Professional Documents

Culture Documents

Mortgage Flow.3

Uploaded by

greergirl2Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mortgage Flow.3

Uploaded by

greergirl2Copyright:

Available Formats

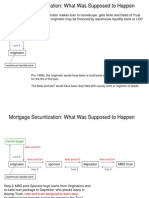

Mortgage Securitization: What Was Supposed to Happen

Step 1: Originator makes loan to homebuyer, gets Note and Mortgage; In NJ, the Mortgage is lien on the property and represents collateral and claim to title; originator may be financed by warehouse liquidity bank or LOC home buyer

Note and Mortgage

Loan $

originator

warehouse liquidity bank

Pre-1990s, the originator would have been a local bank who kept the mortgage in house for the life of the loan.

The Note and Mortgage would have been duly filed with county clerk or registrar as evidence of a lien on the property

In NJ, the Deed might remain with the homebuyer

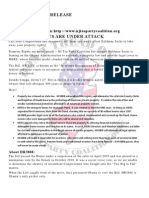

Mortgage Securitization: What Was Supposed to Happen

home buyer

Note and Mortgage

Loan $ Note and Mortgage Note and Mortgage Note and Mortgage

originator

Sale $ warehouse liquidity bank

sponsor

Sale $

depositor

Sale $

MBS trust

Step 2: MBS pool Sponsor buys loans from Originators and re-sells loan package to Depositor, who places loans in issuing Trust; Note and Mortgage assigned at each step. Qualifying loans typically had to be placed in the Trust within a 90 day window.

Mortgage Securitization: What Was Supposed to Happen

home buyer

Note and Mortgage rating agency; bond insurer; credit default swap Note and Mortgage Note and Mortgage

Loan $ Note and Mortgage

originator

Sale $ warehouse liquidity bank

sponsor

Sale $

depositor

Sale $

MBS trust

Bond

Investment $

investor

Step 3: MBS Trust obtains ratings, issues bonds to institutional investors

Mortgage Securitization: What Really Happened

home buyer

Note and Mortgage rating agency; bond insurer; credit default swap

Loan $

originator

sponsor

depositor

MBS trust

Bond

warehouse liquidity bank

Investment $

investor 1. 2. 3. 4. 5. 6. Mortgage separated from Note; never assigned so no chain of title to MBS trust Assignments recorded with MERS, if at all, and not with County Clerk or Registrar Sponsor and Depositor were dummy entities with no assets, so no true sale occurred Loans upstreamed to MBS Trust directly from originator in some cases MBS Trust has no legal interest in the property Warehouse bank may be true lender

And Theres More

Mortgage P&I

Mortgage P&I

home buyer

Title?

loan servicer

Title?

The loan originator, and the pool sponsor and depositor are long gone. The MBS Trust hires a loan servicer to process homebuyer payments and manage the loans via a Pooling and Servicing Agreement. The servicer has no ownership interest in the property and cannot foreclose.

MBS trust

Bond P&I

investor

You might also like

- NJCU - Workshop Presentation - FinalDocument19 pagesNJCU - Workshop Presentation - Finalgreergirl2No ratings yet

- Mortgage Securitization: What Was Supposed To HappenDocument5 pagesMortgage Securitization: What Was Supposed To Happengreergirl2No ratings yet

- NJTPC AG - Press7.25Document1 pageNJTPC AG - Press7.25greergirl2No ratings yet

- NJTPC HR3808.PRDocument2 pagesNJTPC HR3808.PRgreergirl2No ratings yet

- PR MortgageFraudDocument1 pagePR MortgageFraudgreergirl2No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)