Professional Documents

Culture Documents

Why Does Corporate Governance Really Matter

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Why Does Corporate Governance Really Matter

Copyright:

Available Formats

Why Does Corporate Governance

Really Matter? New Book from

Stanford Graduate School of Business

Showcases Research into How Boards

Can Govern Better

Why Does Corporate Governance Really Matter? New Book from Stanford Graduate School of

Business Showcases Research into How Boards Can Govern Better

« Free Stanford GSB Corporate Governance educational material available on “The Market for

Corporate Control”

May 19, 2011 01:47 PM Eastern Daylight Time

Corporate Governance Matters by Professor David Larcker and Brian Tayan

STANFORD, Calif.–(BUSINESS WIRE)–“The debate on the role of boards in the wake of the

financial crisis has created a lot of hype and rhetoric about corporate governance,” says David

Larcker, who is James Irvin Miller Professor of Accounting and Director of the Corporate

Governance Research Program at the Stanford Graduate School of Business and coauthor with

Brian Tayan of the new book Corporate Governance Matters (FT Press). According to

Larcker, many so-called experts are heavy on opinions about governance, but light on the facts.

“The fight for „say on pay‟ and proxy access has gotten a lot of ink – but it is unclear whether it

will actually create shareholder value.”

“The FDA requires research on drug outcomes before approving a pharmaceutical,” he says.

“Shouldn‟t experts that prescribe „cures for bad governance‟ be subject to a similar standard of

review?”

In their book, Larcker and Tayan, a researcher at Stanford GSB, challenge the conventional

wisdom of the many books, reports, and recommendations of blue-ribbon panels on what

constitutes “good” governance. The authors researched hundreds of companies and interviewed

many board directors to uncover the real-life consequences of corporate governance practices –

from director independence to designing appropriate executive pay packages.

“A lot of people want to measure what‟s measurable – we wanted to measure what‟s

informative,” says Tayan. “For example, certain lightning-rod issues, such as „excessive‟ risk

taking and CEO compensation, get a lot of attention from outside observers, while important

issues that are considerably more difficult to assess – such as corporate strategy and succession

planning – tend to get the short shrift.”

Trends Getting in the Way of Good Governance

“Our research shows that many emerging developments that were intended to improve

governance – purportedly to avert the kind of financial disaster we just experienced – just don‟t

hold water,” Larcker explains. These include:

1. Compliance drowning out strategy – “A check-the-box approach is not what we need

from directors. We need instead their best thinking and ability to manage risk

appropriately for corporate growth.”

2. “Federalization of corporate governance” – “As corporate governance becomes

increasingly, and probably inexorably, „federalized‟ through regulations such as Dodd-

Frank, there is a real question as to whether these laws make boards govern better,” he

says. “We‟re still debating whether the 10-year-old Sarbanes Oxley was good for the

economy.”

3. “Shareholder democracy” movement – “The fight for „say on pay‟ and proxy access

has gotten a lot of ink – but it is unclear whether it will actually create shareholder

value.”

4. Rise of proxy advisory firms – “Proxy advisory firms exhibit substantial influence over

the proxy voting process. What is the evidence that their recommendations lead to the

kinds of positive outcomes that stakeholders really care about?”

“We wrote our book for thinkers – for practitioners who want to see how important governance

issues play out in the real world,” says Tayan.

“By integrating several different approaches to the topic – both business and legal – we have

created a practical framework for directors that will help them make decisions that lead to

organizational success.”

To speak with the authors, contact Davia Temin or Suzanne Oaks at 212-588-8788 or

news@teminandco.com.

For information on Corporate Governance Research Program:

http://www.gsb.stanford.edu/cgrp/about/

Contacts

Stanford Graduate School of Business

Helen Chang, 650-723-3358

chang_helen@gsb.stanford.edu

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Diversity in The C-Suite: Fortune 100 C-Suite Organizational ChartsDocument115 pagesDiversity in The C-Suite: Fortune 100 C-Suite Organizational ChartsStanford GSB Corporate Governance Research InitiativeNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Board Composition, Quality, & TurnoverDocument24 pagesBoard Composition, Quality, & TurnoverStanford GSB Corporate Governance Research InitiativeNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Diversity in The C-Suite: The Dismal State of Diversity Among Fortune 100 Senior ExecutivesDocument23 pagesDiversity in The C-Suite: The Dismal State of Diversity Among Fortune 100 Senior ExecutivesStanford GSB Corporate Governance Research InitiativeNo ratings yet

