Professional Documents

Culture Documents

Functions of Money 222

Uploaded by

Mohd Bilal Aman0 ratings0% found this document useful (0 votes)

19 views13 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views13 pagesFunctions of Money 222

Uploaded by

Mohd Bilal AmanCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

FUNCTIONS OF MONEY

THE FOUR FUNCTIONS OF

MONEY

• Medium of exchange.

• Standard of value.

• Store of value.

• Standard of deferred payment.

Medium of Exchange

The most important job of money is to

serve as a medium of exchange

– When any good or service is

purchased, people use money

– Money makes it easier to buy and

sell because money is universally accepted

– Money, then, provides us with a

shortcut in doing business

By acting as a medium of exchange,

money performs its most important function

Money as a Medium of

Exchange

• Money facilitates exchange by reducing

the cost of trading.

• Without money, we would have to barter.

Money As a Medium of

Exchange

Money does not have to have any inherent

value to function as a medium of exchange.

All that is necessary is that everyone believes

that other people will exchange it for their

goods.

Standard of Value

• Money is a common denominator in which the

relative value of goods and services can be

expressed

– A job that pays $2 an hour would be

nearly impossible to fill, while one paying $50

an hour would be swamped with application.

MONEY AS A UNIT OF

ACCOUNT

Money is used as a common denominator to

measure the relative values of goods and services.

Without money, we would have to measure the

value of goods and services in terms of other

goods and services.

Money is a useful unit of account only if its value

relative to the average of all other prices doesn’t

change too quickly.

Store of Value

• If you could buy 100 units of goods and services with

$100 in 1982, how many units could you buy with $100

in 2000?

– Answer: you could have bought just 51 units

– During this period, inflation robbed the dollar

of almost half of its purchasing power

• Over the long run, particularly since World War II,

money has been a very poor store of value

– However, over relatively short periods of time,

say, a few weeks or months, money does not lose

much of its value.

Money as a

Store of Value

Money is a financial asset that can be used to store

wealth (income that you have saved and not

consumed).

As a store of wealth, money pays no interest, but is

perfectly liquid.

Money’s usefulness as a store of wealth depends on

how will it maintains its value.

Standard of

Deferred Payment

• When Dave Winfield signed a 10-year, $23 million

contract with the New York Yankees in 1980, he really

got stuck

– Because over the next 10 years the consumer price

index went up by almost 59%

– Today when a professional ballplayer, entertainer, or

virtually anyone else signs a long-term contract, she or

he is generally protected by an escalator clause, which

calls for increased payments to compensate for any

future inflation.

Standard of Deferred

Payment

How well does money do its job as a

standard of deferred payment?

– About as well as it does as a

store of value

– Usually quite well in the short

run, but not well at all over the long run of,

say, three years or more.

Money

versus Barter

Without money, the only way to do business is by

bartering

For barter to work, I must want what you have and

you must want what I have

– This makes it pretty difficult to do business

“Everything, then, must be assessed in money: for this

enables men always to exchange their services, and so

makes society possible”.

MONEY- MEANING,FUNCTIONS

& EVOLUTION OF MONEY

You might also like

- Assignment On: Barriers of CommunicationDocument6 pagesAssignment On: Barriers of CommunicationMohd Bilal AmanNo ratings yet

- Banking 1Document30 pagesBanking 1Mohd Bilal AmanNo ratings yet

- BilalDocument2 pagesBilalMohd Bilal AmanNo ratings yet

- Emotional IntelligenceDocument15 pagesEmotional IntelligenceMohd Bilal AmanNo ratings yet

- Eastman Auto and Power LimitedDocument10 pagesEastman Auto and Power LimitedMohd Bilal AmanNo ratings yet

- Assignment ON: Measurement of National Income Measurement of National IncomeDocument15 pagesAssignment ON: Measurement of National Income Measurement of National Incomenik1811No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Prepared By:: Sakia Sultana ID: EB143221Document83 pagesPrepared By:: Sakia Sultana ID: EB143221Naomii HoneyNo ratings yet

