Professional Documents

Culture Documents

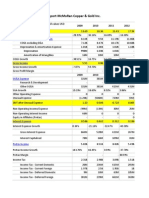

Financial Ratio Calculator: (Complete The Yellow Cells Only, The Spreadsheet Does The Rest)

Uploaded by

tasleemshahzadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Ratio Calculator: (Complete The Yellow Cells Only, The Spreadsheet Does The Rest)

Uploaded by

tasleemshahzadCopyright:

Available Formats

Financial Ratio Calculator (Complete the yellow cells only, the spreadshe

Year

Current Liabilities Inventories Accounts Receivable Credit Sales Cost of Sales Average Inventory Sales Current Assets Fixed Assets Total Assets Total Debt Total Equity Earnings before interest and and taxes (EBIT) Interest Charges Lease Payments Before Dividends before Preferred StockTax Sinking Fund tax Earnings after taxes (EAT) Stockholder's Equity Earnings Per Share Market Price Per Share (Stock Price) Book Value Per Share Dividends (Current) Per Share Expected Dividends Per Share Ratio Liquidity 1 Current Ratio 2. Quick Ratio (acid test) Asset Management 3. Average collection period 4. Inventory turnover 5. Fixed-asset turnover 6. Total asset turnover Financial Leverage Management 7. Debt ratio 8. Debt-to-equity 9. Times interest earned Definition Current assets/ Current liabilities Current assets - Inventories/ Current liabilities Accounts receivable/ Credit sales/365 Cost of sales/ Average inventory Sales/ Fixed assets Sales/ Total assets Total debt/ Total assets Total debt/ Total equity EBIT/ Interest charges EBIT + Lease payments/ Interest + Lease Payments + Before-tax sinking fund + Preferred stock dividends before tax Sales-Cost of sales/ Sales Earnings after Taxes (EAT)/ Sales

2006

$23,226 $25,052 $16,671 $102,612 $77,623 $24,570 $102,612 $45,673 $28,847 $74,520 $43,246 $31,274 $10,483 $2,876 $137 $1,820 $91 $4,565 $31,274 $3.51 $21.84 $24.06 $1.96 $1.96 2006 1.97 0.89

2007

$25,000 $26,000 $17,000 $105,000 $80,000 $26,000 $105,000 $46,000 $29,000 $80,000 $47,000 $31,500 $11,000 $2,900 $140 $1,850 $96 $4,700 $32,000 $3.60 $22.00 $25.00 $2.02 $2.02 2007 1.84 0.80

59.30 3.16 3.56 1.38 58.03% 138.28% 3.65

59.10 3.08 3.62 1.31 58.75% 149.21% 3.79

10. Times fixed charges earned Profitability 11. Gross profit margin 12. Net profit margin

2.16 24.35% 4.45%

2.23 23.81% 4.48%

Earnings after Taxes (EAT)/ Total assets Earnings after Taxes (EAT)/ 14. Return on stockholders' equity Stockholder's equity Market-Based Market price per share/ Earnings per share 15. Price-to-earnings ratio Market price per share/ Book value 16. Market-to-book ratio per share Divident Policy Dividends per share/ Earnings per 17. Payout ratio share Expected Dividend per share/ Market price per share 18. Dividend yield 13. Return on investment

6.13% 14.60%

5.88% 14.69%

6.22 0.91

6.11 0.88

55.70% 8.96%

56.11% 9.18%

s only, the spreadsheet does the rest)

2008

$25,523 $27,530 $18,320 $112,760 $85,300 $27,000 $112,760 $50,190 $31,700 $81,890 $47,523 $34,367 $11,520 $3,160 $150 $2,000 $100 $5,016 $34,367 $3.86 $24.00 $26.44 $2.15 $2.15 2008 1.97 0.89

Brought to you by

www.spreadsheetmarketplace.com

Industry Average 2.4 times 0.92 times

Assessment (User Input)

Trend (User Input)

59.30 3.16 3.56 1.38 58.03% 138.28% 3.65

47 days 3.9 times 4.6 times 1.82 times 47 percent 88.7 percent 6.7 times

2.16 24.35% 4.45%

4.5 times 25.6 percent 5.10 percent

6.13% 14.60%

9.28 percent 17.54 percent

6.22 0.91

8.0 times 1.13

55.70% 8.96%

28 percent 4.2 percent

You might also like

- MBTC and BPI RatiosDocument11 pagesMBTC and BPI RatiosarianedangananNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosAbhishek RampalNo ratings yet

- Keyratio 2011Document6 pagesKeyratio 2011Nikhil YadavNo ratings yet

- Management Accounting Week 02 Assignment AA - MC.U3COM2107062Document2 pagesManagement Accounting Week 02 Assignment AA - MC.U3COM2107062thurainavee1502No ratings yet

- Discounted Cash FlowDocument12 pagesDiscounted Cash FlowViv BhagatNo ratings yet

- Financial Leverage Du Pont Analysis &growth RateDocument34 pagesFinancial Leverage Du Pont Analysis &growth Rateahmad jamalNo ratings yet

- Supplement q4 2012Document14 pagesSupplement q4 2012EnergiemediaNo ratings yet

- Business Analysis and Valuation - IntroductionDocument109 pagesBusiness Analysis and Valuation - IntroductioncapassoaNo ratings yet

- Sears Vs Walmart - v01Document37 pagesSears Vs Walmart - v01chansjoy100% (1)

- Supplement Scientific GlassDocument7 pagesSupplement Scientific GlassDrew ShepherdNo ratings yet

- CH 6 Model 14 Free Cash Flow CalculationDocument12 pagesCH 6 Model 14 Free Cash Flow CalculationrealitNo ratings yet

- Wyeth Analysis TemplateDocument8 pagesWyeth Analysis TemplateAli Azeem RajwaniNo ratings yet

- Valuation WorkbookDocument48 pagesValuation WorkbookJitendra Sutar100% (1)

- Value SpreadsheetDocument58 pagesValue SpreadsheetJitendra SutarNo ratings yet

- ACI Dealinng Certicate Workshop TreasuryCRR Mentanance SLR Requirement Funds Management Forex Bonds Valuations Finance Elective Banks TreasuryDocument210 pagesACI Dealinng Certicate Workshop TreasuryCRR Mentanance SLR Requirement Funds Management Forex Bonds Valuations Finance Elective Banks TreasuryAjay DaraNo ratings yet

- Problems & Solutions On Fundamental AnalysisDocument8 pagesProblems & Solutions On Fundamental AnalysisAnonymous sTsnRsYlnkNo ratings yet

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Document18 pages1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeNo ratings yet

- Descriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsDocument15 pagesDescriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsVALLIAPPAN.PNo ratings yet

- Current Ratio Current Assets Current LiabilitiesDocument15 pagesCurrent Ratio Current Assets Current LiabilitieshelperforeuNo ratings yet

- Financial Performance (Company Update)Document22 pagesFinancial Performance (Company Update)Shyam SunderNo ratings yet

- Valuasi Saham MppaDocument29 pagesValuasi Saham MppaGaos FakhryNo ratings yet

- DCF ExerciseDocument16 pagesDCF ExerciseppdatNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- Financial Statement Analysis FormulasDocument10 pagesFinancial Statement Analysis FormulasKarl LuzungNo ratings yet

- Rasio Keuangan: Return On Net Operating Assets (RNOA)Document3 pagesRasio Keuangan: Return On Net Operating Assets (RNOA)nadhifarahmaNo ratings yet

- Problems 1-30: Input Boxes in TanDocument24 pagesProblems 1-30: Input Boxes in TanSultan_Alali_9279No ratings yet

- Bajaj Auto Financial Analysis: Presented byDocument20 pagesBajaj Auto Financial Analysis: Presented byMayank_Gupta_1995No ratings yet

- Ratio Formula:-: Liquidity RatiosDocument2 pagesRatio Formula:-: Liquidity Ratiosrupeshdahake8586No ratings yet

- Scientific Glass - SolutionsDocument29 pagesScientific Glass - SolutionsShirsendu Bikash Das100% (1)

- Adidas AG AR2010 Financial HighlightsDocument1 pageAdidas AG AR2010 Financial HighlightsGaurav GoyalNo ratings yet

- Nvda DCF ModelDocument99 pagesNvda DCF ModelAJ's Investment IdeasNo ratings yet

- IB Merger ModelDocument12 pagesIB Merger Modelkirihara95100% (1)

- CH 6 Model 13 Financial Statements Scenario AnalysisDocument12 pagesCH 6 Model 13 Financial Statements Scenario AnalysisrealitNo ratings yet

- Financial Planning and ForecastingDocument24 pagesFinancial Planning and ForecastingVenn Bacus Rabadon100% (1)

- RatiosDocument2 pagesRatiossunshine9016No ratings yet

- Corporate Finance Presentation EditorialDocument96 pagesCorporate Finance Presentation EditorialtozammelNo ratings yet

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaNo ratings yet

- Session 16 - FA&ADocument21 pagesSession 16 - FA&AYASH BATRANo ratings yet

- Bank ValuationsDocument20 pagesBank ValuationsHenry So E DiarkoNo ratings yet

- Fin Assignment 2Document7 pagesFin Assignment 2zilan hossanNo ratings yet

- Appendix BDocument6 pagesAppendix Bapi-308136216No ratings yet

- McDonalds Financial AnalysisDocument11 pagesMcDonalds Financial AnalysisHooksA01No ratings yet

- Apple & RIM Merger Model and LBO ModelDocument50 pagesApple & RIM Merger Model and LBO ModelDarshana MathurNo ratings yet

- 04 06 Public Comps Valuation Multiples AfterDocument19 pages04 06 Public Comps Valuation Multiples AfterShanto Arif Uz ZamanNo ratings yet

- 07 12 Sensitivity Tables AfterDocument30 pages07 12 Sensitivity Tables Aftermerag76668No ratings yet

- Financial Feasibility of Business PlanDocument14 pagesFinancial Feasibility of Business PlanmuhammadnainNo ratings yet

- Ratios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosDocument5 pagesRatios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosYasir AamirNo ratings yet

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- Case Study 2Document10 pagesCase Study 2Cheveem Grace Emnace100% (1)

- CMA USA Ratio Definitions 2015Document4 pagesCMA USA Ratio Definitions 2015Shameem JazirNo ratings yet

- Equity Analysis & ValuationDocument39 pagesEquity Analysis & ValuationASHUTOSH JAISWAL100% (1)

- Gasoline Station Revenues World Summary: Market Values & Financials by CountryFrom EverandGasoline Station Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Natural & Processed Cheese World Summary: Market Sector Values & Financials by CountryFrom EverandNatural & Processed Cheese World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Fats & Oils Refining & Blending World Summary: Market Values & Financials by CountryFrom EverandFats & Oils Refining & Blending World Summary: Market Values & Financials by CountryNo ratings yet

- Cyclic Crudes & Intermediates World Summary: Market Values & Financials by CountryFrom EverandCyclic Crudes & Intermediates World Summary: Market Values & Financials by CountryNo ratings yet

- Collection Agency Revenues World Summary: Market Values & Financials by CountryFrom EverandCollection Agency Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Confectionery & Nut Stores World Summary: Market Values & Financials by CountryFrom EverandConfectionery & Nut Stores World Summary: Market Values & Financials by CountryNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet