Professional Documents

Culture Documents

Power of Attorney: WWW - Ftb.ca - Gov

Uploaded by

phamel2648Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Power of Attorney: WWW - Ftb.ca - Gov

Uploaded by

phamel2648Copyright:

Available Formats

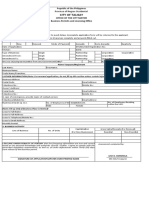

Print and Reset Form Reset Form

STATE OF CALIFORNIA

FRANCHISE TAX BOARD POWER OF ATTORNEY

PO BOX 2828 DECLARATION FOR THE FRANCHISE TAX BOARD

RANCHO CORDOVA CA 95741-2828

FAX NUMBER: (916) 845-0523

This Power of Attorney Declaration remains in effect until you resolve the matters specified on it, or until you

revoke it.

We provide instructions for completing this form on pages 3 and 4. For more information about a power of attorney, visit

www.ftb.ca.gov, then type POA in the Search field. Or see publication Power of Attorney (FTB 1144).

1. Taxpayer information – Complete in full to avoid delays.

Taxpayer’s Name and Address – Personal or Business Social Security #: Business Entity Identification #:

1

(If this is a joint power of attorney, include your spouse/RDP’s

name and address) - - CA Corp #:

- - SOS #:

Check if new Daytime Telephone #:

address FEIN:

Spouse/RDP’s address, if different ( ) -

Note: You must complete and attach page 5 if this power of attorney applies to the combined reporting of

multiple corporations.

2. The taxpayers listed above appoint the following representatives as attorneys-in-fact:

Name and Address Primary Representative IRS CAF #: PTIN:

Telephone #: ( ) -

Fax #: ( ) -

Check if new Address Telephone #:

Name and Address IRS CAF #: PTIN:

Telephone # ( ) -

Fax #: ( ) -

Check if new Address Telephone #:

Note: Attach a list of additional representatives if necessary.

3. Specific issues, tax years, or income periods

The representatives listed can represent you before us for the following:

Tax Years (required): ___________________________________________________________________________

Matters (optional): _____________________________________________________________________________

4. Authorization only for information

Check this box if you only authorize your representative to receive your confidential tax information, but not to act

as your attorney-in-fact.

5. Acts authorized

You authorize your representative as an attorney-in-fact to:

• Receive and inspect your confidential tax information.

• Perform any actions you might perform to resolve your issues with us – such as signing agreements, consents, or

other documents.

The authority granted does not include the power to receive refund checks, the power to substitute another

representative, or the power to sign certain tax returns – unless you specify otherwise in section 6.

1

RDP refers to a registered domestic partner or partnership.

FTB 3520 C1 (REV 11-2007) Page 1

6. List any specific additions or deletions to the acts authorized in this Power of Attorney Declaration.

7. Notices and communications

We will send your primary representative copies of the notices that we send to you. To send them to another

representative instead, indicate this on section 6 above.

Check this box if you do not want us to send copies of these notices to your representative.

8. Retaining or revoking a prior power of attorney

This Power of Attorney Declaration automatically revokes all prior Power of Attorney Declarations for the same

tax years or income periods on file with us – unless you specify otherwise as detailed below. To expedite a

revocation, refer to section 8, page 4.

Check this box if you do not want to revoke a prior Power of Attorney Declaration. You must attach a copy of

each prior Power of Attorney Declaration that you want to remain in effect.

9. Signatures authorizing a power of attorney

If the tax matter concerns a joint return and you declare joint representation, both spouses/RDPs must sign and date

this declaration.

If you are a corporate officer, partner, guardian, tax matter representative, executor, receiver, administrator, or trustee

on behalf of the taxpayers, you certify that you have the authority to execute this by signing the Power of Attorney

Declaration on behalf of the taxpayers.

Check this box if your signature denotes a fiduciary relationship.

Signature Date Title (if applicable)

Print Name

Signature Date Title (if applicable)

Print Name

Signature Date Title (if applicable)

Print Name

Important Information

• Power of Attorney Declarations do not need to be notarized.

• It is illegal to forge another person’s signature.

• We will return this Power of Attorney Declaration to you if it is not signed and dated.

• Retain a copy of this Power of Attorney Declaration for your files.

• Mail or fax this declaration to the respective address or fax number listed on top of page 1 on this form.

FTB 3520 C1 (REV 11-2007) Page 2

Additional Power of Attorney Information and Instructions

Why would I need a power of attorney?

