Professional Documents

Culture Documents

Enterprise Structure & Master Data

Uploaded by

Anurag SrivastavaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Enterprise Structure & Master Data

Uploaded by

Anurag SrivastavaCopyright:

Available Formats

The University of Tennessee Project IRIS

SAP R/3 Enterprise Structure and Master Data (Financial)

PHASE II - Business Blueprint Interim Deliverable

This document defines a proposed enterprise structure and master data for the University within the R/3 system. The organization structure is established to encapsulate and model the Financial, Human Resources and Logistics data within the R/3 system. The proposed enterprise structure was modeled after reviewing University financial reports, legacy system documentation, and best practices in Higher Education as well as discussions with team members. It will be refined through a series of meetings to discuss the business goals, organizational structure, and the high-level business processes to be included in the University of Tennessees SAP R/3 system.

/opt/scribd/conversion/tmp/scratch14498/64261122.doc

Page 1

of 10

DRAFT as of 08/01/11

Enterprise Structure

The Enterprise Structure in R/3 refers to the organizational structure of the Institution. The organizational elements in this structure allow encapsulation of configuration settings and data in each module. For example, the company code organizational element encapsulates the financial accounting settings and data in the financial accounting module for an enterprise. Each element in the R/3 enterprise structure is defined below. The R/3 module in which each organizational element appears is given in parentheses next to its name. The proposed University of Tennessee organizational elements are given under each organizational element. Client (Cross Application) A client in R/3 is a technical entity containing configuration, master data and transactions for an organization. For example the organization may designate Client 100 in the production system PRD as the client in which data may be entered. Other clients may be used for development, testing and training. Proposal: The University will have only one production client in the productive system Client 100. Company Code (Financial Accounting - FI) The Company Code is the smallest organizational unit for which a complete self-contained set of accounts can be drawn up for purposes of external reporting. Proposal: The University will use only one Company Code - UT. Business Area (Financial Accounting - FI) Business areas are units, within an institution, for which a balance sheet and income statement can be produced. In higher education, business areas are typically used to represent fund groups such as Current Unrestricted, Current Restricted, etc. for which balance sheets and income statements are required. In addition to balance sheets by fund groups, the University of Tennessee requires a separate internal balance sheet and income statement for each budget entity such as Knoxville, Martin, Chattanooga, etc. Proposal: The University will have business areas which represent a unique combination of Fund Group and Budget Entity. All existing fund groups and budget entities will be set up as business areas. For asset and liability entries, these business areas will be entered by users. For revenue and expenditure entries, these business areas will be automatically defaulted from cost centers and WBS Elements. The following is a sample partial list of business areas identified:

/opt/scribd/conversion/tmp/scratch14498/64261122.doc

Page 2

of 10

DRAFT as of 08/01/11

Fund Group 11 Current Unrestricted Educational and General Funds 13 Current Unrestricted Auxiliary Funds 21 Current Restricted Educational and General Funds 23 Current Restricted Auxiliary Funds 30 Endowment Funds 40 Life Income Funds 45 Annuity Funds 51 Unexpended Plant Fund 52 Plant Funds for Retirement of Indebtedness 53 Plant Funds for Renewal and Replacement 54 Invested in Plant Funds 60 Loan Funds 90 Agency Funds 11 Current Unrestricted Educational and General Funds 16 Current Unrestricted Hospital Funds 26 Current Restricted Hospital Funds

Budget Entity 01 Knoxville 01 Knoxville 01 Knoxville 01 Knoxville 01 Knoxville 01 Knoxville 01 Knoxville 01 Knoxville 01 Knoxville 01 Knoxville 01 Knoxville 01 Knoxville 01 Knoxville 02 Space Institute 04 - Chattanooga 04 Chattanooga

Business Area 1101 1301 2101 2301 3001 4001 4501 5101 5201 5301 5401 6001 9001 1102 1604 2604

Functional Area (Financial Accounting - FI) The Functional Area is an organizational unit in Accounting that classifies the expenditures of an organization by function. Proposal: The University will use functional areas to enable reporting by function. These functional areas will be defaulted from cost centers and WBS Elements. The following is a sample list of functional areas: Function Code 01 Instruction 02 Research 03 Public Service 04 Academic Support 05 Student Services 06 Institutional Support 07 Operation and Maintenance of Physical Plant 08 Scholarships and Fellowships 09 Auxiliary Enterprises 10 Hospitals 11 Staff Benefits 12 Other Expenditures 13 Service Centers Figure 1 shows the financial accounting structures. Functional Area 1010 1020 1030 1040 1050 1060 1070 1080 1090 1100 1110 1120 1130

/opt/scribd/conversion/tmp/scratch14498/64261122.doc

Page 3

of 10

DRAFT as of 08/01/11

C lie n t

Com pany Code UT

B u s in e s s A r e a n B u B iun se i s se sA sr eA ar e a s C u r U n re s E & G K n o x v ille

F u n c t io n a l A r e a F uFnucnt icot noanl aAl rAe ra e a i In s tr u c tio n

Figure 1 Controlling Area (Controlling - CO) A Controlling Area in R/3 is the organizational unit within an institution, used to represent a closed system for cost accounting purposes. A controlling area may include one or more company codes which must use the same operative chart of accounts as the controlling area. Proposal: The University of Tennessee will use only one Controlling Area UT. Company Code UT will be assigned to Controlling Area UT. Funds Management Area (Funds Management - FM) A Funds Management Area in R/3 is the organizational unit within an institution, used to represent a closed system for funds management and budgeting. A Funds Management Area may include one or more company codes and one or more controlling areas. Proposal: The University of Tennessee will use only one Funds Management Area UT. Company Code UT and Controlling Area UT will be assigned to Funds Management Area UT. Figure 2 shows the relationship between the Company Code, the Controlling Area and the Funds Management Area.

C om pany C ode UT

C o n tro llin g A r e a UT

Funds M anagem ent A re a U T

Figure 2

/opt/scribd/conversion/tmp/scratch14498/64261122.doc

Page 4

of 10

DRAFT as of 08/01/11

Master Data

Master data structures in R/3 represent data relating to individual objects, which remain unchanged over an extended period of time. This allows such data to be created once and used many times. Master data is also used to validate and classify transaction data for reporting.

Financial Accounting Master Data (FI)

Chart of Accounts The Chart of Accounts is a collection of general ledger accounts. Each company code is assigned to a chart of accounts, and the controlling area is assigned to the same chart of accounts. Proposal: Only one Chart of Accounts - UT will be used for the University of Tennessee. Company Code UT and Controlling Area UT will be assigned to Chart of Accounts UT. General Ledger Accounts The General Ledger Accounts (GL Accounts) are the structures that classify debit and credit values for accounting transactions in the FI module and form the basis for creating the balance sheets and income statements. There are five types of General Ledger Accounts in R/3 - assets, liabilities, fund balances, revenues and expenditures. Asset, Liability and Fund Balance GL Accounts can be used, in combination with business areas to create internal balance sheets by business area. Revenue and Expenditure GL Accounts represent the highest level at which revenues or expenditures are recorded by the Institution. They can be used in combination with business areas and functional areas to create income statements by function and business area. Revenue and expenditure can also be further broken down in the Controlling module. Figure 3 shows the relationship between the chart of accounts and the company code:

C h a rt o f A c c ts U T

A s s e ts L ia b ilitie s

C om pany C ode UT

Fund B a la n c e s R even ues

E x p e n d itu re s

Figure 3

/opt/scribd/conversion/tmp/scratch14498/64261122.doc

Page 5

of 10

DRAFT as of 08/01/11

Proposal: At the University of Tennessee several different existing codes will be mapped to R/3 General Ledger Accounts. Existing Code 1. Assets AXXXXXXXX (e.g. A17010001 Cash on Hand Treasurer) 2. Liabilities AXXXXXXXX (e.g. A01560005 A/P Knoxville) 3. Type of Fund Balance or Reserve (e.g. 99 Balance or 84 Reserve for Encumbrances) 4. Expenditure Object Codes (e.g. 391 Operating Supplies) 5. Ledger Activity Codes for Expenditures and Transfers Out (e.g. 050 Charges for Routine Expense) 6. Major and Minor Sources of Funds (e.g. 0101 Tuition and Fees Resident Enrollment) 7. Ledger activity codes for Income and Transfers In (e.g. 001 Endowment Income UT Endowments) 8. Income activity codes XX (e.g. 01 Rent) Revenue Accounts 700000 through 799999 (e.g. 701010 Tuition and Fees Resident Enrollment) Type of R/3 Account Asset Account Proposed Number Range 100000 through 199999 (e.g. 101001 Cash on Hand + Business Area 1117) 200000 through 299999 (e.g. 256005 Accounts Payable + Business Area 1101) 300000 through 399999 (e.g. 399000 Unreserved Fund Balance or 384000 Fund Balance Reserved for Encumbrances) 400000 through 499999 (e.g. 439100 Operating Supplies)

Liability Account

Fund Balance Account

Expenditure Account

/opt/scribd/conversion/tmp/scratch14498/64261122.doc

Page 6

of 10

DRAFT as of 08/01/11

Controlling and Project System Master Data (CO, PS and PCA)

Revenue Elements Revenue elements are used to classify revenues in Controlling. They are linked to revenue GL accounts on a one-for-one basis and have the same number and description. E.g. Revenue Element 701010 Tuition and Fees Resident represents GL Account 701010 Tuition and Fees Resident in CO. Cost Elements Cost elements are used to classify costs in CO according to object of expenditure. Primary Cost Elements represent expenditure GL Accounts in CO. They are linked to Expenditure GL accounts on a one-for-one basis and have the same number and description. E.g. Cost Element 439100 Operating Supplies represents GL Account 439100 Operating Supplies in CO. Proposal: Primary cost elements will be set up for all expenditure GL Accounts. Secondary cost elements are used for internal allocations within a controlling area such as overhead. These cost elements are not directly linked to an Expenditure GL account. Proposal: Ledger Activity Codes for 010 Facilities and Admin Costs and similar internally allocation costs will be mapped to secondary cost elements. Secondary cost elements will be set up in the range 500000 to 599999. E.g. 501000 - Facilities and Admin Costs. Cost Center and Cost Center Hierarchy A Cost Center is a unit within a controlling area that represents a revenue and cost collector for permanent activities. A cost center can be linked to a company code, a business area, a functional area, a fund, a fund center and a profit center allowing all these codes to be automatically defaulted when a user enters a cost center in a document. Costs and revenues posted to a cost center can thus be automatically posted to the company code, business area, fund, fund center and profit center linked to the cost center. A standard hierarchy of cost centers is required for the controlling area and is used by drill-down reports. In addition Cost Centers may optionally belong to additional alternative hierarchies that can also be used by drill-down reports. Proposal: The University will use Cost Centers to represent its current unrestricted income and expenditure accounts (I and E accounts) in R/3. All E accounts with seven-digit numbers will be represented by cost centers with the same seven-digit number. All I and E accounts with nine-digit numbers will be represented by cost centers with ten-digit numbers. The ten-digit number will be created by adding a zero in the eighth position in the ten-digit number. E.g. Account E01102401 will be represented by cost center E011024001. The standard cost center hierarchy will be used to represent the organizational groupings to show Fund Group >Budget Entity >Function > College or Division > Department> Cost Center (7 digit) > Cost Center (10 digit). An alternative hierarchy will be created to represent the State Appropriation hierarchy. Figure 4 shows the relationship between a cost center and other master data and organizational elements.

/opt/scribd/conversion/tmp/scratch14498/64261122.doc

Page 7

of 10

DRAFT as of 08/01/11

C om pany C ode U T

F u n c tio n a l A r e a In s tru c tio n

C o s t C e n te r E011024001

P ro fit C e n te r L 0 1 1 0 0 2 4 0 1 C h e m is tr y

Fund E011024001

B u s in e s s A re a C u r U n r e s t E & G K n o x v ille

F u n d C e n te r U 0 1 1 0 0 2 4 0 1 C h e m is tr y

Figure 4 Work Breakdown Structure Element (WBS Element) and WBS Element Group A WBS element is an element in a project work breakdown structure (WBS) and is used as a revenue and cost collector for activities with discrete start and end dates. At least one WBS element must exist in a project. A WBS element can be linked to a company code, a business area, a functional area (through substitution), a fund, a fund center and a profit center allowing all these codes to be defaulted when a user enters a WBS Element in a document. Costs and revenues posted to a WBS Element can be automatically posted to the company code, business area, fund, fund center and profit center linked to the WBS Element. Additionally, collected costs may be billed or automatically transferred to cost centers or GL Accounts periodically. There is no standard hierarchy required for WBS elements. WBS Elements can be grouped together into WBS Element Groups for reporting. Proposal: The University will use WBS Elements to collect revenues and costs associated with costreimbursable grants, and all other funds other than current unrestricted funds. Thus WBS elements will be used to collect revenues and costs for current restricted funds, endowment, annuity and life income funds, plant funds, loan funds and agency funds. For example a balance account for restricted funds (B Account) with a nine-digit number, will be represented by a WBS Element with a nine-digit number. The nine-digit number will be created by replacing the fourth and fifth digit with two zeros. E.g. Account B01991024 will be represented by WBS Element B01001024. An expenditure account for restricted funds (R Account) with a nine-digit number will be represented by a WBS Element with a ten-digit number. The ten-digit number will be created by adding a zero in the eighth position. E.g. Account R01102410 will become WBS Element R011024010. Related B and R accounts as in the above case will appear in the same project structure. Figure 5 shows the relationships between a WBS Element and other master data and organizational elements.

/opt/scribd/conversion/tmp/scratch14498/64261122.doc

Page 8

of 10

DRAFT as of 08/01/11

C om pany C ode U T

F u n c tio n a l A re a R e s e a rc h

W B S E le m e n t B01001024

P ro fit C e n te r L 0 1 1 0 0 2 4 0 1 C h e m is tr y

W B S E le m e n t R 011024010

Fund B01001024

Fund R 011024010 B u s in e s s A r e a C u r R e s t E & G K n o x v ille

Figure 5

F u n d C e n te r U 0 1 1 0 0 2 4 0 1 C h e m is tr y

Profit Center and Profit Center Hierarchy A Profit Center is an organizational unit in R/3, within which costs and revenue can be analyzed. Costs and revenues posted to cost centers and WBS Elements can be automatically posted to profit centers. A standard profit center hierarchy is required and is used by drill-down reports, and multiple alternative profit center hierarchies can be created to be used by drill-down reports. Proposal: The University will use Profit Centers to represent its reporting organization units in R/3 so that reports can be created across cost centers and WBS element by organizational unit. The profit center number will be based on the department number. For example, department 011002401 will be mapped to profit center L011002401. The standard profit center hierarchy will be used to represent the reporting organizational groupings to show Budget Entity >College or Division > Department.

Funds Management Master Data

Commitment Item and Commitment Item Hierarchy Commitment items represent budget and fund accounting classifications of GL Accounts and cost elements in the Funds Management Module. They are thus used to reflect the type of revenues and expenditures being budgeted and also to detail balances for each fund in FM. Proposal: The University will create Commitment items for each Budget Object Code (two digit). For example budget object code 11 Admin and Professional Salaries will be mapped to commitment item 11 Admin and Professional Salaries. In addition, all fund balance GL accounts will be mapped to FM on a one-for-one basis and assets and liabilities GL accounts will be mapped to Commitment Items on a manyto-one basis.

/opt/scribd/conversion/tmp/scratch14498/64261122.doc

Page 9

of 10

DRAFT as of 08/01/11

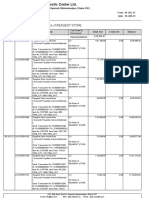

Figure 6 shows the relationship between GL accounts, cost elements and commitment items:

A s s e ts G L A c c o u n t L ia b ilitie s G L Account F u n d B a la n c e G L Account Revenues G L Account E x p e n d it u r e s G L Account R e v e n u e E le m e n t P r im a r y C o s t E le m e n t S e c o n d a ry C o s t E le m e n t

Fund Figure 6

A s s e ts C o m m itm t Ite m L ia b ilitie s C o m m itm t Ite m F u n d B a la n c e C o m m itm t Ite m Revenues C o m m itm t Ite m P r im a r y C o s t C o m m itm t Ite m S e c o n d a ry C o s t C o m m itm t Ite m

A fund represents the lowest level of funding requiring a budget. The fund master includes an application of fund and one or more sources of funds. Budget rules can be specified separately for each fund. Proposal: The University will use Funds for storing the budgets and actuals for all its accounts. Only one application of fund will be created for the Current Unrestricted fund group but individual Sources of funds will be created to represent each account. The current unrestricted sources of funds will have the same numbers as the cost centers representing such accounts (seven-digit or ten-digit number). For all other fund groups an application of fund and a source of funds will be created for each account. These sources and applications of funds will have the same number as the WBS Element representing such accounts (ten-digit number). Attributes such as the Vice-Chancellor and Dean/Department codes will be entered into user defined fields on the fund master. Funds Center and Funds Center Hierarchy A fund center is the organizational unit responsible for preparing and monitoring the budget for one or more funds. Fund centers are organized into a hierarchy along which the budget flows. Since the budget flows along the fund center hierarchy, no alternative hierarchies are allowed. Proposal: The University will create fund centers based on the reporting organization hierarchy of Budget Entity> College or Division> Department. The fund center number will be based on the department number. For example, department 011002401 will be mapped to fund center U011002401.

Name: ________________ ________________ ________________

Title:

Signature: _______________ _______________ _______________

Date: _______________ _______________ _______________

/opt/scribd/conversion/tmp/scratch14498/64261122.doc

Page 10

of 10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Accounting System MannualDocument84 pagesAccounting System MannualBhushan ParalkarNo ratings yet

- 2020 - PRACTIKUM Practice Set Principles of Accounting IDocument73 pages2020 - PRACTIKUM Practice Set Principles of Accounting IaltaheaaNo ratings yet

- Exam 1z0-1054: IT Certification Guaranteed, The Easy Way!Document21 pagesExam 1z0-1054: IT Certification Guaranteed, The Easy Way!Ahmed A. DawoodNo ratings yet

- AIS PaperDocument8 pagesAIS PaperTarra AuliaNo ratings yet

- PT Terus JayaDocument16 pagesPT Terus JayaLinda Wati PriwotoNo ratings yet

- Topic 4: General Ledger and Financial Reporting SystemsDocument45 pagesTopic 4: General Ledger and Financial Reporting SystemsTeo ShengNo ratings yet

- MRC Setup and Usage PDFDocument73 pagesMRC Setup and Usage PDFarajesh07No ratings yet

- Accounting Information Systems 9th Edition Hall Test BankDocument22 pagesAccounting Information Systems 9th Edition Hall Test Bankjenatryphenaotni100% (30)

- Chapter 16 (GENERAL LEDGER AND REPORTING SYSTEM)Document7 pagesChapter 16 (GENERAL LEDGER AND REPORTING SYSTEM)Amara Prabasari100% (1)

- FI ExtractionDocument17 pagesFI ExtractionVinay Reddy100% (1)

- Accounting Information System - Chapter 2Document88 pagesAccounting Information System - Chapter 2Melisa May Ocampo AmpiloquioNo ratings yet

- SAF-T For Romania - SAP - ERPDocument30 pagesSAF-T For Romania - SAP - ERPLiviuNo ratings yet

- AccountingDocument15 pagesAccountingCjhay MarcosNo ratings yet

- SAP Standard BI Content ExtractorsDocument74 pagesSAP Standard BI Content Extractorsnira5050No ratings yet

- 1Z0 General Ledger 002Document2 pages1Z0 General Ledger 002Ashive LightNo ratings yet

- Accounting Information Systems 12th Edition Romney Test BankDocument35 pagesAccounting Information Systems 12th Edition Romney Test Bankvaginulegrandly.51163100% (28)

- Bank ReconciliationDocument8 pagesBank ReconciliationJustine991No ratings yet

- LAS 6 To 8 FABM 1 GAGALACDocument18 pagesLAS 6 To 8 FABM 1 GAGALACAira Venice GuyadaNo ratings yet

- FA Period CloseDocument9 pagesFA Period CloseMd MuzaffarNo ratings yet

- Oracle ERP Cloud Guided Path and Best Configuration Practices 2018 - R13 FinalDocument88 pagesOracle ERP Cloud Guided Path and Best Configuration Practices 2018 - R13 FinalMarcos Paulo Cardoso NonatoNo ratings yet

- Akuntansi Perusahaan Dagang Panorama HijauDocument27 pagesAkuntansi Perusahaan Dagang Panorama Hijausintya saputri100% (1)

- Common Records FieldsDocument50 pagesCommon Records FieldsPriyaNo ratings yet

- STOCK OF Reagent STOREDocument156 pagesSTOCK OF Reagent STORESakib HossainNo ratings yet

- General Ledger Oracle FLEXCUBE Universal Banking Release 12.0.1.0.0 (December) (2012) Oracle Part Number E51465-01Document106 pagesGeneral Ledger Oracle FLEXCUBE Universal Banking Release 12.0.1.0.0 (December) (2012) Oracle Part Number E51465-01Anirudh DeshpandeNo ratings yet

- Name: Group: Date: Chapter Exercise 1 - Preparation of Statement of Profit or Loss From General Ledger AccountsDocument5 pagesName: Group: Date: Chapter Exercise 1 - Preparation of Statement of Profit or Loss From General Ledger AccountsSuy YanghearNo ratings yet

- Answer: D: ExplanationDocument33 pagesAnswer: D: Explanationjaime costaNo ratings yet

- Ledger Account Accounting Workbooks Zaheer SwatiDocument10 pagesLedger Account Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Accounting Gaps Analysis-OracleDocument4 pagesAccounting Gaps Analysis-OracleKhuram ShahzadNo ratings yet

- Financial Accounting (FI) Case Study: Product Motivation PrerequisitesDocument37 pagesFinancial Accounting (FI) Case Study: Product Motivation PrerequisitesThùy LêNo ratings yet

- Answer: C DDocument31 pagesAnswer: C DDuy Nguyen100% (1)