Professional Documents

Culture Documents

Taxation As A Power To Destroy - Case Digest

Uploaded by

Mar AvilaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation As A Power To Destroy - Case Digest

Uploaded by

Mar AvilaCopyright:

Available Formats

1. Power to Destroy vis-a-vis Power to Build Sison vs. Ancheta 130 SCRA 654 FACTS: Batas Pambansa Blg.

135 was challenged by petitioner. The assailed provision amends Section 21 of the National Internal Revenue Code of 1977, which provides for rates of tax on citizens or residents on (a) taxable compensation income, (b) taxable net income, (c) royalties, prizes, and other winnings, (d) interest from bank deposits and yield or any other monetary benefit from deposit substitutes and from trust fund and similar arrangements, (e) dividends and share of individual partner in the net profits of taxable partnership, (f) adjusted gross income. Petitioner as taxpayer alleges that by virtue thereof, "he would be unduly discriminated against by the imposition of higher rates of tax upon his income arising from the exercise of his profession vis-a-vis those which are imposed upon fixed income or salaried individual taxpayers. He characterizes the above section as arbitrary amounting to class legislation, oppressive and capricious in character. For petitioner, therefore, there is a transgression of both the equal protection and due process clauses of the Constitution as well as of the rule requiring uniformity in taxation. Hence, the petition.

ISSUE: Whether the imposition of a higher tax rate on taxable net income derived from business or profession than on compensation is constitutionally infirm.

HELD: The court held that such that the petition should be dismissed. The power to tax under Justice Malcolm "is an attribute of sovereignty. It is the strongest of all the powers of government." It is, to be admitted that for all its plenitude 'the power to tax is not unconfined. There are restrictions. The Constitution sets forth such limits.

You might also like

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemFrom EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- Topic: Extent of Power CIR v. Santos Facts: Compensation Income (After Deducting The Allowable and Additional Exemptions)Document1 pageTopic: Extent of Power CIR v. Santos Facts: Compensation Income (After Deducting The Allowable and Additional Exemptions)finserglenNo ratings yet

- SISON vs. ANCHETA Tax Rates UpheldDocument1 pageSISON vs. ANCHETA Tax Rates UpheldMCNo ratings yet

- Sison vs. Ancheta - Power to classify taxpayers upheldDocument1 pageSison vs. Ancheta - Power to classify taxpayers upheldTheodore0176No ratings yet

- Sison JR VS AnchetaDocument2 pagesSison JR VS AnchetaKath Leen100% (1)

- Sison Vs AnchetaDocument2 pagesSison Vs AnchetadasfghkjlNo ratings yet

- Sison Vs AnchetaDocument24 pagesSison Vs AnchetaEdcel June AmadoNo ratings yet

- SISON vs. ANCHETAG.R. No. L-59431 July 25, 1984Document1 pageSISON vs. ANCHETAG.R. No. L-59431 July 25, 1984Ariel LunzagaNo ratings yet

- Sison Vs AnchetaDocument1 pageSison Vs AnchetamenforeverNo ratings yet

- Sison V Ancheta GDocument2 pagesSison V Ancheta GJan GonzalesNo ratings yet

- I.A. Meaning of Taxation Obligation To Pay Tax Vs Obligation To Pay DebtDocument33 pagesI.A. Meaning of Taxation Obligation To Pay Tax Vs Obligation To Pay DebtVincent Jan TudayanNo ratings yet

- Case DigestsDocument158 pagesCase DigestsJustin Imadhay100% (4)

- Phil Health Providers vs CIR DST RulingDocument3 pagesPhil Health Providers vs CIR DST RulingIrene QuimsonNo ratings yet

- NPC V Cabanatuan DigestsDocument2 pagesNPC V Cabanatuan Digestspinkblush717100% (1)

- Vi. Sison vs. Ancheta (130 Scra 654)Document1 pageVi. Sison vs. Ancheta (130 Scra 654)ROSASENIA “ROSASENIA, Sweet Angela” Sweet AngelaNo ratings yet

- Chamber of Real Estate vs Romulo: SC Rules on MCIT, CWT ConstitutionalityDocument2 pagesChamber of Real Estate vs Romulo: SC Rules on MCIT, CWT ConstitutionalityNolas Jay100% (1)

- Chamber of Real Estates challenges constitutionality of MCIT and CWTDocument4 pagesChamber of Real Estates challenges constitutionality of MCIT and CWTCresteynTeyngNo ratings yet

- 10 SISON vs. ANCHETADocument2 pages10 SISON vs. ANCHETABruno GalwatNo ratings yet

- Sison vs. Ancheta (130 SCRA 654, July 25, 1984)Document5 pagesSison vs. Ancheta (130 SCRA 654, July 25, 1984)Jennilyn Gulfan YaseNo ratings yet

- Mcculloch Vs Maryland FactsDocument11 pagesMcculloch Vs Maryland FactsXirkul TupasNo ratings yet

- 02 Antero Sison Jr. Vs Acting BIR Commissioner Ruben AnchetaDocument2 pages02 Antero Sison Jr. Vs Acting BIR Commissioner Ruben Anchetasunsetsailor85No ratings yet

- Taxation Cases (Digested)Document23 pagesTaxation Cases (Digested)Frizie Jane Sacasac Magbual100% (4)

- NPC V Cabanatuan DigestsDocument2 pagesNPC V Cabanatuan Digestspinkblush717No ratings yet

- Power to Destroy vs Build Taxation ObjectivesDocument67 pagesPower to Destroy vs Build Taxation ObjectivesEric Tamayo0% (1)

- 292 Sison V AnchetaDocument1 page292 Sison V AnchetaJuan Samuel IsmaelNo ratings yet

- Philippines Supreme Court Upholds Simplified Net Income Tax LawDocument8 pagesPhilippines Supreme Court Upholds Simplified Net Income Tax LawJenNo ratings yet

- Sison V AnchetaDocument3 pagesSison V AnchetaRyan Vic AbadayanNo ratings yet

- Napocor Franchise Tax Liability UpheldDocument2 pagesNapocor Franchise Tax Liability UpheldRyan Vic Abadayan100% (1)

- 13 - Sison v. Ancheta - SaleDocument2 pages13 - Sison v. Ancheta - SaleJustine GalandinesNo ratings yet

- Tax Case Digest Sept 9Document31 pagesTax Case Digest Sept 9ARCHIE AJIASNo ratings yet

- Garcia vs. SSS and Caltex vs. PalomarDocument5 pagesGarcia vs. SSS and Caltex vs. PalomarCzar Martinez100% (1)

- Tan Vs Del RosarioDocument33 pagesTan Vs Del RosarioDiana OlosanNo ratings yet

- NPC v. City of CabanatuanDocument2 pagesNPC v. City of CabanatuanRo CheNo ratings yet

- Bandilla Limitations-On-The-Power-Of-TaxationDocument13 pagesBandilla Limitations-On-The-Power-Of-TaxationRalph MondayNo ratings yet

- NPC vs City of Cabanatuan rules on LGU authority to tax govt corpsDocument3 pagesNPC vs City of Cabanatuan rules on LGU authority to tax govt corpsMa Gabriellen Quijada-Tabuñag100% (1)

- National Power Corporation vs. City of CabanatuanDocument21 pagesNational Power Corporation vs. City of CabanatuanMp CasNo ratings yet

- PubCorp Case Set 5Document65 pagesPubCorp Case Set 5Benjie PangosfianNo ratings yet

- Philippine Health Care Providers Ruling Upholds HMO StatusDocument14 pagesPhilippine Health Care Providers Ruling Upholds HMO StatusLester BalagotNo ratings yet

- Taxation Power Upholds Higher Rates for ProfessionalsDocument3 pagesTaxation Power Upholds Higher Rates for ProfessionalsEpictitus StoicNo ratings yet

- 01 Session Notes Taxation 1Document5 pages01 Session Notes Taxation 1Janelle ManzanoNo ratings yet

- Tan vs. Del Rosario Et Al G.R. No. 109289Document4 pagesTan vs. Del Rosario Et Al G.R. No. 109289ZeusKimNo ratings yet

- National Power Corporation Vs Cabanatuan CityDocument2 pagesNational Power Corporation Vs Cabanatuan CityDario G. TorresNo ratings yet

- Whereas A Much Higher Graduated Tax Rates of 5% To 60% Are Applied To Self-Employed/professionalsDocument1 pageWhereas A Much Higher Graduated Tax Rates of 5% To 60% Are Applied To Self-Employed/professionalsCarmela LopezNo ratings yet

- Estates and Trusts CasesDocument105 pagesEstates and Trusts CasesMai ReamicoNo ratings yet

- Tax 2 DigestsDocument14 pagesTax 2 DigestsJJ PernitezNo ratings yet

- Sison v. Ancheta, 130 SCRA 654: SyllabusDocument6 pagesSison v. Ancheta, 130 SCRA 654: SyllabusAname BarredoNo ratings yet

- Limitations I Nthe Power To TaxDocument3 pagesLimitations I Nthe Power To TaxJoshua AmahitNo ratings yet

- NPC Tax Exemption Withdrawn by LGCDocument5 pagesNPC Tax Exemption Withdrawn by LGCEmNo ratings yet

- 18 Tan V Del Rosario 237 SCRA 324 (1994) - DigestDocument15 pages18 Tan V Del Rosario 237 SCRA 324 (1994) - DigestKeith BalbinNo ratings yet

- GR 109289Document5 pagesGR 109289Philip OrtalNo ratings yet

- Sison Vs AnchetaDocument6 pagesSison Vs AnchetaMadelle PinedaNo ratings yet

- "Taxation": Quezonian Educational College Inc. College DepartmentDocument10 pages"Taxation": Quezonian Educational College Inc. College DepartmentSherry Love Boiser AlvaNo ratings yet

- Antero Sison JR v. AnchetaDocument4 pagesAntero Sison JR v. AnchetaL.C.ChengNo ratings yet

- Supreme Court Rules LGU Can Impose Franchise Tax on NPCDocument23 pagesSupreme Court Rules LGU Can Impose Franchise Tax on NPCArste GimoNo ratings yet

- Sison v Ancheta Tax Rates UpheldDocument3 pagesSison v Ancheta Tax Rates UpheldIrene Leah C. RomeroNo ratings yet

- Tan vs. Del Rosario Case DigestDocument7 pagesTan vs. Del Rosario Case DigestReycy Ruth TrivinoNo ratings yet

- Sison VS AnchetaDocument3 pagesSison VS AnchetabelleferiesebelsaNo ratings yet

- Sison, JR., vs. Ancheta, 130 Scra 654Document5 pagesSison, JR., vs. Ancheta, 130 Scra 654Ricky SalinasNo ratings yet

- Higher tax rates on professional income do not violate ConstitutionDocument2 pagesHigher tax rates on professional income do not violate ConstitutionLloyd Edgar G. ReyesNo ratings yet

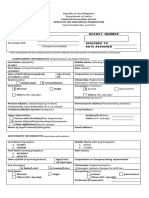

- RegionalTrialCourt TemplateDocument1 pageRegionalTrialCourt TemplateMar AvilaNo ratings yet

- User Manual: Wide LCD MonitorDocument10 pagesUser Manual: Wide LCD MonitorMar AvilaNo ratings yet

- JordanDocument30 pagesJordanMar AvilaNo ratings yet

- Wage Order Car - Wo 14Document24 pagesWage Order Car - Wo 14Mar AvilaNo ratings yet

- Judicial Affidavit Rule SummaryDocument7 pagesJudicial Affidavit Rule Summaryjason_escuderoNo ratings yet

- Lewis Structure of Polyatomic Ions and Metallic BondingDocument9 pagesLewis Structure of Polyatomic Ions and Metallic BondingMar AvilaNo ratings yet

- Love Life of RizalDocument1 pageLove Life of RizalMar AvilaNo ratings yet

- RA08963Document8 pagesRA08963Mar AvilaNo ratings yet

- Judicial Dispute Resolution GuideDocument24 pagesJudicial Dispute Resolution Guidedavs_rojoNo ratings yet

- RA08963Document8 pagesRA08963Mar AvilaNo ratings yet

- Affidavit SampleDocument1 pageAffidavit SampleMar AvilaNo ratings yet

- Legalresearch ExamDocument6 pagesLegalresearch ExamMar AvilaNo ratings yet

- Affidavit Employment Joan2Document1 pageAffidavit Employment Joan2Mar AvilaNo ratings yet

- Affidavit SampleDocument1 pageAffidavit SampleMar AvilaNo ratings yet

- Rules and Regulation For Inssuance of Free Patent ResidentialDocument22 pagesRules and Regulation For Inssuance of Free Patent ResidentialMar AvilaNo ratings yet

- Imperialism in South AsiaDocument1 pageImperialism in South AsiaMar AvilaNo ratings yet

- Affidavit SampleDocument1 pageAffidavit SampleMar AvilaNo ratings yet

- Fundamentals of Criminal InvestigationDocument6 pagesFundamentals of Criminal InvestigationDhiemz GNo ratings yet

- Medical Marijuana - DispensariesDocument26 pagesMedical Marijuana - Dispensaries420100% (12)

- Foreign and Commonwealth Office Statement MalawiDocument2 pagesForeign and Commonwealth Office Statement MalawiMalawi2014No ratings yet

