Professional Documents

Culture Documents

Rikvin2-Singapore Corporate Tax

Rikvin2-Singapore Corporate Tax

Uploaded by

rikvinpteltdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rikvin2-Singapore Corporate Tax

Rikvin2-Singapore Corporate Tax

Uploaded by

rikvinpteltdCopyright:

Available Formats

SINGAPORE CORPORATE TAX

SINGAPORE CORPORATE TAX

New Startup Companies* for First 3 Years of Assessment

8.50% 17.00%

* Qualifying condi ons: No more than 20 individual shareholders throughout basis period for that YA All of whom are individuals benecially and directly holding the shares in their names; OR Where there are non-individual shareholders, at least 1 shareholder is an individual holding at least 10% of the shares.

Taxable income

NO TAX

First S$100,000

S$100,001 - S$300,000

Above S$ 300,000

For All Other Companies - Par al Tax Exemp on

4.25% Taxable income 8.50% 17.00%

Companies that do not meet the qualifying condi ons would s ll be eligible for par al tax exemp on.

First S$10,000

S$10,001 - S$300,000

Above S$ 300,000

TAX-FREE DIVIDEND Tax paid by a company on its chargeable income is the nal tax and all dividends paid to its shareholders are exempt from further taxa on.

0%

Singapore Corporate Tax

Copyright 2011 Rikvin Pte Ltd

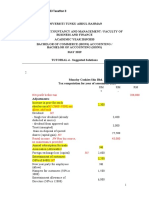

NEW STARTUP COMPANIES FOR FIRST THREE YEARS OF ASSESSMENT

Chargeable Income ($) 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 1,000,000 5,000,000 10,000,000 Es mated Tax (S$) 0 8,500 17,000 34,000 51,000 68,000 85,000 102,000 119,000 136,000 816,000 1,666,000 Eec ve tax rate 0% 4.25% 5.67% 8.50% 10.20% 11.33% 12.14% 12.75% 13.22% 13.60% 16.32% 16.66%

ALL OTHER COMPANIES PARTIAL TAX EXEMPTION

Chargeable Income ($) 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 1,000,000 5,000,000 10,000,000 Es mated Tax (S$) 8,075 16,575 25,075 42,075 59,075 76,075 93,075 110,075 127,075 144,075 824,075 1,674,075 Eec ve tax rate 8.08% 8.29% 8.36% 10.52% 11.82% 12.68% 13.30% 13.76% 14.12% 14.41% 16.48% 16.74%

Singapore Corporate Tax

Copyright 2011 Rikvin Pte Ltd

CAPITAL GAINS TAX

Gains that are of a capital nature are not taxed in Singapore. However, where there is a series of transac ons or where the holding period of an asset is rela vely short, IRAS may take the view that a business is being carried on and a empt to assess the gains as trading prots of the company.

WITHHOLDING TAX ON PAYMENTS TO NON RESIDENTS

Since a non-resident is liable to pay income tax on Singapore-sourced income, any person making payment of a specied nature to a non-resident has to withhold a certain percentage of that payment as Withholding taxes.

Dividends Interest Royal es Company directors renumera on Technical assistance and service fees Rent on moveable property Management fees Charter fees for ship or aircra

Exempt 15% 10% 20% 17% 15% 17% 0 - 2%

Copyright 2011 Rikvin Pte Ltd

RIKVIN PTE LTD

20 Cecil Street, #14-01, Equity Plaza, Singapore 049705 Main Line : (+65) 6438 8887 Fax : (+65) 6438 2436 Email : info@rikvin.com Website : www.rikvin.com

This material has been prepared by Rikvin for the exclusive use of the party to whom Rikvin delivers this material. This material is for informa onal purposes only and has no regard to the specic investment objec ves, nancial situa on or par cular needs of any specic recipient. Where the source of informa on is obtained from third par es, Rikvin is not responsible for and does not accept any liability over the content.

