Professional Documents

Culture Documents

Form - I (A) : Department of Commercial Taxes, Government of Uttar Pradesh

Uploaded by

Prakhar Jain0 ratings0% found this document useful (0 votes)

74 views4 pagesOriginal Title

Form-1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

74 views4 pagesForm - I (A) : Department of Commercial Taxes, Government of Uttar Pradesh

Uploaded by

Prakhar JainCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

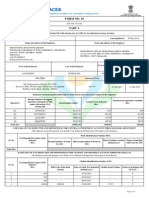

FORM - I [A]

Department of Commercial Taxes, Government of Uttar Pradesh

[See ru le-12 of the UPVAT Rules, 2008]

Treasury Form 209(1) - Challan for Depositing Money

[To be retained by the treasury]

Assessment year 2 0 - 2 0 Tax period (if any) d d m m y y y y

1. Sector/Circle/Assistant

Commissioner/Deputy

Commissioner(Assessment)

2. Name of Treasury / Sub-

Treasury / Bank / Bank

Branch

3. a- Name of person or

dealer on whose behalf

amount is being paid

b- Address

4. TIN / TDN / Registration No.

5. If there is no TIN / TDN / Registration No, then tick whichever is Unregistered Applied for

applicable

6- [Tick the relevant head of account of remittance in the box ]

Head of account Particulars Sl No. Amount(in Rs.)

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax along with monthly returns 01

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax against demand 02

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Registration Fee 03

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Interest 04

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Penalty 05

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax along with monthly returns 06

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax against demand 07

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax Composition Money 08

0 0 4 0 0 0 1 0 2 0 3 0 0 U.P. value added tax - Registration fee 09

0 0 4 0 0 0 1 0 2 0 4 0 0 U.P. value added tax - Interest 10

0 0 4 0 0 0 1 0 2 0 4 0 0 U.P. value added tax - Penalty 11

0 0 4 0 0 0 1 0 2 0 4 0 0 Other Receipts under the U.P. value added tax 12

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. Trade Tax. 13

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax along with monthly returns 14

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax against demand 15

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Composition Money 16

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Penalty 17

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Interest 18

0 0 4 0 0 0 1 0 2 0 5 0 2 U.P. Entry Tax Registration fee 19

0 0 4 0 0 0 8 0 0 0 1 0 0 Other Receipts 20

Total Amount {in figure}

{in words}

Name of depositor : ............................................. Signature of depositor : .........................................

Status of depositor : ............................................

Only for use by Sub-Treasury / Bank

Amount (in figures) Rs . ---------------------------(in words) Rs .------------------------------------------------------------------

Challan No.----------------Date --------------------------

Signature of recipient

Seal of Sub-Treasury / Bank

FORM - I [B]

Department of Commercial Taxes, Government of Uttar Pradesh

[See rule-12 of the UPVAT Rules, 2008]

Treasury Form 209(1) - Challan for Depositing Money

[To be sent by the Treasury Officer to the Assistant Commissioner, Commercial Taxes]

Assessment year 2 0 - 2 0 Tax period (if any) d d m m y y y y

1. Sector/Circle/Assistant

Commissioner/Deputy

Commissioner(Assessment)

2. Name of Treasury / Sub-

Treasury / Bank / Bank

Branch

3. a- Name of person on

whose behalf amount is

being paid

b- Address

4. TIN / TDN / Registration No.

5. If there is no TIN / TDN / Registration No, then tick whichever is Unregistered Applied for

applicable

6- [Tick the relevant head of account of remittance ]

Head of account Particulars Sl No. Amount(in Rs.)

