Professional Documents

Culture Documents

Prepared & Presented by CA. Shrenik Chhabra M. Com, ACA Partner ANS & Associates Chartered Accountants

Uploaded by

riti150 ratings0% found this document useful (0 votes)

7 views15 pagesOriginal Title

Merger Concepts

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views15 pagesPrepared & Presented by CA. Shrenik Chhabra M. Com, ACA Partner ANS & Associates Chartered Accountants

Uploaded by

riti15Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 15

Prepared & Presented By CA.

Shrenik Chhabra

M. Com, ACA

Partner

ANS & Associates

Chartered Accountants

CA. Shrenik Chhabra

Mergers

A merger is a

transaction that results

in the transfer of

ownership and control

of a corporation.

CA. Shrenik Chhabra

3 Types of Mergers

Economists distinguish between three

types of mergers:

1. Horizontal

2. Vertical

3. Conglomerate

CA. Shrenik Chhabra

Horizontal mergers

A horizontal merger results in the consolidation of

firms that are direct rivals—that is, sell substitutable

products within overlapping geographic markets.

Examples:

1. HP-Compaq,

2. Kingfisher-Go-Air,

3. Jet Airways-Sahara,

4. HDFC-Centurian Bank of Punjab

CA. Shrenik Chhabra

Vertical Mergers

The merger of firms that have actual or

potential buyer-seller relationships

Examples:

1. Larson & Trubo-Ultratech

2.

CA. Shrenik Chhabra

Conglomerate mergers

Consolidated firms may sell related products,

share marketing and distribution channels and

perhaps production processes; or they may be

wholly unrelated.

•Product extension conglomerate mergers involve firms that

sell non-competing products use related marketing channels

of production processes.

Examples:

1. Tata-Land rover & Jaguar

2. Tata-Tetley

CA. Shrenik Chhabra

•Market extension conglomerate mergers join together firms

that sell competing products in separate geographic markets.

Examples:

1. Tata-Cores( Asia & Europe)

•A pure conglomerate merger unites firms that have no

obvious relationship of any kind.

Examples:

1. Merger Strategies of Ranbaxy Pharma

CA. Shrenik Chhabra

Anticompetitive Effects of Mergers

Issue: When and how are mergers welfare-reducing (that is, result

in a post-merger decrease in TS ?

•Horizontal mergers eliminate sellers and hence reshape market

structure. Recall that the structuralists believe that

market structure is the primary determinant of market performance.

•Mergers may result in market foreclosure. For example, the

Justice Department feared that Microsoft's proposed acquisition of

Intuit would result in a foreclosure of the market for personal

finance software.

• Mergers may diminish potential competition. For example, the

acquisition of Clorox by Proctor & Gamble eliminated P&G as a

prime potential entrant in the market for household bleach.

CA. Shrenik Chhabra

Horizontal mergers have a direct

impact on seller concentration.

And has its own benefits for

organization as well as for the

customers. Hence the potential to

diminished competition is clear to

see.

Most of the times merger news which we often found in

market are kind of Horizontal Mergers.

CA. Shrenik Chhabra

Welfare Reducing

It would seem at first blush that horizontal mergers

would invariably be welfare-reducing. However, if the

consolidation of direct rivals leads to greater cost

efficiency, then a horizontal merger could (in theory at

least) be welfare-enhancing.

This phenomena is introduced by Oliver willaimson.

CA. Shrenik Chhabra

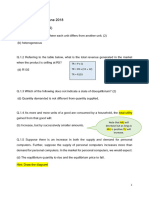

Welfare trade-offs of a horizontal merger

Oliver Williamson contends that

a horizontal merger can be

welfare-enhancing, even if

the post-merger market

structure is monopolistic. Why? Because

the merger may result in greater

technical/cost efficiency.

CA. Shrenik Chhabra

The efficiency

gain from the merger

Price

is indicated

by the shift

from AC to

AC’ If area A2

PM exceeds

area A1, the

A1

PC AC merger

A2 increases the

total

AC’

surplus (TS)

D

0 QM QC Quantity

CA. Shrenik Chhabra

Measuring the Welfare Tradeoffs

Let A1 be computed by

If A1 = A2, 1

the merger is A1 (P )(Q)

2

welfare-neutral

Let A2 be computed by:

A2 AC QM

CA. Shrenik Chhabra

Vertical and conglomerate mergers do

not affect market structure (e.g.,

seller concentration) directly. As you

will discover subsequently, these

types of mergers mergers can

nevertheless have anticompetitive

consequences.