- Loosey-Goosey Governance: Four Misunderstood Terms in Corporate GovernanceDocument17 pagesLoosey-Goosey Governance: Four Misunderstood Terms in Corporate GovernanceStanford GSB Corporate Governance Research InitiativeNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 2019 U.S. Tax SurveyDocument34 pages2019 U.S. Tax SurveyStanford GSB Corporate Governance Research InitiativeNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Principles of Corporate Governance: A Guide To Understanding Concepts of Corporate GovernanceDocument5 pagesThe Principles of Corporate Governance: A Guide To Understanding Concepts of Corporate GovernanceStanford GSB Corporate Governance Research Initiative100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Environmental, Social and Governance (ESG) Activities - Research SpotlightDocument18 pagesEnvironmental, Social and Governance (ESG) Activities - Research SpotlightStanford GSB Corporate Governance Research Initiative78% (9)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Shareholders & Corporate Control: DataDocument18 pagesShareholders & Corporate Control: DataStanford GSB Corporate Governance Research InitiativeNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Evolution of Corporate Governance: 2018 Study of Inception To IPODocument23 pagesThe Evolution of Corporate Governance: 2018 Study of Inception To IPOStanford GSB Corporate Governance Research Initiative100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Board Structure: DataDocument18 pagesBoard Structure: DataStanford GSB Corporate Governance Research InitiativeNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shareholder Activism Research SpotlightDocument21 pagesShareholder Activism Research SpotlightStanford GSB Corporate Governance Research InitiativeNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Governance Gone Wild: Epic Misbehavior at Uber TechnologiesDocument15 pagesGovernance Gone Wild: Epic Misbehavior at Uber TechnologiesStanford GSB Corporate Governance Research InitiativeNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- CEO Compensation: Data SpotlightDocument26 pagesCEO Compensation: Data SpotlightStanford GSB Corporate Governance Research InitiativeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- OpenText Business Center Capture For SAP Solutions 16.3 - Customization Guide English (CPBC160300-CGD-EN-01) PDFDocument278 pagesOpenText Business Center Capture For SAP Solutions 16.3 - Customization Guide English (CPBC160300-CGD-EN-01) PDFAshish Yadav100% (2)

- Factors Affecting Option PricesDocument10 pagesFactors Affecting Option PricesRajneesh MJNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- M310 11 ConstructionProgressScheduleDocument10 pagesM310 11 ConstructionProgressScheduleIan DalisayNo ratings yet

- Case OverviewDocument9 pagesCase Overviewmayer_oferNo ratings yet

- RAMPT Program PlanDocument39 pagesRAMPT Program PlanganeshdhageNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Investment Portfolio: Maria Aleni B. VeralloDocument11 pagesThe Investment Portfolio: Maria Aleni B. VeralloMaria Aleni100% (1)

- Policy Guidelines On Issuance and Operation of Prepayment Instruments in IndiaDocument10 pagesPolicy Guidelines On Issuance and Operation of Prepayment Instruments in IndiaPreethiNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Dollar General Case StudyDocument26 pagesDollar General Case StudyNermin Nerko Ahmić100% (1)

- Amtrak Dining RFPDocument54 pagesAmtrak Dining RFPdgabbard2No ratings yet

- Interesting Cases HbsDocument12 pagesInteresting Cases Hbshus2020No ratings yet

- Case Study The Wedding Project Marketing EssayDocument10 pagesCase Study The Wedding Project Marketing EssayHND Assignment HelpNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Case Problem The Hands On CEO of JetblueDocument3 pagesCase Problem The Hands On CEO of JetblueMarinelEscotoCorderoNo ratings yet

- Chapter 1Document15 pagesChapter 1Yap Chee HuaNo ratings yet

- Chapter 9Document23 pagesChapter 9Hamis Rabiam MagundaNo ratings yet

- Marketing Plan On PepsicoDocument24 pagesMarketing Plan On PepsicoWaqar AfzaalNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Overview of SME: Rowshonara Akter Akhi Lecturer Jahangirnagar UniversityDocument30 pagesOverview of SME: Rowshonara Akter Akhi Lecturer Jahangirnagar UniversityMehedi HasanNo ratings yet

- POM TopicsDocument2 pagesPOM TopicsAnkit SankheNo ratings yet

- Entrep ReportDocument28 pagesEntrep ReportIan RamosNo ratings yet

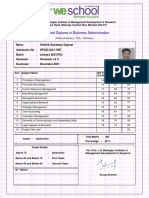

- Advanced Diploma in Business Administration: Hrithik Sandeep GajmalDocument1 pageAdvanced Diploma in Business Administration: Hrithik Sandeep GajmalNandanNo ratings yet

- Oval Private Clients BrochureDocument4 pagesOval Private Clients Brochuremark_leyland1907No ratings yet

- A Project Report ON A Study of Promotion Strategy and Customer Perception of MC Donalds in IndiaDocument18 pagesA Project Report ON A Study of Promotion Strategy and Customer Perception of MC Donalds in IndiaShailav SahNo ratings yet

- Solution Manual For Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt, Ireland, HoskissonDocument28 pagesSolution Manual For Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt, Ireland, Hoskissona7978571040% (1)

- Poultry StudyDocument54 pagesPoultry StudySamuel Fanijo100% (1)

- Casey Loop's Whistleblower Lawsuit vs. The CTADocument18 pagesCasey Loop's Whistleblower Lawsuit vs. The CTAChadMerdaNo ratings yet

- HBO Jieliang Home PhoneDocument6 pagesHBO Jieliang Home PhoneAshish BhalotiaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Accounts Made EasyDocument9 pagesAccounts Made EasyPrashant KunduNo ratings yet

- RMM 0180 Reservations Cum Transport CoordinatorDocument1 pageRMM 0180 Reservations Cum Transport CoordinatorSundar PanditNo ratings yet

- Deborah K Chasanow Financial Disclosure Report For 2010Document20 pagesDeborah K Chasanow Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Internship Report Meezan Bank by Rehan MubeenDocument28 pagesInternship Report Meezan Bank by Rehan MubeenrehanNo ratings yet

- Dear SirDocument2 pagesDear SircaressaNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)