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax along with monthly returns 01

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax against demand 02

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Registration Fee 03

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Interest 04

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Penalty 05

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax along with monthly returns 06

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax against demand 07

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax Composition Money 08

0 0 4 0 0 0 1 0 2 0 3 0 0 U.P. value added tax - Registration fee 09

0 0 4 0 0 0 1 0 2 0 4 0 0 U.P. value added tax - Interest 10

0 0 4 0 0 0 1 0 2 0 4 0 0 U.P. value added tax - Penalty 11

0 0 4 0 0 0 1 0 2 0 4 0 0 Other Receipts under the U.P. value added tax 12

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. Trade Tax. 13

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax along with monthly returns 14

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax against demand 15

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Composition Money 16

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Penalty 17

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Interest 18

0 0 4 0 0 0 1 0 2 0 5 0 2 U.P. Entry Tax Registration fee 19

0 0 4 0 0 0 8 0 0 0 1 0 0 Other Receipts 20

Total Amount {in figure}

{in words}

Name of depositor : ............................................. Signature of depositor : .........................................

Status of depositor : ............................................

Only for use by Sub-Treasury / Bank

Amount (in figures) Rs. ---------------------------(in words) Rs .------------------------------------------------------------------

Challan No.----------------Date --------------------------

Signature of recipient

Seal of Sub-Treasury / Bank

FORM - I [C]

Department of Commercial Taxes, Government of Uttar Pradesh

[See rule-12 of the UPVAT Rules, 2008]

Treasury Form 209(1) - Challan for Depositing Money

[To be submitted by the dealer to the Assistant Commissioner, Commercial Taxes]

Assessment year 2 0 - 2 0 Tax period (if any) d d m m y y y y

1. Sector/Circle/Assistant

Commissioner/Deputy

Commissioner(Assessment)

2. Name of Treasury / Sub-

Treasury / Bank / Bank

Branch

3. a- Name of person on

whose behalf amount is

being paid

b- Address

4. TIN / TDN / Registration No.

5. If there is no TIN / TDN / Registration No, then tick whichever is Unregistered Applied for

applicable

6- [Tick the relevant head of account of remittance ]

Head of account Particulars Sl No. Amount (in Rs.)

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax along with monthly returns 01

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax against demand 02

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Registration Fee 03

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Interest 04

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Penalty 05

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax along with monthly returns 06

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax against demand 07

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax Composition Money 08

0 0 4 0 0 0 1 0 2 0 3 0 0 U.P. value added tax - Registration fee 09

0 0 4 0 0 0 1 0 2 0 4 0 0 U.P. value added tax - Interest 10

0 0 4 0 0 0 1 0 2 0 4 0 0 U.P. value added tax - Penalty 11

0 0 4 0 0 0 1 0 2 0 4 0 0 Other Receipts under the U.P. value added tax 12

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. Trade Tax. 13

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax along with monthly returns 14

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax against demand 15

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Composition Money 16

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Penalty 17

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Interest 18

0 0 4 0 0 0 1 0 2 0 5 0 2 U.P. Entry Tax Registration fee 19

0 0 4 0 0 0 8 0 0 0 1 0 0 Other Receipts 20

Total Amount {in figure}

{in words}

Name of depositor : ............................................. Signature of depositor : .........................................

Status of depositor : ............................................

Only for use by Sub-Treasury / Bank

Amount (in figures) Rs. ---------------------------(in words) Rs .------------------------------------------------------------------

Challan No.----------------Date --------------------------

Signature of recipient

Seal of Sub-Treasury / Bank

FORM - I [D]

Department of Commercial Taxes, Government of Uttar Pradesh

[See rule-12 of the UPVAT Rules, 2008]

Treasury Form 209(1) - Challan for Depositing Money

[To be retained by the dealer]

Assessment year 2 0 - 2 0 Tax period (if any) d d m m y y y y

1. Sector/Circle/Assistant

Commissioner/Deputy

Commissioner(Assessment)

2. Name of Treasury / Sub-

Treasury / Bank / Bank

Branch

3. a- Name of person on

whose behalf amount is

being paid

b- Address

4. TIN / TDN / Registration No.

5. If there is no TIN / TDN / Registration No, then tick whichever is Unregistered Applied for

applicable

6- [Tick the relevant head of account of remittance ]

Head of account Particulars Sl No. Amount (In Rs.)