Use this Power of Attorney Declaration (FTB 3520) to A fiduciary stands in the position of a taxpayer and

grant authority to an individual to receive confidential tax acts as the taxpayer, and so is not a representative.

information, or to represent you before us. To authorize an individual to represent or perform

certain acts on behalf of the estate/trust, the

You can also use this form to authorize an individual to

fiduciary must file a Power of Attorney Declaration.

receive information from our nontax programs, such as

Child Support Collection, Vehicle Registration Collection, New Address Box: If the mailing address provided

Homeowner and Renter Assistance, etc. on the power of attorney is new and you would like

to permanently change your address with us, check

Do you accept other types of power of attorney the new address box. If you check the box, we will

declarations? send all future notices to this address.

We also accept these power of attorney declarations:

• IRS Power of Attorney and Declaration of 2. Representative Information

Representative (Form 2848) or IRS Tax Information Provide your representative’s information:

Authorization (Form 8821) – if they are modified to • Name, address, phone number, and fax number.

state that they apply to Franchise Tax Board matters. • IRS Central Authorization File Number or

• A joint Board of Equalization/Franchise Tax Practitioner Tax Identification Number (if known)

Board/Employment Development Department Power We will not accept your declaration if you designate

of Attorney (BOE 392). You must check the “FTB box” a company or organization as your representative.

to authorize representation before us.

• General or durable power of attorney declarations. 3. Specific Issues, Tax Years, or Income Periods

• Handwritten authority documents. For tax issues, specify the tax years or income

If you do not use our FTB 3520, ensure that your periods covered by your Power of Attorney

declaration includes: Declaration (e.g., 1999-2001, and 2003). Your

• Your name, address, phone number, and social representative can work with us only on the tax

security number or business identification number. years or income periods you designate on your

• The name, address, phone number, and fax number of declaration. You cannot designate “all years” or “all

your representatives. periods.” We will return your declaration to you if

• A clear statement that grants a person (or persons) the tax years or income periods are not listed.

authority to represent you before the Franchise Tax You can list future tax years or income periods on

Board, and that specifies the actions authorized. your declaration – but they cannot exceed three

• The specific matters and tax years or income periods. years beyond the current year. For example, if the

• For estate tax matters, the decedent’s name and date current year is 2007, you can list the 2008, 2009,

of death, and the representative’s authorization. and 2010 tax periods – but not beyond.

• Your signature and the date. If you file a joint

declaration, then both spouses/RDPs must sign and For nontax issues, enter the program’s name on

date it. this line (e.g., Child Support Collection, Vehicle

Registration Collection, Homeowner and Renter

If your declaration does not contain the information Assistance, etc.). You do not need to specify a

noted above, then complete and submit FTB 3520. tax year for nontax issues.

Instructions for Completing FTB 3520 4. Authorization only for Information

1. Taxpayer Information If you check the box in section 4 on page 1, it only

For individuals: Provide your name, address, authorizes us to disclose your confidential

phone number, and social security number. If you information to your representative. As a result, this

file a joint Power of Attorney Declaration, include person will not be able to represent you before us to

similar information for your spouse/RDP. resolve any issues you have.

For businesses (banks, corporations, partnerships, 5. Acts Authorized

or limited liability companies): Provide your business Unless you specify otherwise, your representative is

name, address, phone number, and business entity authorized as an attorney-in-fact to:

identification number (e.g., California corporation • Receive and inspect your account information.

number, Secretary of State number, or FEIN). • Represent you in matters before us.

For fiduciaries (trustees, executors, administrators, • Sign waivers that extend the statutory period for

receivers, or guardians): Provide your estate/trust assessment or determination of taxes.

name, address, phone number, and FEIN (if the IRS • Execute settlement or closing agreements.

did not provide you a FEIN, provide your SSN). The

fiduciary must sign and date the declaration.

FTB 3520 C1 (REV 11-2007) Page 3

6. Authorization for Additions or Deletions

You can increase or decrease the authority you

grant to your representative. To do so, you must

specify the actions you do or do not authorize your

representative to take for you. Below are examples

of additional actions you can authorize:

• Receiving your refund check (but not endorsing it).

Note: to grant your representative this authority,

you must contact us to establish it. For assistance,

call us at (800) 852-5711.

• Substituting or delegating authority to a new

representative.

• Other acts not listed.

7. Notices and Communications

We will send your primary representative copies of

the notices that we send to you. If you wish to

prevent this, mark the box in section 7, page 2.

8. Retaining or Revoking a Prior Power of Attorney

When you file a Power of Attorney Declaration, it

revokes any prior Power of Attorney Declaration you

filed with us for the same tax years or income

periods. To prevent this revocation, mark the box in

section 8, page 2, and attach a copy of the previous

declaration(s) to the new one you submit to us.

