161010 - 035-UPD-es - AR-FastFlex-LED-module 2x8 - 740-Gen-Ficha-TécnicaDocument11 pagesODLI20161010 - 035-UPD-es - AR-FastFlex-LED-module 2x8 - 740-Gen-Ficha-TécnicamyryqNo ratings yet

- Unit 6Document143 pagesUnit 6Venkatesh SharmaNo ratings yet

- Í ( - Zcè3Â Payuan Markâanthonyââ C Ç 0+27eî Mr. Mark Anthony Carpio PayuanDocument2 pagesÍ ( - Zcè3Â Payuan Markâanthonyââ C Ç 0+27eî Mr. Mark Anthony Carpio Payuanmacp16No ratings yet

- BoastDocument2 pagesBoastSyahmil SyazrenNo ratings yet

- TWELFTH NIGHT - Role of Feste in Twelfth NightDocument2 pagesTWELFTH NIGHT - Role of Feste in Twelfth NightAmanda F.50% (2)

- How Newsgroups WorkDocument8 pagesHow Newsgroups WorkPhaniraj LenkalapallyNo ratings yet

- Aniket Nagapure: Work Experience SkillsDocument1 pageAniket Nagapure: Work Experience Skillsaniket nagapureNo ratings yet

- CAENRFID Catalog 2020 WEB PDFDocument33 pagesCAENRFID Catalog 2020 WEB PDFfenixconNo ratings yet

- ECSS v3 BrochureDocument39 pagesECSS v3 BrochureMahesh BhatNo ratings yet

- 501 Reading Comprehension Questions: Spiteful Remarks To The Media, Which Almost Ruined The Referee'sDocument13 pages501 Reading Comprehension Questions: Spiteful Remarks To The Media, Which Almost Ruined The Referee'sKalaivani Rajendran100% (1)

- Inside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)Document10 pagesInside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)QuantDev-MNo ratings yet

- Y4 Unit 1 Our CommunityDocument12 pagesY4 Unit 1 Our Communitymerlyn90No ratings yet

- Canteen MenuDocument3 pagesCanteen MenuAravind ChidambaramNo ratings yet

- Characteristics of Effective FeedbackDocument1 pageCharacteristics of Effective Feedbacklou_rivera_1No ratings yet

- The Nature of B2B MarketingDocument14 pagesThe Nature of B2B MarketingAnshu Singh100% (1)

- Is Tithing Required in The New CovenantDocument3 pagesIs Tithing Required in The New Covenantsuhail farooqNo ratings yet

- Parts Catalog: Inner 2 Way Tray-D1Document18 pagesParts Catalog: Inner 2 Way Tray-D1utilscNo ratings yet

- Bid Docs Supply of Fuel For SPMCDocument41 pagesBid Docs Supply of Fuel For SPMCjoyNo ratings yet

- Abhishek DubeyDocument89 pagesAbhishek DubeyVeekeshGuptaNo ratings yet

- GoatmanDocument2 pagesGoatmanCute AkoNo ratings yet