Professional Documents

Culture Documents

TaxCalculatorFY10 11

Uploaded by

Deepak D BhatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TaxCalculatorFY10 11

Uploaded by

Deepak D BhatCopyright:

Available Formats

http://www.PankajBatra.

com

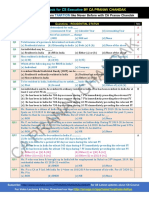

Tax Calculator F.Y. 2010-11

Gender Male

Place of Residence Metro City

Age 21

Number of children 0

Salary Breakup Investment & April May June July August September October NovemberDecember January February March Total

Bills Details

Basic Salary 1,500 1,500 1,500 1,500 9,500 9,500 9,500 9,500 9,500 9,500 9,500 9,500 82,000

House Rent Allowance (HRA) -

Transport Allowance -

Child Education Allowance -

Grade/Special/Management Allowance -

Arrears -

Gratuity -

Leave Travel Allowance (LTA) -

Leave Encashment -

Performance Incentive/Bonus -

Medical Reimbursement -

Food Coupons -

Periodical Journals -

Telephone Reimbursements -

Car Reimbursement -

Internet Expense -

Driver Salary -

Gifts From Non-Relatives -

Gifts From Relatives -

House Rent Income -

TOTAL INCOME 1,500 1,500 1,500 1,500 9,500 9,500 9,500 9,500 9,500 9,500 9,500 9,500 82,000

Exemptions

Actual Rent paid as per rent receipts -

HRA Exemption - - - - - - - - - - - - -

Non-Taxable Allowances

Child Education Allowance - -

Medical Reimbursement - -

Transport Allowance - -

LTA - -

Food Coupons -

Periodical Journals -

Telephone Reimbursement -

Car Expenses Reimbursement -

Internet expense -

Driver Salary -

Other Reimbursement -

Balance Salary 82,000

Professional Tax -

Net Taxable Salary 82,000

House and Loan Status On loan and Self Occupied

Home Loan Interest Component -

Any other Income 105,000 105,000

Gross Total Income 187,000

Deductions under chapter VIA

Insurance Premium/ULIP 6,542

Employee's contribution to PF -

PPF

ELSS, Mutual Fund

NSC/NSS/SCSS/Post Office Deposit -

Tution Fees paid -

Housing Loan Principal repayment -

Fixed Deposit for 5 yrs. or more -

Other Eligible Investments -

Total of Section 80C 6,542

Pension Fund (80 CCC)

Total Deduction under Section 80C & 80CCC 6,542 6,542

80D (Medical insurance premium, Self/Family) -

80D (Medical insurance premium, Parents) -

80E (Interest on Loan for Higher Education) - -

80U (Handicapped person) - -

Donations - 80G (100 % deductions) - -

Donations - 80G (50 % deductions) - -

Long Term Infrastructure Bonds -

Total Income 180,458

Total Income rounded off 180,460

Tax on Total Income 2,046

Surcharge -

Tax Payable 2,046

Education Cess @ 3% 61

Balance 2,107

TDS -

Net Tax Payable 2,107

Monthly Deductions from salary April May June July August September October November December January February March

TDS -

Professional Tax -

Employee's PF Contribution -

Others deductions (transport etc.) -

Employer's PF Contribution -

In Hand 1,500.00 1,500.00 1,500.00 1,500.00 9,500.00 9,500.00 9,500.00 9,500.00 9,500.00 9,500.00 9,500.00 9,500.00

ADVANCE TAX SCHEDULE

Total Tax as per Consolidation Sheet: 2,107

PARTICULARS % PAYABLE PAID DIFFERENCE

Payable upto 15th June, 2010 15% 316 - 316

Payable upto 15th September, 2010 30% 632 - 632

Payable upto 15th December, 2010 60% 1,264 - 1,264

Payable upto 15th March, 2011 100% 2,107 - 2,107

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Residential Status MCQs - Part 1Document5 pagesResidential Status MCQs - Part 1Manikandan ManoharNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Percentage Tax vs. Value-Added Tax (VAT) : What Are The Reasons To Levy Excise Taxes?Document1 pagePercentage Tax vs. Value-Added Tax (VAT) : What Are The Reasons To Levy Excise Taxes?Brithney ButalidNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument4 pagesApplication For Registration: Kawanihan NG Rentas InternasCarl PedreraNo ratings yet