To revoke a declaration, send us a newly signed and

dated copy of it with “REVOKE” written across the

top of page 1. If you do not have a copy of it, send

us a signed statement that instructs us to revoke it.

In your statement, include your name, address,

phone number, and social security number or

business entity identification number. Also include

your representative’s name and address.

A representative can also revoke his or her

representation by sending us a signed and dated

statement that includes the taxpayer’s name,

address, social security number or business entity

identification number, and the tax years or income

periods he or she is withdrawing from.

Mail your retention or revocation statement to the

address listed at the top of page 1 on this form.

Note: after we receive a power of attorney

revocation, we process it in approximately five

business days. To expedite a revocation request, fax

it to us at (916) 845-0523.

9. Signatures Authorizing a Power of Attorney

The taxpayer (or owner, officer, receiver,

administrator, or trustee for the taxpayer) must sign

the Power of Attorney Declaration. If this is a joint

declaration, both spouses/RDPs must sign and date

it. If you do not sign and date it, we will return it to

you without processing it.

FTB 3520 C1 (REV 11-2007) Page 4

AUTHORIZATION SCHEDULE FOR MULTIPLE CORPORATIONS

You must complete this authorization schedule and attach it to FTB 3520 if this power of attorney applies to the combined

reporting of multiple corporations. Provide information for each corporation that this Power of Attorney Declaration is

executed on behalf of.

List the individual who signs the Power of Attorney Declaration as a common corporate officer, receiver, administrator, or

trustee for each of the taxpayers listed below.

BUSINESS ENTITY INFORMATION:

Grantor – Taxpayer’s Name and Address Business Entity Identification Number:

CA Corp #:

SOS #:

FEIN:

Telephone #: ( ) -

Name of Grantor’s Authorized Individual – Required

Title of Signatory

Grantor – Taxpayer’s Name and Address Business Entity Identification Number:

CA Corp #:

SOS #:

FEIN:

Telephone #: ( ) -

Name of Grantor’s Authorized Individual – Required

Title of Signatory

Grantor – Taxpayer’s Name and Address Business Entity Identification Number:

CA Corp #:

SOS #:

FEIN:

Telephone #: ( ) -

Name of Grantor’s Authorized Individual – Required

Title of Signatory

Grantor – Taxpayer’s Name and Address Business Entity Identification Number:

CA Corp #:

SOS #:

FEIN:

Telephone #: ( ) -

Name of Grantor’s Authorized Individual – Required

Title of Signatory

Attach additional authorization schedules if necessary.

FTB 3520 C1 (REV 11-2007) Page 5

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- What Is and Is Not Reportable On 1099Document9 pagesWhat Is and Is Not Reportable On 1099joy100% (3)

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (5)

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of RepresentativeEri TakataNo ratings yet

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of Representativegordon scottNo ratings yet

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of RepresentativeJohn KammererNo ratings yet

- Irs Form 2848Document2 pagesIrs Form 2848john rossiNo ratings yet

- Sav 1980Document2 pagesSav 1980Michael100% (1)

- US TaxRefunds Short NewJerseyDocument11 pagesUS TaxRefunds Short NewJerseyKeziah Cyra PapasNo ratings yet

- Prudential Agent Contracting KitDocument5 pagesPrudential Agent Contracting KitWilliam Rowan100% (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- F 3911Document2 pagesF 3911Sergio Andrés Garavito NavarroNo ratings yet

- 2020 TaxReturnDocument6 pages2020 TaxReturnRicko CooperNo ratings yet

- F 2848Document2 pagesF 2848IRS100% (1)

- Request IRS Tax Return Transcript OnlineDocument2 pagesRequest IRS Tax Return Transcript OnlineBilboDBagginsNo ratings yet

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditFrom EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditNo ratings yet

- Peixoto, Angel - IRS Form 2848Document2 pagesPeixoto, Angel - IRS Form 2848MariaNo ratings yet

- J.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedFrom EverandJ.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedNo ratings yet

- 3 - Irs 2849Document2 pages3 - Irs 2849Hï FrequencyNo ratings yet

- Request For Copy of Personal Income or Fiduciary Tax ReturnDocument2 pagesRequest For Copy of Personal Income or Fiduciary Tax ReturnAsjsjsjsNo ratings yet

- 4 - Irs 8822Document1 page4 - Irs 8822Hï FrequencyNo ratings yet

- Tax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceDocument1 pageTax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceMatthew PickettNo ratings yet

- NM Substitute W9Document2 pagesNM Substitute W9marcelNo ratings yet

- Application For Enrollment To Practice Before The Internal Revenue Service 23Document4 pagesApplication For Enrollment To Practice Before The Internal Revenue Service 23IRSNo ratings yet

