Professional Documents

Culture Documents

Locality

Uploaded by

leejolie0 ratings0% found this document useful (0 votes)

48 views2 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

48 views2 pagesLocality

Uploaded by

leejolieCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

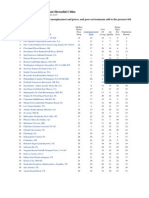

Alternative Plan for 2011 Locality-Based Comparability Payments

Locality Pay Area Locality Payment

Alaska 24.69%*

Atlanta-Sandy Springs-Gainesville, GA-AL 19.29

Boston-Worcester-Manchester, MA-NH-RI-ME 24.80

Buffalo-Niagara-Cattaraugus, NY 16.98

Chicago-Naperville-Michigan City, IL-IN-WI 25.10

Cincinnati-Middletown-Wilmington, OH-KY-IN 18.55

Cleveland-Akron-Elyria, OH 18.68

Columbus-Marion-Chillicothe, OH 17.16

Dallas-Fort Worth, TX 20.67

Dayton-Springfield-Greenville, OH 16.24

Denver-Aurora-Boulder, CO 22.52

Detroit-Warren-Flint, MI 24.09

Hartford-West Hartford-Willimantic, CT-MA 25.82

Hawaii 16.51*

Houston-Baytown-Huntsville, TX 28.71

Huntsville-Decatur, AL 16.02

Indianapolis-Anderson-Columbus, IN 14.68

Los Angeles-Long Beach-Riverside, CA 27.16

Miami-Fort Lauderdale-Pompano Beach, FL 20.79

Milwaukee-Racine-Waukesha, WI 18.10

Minneapolis-St. Paul-St. Cloud, MN-WI 20.96

New York-Newark-Bridgeport, NY-NJ-CT-PA 28.72

Philadelphia-Camden-Vineland, PA-NJ-DE-MD 21.79

Phoenix-Mesa-Scottsdale, AZ 16.76

Pittsburgh-New Castle, PA 16.37

Portland-Vancouver-Beaverton, OR-WA 20.35

Raleigh-Durham-Cary, NC 17.64

Richmond, VA 16.47

Sacramento—Arden-Arcade—Yuba City, CA-NV 22.20

San Diego-Carlsbad-San Marcos, CA 24.19

San Jose-San Francisco-Oakland, CA 35.15

Seattle-Tacoma-Olympia, WA 21.81

Washington-Baltimore-Northern Virginia, DC-MD-VA-WV-PA 24.22

Rest of U.S. 14.16*

* Under the Non-Foreign Area Retirement Equity Assurance Act of 2009 (sections 1911-1919,

Public Law 111-84, October 28, 2009), two-thirds of the applicable locality pay rate will be

payable in non-foreign areas effective with the first pay period in January 2011. Those two-

thirds payable locality rates are 16.46% in Alaska, 11.01% in Hawaii, and 9.44% in other

non-foreign areas (as identified in 5 CFR 591.205(b)(3)-(16)) that are part of the Rest of U.S.

locality pay area.

You might also like

- Trains, Buses, People, Second Edition: An Opinionated Atlas of US and Canadian TransitFrom EverandTrains, Buses, People, Second Edition: An Opinionated Atlas of US and Canadian TransitRating: 5 out of 5 stars5/5 (1)

- The WPA Guide to New York: The Empire StateFrom EverandThe WPA Guide to New York: The Empire StateRating: 4 out of 5 stars4/5 (19)

- U.S. Commute TimesDocument3 pagesU.S. Commute TimesThe Virginian-PilotNo ratings yet

- Ranking of US Most Stressed CitiesDocument2 pagesRanking of US Most Stressed CitiesOol4No ratings yet

- CipherDocument25 pagesCipherSwaratNo ratings yet

- HPIPKDocument2 pagesHPIPKBrett WidnessNo ratings yet

- Venture Capital First FinancingsDocument3 pagesVenture Capital First FinancingsWilliam HarrisNo ratings yet

- America's Safest CitiesDocument2 pagesAmerica's Safest Citiesdeja980No ratings yet

- Metropolitan Transit RankingsDocument1 pageMetropolitan Transit RankingsGreg SaulmonNo ratings yet

- Bike 2 WorkDocument2 pagesBike 2 WorkJoseph CortrightNo ratings yet

- Top 100 U.S. Housing Markets For Over/Underpricing FAU BusinessDocument3 pagesTop 100 U.S. Housing Markets For Over/Underpricing FAU BusinessABC6/FOX28No ratings yet

- Rent Vs Buy 50+cities 2011 Q1Document1 pageRent Vs Buy 50+cities 2011 Q1Nicole Meyer JohnsrudNo ratings yet

- Metropolitan Area Gross Domestic Product: 2005 (Usa)Document9 pagesMetropolitan Area Gross Domestic Product: 2005 (Usa)jproso89No ratings yet

- Urban Roads TRIP Report October 2018Document24 pagesUrban Roads TRIP Report October 2018HPR NewsNo ratings yet

