Professional Documents

Culture Documents

Greek Debt Calc

Uploaded by

bharat0 ratings0% found this document useful (0 votes)

20 views3 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views3 pagesGreek Debt Calc

Uploaded by

bharatCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 3

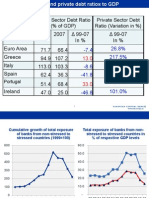

Greek debt to GDP calculator

Greek government assumptions in orange can be changed

Assumptions

Primary balance (% of GDP)***

Real GDP growth (%)

Inflation

Nominal GDP growth

Interest rate (%)*

2009

-7.7

0.4

5.1

2010

-3.5

-0.3

2.0

1.7

4.7

2011

-0.2

1.5

2.0

3.5

4.7

2012

2.6

1.9

1.9

3.8

4.6

2013

3.2

2.5

1.9

4.4

4.6

122

120

118

Results of change

% point debt ratio change

Gross debt ratio for given

growth and interest rates

113.4

7.0

0.2

-2.9

-4.3

116

120.4

120.6

117.7

113.4

114

112

Greek government estimates

110

Gross Debt/GDP ratio as

announced by Greece

Implicit sale(-) / purchase(+) of

assets**

113.4

120.4

120.6

117.7

113.4

108

2009

0.9

-1.1

-1.0

2010

-1.3

*Effective debt service interest rate

**Estimated proceeds from Greek asset sales/privatisations

***Government net borrowing or net lending excluding interest payments on consolidated government liabilities.

Greek base assumptions

2009

Row 18

122

Primary balance (%)

Real GDP growth (%)

Inflation

Nominal GDP growth

Interest rate (%)*

Row 15

120

-7.7

0.4

5.1

118

116

% point debt ratio change

114

Gross debt ratio for given

growth and interest rates

112

110

108

2009

2010

d government liabilities.

2011

2012

2013

Gross Debt/GDP ratio as

announced by Greece

Implicit sale(-) /

purchase(+) of assets

113.4

2010

2011

2012

2013

-3.5

-0.3

2.0

1.7

4.7

-0.2

1.5

2.0

3.5

4.7

2.6

1.9

1.9

3.8

4.6

3.2

2.5

1.9

4.4

4.6

7.0

0.2

-2.9

-4.3

120.4

120.6

117.7

113.4

120.4

120.6

117.7

113.4

0.9

-1.1

-1.0

-1.3

You might also like

- FMI PortugalDocument1 pageFMI Portugalnrodrigo_cincodiasNo ratings yet

- Ii. Aggregate Demand: Demand Conditions Remain Supportive of GrowthDocument5 pagesIi. Aggregate Demand: Demand Conditions Remain Supportive of GrowthKhizer Ahmed KhanNo ratings yet

- Denmark An Exemplary Economic PolicyDocument7 pagesDenmark An Exemplary Economic PolicyzfxmanNo ratings yet

- 28PDE Set2012inglesDocument3 pages28PDE Set2012inglesKrisztian KissNo ratings yet

- What Is The Economic Outlook For OECD Countries?: An Interim AssessmentDocument24 pagesWhat Is The Economic Outlook For OECD Countries?: An Interim Assessmentapi-25892974No ratings yet

- Country Strategy 2011-2014 GreeceDocument19 pagesCountry Strategy 2011-2014 GreeceBeeHoofNo ratings yet

- Spain OECD Economic Outlook Projection Note November 2022Document3 pagesSpain OECD Economic Outlook Projection Note November 2022ELENE GOIKOETXEANo ratings yet

- Central Bank of Egypt: Economic ReviewDocument205 pagesCentral Bank of Egypt: Economic ReviewybouriniNo ratings yet

- Philippine Economy Posts 5.7 Percent GDP GrowthDocument2 pagesPhilippine Economy Posts 5.7 Percent GDP GrowthddewwNo ratings yet

- What Is The Economic Outlook For OECD Countries?: An Interim AssessmentDocument24 pagesWhat Is The Economic Outlook For OECD Countries?: An Interim AssessmentAnna DijkmanNo ratings yet

- Georgian Economy OverviewDocument41 pagesGeorgian Economy Overviewlevan_vachadzeNo ratings yet

- Analyst Presentation 9M 2011Document18 pagesAnalyst Presentation 9M 2011gupakosNo ratings yet

- OECD's Interim AssessmentDocument23 pagesOECD's Interim AssessmentTheGlobeandMailNo ratings yet

- Economic Analysis of GreeceDocument15 pagesEconomic Analysis of GreeceGiorgosB.No ratings yet

- Ii. Aggregate DemandDocument6 pagesIi. Aggregate Demandanjan_debnathNo ratings yet

- Fernando Gonzales - ECBDocument10 pagesFernando Gonzales - ECBMachaca Alvaro MamaniNo ratings yet

- All ChapterDocument294 pagesAll ChapterManoj KNo ratings yet

- Republic of ItalyDocument6 pagesRepublic of ItalylassanceblogNo ratings yet

- FICCI Eco Survey 2011 12Document9 pagesFICCI Eco Survey 2011 12Krunal KeniaNo ratings yet

- The Greek Economy & Its Stability Programme: Written byDocument44 pagesThe Greek Economy & Its Stability Programme: Written bypapaki2No ratings yet

- Monthly Report: 1. General InformationDocument1 pageMonthly Report: 1. General InformationBeatrice NicoletaNo ratings yet

- The 2011 Economic Outlook - Credit Given Where Credit Is DueDocument37 pagesThe 2011 Economic Outlook - Credit Given Where Credit Is Duerogerwilcomina3407No ratings yet

- Barbados: Barbados Country Report: GDP Data and GDP Forecasts Economic, Financial and Trade Information The BestDocument3 pagesBarbados: Barbados Country Report: GDP Data and GDP Forecasts Economic, Financial and Trade Information The BestPhoenix GriffithNo ratings yet

- Bop Annual 2011Document65 pagesBop Annual 2011rajNo ratings yet

- FICCI Eco Survey 2011 12Document9 pagesFICCI Eco Survey 2011 12Anirudh BhatjiwaleNo ratings yet

- 2008 Moodys Together: Tests of Equality of Group MeansDocument18 pages2008 Moodys Together: Tests of Equality of Group Meansmainmei56No ratings yet

- 2012-03-19 Greece Is Changing Updated Mar 2012Document64 pages2012-03-19 Greece Is Changing Updated Mar 2012guiguichardNo ratings yet

- GfiDocument17 pagesGfiasfasfqweNo ratings yet

- 2010 KurzfassungDocument3 pages2010 Kurzfassungurz_spiderman2630No ratings yet

- How The Global Financial Crisis Has Affected The Small States of Seychelles & MauritiusDocument32 pagesHow The Global Financial Crisis Has Affected The Small States of Seychelles & MauritiusRajiv BissoonNo ratings yet

- I. Economic Environment (1) I: The Philippines WT/TPR/S/149Document16 pagesI. Economic Environment (1) I: The Philippines WT/TPR/S/149Ky LyNo ratings yet

- CR 1349Document29 pagesCR 1349John WayneNo ratings yet

- Root Cause of Greek Debt CrisisDocument28 pagesRoot Cause of Greek Debt CrisisKrishna KanthNo ratings yet

- Highlights: Economic Advisory Council To The PM Economic Outlook 2012/13Document6 pagesHighlights: Economic Advisory Council To The PM Economic Outlook 2012/13mustaneer2211No ratings yet

- KPMG Budget BriefDocument52 pagesKPMG Budget BriefAsad HasnainNo ratings yet

- Informare Investitori 25iunie 2014Document9 pagesInformare Investitori 25iunie 2014MihailMarcuNo ratings yet

- Inddec 10Document12 pagesInddec 10Surbhi SarnaNo ratings yet

- Taxation Trends in The European Union - 2012 50Document1 pageTaxation Trends in The European Union - 2012 50d05registerNo ratings yet

- Sidvin Pharma - Form Vat 105 - July-11Document4 pagesSidvin Pharma - Form Vat 105 - July-11Lakshmi NarayanaNo ratings yet

- What Is The Economic Outlook For OECD Countries?: Angel GurríaDocument22 pagesWhat Is The Economic Outlook For OECD Countries?: Angel GurríaJohn RotheNo ratings yet

- The Deceit of Good Economics and Good Governance: YEAREND 2012Document38 pagesThe Deceit of Good Economics and Good Governance: YEAREND 2012ibonsurveysNo ratings yet

- Economic Survey PDFDocument373 pagesEconomic Survey PDFVaibhavChauhanNo ratings yet

- Government Finance 2Document7 pagesGovernment Finance 2Yohannes MulugetaNo ratings yet

- France 2019 OECD Economic Survey OverviewDocument66 pagesFrance 2019 OECD Economic Survey OverviewAntónio J. CorreiaNo ratings yet

- Presentation On Union Budget: 2010-11 & Current Fiscal Situation by prof-SC SharmaDocument53 pagesPresentation On Union Budget: 2010-11 & Current Fiscal Situation by prof-SC Sharmavinod_varyaniNo ratings yet

- National Economic Accounts Prov2012 170513Document30 pagesNational Economic Accounts Prov2012 170513Vassos KoutsioundasNo ratings yet

- Eurofer - Market Report-2011-JanuaryDocument16 pagesEurofer - Market Report-2011-JanuarytetsuiaNo ratings yet

- First Four Months Macroecon - NRB FY 2009-10Document43 pagesFirst Four Months Macroecon - NRB FY 2009-10Chandan SapkotaNo ratings yet