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax along with monthly returns 01

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax against demand 02

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Registration Fee 03

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Interest 04

0 0 4 0 0 0 1 0 1 0 1 0 0 Central Sales Tax Penalty 05

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax along with monthly returns 06

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax against demand 07

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. value added tax Composition Money 08

0 0 4 0 0 0 1 0 2 0 3 0 0 U.P. value added tax - Registration fee 09

0 0 4 0 0 0 1 0 2 0 4 0 0 U.P. value added tax - Interest 10

0 0 4 0 0 0 1 0 2 0 4 0 0 U.P. value added tax - Penalty 11

0 0 4 0 0 0 1 0 2 0 4 0 0 Other Receipts under the U.P. value added tax 12

0 0 4 0 0 0 1 0 2 0 1 0 0 U.P. Trade Tax. 13

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax along with monthly returns 14

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax against demand 15

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Composition Money 16

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Penalty 17

0 0 4 0 0 0 1 0 2 0 5 0 1 U.P. Entry Tax Interest 18

0 0 4 0 0 0 1 0 2 0 5 0 2 U.P. Entry Tax Registration fee 19

0 0 4 0 0 0 8 0 0 0 1 0 0 Other Receipts 20

Total Amount {in figure}

{in words}

Name of depositor : ............................................. Signature of depositor : .........................................

Status of depositor : ............................................

Only for use by Sub-Treasury / Bank

Amount (in figures) Rs. ---------------------------(in words) Rs .------------------------------------------------------------------

Challan No.----------------Date --------------------------

Signature of recipient

Seal of Sub-Treasury / Bank

You might also like

- Up Vat Challan FormatDocument8 pagesUp Vat Challan FormatVirender SainiNo ratings yet

- Bajaj Octagonal PolesDocument1 pageBajaj Octagonal PolesGoutam MandalNo ratings yet

- 2551Q-Miflores-1st-QuarterDocument3 pages2551Q-Miflores-1st-Quartercatherine aleluyaNo ratings yet

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaNo ratings yet

- eFPS Home Efiling and Payment System PDFDocument2 pageseFPS Home Efiling and Payment System PDFruzell sedanoNo ratings yet

- GSTR9Document21 pagesGSTR9Sadiya ShaikhNo ratings yet

- Quarterly Income Tax Return: Yes NoDocument3 pagesQuarterly Income Tax Return: Yes NoSusan P LauronNo ratings yet

- BIR Form 1702QDocument3 pagesBIR Form 1702QMique VillanuevaNo ratings yet

- Income Tax Payment Challan: PSID #: 41614961Document1 pageIncome Tax Payment Challan: PSID #: 41614961Zubair KhanNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoDerwin AraNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Games NathanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: COBPS9708EDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: COBPS9708Evikas guptaNo ratings yet

- 2551Q - 2nd Qtr. - 2023 UA pg1Document1 page2551Q - 2nd Qtr. - 2023 UA pg1Cedric Francis SumagangNo ratings yet

- Bir 2551 Q 3 RDDocument2 pagesBir 2551 Q 3 RDavbyNo ratings yet

- Meet 11-Accounting For Income Taxes-DYP PDFDocument19 pagesMeet 11-Accounting For Income Taxes-DYP PDFRENDY FILIANGNo ratings yet

- Tax Updates BGC Jekell Dec13, 2019Document115 pagesTax Updates BGC Jekell Dec13, 2019Darlene GanubNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: BYXPN1556JDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: BYXPN1556JA2a PancardNo ratings yet

- 2551Q LboDocument2 pages2551Q Lboava1234567890No ratings yet

- PDF 149489140300821Document1 pagePDF 149489140300821Gamer JiNo ratings yet

- Form GSTR-1: 4A, 4B, 4C, 6B, 6C - B2B InvoicesDocument5 pagesForm GSTR-1: 4A, 4B, 4C, 6B, 6C - B2B InvoicesDEVENDRA BHARDWAJNo ratings yet

- WB12BC3117 Tax ADocument1 pageWB12BC3117 Tax Azaid AhmedNo ratings yet

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoRichelle Ann RodriguezNo ratings yet

- Republic of the Philippines Annual Income Tax ReturnDocument14 pagesRepublic of the Philippines Annual Income Tax ReturnJoyce Ann CortezNo ratings yet

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberJenny Lyn MasgongNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challangandapur khanNo ratings yet

