Professional Documents

Culture Documents

Itr 62 Form 16 A

Itr 62 Form 16 A

Uploaded by

av_meshramOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr 62 Form 16 A

Itr 62 Form 16 A

Uploaded by

av_meshramCopyright:

Available Formats

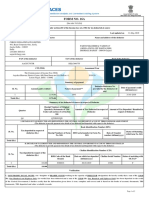

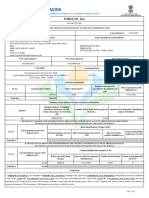

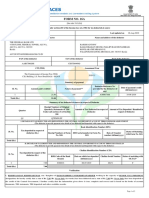

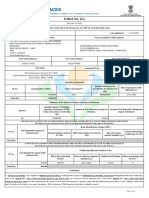

FORM NO.

16A

[See rule 31(1)(b)]

Certificate of deduction of tax at source under section 203

of the Income-tax Act, 1961

For interest on securities; dividends; interest other than “interest on securities”; winnings from lottery or crossword

puzzle ; winnings from horse race; payments to contractors and sub-contractors; insurance commission; payments to

non-resident sportsmen/sports associations; payments in respect of deposits under National Savings Scheme;

payments on account of repurchase of units by Mutual Fund or Unit Trust of India; commission, remuneration or

prize on sale of lottery tickets; commission or brokerage; rent; fees for professional or technical services; royalty and

any sum under section 28(va); income in respect of units; payment of compensation on acquisition of certain

immovable property; other sums under section 195; income in respect of units of non-residents referred to in section

196A; income from units referred to in section 196B; income from foreign currency bonds or shares of an Indian

company referred to in section 196C; income of Foreign Institutional Investors from securities referred to in section

196D

Name and address of the person Acknowledgement Nos. of all Name and address of the person

deducting tax Quarterly Statements of TDS under to whom payment made or in

sub-section (3) of section 200 as whose account it is credited

provided by TIN Facilitation Centre

or NSDL web-site

Quarter Acknowledgement

No.

TAX DEDUCTION A/C NO. OF THE NATURE OF PAYMENT PAN NO. OF THE PAYEE

DEDUCTOR

PAN NO. OF THE DEDUCTOR FOR THE PERIOD

__________ TO ___________.

DETAILS OF PAYMENT, TAX DEDUCTION AND DEPOSIT OF TAX INTO

CENTRAL GOVERNMENT ACCOUNT

(The Deductor is to provide transaction-wise details of tax deducted and deposited)

S. No. Amount Date of TDS Surcharge Education Total tax Cheque/DD BSR Code Date on Transfer

paid/ payment/ Cess deposited No. (if any) of Bank which tax voucher/

credited credit Rs. Rs. branch deposited Challan

Rs. Rs. (dd/mm/yy) Identification

No.

1.

2.

3.

4.

Certified that a sum of Rs. (in words) __________________________ has been deducted at source and paid to the

credit of the Central Government as per details given above.

Printed from www.taxmann.com

Place _________________ ___________________________________

Date _______________ Signature of person responsible for deduction of tax

Full Name._______________________

Designation ___________________________

Printed from www.taxmann.com

You might also like

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- TDS Form 16 & 16ADocument14 pagesTDS Form 16 & 16AVaibhav NagoriNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- Form No. 16-ADocument1 pageForm No. 16-AJay100% (6)

- Form No 16Document2 pagesForm No 16scorpio.vinodNo ratings yet

- Form 16a - TDS - Blank 16aDocument1 pageForm 16a - TDS - Blank 16aJayNo ratings yet

- Welcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)Document9 pagesWelcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)SagarDaveNo ratings yet

- 0002 Payment Certificate 2010Document3 pages0002 Payment Certificate 2010SreedharanPNNo ratings yet

- Rajesh TambeDocument1 pageRajesh TambemodakmmNo ratings yet

- Form No. 16ADocument2 pagesForm No. 16Asen_pratishNo ratings yet

- Bgupv5366d Q4 2019-20Document2 pagesBgupv5366d Q4 2019-20Parth VaishnavNo ratings yet