- Scribd Assignment 5Document3 pagesScribd Assignment 5Antoine GaraNo ratings yet

- Egypt Economic ProfileDocument16 pagesEgypt Economic ProfileSameh Ahmed HassanNo ratings yet

- Interim Budget 2009-10Document12 pagesInterim Budget 2009-10allmutualfundNo ratings yet

- BangladeshDocument2 pagesBangladeshSumon DasNo ratings yet

- Executive SummaryDocument45 pagesExecutive SummaryMekon-Engineering MkeNo ratings yet

- RBA Chart Pack (8 May 2013)Document34 pagesRBA Chart Pack (8 May 2013)leithvanonselenNo ratings yet

- State of The Economy and Prospects: Website: Http://indiabudget - Nic.inDocument22 pagesState of The Economy and Prospects: Website: Http://indiabudget - Nic.insurajkumarjaiswal9454No ratings yet

- DownloadDocument2 pagesDownloadbagus_mulyawanNo ratings yet

- FactSheet 2010 - 11 - 02Document1 pageFactSheet 2010 - 11 - 02ThailandToday TodayTodayNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Property Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksFrom EverandProperty Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- The Startup of You - Executive SummaryDocument9 pagesThe Startup of You - Executive SummaryYohanes LiebertoNo ratings yet

- 2012 Social Security ChangesDocument3 pages2012 Social Security ChangesbharatNo ratings yet

- Sarbanes Oxley PresentationDocument16 pagesSarbanes Oxley PresentationAdil ZerozerosevenNo ratings yet

- How To Make An Origami Flower: What You Will NeedDocument4 pagesHow To Make An Origami Flower: What You Will NeedbharatNo ratings yet

- FI GL Closing Operations Part2Document161 pagesFI GL Closing Operations Part2bharatNo ratings yet

- What Is Section 498a of The Indian Penal CodeDocument3 pagesWhat Is Section 498a of The Indian Penal CodebharatNo ratings yet

- Economic Enviornment of BusinessDocument33 pagesEconomic Enviornment of BusinessbharatNo ratings yet

- Useful Guidelines of RBIDocument68 pagesUseful Guidelines of RBIbharatNo ratings yet

- World's Top Leading Public Companies ListDocument20 pagesWorld's Top Leading Public Companies ListbharatNo ratings yet

- Adbur PVT LTDDocument9 pagesAdbur PVT LTDArun SachuNo ratings yet

- Matrimonial Bio DataDocument1 pageMatrimonial Bio DatabharatNo ratings yet

- GIFT Corporate Presentation NewDocument53 pagesGIFT Corporate Presentation NewbharatNo ratings yet

- The World's Most Innovative CompaniesDocument10 pagesThe World's Most Innovative CompaniesbharatNo ratings yet

- Private Equity InvestmentsDocument1 pagePrivate Equity InvestmentsbharatNo ratings yet

- Stevejobs StandfordconvocationspeechDocument6 pagesStevejobs Standfordconvocationspeechapi-272667476No ratings yet

- Lokpal Bill: ... Understanding The Drafts of and Civil SocietyDocument28 pagesLokpal Bill: ... Understanding The Drafts of and Civil SocietyAbhishek GourNo ratings yet

- 09-11 Jobs & ProfilesDocument27 pages09-11 Jobs & ProfilesbharatNo ratings yet

- Leveraged BuyoutDocument9 pagesLeveraged Buyoutbharat100% (1)

- 10 Most Corrupt Indian PoliticiansDocument4 pages10 Most Corrupt Indian PoliticiansbharatNo ratings yet

- Bharat PicDocument1 pageBharat PicbharatNo ratings yet

- Essential Intelligence On Complex Business Sectors, Made SimpleDocument20 pagesEssential Intelligence On Complex Business Sectors, Made SimplebharatNo ratings yet

- Capital Adequacy RatioDocument4 pagesCapital Adequacy RatiobharatNo ratings yet

- Draft Lokpal Bill 2011Document28 pagesDraft Lokpal Bill 2011FirstpostNo ratings yet

- Jan Lokpal Big OffsetDocument16 pagesJan Lokpal Big OffseteklakshNo ratings yet

- Lokpal Bill 1.9Document29 pagesLokpal Bill 1.9harish_afriendforeverNo ratings yet

- Lokpal BillDocument2 pagesLokpal BillManasa VedulaNo ratings yet

- Anna HazareDocument11 pagesAnna HazarebharatNo ratings yet

- Civil Society S Lokpal BilDocument27 pagesCivil Society S Lokpal Bilmuthoot2009No ratings yet

- Justice N.santosh HegdeDocument1 pageJustice N.santosh HegdebharatNo ratings yet

- Anna HazareDocument20 pagesAnna HazarebharatNo ratings yet