- ATO Tax CompensationDocument3 pagesATO Tax CompensationJohnNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormYaacov KotlickiNo ratings yet

- Request For Copy of Tax Return: Illinois Department of RevenueDocument1 pageRequest For Copy of Tax Return: Illinois Department of RevenueAsjsjsjsNo ratings yet

- Inf FormDocument15 pagesInf Formxanixe2435No ratings yet

- Power of Attorney Authorization To Disclose Tax InformationDocument4 pagesPower of Attorney Authorization To Disclose Tax InformationaghorbanzadehNo ratings yet

- Tax Change AddressDocument3 pagesTax Change AddressamoszhouNo ratings yet

- City of Talisay: Requirements: 1. Brgy. Clearance 2. Dti/Sec/Cda 3. Sanitary Permit 4. OthersDocument1 pageCity of Talisay: Requirements: 1. Brgy. Clearance 2. Dti/Sec/Cda 3. Sanitary Permit 4. OthersDexter Q. JaducanaNo ratings yet

- Auth Representative Consent FormDocument2 pagesAuth Representative Consent FormRaminder SinghNo ratings yet

- Form 11-C Occupational Tax and Registration Return for WageringDocument6 pagesForm 11-C Occupational Tax and Registration Return for Wageringeugenio02No ratings yet

- Revised-Customer-Information-Sheet-July-2023-1Document1 pageRevised-Customer-Information-Sheet-July-2023-1emzthineNo ratings yet

- Application For Relief From Double Taxation: (Name of Contracting State)Document2 pagesApplication For Relief From Double Taxation: (Name of Contracting State)Atty Rester John NonatoNo ratings yet

- Change of Personal Particulars FormDocument3 pagesChange of Personal Particulars FormAntony VijayNo ratings yet

- State District of ColumbiaDocument20 pagesState District of ColumbiaRoger federerNo ratings yet

- Certificate of Discharge From Federal Tax Lien: Instructions On How To Apply ForDocument4 pagesCertificate of Discharge From Federal Tax Lien: Instructions On How To Apply ForLaLa BanksNo ratings yet

- Business Permit App FormDocument1 pageBusiness Permit App FormcheansiaNo ratings yet

- Online Filing of The Personal Income Tax Return by An Accredited PersonDocument2 pagesOnline Filing of The Personal Income Tax Return by An Accredited PersondtoxidNo ratings yet

- Application Form FA10C New Custom Food Control Plan Under Food Act 2014Document7 pagesApplication Form FA10C New Custom Food Control Plan Under Food Act 2014Fatemeh ArefianNo ratings yet

- Can Tax Residency t2062 Fill 18eDocument6 pagesCan Tax Residency t2062 Fill 18eMax PowerNo ratings yet

- California Tax Power of Attorney Form 3520 PitDocument5 pagesCalifornia Tax Power of Attorney Form 3520 Pitjohn rossiNo ratings yet

- 53131BIR Form No. 0901-C (Capital Gain)Document2 pages53131BIR Form No. 0901-C (Capital Gain)jamesNo ratings yet

- International Business or Company Tax Reg FormDocument4 pagesInternational Business or Company Tax Reg FormNithinNo ratings yet

- Client Benefit Retainer AgreementDocument4 pagesClient Benefit Retainer AgreementHarvey BenderNo ratings yet

- Nevada Business Registration Form InstructionsDocument3 pagesNevada Business Registration Form InstructionstibymiaNo ratings yet

- Form 4506 TDocument2 pagesForm 4506 Tbhill07No ratings yet

- IRC Taxpayer Guide RegistrationDocument13 pagesIRC Taxpayer Guide RegistrationAwong Zoo KiipaNo ratings yet

- FCB Acc OpeningAppFormCorporate 2Document12 pagesFCB Acc OpeningAppFormCorporate 2Matthew12Alexander12No ratings yet

- Ms Withholding ApplicationDocument4 pagesMs Withholding ApplicationBilal ChoudhryNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnMarie LópezNo ratings yet

- Submit Form to the New York City AgencyDocument3 pagesSubmit Form to the New York City AgencyЛена КиселеваNo ratings yet

- Aviva Investors UK Fund Services Limited Investment Funds Application Form For CorporationsDocument16 pagesAviva Investors UK Fund Services Limited Investment Funds Application Form For CorporationsFerdee FerdNo ratings yet

- Sworn Statement SampleDocument1 pageSworn Statement Samplecs.szeleeNo ratings yet

- US Internal Revenue Service: f2350 - 2005Document3 pagesUS Internal Revenue Service: f2350 - 2005IRSNo ratings yet