- Challan No./ ITNS 282: Tax Applicable (Tick One)Document2 pagesChallan No./ ITNS 282: Tax Applicable (Tick One)satishkumar.mandora.smNo ratings yet

- Form 16a New FormatDocument2 pagesForm 16a New FormatJayNo ratings yet

- Alasian Craft Aaufa3568m Fy201718Document2 pagesAlasian Craft Aaufa3568m Fy201718SUDHIRNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPrakash PandeyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NN Sarfaesi Solutions AgencyNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToSOUMYA RANJAN PATRANo ratings yet

- It 000147087234 2024 12Document1 pageIt 000147087234 2024 12Revenue sectionNo ratings yet

- Form 16 ADocument2 pagesForm 16 AParminderSinghNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rayon fashionNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaskiezer agrudaNo ratings yet

- Form 16 ADocument2 pagesForm 16 Asatyampandey7986659533No ratings yet

- Aaacl4159l Q3 2024-25Document3 pagesAaacl4159l Q3 2024-25vbgrandvizagNo ratings yet

- Bocpv0011d 2023Document4 pagesBocpv0011d 2023Vyshak Bisha ValsanNo ratings yet

- Form 16ADocument1 pageForm 16Abkrawat2008No ratings yet

- Form 16 - Fy 2019-20Document4 pagesForm 16 - Fy 2019-20CA SHOBHIT GoelNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRajesh AntonyNo ratings yet

- Form 16 Excel FormatDocument4 pagesForm 16 Excel FormatAUTHENTIC SURSEZNo ratings yet

- Form 16A. Tata CapitalDocument1 pageForm 16A. Tata CapitalparshantduggalNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Subhransu SarangiNo ratings yet

- Prabha Maheshwari - Eorpm9411l - Q1 - Ay202324 - 16aDocument2 pagesPrabha Maheshwari - Eorpm9411l - Q1 - Ay202324 - 16aankur maheshwariNo ratings yet

- Acfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaDocument3 pagesAcfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaapi-564750164No ratings yet

- BLFPN0819K 2021Document4 pagesBLFPN0819K 2021anjana19780316No ratings yet

- Dividend Warrant Cert Withheld 1595396738716 PDFDocument1 pageDividend Warrant Cert Withheld 1595396738716 PDFRafay IkramNo ratings yet

- It 000130629196 2021 00Document1 pageIt 000130629196 2021 00muhammad faiqNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToDevasyrucNo ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- HSRPM9590K Q3 2023-24Document3 pagesHSRPM9590K Q3 2023-24jishna mathewNo ratings yet

- Crzpb6128e 2021Document4 pagesCrzpb6128e 2021PAMELANo ratings yet

- Tax Deducted at SourceDocument3 pagesTax Deducted at SourceShivam SharmaNo ratings yet

- T.D.S./Tcs Tax ChallanDocument3 pagesT.D.S./Tcs Tax ChallanRukmani GuptaNo ratings yet

- A.Y. 2022-23Document4 pagesA.Y. 2022-23LAXMI FINANCENo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ElvisPresliiNo ratings yet

- DividendWarrant U 9542907Document1 pageDividendWarrant U 9542907hinaNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- Aaqha9773c 2023Document4 pagesAaqha9773c 2023Bhavesh JainNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghNo ratings yet

- Cfa AccountsDocument4 pagesCfa AccountsBhavesh SharmaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rahul kumarNo ratings yet

- Gojps4182g 2022Document4 pagesGojps4182g 2022Raj MishraNo ratings yet

- BDTPD4716P 2021Document4 pagesBDTPD4716P 2021SANJAY KUMARNo ratings yet

- Income Tax Payment Challan: PSID #: 50454183Document1 pageIncome Tax Payment Challan: PSID #: 50454183Shehla FarooqNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet