Professional Documents

Culture Documents

Cover Letter and Brief To Court For Foreclosure Defense 8-16-11

Uploaded by

jack1929Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cover Letter and Brief To Court For Foreclosure Defense 8-16-11

Uploaded by

jack1929Copyright:

Available Formats

Earl S.

David

Attorney at Law

1091 River Avenue, Unit 17 Lakewood, NJ 08701 Tel. 908.907.0953

Email:earlsdavid@yahoo.com

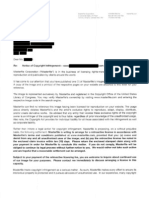

August 16, 2011 The Honorable , P.J.C.H. Ocean County Superior Court 206 Courthouse Lane Toms River, NJ 08754 Re: Docket # Bank v. Home owner.* Motion return date Dear Judge : Please accept this letter in lieu of a formal brief which is in reply to plaintiff's opposition to defendant's motion to vacate default judgment. Please excuse our late response as we recently received plaintiff's opposition which incorrectly lists the return date as Friday July 19, 2011. In light of the recent Appellate Division decisions in Bank of New York v. Laks, A-4221-09, and Deutsche Bank National Trust Company, et al v. Mitchell et al, A-4925-09T3, I am respectfully requesting vacatur of the default judgment. In Bank of New York v. Laks, the Appellate Division stated that the notice of intention to foreclose must not only identify the lender, but it must list the phone number of a representative. The Court said the following," The third, and the one critical in this case, is the "name and address of the lender and the telephone number of a representative of the lender whom the debtor may contact if the debtor disagrees with the lender's assertion that a default has occurred or the correctness of the mortgage lender's calculation of the amount required to cure default." N.J.S.A. 2A:50-56(c)(11). As per the notice of intent to foreclose in this particular case, it is lacking the telephone number and representative and it is thus in violation of the law and the intent of the legislature who drafted the provision of the law. See attached copy of Notice of Intention to Foreclose as Exhibit A.

Moreover, the original complaint was filed on or about January 16, 2009 in the name of a different Plaintiff, Bank . This was not listed in the Notice of Intent to Foreclose. This is a novel issue of first impression that the Court must entertain;A notice of intent to foreclose with a different entity than the named Plaintiff in the complaint. As Mr. Homeowner is not a native of the United States the process was aliento himand he was genuinely confused with the document that he received. Moreover, despite calls to Plaintiff's attorney that nothing would happen as long as he seeks a modification, he and his wife felt swamped by the paperwork and the office of Zucker Goldberg was unhelpful. See supplemental certification of Mr. Homeowner. Another important issue that needs to be addressed in this case is the amended complaint that was filed on June 10, 2009. In Deutsche Bank National Trust, et al v. Mitchell et al, the Appellate Division vacated summary judgment since the assignment of mortgage was not perfected until after the filing of the complaint, the Court stated that plaintiff lacked standing to prosecute the action. In the case at bar,the assignment of mortgage was made on January 15, 2009, just one day before the original complaint was filed. Moreover, it was not perfected until January 29, 2009 when it was recorded with the County Clerk. See attached copy of Assignment of Mortgage that was retrieved from the online website of the Ocean County Clerk, marked as exhibit B. In Plaintiff's opposition response to my motion, they also attached the same assignment of mortgage which can be found at page 8 of their 15 page opposition to my motion. However, there are two glaring differences which I respectfully request the Court to address. First, the loan number on the top right corner is clearly blacked out. On the County Clerk website the loan number is listed as xxxxxxx. The original mortgage which is also located on the County Clerk web page lists the number as xxxxxx. Moreover, on the County Clerk web page on the bottom right side of the page there is a bar code with the date the document was recorded and that is 01/29/2009. In the document provided by Plaintiff's attorney, that section is not there. Was it whited out? If it was removed the question is why was it removed? In my opinion, it was done as a diversion so the Court should not notice that the document was not perfected until after the complaint was filed, which we recently learned in Deutsche Bank v. Mitchell, is a fatal flaw that is not fixed with an amended complaint but the action must be dismissed, which was the ruling in that Appellate Division case and that is binding on this Court. A document presented to Court should be transparent and not be riddled with blackouts and white outs. This questionable behavior should not be tolerated by this Court or any Court. If the Court is not ready to dismiss this action based on Plaintiff's nefarious actions, then we should at least have the right to have the case reopened and depose the individual who actually changed the official document. On a final note, Plaintiff is in breach of it's own contract as per point 20. of the mortgage as it says that , "If there is a change of the Loan Servicer, Borrower will be given written notice of the change which will state the name and address of the new loan servicer." Plaintiff's written notice appears to be the complaint which is not in compliance with the mortgage contract that was

drafted by the lender. See attached point 20 of the mortgage marked asExhibit C as a reference.

Another point worth mentioning is that the agent of the assignment of mortgage, , was a former employee of Plaintiff law firm and it appears that he was wearing two hats, as attorney in fact of Wells Fargo and as employee of the law firm that instituted the lawsuit. Unfortunately, as noted above, Plaintiff's response to our motion raises more questions and it shows the Court that their case is procedurally defective and legally deficient. Wherefore, we respectfully request the Court to grant our motion in the entirety.

Sincerely,

Earl S. David cc:

*Names of parties have been changed to protect the identity of the actual parties. This is a real case. The lesson to be learned is to always review all of the paperwork. You may find mistakes that can save your home. Please visit me at www.foreclosure-defenders.com. I do not charge for initial consultation.

You might also like

- Race, Class, and Gender in The United States An Integrated Study 10th EditionDocument684 pagesRace, Class, and Gender in The United States An Integrated Study 10th EditionChel100% (10)

- Petition for Certiorari Denied Without Opinion: Patent Case 96-1178From EverandPetition for Certiorari Denied Without Opinion: Patent Case 96-1178No ratings yet

- Tremblay v. OpenAIDocument17 pagesTremblay v. OpenAITHRNo ratings yet

- Act of Expatriation and Oath of AllegianceDocument1 pageAct of Expatriation and Oath of AllegianceCurry, William Lawrence III, agent100% (1)

- Sample Answer Foreclosure Defense New JerseyDocument15 pagesSample Answer Foreclosure Defense New Jerseyjack1929100% (23)

- Petition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)From EverandPetition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)No ratings yet

- Petition for Certiorari: Denied Without Opinion Patent Case 93-1413From EverandPetition for Certiorari: Denied Without Opinion Patent Case 93-1413No ratings yet

- 2015-10-02 Order Granting Defendants Motion To Dismiss Under Civil Rule 12 (B)Document3 pages2015-10-02 Order Granting Defendants Motion To Dismiss Under Civil Rule 12 (B)GrowlerJoeNo ratings yet

- Plaintiff's Objection To Defendants Motion To DismissDocument4 pagesPlaintiff's Objection To Defendants Motion To DismissEd Furlong100% (1)

- Summery JudgemntDocument3 pagesSummery JudgemntLiam KeNo ratings yet

- Cronshaw, Mark-Memorandum in Support of 12 (B) (6) Motion To DismissDocument17 pagesCronshaw, Mark-Memorandum in Support of 12 (B) (6) Motion To DismissJ DoeNo ratings yet

- Motion To Object/strike Defendant's Amended "Answer"Document4 pagesMotion To Object/strike Defendant's Amended "Answer"Ed FurlongNo ratings yet

- Objections To Magistrate's ReportDocument6 pagesObjections To Magistrate's ReportNoel MorganNo ratings yet

- FDIC v. Philadelphia Gear Corp., 476 U.S. 426 (1986)Document15 pagesFDIC v. Philadelphia Gear Corp., 476 U.S. 426 (1986)Scribd Government DocsNo ratings yet

- Ohio Affidavit Notice Non-AbandonmentDocument2 pagesOhio Affidavit Notice Non-AbandonmentOnionBiscuitNo ratings yet

- Order Show Cause IIDocument4 pagesOrder Show Cause IIHarry DavidoffNo ratings yet

- Highwoods Properties v. City of Brookhaven EMERGENCY MOTION FOR EXPEDITED REVIEW, SUPERSEDEAS, AND INJUNCTION PENDINGDocument27 pagesHighwoods Properties v. City of Brookhaven EMERGENCY MOTION FOR EXPEDITED REVIEW, SUPERSEDEAS, AND INJUNCTION PENDINGThe Brookhaven PostNo ratings yet

- Option One Mortgage Corporation'S Motion For Reconsideration, Alteration or Amendment of Order Denying Motions To Quash DiscoveryDocument16 pagesOption One Mortgage Corporation'S Motion For Reconsideration, Alteration or Amendment of Order Denying Motions To Quash DiscoveryKitteeKatteeNo ratings yet

- City of Dallas v. MitchellDocument3 pagesCity of Dallas v. MitchellMichael FociaNo ratings yet

- Separation of East Pakistan Javed Iqbal PDFDocument22 pagesSeparation of East Pakistan Javed Iqbal PDFsabaahat100% (2)

- Bob Motion To DismissDocument4 pagesBob Motion To DismissRobert MillerNo ratings yet

- Legal Memorandum in Opposition To Motion To Strike Defendants Answer Us Bank v. Trop 2-8-11 F-F-28757-10Document10 pagesLegal Memorandum in Opposition To Motion To Strike Defendants Answer Us Bank v. Trop 2-8-11 F-F-28757-10jack1929100% (1)

- 09 16 10 ComplaintDocument22 pages09 16 10 ComplaintMike Rothermel100% (1)

- Mistake of Fact & Mistake of LawDocument5 pagesMistake of Fact & Mistake of LawFrancesco Celestial BritanicoNo ratings yet

- Lis Pendens To "Cloud Marketability of Title" SampleDocument0 pagesLis Pendens To "Cloud Marketability of Title" SampleCFLA, IncNo ratings yet

- May 22, 2017 Appeal 17-7003-Corrected Appellant's BriefDocument46 pagesMay 22, 2017 Appeal 17-7003-Corrected Appellant's Brieflarry-612445No ratings yet

- Mandatory Disclosures SampleDocument3 pagesMandatory Disclosures SampleFreedomofMindNo ratings yet

- Basic Legal TermDocument9 pagesBasic Legal TermdaniyalNo ratings yet

- 04.17.23 Article III Standing and Memo of LawDocument15 pages04.17.23 Article III Standing and Memo of LawThomas WareNo ratings yet

- 78.0 Order On Motion To Dismiss For Failure To State A ClaimDocument7 pages78.0 Order On Motion To Dismiss For Failure To State A ClaimCopyright Anti-Bullying Act (CABA Law)No ratings yet

- 1a. Motion To DismissDocument7 pages1a. Motion To Dismiss1SantaFeanNo ratings yet

- LIBERI V TAITZ (C.D. CA) - 311.0 - OPPOSITION To MOTION To Dismiss Case Pursuant To FRCP 12 (B) (6) - Gov - Uscourts.cacd.497989.311.0Document7 pagesLIBERI V TAITZ (C.D. CA) - 311.0 - OPPOSITION To MOTION To Dismiss Case Pursuant To FRCP 12 (B) (6) - Gov - Uscourts.cacd.497989.311.0Jack RyanNo ratings yet

- Readings in Philippine HistoryDocument11 pagesReadings in Philippine HistoryWilliam DC RiveraNo ratings yet

- Legal English Vocabulary (English-German)Document6 pagesLegal English Vocabulary (English-German)MMNo ratings yet

- Parking Citation Contest - RedactedDocument1 pageParking Citation Contest - RedactedAnonymous LqDr43eNo ratings yet

- Remedies For Breach of ContractDocument2 pagesRemedies For Breach of ContractShakil Faraji100% (1)

- Physiotherapy License Exams Preparatory CDDocument1 pagePhysiotherapy License Exams Preparatory CDeins_mpt33% (3)

- Motion To Change Judge and Venue Brunetti 9-17-18Document8 pagesMotion To Change Judge and Venue Brunetti 9-17-18Conflict GateNo ratings yet

- Velasco V People GR No. 166479Document2 pagesVelasco V People GR No. 166479Duko Alcala EnjambreNo ratings yet

- MRS V JPMC Doc 151-1, Fourth Amended Complaint, March 6, 2017Document88 pagesMRS V JPMC Doc 151-1, Fourth Amended Complaint, March 6, 2017FraudInvestigationBureau100% (2)

- Case Dismissed For Lack of Capacity To Sue, in Pinella County, Fla, 01-15-2010Document3 pagesCase Dismissed For Lack of Capacity To Sue, in Pinella County, Fla, 01-15-2010wicholacayo100% (2)

- Cross-Complaint: Cross-Complaint For Quiet Title of Easement, Injunctive Relief, and TrespassDocument6 pagesCross-Complaint: Cross-Complaint For Quiet Title of Easement, Injunctive Relief, and TrespassAbby ReyesNo ratings yet

- LNV Corporation vs. Catherine GebhardtDocument20 pagesLNV Corporation vs. Catherine Gebhardtbealbankfraud100% (2)

- Disclosure OrdinanceDocument6 pagesDisclosure OrdinanceAnonymous 0xqCcbNxNo ratings yet

- Mark Fiore Notice of Intent To LienDocument1 pageMark Fiore Notice of Intent To LienDemetrius BeyNo ratings yet

