Professional Documents

Culture Documents

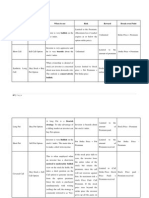

Call ITM Put ITM S.no Name When To Use Risk

Uploaded by

itsvijay86Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Call ITM Put ITM S.no Name When To Use Risk

Uploaded by

itsvijay86Copyright:

Available Formats

Call Put S.

no

ITM ITM Name 1 Long Call 2 Long Put 3 Short Call 4 Short Put

5 Protective

Risk Limited to Premium Limited to Premium Unlimited Unlimited Limited to stock price+Put Premium-Put Put (Synthetic Long Call) Conservatively Bullish Strike Price

St>X ST<X When to use Bullish Bearish Bearish Bullish

ATM ATM

Neutral to Stock Price-Call 6 Covered Call moderately Bullish premium 7 Long Combo Bullish Unlimited 8 Protective Call (Synthetic Long Put) Conservatively Bearish 9 10 11 12 13 14 15 16 17 18 19 20 21

ST=X OTM ST=X OTM Reward Strategy Unlimited Long Call Unlimited Long Put Limited to premium Short Call Limited to premium Short Put

ST<X St>X Break Even Strike Price+ Premium Strike Price-Premium Strike Price+ Premium Strike Price-Premium

Unlimited Limited to (call strike price-stock price paid+premium Stock price paid received) Long Stock+sell call Premium received Unlimited Buy Call+Sell put Higher strike + Net debit Stock price-call premium Sell Stock+Long Call Stock price-call premium

Put Premium+Stock Long Stock+Long Put Price

You might also like

- Formula Options Trading StrategiesDocument2 pagesFormula Options Trading StrategiesSameer88% (8)

- Option Trading Strategies SummaryDocument6 pagesOption Trading Strategies SummaryRavi Khushalani100% (1)

- Option Trading Workbook (Deb Sahoo)Document25 pagesOption Trading Workbook (Deb Sahoo)Deb SahooNo ratings yet

- Strategies of Trading in Future and Options: By: Vikash Chander Monika Yadav Sumit Debnath Rohit SoniDocument8 pagesStrategies of Trading in Future and Options: By: Vikash Chander Monika Yadav Sumit Debnath Rohit SoniVikash Chander KhatkarNo ratings yet

- Options StrategiesDocument9 pagesOptions Strategiessneha496100% (1)

- Formula Options - Trading - Strategies PDFDocument2 pagesFormula Options - Trading - Strategies PDFSameer Shinde100% (1)

- Derivatives Buy PutDocument11 pagesDerivatives Buy PutRajan kumar singhNo ratings yet

- Options Theory For Professional TradingDocument4 pagesOptions Theory For Professional TradingRaju.KonduruNo ratings yet

- Cheat SheetDocument9 pagesCheat SheetIndra VijayakumarNo ratings yet

- SIE Exams - Exam DumpDocument2 pagesSIE Exams - Exam DumpBAnne LabelNo ratings yet

- Jignesh Shah Dhiren Prajapati Kaustubh Parkar Akash Jadhav Deepali Jain Rahul GavaliDocument43 pagesJignesh Shah Dhiren Prajapati Kaustubh Parkar Akash Jadhav Deepali Jain Rahul GavaliDhiren Praj100% (1)

- No More Struggles With The Strangles Trading StrategyDocument10 pagesNo More Struggles With The Strangles Trading StrategyDomNo ratings yet

- Different Option StrategiesDocument43 pagesDifferent Option StrategiessizzlingabheeNo ratings yet

- Long StraddleDocument13 pagesLong Straddleraj0386100% (1)

- Advancedoptionsspreads 141218174938 Conversion Gate01 PDFDocument4 pagesAdvancedoptionsspreads 141218174938 Conversion Gate01 PDFManoj Kumar SinghNo ratings yet

- Options Summary Notes by CA Gaurav Jain SirDocument14 pagesOptions Summary Notes by CA Gaurav Jain Sirqamaraleem1_25038318No ratings yet

- Option Trading Strategies & Option SpreadsDocument30 pagesOption Trading Strategies & Option SpreadsPushkar GautamNo ratings yet

- Option Markets & ContractsDocument46 pagesOption Markets & Contractsroshanidharma100% (1)

- Lecture 9 OptionsDocument38 pagesLecture 9 OptionsHuế HoàngNo ratings yet

- Complete Hedging FormulaDocument2 pagesComplete Hedging Formulavasanthshm123No ratings yet

- Option Market - Part II: Call Options Payoffs and Profits at ExpirationDocument9 pagesOption Market - Part II: Call Options Payoffs and Profits at ExpirationAhmedTalbaKishwaNo ratings yet

- Bull Call Spread: Column1 Column2 Column3 Sr. Strategy CombinationDocument9 pagesBull Call Spread: Column1 Column2 Column3 Sr. Strategy Combinationviky6No ratings yet

- Value Creation Through Risk Management: Dr. Shantanu Chakraborty Asst. Professor IiswbmDocument13 pagesValue Creation Through Risk Management: Dr. Shantanu Chakraborty Asst. Professor IiswbmAbhijit Kumar BasuNo ratings yet

- FINS 2624 Tutorial Week 2 SlidesDocument17 pagesFINS 2624 Tutorial Week 2 SlidesWahaaj RanaNo ratings yet

- Derivatives Workshop: Actuarial Society October 30, 2007Document28 pagesDerivatives Workshop: Actuarial Society October 30, 2007Animesh ChaturvediNo ratings yet

- 2 - Option Pay Off - Call PutDocument145 pages2 - Option Pay Off - Call PutPratik KhetanNo ratings yet

- 6 - Options StrategiesDocument23 pages6 - Options StrategiesRidhavi KyalNo ratings yet

- 6-Options BasicsDocument25 pages6-Options BasicsNine Not Darp EightNo ratings yet

- OptionsDocument41 pagesOptionsSilenceNo ratings yet

- Single Stock Option's Seminar: Part I Option Trading OverviewDocument28 pagesSingle Stock Option's Seminar: Part I Option Trading Overviewmr25000No ratings yet

- Options (Fundamentals)Document69 pagesOptions (Fundamentals)Alain AquinoNo ratings yet

- Derivatives Buy PutDocument10 pagesDerivatives Buy PutRajan kumar singhNo ratings yet

- Derivative StrategiesDocument32 pagesDerivative Strategieschelsea1989No ratings yet

- Options & ModelsDocument48 pagesOptions & ModelsPraveen Kumar SinhaNo ratings yet

- An Introduction To Derivatives: A Presentation by Derivative ResearchDocument45 pagesAn Introduction To Derivatives: A Presentation by Derivative ResearchUmeshwari RathoreNo ratings yet

- Black Blue Dark Simple Digital 5G Technology Technology PresentationDocument12 pagesBlack Blue Dark Simple Digital 5G Technology Technology PresentationRahul KumarNo ratings yet

- RM 3Document96 pagesRM 3ankitadarji31No ratings yet

- Risk Management Applications of Option Strategies P G: OutlineDocument30 pagesRisk Management Applications of Option Strategies P G: OutlineRuby NguyenNo ratings yet

- Basic Option Strategies: Ron Shonkwiler (Shonkwiler@math - Gatech.edu) WWW - Math.gatech - Edu/ ShenkDocument67 pagesBasic Option Strategies: Ron Shonkwiler (Shonkwiler@math - Gatech.edu) WWW - Math.gatech - Edu/ ShenkthiruvilanNo ratings yet

- Basic Option Strategies: Ron Shonkwiler (Shonkwiler@math - Gatech.edu) WWW - Math.gatech - Edu/ ShenkDocument67 pagesBasic Option Strategies: Ron Shonkwiler (Shonkwiler@math - Gatech.edu) WWW - Math.gatech - Edu/ ShenkthiruvilanNo ratings yet

- Derivatives Talking PointsDocument4 pagesDerivatives Talking PointsAlice KujurNo ratings yet

- RM1 04 v5 Intro To OptionsDocument65 pagesRM1 04 v5 Intro To OptionsDaniel DöllerNo ratings yet

- Options CA - CS.CMA - MBA: Naveen. RohatgiDocument38 pagesOptions CA - CS.CMA - MBA: Naveen. RohatgiDivyaNo ratings yet

- OptionsDocument30 pagesOptionsJubit JohnsonNo ratings yet

- Options MSCFIÂ DECÂ 2022Document8 pagesOptions MSCFIÂ DECÂ 2022kenedy simwingaNo ratings yet

- Option Writing WebinarDocument46 pagesOption Writing WebinarSwastik TiwariNo ratings yet

- Future and OptionsDocument8 pagesFuture and OptionsshashvatNo ratings yet

- Advanced Options Spreads: Complex Put and Call TradesDocument4 pagesAdvanced Options Spreads: Complex Put and Call TradesManoj Kumar SinghNo ratings yet

- Option Strategies The BasicDocument22 pagesOption Strategies The BasicarmailgmNo ratings yet

- Option StrategiesDocument39 pagesOption StrategiesDebashish SharmaNo ratings yet

- Derivatives: Options MarketsDocument41 pagesDerivatives: Options MarketsALEEM MANSOORNo ratings yet

- Hedging Risk With DerivativesDocument36 pagesHedging Risk With DerivativesSoumyadeep RoyNo ratings yet

- Option Pricing Theory & Financial OptionsDocument70 pagesOption Pricing Theory & Financial OptionsPiyush KhemkaNo ratings yet

- Option Strategies - 5nov20Document28 pagesOption Strategies - 5nov20maheshsNo ratings yet

- Assignment 1 - Lecture 4 Protective Call & Covered Call Probelm Hatem Hassan ZakariaDocument8 pagesAssignment 1 - Lecture 4 Protective Call & Covered Call Probelm Hatem Hassan ZakariaHatem HassanNo ratings yet

- Intro To OptionsDocument22 pagesIntro To OptionsFatima MosawiNo ratings yet

- Prest On Basics (F&O) - YashodhanDocument13 pagesPrest On Basics (F&O) - YashodhanAkshay SahooNo ratings yet

- Put-Call Parity: By: Shruti Agrawal-201 Suhas Anjaria-202 Kankana Dutta-205 Aabhas Garg-207Document24 pagesPut-Call Parity: By: Shruti Agrawal-201 Suhas Anjaria-202 Kankana Dutta-205 Aabhas Garg-207Aabbhas GargNo ratings yet