- Question Bank: St. Xavier's Catholic College of Engineering Chunkankadai, Nagercoil - 629 003Document8 pagesQuestion Bank: St. Xavier's Catholic College of Engineering Chunkankadai, Nagercoil - 629 003rijaNo ratings yet

- E-Banking in MoroccoDocument21 pagesE-Banking in Moroccopse100% (1)

- Barings Bank Case StudyDocument2 pagesBarings Bank Case Studyjohnnyboy30003223100% (2)

- Brechner6e - Ch07 Invoices, Trade & Cash DiscountsDocument45 pagesBrechner6e - Ch07 Invoices, Trade & Cash DiscountsadamNo ratings yet

- International Business Law 6th Edition August Test BankDocument21 pagesInternational Business Law 6th Edition August Test Bankchristabeldienj30da100% (33)

- 06-03 Great Asian Sales Center Vs CADocument2 pages06-03 Great Asian Sales Center Vs CABernz Velo TumaruNo ratings yet

- CFS Session 1 Choosing The Firm Financial StructureDocument41 pagesCFS Session 1 Choosing The Firm Financial Structureaudrey gadayNo ratings yet

- SQLDocument3 pagesSQLcoke911111No ratings yet

- Reply Position Paper Tayao LatestDocument13 pagesReply Position Paper Tayao LatestRowena Mae Mencias100% (1)

- What If We Were Like Our Neighbors?: Welcome Guests!Document8 pagesWhat If We Were Like Our Neighbors?: Welcome Guests!John C StarkNo ratings yet

- Ebook Corporate Finance PDF Full Chapter PDFDocument67 pagesEbook Corporate Finance PDF Full Chapter PDFmyrtle.sampson431100% (25)

- Bir Form 1701aDocument4 pagesBir Form 1701aandreaNo ratings yet

- Annual Financial Statements of The ChurchDocument9 pagesAnnual Financial Statements of The ChurchKath Nidoy RoderoNo ratings yet

- SecuritizationDocument15 pagesSecuritizationAnkit LakhotiaNo ratings yet

- Chapter 7 - 18may 2022Document51 pagesChapter 7 - 18may 2022Hazlina HusseinNo ratings yet

- Unit 22Document4 pagesUnit 22Thu ĐàoNo ratings yet

- Mahusay Module 4 - Acc4115Document4 pagesMahusay Module 4 - Acc4115Jeth MahusayNo ratings yet

- RECORDING BUSINESS TRANSACTIONS PostingDocument76 pagesRECORDING BUSINESS TRANSACTIONS PostingThriztan Andrei BaluyutNo ratings yet

- Inventory ManagementDocument109 pagesInventory ManagementsreevardhanNo ratings yet

- Eneyew LakeDocument45 pagesEneyew LakeAbdi fatah BashirNo ratings yet

- CE 22 Lecture 3-1 Simple and Compound Interest, Single Cash FlowsDocument30 pagesCE 22 Lecture 3-1 Simple and Compound Interest, Single Cash FlowsOscar Sheen VillaverdeNo ratings yet

- Module 2 Special Topics in Financial ManagementDocument16 pagesModule 2 Special Topics in Financial Managementkimjoshuadiaz12No ratings yet

- Annuity, Gradient, PerpetuityDocument2 pagesAnnuity, Gradient, PerpetuityJsbebe jskdbsj100% (3)

- Luxury Fusionwear at Citrine, KolkataDocument36 pagesLuxury Fusionwear at Citrine, KolkataCitrine KolkataNo ratings yet

- Central Banking (Notes)Document8 pagesCentral Banking (Notes)Trish BustamanteNo ratings yet

- UBL Internship ReportDocument58 pagesUBL Internship Reportbbaahmad89100% (1)

- Exercise 3 SolutionDocument3 pagesExercise 3 SolutioneyNo ratings yet

- FIN534 Homework Chapter 10Document2 pagesFIN534 Homework Chapter 10Freds_filesNo ratings yet

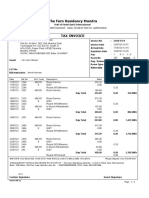

- The Fern Residency Mundra: MR - Yash VithalaniDocument2 pagesThe Fern Residency Mundra: MR - Yash VithalaniPREM KUMAR KUSHAWAHANo ratings yet