Professional Documents

Culture Documents

2009 Sit in Movement Inc 990 Form

2009 Sit in Movement Inc 990 Form

Uploaded by

triadwatch0 ratings0% found this document useful (0 votes)

289 views26 pages2009 990 form for the sit in movement inc which is the international civil rights museum in greensboro nc

Original Title

2009 sit in movement inc 990 form

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document2009 990 form for the sit in movement inc which is the international civil rights museum in greensboro nc

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

289 views26 pages2009 Sit in Movement Inc 990 Form

2009 Sit in Movement Inc 990 Form

Uploaded by

triadwatch2009 990 form for the sit in movement inc which is the international civil rights museum in greensboro nc

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 26

SCANNED MAY 2 6 2010

*

70 990

For the 2009 calendar,

Return of Organization Exempt From Income Tax

Under section 501), 527, or 4947(X1) ofthe Internal Revenue Code

“xcept Isc lung Benet rst or private foundation)

The exganzation may have to use 2 copy f ths return say state eprtngrequrererts

2009, and ending

2009

(Open to Public Inspection

ar, or tax year beginning

ic

B check apocatie D Enpiayeriaericnion Rarer

asin ctoe |S] STT-IN MOVEMENT, INC 56-1856093

ome change vy, {PO BOX 847 TE Telechane number

at een spncie [GREENSBORO, NC 27402 336 274 9199

[ajeeooees 6 con 22,060,522

ecvicaton peodng| F hams arenas oipmensoner Melvin "Skip" Alston [Mae hwsgoe etme = re Be

Same As C Above eS ee nea

1_Toreremptsiaus K]so1@ C3 __)=Gnserino) [ Tere@cer [Te

J Website» N/A co emngton nab *

Hornet ogmaion_[X]oupmaten | [To [| mesaten | Love [Everatamain 1994 [Msosaepiemce NO

[Pan —| Summary

7 Brelly describe the organiauon's mason or moat agaicant aces -TO_l

| -

i} -

J) 2 Gece [site organ coined is operons or deposed a wore han 25 oti ase

3 3 umber of voting members ofthe governing body Part Vl, hne 1a) 3

| 4 Number of independent votng members ofthe govering body Pat Vi, ine 16) 7

8) 5 Tota rumberof employees Pant Vine 23) 5

| 6 Total number of volunteers (estimate if necessary) €

3] 7a Total goss unrelated business revenue fom Part Vl, column (), tne 12 7a

b Nel uivelated business laxable income from Form 990-T, ine 36 70

{8 Contabutons and grants Part Vl ine 1h

3 | 3 Progam scree evens at Vil tne 2)

F | 10° Investment come art Vil cok (8, hoes 3,4, and 7 3466.[ 3807, 047

31. Other revenue (Patt Vil, eotumn (A), nes 5, 6d, Be, Se, 10, and 11) 150,922] 5,729,168.

12 Total revenue ~ ad hines 8 tough 11 (rusl equa Pat Vil column (A), ne 1 3/190, 266.| 12,372,799.

73 Granls and simular amounts pad (Pant IX, column (A), hnes 1-3)

14 Beneits pad toot for members (Part, eal (4), ine 4

«| 15. Solan, cther compensation, employee bene ines 5:10) 213,075 26U,126

$162 Professional fundrarsing fees (Part IX, column (A), ree CEIVED

J _® Total tuncrassing expenses (Part IX, column ©) re a= =

7” oneremperecs at coun (nes af THAT 2010 430,166.| 1,645,072

19 Revenue less expences Subtract ine 18 from Ine Weyer 2 Z,547,005,| 10, 460,601

Wl f2O8BEN_UT- | Beginning of Year_| End of Year

$4] 20 Total assets art X, tne 16) 11, 994,501] 23, 653, 258

B21 Total abites @an x ine 26 21887, 380-| 4,085,576

#2) 22 Net assets or fund balances Sublract ne 21 from line 20 9,107,121.| 19,567,722.

