Professional Documents

Culture Documents

Expected Loss

Expected Loss

Uploaded by

Muhammad Rizwan VirkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Expected Loss

Expected Loss

Uploaded by

Muhammad Rizwan VirkCopyright:

Available Formats

Expected Loss

The expected loss (EL)

is the amount that an institution expects to lose on a credit exposure over a given time horizon.

EL = PD x LGD x EAD xM

If we ignore correlation between the LGD variable, the EAD variable and the default event, the

expected loss for a portfolio is the sum of the individual expected losses.

What Does Default Probability Mean?

The degree of likelihood that the borrower of a loan or debt will not be able to make the

necessary scheduled repayments. Should the borrower be unable to pay, they are then said to be

in default of the debt, at which point the lenders of the debt have legal avenues to attempt

obtaining at least partial repayment.

Generally speaking, the higher the default probability a lender estimates a borrower to have, the

higher the interest rate the lender will charge the borrower (as compensation for bearing higher

default risk).

Probability of Default:

It is the assessment of the likelihood of default of the borrower over one year.Expressed as a %,

and counterparty specific.(PD)

Loss Given Default:

ItIs the assessment of the loss incurred on a facility at default of a counterparty. Expressed as a

%, and transaction specific.(LGD)

Exposure at Default:

Expected gross exposure of the facility upon default of the obligor. Expressed in amounts, and

transaction specific.(EAD)

M = Effective Maturity = Sum of (time × future cash flow)

Sum of future cash flows

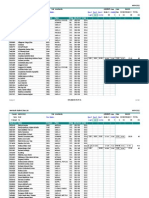

Formulas of four components

PD = Probability of Default = Number of defaults during last 12 months

Number of counterparties 12 months ago

LGD = Loss Given Default = Losses incurred after default during last 5 or 7 years

Total outstanding amount at default

EAD = Exposure At default = Total outstanding amount+CCFX Underdrawn amount

M = Effective Maturity = Sum of (time × future cash flow)

Sum of future cash flows

Example In percentage

EL = PD x LGD x EAD Xm

We can calcukate expected loss if probability default is 0.07% , lgd ia 39.5% and ead

expected that 2.8 million for 2.5 years then we can calculate expected loss as given

below.

Expected Loss(£) / (%)= Probability of Default (%) X LGD % X EAD (£) x M

£784 = 0.07% X 39.5 % X 2.8M X 2.5 YEARS

0.028%

You might also like

- FINS3630 Finals Formula SheetDocument3 pagesFINS3630 Finals Formula SheetElaineKongNo ratings yet

- Delmon, Jeffrey (2011) - Public-Private Partnership Projects in Infrastructure - An Essential Guide For Policy Makers (0521152283) (20170104) $$$$$Document256 pagesDelmon, Jeffrey (2011) - Public-Private Partnership Projects in Infrastructure - An Essential Guide For Policy Makers (0521152283) (20170104) $$$$$QwikRabbitNo ratings yet

- IFRS 9 - ECL ModelDocument38 pagesIFRS 9 - ECL ModelAntreas Artemiou50% (2)

- Calculating Lifetime Expected Loss For IFRS 9: Which Formula Is Correct?Document15 pagesCalculating Lifetime Expected Loss For IFRS 9: Which Formula Is Correct?Belkis RiahiNo ratings yet

- Employee Hardship Fund Grant ApplicationDocument2 pagesEmployee Hardship Fund Grant Application_clinton100% (2)

- Death Penalty: A Position PaperDocument6 pagesDeath Penalty: A Position PaperAisha Nicole Dones0% (1)

- St. Michael School of Cavite, Inc. and Spouses Claveria V Masaito Development Corporation and Rexlon Realty Group, Inc.Document1 pageSt. Michael School of Cavite, Inc. and Spouses Claveria V Masaito Development Corporation and Rexlon Realty Group, Inc.Sj Eclipse100% (1)

- Credit Risk MGMTDocument4 pagesCredit Risk MGMTNagaratnam ChandrasekaranNo ratings yet