- 1701 - ITR For 2022 SampleDocument1 page1701 - ITR For 2022 SampleKaixeR 0125No ratings yet

- Letters p1 Individual and Company Nil Estimate 3Document3 pagesLetters p1 Individual and Company Nil Estimate 3Mark SilbermanNo ratings yet

- Monthly Remittance Form: For Creditable Income Taxes Withheld (Expanded)Document1 pageMonthly Remittance Form: For Creditable Income Taxes Withheld (Expanded)Jonalyn BalerosNo ratings yet

- Income Tax Payment Challan: PSID #: 138637167Document1 pageIncome Tax Payment Challan: PSID #: 138637167naeem1990No ratings yet

- 1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Document5 pages1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Jennylyn TagubaNo ratings yet

- Vat NotesDocument7 pagesVat NotesZulqarnainNo ratings yet

- WTAXESDocument31 pagesWTAXESlance757No ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- VAT Compliance RequirementsDocument44 pagesVAT Compliance RequirementsAcademe100% (2)

- GSTR4 33aqnpb5923e1z5 2021-22Document4 pagesGSTR4 33aqnpb5923e1z5 2021-22Sudhar SanNo ratings yet

- Monthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)Derick MoranteNo ratings yet

- Itr Receipt A.Y 2021-22Document1 pageItr Receipt A.Y 2021-22Parminder SinghNo ratings yet

- 2307 BirDocument3 pages2307 BirPFMPC SecretaryNo ratings yet

- Itr 23-24Document1 pageItr 23-24Ashwani KumarNo ratings yet

- Itr Ay 2021-22Document1 pageItr Ay 2021-22Ubfinancial ServicesNo ratings yet

- 2551Q Jan 2018 ENCS Final Rev 3Document2 pages2551Q Jan 2018 ENCS Final Rev 3MIS MijerssNo ratings yet

- Income Tax Payment Challan: PSID #: 138638394Document1 pageIncome Tax Payment Challan: PSID #: 138638394naeem1990No ratings yet

- Preliminary Assessment NoticeDocument3 pagesPreliminary Assessment NoticeHanabishi RekkaNo ratings yet

- 1702 RTDocument4 pages1702 RTMaricor TambalNo ratings yet

- Acknowledgement FormDocument1 pageAcknowledgement Formuniquerj4uNo ratings yet

- VAT Guide SummaryDocument22 pagesVAT Guide SummaryAkash TeeluckNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementDivyaraj JadejaNo ratings yet

- Income Tax Payment Challan: PSID #: 138458893Document1 pageIncome Tax Payment Challan: PSID #: 138458893naeem1990No ratings yet

- Sachin It CPCDocument1 pageSachin It CPCADARSH PATTARNo ratings yet

- Vat GuideDocument93 pagesVat Guidewaiting4addNo ratings yet

- Rani Vaishnav Itr 1Document1 pageRani Vaishnav Itr 1Niraj JaiswalNo ratings yet

- BIR Form 2550M Monthly VAT SummaryDocument2 pagesBIR Form 2550M Monthly VAT SummaryLulu Adaro VillanuevaNo ratings yet

- Indian Income Tax Return Acknowledgement Form ITR-3Document1 pageIndian Income Tax Return Acknowledgement Form ITR-3Aishwary JainNo ratings yet

- Individual Tax Payer - Part 2Document18 pagesIndividual Tax Payer - Part 2Ems TeopeNo ratings yet

- Indian Income Tax Return Acknowledgement FormDocument1 pageIndian Income Tax Return Acknowledgement FormMratunjay 27No ratings yet

- JNJ Online Shop BIR Form 2307 CertificateDocument5 pagesJNJ Online Shop BIR Form 2307 CertificateReagan RodriguezNo ratings yet

- 1601 eDocument3 pages1601 eJulius Sangalang100% (1)

- LankaBangla FInance Presents Econprodigy 5.0 - Round 1 CaseDocument4 pagesLankaBangla FInance Presents Econprodigy 5.0 - Round 1 CaseRafid ChyNo ratings yet