fart IT ‘Signature Block

ces fis ies sR SPRUURRLSTEPSE TEBE Ht grt an tll

sign |>

Here

> Melvin’ "Skip" Alston Chairman

Toate ditrane si

pa Vere oa S =

ai Ey © " eyes > mae

bat lace» armen nsome( Afni |4/a3/0 ia 372 16-01

2rerS Tress Oliver W- Bowie; CPA, PR 19629

Only Spee, > Eo. Box 22052 en _+ wa SO

et tha Greensboro, NC 27420 [prone no» (336) 273-9461

‘May he RS discuss Un tun with the preparer shown above? Gee naluchons) Thves Ine

BAR For

rivacy Act and Paperwork Reduction Act Nolice, see the separate instructions. TeEAaa Waza Form 890 (209

orm 990,005) _SIT-IN MOVEMENT, TNC 56 1856093 Pagez

» [Pargili_| Statement of Program Service Accomplishments

1 Baely describe the organzaton’s masion

70 ES! NTERN

2 Did the organization underlake any significant program sewices dunng the year which were nal isled on the prior

Foxm 99001 950-627 1 ves Eno

I1¥es, descnbe these new serves on Schedule ©

3 Did the organzabon cease conducting, or make sqnitcant changes im how conducts, any rogram servces? [] Yes [E]_ Wo

"Yes, describe these changes on Sehedule O

4 Describe the exemot purpose achievements for each ofthe organization's thvee largest program serwces by expenses. Section 501(c)(3)

‘3nd-501()(0) organizalions and sechon 4947(a)(1) trusts ae required lo report the amount of gras and allocations to others, the tote

xpenses, end revenue, i ary. lor each program Service reported

4a(Code [1] Expenses $__1, 341, 411. including grants of $. ) Revenue 8, y

“PLANNING AND THE DEVELOPMENT OF THE PROPOSED MUSEUM. THE ORGANIZATION HAS ENGAGED _

"IRM:

4b (Code [7 Expenses $ including orants of $, ) Revenue § >

THE_OR( PURCHA: HOR: TION,

TINTERNATIONAL CIVIL RIGHTS MUSEUM IN EARLY 1995.

inching gras of § ) Revenue §. )

ELON

“4d Other progiam services (Desenbe m Schedule O)

Expenses _$ including grants of _$ )everve_$ )

“de Total program sence expenses > 1,341, 417

BAA sees ono0e Form 990 (2009)

Foxr980 (2009) _SIT-IN MOVEMENT, INC 56 1856093, Page 3

[Partiv_ [Checklist of Required Schedules

Yes] No

1 «the organization described in section 501(C(3) oF 4947.) other than a private foundation)” If Yes," complete

Schedule A on

2. Is the ergantzation required to complete Schedule B, Schedule of Contibutors? 2 x

3. Did the organization engage in dtect or nsec! politcal campaign actuties on behal of orn opposition to candidates

for pobie tice? Yes, complete Schedule ©. Par) 3 x

4. Section 501(€}3) organizations Did the organization engage in lobbying alwites? If "Yes." complete

Shecuie C Part , n

5 Section $01(€X4, 501(€X6), and 501(¢X6) organizations. Is the oxganzation subject fo the section 6033(e) noice and

‘SSoringreschemont ond proky aA Yess compare Schecue e Pat 5

Did the organization maintain any donor advise funds or any similar funds or accounts where donors have the night 10

Brovide aduce on he cisinbulon oF mvestment of amounis mn such funcs oF accounts? IfYes complete Schedule O

Bot 6 x

7 Did the organization recewe or hold a conservation easement, including easements to preserve open space, the

nuronment histone land aress or stone sivuclnes? If Yas, complete Schedule D Port z rd

