Professional Documents

Culture Documents

Wipro Technologies Q3 2011 Analysis

Uploaded by

businessviewsreviewsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wipro Technologies Q3 2011 Analysis

Uploaded by

businessviewsreviewsCopyright:

Available Formats

Businessviewsreviews Wipro Q3 2011 Report

Wipro Q3 PAT rises 10%, y-o-y, IT’s CEOs resign

Company Snapshot

Industry: IT services Consulting, Application

Services: Outsourcing, BPO, Development and Maintenance,

Software Products BPO

Founded: 1945 BSE Code: 507685

Headquarters: Bangalore, NYSE: WIT

Karnataka, India Key people

Services: Product Engineering Azim Premji, (Chairman)

Solutions, Technology, TK Kurien , (joint CEO)

Infrastructure Services,

Jargon-free reports for easy understanding from www.businessviewsreviews.blogspot.com

Businessviewsreviews Wipro Q3 2011 Report

The much-awaited financial results of Wipro’s Q3 FY’11 result

were announced early morning today which have more or less

met analysts’ forecasts.

Results of IT Services

The Bangalore-headquartered technology major while releasing its

financial results under International Financial Reporting Standards

(IFRS) has said that its IT Services Revenues, in dollar, terms were

$1,344 million, a sequential increase of 5.6% and YoY increase of

19.3%. When translated into Indian rupees, the IT Services

Revenues were up 15% Y-o-Y to Rs. 59.49 billion ($1,328 million).

Wipro’s IT Services Earnings Before Interest and Tax (EBIT) rose 8%

y-o-y to Rs 13.21 billion ($295 million*).

However, the company’s margins at 22.8% was flat during the

quarter over the immediate preceding September’10 quarter but

was significantly lower than 23.7% reported a year ago. “The

operating margins for IT Services business was flat, despite lower

working days and drop in utilization,” said Suresh Senapaty,

Executive Director & Chief Financial Officer, Wipro.

Also, price realization related to onsite projects was down by 3.6%

Y-o-Y. Further, Net Utilization (Excluding Trainees) was lower at

79.9% (Q3FY11) vs. 84.5% (Q3FY10), Y-o-Y.

Jargon-free reports for easy understanding from www.businessviewsreviews.blogspot.com

Businessviewsreviews Wipro Q3 2011 Report

Higher attrition rate (Voluntary TTM at 21.6% vs. 9.9%, Y-o-Y) too is

a concern for the company. In terms of verticals, Technology and

Healthcare & Services saw de-growth of almost identical level of

3.5%

In terms of Geography, APAC and Other Emerging Markets grew the

highest at 37.8% Y-o-Y. India & Middle East business saw a growth

of 18.9% Y-o-Y.

In terms of Practices, Consulting business saw edged higher,

clocking a growth of nearly 60% Y-o-Y, as compared to others.

The company’s IT Services business added 36 new clients during

the third quarter ending December 31, 2010. There was also a net

addition of 3,591 employees during the same quarter. The company

also said that its Consumer Care and Lighting Revenues grew 21%

while the EBIT grew 14%, y-o-y.

Wipro is a $6bn enterprise (based on consolidated revenues of

FY'10) with major interests in Software Services Computer

Hardware, Consumer Products, and Lighting Solutions. Wipro’s IT

Services businesses accounted for 76% of its consolidated revenues

during the just concluded third quarter (i.e., Q3FY11). The

Bangalore-based firm is India’s third largest software exporter

behind TCS and Infosys.

See Growth Metrics below:

Jargon-free reports for easy understanding from www.businessviewsreviews.blogspot.com

Businessviewsreviews Wipro Q3 2011 Report

Jargon-free reports for easy understanding from www.businessviewsreviews.blogspot.com

Businessviewsreviews Wipro Q3 2011 Report

Jargon-free reports for easy understanding from www.businessviewsreviews.blogspot.com

Businessviewsreviews Wipro Q3 2011 Report

Jargon-free reports for easy understanding from www.businessviewsreviews.blogspot.com

Businessviewsreviews Wipro Q3 2011 Report

Jargon-free reports for easy understanding from www.businessviewsreviews.blogspot.com

Businessviewsreviews Wipro Q3 2011 Report

Results of Wipro Ltd. (Consolidated)

The company also said that its Consolidated Revenues (which

include other businesses such as soaps and bulbs) were up 12% y-

o-y to Rs. 78.29 billion ($1.75 billion*) while Consolidated PAT grew

10% y-o-y to 13.19 billion ($294 million*).

