Professional Documents

Culture Documents

Income Tax Rates

Uploaded by

shahiddon9160 ratings0% found this document useful (0 votes)

14 views2 pagesA set of New Direct Tax Codes have been proposed, which will be active from Financial Year 2011. Senior citizen age reduced from 64 years to 60 years. People above 80 years of age to be included in the newly introduced 'Very senior citizen' category. From now onwards there will be only 2 pages in the IT filing form for individuals. More cases can now be appealed against. New fields have been added to the e-TDS / TCS form. These new fields are Ministry name; PAO

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA set of New Direct Tax Codes have been proposed, which will be active from Financial Year 2011. Senior citizen age reduced from 64 years to 60 years. People above 80 years of age to be included in the newly introduced 'Very senior citizen' category. From now onwards there will be only 2 pages in the IT filing form for individuals. More cases can now be appealed against. New fields have been added to the e-TDS / TCS form. These new fields are Ministry name; PAO

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagesIncome Tax Rates

Uploaded by

shahiddon916A set of New Direct Tax Codes have been proposed, which will be active from Financial Year 2011. Senior citizen age reduced from 64 years to 60 years. People above 80 years of age to be included in the newly introduced 'Very senior citizen' category. From now onwards there will be only 2 pages in the IT filing form for individuals. More cases can now be appealed against. New fields have been added to the e-TDS / TCS form. These new fields are Ministry name; PAO

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

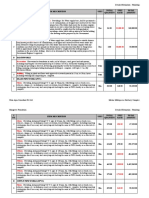

Income Tax Rates/Slabs for Assessment Year 2012-13 (FY 2011-12)

Income Tax Rates/Slabs Rate (%)

Upto 1,80,000 NIL

Upto 1,90,000 (for women)

Upto 2,50,000 (senior citizens)

1,80,001 – 5,00,000 10

5,00,001 – 8,00,000 20

8,00,001 and above 30

Tax amendments for the FY 2011-12 are mentioned below :

Increase in base income tax slab of men and senior citizens.

Tax exemption limit remains the same i.e Rs. 20,000 on investment in

tax saving Infrastructure bonds.

A set of New Direct Tax Codes have been proposed, which will be

active from Financial Year 2011.

Senior citizen age reduced from 64 years to 60 years.

People above 80 years of age to be included in the newly introduced

'Very Senior citizen' category.

Income Tax Rates/Slabs for Assesment Year 2011-12 (F Y 2010-11)

Income Tax Rates/Slabs Rate (%)

Up to 1,60,000 NIL

Up to 1,90,000 (for women)

Up to 2,40,000 (for resident individual of 65 years or above)

1,60,001 – 5,00,000 10

5,00,001 – 8,00,000 20

8,00,001 upwards 30

Few amendments made to the taxation system for the FY 2010-11:

From now onwards there will be only 2 pages in the IT filing form for

individuals.

More cases can now be appealed against.

Rs. 20,000 tax exemption will be provided for investments in certain

investment bonds. This is in addition to the already allowed exemption

(Rs. 1,00,000) in certain savings instruments.

Tax Exemption will be given for contribution to the Central Government

Health Scheme (CGHS).

New fields have been added to the e-TDS/TCS form. These new fields

are Ministry name; PAO / DDO code; PAO / DDO registration no.; State

name; and Name of the utility used for return preparation.

You might also like

- Supply Chain Management AssignDocument7 pagesSupply Chain Management Assignshahiddon916No ratings yet

- Tata GroupDocument2 pagesTata Groupshahiddon916No ratings yet

- DeductionsDocument16 pagesDeductionsshahiddon916No ratings yet

- Management: Organization Chart Branch ManagerDocument1 pageManagement: Organization Chart Branch Managershahiddon916No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Consultant Agreement PDFDocument6 pagesConsultant Agreement PDFRathore&Co Chartered AccountantNo ratings yet