CA. Shrenik Chhabra

Thanks to all of you for listening me.

Thanks god for inspiring me and to

motivate me to doing hard work for my

dream job.

CA. Shrenik Chhabra

You might also like

- Prepared & Presented by CA. Shrenik Chhabra M. Com, ACA Partner ANS & Associates Chartered AccountantsDocument15 pagesPrepared & Presented by CA. Shrenik Chhabra M. Com, ACA Partner ANS & Associates Chartered AccountantsSoni TanyaNo ratings yet

- Types of Mergers and Their EffectsDocument14 pagesTypes of Mergers and Their EffectsNisarg ShahNo ratings yet

- Merger 103Document14 pagesMerger 103Pradeep BiradarNo ratings yet

- Merger 103Document14 pagesMerger 103Arun SandhuNo ratings yet

- Types of MergersDocument14 pagesTypes of MergersAyushi DhingraNo ratings yet

- Memo Exam Jun 2018Document12 pagesMemo Exam Jun 2018Nathan VieningsNo ratings yet

- Solved How Does A Generic Drug Differ From Its Brand Name PreviouslyDocument1 pageSolved How Does A Generic Drug Differ From Its Brand Name PreviouslyM Bilal SaleemNo ratings yet

- Assgnmt 5Document4 pagesAssgnmt 5Heap Ke XinNo ratings yet

- Eco 101 Midterm Review Sheet (Prof. KellyDocument3 pagesEco 101 Midterm Review Sheet (Prof. KellyMd MahfuzNo ratings yet

- Contract CostingDocument6 pagesContract CostingAakash HaritNo ratings yet

- Government Intervention in Markets LectureDocument117 pagesGovernment Intervention in Markets LectureNima MoaddeliNo ratings yet

- Market Structures: Perfect CompetitionDocument23 pagesMarket Structures: Perfect CompetitionAshish PandeyNo ratings yet

- Economics HelpsDocument3 pagesEconomics HelpssahilsureshNo ratings yet

- Comparing Perfect Competition and MonopolyDocument3 pagesComparing Perfect Competition and MonopolyChanguoi YOtoNo ratings yet

- Perfect CompetitionDocument15 pagesPerfect CompetitionFabian MtiroNo ratings yet

- ME Problems PC MonopolyDocument7 pagesME Problems PC MonopolyDevan BhallaNo ratings yet

- Transfer Pricing Methods & Goal CongruenceDocument12 pagesTransfer Pricing Methods & Goal CongruenceMM Fakhrul IslamNo ratings yet

- This Study Resource Was: M Ali Ahsan KhanDocument7 pagesThis Study Resource Was: M Ali Ahsan KhanShary KhanNo ratings yet

- Tutorial For Students Economics BasicDocument5 pagesTutorial For Students Economics BasicasadullahqNo ratings yet

- Updated Cost Structure PPTDocument35 pagesUpdated Cost Structure PPTtanishasheth26No ratings yet

- Impairment of Assets (IAS 36)Document7 pagesImpairment of Assets (IAS 36)sadikiNo ratings yet

- Transfer PricingDocument11 pagesTransfer Pricingarun_batraNo ratings yet

- Monopolistic Comp FRQs AnswersDocument4 pagesMonopolistic Comp FRQs AnswersHeizlyn Amyneina100% (1)

- Extensions To Basic ModelDocument5 pagesExtensions To Basic ModelhashimNo ratings yet

- CH-6-Micro-Cost of Production, Revenue & Producer EquilibriumDocument10 pagesCH-6-Micro-Cost of Production, Revenue & Producer Equilibriumriyamarandi46No ratings yet

- CLASS XI ECONOMICS CH-6-Micro-Cost of production, revenue & producer equilibrium (COMPETENCY – BASED TEST ITEMS) MARKS WISEDocument21 pagesCLASS XI ECONOMICS CH-6-Micro-Cost of production, revenue & producer equilibrium (COMPETENCY – BASED TEST ITEMS) MARKS WISEMOHAMMAD SYED AEJAZNo ratings yet

- Theory of The FirmDocument56 pagesTheory of The FirmoogafelixNo ratings yet

- CH 08Document41 pagesCH 08samazayedddNo ratings yet

- Merger 103Document14 pagesMerger 103JasonNo ratings yet

- Solved Define Both Kahn and Antonucci S Social Convoy Theory and CarsteDocument1 pageSolved Define Both Kahn and Antonucci S Social Convoy Theory and CarsteM Bilal SaleemNo ratings yet

