Professional Documents

Culture Documents

L-22-2006-07 Cont of Cal Ratios

L-22-2006-07 Cont of Cal Ratios

Uploaded by

Sudhir KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

L-22-2006-07 Cont of Cal Ratios

L-22-2006-07 Cont of Cal Ratios

Uploaded by

Sudhir KumarCopyright:

Available Formats

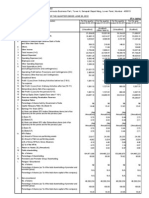

Additional analytical ratios as per IRDA circular no.

IRDA/F&I/CIR/F&A/012/01/2010

Sl.No. Particular FY 2006-07

13

Investment Yield (Gross and Net) (Refer Note 1) With Realised gains Shareholder's Funds Policyholder's Funds Par Non-Par Linked Fund Save & Grow Money Fund Grow Money Fund Steady Money Fund Save and Grow pension Fund Grow Money pension Fund Steady Money pension Fund 5.50% NA NA 7.30% 13.30% 2.10% NA NA NA Without Realised gains 5.40% NA NA

14

Conservation Ratio (Refer Note 2) Individual Participating Unit Linked Non-Participating - Individual Non-Participating - Group Pension

Persistency Ratio For 13th month For 25th month For 37th month For 49th Month for 61st month By No of Policies NA NA NA NA NA

NA NA NA NA NA

By Annualised Premium NA NA NA NA NA

15

16

NPA Ratio Gross NPA Ratio Net NPA Ratio

NIL NIL

Sl.No.

Particular

FY 2006-07

1 2 3 4 5 6

Equity Holding Pattern for Life Insurers (a) No. of shares (b) Percentage of shareholding (Indian / Foreign) ( c) %of Government holding (in case of public sector insurance companies) (a) Basic and diluted EPS before extraordinary items (net of tax expense) for the period (not to be annualized) (b) Basic and diluted EPS after extraordinary items (net of tax expense) for the period (not to be annualized) (iv) Book value per share

150,000,006 74% / 26% NA Basic Rs. (7.82) Diluted Rs. (7.78) Basic Rs. (7.82) Diluted Rs. (7.78) Rs. 7.03

Note 1 Note 2

Investment yields are as per Table no 11.2.2 (TWRR) of the Appointed Actuary's Annual Report FY 2006-07 was the first year of business for the company, therefore conservation ratio is not applicable

You might also like

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- ICICI KotakDocument4 pagesICICI KotakwowcoolmeNo ratings yet

- Exide Industries: Top Line Disappoints Hinting at Possible Loss of Market ShareDocument5 pagesExide Industries: Top Line Disappoints Hinting at Possible Loss of Market ShareRinku RinkyuerNo ratings yet

- Pi Industries Edel Q1fy12Document7 pagesPi Industries Edel Q1fy12equityanalystinvestorNo ratings yet

- Kingfisher Airlines LTD.: Result UpdateDocument4 pagesKingfisher Airlines LTD.: Result UpdateSagar KavdeNo ratings yet

- Mfi BSD ReturnsDocument18 pagesMfi BSD ReturnstodzaikNo ratings yet

- HDFC 1Q Fy 2014Document10 pagesHDFC 1Q Fy 2014Angel BrokingNo ratings yet

- Elpl 2009 10Document43 pagesElpl 2009 10kareem_nNo ratings yet

- Market Outlook 5th August 2011Document4 pagesMarket Outlook 5th August 2011Angel BrokingNo ratings yet

- Yes Bank: Emergin G StarDocument5 pagesYes Bank: Emergin G StarAnkit ModaniNo ratings yet

- Market Outlook 22nd November 2011Document4 pagesMarket Outlook 22nd November 2011Angel BrokingNo ratings yet

- Toyota Financial 2011Document19 pagesToyota Financial 2011Lioubov BodnyaNo ratings yet

- Banks - HBL - Expense Burden Trims ROE Protential For 2018-19 - JSDocument4 pagesBanks - HBL - Expense Burden Trims ROE Protential For 2018-19 - JSmuddasir1980No ratings yet

- 4Q16 Earnings PresentationDocument20 pages4Q16 Earnings PresentationZerohedgeNo ratings yet

- Icici Bank: Wholesale Pain, Retail DelightDocument12 pagesIcici Bank: Wholesale Pain, Retail DelightumaganNo ratings yet

- BritanniaDocument3 pagesBritanniaDarshan MaldeNo ratings yet

- Bajaj Finance LTD PresentationDocument31 pagesBajaj Finance LTD Presentationanon_395825960100% (2)

- Bajaj Finserv LimitedDocument31 pagesBajaj Finserv LimitedDinesh Gehi DGNo ratings yet

- Market Outlook 16th March 2012Document4 pagesMarket Outlook 16th March 2012Angel BrokingNo ratings yet

- Reliance Single PremiumDocument80 pagesReliance Single Premiumsumitkumarnawadia22No ratings yet

- 4q18 Conference Call PresentationDocument33 pages4q18 Conference Call PresentationsamsNo ratings yet

- Liquidity Ratios: Current RatioDocument7 pagesLiquidity Ratios: Current RatioClarisse PoliciosNo ratings yet

- Sbi, 1Q Fy 2014Document14 pagesSbi, 1Q Fy 2014Angel BrokingNo ratings yet

- Bank of India, 4th February, 2013Document12 pagesBank of India, 4th February, 2013Angel BrokingNo ratings yet

- Research: Sintex Industries LimitedDocument4 pagesResearch: Sintex Industries LimitedMohd KaifNo ratings yet

- Market Outlook 5th October 2011Document4 pagesMarket Outlook 5th October 2011Angel BrokingNo ratings yet

- 28061337530502balance of Payments - 280613Document5 pages28061337530502balance of Payments - 280613kaizenlifeNo ratings yet

- ICICI Bank, 4th February, 2013Document16 pagesICICI Bank, 4th February, 2013Angel BrokingNo ratings yet

- BHEL-4QFY13 Result Update - 24 May 2013Document5 pagesBHEL-4QFY13 Result Update - 24 May 2013Ravi ShekharNo ratings yet

- Punjab National Bank: Performance HighlightsDocument12 pagesPunjab National Bank: Performance HighlightsAngel BrokingNo ratings yet

- Financial Results Sep 2011Document1 pageFinancial Results Sep 2011Shankar GargNo ratings yet

- Audited Financial 2011Document1 pageAudited Financial 2011gayatri9324814475No ratings yet

- Managerial Accounting Assignment: Company Chosen: SAILDocument11 pagesManagerial Accounting Assignment: Company Chosen: SAILBloomy devasiaNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Indian Hotel JPMDocument25 pagesIndian Hotel JPMViet VuNo ratings yet

- Jubliant Food Works ReportDocument6 pagesJubliant Food Works ReportSrinivasan IyerNo ratings yet

- Market Outlook 11th August 2011Document4 pagesMarket Outlook 11th August 2011Angel BrokingNo ratings yet

- 2013-14 SPIL - Annual ReportDocument144 pages2013-14 SPIL - Annual ReportAnshumanSharmaNo ratings yet

- PI Industries Q1FY12 Result 1-August-11Document6 pagesPI Industries Q1FY12 Result 1-August-11equityanalystinvestorNo ratings yet

- Financial Results MARCH2011Document4 pagesFinancial Results MARCH2011Rajat KukretiNo ratings yet

- Investor Presentation Mar31 2010Document19 pagesInvestor Presentation Mar31 2010Sahil GoyalNo ratings yet

- Annual Report AnalysisDocument257 pagesAnnual Report AnalysisvinaymathewNo ratings yet

- Drools Pet Food Private LimitedDocument6 pagesDrools Pet Food Private Limitedkasimmalnas.ipsNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Yes Bank - EnamDocument3 pagesYes Bank - Enamdeepak1126No ratings yet

- ONGC Dividend Policy - PPTX PresentationDocument22 pagesONGC Dividend Policy - PPTX PresentationvaishuladNo ratings yet

- Idbi, 1Q Fy 2014Document12 pagesIdbi, 1Q Fy 2014Angel BrokingNo ratings yet

- Union Bank of India: Earnings Affected by High Provisions, Fresh Slippages ModerateDocument4 pagesUnion Bank of India: Earnings Affected by High Provisions, Fresh Slippages Moderateajd.nanthakumarNo ratings yet

- FY14 HPQ Salient Points 20141125Document2 pagesFY14 HPQ Salient Points 20141125Amit RakeshNo ratings yet

- Crisil: JBF Industries LTDDocument14 pagesCrisil: JBF Industries LTDpriyaranjanNo ratings yet

- RBI PolicyDocument3 pagesRBI Policyvinitt88No ratings yet

- Hitech Plast LTD IER Quarterly Update First CutDocument1 pageHitech Plast LTD IER Quarterly Update First Cutshri nidhi vyasNo ratings yet

- Market Outlook 13th December 2011Document4 pagesMarket Outlook 13th December 2011Angel BrokingNo ratings yet

- Allahabad Bank: 15.8% Growth in Loan BookDocument4 pagesAllahabad Bank: 15.8% Growth in Loan Bookcksharma68No ratings yet

- Stock Advisory For Today - Natural View On The Stock Dena Bank, Nestle India and Buy Vardhman TextilesDocument29 pagesStock Advisory For Today - Natural View On The Stock Dena Bank, Nestle India and Buy Vardhman TextilesNarnolia Securities LimitedNo ratings yet

- India BullsDocument2 pagesIndia Bullsrajesh_d84No ratings yet

- Market Outlook 1st November 2011Document13 pagesMarket Outlook 1st November 2011Angel BrokingNo ratings yet

- Ruffer Investment Company LimitedDocument19 pagesRuffer Investment Company LimitedForkLogNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet