Professional Documents

Culture Documents

Heath Guard Brochure

Heath Guard Brochure

Uploaded by

Aravind MelepatCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Heath Guard Brochure

Heath Guard Brochure

Uploaded by

Aravind MelepatCopyright:

Available Formats

We have signed up with over 2300 hospitals across India.

Given below are some of the network hospitals

· Ahmedabad: Krishna Heart Institute, Sterling Hospital

· Aurangabad: Kamalnayan Bajaj Hospital, MGM Medical Centre

· Banglore: Manipal Hospital, Sagar Apollo Hospital, M.S. Ramaiah

Hospital · Bhopal: Ayushman Hospital · Bhubaneswar: Kalinga Hospital

Ltd. · Chennai: Sri Ramachandra Medical Centre, Sankara Nethralaya,

What would be my premium cost? Dr.Agarwal's Eye Hospital Ltd. · Cochin: Cochin Hospital, Ernakulam

Medical Centre, Gautham Hospital · Coimbatore: KG Hospital, PSG

The insured can opt for a sum assured from Rs. 1 lac to Rs.10 lacs. Hospitals · Guwahati: Down Town Hospital Ltd. · Hyderabad: Apollo

Hospitals, Yashoda Super Speciality Hospital, Care Hospital · Indore:

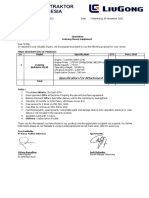

Sum 90 day-25 yrs 26-40 yrs 41-45 yrs 46-55 yrs CHL- ApolloHospitals, Gokuldas Hospitals Ltd. · Jaipur: Apex Hospitals

insured

(Pvt.) Ltd., Tongia Heart & General Hospital · Jallandhar: Sacred Heart

1,00,000 1,254 1,453 1,862 2,793 Hospital, Kapil Hospital · Jammu: Acharya Shri Chander College of

1,50,000 1,882 2,110 2,727 4,190 Medical Sciences & Hospital · Kanpur: Regency Hospital Ltd. · Kolkata :

2,00,000 2,338 2,736 3,591 5,586 Apollo Gleneagles Hospitals, Bhagirathi Neotia Hospital · Lucknow:

3,00,000 3,306 3,876 5,054 6,983 Shekhar Hospital Pvt. Ltd. · Ludhiana: Lifeline Superspeciality Hospital

4,00,000 4,332 5,130 6,517 10,416 · Madurai: Meenakshi Mission Hospital, Vadamalayan Hospitals

5,00,000 5,244 6,156 7,980 12,697 · Goa: Vrundavan Hospital, Kerkar Hospital · Mumbai: Dr. Balabhai

7,50,000 6,688 7,510 9,736 15,490 Nanavati Hospital, Asian Heart Institute, Jaslok Hospital,

10,00,000 8,160 9,163 11,877 19,757 Dr. L H Hiranandani Hospital · Mysore: Vikram Hospital & Heart Centre

· Nasik: Shri Samarth Super Speciality Hospital · New Delhi: Max

Service tax extra.

Hospital, Saroj Hospital & Heart Institute, St. Stephens' Hospital,

Moolchand Hospital, Rajiv Gandhi Cancer Institute, Pushpawati

Singhania Institute, Indraprastha Apollo Hospitals, Escorts Heart

Get yourself and your family Institute · Patna: Sahyog Hospital · Pune: Deenanath Mangeshkar

Hospital, Ruby Hall Clinic, Jehangir Hospital, Poona Hospital, Sancheti

covered by Health Guard Institute · Raipur: Modern Medical Institute · Rajkot: Yash Hospital

· Ranchi: Abdur Razzaque Hospital · Trivandrum: Kerala Institute of

today and sleep easy. Medical Sciences · Vadodara: Bhailal Amin General Hospital

· Visakhapatnam: Apollo Hospitals, Care Hospital

Cashless facility offered through network hospitals of Bajaj Allianz only.

Cashless facility is subject to mandatory pre authorisation by Bajaj Allianz and subject

to policy conditions.

Health Guard

( BJ AZ 13/02/08)

* The network of hospitals is subject to change without notice.

* The company reserves the right to decline any proposal without citing any reason.