8 Did the organization maintain collections of works of art, historical reasies, or other simular assets? If 'Yes,

eampiete Schedule 0, Part it 8 x

‘9 id the organization report an amount in Pat X, line 21, serve as a custodian for amounts no! sted in Pat X

rouge ced counseling, debt management crac tepar, oF dbl negotahon senmces? If Yes, completa

Schedule D. Bart a 7 : 7 9

10 Did the organization, directly or tirough a related organization, hold assels in lerm, petmanent, or quasiendowments? i

Yes complete Seheduie D, Part V 10

11s the exgarzabon's answer to any of the following queshons "Yes? 1 so, complete Schedule O. Parts VI. Vl. Vil IX, or

35 sppleable nix

‘Dd the organization report an amount for land, bulings and equipment im Patt X, ne 107 If'Yes.’ complete Schedule

Bean Vi

‘01d the organization report an amount for vestments other secures in Part X, line 12 thal 1s 5% oF more of oll

S3sets reported m Part X ine 16° If Ves. compete Schedule B Part Vil

ad the organization report an amount for investments program related im Part X, line 13 thats 5% or more of ts total

{assets reported in Part line 16° If 'Yes," complete Schedule B, Part Vill

Did the orgaruzation report an amount fr other assets Part X, ine 15 that 1 5% or more of ts otal asses reported

Patt & ine 16" If Yes, complete Schedule D. Part IX

Did the organization report an amount for other labies sn Part X, ine 25° if Yes," complete Schedule O, Part X

‘Did he organization's separate or consolidated fmancial statements othe lax year include a footnote that addresses

‘he organidatons abit for unceriamn tox postions unger FIN 88? I Yes, complete Schoguie D, Part X

12 Q@ the axganzaton oban separate, dependent aude nancial statement forte tox year? I Yes, complete

Sthadie B Parts Mi and 12 x

‘12AWas the organization included in consolidated, independent ausited fmancal statement forthe tax Yes] No

year? if Yes," completing Schedule D, Parts Xi, Xll, and Xill1s optional heal x

13 Is the organization a school described in section 170(0)(1(ANID? If Yes," complete Schedule E 3 x

“14a Did the organization maintain an ofice, employees, or agents outside of the United States? naa] x

'b Did the organization have aggregate revenves or expenses af more than $10,000 fram grantmaking, funcrasing,

Business, and program service acmlies oulide the United States? If Yes, complete Schedule F Part? vw} | x

15_ Did the organization report on Part 1X, column (A), ne 3, more than $5,000 of grants or assistance to any organization

ereniiy located outa the United States? I Yee," comblote Schedule Part 15 i

16 Did the organization report on Part IX, column (A), ne 3, mere than $5,000 of aggregate grants or assistance to

Imdnndusis iocated outa the United States? If Yes, complete Seheduie F. Par Il 16 ra

17 Did the oxganizatin report a total of more than $15,000 of expenses for professional fundraising services on Part IX.

Column (Sy hnes 6 and Tie? it Yes, complete Schedule G, Bartl v x

18. Did the organizatin report more than $15,000 teal of fundrasing event gross income and contributions on Part Vl

Iines te and 8a? 11's, complete Schedule G, Part we| x

19 Did the ocganization ceport more than $15,000 of gross income from gaming actwites on Part Vill ine 93? If "Yes,

‘compete Berecule CPt It 1” x

20 Did he organization operate one or more hospitals? If'Yes," complete Schedule H 20 x

BAR Tina aa

Form 880 (2008)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Reading & Writing - BooksDocument78 pagesReading & Writing - BooksThe 18th Century Material Culture Resource Center100% (5)

- Thundarr The Barbarian: The Wizard's Graveyard: North Texas RPG Con 2014Document11 pagesThundarr The Barbarian: The Wizard's Graveyard: North Texas RPG Con 2014Tim SniderNo ratings yet

- PopUpCzechCatalog PDFDocument140 pagesPopUpCzechCatalog PDFAusarNo ratings yet

- ActiveX-VBA Developers GuideDocument362 pagesActiveX-VBA Developers GuideChristian Parra OrtegaNo ratings yet