- TAXATIONDocument9 pagesTAXATIONkekadiegoNo ratings yet

- The Most Common GST Tax CodesDocument9 pagesThe Most Common GST Tax Codesvickykumar20005325No ratings yet

- Itr 2Document141 pagesItr 2Maitri SaraswatNo ratings yet

- Registered Post: On 29 Sep 2022 Vide This Officeletter No. 8926/07/E8 DT 29 Sep 2022. andDocument1 pageRegistered Post: On 29 Sep 2022 Vide This Officeletter No. 8926/07/E8 DT 29 Sep 2022. andSunil SalunkeNo ratings yet

- Taxation Law Bar Exams (1994-2006) PDFDocument86 pagesTaxation Law Bar Exams (1994-2006) PDFNoel Alberto Omandap100% (1)

- Exempted Income Under Section 10Document21 pagesExempted Income Under Section 10Vaishali SharmaNo ratings yet

- Exercises Tax2Document9 pagesExercises Tax2Helen Faith EstanteNo ratings yet

- FREE SAP FI Certification QuestionsDocument8 pagesFREE SAP FI Certification Questionsmasindevicky100% (1)

- D. All of The Above: A. Progressive TaxDocument6 pagesD. All of The Above: A. Progressive TaxMohammadNo ratings yet

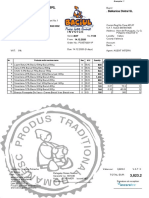

- SC Meridian Agroind SRL: - Balkanica Distral SLDocument2 pagesSC Meridian Agroind SRL: - Balkanica Distral SLMeridian AgroindNo ratings yet

- Bsa2105 FS2021 011 Vatex1 Solution PDFDocument6 pagesBsa2105 FS2021 011 Vatex1 Solution PDFedrianclydeNo ratings yet

- 2550m April 2019 - LGSLDocument3 pages2550m April 2019 - LGSLexergyNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDprernaNo ratings yet

- Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectDocument1 pageBranch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectSaurya anandNo ratings yet

- Chapter 4 EXERCISES - Estates and TrustsDocument9 pagesChapter 4 EXERCISES - Estates and TrustscathyydumpNo ratings yet

- BIR Ruling No 039-2002Document2 pagesBIR Ruling No 039-2002Ton Ton Cananea100% (1)

- A Case Study: Ms - Rajeshwari BandaruDocument12 pagesA Case Study: Ms - Rajeshwari BandaruVin M.No ratings yet

- Financial Relation Between Centre and StateDocument4 pagesFinancial Relation Between Centre and StateGhazala ShaheenNo ratings yet

- OD329406902129978100Document1 pageOD329406902129978100yy11997199No ratings yet

- Group 4: Assessmen T QuestionsDocument16 pagesGroup 4: Assessmen T Questionsrld LobianoNo ratings yet

- servAcknoReport 1Document1 pageservAcknoReport 1Petas SarNo ratings yet

- 1 Dio, RC, Tax Due. WorldDocument14 pages1 Dio, RC, Tax Due. WorldAngelou J. Delos ReyesNo ratings yet

- Fiscal Policy of PakistanDocument26 pagesFiscal Policy of PakistanMuhammad Muavia Siddiqy60% (5)

- RMO No. 10-2019 - DigestDocument3 pagesRMO No. 10-2019 - DigestAMNo ratings yet

- Payslip Name: Juan Dela Cruz Month: January 1-31, 2020 Contract SalaryDocument3 pagesPayslip Name: Juan Dela Cruz Month: January 1-31, 2020 Contract SalaryTESDAR12 SKTESDANo ratings yet

- Tax ExemptDocument2 pagesTax ExemptLj PerrierNo ratings yet