- Pages: 182-185: Ch11 Market Power: Perfect Competition and Monopolistic CompetitionDocument5 pagesPages: 182-185: Ch11 Market Power: Perfect Competition and Monopolistic CompetitionGiu AragãoNo ratings yet

- Lecture 5: Market Structure - Monopoly: I. The Definition of MonopolyDocument6 pagesLecture 5: Market Structure - Monopoly: I. The Definition of MonopolyMehboob MandalNo ratings yet

- Unit 3 Monopoly: StructureDocument23 pagesUnit 3 Monopoly: StructureNeha SinghNo ratings yet

- Solved in A Competitive Market With No Government Intervention The EquilibriumDocument1 pageSolved in A Competitive Market With No Government Intervention The EquilibriumM Bilal SaleemNo ratings yet

- Assignment 2 Apllied EcoDocument10 pagesAssignment 2 Apllied EcoAthikah AnuarNo ratings yet

- BB 107 (Spring) Tutorial 7(s)Document4 pagesBB 107 (Spring) Tutorial 7(s)Chin HongNo ratings yet

- 영어독해와 작문 자율과제_독과점의 오해_이주현_scriptDocument2 pages영어독해와 작문 자율과제_독과점의 오해_이주현_scriptSeungkyoo HanNo ratings yet

- The Traditional Theory of Costs (With Diagram)Document14 pagesThe Traditional Theory of Costs (With Diagram)Abhinandan MazumderNo ratings yet

- Chap. 5 Perfect Comp.Document9 pagesChap. 5 Perfect Comp.amanuelNo ratings yet

- Chapter 8 Cost ConceptsDocument28 pagesChapter 8 Cost ConceptsRajveer SinghNo ratings yet

- Micro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCDocument6 pagesMicro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCAhmadnur JulNo ratings yet

- Micro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCDocument6 pagesMicro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCSoweirdNo ratings yet

- Perfect Competition: P SivakumarDocument33 pagesPerfect Competition: P SivakumarAnonymous 1ClGHbiT0JNo ratings yet

- Economics Principles and Policy 13th Edition Baumol Solutions ManualDocument4 pagesEconomics Principles and Policy 13th Edition Baumol Solutions Manualedwardleonw10100% (31)

- Solutions PepallDocument48 pagesSolutions PepallJoseph Guen67% (6)

- XII - Accounts - Sample Paper-1Document27 pagesXII - Accounts - Sample Paper-1zainab.xf77No ratings yet

- Youtube Channel-Grooming Education Academy by Chandan PoddarDocument3 pagesYoutube Channel-Grooming Education Academy by Chandan Poddargagan vermaNo ratings yet

- Part 06 Pure CompetitionDocument11 pagesPart 06 Pure CompetitionYuhan Hazel YouNo ratings yet

- Solved Using The Cost Data Shown in Table 8 1 Calculate TheDocument1 pageSolved Using The Cost Data Shown in Table 8 1 Calculate TheM Bilal SaleemNo ratings yet

- Current Cost Accounting (CCA) - Objective and EvaluationDocument36 pagesCurrent Cost Accounting (CCA) - Objective and Evaluationfrieda20093835No ratings yet

- UoB PEAB Sample Exam Paper 2014Document11 pagesUoB PEAB Sample Exam Paper 2014Elliot BeagleyNo ratings yet

- Firm'S Cost of ProductionDocument9 pagesFirm'S Cost of ProductionKhurram ShehzadNo ratings yet

- Chapter 10-Monopolistic Competition and Oligopoly: Multiple ChoiceDocument32 pagesChapter 10-Monopolistic Competition and Oligopoly: Multiple ChoicePeerapon JatuparisutNo ratings yet

- Solved The Marginal and Average Cost Curves of Taxis in MetropolisDocument1 pageSolved The Marginal and Average Cost Curves of Taxis in MetropolisM Bilal SaleemNo ratings yet

- Solved Explain The Error in The Following Statement A Firm OutDocument1 pageSolved Explain The Error in The Following Statement A Firm OutM Bilal SaleemNo ratings yet

- Memo Exam Jun 2016Document13 pagesMemo Exam Jun 2016Nathan VieningsNo ratings yet

- The Customer Catalyst: How to Drive Sustainable Business Growth in the Customer EconomyFrom EverandThe Customer Catalyst: How to Drive Sustainable Business Growth in the Customer EconomyNo ratings yet