- Uganda, Republic Of.Document8 pagesUganda, Republic Of.Angelo LippolisNo ratings yet

- Aztec and Maya Revival Exhibition GuideDocument20 pagesAztec and Maya Revival Exhibition Guidelane250aNo ratings yet

- David Ogilvy 10 Tips On WritingDocument9 pagesDavid Ogilvy 10 Tips On WritingmalingyeeNo ratings yet

- MMA - H. Winlock - Temple of Ramses I at Abydos - 1931 PDFDocument68 pagesMMA - H. Winlock - Temple of Ramses I at Abydos - 1931 PDFoupouaout7100% (2)

- Summary Catalogue of European Decorative Arts in The J. Paul Getty MuseumDocument289 pagesSummary Catalogue of European Decorative Arts in The J. Paul Getty Museumvthiseas100% (3)

- PDFDocument447 pagesPDFArianna Violin100% (1)

- Brooks Pierce Contract With City of GreensboroDocument7 pagesBrooks Pierce Contract With City of GreensborotriadwatchNo ratings yet

- Revised Proposed Congressional District 6 NCDocument1 pageRevised Proposed Congressional District 6 NCtriadwatchNo ratings yet

- Advertising Tax Lien Costs and Corresponding Publications With Collection RatesDocument2 pagesAdvertising Tax Lien Costs and Corresponding Publications With Collection RatestriadwatchNo ratings yet

- Center Pointe Noise ComplaintDocument58 pagesCenter Pointe Noise ComplainttriadwatchNo ratings yet

- Proposed Senate District #27 NC Redistricting in 2011Document1 pageProposed Senate District #27 NC Redistricting in 2011triadwatchNo ratings yet

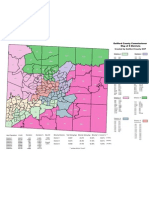

- Chairman Skip Alston Redistricting Map On Precinct Overlay 2011Document1 pageChairman Skip Alston Redistricting Map On Precinct Overlay 2011triadwatchNo ratings yet

- Noise CFS About or From 201 N Elm ST - Jan 2011-Mar 11 2012Document2 pagesNoise CFS About or From 201 N Elm ST - Jan 2011-Mar 11 2012triadwatchNo ratings yet

- Guilford County Final Proposed Redistricting PlansDocument6 pagesGuilford County Final Proposed Redistricting PlanstriadwatchNo ratings yet

- Opinion Letter On Greensboro Councilman Zack Matheny and Robbie PerkinsDocument4 pagesOpinion Letter On Greensboro Councilman Zack Matheny and Robbie PerkinstriadwatchNo ratings yet

- Guilford County GOP MAP Proposed For 2011Document1 pageGuilford County GOP MAP Proposed For 2011triadwatchNo ratings yet

- North Carolina Redistricting in 2011 New Map For Congressional District 12Document1 pageNorth Carolina Redistricting in 2011 New Map For Congressional District 12triadwatchNo ratings yet

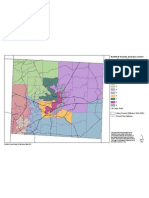

- Guilford County Commissioners 2011 Redistricting Numbers For 8 DistrictsDocument21 pagesGuilford County Commissioners 2011 Redistricting Numbers For 8 DistrictstriadwatchNo ratings yet

- North Carolina Redistricting New Congressional Map For District #13 in 2011Document1 pageNorth Carolina Redistricting New Congressional Map For District #13 in 2011triadwatchNo ratings yet

- Distdetail 6Document1 pageDistdetail 6triadwatchNo ratings yet

- 1991 Guilford County Commissioners DistrictsDocument1 page1991 Guilford County Commissioners DistrictstriadwatchNo ratings yet