- DL5/DL6 With CBD6S: User ManualDocument32 pagesDL5/DL6 With CBD6S: User ManualMeOminGNo ratings yet

- Overview 6T40-45 TransmissionDocument14 pagesOverview 6T40-45 TransmissionLeigh100% (1)

- CV HariDocument4 pagesCV HariselvaaaNo ratings yet

- Philippine Phoenix Surety & Insurance, Inc. Vs Woodworks, Inc Digest - MungcalDocument1 pagePhilippine Phoenix Surety & Insurance, Inc. Vs Woodworks, Inc Digest - Mungcalc2_charishmungcalNo ratings yet

- 03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019Document52 pages03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019samir bendreNo ratings yet

- PSI 8.8L ServiceDocument197 pagesPSI 8.8L Serviceedelmolina100% (1)

- Case Study On DominoDocument7 pagesCase Study On Dominodisha_pandey_4No ratings yet

- PIL HANDOUT in TextDocument173 pagesPIL HANDOUT in Textbhargavi mishraNo ratings yet

- HTTP ProtocolDocument16 pagesHTTP ProtocolHao NguyenNo ratings yet

- Zambia Urban Housing Sector ProfileDocument205 pagesZambia Urban Housing Sector ProfileJosephine ChirwaNo ratings yet

- PPR 8001Document1 pagePPR 8001quangga10091986No ratings yet

- Among Us Hack Mod Menu Mod AlwaysDocument4 pagesAmong Us Hack Mod Menu Mod AlwaysC JNo ratings yet

- Spark - Eastern Peripheral Road Project (Epr) Weekly Quality MeetingDocument6 pagesSpark - Eastern Peripheral Road Project (Epr) Weekly Quality Meetingengr.s.a.malik6424No ratings yet

- LCD Television Service Manual: Chassis MTK8222 Product TypeDocument46 pagesLCD Television Service Manual: Chassis MTK8222 Product TypetvdenNo ratings yet

- Area & Perimeter - CRACK SSC PDFDocument10 pagesArea & Perimeter - CRACK SSC PDFSai Swaroop AttadaNo ratings yet

- Rachel Mitchell Task 1Document1,003 pagesRachel Mitchell Task 1nazmul HasanNo ratings yet

- Nammcesa 000010 PDFDocument1,543 pagesNammcesa 000010 PDFBasel Osama RaafatNo ratings yet

- UNV EZAccess Datasheet - V1.2-EN - 883121 - 168459 - 0Document3 pagesUNV EZAccess Datasheet - V1.2-EN - 883121 - 168459 - 0Agus NetNo ratings yet

- 2010 LeftySpeed Oms en 0Document29 pages2010 LeftySpeed Oms en 0Discord ShadowNo ratings yet

- Anwar Hossain PDFDocument4 pagesAnwar Hossain PDFnodaw92388No ratings yet

- 2UEB000133 ACS2000 4kV Motor Temp Supervision Rev BDocument3 pages2UEB000133 ACS2000 4kV Motor Temp Supervision Rev BSherifNo ratings yet

- Retdem CathDocument17 pagesRetdem CathShane Aileen AngelesNo ratings yet

- Lecun 20201027 AttDocument72 pagesLecun 20201027 AttEfrain TitoNo ratings yet

- G6Document14 pagesG6Arinah RdhNo ratings yet

- Buyer Persona TemplateDocument18 pagesBuyer Persona TemplateH ANo ratings yet

- EU MEA Market Outlook Report 2022Document21 pagesEU MEA Market Outlook Report 2022ahmedNo ratings yet

- Sustainable Project Management. The GPM Reference Guide: March 2018Document26 pagesSustainable Project Management. The GPM Reference Guide: March 2018Carlos Andres PinzonNo ratings yet

- Rfa TB Test2Document7 pagesRfa TB Test2Сиана МихайловаNo ratings yet

- Genetic Engineering AssignmentDocument20 pagesGenetic Engineering AssignmentAcyl Chloride HaripremNo ratings yet