- Credit Risk MGMTDocument4 pagesCredit Risk MGMTmail2ncNo ratings yet

- MGT201 Solved Mid Term Subjective For Mid Term ExamDocument22 pagesMGT201 Solved Mid Term Subjective For Mid Term ExammaryamNo ratings yet

- FM Handout 3Document23 pagesFM Handout 3Rofiq VedcNo ratings yet

- Operating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingDocument5 pagesOperating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingzacchariahNo ratings yet

- Stock ValuationDocument37 pagesStock ValuationNathan GaoNo ratings yet

- Problem Set 4 Solution v2Document3 pagesProblem Set 4 Solution v2Carol VarelaNo ratings yet

- Risk MeasuresDocument7 pagesRisk MeasurestatendaNo ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument58 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskKen DaffyNo ratings yet

- Lec 13 HandoutDocument53 pagesLec 13 Handout賴永岫No ratings yet

- Fin5203 Module 8 Fl22Document78 pagesFin5203 Module 8 Fl22merly chermonNo ratings yet

- Cost of Capital, Optimal Capital Structure, and Leverages 1.0 The Fundamental ConceptDocument5 pagesCost of Capital, Optimal Capital Structure, and Leverages 1.0 The Fundamental ConceptMacy AndradeNo ratings yet

- Trade-Off Between Risk & ReturnDocument23 pagesTrade-Off Between Risk & Returnmarlon ventulanNo ratings yet

- 3 Cost of CapitalDocument31 pages3 Cost of CapitalWei DengNo ratings yet

- Potential Loss and Its MeasurementDocument5 pagesPotential Loss and Its MeasurementLeo SaimNo ratings yet

- CH 4Document4 pagesCH 4jeneneabebe458No ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument50 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing Riskanon_447537688No ratings yet

- Session 2... 3 Stock ValuationDocument26 pagesSession 2... 3 Stock Valuationkrishna priyaNo ratings yet

- Chap008 AccountingDocument85 pagesChap008 Accountingla ziiNo ratings yet

- Essentials of Investments 9th Edition Bodie Solutions ManualDocument14 pagesEssentials of Investments 9th Edition Bodie Solutions ManualsamanthaadamsgofinbesmrNo ratings yet

- Ratio Analysis I. Profitability RatiosDocument4 pagesRatio Analysis I. Profitability RatiosEnergy GasNo ratings yet

- The Cost of Capital 3mcj 5 gXIlDocument3 pagesThe Cost of Capital 3mcj 5 gXIlKinNo ratings yet

- Stock Valuation: Before You Go On Questions and AnswersDocument36 pagesStock Valuation: Before You Go On Questions and AnswersNguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Lecture 6 - Stock Valuation - Stu (7 Files Merged)Document175 pagesLecture 6 - Stock Valuation - Stu (7 Files Merged)JaydeNo ratings yet

- Stock ValuationDocument17 pagesStock ValuationbmunirbNo ratings yet

- Handout - Chapter 7 8 - Bond Stock ValuationDocument37 pagesHandout - Chapter 7 8 - Bond Stock ValuationNhư Quỳnh Dương ThịNo ratings yet

- 2.6. Cost of CapitalDocument34 pages2.6. Cost of Capitalaprilia wahyu perdaniNo ratings yet

- Cost of CapitalDocument56 pagesCost of CapitalAndayani SalisNo ratings yet

- 7 Dividend Valuation ModelDocument11 pages7 Dividend Valuation ModelDayaan ANo ratings yet

- RISK MANAGEMENT - ERASMUS - 2019 - BplusDocument61 pagesRISK MANAGEMENT - ERASMUS - 2019 - BplusVISHAL PATILNo ratings yet

- Risk and Return - Lu-6Document54 pagesRisk and Return - Lu-6Mega capitalmarket100% (1)