- MR Motil's Response To Capital One's Motion To Amend ClaimDocument8 pagesMR Motil's Response To Capital One's Motion To Amend ClaimRobert Lee ChaneyNo ratings yet

- Bitanga vs. Pyramid Construction Engineering Corporation, G.R. No. 173526, 28 August 2008Document3 pagesBitanga vs. Pyramid Construction Engineering Corporation, G.R. No. 173526, 28 August 2008Bibi JumpolNo ratings yet

- Manual Survey Pro For RangerDocument337 pagesManual Survey Pro For RangerIni ChitozNo ratings yet

- Case Info Sheet PDFDocument3 pagesCase Info Sheet PDFRichNo ratings yet

- Scheffler V NCO Financial Systems Inc FDCPA ComplaintDocument5 pagesScheffler V NCO Financial Systems Inc FDCPA ComplaintghostgripNo ratings yet

- Uber Fair Credit Class ActionDocument20 pagesUber Fair Credit Class Actionjeff_roberts881No ratings yet

- Form Civil Affidavit of Debt SCDocument2 pagesForm Civil Affidavit of Debt SCEduardo NegapatanNo ratings yet

- Jannett Spence Lawsuit Against Eric Readon.Document47 pagesJannett Spence Lawsuit Against Eric Readon.Amanda RojasNo ratings yet

- InjunctionDocument4 pagesInjunctionnatrix029100% (3)

- PrecedentialDocument44 pagesPrecedentialScribd Government Docs100% (1)

- BB&T First Motion To DismissDocument15 pagesBB&T First Motion To DismissSean G. DeVriesNo ratings yet

- Douglas Bruce v. City and County of Denver, Et Al.Document19 pagesDouglas Bruce v. City and County of Denver, Et Al.Michael_Roberts2019No ratings yet

- Plaintiffs First Amended Complaint, Gillespie V Barker, Rodems, Cook, 05-CA-7205, May 5, 2010Document151 pagesPlaintiffs First Amended Complaint, Gillespie V Barker, Rodems, Cook, 05-CA-7205, May 5, 2010Neil GillespieNo ratings yet

- HP Locate FDCPA LawsuitDocument15 pagesHP Locate FDCPA LawsuitRick HartmanNo ratings yet

- Second Amended Objection To Proof of ClaimDocument5 pagesSecond Amended Objection To Proof of Claimajv3759No ratings yet

- Stroman ComplaintDocument79 pagesStroman ComplaintFrank JeanNo ratings yet

- Gahler Opposition To FroshDocument27 pagesGahler Opposition To FroshRohan MNo ratings yet

- Masterfile Settlement Demand Letter: 1st Contact DieselfishDocument5 pagesMasterfile Settlement Demand Letter: 1st Contact DieselfishExtortionLetterInfo.comNo ratings yet

- Divorce With or Without ChildrenDocument19 pagesDivorce With or Without ChildrenJoseph Oswald0% (1)

- Interrogatories Directed at American Express Centurion BankDocument5 pagesInterrogatories Directed at American Express Centurion Bankluke17No ratings yet

- Mills Response To First Horizon's Motion To DismissDocument38 pagesMills Response To First Horizon's Motion To DismissForeclosure Fraud100% (3)

- DISTRICT COURT OF - Case No.: 123456-123Document1 pageDISTRICT COURT OF - Case No.: 123456-123marlonttee100% (1)

- Govino LLC v. Whitepoles LLC - R&R On Default JudgmentDocument25 pagesGovino LLC v. Whitepoles LLC - R&R On Default JudgmentSarah BursteinNo ratings yet

- SEC v. Babikian Doc 40 Filed 23 May 14Document3 pagesSEC v. Babikian Doc 40 Filed 23 May 14scion.scionNo ratings yet

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryFrom EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNo ratings yet

- Ad 8-14-11Document1 pageAd 8-14-11jack1929No ratings yet

- Ad On ScribdDocument1 pageAd On Scribdjack1929No ratings yet

- Cover Letter and Brief To Court 08-15-11 12-30 Am - 10Document2 pagesCover Letter and Brief To Court 08-15-11 12-30 Am - 10jack1929No ratings yet

- New Jersey Court - BONY V Elghossain - Paintiff Must Name LenderDocument6 pagesNew Jersey Court - BONY V Elghossain - Paintiff Must Name LenderAsburyParkHistorianNo ratings yet

- Chase v. Mordechai Cohen Judgment Vacated FileDocument3 pagesChase v. Mordechai Cohen Judgment Vacated Filejack1929No ratings yet

