Professional Documents

Culture Documents

Presentation 1

Uploaded by

smores0120 ratings0% found this document useful (0 votes)

6 views10 pagesOriginal Title

Presentation1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views10 pagesPresentation 1

Uploaded by

smores012Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF or read online from Scribd

You are on page 1of 10

Collusive Behaviour in an Oligopoly

A2 Economics

Collusion represents an attempt by firms to recognize their

interdependence and act together rather than compete

Collusion — can seen as a move towards joint-profit

maximization

Collusion normally requires control over the market

supply of a commodity

Overt collusion

+ This is the creation of a price fixing arrangement with

a producer cartel responsible for allocating output /

supply within the market

* Tacit collusion

— Dominant firm ‘price leadership’

* One firm's price changes are matched by the other firms

* Price leadership often happens in segments of a market

— E.g. the market for mortgage lending

— The market for breakfast cereals

— Barometric-firm leadership

* The price leader is the one judged to have best knowledge of

prevailing market conditions

+ OPEC cartel (periodic tensions / breakdown of cartel agreement)

+ ‘Over the counter’ pharmaceuticals (ended May 2001)

+ Electrical goods retailers and computer games producers —

investigated by the Competition Commission in 2000

+ Most collusive activity takes place between firms in the same industry.

+ Recent examples:

Bus service operators in some cities

Car body parts suppliers

Steel producers within the European Union

Coffee producers (coffee export retention scheme)

Independent schools

West Midlands roofing contractors cartel!

* But not all horizontal agreements are bad or illegal!

Strategic Alliances to share R and D, for example, if registered, can be

exempted from EU competition law

+ Vertical restraints refer to the methods used by

manufacturers to restrict the ways in which retailers can

market their product

+ Examples include Franchising and Distribution channels

+ Examples in the UK in recent years include:

— Car manufacturers and agreements with distributors

— Football Kit Manufacturers

— Net Book Agreement (ended in 1995)

— Over the Counter Pharmaceutical products (ended in May 2001)

Competition law prohibits almost any attempt to fix prices - for

example, you cannot

— Agree prices with your competitors, e.g. you can’t agree to work from a

shared minimum price list

— Share markets or limit production to raise prices

= Impose minimum prices on different distributors such as shops

— Agree with your competitors what purchase price you will offer your

suppliers

— Cut prices below cost in order to force a smaller or weaker competitor

out of the market

The law doesn't just cover formal agreements. It also includes other

activities with a price-fixing effect. For example, you shouldn't discuss

your pricing plans with your competitors. If you then all "happen" to

raise your prices, you are fixing prices,

There is only a small number of firms in the industry

The industry has substantial entry barriers

A large number of customers.

Total market demand not too variable

— Low income elasticity of demand

— Demand fairly inelastic with respect to price, interest rates etc

Firm's output can be easily monitored

— Easier to control total supply and identify firms who are cheating

on output quotas

Price discounts are hard to deliver

— Hard for firms to under-cut their rivals and break the cartel

Most cartel arrangements experience difficulties

Falling demand creates excess capacity in the industry e.g.

during an economic downturn

Entry of non-cartel firms into the industry

Exposure of price fixing by Government agencies

Over-production which breaks the price fixing

— OPEC one of the best examples — but other international

commodity agreements have suffered from similar problems

Prisoners’ Dilemma suggests that collusion breaks down

— Incentive to cheat because joint-profit maximization does not

mean each firm is maximising profits on their own

* Consumers may gain from

— Period of relative price stability

— Areduction of some of the wasteful costs of advertising and

marketing if producers co-operate rather than compete with

each-other

— Guaranteed supply from the producer cartel

+ Producer cartels may be successful in raising the price of

exported commodities

— May help to fund higher levels of capital investment

— Boost to export revenues for countries with a high dependency

on exports of primary commodities

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

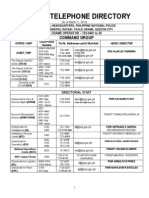

- PNP Telephone DirectoryDocument24 pagesPNP Telephone Directorysmores01267% (3)

- Citizens CharterDocument32 pagesCitizens Chartersmores012No ratings yet

- The Company Men: Film Reaction ReportDocument7 pagesThe Company Men: Film Reaction Reportsmores012No ratings yet

- Starwood Hotels (HOT) Stock Research: Discretionary DescriptionDocument3 pagesStarwood Hotels (HOT) Stock Research: Discretionary Descriptionsmores012No ratings yet

- HistoryDocument6 pagesHistorysmores012No ratings yet