- Credit Risk: Individual Loan Risk: Default Risk ModelsDocument6 pagesCredit Risk: Individual Loan Risk: Default Risk ModelsPranav ChandraNo ratings yet

- Essentials of Corporate Finance 1st Edition Parrino Solutions ManualDocument36 pagesEssentials of Corporate Finance 1st Edition Parrino Solutions Manualderrickgrantpnykbwjzfx100% (28)

- Answers Practice1Document7 pagesAnswers Practice1helal uddinNo ratings yet

- Chapter 12 Determinants of Beta and WACCDocument7 pagesChapter 12 Determinants of Beta and WACCAbdul-Aziz A. AldayelNo ratings yet

- Chapter 11 Bond ValuationDocument24 pagesChapter 11 Bond Valuationfiq8809No ratings yet

- Chapter 3 B Bond ValuationDocument38 pagesChapter 3 B Bond ValuationLakachew GetasewNo ratings yet

- Doubt Clearing SessionsDocument4 pagesDoubt Clearing SessionsHannahNo ratings yet

- CF Lecture 4 Cost of Capital v1Document43 pagesCF Lecture 4 Cost of Capital v1Tâm NhưNo ratings yet

- R P - P - + C: Chapter Seven Basics of Risk and ReturnDocument13 pagesR P - P - + C: Chapter Seven Basics of Risk and ReturntemedebereNo ratings yet

- 3 Capital Budgeting TechniquesDocument42 pages3 Capital Budgeting TechniquesfnhshafiraNo ratings yet

- The Cost of Capital, Capital Structure and Dividend PolicyuitsDocument33 pagesThe Cost of Capital, Capital Structure and Dividend PolicyuitsArafath RahmanNo ratings yet

- Chapter 1 FMDocument47 pagesChapter 1 FMabdellaNo ratings yet

- Introduction To FinanceDocument48 pagesIntroduction To Financesprayzza tvNo ratings yet

- Chapter 9: Stocks ValuationDocument35 pagesChapter 9: Stocks ValuationTaVuKieuNhiNo ratings yet

- Corporate Finance 7Document2 pagesCorporate Finance 7Mujtaba AhmadNo ratings yet

- BFD - Weighted Average Cost of Capital by Ahmed Raza Mir & Taha PopatiaDocument6 pagesBFD - Weighted Average Cost of Capital by Ahmed Raza Mir & Taha PopatiaAiman TuhaNo ratings yet

- Wiley American Finance AssociationDocument13 pagesWiley American Finance AssociationMissaoui IbtissemNo ratings yet

- CH 13 - Liabilities:: Value of Obligation - Proceeds Yet To Be DelieveredDocument2 pagesCH 13 - Liabilities:: Value of Obligation - Proceeds Yet To Be DelieveredlovelaugherlifeNo ratings yet

- CDS Default ProbabilitiesDocument8 pagesCDS Default ProbabilitiesjhanishantNo ratings yet

- Lecture 18 BH CH 9 Stock and Their Valuation Part 2Document23 pagesLecture 18 BH CH 9 Stock and Their Valuation Part 2Alif SultanliNo ratings yet

- FIN 308-Chapter 6-With NotesDocument56 pagesFIN 308-Chapter 6-With NotesrNo ratings yet

- FIN422 - 1 Spring 2023 Solutions To HW#4 Selected End - of - Chapter 13 ProblemsDocument4 pagesFIN422 - 1 Spring 2023 Solutions To HW#4 Selected End - of - Chapter 13 Problemssama116676No ratings yet

- Stock Valuation and Risk: Financial Markets and Institutions, 7e, Jeff MaduraDocument33 pagesStock Valuation and Risk: Financial Markets and Institutions, 7e, Jeff MaduraRASHID PERVEZNo ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument40 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskMSA-ACCA100% (2)

- Exercise5 - SolutionsDocument3 pagesExercise5 - SolutionsMarine LalNo ratings yet

- 438 Bail ApplicationDocument17 pages438 Bail ApplicationPrasanna KallinakoteNo ratings yet