Disclaimer: The above information is only indicative in nature. For details of the Complete health protection for you and your family

coverage & exclusions please contact our nearest office. Call : 1-800-225858 (free calls from BSNL/MTNL lines only) or

1-800-1025858 (free calls from Bharti - mobile / landline)

Insurance is the subject matter of solicitation

or 020-30305858

@

info@bajajallianz.co.in

Bajaj Allianz General Insurance

www.bajajallianz.co.in

Bajaj Allianz The Health Guard Policy in a nutshell

Bajaj Allianz General Insurance Company is a dynamic partnership

Covers emergency ambulance charges (up to Rs 1000 ) Provides cashless benefit

between two giants: Bajaj Auto Ltd. India's largest 2 & 3 wheeler giant

and diversified into Auto Finance, Steel, etc. & Allianz SE, Germany Covers pre and post hospitalization expenses Provides cumulative bonus of 5% to your sum assured

the world's largest insurance company with 700 subsidiaries across Covers medical expenses (you & your family) during for every claims free year

70 countries. This joint venture company incorporates global expertise hospitalization

with local experience. The comprehensive, innovative solutions combine

the technical expertise and experience of the 110 year old Allianz SE, and

10% co-payment of the admissible claim to be paid by the member

+

in-depth market knowledge and good will of Bajaj Auto. Competitive How does the Health Guard policy benefit me? if treatment is taken in a hospital other than a network hospital.

pricing and quick honest response have earned the company the

In these times of rising medical costs, Bajaj Allianz's Health Guard Policy Waiver of the co-payment clause is available on payment of

customer's trust and market leadership in a very short time.

is the perfect Health protection for you and your family. It takes care of additional premium.

the expensive medical treatment incurred during hospitalization Covers ambulance charges in an emergency subject to limit of

+

resulting from serious accident or illness. The policy covers pre and post Rs.1000/-

hospitalization expenses and also ambulance charges in case of an 130 daycare procedures are covered subject to terms & conditions

+

The Bajaj Allianz Advantage

emergency (subject to a limit of Rs. 1000/-) E-opinion rider cover inbuilt for sum insured of Rs. 5 lacs,

+

Rs. 7.5 lacs and Rs. 10 lacs

What is the eligible age?

HAT : In-house Claim Administration What benefits do I get?

Entry age for proposer is 18 yrs - 55 yrs. Policy can be renewed upto

+

Cumulative bonus of 5% to your sum assured for every claims free

+

70 yrs*.

year

Global expertise & local knowledge Children from 3 months to 5 yrs are eligible if both the parents are

+

Family discount of 10% is applicable

+

insured with Bajaj Allianz.

Health Check up in designated Bajaj Allianz Diagnositc Centers or

+

Children from 6 yrs to 18 yrs are eligible if one parent is insured

+

Reimbursement upto Rs. 1000/- at the end of continuous four claims

Innovative packages to match individual needs with Bajaj Allianz

free years.

* Conditions apply Income tax benefit on the premium paid as per section 80-D of the

+

Any restrictions on value of sum insured? Income Tax Act

Quick disbursement of claims

Sum insured from Rs. 1 lac to Rs.10 lacs can be opted from 3

+

Any exclusions?

months to 55 yrs. All diseases/injuries existing at the time of proposing this insurance

+

No tests required for SI upto Rs.10 lacs and age upto 45 yrs (Subject

+ Any disease contracted during the first 30 days of commencement of

+

to clean proposal form.) the policy

In house Certain diseases such as hernia, piles, cataract (liability restricted

+

What are the details of coverage the policy offers?

upto 10% of SI, max. upto Rs. 25,000), sinusitis shall be covered after a

administration

With Health Guard, the member has access to cashless facility at

+ waiting period of 2 years

of hospital various empanelled hospitals across India. (subject to exclusions Non Allopathic medicine

+

reimbursement and conditions) Congenital diseases

+

In case the member opts for hospitals besides the empanelled ones,

+ All expenses arising from AIDS and related diseases

+

claim

the expenses incurred by him shall be reimbursed within 14 working Cosmetic, aesthetic or related treatment

+

days from submission of all documents Use of intoxicating drugs, alcohol

+

Pre and post hospitalization expenses covers relevant medical

+ Joint replacement surgery (other than due to accidents shall have a

+

expenses incurred 60 days prior to and 90 days after hospitalization waiting period of four years)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ruth Bader Ginsburg & Child Sex TraffickingDocument7 pagesRuth Bader Ginsburg & Child Sex TraffickingEdward de Burseblades100% (1)