- Guilford County Commissioner Skip Alston's District Breakdown As of May 6, 2011Document1 pageGuilford County Commissioner Skip Alston's District Breakdown As of May 6, 2011triadwatchNo ratings yet

- 1991 Guilford County Commissioners DistrictsDocument1 page1991 Guilford County Commissioners DistrictstriadwatchNo ratings yet

- Guilford County Commissioner MapDocument1 pageGuilford County Commissioner MaptriadwatchNo ratings yet

- The Yarm Helmet: Medieval ArchaeologyDocument35 pagesThe Yarm Helmet: Medieval ArchaeologyŁukasz CzarkowskiNo ratings yet

- Research About The Famous Golden Face MaskDocument9 pagesResearch About The Famous Golden Face MaskjfrNo ratings yet

- Hermann Czech - Architectural ConceptDocument7 pagesHermann Czech - Architectural ConceptYuchen WuNo ratings yet

- Manual Plan e Informes de Marketing Internacional UF1783Document20 pagesManual Plan e Informes de Marketing Internacional UF1783Lesli TammyNo ratings yet

- Library Staff-Role and ResponsibilitiesDocument32 pagesLibrary Staff-Role and ResponsibilitiesdyvakumarNo ratings yet

- Netbeans-Platform RefCardDocument6 pagesNetbeans-Platform RefCardRajan KadamNo ratings yet

- LC-3 Assembly LanguageDocument18 pagesLC-3 Assembly LanguageElad TalicNo ratings yet

- PyxmlDocument18 pagesPyxmlOkibe Jeffery IfereNo ratings yet

- The Artistry of Pierre PugetDocument14 pagesThe Artistry of Pierre Pugetapi-353369365No ratings yet

- Instant Download Statistical Concepts For Criminal Justice and Criminology 1st Edition Williams III Test Bank PDF Full ChapterDocument32 pagesInstant Download Statistical Concepts For Criminal Justice and Criminology 1st Edition Williams III Test Bank PDF Full ChapterTiffanyHernandezngjx100% (7)

- Doosan Dielsel Forklift d50s 5 d60s 5 d70s 5 d80s 5 d90s 5 g50s 5 g60s 5 g70s 5 Electric Schematic Service Operaton Maintenance Manual Cd4271e 05Document22 pagesDoosan Dielsel Forklift d50s 5 d60s 5 d70s 5 d80s 5 d90s 5 g50s 5 g60s 5 g70s 5 Electric Schematic Service Operaton Maintenance Manual Cd4271e 05codyburton010800qae100% (94)

- Introduction To Obspy LionDocument54 pagesIntroduction To Obspy LionBenja LedesmaNo ratings yet

- Regioni D'italia: CampaniaDocument52 pagesRegioni D'italia: CampaniaMarianne Sheena Sarah SablanNo ratings yet

- Further Nores On Baburnama Turki MSS PDFDocument8 pagesFurther Nores On Baburnama Turki MSS PDFNajaf HaiderNo ratings yet

- TUETH Laughter in The Living Room. Television Comedy and The American Home AudienceDocument3 pagesTUETH Laughter in The Living Room. Television Comedy and The American Home AudienceLibros de BauboNo ratings yet

- 212a - Object Oriented Programming With C++Document20 pages212a - Object Oriented Programming With C++Leizza Ni Gui DulaNo ratings yet

- Annie CabigtingDocument2 pagesAnnie Cabigtingkathleen dela cruzNo ratings yet

- FSX - Sim Connect - SDK DocumentationDocument152 pagesFSX - Sim Connect - SDK Documentationc_s_wagonNo ratings yet

- A Numismatic Bibliography of The Far East: A Check List of Titles in European Languages / by Howard Franklin BowkerDocument148 pagesA Numismatic Bibliography of The Far East: A Check List of Titles in European Languages / by Howard Franklin BowkerDigital Library Numis (DLN)No ratings yet

- Businesses Within The AreaDocument2 pagesBusinesses Within The AreaDeryl GalveNo ratings yet