- History of Philippine Banking from Obras Pias to Modern BanksDocument2 pagesHistory of Philippine Banking from Obras Pias to Modern BanksAndrea Nicole De LeonNo ratings yet

- Philippine Construction Industry RoadmapDocument22 pagesPhilippine Construction Industry RoadmapAdrian RuizNo ratings yet

- ESI (Economic and Social Issues) : EssayDocument4 pagesESI (Economic and Social Issues) : EssayDskNo ratings yet

- Global Marketing Chapter 2Document32 pagesGlobal Marketing Chapter 2terra saptinaNo ratings yet

- The Philippine Tourism IndustryDocument18 pagesThe Philippine Tourism IndustryKayeNo ratings yet

- Impact of Remittances on Development in Third World CountriesDocument1 pageImpact of Remittances on Development in Third World CountriesMobaraz KhokharNo ratings yet

- List of Bank Nodal OfficersDocument3 pagesList of Bank Nodal Officersets opt03No ratings yet

- How COVID-19 Impacted India's Macroeconomic VariablesDocument3 pagesHow COVID-19 Impacted India's Macroeconomic VariablesShruti GangarNo ratings yet

- Statement-I Consolidated Fund of TamilnaduDocument3 pagesStatement-I Consolidated Fund of TamilnadukanaharajNo ratings yet

- Summary of Proposed National Budget FY2023-24Document15 pagesSummary of Proposed National Budget FY2023-24Zaki Al FahadNo ratings yet

- History of Cooperative Movement in IndiaDocument2 pagesHistory of Cooperative Movement in IndiaTerry YanamNo ratings yet

- Free Numerical Reasoning Test QuestionsDocument16 pagesFree Numerical Reasoning Test QuestionsautojunkNo ratings yet

- Cir Vs Tours SpecialistDocument1 pageCir Vs Tours SpecialistJ.C. S. MaalaNo ratings yet

- Business CycleDocument9 pagesBusiness CycleHarsha SekaranNo ratings yet

- Tariffs: Meaning and Types - International Trade - EconomicsDocument6 pagesTariffs: Meaning and Types - International Trade - EconomicsLuz AlbanoNo ratings yet

- Unemployment in IndiaDocument15 pagesUnemployment in IndiaSuraj100% (2)

- The Determination of Exchange RatesDocument33 pagesThe Determination of Exchange RatesBorn HyperNo ratings yet

- 10 NDocument23 pages10 Nssvs1234No ratings yet

- Economics PPT Module 6Document10 pagesEconomics PPT Module 6Sujo GeorgeNo ratings yet

- Wacana UTS FTA - Understanding by Sanya Smith TWNDocument37 pagesWacana UTS FTA - Understanding by Sanya Smith TWNMohd NajibNo ratings yet

- Lecture Session 8 - Currency Futures Forwards Payoff ProfilesDocument8 pagesLecture Session 8 - Currency Futures Forwards Payoff Profilesapi-19974928No ratings yet

- Impact of U.S. Fed Rate Hike On Indian EconomyDocument5 pagesImpact of U.S. Fed Rate Hike On Indian EconomyT ForsythNo ratings yet

- Solved Suppose A Small Country Has The Following Monies in Circulation Cash CurrencyDocument1 pageSolved Suppose A Small Country Has The Following Monies in Circulation Cash CurrencyM Bilal SaleemNo ratings yet

- Efu Life Assurance LTD.: Total 20,480 Provisional Sales Tax 0.0 0Document1 pageEfu Life Assurance LTD.: Total 20,480 Provisional Sales Tax 0.0 0ASAD RAHMANNo ratings yet

- Eco ProjectDocument6 pagesEco ProjectRaghav AgarwalNo ratings yet

- Sail May Mis 2022Document15 pagesSail May Mis 2022Richard DassNo ratings yet

- Nmims - Big Bad BumblebeesDocument5 pagesNmims - Big Bad BumblebeesDebashish HotaNo ratings yet

- IBA - Group 2. Revised - 1560920448Document9 pagesIBA - Group 2. Revised - 1560920448LýHuyHoàngNo ratings yet

- IFM Chapter 04Document44 pagesIFM Chapter 04Mahbub TalukderNo ratings yet