Company Registra on | Immigra on | Accoun ng | Taxa on | Oshore

Copyright 2011 Rikvin Pte Ltd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Income Taxation Rex Banggawan SolmanDocument59 pagesIncome Taxation Rex Banggawan SolmanKrysthel Anne Cabillo88% (8)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 12A (Ground Floor), Prakash Deep Building, 7 Tolstoy Marg, New Delhi, INDocument1 page12A (Ground Floor), Prakash Deep Building, 7 Tolstoy Marg, New Delhi, INwdwdwNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ISA Manager Transfer FormDocument2 pagesISA Manager Transfer FormAlessioNavarraNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)AnesNo ratings yet

- C749EMVSN60243Document2 pagesC749EMVSN60243billababagamingNo ratings yet

- 4562 Lecture 7 Problem SetDocument6 pages4562 Lecture 7 Problem SetJared BergerNo ratings yet

- Realme Buds Wireless 2sDocument1 pageRealme Buds Wireless 2spraveenNo ratings yet

- Oregon Income Tax Instructions and SchedulesDocument36 pagesOregon Income Tax Instructions and SchedulesStatesman JournalNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRia SinghalNo ratings yet

- South Africa Airways v. CIRDocument2 pagesSouth Africa Airways v. CIRAlyanna ApacibleNo ratings yet

- 1.0 Accounting Period and MethodDocument22 pages1.0 Accounting Period and MethodJem ValmonteNo ratings yet

- CHAPTER 15 Transfer Business TaxDocument9 pagesCHAPTER 15 Transfer Business TaxJamaica DavidNo ratings yet

- Government of Tamilnadu Treasury Bill For Salary (Employee) : Drawing Officer Treasury Reference NumberDocument2 pagesGovernment of Tamilnadu Treasury Bill For Salary (Employee) : Drawing Officer Treasury Reference NumberMani Vannan JNo ratings yet

- RMC No. 44-2021 RevisedDocument2 pagesRMC No. 44-2021 RevisedDessere Ann AnchetaNo ratings yet

- A Rush Order Was Accepted by Bartley S Conversions For FiveDocument1 pageA Rush Order Was Accepted by Bartley S Conversions For FiveAmit PandeyNo ratings yet

- Fastnet Cable Broadband Fastnet Cable Broadband Fastnet Cable Broadband Fastnet Cable BroadbandDocument1 pageFastnet Cable Broadband Fastnet Cable Broadband Fastnet Cable Broadband Fastnet Cable BroadbandSubham sikdarNo ratings yet

- Tax Codes To Use From 6 April 2021: For All EmployeesDocument1 pageTax Codes To Use From 6 April 2021: For All EmployeesAmritaShuklaNo ratings yet

- Adobe Scan 15 Nov 2022Document1 pageAdobe Scan 15 Nov 2022Indika PravindaNo ratings yet

- Income Tax Payment Challan: PSID #: 162486635Document1 pageIncome Tax Payment Challan: PSID #: 162486635samNo ratings yet

- Trading IncomeDocument15 pagesTrading IncomeJalees Ul HassanNo ratings yet

- Form No 49BDocument5 pagesForm No 49BVedant DistributorsNo ratings yet

- Maple LeafDocument1 pageMaple LeafHenry KimNo ratings yet

- UAF TA DA FormDocument1 pageUAF TA DA FormWaqar Akbar KhanNo ratings yet

- GST Charts by Vishal SirDocument3 pagesGST Charts by Vishal SirVikram KatariaNo ratings yet

- Excel ExerciseDocument5 pagesExcel ExercisemasturaNo ratings yet

- Answers To Concept ChecksDocument5 pagesAnswers To Concept ChecksSuhaybAhmed100% (1)

- 4 A TUTORIAL 4 AnswerDocument6 pages4 A TUTORIAL 4 AnswerLee HansNo ratings yet

- Bir Form 1604E - Schedule 4 Alphalist of Payees Subject To Expanded Withholding Tax As of December 31,2019Document8 pagesBir Form 1604E - Schedule 4 Alphalist of Payees Subject To Expanded Withholding Tax As of December 31,2019Ritchelle Quijote DelgadoNo ratings yet

- Computation of Total Income Income From Salary (Chapter IV A) 182370Document2 pagesComputation of Total Income Income From Salary (Chapter IV A) 182370Krishna AgarwAlNo ratings yet

- Capital Gains Group F6Document2 pagesCapital Gains Group F6Wajih RehmanNo ratings yet