- Pace of Economic Recovery: GMP and Jobs (January 2010)Document8 pagesPace of Economic Recovery: GMP and Jobs (January 2010)Dustin Tyler JoyceNo ratings yet

- Top 50 Metropolitan Statistical AreasDocument9 pagesTop 50 Metropolitan Statistical AreasRasi RathoreNo ratings yet

- 50 States With Capital and CodeDocument4 pages50 States With Capital and CodeKatherine BernalNo ratings yet

- SP Shadow Inventory Variation 060910Document14 pagesSP Shadow Inventory Variation 060910shazzakNo ratings yet

- P06 ZillowDataDocument198 pagesP06 ZillowDataLucy LambNo ratings yet

- Friday Newsletter 06-25-2010Document11 pagesFriday Newsletter 06-25-2010Gerrie SchipskeNo ratings yet

- US History Blank Map (Mdelacruz)Document8 pagesUS History Blank Map (Mdelacruz)BRIAN OSCAR GOICO DE LOS SANTOSNo ratings yet

- Bus Operating CostsDocument4 pagesBus Operating CostsMichael AndersenNo ratings yet

- Sp06 EranksDocument3 pagesSp06 Eranksnyc100% (1)

- City Crime 2008 RankDocument2 pagesCity Crime 2008 Rankwatson22No ratings yet

- Usa PDFDocument3 pagesUsa PDFNICOLL TORRES ROBLESNo ratings yet

- JB Marketing Official List of Markets For TV StreamingDocument2 pagesJB Marketing Official List of Markets For TV Streamingapi-629341413No ratings yet

- ARP NY Local Aid 3.8.21 FullDocument33 pagesARP NY Local Aid 3.8.21 FullGeorge Stockburger100% (1)

- Appendix D Cold Water Inlet Temperatures For Selected U.S. LocationsDocument2 pagesAppendix D Cold Water Inlet Temperatures For Selected U.S. LocationsGoulou VelievNo ratings yet

- Urbanized Areas Census Tract Weighted Densities CorrectedDocument3 pagesUrbanized Areas Census Tract Weighted Densities CorrectedAustin ContrarianNo ratings yet

- Metro Crime Ranking 2010-2011 HightolowDocument2 pagesMetro Crime Ranking 2010-2011 HightolowdetaoshNo ratings yet

- City Crime Metro Rank 2011Document2 pagesCity Crime Metro Rank 2011Helen BennettNo ratings yet

- 2015 2016 Dma Ranks HispanicDocument6 pages2015 2016 Dma Ranks HispanicClayton JensenNo ratings yet

- SH June09 Competitive MarketsDocument2 pagesSH June09 Competitive MarketsSimply HiredNo ratings yet

- Description: Tags: Pau89genDocument27 pagesDescription: Tags: Pau89genanon-271567No ratings yet

- Job FactsDocument1 pageJob FactsbillwhitefortexasNo ratings yet

- 2012 Fact Sheet Rankings CNTDocument2 pages2012 Fact Sheet Rankings CNTbengoldman_sbdcNo ratings yet

- Iheart Media Division Presidents and Market NamesDocument3 pagesIheart Media Division Presidents and Market NamesMichael_Lee_RobertsNo ratings yet

- A Soulful Mystery Suspense Thriller in Telugu & Tamil: U-TurnDocument4 pagesA Soulful Mystery Suspense Thriller in Telugu & Tamil: U-TurnAnonymous JDGZyaNo ratings yet

- Fed Reserve Member Banks 6-20-09Document229 pagesFed Reserve Member Banks 6-20-09Ragnar DanneskjoldNo ratings yet

- Common Airport CodesDocument2 pagesCommon Airport CodesElmachiNo ratings yet

- Description: Tags: Pau90genDocument26 pagesDescription: Tags: Pau90genanon-378474No ratings yet

- Appendix A: Federal Communications Commission DA 14-759Document10 pagesAppendix A: Federal Communications Commission DA 14-759Olu AdesolaNo ratings yet

- MN District 20Document1 pageMN District 20spsolomonNo ratings yet

- Ac135 13PDocument87 pagesAc135 13Pemanresu1No ratings yet

- Vuelos, AbreviacionesDocument78 pagesVuelos, AbreviacionesALBERTO HERNÁNDEZNo ratings yet

- Cy22 Commercial Service EnplanementsDocument16 pagesCy22 Commercial Service EnplanementsPhuong NgoNo ratings yet

- Excerpt From The Texas Transportation Institute's 2010 Mobility ReportDocument1 pageExcerpt From The Texas Transportation Institute's 2010 Mobility ReportCity Limits (New York)No ratings yet

- Grupo Sharon Motores Super Nuevos y Mejores CoolDocument9 pagesGrupo Sharon Motores Super Nuevos y Mejores CoolAlex B'cNo ratings yet