- CRMD v. CBTC PDFDocument2 pagesCRMD v. CBTC PDFNaj AilaNo ratings yet

- Funa Vs Agra DigestDocument4 pagesFuna Vs Agra DigestEva Trinidad0% (1)

- Civil Rights & Civil Responsibilities - Lewis A. Brandon, III Keynote SpeakerDocument2 pagesCivil Rights & Civil Responsibilities - Lewis A. Brandon, III Keynote SpeakerBeloved Community Center of GreensboroNo ratings yet

- Retail Banking at HDFC BankDocument59 pagesRetail Banking at HDFC BankHardip MatholiyaNo ratings yet

- CAL ES PhilIRI 2021-2022Document9 pagesCAL ES PhilIRI 2021-2022Anacel FaustinoNo ratings yet

- Part A & BDocument6 pagesPart A & BRiya PrajapatiNo ratings yet

- 071 Quot - Bulldozer B230 SjaDocument2 pages071 Quot - Bulldozer B230 SjaFebri HardimanNo ratings yet

- Quizzer 6Document2 pagesQuizzer 6Midas PhiNo ratings yet

- Huntington National Bank 2021 Q3 Earnings ReviewDocument40 pagesHuntington National Bank 2021 Q3 Earnings ReviewUrderglewerNo ratings yet

- Value Date Post Date Remitter Branch Description Chequ Eno DR CR BalanceDocument2 pagesValue Date Post Date Remitter Branch Description Chequ Eno DR CR BalanceShweta ShirsatNo ratings yet

- AGD3 and DEARBC Technical MeetingDocument2 pagesAGD3 and DEARBC Technical Meetinghanah bahnanaNo ratings yet

- Bal Pricelist 6 Dec 2013 UpdatedDocument12 pagesBal Pricelist 6 Dec 2013 UpdateddbedadaNo ratings yet

- Flipkart Invoice Vivo T2X 5GDocument1 pageFlipkart Invoice Vivo T2X 5GShubhankar HalderNo ratings yet

- How Had The USSR Gained Control Over Eastern EuropeDocument14 pagesHow Had The USSR Gained Control Over Eastern EuropeTom WatersNo ratings yet

- Scrap 5Document14 pagesScrap 5Bryent GawNo ratings yet

- IC Accounts Payable Ledger Template Updated 8552Document2 pagesIC Accounts Payable Ledger Template Updated 8552M Monjur MobinNo ratings yet

- Justice Without DelayDocument72 pagesJustice Without DelayCPLJNo ratings yet

- Constitutional Law IDocument10 pagesConstitutional Law IJanine Blaize Oplay CaniwNo ratings yet

- Condemnation of The Hardness of The Heart Al Hafiz Ibn Rajab AlDocument97 pagesCondemnation of The Hardness of The Heart Al Hafiz Ibn Rajab AlWryfNo ratings yet

- 130 Darcen vs. V.R. Gonzales Credit Enterprises, Inc.Document16 pages130 Darcen vs. V.R. Gonzales Credit Enterprises, Inc.유니스No ratings yet

- Texe Marrs 2011 - 2010 TrilogyDocument15 pagesTexe Marrs 2011 - 2010 TrilogyteddybruskyNo ratings yet

- UM Panabo College: Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document18 pagesUM Panabo College: Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Kenneth PadaoNo ratings yet

- Samsung SCX 4100 Reman EngDocument8 pagesSamsung SCX 4100 Reman EngNga PhanNo ratings yet

- 3 Foreign Exchange Markets - IIDocument5 pages3 Foreign Exchange Markets - IINaomi LyngdohNo ratings yet

- CNN - Breaking News, Latest News and VideosDocument18 pagesCNN - Breaking News, Latest News and Videosal457No ratings yet

- 22 People V Gutierrez (D)Document1 page22 People V Gutierrez (D)Dexter LedesmaNo ratings yet

- Brampton Law FirmsDocument4 pagesBrampton Law FirmsRakesh KaundalNo ratings yet

- Lease Accounting QuizDocument1 pageLease Accounting QuizLanie Lamazon0% (1)

- 12.13 Death Series Day 1.a7Document1 page12.13 Death Series Day 1.a7Reading_EagleNo ratings yet