- Gmac v. Boots F-33406-08 Default VacatedDocument2 pagesGmac v. Boots F-33406-08 Default Vacatedjack1929No ratings yet

- Earl S. David: Attorney at LawDocument4 pagesEarl S. David: Attorney at Lawjack1929No ratings yet

- Earl S. David: Attorney at LawDocument3 pagesEarl S. David: Attorney at Lawjack1929No ratings yet

- Earl S. David: Attorney at LawDocument4 pagesEarl S. David: Attorney at Lawjack1929No ratings yet

- Shira Brief 21044-10Document3 pagesShira Brief 21044-10jack1929No ratings yet

- Stipulation of Dismissal 2011 - 02!15!16!52!26Document1 pageStipulation of Dismissal 2011 - 02!15!16!52!26jack1929No ratings yet

- Tracy Boots Certification in Support of Motion 10-27-10Document4 pagesTracy Boots Certification in Support of Motion 10-27-10jack1929No ratings yet

- Mordechai Cohen Certificaiton in Support of MotionDocument3 pagesMordechai Cohen Certificaiton in Support of Motionjack1929No ratings yet

- Certification Chaim Friedman 9-19-10Document6 pagesCertification Chaim Friedman 9-19-10Brendon StevensNo ratings yet

- Trop Opposition MotionDocument11 pagesTrop Opposition Motionjack1929No ratings yet

- Trop Opposition MotionDocument11 pagesTrop Opposition Motionjack1929No ratings yet

- Irr SSMDocument25 pagesIrr SSMPaulo Edrian Dela PenaNo ratings yet

- Types of IP AddressesDocument3 pagesTypes of IP Addressesbekalu amenuNo ratings yet

- Cat Forklift v225b Spare Parts ManualDocument23 pagesCat Forklift v225b Spare Parts Manualethanmann190786ikm100% (81)

- Using The PN5180 Without Library: Rev. 1.0 - 7 January 2020 Application Note 581710 Company PublicDocument20 pagesUsing The PN5180 Without Library: Rev. 1.0 - 7 January 2020 Application Note 581710 Company PublicvishnurajNo ratings yet

- Long List SundayDocument4 pagesLong List SundayOmary MussaNo ratings yet

- Partnership TaxDocument24 pagesPartnership TaxMadurikaNo ratings yet

- Government and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions ManualDocument26 pagesGovernment and Not For Profit Accounting Concepts and Practices 6th Edition Granof Solutions Manualadelarichard7bai100% (29)

- 2020 - UMass Lowell - NCAA ReportDocument79 pages2020 - UMass Lowell - NCAA ReportMatt BrownNo ratings yet

- Mayo Et Al v. Krogstel Et Al - Document No. 6Document2 pagesMayo Et Al v. Krogstel Et Al - Document No. 6Justia.comNo ratings yet

- Peoria County Inmates 12/20/12Document6 pagesPeoria County Inmates 12/20/12Journal Star police documentsNo ratings yet

- Office of The Municipal Economic Enterprise and Development OfficerDocument11 pagesOffice of The Municipal Economic Enterprise and Development Officerrichard ferolinoNo ratings yet

- Microsoft Dynamics AX Lean AccountingDocument26 pagesMicrosoft Dynamics AX Lean AccountingYaowalak Sriburadej100% (2)

- Trusts Reading ListDocument6 pagesTrusts Reading Listtalisha savaridasNo ratings yet

- Case 14 G.R. No. 170672Document6 pagesCase 14 G.R. No. 170672Love UmpaNo ratings yet

- Additional Land Title CaseDocument2 pagesAdditional Land Title CaseAure ReidNo ratings yet

- CV - Astha GuptaDocument2 pagesCV - Astha GuptaAmitNo ratings yet

- Shailesh ChaurasiyaDocument107 pagesShailesh ChaurasiyaPrîthvî PârmârNo ratings yet

- TTCL OrganisationDocument35 pagesTTCL OrganisationJohn MwangaNo ratings yet

- SAP FICO Course Content by Archon Tech SolutionsDocument4 pagesSAP FICO Course Content by Archon Tech SolutionsCorpsalesNo ratings yet

- Chapter 7Document24 pagesChapter 7Ranin, Manilac Melissa SNo ratings yet

- Database Design Project: Oracle Baseball League Store DatabaseDocument4 pagesDatabase Design Project: Oracle Baseball League Store Databasehalim perdanaNo ratings yet