- With USA Premiers On Sep 12th (Wednesday) Ticket Prices: Adult $12, Kids $8. A Soulful Mystery Suspense Thriller in Telugu & TamilDocument3 pagesWith USA Premiers On Sep 12th (Wednesday) Ticket Prices: Adult $12, Kids $8. A Soulful Mystery Suspense Thriller in Telugu & TamilAnonymous JDGZyaNo ratings yet

- SF54 1TTDocument36 pagesSF54 1TTAlexandre FressattoNo ratings yet

- 56MM2008 2009Document3 pages56MM2008 2009johnsterlingNo ratings yet

- Distance From LocationDocument1 pageDistance From LocationRaunak SinghNo ratings yet

- GIS LinksDocument7 pagesGIS Linkskashish vermaNo ratings yet

- Katherine - Alvarez EX2019 ChallengeYourself 6 4Document13 pagesKatherine - Alvarez EX2019 ChallengeYourself 6 4k aNo ratings yet

- Data CollectionDocument36 pagesData Collectionapi-341377732No ratings yet

- Brookings VMT Cities RankingDocument2 pagesBrookings VMT Cities RankingjlhughesNo ratings yet

- Katherine - Alvarez EX2019 ChallengeYourself 6 4 2Document13 pagesKatherine - Alvarez EX2019 ChallengeYourself 6 4 2k aNo ratings yet

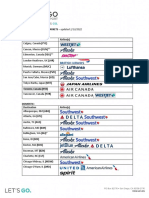

- CURRENT AIR SERVICE MARKETS - Updated 1/13/2022 International: Destination Airline(s)Document4 pagesCURRENT AIR SERVICE MARKETS - Updated 1/13/2022 International: Destination Airline(s)bmw02freakNo ratings yet

- Tech Town INDEX 2020: The Best Places For IT Pros To Live and WorkDocument32 pagesTech Town INDEX 2020: The Best Places For IT Pros To Live and WorkMehdi AhmadiNo ratings yet

- Welch Protest BidDocument4 pagesWelch Protest BidleejolieNo ratings yet

- 2011 Regulatoryagency EODocument2 pages2011 Regulatoryagency EOleejolieNo ratings yet

- FEHB Program Carrier Letter: All CarriersDocument8 pagesFEHB Program Carrier Letter: All CarriersleejolieNo ratings yet

- Fed-Postal Pension Letter POTUS 070111Document2 pagesFed-Postal Pension Letter POTUS 070111leejolieNo ratings yet

- 2011 Reg MemoDocument1 page2011 Reg MemoleejolieNo ratings yet

- 2011 Reg MemoDocument1 page2011 Reg MemoleejolieNo ratings yet

- Deltek ItspendingDocument4 pagesDeltek ItspendingleejolieNo ratings yet

- TSP Report Oct. 2011Document14 pagesTSP Report Oct. 2011leejolieNo ratings yet

- April 7, 2011: OMB Memo: Planning For A Government ShutdownDocument16 pagesApril 7, 2011: OMB Memo: Planning For A Government ShutdownChristopher DorobekNo ratings yet

- Saunders ComplaintDocument31 pagesSaunders ComplaintleejolieNo ratings yet

- CRS MemoDocument4 pagesCRS MemoleejolieNo ratings yet

- Memo For SESDocument3 pagesMemo For SESleejolieNo ratings yet

- Do DsourceselectionDocument47 pagesDo DsourceselectionleejolieNo ratings yet

- GAO DebtlimitanalysisDocument44 pagesGAO DebtlimitanalysisleejolieNo ratings yet

- NavyDocument1 pageNavyleejolieNo ratings yet

- Obama MemoDocument2 pagesObama MemoleejolieNo ratings yet

- MC AfeeDocument20 pagesMC AfeeleejolieNo ratings yet

- TSP WithdrawalDocument25 pagesTSP WithdrawalleejolieNo ratings yet

- Monthly Activity Reports: Office of Research and Strategic PlanningDocument6 pagesMonthly Activity Reports: Office of Research and Strategic PlanningleejolieNo ratings yet

- SocialsecurityDocument1 pageSocialsecurityleejolieNo ratings yet

- NavyDocument1 pageNavyleejolieNo ratings yet

- Army MemoDocument2 pagesArmy MemoleejolieNo ratings yet

- ActiacDocument2 pagesActiacleejolieNo ratings yet

- SBInet NewplanDocument2 pagesSBInet NewplanleejolieNo ratings yet

- Special Counsel ReportDocument2 pagesSpecial Counsel ReportleejolieNo ratings yet

- SBInet Assessment ReportDocument17 pagesSBInet Assessment ReportleejolieNo ratings yet

- FEW GoalsDocument2 pagesFEW GoalsleejolieNo ratings yet

- Spending Reduction PlanDocument3 pagesSpending Reduction PlanempressrulerNo ratings yet

- Onvia ForecastDocument22 pagesOnvia ForecastleejolieNo ratings yet

- OPM Pay Freeze MemoDocument4 pagesOPM Pay Freeze MemoleejolieNo ratings yet