- 0275970345Document164 pages0275970345Ana NovovicNo ratings yet

- Revised Cont - Asses - Grade (13.11.14, 2.31 AM)Document115 pagesRevised Cont - Asses - Grade (13.11.14, 2.31 AM)Aminul RanaNo ratings yet

- Important Questions of Pakistan AffairsDocument2 pagesImportant Questions of Pakistan AffairsRohail AfzalNo ratings yet

- Brochure Online Short Course - CIF2022-Ver2Document19 pagesBrochure Online Short Course - CIF2022-Ver2maryam cookNo ratings yet

- Vocabulary Practice Test 1 Answer KeyDocument3 pagesVocabulary Practice Test 1 Answer KeyLeah Ato AntioquiaNo ratings yet

- NYAMPALA SAFARIS LTD & Others V Zambia Wildfires Authority & Others (2004) ZR 49 1Document28 pagesNYAMPALA SAFARIS LTD & Others V Zambia Wildfires Authority & Others (2004) ZR 49 1mayabalbbuneNo ratings yet

- Circuits and Equipment Operating at Less Than 50 VoltsDocument1 pageCircuits and Equipment Operating at Less Than 50 VoltsjivajiveNo ratings yet

- Cannon March20 2014Document44 pagesCannon March20 2014Dave MundyNo ratings yet

- FarrellDocument227 pagesFarrellAlinaNo ratings yet

- Application Form MalaysiaDocument2 pagesApplication Form MalaysiaKatrice LiNo ratings yet

- United States v. Bost, 4th Cir. (2000)Document4 pagesUnited States v. Bost, 4th Cir. (2000)Scribd Government DocsNo ratings yet

- 1-7 Buck Ruxton & The Jigsaw Murders Case v1Document9 pages1-7 Buck Ruxton & The Jigsaw Murders Case v1Francisco GonzálezNo ratings yet

- Philo L261Document2 pagesPhilo L261Βασίλειος ΣωτήραςNo ratings yet

- Wac - Gen y in The WorkforceDocument6 pagesWac - Gen y in The WorkforceSatyajitBeheraNo ratings yet

- Marriage - How To Perform The Nikah According To The Sunna in The Hanafi SchoolDocument4 pagesMarriage - How To Perform The Nikah According To The Sunna in The Hanafi SchoolAsfiaFatimaNo ratings yet

- 1-9 Sources of Obligations CasesDocument100 pages1-9 Sources of Obligations CasesVhinj CostillasNo ratings yet

- Freehold CovenantsDocument88 pagesFreehold CovenantsHUi XinhuiNo ratings yet

- DL3 Sde 0905Document4 pagesDL3 Sde 0905md. alamNo ratings yet

- Itinerary Receipt: Rab, 2 Okt 2019 Pukul 8.52 PMDocument2 pagesItinerary Receipt: Rab, 2 Okt 2019 Pukul 8.52 PMAndika ElsaNo ratings yet

- I'll Be Home For XmasDocument2 pagesI'll Be Home For XmasQueen HezumuryangoNo ratings yet

- Nationstar Mortgage LLC Et Al V Rodriguez, 132 Nev 55Document7 pagesNationstar Mortgage LLC Et Al V Rodriguez, 132 Nev 55DinSFLA0% (1)

- Assignment Percentage Tax ComputationDocument2 pagesAssignment Percentage Tax ComputationAngelyn SamandeNo ratings yet

- SB 12-163 - Reduction of Controlled Substances Possession Penalties-2Document2 pagesSB 12-163 - Reduction of Controlled Substances Possession Penalties-2Senator Mike JohnstonNo ratings yet

- Rule: Domestic Mail Manual: Temporary Mail Forwarding PolicyDocument2 pagesRule: Domestic Mail Manual: Temporary Mail Forwarding PolicyJustia.comNo ratings yet

- Almonte v. Vasquez Case DigestDocument3 pagesAlmonte v. Vasquez Case DigestNxxxNo ratings yet