- Viran Al Nagapan V Deepa AP Subramaniam (PDocument12 pagesViran Al Nagapan V Deepa AP Subramaniam (PraihanazzNo ratings yet

- Macaset v. MacasaetDocument2 pagesMacaset v. MacasaetBea Charisse MaravillaNo ratings yet

- Agoda General Terms and ConditionsDocument24 pagesAgoda General Terms and ConditionsDonni AhmadNo ratings yet

- Audit Letter: Document 9999ADocument3 pagesAudit Letter: Document 9999AKihan KatamiNo ratings yet

- Ronald T. Swafford v. New Mexico Department of Corrections, 52 F.3d 338, 10th Cir. (1995)Document7 pagesRonald T. Swafford v. New Mexico Department of Corrections, 52 F.3d 338, 10th Cir. (1995)Scribd Government DocsNo ratings yet

- Security and Peacebuilding at The Local LevelDocument32 pagesSecurity and Peacebuilding at The Local LevelRichard AbankwaNo ratings yet

- Sample Ex-Parte Application For Extension of Time To Plead For California EvictionDocument3 pagesSample Ex-Parte Application For Extension of Time To Plead For California EvictionStan Burman67% (3)

- Almansoori Inspection Services: Lifting Equipment Thorough Examination ReportDocument4 pagesAlmansoori Inspection Services: Lifting Equipment Thorough Examination ReportRanjithNo ratings yet

- Petition For BailDocument3 pagesPetition For BailTauMu Academic100% (2)

- UndertakingDocument2 pagesUndertakingpratik parulekarNo ratings yet

- LETTER To Andrew Wallet Re Britney Spears Conservatorship February 4, 2017 Expert Witness TestimonyDocument1 pageLETTER To Andrew Wallet Re Britney Spears Conservatorship February 4, 2017 Expert Witness Testimonysonlight gmialNo ratings yet

- The 28 Great Ideas That Changed The World ShowDocument69 pagesThe 28 Great Ideas That Changed The World ShowJeff AkinNo ratings yet

- PermitDocument4 pagesPermitฮันนี่ คริสNo ratings yet

- 1stexam Digest Allcases Crim1Document52 pages1stexam Digest Allcases Crim1Alexa Neri ValderamaNo ratings yet

- Restitution Proposal - May 13, 2022Document9 pagesRestitution Proposal - May 13, 2022Trisha Powell CrainNo ratings yet

- NYS Festival of BalloonsDocument1 pageNYS Festival of Balloonssgreene1130No ratings yet

- Contract Law EssentialsDocument226 pagesContract Law EssentialsNavin SoborunNo ratings yet

- THE PEOPLE OF THE PHILIPPINE ISLANDS, Plaintiff-Appellee, vs. H. JANSSEN, Defendant-AppellantDocument2 pagesTHE PEOPLE OF THE PHILIPPINE ISLANDS, Plaintiff-Appellee, vs. H. JANSSEN, Defendant-AppellantPaulyn MarieNo ratings yet

- Treasury and War Justicia (Supreme Council of Grace andDocument4 pagesTreasury and War Justicia (Supreme Council of Grace andCaila PanerioNo ratings yet

- Chapter 4 - Overview of Auditor's Legal LiabilityDocument13 pagesChapter 4 - Overview of Auditor's Legal LiabilityJima KromahNo ratings yet

- To Be Accomplished by The Office: Republic of The Philippines Department of JusticeDocument2 pagesTo Be Accomplished by The Office: Republic of The Philippines Department of JusticeKrystal Rain AgustinNo ratings yet

- Malayan Insurance Company v. St. Francis Square Realty CorporationDocument54 pagesMalayan Insurance Company v. St. Francis Square Realty CorporationBeltran KathNo ratings yet

- Affirmative Action LawDocument22 pagesAffirmative Action LawAnubhav VermaNo ratings yet

- NAB Ordinance and Bail Case Law SummaryDocument21 pagesNAB Ordinance and Bail Case Law SummarykingNo ratings yet

- A Chance To Die: A Biography of José Abad Santos Book ReviewDocument12 pagesA Chance To Die: A Biography of José Abad Santos Book ReviewKyla JavierNo ratings yet

- Rescinding Contract for Breach of ObligationDocument9 pagesRescinding Contract for Breach of ObligationChristia Sandee SuanNo ratings yet

- Legalese TermsDocument3 pagesLegalese TermsMarius Sumira100% (2)