The company’s results were almost in line with analysts’

expectations. A CNBC-TV18 poll of brokerages had estimated

consolidated net profit of Rs 13.18 billion and consolidated

revenues of Rs 80.02 billion. However, some analysts felt that

results were disappointing. “Wipro's third quarter results are below

our expectation. Revenue growth was lower-than-expected, whereas

PAT was in-line with our estimates. We expect the stock to see

correction as results lack any positive surprise,” said a report from

brokerage house.

Analysts have also expressed surprise at the change of guard at the

firm’s IT Services. “The management rejig has made the investors

cautious, as it is now a big responsibility for Kurien, who will alone

handle the position held by two people earlier,” NDTV Profit quoted

Geojit BNP Paribas Financial Services’ AVP Gaurang Shah as

saying.

Jargon-free reports for easy understanding from www.businessviewsreviews.blogspot.com

Businessviewsreviews Wipro Q3 2011 Report

Highlights of the Results:

IT Services Revenue in dollar terms was $1,344 million, a sequential

increase of 5.6% and YoY

Increase of 19.3%. Non-GAAP constant currency revenue was $1325

million.

IT Services Revenues were Rs. 59.49 billion ($1,328 million1),

representing an increase of 15% over the same period last year.

Total Revenues were Rs. 78.29 billion ($1.75 billion1), representing an

increase of 12% over the same period last year.

Net Income was Rs. 13.19 billion ($294 million1), representing an

increase of 10% over the same period last year.

Non-GAAP Adjusted Net Income (excluding impact of accelerated

amortization of stock based compensation) was Rs. 13.09 billion ($292

million1), representing an increase of 9% over the same period last year.

IT Services Earnings Before Interest and Tax (EBIT) was Rs. 13.21 billion

($295 million1), representing an increase of 8% over the same period last

year.

IT Services added 36 new clients in the quarter.

Net addition of 3,591 employees in the current quarter.

Consumer Care and Lighting Revenue grew 21% over the same period

last year and EBIT grew 14%.

Wipro declares an interim dividend of `2 ($0.041) per share /ADS.

(Source: Wipro)

(*For the convenience of the reader, the amounts in Indian rupees in this release have been

translated into United States dollars at the noon buying rate in New York City on December 30,

2010, for cable transfers in Indian rupees, as certified by the Federal Reserve Board of New

York, which was US $1=Rs.44.80. However, the realized exchange rate in our IT Services

business segment for the quarter ended December 31, 2010 was US$1=Rs.44.27)

Jargon-free reports for easy understanding from www.businessviewsreviews.blogspot.com

Businessviewsreviews Wipro Q3 2011 Report

However, the company surprised market by saying that Suresh

Vaswani and Girish Paranjpe, the joint CEOs of IT Services, are

stepping down and in place TK Kurien will be the new CEO of

Wipro. Making the announcement Azim Premji, Wipro’s Chairman

said, “The Joint CEO structure was one of the key factors that

successfully helped us navigate the worst economic crisis of our

times. With the change in environment, there is a need for a simpler

organization structure. Kurien’s track record makes him uniquely

positioned to lead Wipro through the next phase of growth.”

Wipro’s Q3FY11 performance lags bigger rivals TCS and Infosys.

Earlier, TCS came out with better-than-expected Q3 numbers,

bettering market estimates, and Infosys’ numbers although good yet

disappointed the street.

In its Outlook for the Quarter ending March 31, 2011, the company

said, “We expect Revenues from our IT Services business to be in

the range of $1,384 million to $1,411 million, a sequential increase

of 3% to 5%( based on the constant currency exchange rates:

GBP/USD at 1.58, Euro/USD at 1.35, AUD/USD at 1.01, USD/INR

at 44.98).

The shares of Wipro fell 4% in the morning trade after the

announcement of the result.

Jargon-free reports for easy understanding from www.businessviewsreviews.blogspot.com

You might also like

- Cognizant and Indian IT's Big 4 - The David' Is Fast Closing inDocument4 pagesCognizant and Indian IT's Big 4 - The David' Is Fast Closing inbusinessviewsreviewsNo ratings yet

- Indian FM Radio Industry: Sound of Money - Q4 Results Add On ViewsDocument9 pagesIndian FM Radio Industry: Sound of Money - Q4 Results Add On ViewsbusinessviewsreviewsNo ratings yet

- Breaking The Glass Ceiling - Women of Indian BankingDocument4 pagesBreaking The Glass Ceiling - Women of Indian BankingbusinessviewsreviewsNo ratings yet

- SBI - Who Says Elephants Can't DanceDocument7 pagesSBI - Who Says Elephants Can't DancebusinessviewsreviewsNo ratings yet

- ICICI Bank Continues Strong Growth Momentum in Q3Document5 pagesICICI Bank Continues Strong Growth Momentum in Q3businessviewsreviewsNo ratings yet

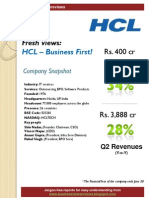

- Fresh Views - HCL Business First - Q2 2011 AnalysisDocument8 pagesFresh Views - HCL Business First - Q2 2011 AnalysisbusinessviewsreviewsNo ratings yet

- Corporate Analysis - TCS Vs InfosysDocument2 pagesCorporate Analysis - TCS Vs InfosysbusinessviewsreviewsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Second LessonDocument47 pagesSecond LessonGiorgio FranchiniNo ratings yet

- Volume - 4 Simple Trading Strategies Using Chart Pattterns: Why Is Volume Important?Document20 pagesVolume - 4 Simple Trading Strategies Using Chart Pattterns: Why Is Volume Important?Anshuman Gupta100% (1)

- 5 Investment Books For 2021Document4 pages5 Investment Books For 2021Yassine MafraxNo ratings yet

- CorporationDocument7 pagesCorporationDo RaemondNo ratings yet

- Marketing That MattersDocument10 pagesMarketing That MattersMark William George DvorakNo ratings yet

- Nse Academy'S Certification in Financial Markets (NCFM) : Registration FormDocument9 pagesNse Academy'S Certification in Financial Markets (NCFM) : Registration FormmailnowNo ratings yet

- Financial and Technical AnalysisDocument62 pagesFinancial and Technical AnalysisBhupender Singh RawatNo ratings yet

- Ray Dalio: I Have Some Bitcoin'Document5 pagesRay Dalio: I Have Some Bitcoin'Bogdan L MorosanNo ratings yet

- Chapter 8.1 - OPTIONS MARKETDocument45 pagesChapter 8.1 - OPTIONS MARKETfarah zulkefliNo ratings yet

- Role of FIDocument39 pagesRole of FIVaibhav MahamunkarNo ratings yet

- Marginal Cost of CapitalDocument13 pagesMarginal Cost of CapitalShubham RanaNo ratings yet

- PMS Master CircularDocument100 pagesPMS Master CircularLouis NoronhaNo ratings yet

- BMW Financial Statement Analysis Reveals Profitability and Liquidity TrendsDocument27 pagesBMW Financial Statement Analysis Reveals Profitability and Liquidity Trendssaurabhm707No ratings yet

- Computron Industries Ratio Analysis For ClassDocument8 pagesComputron Industries Ratio Analysis For ClassRishabh JainNo ratings yet

- Corporate Bond Raising ProcessDocument3 pagesCorporate Bond Raising ProcessZahed IbrahimNo ratings yet

- Sovereign Gold Bonds - InfoDocument5 pagesSovereign Gold Bonds - InfoShawn SriramNo ratings yet

- December 2010 RecapDocument23 pagesDecember 2010 RecapManish MishraNo ratings yet

- Exchange Rate Regimes - Fix or Float - Março 2008Document2 pagesExchange Rate Regimes - Fix or Float - Março 2008Rúbia RodriguesNo ratings yet

- 11 Derivatives PDFDocument23 pages11 Derivatives PDFReshmi SinghaNo ratings yet

- EC3314 Spring PSet 4 SolutionsDocument6 pagesEC3314 Spring PSet 4 Solutionschristina0107No ratings yet

- Assignment 1Document6 pagesAssignment 1suhasNo ratings yet

- New Straits Times - Interview The Experts With Kathlyn Toh - Trading Success SecretsDocument1 pageNew Straits Times - Interview The Experts With Kathlyn Toh - Trading Success SecretsBeyond InsightsNo ratings yet

- 10 Biggest Mistakes Options Trading PDFDocument80 pages10 Biggest Mistakes Options Trading PDFDanno NNo ratings yet

- Angel+Crowdfunding Options for StartupsDocument16 pagesAngel+Crowdfunding Options for StartupsPrachi BharadwajNo ratings yet

- Investment AccountingDocument7 pagesInvestment AccountingNikhil NagendraNo ratings yet

- EntrepDocument7 pagesEntrepPantz Revibes PastorNo ratings yet

- Financial Modelling HandbookDocument76 pagesFinancial Modelling Handbookreadersbusiness99No ratings yet

- Investors Behavior in Equity Market: A Study of Investors in Ahmedabad CityDocument5 pagesInvestors Behavior in Equity Market: A Study of Investors in Ahmedabad CityKavitha KavithaNo ratings yet

- 8923 - Foreign Currency HedgingDocument7 pages8923 - Foreign Currency HedgingThalia BontigaoNo ratings yet

- Chapter 5 M&ADocument30 pagesChapter 5 M&Achand1234567893No ratings yet